Tax season is nearing its end, and as you gear up to file your taxes—whether doing it yourself or enlisting a professional’s help—you’re likely wondering about the potential size of your tax bill. The federal government’s seven tax brackets for the 2023 tax year are crucial in calculating your dues. These brackets, which depend on your taxable income and filing status, are linked to specific federal tax rates, shaping your final tax liability.

Importantly, being in a particular tax bracket doesn’t mean your entire income is taxed at that rate. As I’ll detail shortly, only the portion of your income that falls within a bracket’s range is taxed at that bracket’s rate. Therefore, if your income stretches into the highest bracket, the income below that threshold is taxed at the lower rates applicable to the lower brackets.

If you’re trying to determine how much you’ll owe the Internal Revenue Service (IRS), read on. I’ll lay out the seven tax brackets for the 2023 tax year in easy-to-understand tables, provide mathematical examples of how those brackets work, and provide some tips that might help you lower your tax rate.

WealthUp Tip: The deadline for filing your federal income tax return for the 2023 tax year is April 15, 2024 (April 17 for residents of Maine and Massachusetts).

Table of Contents

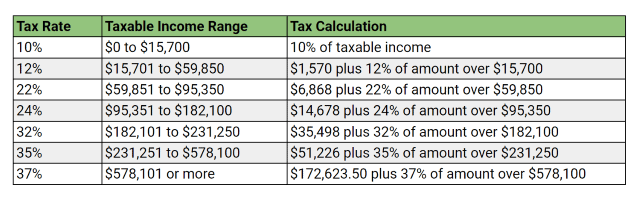

Federal Income Tax Rates for the 2023 Tax Year

The current federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Note, however, that these rates are scheduled to rise in 2026. At that point, the rates will jump to 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%.

Will The Lower Tax Rates Be Extended?

The lower tax rates could be extended by Congress, but whether or not to keep the lower rates is a politically charged issue. Right now, it would be difficult to get an extension of the lower rates through Congress and signed by President Biden. So, whether the lower federal income tax rates will continue likely depends on who controls Congress and the White House after the 2024 election.

Federal Income Tax Brackets for the 2023 Tax Year

As noted earlier, your federal income tax return for the 2023 tax year will be due on April 15, 2024, for most people. The federal income tax brackets that will apply to your 2023 tax return, based on the filing status you use—i.e., single, married filing jointly, surviving spouse, married filing separately, or head of household—are available in the tables shown in the following slides.

Related: Federal Tax Brackets and Rates [2023 + 2024]

The tables provide the tax rate, taxable income range, and tax calculation instructions for each tax bracket. So, once you know your 2023 filing status and taxable income, you can find the tax bracket—and highest tax rate—that will apply to you.

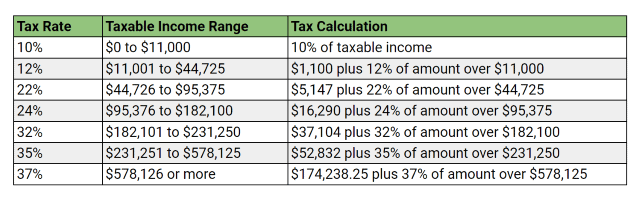

2023 Tax Brackets for Single Filers

You can generally file as a single taxpayer for the 2023 tax year if any of the following was true on Dec. 31, 2023:

– You were never married.

– You were legally separated.

– You were widowed before Jan. 1, 2023, and didn’t remarry before the end of 2023.

See the table above for the 2023 tax brackets for single filers.

Related: What’s Your Standard Deduction?

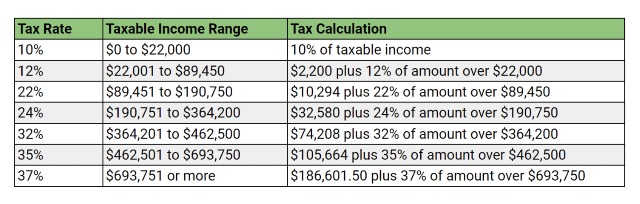

2023 Tax Brackets for Married Couples Filing Jointly and Surviving Spouses

Married couples can generally file a joint tax return for the 2023 tax year if any of the following apply:

– You were married at the end of 2023, even if you didn’t live with your spouse at that time.

– Your spouse died in 2023 and you didn’t remarry in 2023.

– You were married at the end of 2023 and your spouse died in 2024 before filing a 2023 return.

A married couple filing jointly reports their combined income and deducts their combined allowable expenses on one return. They can file a joint return even if only one spouse had income or if they didn’t live together for the entire year.

Related: Do You Have to File Taxes This Year?

The tax bracket for surviving spouses is the same as the bracket for surviving spouses. You can generally file as a surviving spouse for the 2023 tax year if all of the following apply:

– Your spouse died in 2021 or 2022 and you didn’t remarry before the end of 2023.

– You have a child or stepchild (not a foster child) whom you can claim as a dependent or could claim as a dependent except that, for 2023, the child had gross income of $4,700 or more, the child filed a joint return, or you could be claimed as a dependent on someone else’s return.

– The child or stepchild lived in your home for all of 2023.

– You paid over half the cost of keeping up your home.

– You could have filed a joint return with your spouse the year your spouse died, even if you didn’t actually do so.

See the table above for the 2023 tax brackets for joint filers and surviving spouses.

Related: Child Tax Credit FAQs [What Every Parent Needs to Know]

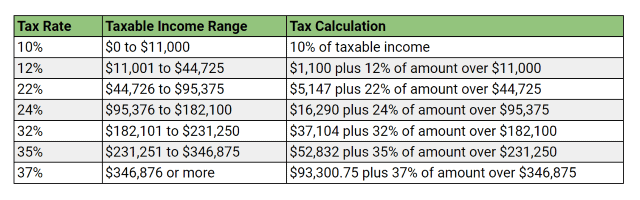

2023 Tax Brackets for Married Couples Filing Separately

You can use the married filing separately filing status for the 2023 tax year if you are married at the end of 2023 and file a separate return.

Related: 11 Ways to Avoid Taxes on Social Security Benefits

If you’re married and file a separate return, you generally report only your own income, deductions, and credits.

See the table above for the 2023 tax brackets for married taxpayers filing a separate return.

Related: How Are Social Security Benefits Taxed?

2023 Tax Brackets for Head-of-Household Filers

You can generally use the head of household filing status for the 2023 tax year if you’re unmarried (or considered unmarried) and either Test 1 or Test 2 applies:

– Test 1. You paid over half the cost of keeping up a home that was the main home for all of 2023 of a parent whom you can claim as a dependent (your parent didn’t have to live with you).

– Test 2. You paid over half the cost of keeping up a home in which you lived and in which one of the following also lived for more than half of the year: (a) any person whom you can claim as a dependent (with some exceptions), (b) your unmarried child who isn’t your dependent, (c) your married child who isn’t your dependent only because you can be claimed as a dependent on someone else’s 2023 return, or (d) your child who, even though you are the custodial parent, isn’t your dependent because of the rule for children of divorced or separated parents.

See the table above for the 2023 tax brackets for head-of-household filers.

Related: 10 States That Tax Social Security Benefits

How the Tax Brackets Work

Many people think that all their income is taxed at the rate tied to their tax bracket. Fortunately, that’s not how the federal income tax brackets work. Instead, unless you’re in the 10% bracket, at least some of your income is taxed at a lower tax rate than the rate connected to your tax bracket.

Related: Saver’s Credit: What Is It, How Much, Who’s Eligible + More

This is because the federal tax system uses marginal tax rates, which basically means that only the income that falls within the taxable income range for each tax bracket is taxed at that bracket’s corresponding tax rate. Income below your marginal tax bracket is taxed at lower rates according to the income ranges for any lower tax bracket. As a result, marginal tax rates reduce income taxes for almost everyone.

Related: 30 Tax Statistics and Facts That Might Surprise You

Example of How the Tax Brackets Work

Here’s an example to illustrate how the marginal tax rates work:

Nicholas is a single filer and has $60,000 of taxable income for the 2023 tax year. That puts him in the 22% tax bracket. However, he doesn’t owe 22% of $60,000, which would be $13,200 ($60,000 x .22 = $13,200). He actually owes less.

The first $11,000 of Nicholas’s income is taxed at the 10% marginal tax rate, which results in $1,100 of tax.

The next $33,725 of his income (i.e., from $11,0016 to $44,725) is taxed at the 12% marginal tax rate, which adds $4,047 of tax.

And, finally, the remaining $15,275 of Nicholas’s income (i.e., from $44,726 to $60,000) is taxed at the 22% rate, which comes to $3,361 of tax.

As a result, Nicholas’s total tax, when all of the separate amounts are added up, comes to $8,508, which is $4,692 less than the $13,200 tax if a flat 22% applied to all his income.

Related: Does My Child Have to File a Tax Return?

WealthUp Tip: The tax amount resulting from use of the tax brackets isn’t necessarily what you will owe the IRS when your tax return is finished. After the tax is calculated, your final tax bill could be lower once any tax credits, withheld taxes, or estimated tax payments are subtracted from the total. In some cases, your credits, withholding, and estimated payments can surpass the amount calculated using the tax brackets, in which case you might be due a refund.

Related: 8 Free Tax Filing Options for 2024

What’s Your Effective Tax Rate?

There’s a different tax rate that you may have heard of: an effective tax rate. It refers to the percentage of your taxable income paid in income tax. Because use of marginal tax rates results in your income being taxed at different rates, it’s not necessarily the best indicator of your overall income tax burden. Many people believe using your effective tax rate provides a clearer picture.

Related: What’s Your Capital Gains Tax Rate for 2023?

To calculate your effective tax rate, divide your tax as calculated using the tax brackets or tax tables (Line 16 on your 2023 Form 1040) by your taxable income (Line 15 on your 2023 return). To illustrate using the earlier example, Nicholas’s effective tax rate is 14.18% ($8,508 ÷ $60,000 = 0.1418), even though he falls within the 22% tax bracket.

Like WealthUp’s Content? Be sure to follow us.

There’s Still Time to Cut Your 2023 Tax Bill

Even though the 2023 tax year has ended, you can still lower your 2023 tax bill … and save for future expenses at the same time. That’s a win-win!

You have until the April 15, 2024, tax filing deadline to contribute to an individual retirement account (IRA) and health savings account (HSA) for the 2023 tax year (April 17 if you live in Maine or Massachusetts). If you don’t request a tax filing extension, it’s also the deadline to contribute to a solo 401(k) plan or simplified employee pension (SEP) plan for 2023.

If you make “pre-tax” contributions to one of these accounts (e.g., to a traditional IRA instead of a Roth IRA), you can generally claim a tax deduction for the amount contributed. So, if you make a contribution for the 2023 tax year before the April deadline, that tax deduction can reduce the amount of tax you owe for 2023 (i.e., on the federal income tax return you file in 2024).

Just make sure you don’t exceed the 2023 annual contribution limits for the type of account that you put money in for the 2023 tax year. Doing so can result in a stiff penalty from the IRS.

WealthUp Tip: If you put money in one of these accounts in 2024 before the April 15 (or April 17) due date, make sure you let the account administrator know that your contribution is for the 2023 tax year.

Click on the following links for information about contribution limits for the current year:

– IRA Contribution Limits for 2024

– 401(k) Contribution Limits for 2024

Related: Capital Gains Tax: What You Need to Know

Millions of Americans sell stocks, bonds, cryptocurrency, real estate, precious metals, and other types of investment property every year. However, if you sell investments during the year, you might owe capital gains tax on any profits.

The good news is that you’ll pay a lower tax rate on capital gains when compared to income taxes on wages, tips, and other “ordinary” income. On the other hand, there are a few landmines to avoid when you sell investment property. Get all the details with our guide to the capital gains tax.

Related: Don’t Believe These 17 Social Security Myths

Lots of misinformation circulates around Social Security: Is it solvent? Will it fold? Will retirees have Social Security ten years from now? Most of these are myths perpetuated time and again. Fortunately, we’ve created a comprehensive list of Social Security myths and debunk each one of them.

Related: How Are Social Security Benefits Taxed?

In many cases, Social Security benefits are subject to federal taxation. To learn how your Social Security benefits are taxed, we’ve got an entire guide to walk you through the calculation.

Please Don’t Forget to Like, Follow and Comment

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Subscribe to The Weekend Tea, our weekly newsletter to read more about investing, spending, taxes, and more, and

3. Give the article a Thumbs Up on the top-left side of the screen.

4. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!