The humble 401(k) plan has become one of the most common ways Americans save for retirement.

It’s no wonder why. These accounts are widely offered by employers, they’re easy to set up, they offer enormous tax advantages, and in many cases, they come with “free” money (in the form of employer matches).

By and large, contributing to a 401(k) is a pretty straightforward process and an easy way to boost your retirement savings. However, there are a number of mistakes, bad habits, and broken rules that, across the life of your account, could significantly weigh on your full earnings potential.

Let’s talk about these common 401(k) mistakes—and how to avoid them.

Featured Financial Products

Table of Contents

Avoid These 401(k) Mistakes:

The higher your 401(k) balance, the better your position heading into retirement.

But both on the way to building that balance, and once you’ve called it a career, there are a variety of costly 401(k) mistakes that could stunt your portfolio’s growth or bleed it down faster.

We suggest learning from others’ errors rather than making those blunders yourself. So read on to learn about some of the most common 401(k) money mistakes and become aware of these dangers.

1. Not Knowing There’s More Than One Type of 401(k)

The 401(k) that most people think of (and most people invest with) is the traditional 401(k).

But there are more.

For one, there’s a Roth 401(k). If you’re familiar with the differences between traditional and Roth IRAs, the 401(k) equivalents work similarly:

1. Contributions: Traditional 401(k) employee contributions are made with pre-tax dollars. Roth 401(k) employees contributions are made with after-tax dollars.

— Historically, employer contributions were placed in a traditional 401(k) account, regardless of whether the employee contributed to a traditional or Roth 401(k). However, the SECURE 2.0 Act, passed in December 2022, allowed (but did not require) employers to begin making matching contributions to Roth 401(k)s.

— Both 401(k)s allow funds to grow tax-deferred/tax-free as long as that money is in the account.

2. Withdrawals: Traditional 401(k) withdrawals made at or after age 59½ are taxed as ordinary income. Roth 401(k) withdrawals made at or after age 59½ are tax-free (as long as the account has been open for at least five years).

3. RMDs: Traditional 401(k)s have required minimum distributions (RMDs) beginning at age 73. Roth 401(k)s don’t have RMDs.

The tax distinctions are important. If you believe your current tax bracket is higher than the tax bracket you’ll fall within during retirement, you’re best off with a traditional 401(k), where you avoid taxes now and only are taxed at the later, lower rate. Conversely, if you believe your current tax bracket is lower than the tax bracket you’ll fall within during retirement, you can use a Roth 401(k) to take advantage of your current tax rate, then withdraw funds tax-free once you hit retirement.

And some people simply want to have both options available in retirement, so they contribute to both a traditional and a Roth account, whether that’s by splitting 401(k)s, or pairing a traditional/Roth 401(k) with a Roth/traditional IRA.

By the way, there are also solo 401(k)s. A solo 401(k) is a small-business 401(k) alternative; you can only have one if you’re self-employed, or you own a small business with no employees, or only your spouse as an employee. Solo 401(k)s have different rules than workplace 401(k)s, but are mostly similar in form. And yes, there are both traditional and Roth solo 401(k)s.

If you’re unsure how to navigate your 401(k) choices, you should discuss your options with a financial advisor.

Related: 13 Baby Boomer Retirement Statistics You Should Know

2. Not Contributing Enough Money

Very broadly speaking, you’ll benefit from contributing as much to your 401(k) as you can afford, up to the annual limit. The more you contribute, the more you can take advantage of your 401(k)’s tax benefits.

But if you can’t afford to max out your 401(k), you should at least contribute up to the company match.

Let’s say you make $100,000 a year, and your employer matches every dollar you contribute, up to 4% of your salary. If you contribute 2% of your salary ($2,000) across the year, they’ll match you along the way, giving you another $2,000 in effectively free money. That’s great, but remember—your employer will match up to 4%, or a total of $4,000. So if you only contribute 2%, you’re leaving $2,000 on the table! So unless it’s a true hardship, you should contribute at least up to the company match.

And if you don’t contribute the max right out of the gate, you should try to increase your contributions over time, as you make more money. So let’s say you start a new job and only contribute 2% annually. Try to make it a goal to contribute 3% the next year, 4% the year after, and so forth.

Interestingly, this advice is going to gradually become antiquated over time.

In 2022, Congress passed the SECURE 2.0 Act. Per that act, in 2025, any companies that established a 401(k) plan following passage of SECURE 2.0 (Dec. 29, 2022, to be specific) will have to auto-enroll new employees, as well as existing employees who haven’t already opted out, into their 401(k) plans. Businesses also will have to establish an automatic default contribution rate—of anywhere between 3% and 10%—for any employee that doesn’t manually set their own rate.

On top of that, these 401(k) plans will also have to auto-escalate contributions—regardless of whether you chose your initial rate or auto-opted into it. Contributions must be automatically escalated by 1 percentage point per year (example: 3% in 2024, 4% in 2025, 5% in 2026 …) up to a predetermined rate, set by the employer, that must fall between 10% and 15%.

No matter what, you’ll have to mind 401(k) contribution limits. In 2024, that’s $23,000 annually (up from $22,500 in 2023). However, if you’re 50 or older, you can contribute an additional $7,500 in “catch-up” contributions, for a grand total of $30,500. Solo 401(k)s are a little more complicated, as you control both employee and employer contributions; to learn more, check out our solo 401(k) guide.

Related: 8 Special Tax Breaks for Senior Citizens

Featured Financial Products

3. Making the Wrong Investment Choices

OK, saying “the wrong investment choices” implies black-and-white “right” and “wrong” when it comes to selecting your investments. It’s not that simple. You could, in theory, put all of your contributions into any one of the investments in a 401(k) and walk away with more money after 30 or 40 years no matter what.

So instead, let’s look at it this way: You can make some choices that will improve your odds of meeting your personal investment goals.

401(k) plan investment options, with few exceptions, are limited to a handful of mutual funds. That’s opposed to self-directed accounts like brokerages and individual retirement accounts, or IRAs, which allow you to select from thousands of stocks, exchange-traded funds, mutual funds, and other assets and vehicles.

These funds will almost always hold dozens, if not hundreds or even thousands, of stocks, bonds, or both. Exactly what each fund holds will depend on its strategy—one fund might hold nothing but small, growth-oriented stocks, while another fund might hold a variety of short-term U.S. Treasury bond issues, while another might hold a 50/50 blend of large-cap stocks and investment-grade corporate debt.

When you first set up your 401(k), you’ll be asked how much of each contribution you want to allocate to one or more of these funds. When you make these decisions, you’ll want to take into account factors such as how much time you have until retirement and how much risk you’re willing to accept. If you’re young, you can afford to be aggressive and take risks to grow your money, as you’ll have plenty of time to make up for setbacks in the market. The closer to retirement you get, the more conservative you might want to invest to protect your money.

You can research the funds yourself and determine which ones would be right for your particular needs. Or, if you simply want to “set it and forget it,” you could sink all of your money into a target-date fund. A target-date fund series will have several funds, each based on a specific year—say, 2025, 2030, 2035, and so on. You select a fund based on the rough year in which you think you’ll retire. The fund might start out with an aggressive portfolio, but over time, management will change its investments to become more conservative. So, your portfolio might be stock-heavy in your 20s and 30s, but be heavier in bonds by the time you retire in your 60s.

If you’re auto-enrolled in a 401(k) plan but don’t make an investment selection, your plan might funnel your contributions into a qualified default investment alternative (QDIA), which is effectively a default fund chosen from among the plan’s investment options. And in some cases, that QDIA will be a target-date fund.

Related: 6 HSA Money Mistakes to Avoid

4. Not Knowing Your Vesting Schedule

In a regular 401(k) setup, any contributions to your fund immediately belong to you. If you quit the next day, you can roll over every cent of that 401(k) without issue.

That’s not the case if your 401(k) involves “vesting.” With 401(k)s that require you to be vested, all of your contributions will immediately belong to you. However, while your company might provide a match or profit sharing, and those funds will immediately go into your 401(k), that money won’t actually belong to you until you reach a certain milestone.

There are two primary types of vesting plans:

— Cliff vesting: You’re 100% vested after a set time.

Example: You’re hired on Jan. 1, 2025. Your company has a 401(k) plan with an employer match. There is a three-year vesting period, thus your 401(k) match will vest on Jan. 1, 2028. If you quit on Dec. 31, 2027, you will forfeit your entire unvested company match. If you quit on Jan. 2, 2028, every cent of your 401(k) is yours.

— Graded vesting: You become gradually vested across various time milestones.

Example: You’re hired on Jan. 1, 2025. Your company has a 401(k) plan with an employer match. There is a five-year vesting period, where 20% of match contributions vests every year. If you quit on Jan. 2, 2026, only 20% of any employer matches are yours. If you quit on Jan. 2, 2028, 60% of any employer matches are yours. If you quit on Jan. 2, 2030, every cent of your 401(k) is yours.

Vesting plans vary by company, but the most common vesting periods are between three and five years.

As you might have guessed, vesting systems exist to help businesses retain employees. If you have a five-year cliff vesting schedule, you’ll be a lot more hesitant to look elsewhere for a new job if it means losing, say, four years’ worth of company matches in your 401(k).

Not knowing that your 401(k) has a vesting schedule, or not knowing what that vesting schedule is, could result in you leaving thousands of dollars behind if you quit too early.

This doesn’t mean you should never switch jobs before you’re fully vested—but you should at least be aware of the consequences.

Related: What Is Medicare? A Guide to Types of Medicare Coverage

5. Treating Your 401(k) Like Day Trading

Few people mistake their 401(k) for a brokerage account. When all you have is a handful of mutual funds to choose from, it’s difficult to meaningfully day trade anyways.

In fact, a 401(k) doesn’t inherently come with guardrails to keep you from buying and selling your funds whenever you like. (But because there can be significant financial consequences for the employer, who sponsors the plan, many employers set limits on trading.)

It’s more a day-trading mindset that you want to avoid.

401(k)s are designed for long-term saving. Paying too much attention to the market’s everyday swings will stress you out, and potentially cause you to make some rash decisions that could hurt your longer-term strategy. So, as a general rule, try to avoid checking your 401(k) balance every day, and try to avoid making adjustments to your 401(k) more than once a quarter.

Most people can get away with rebalancing their portfolios just once a year. And if your money is in a target-date fund, it will automatically adjust your target allocation over time.

And if you’re ever unsure, you can talk to a financial advisor about whether and how you should tinker with your account.

Related: Best Vanguard Retirement Funds for a 401(k) Plan

6. Withdrawing Funds Too Early

A 401(k) is designed to be a retirement savings account … but you might be tempted once or twice to withdraw your funds sometime before you actually retire. Maybe you’ll have a significant debt to pay off, or maybe you’ll see those account funds as the only way to afford a down payment on a new home.

You’re well within your rights to do so, but just understand that withdrawing money from your 401(k) too early has significant downsides.

Related: How Long Will My Savings Last in Retirement? 4 Retirement Withdrawal Strategies

First, let’s define “early”: Funds withdrawn from a 401(k) before age 59½ are considered “early” withdrawals.

For the most part, early withdrawals are subject not just to income tax, but an additional 10% early withdrawal tax. But there are exceptions. The IRS has a full list of exceptions, but examples include some unreimbursed medical expenses, $5,000 per child for qualified birth or adoption expenses, and up to $22,000 to qualified individuals who sustain economic losses because of a federally declared disaster where they live.

Just know that by withdrawing that money, you’re forfeiting that money’s ability to grow tax-deferred or tax-free. That will have a much larger long-term impact than pulling the same amount of money out of savings or a taxable account.

Related: Best Schwab Retirement Funds for a 401(k) Plan

Featured Financial Products

7. Investing Too Much in Company Stock

While 401(k)s typically are limited to mutual funds, there’s one common exception: your own company’s stock.

It’s easy to see the appeal of investing in company stock when you suspect it will grow significantly in value. After all, who wouldn’t want to invest in their company if they thought they were the next Apple (AAPL) or Amazon (AMZN)?

Investing in your company’s stock can be wise … but don’t go overboard. The Financial Industry Regulatory Authority (FINRA) itself doesn’t offer direct advice on how much company stock to own, but they note that “some experts recommend investing no more than 10 percent of total investment assets in a single stock, including stock of your company—and that could be too high, depending on your goals and circumstances.”

Why should you be cautious? For one, you could end up having too much single-company risk. 401(k)s allow you to invest in funds that might hold dozens, hundreds, or even thousands of securities all at once, dramatically lowering the ability for losses in any one stock or bond to significantly weigh on your portfolio. But if you invest too much in your own company’s stock, declines in that stock’s worth could leave you hemorrhaging money.

It’s also worth noting that your company might restrict when you can buy, sell, or transfer your stock. The biggest risk there is that, in the event your company’s stock declines significantly, you might not be able to exit the stock in a timely fashion.

Related: Best Fidelity Retirement Funds for a 401(k) Plan

8. Cashing Out Your 401(k) When You Change Jobs

You’ve built up a substantial 401(k) at one company, but now you’re switching jobs. You have several options for what to do with the funds in your old 401(k), including:

1. Keep your money in your old 401(k) plan.

2. Transfer your old 401(k)’s funds into your new 401(k).

3. Roll over your old 401(k) into an IRA.

4. Liquidate your old 401(k) account.

That last option can be a huge mistake.

If you are under 59½ years old, liquidating your 401(k) would require you to pay not only income taxes on that money, but an additional 10% penalty. This would enormously diminish your overall retirement savings. The best way out of that situation would be to reconsider and take the funds from your liquidated 401(k) and put them into a qualified retirement plan (401(k)) or IRA. You would have 60 days from receipt of the funds to do so.

Also, a note: If you have less than $1,000 in your 401(k) account, your employer may automatically cash out your account and send you a check for the balance. In that event, the 60-day rule for handling that distribution still applies.

Plus, you would be diminishing your overall retirement savings. Note that if you have under $1,000 in your account, your employer is allowed to automatically cash out your account and send you a check for the balance. In this situation, you can avoid paying the early withdrawal penalty if you put the funds in a qualified retirement plan within 60 days. Your employer would withhold the income taxes for you.

Related: Does Your Credit Score Matter in Retirement?

9. Not Updating Your Beneficiary

You might have set up your 401(k) decades ago, have it on autopilot, and rarely think about it.

That’s fine—unless you’ve had some major relationship changes during that time. In which case, you’ll want to make sure to update your beneficiary.

Let’s say that 20 years ago, you set your then-spouse as your beneficiary. But 10 years ago, you divorced. Today, you’re single. If you pass away, the plan administrator is required to give the proceeds to your named beneficiary … which means if you pass away without changing your beneficiary, your ex-husband would receive those funds. And in fact, beneficiary designations supersede wills, so even if you wrote in your will that you wanted the 401(k) money to go to your siblings, if your ex-husband was still designated as the beneficiary, he would get the money, and not your siblings.

Related: Are You Retirement-Ready? 10 Questions to Ask Yourself

10. Forgetting About Catch-Up Contributions

Many people struggle to contribute much, if anything, to retirement accounts when they first enter the professional world. But as they become more established in their careers, they’re increasingly stable enough to improve and even max out their annual 401(k) contributions.

Still, if you got a late start, you might not have enough saved for a comfortable retirement. Fortunately, the law allows for workers age 50 and over to make annual catch-up contributions—to numerous accounts, not just 401(k)s—that makes their annual contribution limit higher than their younger counterparts’ limit.

The 2024 catch-up contribution limit for a 401(k) account is $7,500—so, in addition to the $23,000 limit, you can contribute a total of $30,500 in 2024 if you’re able. But starting in 2025, for individuals between the ages of 60 to 63, the catch-up contribution limit is the higher of $10,000 or 150% of the regular catch-up limit, as indexed for inflation. (Regular 2025 catch-up contribution limits have not yet been set.)

If you fit the age requirement and have enough money to do so, taking advantage of catch-up contributions can be a great way to boost your retirement savings.

Related: Is Your Retirement on Track? Here Are the Average 401(k) Balances By Age

Featured Financial Products

Related: 11 Ways To Avoid Paying Taxes on Your Social Security

If you’re looking to minimize the tax bite taken out of your Social Security benefits in retirement, you’ve got several available actions to reduce how much you pay each year. We outline several ways to avoid paying taxes on your Social Security benefits.

Related: How Are Social Security Benefits Taxed?

In many cases, Social Security benefits are subject to federal taxation. To learn how your Social Security benefits are taxed, we’ve got an entire guide to walk you through the calculation.

Related: 10 States That Tax Social Security Benefits

While most states don’t subject Social Security benefits to taxation, at least 10 states do tax Social Security. To see if you live in one of them, or you’re considering a relocation for retirement and taxation of your Social Security is a sticking point, we’ve got you covered with all of the details.

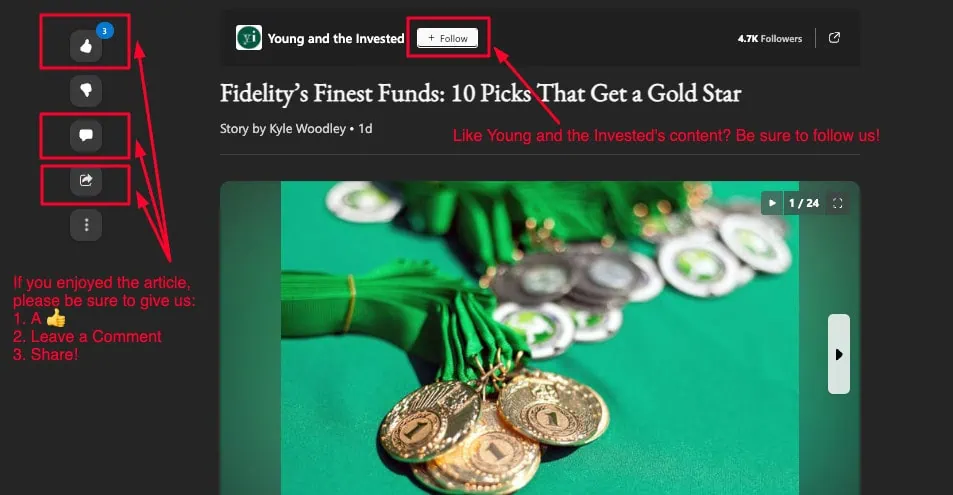

Please Don’t Forget to Like, Follow and Comment

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Subscribe to The Weekend Tea, our weekly newsletter to read more about investing, spending, taxes, and more, and

3. Give the article a Thumbs Up on the top-left side of the screen.

4. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!