Love them or loathe them, banks play a pivotal role in the financial landscape, providing millions of Americans with a secure place to save and occasionally increase their funds. Yet, it’s important to remember that banking services often come at a cost.

Banks charge a wide variety of fees. It’s understandable—after all, banks are businesses, not charities—but those fees do cut into our savings, our earnings, and our potential returns. It’s a begrudging trade-off: credit cards are convenient, but paying credit card fees sure isn’t.

Happily, while credit card and bank fees are aggravating, you do have ways of reducing or even avoiding them. So if you’re trying to hold on to more of your hard-earned cash, read on as I go over some of the most common bank fees, then the most common credit card fees, and discuss whether you can dodge them.

Table of Contents

Bank Fees

Are bank fees diminishing your bank account faster than you can fill it? Consider banishing the following fees.

1. Minimum Balance Requirements

Some bank accounts have minimum balance requirements, which trigger a fee should you dip below the minimum. While a standard savings or checking account may require a minimum balance, but this is usually more common for a money market or high-yield savings account.

The clear way to avoid this is by keeping enough money in your account to satisfy the minimum. However, it’s tricky to avoid temporary dips below the threshold in a primary checking account, where money is frequently coming in and going out. So, if you’re worried about this issue, seek out bank accounts that don’t carry minimum balance requirements.

2. Monthly Maintenance Fee

Monthly account maintenance fees are meant to help cover a bank’s operating costs. But naturally, no expense adds up quite like one you have to pay regularly.

Luckily, monthly maintenance fees are easy to avoid.

Many financial institutions waive monthly fees if you use enough qualifying services. For example, a credit union I use waives the monthly fee if you use at least five qualifying services or have combined deposit and/or loan account balances of $20,000. Many of these qualifying services are simple to meet, such as having a savings account, checking account, paperless statements, mobile or direct deposit, and debit card usage.

But it’s also easy to find a bank account with no monthly fees whatsoever, especially among larger banks and financial apps. Among accounts we rate, Bread Savings, Sofi Checking and Savings and Axos Rewards Checking all offer robust banking offerings with no monthly fees.

Related: 7 Best Wealth + Net Worth Tracker Apps [View All Your Assets]

3. Overdraft Fees + Nonsufficient Funds Fees (NSFs)

Two of the most common banking fees are overdraft fees and nonsufficient funds (NSF) fees. Both fees involve trying to spend more money than you have in your account, but they’re not quite the same.

A bank charges an overdraft fee when it clears a transaction that’s overdrawn the account and temporarily covers your shortfall. But if a bank declines to cash a check or approve a payment that would overdraw the account, it will charge an NSF fee.

The glib answer: Don’t overdraw your account. But if we’re being practical, and you want to prevent an accidental overdraft or NSF fee, consider switching where you do your banking. Many banks and credit unions provide overdraft protection (though that sometimes requires its own fee), or otherwise allow you to avoid overdraft fees as long as you aren’t overdrawn by a substantial amount and reimburse the account in a timely manner. For instance, Axos Rewards Checking charges no overdraft fees whatsoever.

Related: The 7 Best Vanguard Index Funds for Beginners

4. ATM Withdrawal Fee

You know the drill: If you go to an ATM within your bank’s network, you can use it for free. But if you go to another bank’s ATM or a third-party machine, get ready to pay a few bucks in ATM withdrawal fees.

ATM fees are naturally frustrating because it’s an extra charge to access your own money. And while the fees might only be a couple bucks in many locations, a few are eye-poppingly high. I recently used an ATM while traveling to Costa Rica, and I was charged a $7.80 fee!

You have two realistic options for getting around these fees. You can either bank with an institution that has an exceedingly high number of in-network bank and/or third-party ATMs. Or you can bank with a financial institution that reimburses out-of-network ATM fees.

Related: 50+ Best Money-Making Apps That Pay You Real Money

5. Wire Transfer Fees

Usually, banks charge fees for wire transfers, and those fees may differ depending on the nature of the transfer. For instance …

— Incoming domestic (U.S.) transfers usually range between $0 and $15

— Incoming international transfers usually range between $0 and $20.

— Outgoing U.S. transfers usually range between $15 and $40.

— Outgoing international transfers usually range between $35 and $50.

There’s no negotiating these funds, but you can find ways around them.

If you expect to make frequent wire transfers, you should comparison-shop among banks. Some banks offer one or more free incoming and outgoing wire transfers with high-level accounts, though that’s not the norm for a standard savings or checking account.

Of course, the best way to avoid wire transfer fees is, when the choice is available, to use another method to transfer money. Many banks permit free ACH transfers between bank accounts, though those payments aren’t instantaneous. You could also use apps like Zelle—an instant transfer method between bank accounts—as long as both financial institutions have Zelle functionality. In a pinch, peer-to-peer money apps, such as PayPal and Venmo, can let you send money to friends or family for free, too.

Related: The 7 Best Fidelity Index Funds for Beginners

Credit Card Fees

What’s not to love about credit cards? They’re easy to use, they’re accepted virtually everywhere, and many of them come with great financial perks.

That said, if you’re not careful, you could accumulate a laundry list of different fees.

Like Young and the Invested’s content? Be sure to follow us.

6. Annual Credit Card Fees

Most cards don’t charge annual credit card fees anymore, but these fees are still commonly found among rewards cards—especially the higher-end ones. This fee is one of the most important things to weigh when choosing a credit card—after all, you don’t want to end up spending more on fees than you reap in rewards.

While annoying, credit card companies are typically upfront about annual fees, so if you don’t want to pay an annual fee, simply choose from the credit card world’s wide variety of free options. And though it won’t work often, it’s worth at least calling to see if you can get the fee waived; the worst they can say is “no.”

But sometimes, it pays to pay the fee. Just make sure you take a close look at all of the rewards, and how likely you’ll be to use them all, to get an idea of whether you’re going to come out ahead.

Related: 12 Best Apps That Give You Money for Signing Up [Free Money]

7. Foreign Transaction Fees

Credit cards that charge foreign transaction fees make you pay every time you make a card purchase abroad or with a foreign merchant. Generally, the fee is between 1% to 3% of the transaction cost, depending on the credit card. While that might not seem like a high amount, that will add up in a hurry if you frequently travel.

Like with many fees, the best way to avoid foreign transaction charges is to shop around—many cards (especially travel-oriented cards) don’t charge foreign transaction fees. Alternatively, though, if you rarely travel internationally, when you do, you might opt to primarily pay in cash.

Related: The 7 Best Vanguard ETFs for 2024 [Build a Low-Cost Portfolio]

8. Late Fees

Credit card companies often charge a late fee if you don’t make your card payment on time. Late fees are a one-time charge that typically costs between $25 and $40.

It’s recommended to put credit card bills on autopay or set calendar reminders so you always pay on time. Still, accidents happen.

A quick call to your credit card issuer can often get this fee removed, especially if it’s a first-time offense. Some companies are more strict, however, and might refuse to waive the fee.

But the best way to avoid these fees is to (obviously) pay on time. My advice? You can set a calendar reminder so you always know to pay your bill on time. Or set up autopay to at least cover the minimum charge you’d face each month (and manually go into your account to pay off greater amounts as you can).

Related: 7 Best Fidelity ETFs for 2024 [Invest Tactically]

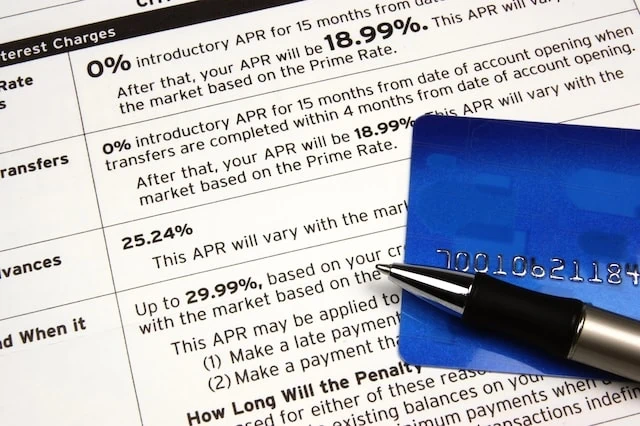

9. Credit Card Interest

Just about every credit card charges you interest on purchases—at some point.

The interest on a card is expressed through annual percentage rate (APR). You can use this APR to determine how much you’ll be charged in interest every year as a percentage of the balance you hold. And while many credit cards will offer a 0% introductory APR when you first sign up, eventually, you’ll be held to that rate.

The easiest way to avoid paying interest is to pay your full balance on time every month. If you do that, you’ll never be charged any interest.

However, if you pay less than the full balance, you’ll be charged interest. Depending on the source, the average credit card APR right now sits between 22% and 28%. You’ll also be charged interest if you pay the full balance late, though if you usually make on-time payments, you can call your credit card company to see if they’ll waive the interest.

Related: The 7 Best Dividend ETFs [Get Income + Diversify]

10. Inactivity Fee

“Well, I won’t rack up any fees if I just leave my credit card in a drawer!” Wrong, my friend. Let’s say you have an emergency credit card you haven’t touched in a year or more—you might get hit with an inactivity fee (or inactive account fee). Sometimes the fee only applies to cards that carry a balance, but it can even be added on some cards without a balance.

Some people avoid this fee by making an infrequently used credit card the payment method for one annual subscription—so that way you’re using it at least once per year.

It’s worth seriously considering this option: Cards that are inactive for very long periods might be canceled by the credit card company altogether. And especially if it’s one of your earlier or larger lines of credit, having that card shut down could negatively impact your credit score.

Related: 60 Personal Finance Statistics You Might Not Know (But Should!)

11. Balance Transfer Fees

Sometimes people transfer an outstanding balance from one credit card to a different one to take advantage of a lower APR. But when you make that move, you could be hit with a balance transfer fee.

This fee is relatively easy to get around. Credit cards occasionally have promotions where they’ll allow customers to execute free balance transfers. Even outside of a promotional period, you might be able to find a new card offering a $0 introductory balance transfer fee. Just read the fine print: You don’t want to sign up for a card for the beneficial balance transfer fee alone, only to find out it charges a host of other fees.

Related: How to Get Free Stocks for Signing Up: 10 Apps w/Free Shares

12. Cash Advance Fees

Most card companies allow you to withdraw cash by using your credit card—a transaction known as a cash advance. However, not only will you incur cash advance fees for this kind of transaction, but you’ll also be charged interest on the withdrawn money, the interest will typically begin accruing immediately, and the rate you’ll be charged will usually be higher than the rate charged on regular purchases.

We never recommend getting a cash advance except in an emergency, just given how high the financial penalties are. You’re better off withdrawing money from an ATM, getting cash back from a store, or borrowing money from your savings account or emergency fund.

Related: 11 Best Alternative Investments [Options to Consider]

Read the Fine Print, Weigh Fees Against Account Perks and Your Behaviors

Before you open your next credit card or bank account, read the terms closely to make sure you understand all possible fees you will or might incur.

If a bank or card charges a monthly or annual fee, see if the price will actually be worth the perks. And try to avoid usage fees on transactions you’ll complete frequently—if you travel internationally often, for instance, you’ll want to avoid a credit card with foreign transaction fees.

Related: Stop Shrinkflation! 10 Products Affected + Tips to Save Money

Shrinkflation is the deceptive practice of making products smaller instead of raising costs to cover any rise in the cost of producing that product. We cover several examples of shrinkflation and tips to save money.

Related: The Best Fidelity ETFs for 2024 [Invest Tactically]

If you’re looking to build a diversified, low-cost portfolio of funds, Fidelity’s got a great lineup of ETFs that you need to see.

In addition to the greatest hits offered by most fund providers (e.g., S&P 500 index fund, total market index funds, and the like), they also offer specific funds that cover very niche investment ideas you might want to explore.

Related: 9 Best Monthly Dividend Stocks for Frequent, Regular Income

The vast majority of American dividend stocks pay regular, reliable payouts—and they do so at a more frequent clip (quarterly) than dividend stocks in most other countries (typically every six months or year).

Still, if you’ve ever thought to yourself, “it’d sure be nice to collect these dividends more often,” you don’t have to look far. While they’re not terribly common, American exchanges boast dozens of monthly dividend stocks.

Please Don’t Forget to Like, Follow and Comment

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Subscribe to The Weekend Tea, our weekly newsletter to read more about investing, spending, taxes, and more, and

3. Give the article a Thumbs Up on the top-left side of the screen.

4. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!