The average American, I’m sorry to say, isn’t saving enough money.

In some cases, it’s a matter of means—sadly, many adults are only able to live paycheck-to-paycheck. However, many others have the means but simply need a little help with financial structure and discipline … and that’s where automatic savings apps and savings accounts can be a difference-maker.

Americans are at least able to save more than they used to. The percentage of American adults who could cover a small $400 emergency with cash or cash equivalents is 68%—the highest it has been since the Federal Reserve began surveying adults on the matter in 2013.

However, bigger emergencies are a less inspiring story. According to a YouGov survey, roughly half of Americans have less than $5,000 in savings, 40% have less than $1,000 in savings, and 12% have no savings at all.

If you find yourself in one of these “not enough saved” boats, don’t despair. All you might need is a shove in the right direction—and a helping hand.

Today, I’m going to introduce you to several money-saving apps and accounts. These products all boast automated savings features that allow you to save without thinking about it. And in many cases, they also have features that can actually accelerate your saving.

First, I’ll dive into today’s best money-saving apps and savings accounts so you can compare and contrast their automated savings features and pick the right one for you. Then I’ll answer a number of questions related to these apps and saving in general.

Automatic Savings Tools—Our Top Picks

|

Primary Rating:

4.6

|

Primary Rating:

3.6

|

Primary Rating:

4.1

|

|

No-commission equity trading. Robinhood Gold: Free 30-day trial, then $5/mo.

|

Personal: $3/mo. Personal Plus: $5/mo. Premium: $9/mo.

|

Free (no monthly fees).

|

The Best Automatic Savings Apps + Savings Accounts

Below are my top choices for apps and/or savings accounts that allow you to automatically save.

1. Robinhood Cash Management (Best for APY on Round-Ups)

- Function(s): Saving, spending, investing

- Available: Sign up here

Robinhood is best known for entering the market over a decade ago and changing the retail brokerage market by eliminating trading commissions on stocks and exchange-traded funds (ETFs). Lowering this hurdle brought down the cost of investing for small investors and by extension gave broader access to the stock market than any point in history.

The company continued to add features to its stock trading app that give their customers the power to earn on their money. One such product is the Robinhood Gold Cash Sweep account, a way to earn up to 4% on your idle cash and do so while enjoying up to $2.25m in FDIC-coverage on your money held there. That amounts to many multiples more than what the average savings account pays and they’re even sweetening the deal with a promotional unlimited 1% deposit boost bonus. (Editor’s Note: Getting this APY rate and deposit bonus requires enrolling in a Robinhood Gold subscription for $5 per month after a free 30-day trial.)

But what’s even better isn’t just earning this competitive APY, is pairing it with Robinhood’s Round-Ups. You can round up your Robinhood Cash card transactions to the next dollar, and set aside the spare change to invest in your choice of stock, ETF, crypto, or brokerage cash balance to earn interest. Your round-ups will deposit each week.

After you’ve turned on round-ups and selected an investment, Robinhood will automatically round up completed eligible transactions to the nearest dollar, and set aside the rounded-up change in your spending account. (If you’re not yet ready to invest in a stock, ETF, or crypto, you can select brokerage cash as your round-up option. Your weekly round-ups total will go into your brokerage cash balance and earn interest via the brokerage cash sweep program.)

So, if you’re looking for a place to stash your cash with a healthy yield with the added boost of Round-Ups and also with the flexibility to invest it in the market, consider opening a Robinhood account, funding it and earning interest on your automatic savings. On top of the competitive interest rate and deposit boost bonus, they also offer free stock for opening and funding an investment account.

- Robinhood is a pioneer in the investing app world, offering commission-free trades on stocks, ETFs, options, and cryptocurrency, as well as one of the deepest libraries of investing educational content.

- Investing for retirement? Robinhood will match 1% of any IRA transfers or 401(k) rollovers, as well as any annual contributions*, made to your Robinhood Retirement account—and you can get a 3% match on any new contributions if you subscribe to Robinhood Gold.

- Want more advanced trading tools? Download Robinhoold Legend—a desktop trading platform with real-time data, customizable layouts, deeper asset analysis, and more—for free.

- Robinhood Gold also includes Level II market data provided by Nasdaq, higher interest rates on uninvested brokerage cash, lower margin trading rates, bigger Instant Deposits, and access to the Robinhood Gold Card (a 3% cash-back Visa credit card).

- Special offer: Sign up for Robinhood, link a bank account, and fund your account with at least $10, and receive a randomly selected cash amount between $5 and $200 to put toward certain fractional shares.

- Very good selection of available investments in brokerage accounts

- 1% match on rollovers, IRA transfers, and new contributions to IRAs and Roth IRAs (3% new-contribution match with Robinhood Gold)

- Automated recommended portfolios

- Intuitive interface

- Extensive educational library

- No mutual funds in brokerage or IRAs

- No robo-advisor functionality

2. Acorns (Best for Using Round-Ups to Invest)

- Function(s): Saving, spending, investing

- Available: Sign up here

Acorns is an investing app geared toward minors, young adults, and millennials, that pioneered round-up capabilities. Acorns’ Round-Ups feature rounds up purchases made on linked debit and credit cards to the nearest dollar, investing the difference on your behalf. On average, Acorns users invest over $30 each month from Round-Ups.

With Acorns, once your Round-Ups reach at least $5, they can be swept into your Acorns Invest account. You can choose to round up manually, deciding which transactions will be invested, or use Automatic Round-Ups to simplify the process. And if you have Automatic Round-Ups selected, these Real-Time Round-Ups will be invested as soon as your transaction clears.

Want to save faster? Take advantage of Round-Ups Multiplier, which lets you choose to multiply the amount that would normally be rounded up by 2x, 3x, or 10x. You can turn Multiplier on and off whenever you want.

Not sure what to do if the transaction is an even dollar amount? (Say, $1.00 or $2.00.) Whole-Dollar Round-Ups let you select how much to round up whenever this happens.

The Acorns investment account itself is an automated platform that uses pre-built portfolios of exchange-traded funds (ETFs) to keep investors exposed to stocks and bonds—ideal for younger, less experienced investors, as well as people who just want to keep things simple. Learn more or sign up today.

- Acorns allows you to sign up for investment, retirement, and checking accounts for you and your family, learn how to earn more money, and grow your investing knowledge.

- Famous for investing spare change automatically through Round-Ups, this all-in-one financial app helps younger generations start investing earlier.

- Invest in expert-built portfolios made up of diversified ETFs.

- New Premium tier includes perks such as live Q&As with financial experts, a 50% match on Acorns Earn rewards (up to $200/mo.), $10,000 in life insurance, and the ability to pick individual stocks for their portfolios.

- Earn even more with Later Match: Acorns will match up to 1% (Personal Plus) or 3% (Premium) of all new IRA contributions.

- Special offer: Get $20 to start*.

- Robo-advisor with affordable fees (on larger portfolios)

- Fixed fee model

- Round-ups

- FDIC/SIPC insurance

- IRA match (Personal Plus and Premium)

- High fixed fees for small balances

- Limited investment selections

- Must subscribe to Premium for any self-directed investing options

Related: How to Invest as a Teenager [Start Investing as a Minor Under 18]

3. Greenlight (Best Investment Account With Parental Controls)

- Function(s): Saving, spending, investing

- Available: Sign up here

Greenlight, through its Max and Infinity plans, is an investment account for kids that comes paired with a debit card and bank account. It’s easy to use, it allows your child to spend and save, and it can teach your kid the basics of banking and investing.

Greenlight offers a number of Savings Boosts, such as savings rewards and cash back to savings. Another Savings Boost? Round Ups, which allows change from transactions to be funneled into your savings. You can have Round Ups set to always round up, never round up, or ask you before transferring.

A few features of the investing account:

- Start investing with as little as $1 in your account.

- Buy fractional shares of companies you admire (kid-friendly stocks).

- No trading commissions beyond the monthly subscription fee.

- Kids can only invest in stocks and ETFs with a market capitalization over $1 billion.

- Parents must approve every trade directly in the app.

Consider opening a Greenlight Max or Infinity account to start investing today.

- Greenlight offers flexible parental controls for each child and real-time notifications of each transaction.

- Greenlight is the only debit card letting you choose the exact stores where kids can spend on the card.

- Parents can use this app to teach them how to invest with a brokerage account through Greenlight Max and Greenlight Infinity plans

- Best-in-class parental controls (can prohibit specific stores)

- Can add brokerage account to invest in stocks

- Intuitive Parent and Kid apps

- Competitive cash back and interest rates

- High price points

- No cash reload options

- No parent / child lending

Related: How to Invest Money: 5 Steps to Start Investing w/Little Money

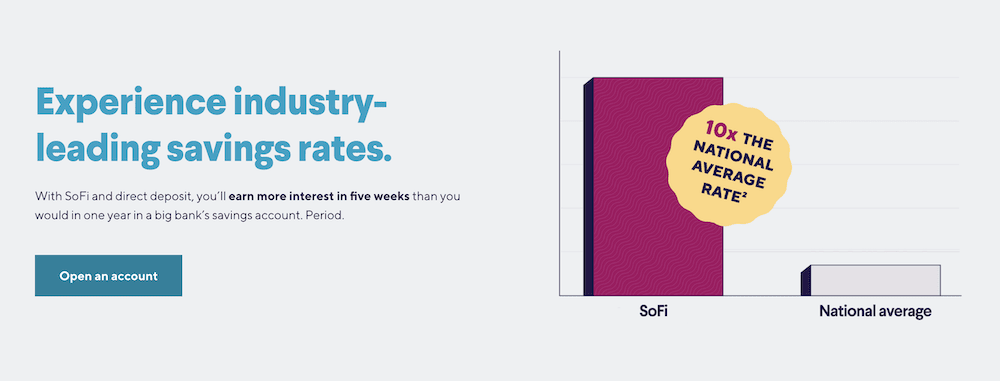

4. SoFi® Checking and Savings Account

- Function(s): Saving, spending, investing (through SoFi Invest®)

- Available: Sign up here

The SoFi Checking and Savings Account sounds like your run-of-the-mill bank account, but it’s more: It’s also a high-yield savings account that earns 10 times the national average percentage yield (APY) and more than the average high-yield account. Better still, it boosts your ability to save right off the bat by rewarding you with $50 to $300 upon sign-up.

SoFi allows you to organize your money by setting up Vaults, earmarked savings goals you can set up within your SoFi savings account. With these, you can enable Roundups, a way to help you save automatically—every time you spend using your SoFi debit card. If you enable Roundups, each purchase on your SoFi Money debit card will be rounded up to the next whole dollar. That amount will automatically be transferred from your spending balance to the Vault of your choice.

Sofi Checking and Savings covers all of the basics: No monthly account fees, no minimum balances, and website and mobile app access. But it also has several perks that match or top the competition.

- SoFi's Checking and Savings Account is a free, no-monthly fee account that offers an above-average yield on the savings side, and up to 15% cash back when using your checking account's debit card.

- SoFi's high-yield savings account currently pays 4.30% APY, which is 10x the national average savings rate, and higher than the average high-yield rate.

- Available FDIC insurance of up to $2 million is 8x the typical insured amount at most financial institutions.*

- Round up debit card purchases, and the excess is automatically sent to your savings Vault.

- Special Offer: If you set up a qualifying direct deposit within the promotion period, you can earn up to a $300 cash bonus.**

- No account fees

- Above-average yield (4.60% APY) on its high-yield savings account

- Offers up to $50 of overdraft coverage with minimum monthly direct deposits in place

- Round-ups

- Up to $2 million in FDIC insurance

- Not as competitive yield as other banking institutions

- High direct deposit threshold for maximum cash bonus

5. Current Bank (High-Powered Banking App)

- Function(s): Saving, spending

- Available: Sign up here

Current provides a wide range of banking services, as well as financial tools and other perks that set it apart from traditional accounts.

Among Current’s most popular features are Savings Pods. Each Current account comes with three Savings Pods, which are like digital envelope savings plans, or like having multiple savings accounts. Most people have more than one savings goal—and Savings Pods allow you to choose how much you want to allocate toward each goal.

Current’s Round-Ups feature allows you to automatically send digital “change” into the Savings Pod of your choice. But note that you can’t use Round-Ups for multiple Savings Pods—the feature can only be enabled for one Pod at a time.

Current offers a high APY on the first $2,000 in each of your three Savings Pods, though the APY on additional balances is close to the national average for all (not just high-yield) savings accounts. Other features include no fees for overdrafts under $200, faster paydays with direct deposit, and points that you can redeem for cash back in your account.

- Current is a financial technology platform that lets teens enjoy not just traditional banking basics, but numerous features meant to simplify spending, streamline saving, and set them on the path toward more organized finances.

- Teens can spend with the Current Visa debit card, which allows them to purchase in-store and online, as well as withdraw money fee-free from more than 40,000 in-network Allpoint ATMs.

- Current Teen Accounts also come with Savings Pods, which earn 0.25% APY and allow you to round up purchases (overages are funneled into your savings).

- Parents can monitor their kids' spending, adjust maximum ATM withdrawal and spending limits, and even toggle spending categories (and the Current debit card itself) on and off.

- Parents can also automate allowance payments, pay for chores, instantly transfer money to their teens, and more.

- Free account (no monthly maintenance fees)

- Good parental controls

- Fee-free ATMs

- Cash reloads

- Gas hold deposits

- 24/7 email and live-chat support

- No direct deposit

- No paired investment account

- No card customization

Related: How to Invest Money: 5 Steps to Start Investing w/Little Money

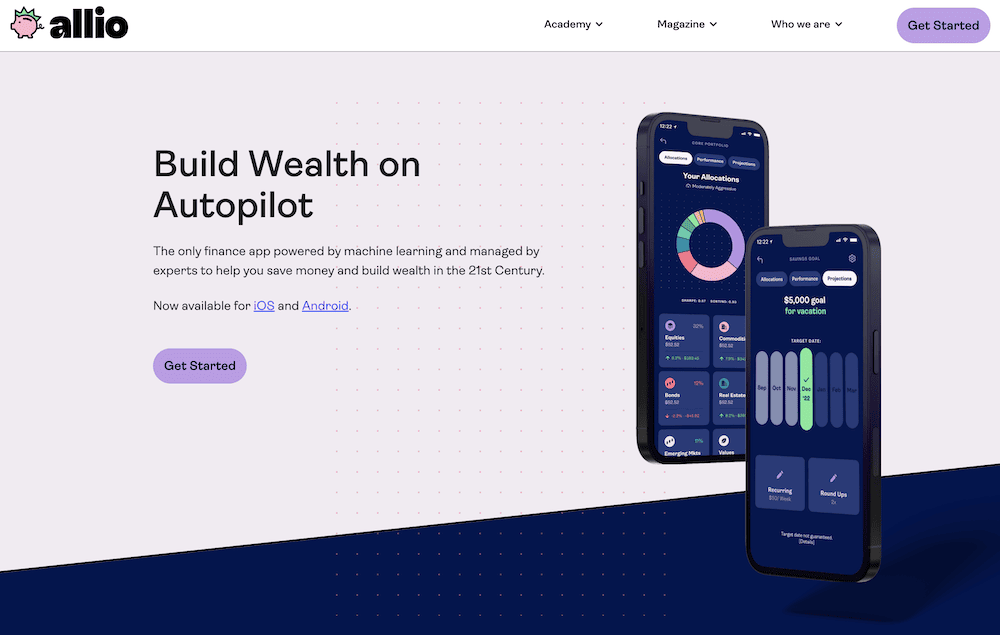

6. Allio Finance (Automatically Save Toward Retirement)

- Function(s): Saving, spending

- Available: Sign up here

Allio Finance, which bills itself as “the only finance app powered by machine learning and managed by experts” is an automatic savings app, but one that focuses on meeting savings needs by investing. When you set up your account, you choose some sort of savings goal—a house down payment, vacation, etc. Allio will assess your risk, then it will construct a portfolio to reach that goal and provide you with an estimate of when you should expect to reach that goal.

The automatic savings component of Allio, like with many of these apps, comes with round-ups. When you determine how you want to fund your portfolio, you can select round-ups as one of the options. Once you link an account, any spare change from purchases using that account will be diverted into your Allio account. Allio also has a multiplier, so you can decide to double or triple any spare change from purchases. Just note that Allio won’t invest that money until you’ve reached $10 worth of round-ups.

Allio is not self-directed—that is, you can’t choose individual stocks or funds. Instead, Allio uses human experts and machine learning to create “institutional-grade” (read: complex) portfolios made up of ETFs. To Allio’s credit, these portfolios include many more asset classes than most similar crafted-portfolio services. In addition to stocks and bonds, Allio’s portfolios include alternative investments such as real estate, gold, and cryptocurrency.

Allio has one of the more curious price structures among investment apps. Rather than subscription tiers, instead, you pay monthly fees for various options. For instance:

- Core Portfolio ($1/mo.): Invest in Allio’s Core Portfolio.

- Allio Impact Funds ($1/mo. each): Allio offers proprietary impact investment funds that target themes such as clean energy made-in-America goods, animal welfare, and more.

- Holistic Account View ($1/mo., first month free): This feature turns Allio into a basic net-worth tracker that allows you to view all of your investment accounts from one dashboard.

- Unlimited Savings Goals ($1/mo.): Set as many goals as you’d like.

And if your account balance is over $10,000, you pay nothing for all of the above features.

If you want to invest without thinking about it, you can also set up recurring deposits. Also note that Allio has no required account minimums.

- Allio Finance uses both human experts and machine learning to optimize your investments so you can reach your savings goals faster without taking on unnecessary risk.

- Allio's pricing structure ensures you pay only for what you want. Whether you invest in Allio's Core Portfolio or Impact Funds, get a holistic view of your accounts, and/or set unlimited savings goals, it costs you $1 per month ... and all of these options are free if you invest more than $10,000 with Allio.

- Round-ups help you fund your account with spare change. Accelerate your savings with the multiplier feature, which lets you double or triple your round-ups.

- Curated portfolios invest in more types of assets than competitors

- Round-ups

- All fees waived if you invest $10,000 or more

- SIPC insurance

- High fees compared to other savings apps

- No self-directed investing

Related: 7 Best Teen Checking Accounts [Bank Accounts for Teenagers]

7. Chime Bank (Smart, Free Online Banking)

- Function(s): Saving, spending

- Available: Sign up here

Chime was created with the idea that basic banking services should be easy and free. Thus, users aren’t charged service fees, overdraft fees, or foreign transaction fees. Chime customers also have access to more than 60,000 fee-free ATMs nationwide, enjoy 24/7 live support, and they can get paid up to two days earlier if they set up direct deposit.

When you open a Chime checking account, you can choose to enroll in savings, too. Chime’s high-yield savings account boasts an average annual percentage yield (APY) that’s several times higher than the national savings account yield.

Chime makes it easy to save by automatically depositing money from every paycheck into your savings account. Simply select the amount you want to save each month, and let Chime do the rest.

With Chime’s Save When You Spend feature, round-ups from your Chime Visa Debit Card are automatically transferred from your checking account into your savings account, helping you put that high yield to work more quickly.

- Chime banking is a financial technology platform that charges no monthly, transaction, or overdraft fees, requires no minimum balance, and offers access to more than 60,000 fee-free ATMs.

- Build your credit with Chime's no-fee Visa secured credit card.

- High-yield savings account currently offers 2.00% APY and provides automated saving services.

- Chime's Save When You Spend feature automatically rounds up transactions to the nearest dollar and funnels those round-ups into the Automatic Savings Account app.

- Age requirement: 18 or older

- Access to 60,000-plus fee-free ATMs

- Round-ups

- Get paid early on direct deposit paychecks

- FDIC insurance

- No physical branches

- Must sign up for direct deposit to use mobile check deposit service

- Savings APY lower than typical high-yield savings account

Related: 7 Best Step Alternatives [Apps Like Step Banking]

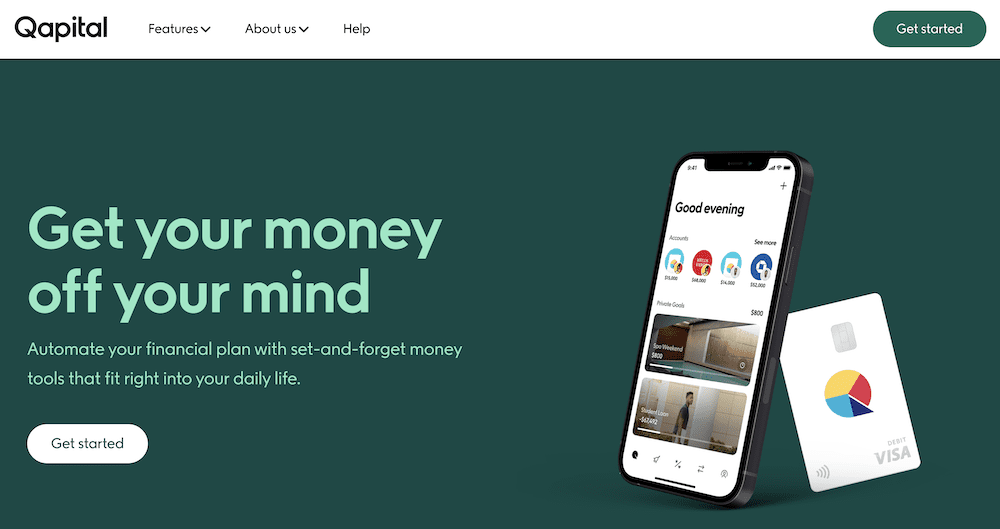

8. Qapital (Customizable Savings App With Round-Ups)

- Function(s): Saving, spending, investing

- Available: Sign up here

Qapital is a highly customizable savings app that pulls money from an existing checking account you connect with the app.

Qapital has one of the more flexible round-up programs. Like with most programs, when you make a purchase with an account that its “Round-Up Rule” is applied to, Qapital will deposit the spare change into one of your Goals (investment or savings).

However, unlike most programs, you don’t just have to round up to the nearest dollar—you can round up even higher. So, let’s say you selected $4 for your Round Up Rule amount: If you spent $5.50 on a coffee, the purchase wouldn’t be rounded up to $6—it would be rounded up to $9! And whole-dollar amounts are always rounded up to your Round Up Rule amount; if it’s set to $2 and you spend $1, you’ll be charged $3 and a full $2 will be saved toward your goal.

You can save in other ways, too. For instance, you can set Qapital to save a dollar every time you go for a jog, or five bucks every time you go to a baseball game.

People who want to incorporate Qapital further into their financial lives can sign up for the Qapital Visa Debit Card and spending account. The fee-free card provides no-fee access to more than 55,000 ATMs, and is compatible with Apple Pay, Google Pay, and Samsung Pay. It offers round-ups, too, as well as money management features such as Spending Sweet Spot and Money Missions.

When you’ve reached a certain savings goal, you can cash it out through the debit card, or through one of your bank accounts.

If you prefer to invest with your round-ups, you can pick from several pre-built portfolios—from very conservative (90% bonds, 10% stocks) to very aggressive (10% bonds, 90% stocks).

- Qapital is a personal finance app that automates many common decisions for individuals and couples, allowing you to focus elsewhere.

- The app provides tips rooted in behavioral psychology to supercharge your savings, reduce your debt and invest in your future.

- The service claims to help Premier users save an average of $5,000 per year.

- Automates personal finance decisions

- Can manage finances jointly with a significant other

- Offers free investment plans (no AUM fees)

- FDIC/SIPC insurance

- Can only invest with Complete or Premier

- Only receive a Visa debit card with Complete or Premier

- Low interest rate on Qapital Spending Account

Related: 8 Best Personal Capital Alternatives

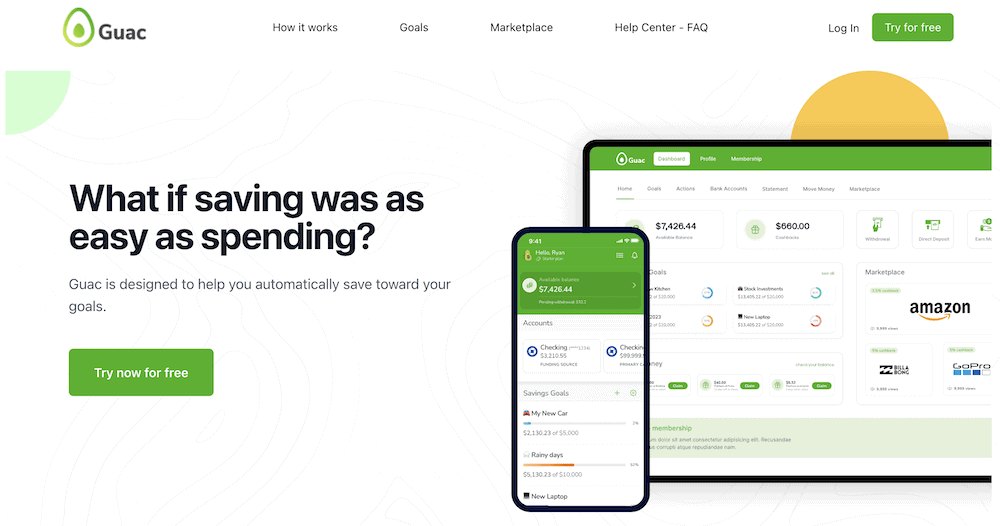

9. Guac (Automated Savings App With “Tips”)

- Function(s): Saving, spending

- Available: Sign up here

Guac is a straightforward savings app that helps you set goals, save toward them, and track your progress along the way. Simply create a goal, set the dollar amount you want to reach, even add a photo to remind yourself what you’re saving toward, and Guac will set you on the path toward achieving that goal.

Guac’s main savings feature is “tipping,” which has a similar thrust as round-ups. When you link a debit or credit card, you can determine how much you’d like to tip yourself every time you make a purchase. Then, when you buy something, Guac automatically pulls the tip from your linked account and puts it toward your Guac savings.

Users can also earn cash-back rewards when they shop through Guac’s marketplace. The “Guac Double Dip” allows you to earn double the cash-back rewards with any of Guac’s partners.

Other features include access to real-time credit scores, opportunities to improve your credit (albeit via access to personal loans), and gift cards with bonuses of up to 20%. Guac also offers protection against overdrafts and up to $250,000 in FDIC insurance.

All of the above is available in the Green plan, a no-subscription-fee tier that does charge a 1.5% transaction fee on tips. However, you can also upgrade to Gold, which costs $4.99 per month. Gold allows you to move your Guac balance back to your bank with same-day transfers for free, whereas Starter members must wait one to two business days or pay a 1.5% fee for same-day transfers. Gold also allows you to link a credit card for tips instead of linking your bank through Plaid, and it can support tips on more than one card; Starter users can only link tips to one card.

One aspect of Guac that I strongly hope they improve is the app’s frequently asked questions (FAQs) section. It’s the first time I’ve ever seen FAQs answered in video format only—no text answers! This hardly cripples the app, but it could be a source of extreme annoyance as you’re trying to get started.

- Guac helps you set goals, save toward them, and track your progress along the way.

- Put money toward savings every time you spend through Guac's "tipping" feature.

- Earn 2x cash-back rewards when you shop through Guac's marketplace.

- "Tipping" feature

- FDIC insurance

- Thin features for paid Pro tier

- Worst-in-class FAQ section

Related: Best GoHenry Alternatives [Debit Cards Like GoHenry]

What Is an Automatic Savings App?

An automated savings app, whether it’s connected to a traditional savings account or a financial technology product, helps you save without any extra effort. Once you get everything set up, you just relax and watch your savings grow.

How Do Automatic Savings Apps and Accounts Work?

The exact way you save money might differ depending on the app or savings account you’re using. For instance, you might have automatic transfers of money that flow from your checking account to a savings account. You might have money deposited in your account every time you shop thanks to round-ups, cash-back, or other rewards. The common thread here is that you go about your day as normal, but you save more than you used to save.

Should I Use an Automatic Savings App or Savings Account?

As a general rule, yes. I think most people could benefit from the savings simplicity of an automatic savings app. If you’re already a savings pro, you probably don’t need these apps, per se, but you can still benefit from high APYs, savings matches, and other perks. But the prime candidates for these products are people who aren’t saving as much money as they wish they were.

Features to Look for in Automatic Savings Apps and Accounts

Round-Ups or Tipping

Round-ups, or the ability to “tip” yourself with every purchase, are simple ways to incrementally save. Also, they have the fringe benefit of making you feel slightly less guilty about your purchases given that you’re simultaneously saving.

Recurring Transfers

One of the fastest and easiest ways to save is to set up recurring transfers. That’s when you either have your paychecks automatically transferred into a savings account (or similar account), or have money regularly transferred into savings from a linked bank account.

High APY or Savings Match

The higher the annual percentage yield (APY) of an account, the more money your savings can passively earn. You typically won’t get much of a yield from a traditional savings account, but high-yield savings accounts and some financial apps offer high APYs. Some products will instead (or also) offer a savings match, usually up to a certain dollar amount of savings, which can motivate you to save more.

Cash Back

If you’re shopping anyway, you might as well earn a little money while you’re at it. Cash-back rewards return a certain portion of your purchase price—in some cases, directly into a savings account. Cash-back rewards vary widely by size and type of expenditure, so you’ll want to look around to find the program that will benefit you the most.

Investment Options

Some automatic savings apps put your money in an interest-bearing account, but others deposit that money into an investment account. If you’re interested in investing, but have struggled to put aside money for investing or even haven’t yet opened a brokerage account, a savings account that comes with an investment account could be a great fit for you.

Low or No Fees

Try to choose money-saving apps with little to no fees. Monthly, account minimum, overdraft, and other fees can cut into your ability to save.

Multiple Accounts

Sometimes it can be tough to save when all of your money is flowing in and out of a single account, especially if it’s a checking account. It’s too easy to spend money you planned on saving when it’s coming out of the bucket you usually spend from. At a minimum, you want an app or bank that offers multiple accounts or “buckets”—preferably, at least separate spending and savings accounts so you can silo away money meant for later.

Debit Cards

So, a standard debit card won’t help you with saving money. However, some of the automatic savings apps mentioned above have feature-packed debit cards that will help with your savings efforts. Debit cards that offer round-ups, cash-back, or other rewards are a great way to save.

Automatic Savings Apps: Frequently Asked Questions (FAQs)

Can you automate savings?

Yes. You can and should automate at least some of your savings. Many financial apps and some banks often allow you to set up regular transfers of money into savings. They might also come with features such as round-ups that automatically save for you anytime you make a purchase.

What is the way to auto-save money?

You can auto-save money in a few ways.

One common way is to set up recurring transfers from a checking account to a savings account or other interest-bearing bank account.

Another way is to use a money-saving app. These apps can automatically help you save cash through round-ups, cash-back rewards, savings matches, and more. The more savings features you opt into, the more you can save.

Do savings apps work?

Savings apps are a great tool, but depending on the app and the amount of effort you put in, results will vary.

For instance, some apps save you money by rounding up your purchases and sending the spare change to a savings account. The more frequently someone makes purchases with a linked card, the more money is set aside. If you don’t use the card often, you won’t save as much.

Similarly, the more money you have in a high-interest account, the more you will save. The more often and the higher the dollar amount of automatic transfers, the faster one’s savings will accumulate.

And if the savings app is connected with a spending account, you should use the app to analyze your spending and income patterns so you can better understand when you make good (or bad) decisions.

Lastly, you have to be dedicated to saving to some degree. If you frequently pull money out of your savings account to spend on things you don’t need, you can’t blame the app.

How can I trick myself to save money?

Saving money can be difficult. Maybe you think you don’t have extra money to spare, or maybe you’re just forgetful about socking away a few dollars. The good news is, that by putting your savings on autopilot, you’re essentially “tricking” yourself into saving.

Are savings apps safe?

Some people find it comforting to handle all of their finances through banks with physical locations, such as Bank of America or JPMorgan Chase. However, fintech companies without brick-and-mortar buildings can keep your money just as safe—you just need to ensure they have the right protections in place.

For instance, you’ll want to see security features such as encryption technology, secure login, biometric authentication. You’ll also want to make sure your account is insured by the FDIC, National Credit Union Administration (NCUA) or SIPC.

![How to Open a Security Deposit Account [Hold Rent Deposits] 53 How to Open Security Deposit Account](https://wealthup.com/wp-content/uploads/How-to-Open-Security-Deposit-Account-600x403.webp)

![7 Best Debit Cards for Teens [Reviewed by a CPA + Father] 54 best debit cards for teens hires](https://wealthup.com/wp-content/uploads/best-debit-cards-for-teens-hires-600x403.webp)