“Stocks go up” isn’t the only way to get ahead in the market. Thank goodness, because stocks don’t always go up.

Dividend stocks generate another type of return, paying a portion of their profits directly to shareholders in the form of, well … dividends. This extra income helps boost your overall return in good times when stocks are heading higher, and they help to reduce portfolio losses when the stock market slips up.

Like with any kind of stock, you can choose to pick individual winners among dividend stocks. But if you want to lessen your research burden while also diversifying across dozens or hundreds of stocks, you can just buy dividend ETFs instead.

Here are some of the best dividend ETFs you can buy. I’ll give you a quick primer on dividend stocks, discuss why you might want to buy dividend funds to get exposure to these stocks, and list what I believe are some of the best dividend ETFs you can own right now.

Disclaimer: This article does not constitute individualized investment advice. These funds appear for your consideration and not as personalized investment recommendations. Act at your own discretion.

Editor’s Note: Tabular data presented in this article are up-to-date as of Sept. 3, 2025.

Featured Financial Products

Table of Contents

What Is a Dividend Stock?

A dividend is a cash payment from a company to shareholders. Companies that regularly provide these cash payments are referred to as dividend stocks.

Often, investors favor dividend stocks because, to regularly pay out those dividends, they have to generate consistent and significant profits—a good sign that the company is financially healthy and well-managed.

Why Invest in Dividend Stocks via ETFs?

As a group, dividend stocks are pretty common, but they’re not created equally. Some companies only pay nominal dividends that are just a penny or two per share, with no prospect for dividend growth anytime soon. Others may offer generous but unsustainable dividend payouts that might be eliminated altogether in the future.

That’s why exchange-traded funds are a good alternative to individual dividend stocks. ETFs spread your money around, rather than force you to rely on one company’s specific strengths and weaknesses.

And finding the best stocks capable of consistently paying dividends and enjoying significant future dividend growth can be a daunting task, even for seasoned investors. So instead, why not try to gain exposure to dividend-paying stocks via a single, diversified holding that’s tasked with finding great companies for you?

That’s what the best dividend ETFs have to offer.

Dividend Yields, Explained

A term you’re going to want to familiarize yourself with is dividend yield.

A dividend yield tells you how much of your investment you can expect to get back in the form of dividends. A stock’s dividend yield, for instance, is calculated on an annualized basis, and expressed as a percentage of share price. Example: If a stock trades for $200 and pays $1 per quarter, that’s $4.00 in annual payouts—or 2.0% of the share price. So its dividend yield is 2.0%. Pretty easy.

But a fund’s dividend yield is calculated a little differently. It’s much more difficult to estimate future payouts for an ETF or mutual fund because they own groups of many different stocks paying on changing cycles.

The fairest way to measure yield in dividend ETFs and mutual funds is to calculate the distributions over the last calendar year. Dividends might change for these funds going forward, but a trailing 12-month look is the most faithful way to calculate yield.

Related: 10 Best Stock Advisor Websites & Services to Seize Alpha

What Is Yield on Cost?

When you look up an ETF’s information, the dividend yield listed is based on the past year’s worth of dividend payments and the current ETF share price.

That yield is often very different than the one current ETF shareholders enjoy. That yield is called “yield on cost,” which is the payout based on what you said, at the moment you invested.”

Let’s say you buy an ETF at $100, and it pays $1 per share annually. It yields 1.0% when you buy it ($1 / $100 x 100 = 1.0%).

In a year, that ETF has doubled to $200 per share, but the dividends it pays also doubled, to $2 per share. If you look up its information, its dividend is still 1.0% ($2 / $200 x 100 = 1.0%).

That’s not your yield on cost, however. You’re still receiving that higher dividend of $2 per share. But your cost basis is still the original $100 you bought the ETF share at. So now, your yield on cost has doubled, to 2.0% ($2 / $100 * 100 = 2.0%)!

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

Our Favorite Dividend ETFs

Like with any investment, what constitutes the best ETFs for the yield-minded depends on the individual’s personal goals. There are many ways to invest for dividend income; the following list of options should provide something that fits in most portfolios.

Our best dividend ETFs are listed by yield, from smallest to largest.

1. Vanguard Dividend Appreciation ETF

— Assets under management: $93.1 billion*

— Dividend yield: 1.7%

— Expense ratio: 0.05%, or 50¢ per year on every $1,000 invested

The first few ETFs I’ll focus on probably won’t impress you with their current dividend yields, but they nonetheless warrant a serious once-over.

For instance, despite its sub-2% yield, the Vanguard Dividend Appreciation ETF (VIG) is the market’s largest dividend ETF by assets. While most dividend ETFs are attractive because of their current yields, VIG prioritizes dividend growth—so a low yield now, over time, should blossom into a higher yield on cost the longer you hold.

Related: 5 Best Vanguard Dividend Funds [Low-Cost Income]

But dividend growth isn’t just about reaping more cash over time; it’s also a sign of corporate-financial quality. If a company can regularly raise the level of cash distributions it makes to its shareholders, especially over the course of many years, that’s a strong statement about its financial durability through thick and thin.

This Vanguard index fund is benchmarked to the S&P U.S. Dividend Growers Index, which holds stocks that have consistently improved their payouts every year for at least 10 consecutive years. (Interestingly, the index excludes the 25% highest-yielding companies that would be eligible to be in the index.)

Currently, VIG holds roughly 340 top dividend stocks in the U.S., led by tech giants Broadcom (AVGO) and Microsoft (MSFT), mega-bank JPMorgan Chase (JPM), and Big Pharma name Eli Lilly (LLY). It’s also weighted by size, which means the bigger the stock, the more influence it has on the portfolio. For instance, this fund’s top five companies command more than 20% of the portfolio’s assets!

Vanguard Dividend Appreciation holds stable, decent-paying stocks, and provides access to them for one of the lowest annual expense ratios among dividend ETFs. It just doesn’t pay a high yield right now.

* Vanguard fund assets are spread across multiple share classes, including mutual funds and ETFs alike. Assets listed for each Vanguard ETF in this story are for the ETF share class only.

Related: The 9 Best Fidelity Index Funds to Buy for 2025

2. ProShares S&P 500 Aristocrats ETF

— Assets under management: $11.7 billion

— Dividend yield: 2.0%

— Expense ratio: 0.35%, or $3.50 per year on every $1,000 invested

Of course, there’s dividend growth, and there’s dividend growth. The ProShares S&P 500 Aristocrats ETF (NOBL) clearly falls into the latter.

This dividend ETF invests in the S&P 500 Dividend Aristocrats, which are an elite group of stocks that have upped the ante on their payouts for at least 25 consecutive years. How long is 25 years? That covers not just COVID and the 2020s’ pair of bear markets, but also the Global Financial Crisis of 2008 … and even the dot-com boom and bust in 1999-2000!

More impressive still? NOBL holds stocks that have raised their dividends for even longer periods of time, including a number of Dividend Kings that have hit the half-century mark.

Related: 8 Best-in-Class Bond Funds to Buy

“From an evergreen standpoint, companies that consistently grow their dividends are demonstrating quality,” says Simeon Hyman, global investment strategist at ProShares. “You can’t manufacture a dividend out of thin air. These companies have to be generating consistent earnings, consistent cash flow, have appropriate levels of leverage … and that comes through in spades. If you look at the Aristocrats, you’ll see things like better return on assets (RoA) compared to the S&P 500, and a whole host of other measures.”

In other words … the kinds of companies that have already proven many times that they can survive economic and market tumult.

This Dividend Aristocrats ETF has a tight portfolio of fewer than 70 holdings. And like with other dividend ETFs that mostly focus on payout growth, NOBL doesn’t offer a very large payday. Still, if you want to prioritize stability and consistency in your dividend payments, this fund is worth a look.

Related: 10 Best Dividend Stocks to Buy [Steady Eddies]

Featured Financial Products

3. iShares Core Dividend Growth ETF

— Assets under management: $33.7 billion

— Dividend yield: 2.1%

— Expense ratio: 0.08%, or 80¢ per year on every $1,000 invested

The iShares Core Dividend Growth ETF (DGRO) is another well-established and cost-effective dividend ETF. And like VIG, it is committed to dividend growth rather than dividend yield.

To be included in DGRO, companies must pay a qualified dividend, boast at least five years of uninterrupted annual dividend growth, and have an earnings payout ratio of less than 75%. (This last number means a company can spend no more than 75% of its profits to pay its dividends.) It also has another filter similar to VIG in that, prior to screening its available universe of stocks for dividend growth and payout ratio, it excludes the top 10% of dividend yields.

Related: 7 Best Schwab Index Funds for Thrifty Investors

Put more succinctly: DGRO tries to hold dividend growers that aren’t falling apart nor stretching to afford their distributions.

About 400 stocks make the cut, with the typical mega-cap names at the top of the list. That includes tech stocks like Apple (AAPL) that might not have particularly generous yields right now, but that are likely to bolster their payouts in the years to come, but also some more bountiful dividend growers like Johnson & Johnson (JNJ).

This ETF also doesn’t have a sky-high current dividend yield. However, investors who plan to buy and hold for many years could see the income payments grow significantly over time.

Related: The 7 Best Vanguard ETFs for 2025 [Build a Low-Cost Portfolio]

4. Utilities Select Sector SPDR Fund

— Assets under management: $21.0 billion

— Dividend yield: 2.7%

— Expense ratio: 0.08%, or 80¢ per year on every $1,000 invested

If you’re more concerned about high current yield rather than dividend growth, the rest of the funds on my list will be more to your taste.

Utility stocks’ appeal usually comes from their defensive nature. Even in the worst economic environments, Americans will cut down on virtually every other expenditure before they’d let their power go out or have their faucets run dry. That means pretty stable demand for utility companies, who aren’t usually a fount of growth, but are typically allowed to raise rates little by little over the years, and generally pay generous and rising dividends to boot.

However, of late, utilities have been juiced by a new growth driver: data centers and artificial intelligence. “Goldman Sachs Research forecasts global power demand from data centers will increase 50% by 2027 and by as much as 165% by the end of the decade (compared with 2023),” writes James Schneider, a senior equity research analyst covering U.S. telecom, digital infrastructure, and IT services.

Related: 8 Best Stock Picking Services, Subscriptions, Advisors & Sites

The best way to get this exposure is an oldie but a goodie: the Utilities Select Sector SPDR Fund (XLU). The XLU is an index fund that holds all utility-sector stocks in the S&P 500, which includes electric, gas, and water utilities; multi-utilities; and independent power and renewable electricity producers. Right now, that’s a roughly 30-stock set of names including NextEra Energy (NEE), Southern Co. (SO), and Constellation Energy (CEG).

Naturally, if you buy a sector ETF, you run the risk of the entire fund’s portfolio struggling if the sector itself falls on hard times. But in XLU, there’s also some significant single-stock risk—the aforementioned names account for more than a quarter of XLU’s weight, including almost 12% for NEE alone.

But you’re also receiving a bit of compensation in the form of above-average dividends. Utilities tend to be one of the highest-yielding sectors, and right now, SPDR’s utility ETF doles out more than twice the yield of the S&P 500.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

5. Schwab U.S. Dividend Equity ETF

— Assets under management: $72.6 billion

— Dividend yield: 3.7%

— Expense ratio: 0.06%, or 60¢ per year on every $1,000 invested

You might not want to put all of your chips into one sector. That’s OK—you can still get an above-average level of yield across several market sectors with high-yield dividend ETFs like the Schwab U.S. Dividend Equity ETF (SCHD).

While SCHD doesn’t explicitly target dividend growth, that doesn’t mean it’s throwing quality out the window. To be included in the fund’s tracking index, the Dow Jones U.S. Dividend 100, a company must have 10 consecutive years of dividend payments, have a float-adjusted market capitalization of at least $500 million, and meet minimum liquidity criteria. The index then selects stocks based on four metrics: cash flow to total debt, return on equity, dividend yield, and five-year growth rate.

Related: The 7 Best Gold ETFs You Can Buy

SCHD implements a few other controls to prevent excessive single-stock and even single-sector risk, including a modified market-cap weighting, a 4% weighting cap on individual stocks, and a 25% weighting cap on sectors. The index rebalanced quarterly to keep those portfolio caps tight, and its holdings are reviewed once a year.

The result is a basket of roughly 100 large-caps with pretty decent yields, including the likes of PepsiCo (PEP), Chevron (CVX), and Altria Group (MO). At the moment, the portfolio is heaviest in energy (19%), consumer staples (19%), and health care (15%)—historically dividend-friendly sectors.

Costs are about as low as you could want, too, at just 0.06%, making SCHD one of the cheapest high-dividend ETFs on offer.

Related: 10 Best Index Funds You Can Buy

6. Vanguard Real Estate ETF

— Assets under management: $33.5 billion

— Dividend yield: 3.8%

— Expense ratio: 0.13%, or $1.30 per year on every $1,000 invested

One of the best income-producing corners of the markets is real estate, and to tap the potential of properties, we’ll want one of the most popular Vanguard ETFs: the Vanguard Real Estate ETF (VNQ).

As the name implies, this dividend ETF is focused solely on real estate investment trusts (REITs) and related investments. So, the companies in this fund own all sorts of real estate—from office buildings and apartments to hotels and even driving ranges. Currently, top holdings include health care real estate giant Welltower (WELL), industrial property and warehouse owner Prologis (PLD), and telecom infrastructure company American Tower (AMT).

Related: 9 Best Real Estate Crowdfunding Sites + Platforms

Interestingly, the ETF’s largest allocation is to the Institutional Plus shares of the Vanguard Real Estate II Index Fund, which is itself a basket of REITs that’s extremely similar to VNQ.

REITs are required to pay out at least 90% of their profits to shareholders, which they do in exchange for favorable tax treatment. As a result, real estate tends to be one of the highest-yielding sectors; VNQ’s nearly 4% yield is more than triple that of the S&P 500.

And like with XLU, keep in mind that while this dividend ETF is highly diversified, at about 155 REITs, these businesses are in many ways interrelated. That means putting your money into this fund exposes you to any volatility from the real estate industry.

Related: 7 Best Banks for Real Estate Investors + Landlords

7. SPDR S&P Emerging Markets Dividend ETF

— Assets under management: $865.8 million

— Dividend yield: 4.4%

— Expense ratio: 0.49%, or $4.90 per year on every $1,000 invested

International investments are typically split into two categories: 1.) Developed markets (DMs), which are slower-growing but more established economies with highly regulated markets, little if any state ownership of businesses, and other trappings you’d expect from stable nations; and 2.) emerging markets (EMs), which are faster-growing but less established economies that may have less transparent markets, more state-owned companies, geopolitical unrest, and other characteristics you’d expect out of developing but less secure nations.

Investors generally look to developed markets for income and security, and emerging markets for growth. But that doesn’t mean EMs can’t deliver generous dividends.

Related: 7 Low- and Minimum Volatility ETFs for Peace of Mind

The SPDR S&P Emerging Markets Dividend ETF (EDIV) is a collection of the 100 emerging-market stocks with the highest risk-adjusted yields after meeting certain requirements, such as being profitable (by adjusted earnings per share) and paying stable or increasing dividends over a three-year period. Rather than by size, stocks are weighted based on their trailing 12-month dividend yield. But no stock can be weighted at greater than 3%, and no single country nor sector can be weighted at more than 25%.

Financials, which often feature prominently in EM funds, are the top weight at 30% of assets. Communication service and consumer staples enjoy double-digit weights, too. Meanwhile, the fund is heaviest in Taiwanese stocks (24%), with the rest scattered among roughly 15 other countries, including South Africa, Thailand, and Malaysia. China is decently represented at just 7% of assets, but that represents a swift demotion from more than 20% just a couple months prior.

Top holdings are quite different than your average emerging-market ETF. Right now, they include Thailand’s PTT Public Company Limited, Brazilian brewer Ambev (ABEV), and Saudi Telecom.

These companies fuel a generous 4%-plus dividend. But you should understand how you’re getting that dividend. Most ETFs’ distributions vary from one quarter to the next, but EDIV’s are particularly “lumpy.” Its four most recent dividends were 63.7¢, 28.7¢, 16.7¢, and 58.8¢.

Related: 5 Best AI ETFs for the Artificial Intelligence Era

8. iShares International Select Dividend ETF

— Assets under management: $5.8 billion

— Dividend yield: 4.9%

— Expense ratio: 0.49%, or $4.90 per year on every $1,000 invested

Right now, if you want a yield of 4% or more, it’s difficult to find that in dividend ETFs without looking overseas. Indeed, most of the highest-yielding equity ETFs are either international or global (U.S. plus international).

International dividend stocks are a slightly different animal. They often pay less frequently than U.S. dividend stocks—maybe once or twice a year instead of each quarter. Their payouts typically fluctuate more based on seasonal profitability of the companies as well as currency exchange rates. They’re taxed differently, too. But as you can see by the yield of the iShares International Select Dividend ETF (IDV), international stocks (especially those from developed markets) tend to be more generous as a group.

Related: 5 Best Vanguard Dividend Funds [Low-Cost Income]

This roughly 100-stock dividend ETF’s portfolio includes the world’s largest and most established firms. This includes $140 billion French utility giant TotalEnergies (TTE) and $120 billion consumer company British American Tobacco (BTI). The U.K. is the most heavily weighted country at 20% of assets; Italy, France, Spain and Germany are among other countries with prominent weightings in this ETF.

If you yearn for higher yield and want to diversify your portfolio to include international equities, IDV does the trick. In 2025, this has been a winning formula, as international developed markets have performed much better than U.S. stocks.

Related: The 7 Best Closed-End Funds (CEFs) That Yield Up to 11%

9. Global X SuperDividend ETF

— Assets under management: $984.2 million

— Dividend yield: 9.7%

— Expense ratio: 0.58%, or $5.80 per year on every $1,000 invested

“No no,” you say. “Where are the really high yields?”

OK. You asked for it.

The Global X SuperDividend ETF (SDIV) prioritizes yield above all else, generating a current payout of 10% that’s literally eight times that of the S&P 500, and well more than double the 10-year Treasury yield.

Global X’s fund definitely does not look like most other dividend ETFs.

Related: 9 Best Alternative Investments [Options to Consider]

This is a global fund made up of roughly 100 of the world’s highest-yielding securities. But unlike many global funds, which tend to weight the U.S. at 50% or more, America accounts for less than a quarter of assets. Other countries fill that vacuum, including Hong Kong (16%), the U.K. (9%), and Brazil (9%). Also, SDIV is extremely tilted toward just a handful of sectors—financials (30%), energy (24%), real estate (13%), and materials (11%) make up almost 80% of the fund!

I hope it goes without saying that the much higher rewards come with much higher risk. SDIV really is all about high dividend yield—but quality simply isn’t as important. The index’s only real quality check is a periodic review for dividend stability. (Global X gives this example: “no official announcement as of the Selection Day that dividend payments will be canceled or significantly reduced in the future.”)

In other words: SDIV is good for aggressive investors who want high income. But people looking for stability might want to search elsewhere.

Related: Best Vanguard Funds to Hold in an HSA

Featured Financial Products

Learn More About These and Other Funds With Morningstar Investor

If you’re buying a fund you plan on holding for years (if not forever), you want to know you’re making the right selection. And Morningstar Investor can help you do that.

Morningstar Investor provides a wealth of information and comparable data points about mutual funds and ETFs—fees, risk, portfolio composition, performance, distributions, and more. Morningstar experts also provide detailed explanations and analysis of many of the funds the site covers.

With Morningstar Investor, you’ll enjoy a wealth of features, including Morningstar Portfolio X-Ray®, stock and fund watchlists, news and commentary, screeners, and more. And you can try it before you buy it. Right now, Morningstar Investor is offering a free seven-day trial. You can check out the current deal, as well as discounted rates for students and teachers, by visiting the Morningstar Investor website.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

How Do Dividend ETFs Pay Investors?

When you own an ETF, you own parts of shares of various dividend stocks with different payout schedules. However, you don’t get paid when those stocks pay out—you get paid based on the ETF’s payout schedule.

Dividend ETFs pay their investors the same way as dividend stocks do, with deposits appearing on your brokerage statement on a regular cycle. Some funds—like the Global X SuperDividend ETF (SDIV)—pay you on a monthly cycle. But the majority, including the other six dividend ETFs on this list, all pay on a quarterly schedule, which is similar to most U.S. dividend stocks.

Why Does a Fund’s Expense Ratio Matter So Much?

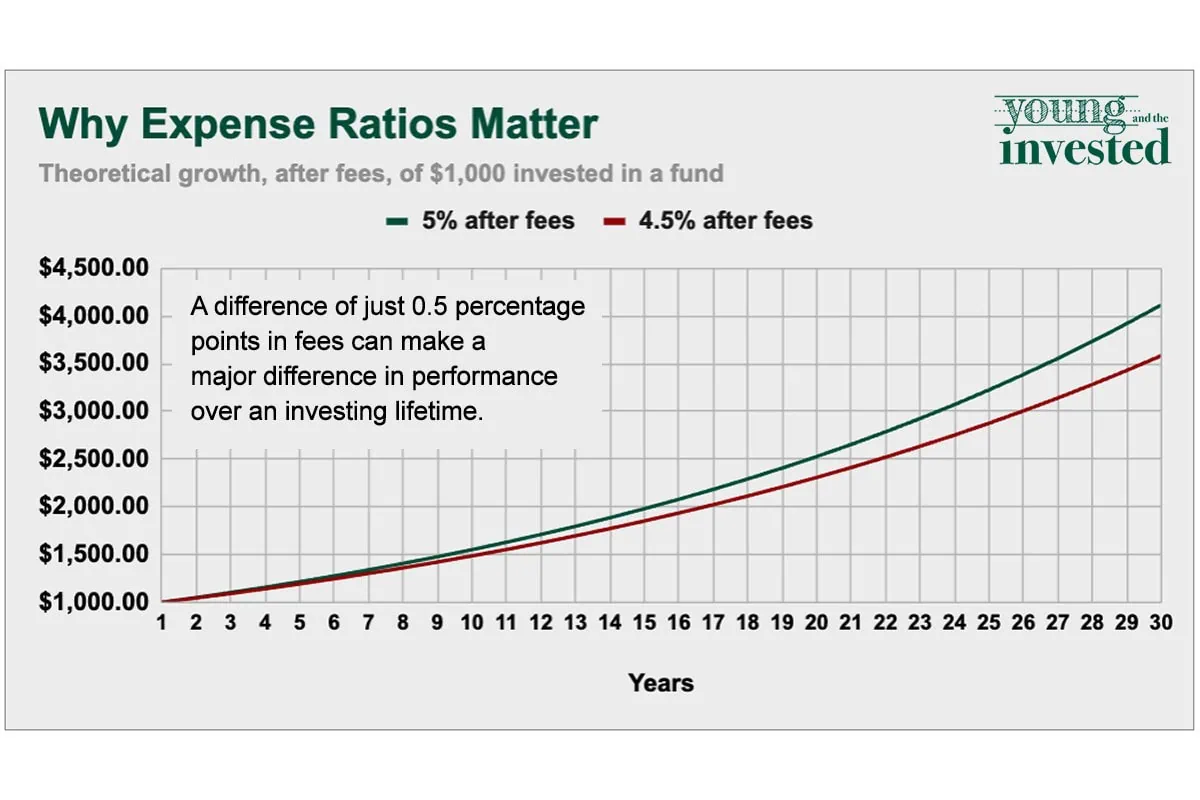

Every dollar you pay in expenses is a dollar that comes directly out of your returns. So, it is absolutely in your best interests to keep your expense ratios to an absolute minimum.

The expense ratio is the percentage of your investment lost each year to management fees, trading expenses and other fund expenses. Because index funds are passively managed and don’t have large staffs of portfolio managers and analysts to pay, they tend to have some of the lowest expense ratios of all mutual funds.

This matters because every dollar not lost to expenses is a dollar that is available to grow and compound. And over an investing lifetime, even a half a percent can have a huge impact. If you invest just $1,000 in a fund generating 5% per year after fees, over a 30-year horizon, it will grow to $4,116. However, if you invested $1,000 in the same fund, but it had an additional 50 basis points in fees (so it only generated 4.5% per year in returns), it would grow to only $3,584 over the same period.

Related: 7 High-Quality, High-Yield Dividend Stocks

Want to talk more about your financial goals or concerns? Our services include comprehensive financial planning, investment management, estate planning, taxes, and more! Schedule a call with Riley to discuss what you need, and what we can do for you.

Related: 13 Best Long-Term Stocks to Buy and Hold Forever

As even novice investors probably know, funds—whether they’re mutual funds or exchange-traded funds (ETFs)—are the simplest and easiest ways to invest in the stock market. But the best long-term stocks also offer many investors a way to stay “invested” intellectually—by following companies they believe in. They also provide investors with the potential for outperformance.

So if you’re looking for a starting point for your own portfolio, look no further. Check out our list of the best long-term stocks for buy-and-hold investors.

Related: 9 Best Fidelity ETFs You Can Buy [Invest Tactically]

Investors often look to exchange-traded funds (ETFs) for cheap, passive exposure to basic broader market indexes like the S&P 500.

But Fidelity’s ETF suite really shines because in addition to some of those plain-vanilla offerings, Fidelity also provides more tactical ways of tapping into specific corners of Wall Street. See what we mean by checking out our list of the best Fidelity ETFs.

Please Don’t Forget to Like, Follow and Comment

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Subscribe to Retire With Riley, our free weekly retirement planning newsletter, and

3. Give the article a Thumbs Up on the top-left side of the screen.

4. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!