Whenever you set out to find the best dividend stocks, you actually want to look for the best stocks that also pay dividends.

It sounds like I said the same thing twice, but the emphasis matters. Investors occasionally seek out dividend stocks with more of a focus on yield, but less of a focus on quality. That can work out, but it can also flame out spectacularly—after all, if a high payout is built on a shaky foundation, you might not receive that payout in perpetuity. And if that happens … well, it’s hard to imagine you’d love the stock you’re left with.

Keeping an eye out for quality will give you a better chance of buying 1.) durable dividends that will keep delivering a steady (and even growing) stream of income over time, and 2.) companies whose sales and profits will continue to improve, resulting in higher share prices over time, too.

If that sounds like a good plan to you, read on as I discuss the importance of dividends and dividend safety, followed by a look at my recently updated list of the 10 best dividend stocks for 2025.

Disclaimer: This article does not constitute individualized investment advice. These securities appear for your consideration and not as personalized investment recommendations. Act at your own discretion.

Editor’s Note: Tabular data presented in this article are up-to-date as of March 31, 2025.

Featured Financial Products

Table of Contents

Why Dividend Stocks?

Dividend stocks can do wonders for the long-term performance of your portfolio. These companies pay a regular flow of their profits directly back to shareholders, meaning you receive some sort of return—even when share prices aren’t cooperating.

Stocks that can both grow and pay dividends are the ultimate long-term stocks given just how much in additional returns they can generate over the long term.

The Importance of Dividends

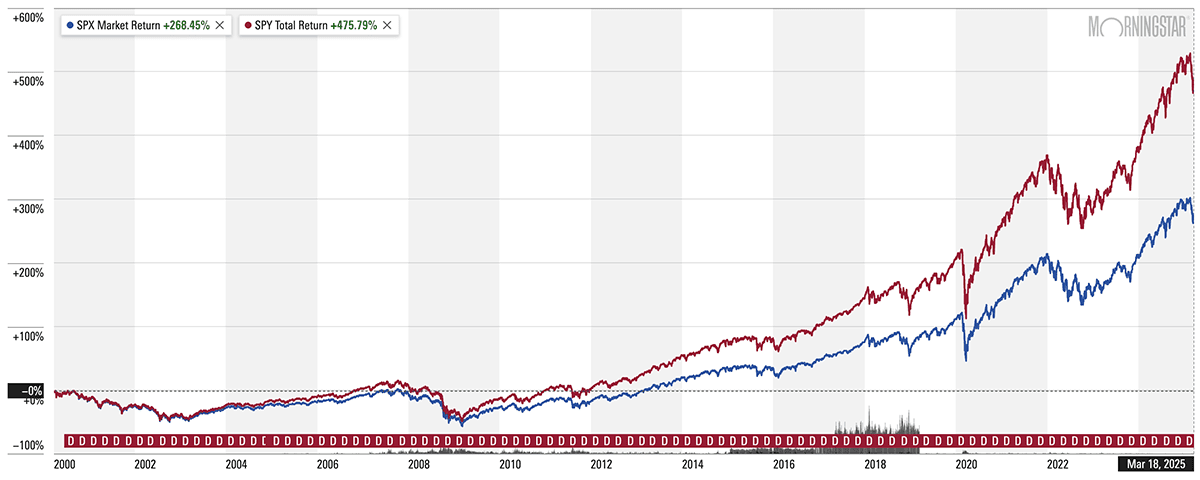

The image above shows a look at the return someone could expect if they received just the price returns from the S&P 500 over the past 25 years.

Next, we’ll look at what your returns might look like in comparison when you reinvest those dividends.

But What If I Reinvested My Dividends?

Now look at the chart above to see how much better the return is when you factor in dividends had you had reinvested those dividends back into the S&P 500 (returns illustrated by an S&P 500-tracking ETF; note that expenses are included in performance).

The price return is a little less than 270%. The total return (price plus dividends) is more than 475%!

Just like price return on stocks can be improved upon with dividends, though, a stock that pays dividends but doesn’t go anywhere isn’t exactly ideal, either. Thus, the best dividend stocks will provide both a steady baseline of income and provide you with the potential for meaningful price upside.

Dividend Yields (And Dividend Safety)

Dividend yield is a simple calculation—annual dividend / price x 100—that can mean a world of difference for investors, especially those reliant on income.

But dividend yield isn’t everything. Sometimes, stocks with high yields can look more attractive, but they’re actually flashing a warning signal that the dividend isn’t sustainable. You see, a company can get a very high annual dividend yield in two very different ways: the dividend growing very rapidly, or the share price falling very quickly.

For example, Alpha Corp., which trades for $100 per share, pays a 75¢-per-share quarterly dividend, or $3 across the whole year. It yields 3.0%. In a month, however, it yields 6.0%. Here are two ways that could have happened:

1. Alpha Corp. doubled its dividend to $1.50 per share quarterly, good for a $6-per-share annual dividend. The share price stays the same. ($6 / $100 x 100 = 6.0%)

2. Alpha Corp. kept its dividend at 75¢ quarterly ($3 annually), but its share price plunged in half to $50 per share. ($3 / $50 x 100 = 6.0%)

In one of those scenarios, Alpha Corp. has a very safe dividend. In the other one, Alpha’s dividend could be ready to implode.

So, if you’re sniffing out the best dividend stocks to buy for 2025, make sure you’re not just looking at yield, but also gauging a dividend’s safety. Among other things, you’ll want to look at payout ratio, which determines what percentage of a company’s profits, distributable cash flow, and other financial metrics (depending on the type of stock) are being used to finance the dividend. Generally speaking, the lower the payout ratio, the more sustainable the payout.

How We Chose the Best Dividend Stocks to Buy

Before I started this article, I was video calling a colleague and joked, in a pseudo-philosophical voice, “What is a good dividend stock, anyways?”

But I was only partly kidding. What’s ideal to one investor might not fit the bill for another. Ultimately, though, I coalesced around safe dividends, with some capacity to grow, sporting above-average yields, paid by larger (and thus likelier to be more stable) companies. Specifically, they have to …

— Be in the S&P 500.

— Have a yield greater than 1.5%, to ensure they’re better than the overall market. Most of the stocks on here are around 2% or higher. (And if that’s too low a yield for you, I suggest you instead check out our list of high-yield dividend stocks, which have payouts of 5%-plus.)

— Have an earnings payout ratio below 70%. This is a generally safe level where there’s still at least some room for dividend growth, and the lower the payout ratio, typically the more growth potential there is. (Note: Free cash flow payout ratio is an even better metric, but screening data for this tends to be unreliable.)

— Have at least a consensus Buy rating according to analysts tracked by S&P Global Market Intelligence. S&P boils down consensus ratings down to a numerical system where anything less than 1.5 is a Strong Buy, 1.5 to 2.5 is a Buy, between 2.5 and 3.5 is a Hold, 3.5 to 4.5 is a Sell, and anything greater than 4.5 is a Strong Sell. In this case, I only included stocks with a 2.0 rating or less—so at least a pretty firm consensus Buy rating, if not an outright Strong Buy.

I also limited the energy sector to just one stock. Energy companies were extremely overrepresented in the screen; most problematic is that several sport variable dividends that rise and fall based on available cash flow, which is largely tethered to the motion of energy prices. So a 3% yield today could be 1% in a year, 2% the year after, and so on. Instead, the list is populated with stocks that have more traditional dividend programs—regular payouts that typically only change when the company announces a hike.

The equities here are listed in reverse order of their consensus analyst rating, starting with the worst-rated stock and ending with the best-rated stock.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

10. Mondelez International

— Sector: Consumer staples

— Market cap: $87.7 billion

— Dividend yield: 2.8%

— Consensus analyst rating: 1.89 (Buy)

Mondelez International (MDLZ) is a prototypical defensive-minded, dividend-yielding consumer staples play that peddles its snacks to people in more than 150 countries worldwide. It’s responsible for brands including Oreo, Belvita, Tang, Cadbury, Philadelphia, Toblerone, and Halls. It’s the world’s top producer of cookies and crackers (they say “biscuits”; I decline) and No. 2 in chocolate.

There’s a reason “consumer staples” are often referred to as “consumer defensive.” That’s because while our consumption of certain products might ebb and flow with the economy, there are certain products we will hunker down and keep consuming no matter what. Sure, there are more true “needs” like basic produce, dairy, proteins, and personal-care items. But it applies to snacks too. After all, if the economy forces you to cut back on going out, you’ll still want treats at home—and price be darned, you probably won’t downgrade from Oreos to store-brand cookies unless you have no other choice.

Related: 11 Best Alternative Investments [Options to Consider]

Both Mondelez’s operational and stock performances have seemed downright agnostic for more than a decade. However, MDLZ took a nasty fall near the end of 2024 to finish the year with a roughly 15% decline (even after factoring in dividends), and 2025 is expected to be a “setback” year financially amid high cocoa prices, among other headwinds.

However, Mondelez’s stock has managed a strong rebound to start 2025, and analysts remain positive.

“We continue with our Buy rating supported by the strong growth outlook for Mondelez as its sales growth continues to outperform our expectations, driven by strong execution and category growth rates,” say Stifel analysts, whose Buy rating is among the 19 Buys on MDLZ shares, offset by nine Holds and no Sells. “The company’s dominance in its categories lends itself to consistent market share gains, and with its emerging market presence (~40% of its sales), the strength of its balance sheet with leverage near 2x (including the value of joint ventures), and a compelling valuation level in relation to these features, we expect continued upside for the shares from this level.

A reminder: Mondelez was previously Kraft Foods, but it adopted the new name after it spun off Kraft Foods Group–the company’s North American grocery business—in 2012. Its dividend was stagnant for a few years before that transaction, but it has grown at a pretty reliable 10% average annual rate after that, including an 11% improvement, to 47¢ per share, announced in July 2024. And between Mondelez’s consistent earnings growth and moderate 65% payout ratio, MDLZ should have the resources to continue its brisk dividend-growth pace.

Related: 6 Best Stock Recommendation Services [Stock Tips + Picks]

Featured Financial Products

9. Abbott Laboratories

— Sector: Health care

— Market cap: $230.1 billion

— Dividend yield: 1.8%

— Consensus analyst rating: 1.78 (Buy)

Abbott Laboratories (ABT) is a large health care firm that develops, makes, and sells medical devices, diagnostic products, nutritional products, and generic pharmaceuticals. Among other things, it’s responsible for FreeStyle (and FreeStyle Libre) glucose monitors, Pedialyte hydration products, Similac formulas, PediaSure children’s nutritional products, and BinaxNow COVID-19 antigen tests.

Medical devices are Abbott’s biggest breadwinner at about 45% of revenues, and has been a key driver of growth of late. The company has reported eight consecutive quarters of double-digit growth in medical devices, with more-than-20% organic growth in diabetes and structural heart products.

That’s among the many reasons William Blair is in a crowded bull camp of 20 Buys (versus seven Holds and no Sells) on ABT shares.

Related: 7 Best High-Dividend ETFs for Income-Minded Investors

“Though there were puts and takes to Abbott’s individual segment performance in the fourth quarter, we continue to like the outlook heading into 2025 as the company laps COVID and returns to a more balanced bottom-line and accelerating top-line growth story. While we expect upside to potentially materialize in EPS should macro headwinds ease in the coming quarters, we view 2024 as a transition year away with earnings reaccelerating to low-double-digit growth in 2025.”

Argus Research’s David Toung (Buy) offers other reasons to like Abbott right now:

“We believe that Abbott’s growth drivers (including the FreeStyle Libre, electrophysiology products, leadless pacemakers, and cardiovascular devices) and its ability to develop and launch new products could lead to continued growth in sales and earnings,” Toung says. “We note that Abbott plans to expand the FreeStyle portfolio beyond the diabetic market and to the consumer market.”

Abbott also is a Dividend King—a Dividend Aristocrat with at least 50 consecutive years of payout growth—whose cash distribution streak has continued even after spinning off biopharma unit AbbVie (ABBV) at the start of 2013. And the dividend itself dates back a full century, to 1924. For now, a safe payout ratio of 46% of 2025’s projected earnings implies both streaks can continue.

Related: The 8 Best Dividend ETFs [Get Income + Diversify]

8. Emerson Electric

— Sector: Industrials

— Market cap: $61.8 billion

— Dividend yield: 1.9%

— Consensus analyst rating: 1.76 (Buy)

Emerson Electric (EMR) is an industrial-sector firm that was founded in 1890 and headquartered in St. Louis. Emerson has established itself as a global leader in technology and engineering, providing innovative solutions in process control, industrial automation, heating, ventilation, and air conditioning (HVAC), and more.

The company’s emphasis on technological advancement and diversified market penetration has been crucial in maintaining a competitive edge over the last 125-plus years. What once was a maker of electric motors and fans is now a global industrial-technology giant that produces not just tens of thousands of products, but even industry, automation, and operations management software.

Related: Best Vanguard Retirement Funds for a 401(k) Plan

Argus Research has noted for a while now that Emerson has been “divesting legacy segments and investing in new businesses that target energy security and affordability, sustainability & decarbonization, nearshoring, and digital transformation.” And indeed, in Emerson’s Q4 earnings release, management said it plans to transform the company into a pure-play industrial technology company.

“Since Emerson began realigning its portfolio, the company has achieved sales growth at the high end or above its target of 4%-7%,” says Argus analyst Kristina Ruggeri (Buy), who adds that a better valuation amid EMR’s underperformance in 2025 is yet another reason to snap up shares.

Ruggeri in a vast majority, as the pros have 21 Buys on EMR shares, greatly outnumbering six Holds and two Sells.

While its most recent payout increases haven’t been much to crow about, Emerson Electric is one of the best dividend stocks for payout growth. This industrial firm’s dividend track record spans 68 consecutive years, including a 1% uptick to its payout, to 52.75¢ per share quarterly, announced in November 2024. Meanwhile, the company pays out just 35% of 2025’s expected earnings—a conservative ratio that offers safety and room to grow.

Related: 5 Best Vanguard Retirement Funds [Start Saving More, for Less]

7. BlackRock

— Sector: Financials

— Market cap: $146.1 billion

— Dividend yield: 2.2%

— Consensus analyst rating: 1.72 (Buy)

BlackRock (BLK) is one of the world’s largest asset management firms, boasting about $10 trillion in assets across its many lines of business. Individual investors know it well for both its BlackRock mutual funds and closed-end funds (CEFs), as well as its iShares exchange-traded funds (ETFs). But it also manages money for institutional clients, including pension plans, foundations, charities, and insurance companies, among others.

With the exception of a few understandable hiccups (COVID, for instance), BlackRock has been in a broader consistent uptrend since the depths of the Great Recession. That has come alongside similar progression in both the company’s top and bottom lines.

It’s difficult to find any Wall Street pros with something negative to say about BLK. Shares currently enjoy 14 Buy calls versus four Holds and no Sells, and the analysts’ consensus for long-term earnings growth sits near 13% annually.

Related: The 10 Best Vanguard Index Funds You Can Buy

“We believe that BLK remains well positioned to deliver above-peer organic growth given its unmatched product breadth and distribution footprint (helped by its iShares franchise),” say Keefe, Bruyette & Woods analysts Aidan Hall and Kyle Voigt, who rate BLK at Outperform. “Also, its scale and demonstrated ability to generate operating leverage bodes well for future earnings growth and operating leverage.”

BlackRock has been a fount of dividend growth since the Great Recession, too. In the past decade alone, BLK has managed to average 10% annual dividend growth, though that pace has been slowing in recent years—its most recent hike, announced in January 2025, was a mere 2% bump to $5.21 per share. Still, a payout ratio around 45% should keep investors plenty confident in the dividend’s health and its ability to keep growing.

Related: The 7 Best Vanguard ETFs for 2025 [Build a Low-Cost Portfolio]

6. Cigna Group

— Sector: Health care

— Market cap: $89.4 billion

— Dividend yield: 1.8%

— Consensus analyst rating: 1.72 (Buy)

Cigna Group (CI) is perhaps best known for the Cigna brand, which is one of America’s largest health insurers, offering health, dental, and other plans. But Cigna actually makes up less than half of Cigna Group’s revenues—60% come from its Evernorth Health Services unit, which includes its Express Scripts pharmacy and pharmacy benefit management businesses, Accredo specialty pharmacy, MDLive telehealth, and more.

One thing Cigna does not include is Humana—a possibility as far back as late 2023 when the companies discussed a merger. However, in November 2024, Cigna confirmed it would not be pursuing the rival insurer, so any purchase of Cigna would have to be on its own merits.

Fortunately, Wall Street seems to think there are plenty of those.

Related: 7 Best Schwab Funds You Can Buy: Low Fees, Low Minimums

“Cigna’s managed care portfolio targets strong growth business lines, and is highly diversified, with a relative concentration in the stable ASO business,” says Oppenheimer, which rates the stock at Outperform. “We believe the market is undervaluing the opportunity from the highly accretive Express Scripts deal, which should pay strong long-term returns for shareholders given the diversification, opportunity to cross-sell its services, and a more equity-friendly capital structure.”

Oppenheimer, which also notes that CI trades at a discount to its peers, is one of 19 Buy-equivalent ratings on CI shares. Meanwhile, the Street has six Holds and not a single Sell on the stock.

Unlike many of the dividend stocks on this list, Cigna doesn’t have a particularly illustrious dividend history. In 2004, the company cut its quarterly payout by 92%, to 2.5¢ per share (adjusted for its 3-for-1 stock split in 2007). Then in 2008, the company transitioned to 4¢ annual dividends, which lasted until 2021, when Cigna announced a new quarterly dividend of $1 per share. Since then, the company has raised its payout by another 51%.

Cigna certainly has more headroom for higher dividends going forward—the company’s current payout represents just 20% of 2025’s expected earnings.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

5. Bank of America

— Sector: Financials

— Market cap: $315.4 billion

— Dividend yield: 2.5%

— Consensus analyst rating: 1.59 (Buy)

Bank of America (BAC) is one of the world’s largest banks, serving roughly 69 million Americans through 3,800 branches and 15,000 ATMs across 39 states. However, BofA is much, much more than its consumer business—it also provides financial products and services for small and midsized businesses, large corporations, institutional investors, and even governments. Its offerings range from checking and savings accounts to commercial loans, trade finance, treasury management, and securities clearing.

Related: 12 Best Investment Opportunities for Accredited Investors

BAC shares enjoyed a market-beating 35% return in 2024, but they’ve cooled off in 2025 alongside the rest of the banking industry. You can chalk that up to economic skittishness and the absence (so far, anyways) of a much-hoped-for Trump-administration bounce in mergers and acquisitions (M&A).

You can also blame, of all people, Warren Buffett. The Oracle of Omaha’s Berkshire Hathaway (BRK.B) sold roughly a third of its stake in Bank of America—a massive 352 shares—across 2024. KBW, which rates shares at Outperform, notes that the overhang remains, saying “we believe Berkshire’s pace of selling has slowed, resulting in some uncertainty around Berkshire’s longer-term strategy.”

Related: 8 Best Stock Picking Services, Subscriptions, Advisors & Sites

And yet, the analyst community seems undeterred. BofA’s stock currently enjoys 19 Buy calls versus three Holds and no Sells, putting it among the best dividend stocks you can buy at this point in 2025.

Back in January, Oppenheimer (Outperform) wrote that “big banks are still distrusted by the market, and on a price-to-tangible book value (TBV) basis, BAC trades at a ~20% discount to the historical average large capitalization regional bank, even though ~80% of its revenue base is relatively stable and predictable. … Over time, BAC should achieve a multiple more in line with regional banks.” The stock trades at an even cheaper TBV today.

As for the dividend? Bank of America has raised its cash distribution by 44% between 2020 and today—most recently, it announced an 8% hike, to 26¢ per share, effective as of the September 2024 payout. It’s also very well-covered at less than 30% of 2025’s expected earnings.

Related: 7 Best Fidelity ETFs for 2025 [Invest Tactically]

4. Targa Resources

— Sector: Energy

— Market cap: $43.6 billion

— Dividend yield: 1.5%

— Consensus analyst rating: 1.57 (Buy)

Energy businesses are typically referred to by their “stream.” Upstream companies search for and extract oil, gas, and other raw energy resources; midstream companies transport, store, and sometimes process those resources; and downstream companies refine these resources into final products such as gasoline, diesel, and natural gas liquids (NGLs).

Related: 10 Best Vanguard Funds for the Everyday Investor

Targa Resources (TRGP) deals in the midstream energy market segment—alongside its subsidiary, Targa Resource Partners LP, it owns a wide array of gathering, processing, logistics, and transportation assets across numerous natural resource plays, including the Permian Basin, Bakken Shale, Anadarko Basin, and the Gulf of Mexico, among others. The Permian Basin is arguably Targa’s biggest growth driver; roughly 3 in 5 lower-48 U.S. shale rigs are located there, and about 80% of Targa’s natural gas inlet volumes are sourced from there.

Targa went public in 2010, peaked in 2014, cratered, then largely hovered for a few years after that. But after bottoming out during COVID, the stock has roared back to life and has since eclipsed its decade-ago peaks to hit all-time highs. Even after a doubling for TRGP shares in 2024, the analyst community remains wildly bullish: 20 Buys dwarf a pair of Hold calls and a single Sell.

Much of this can be attributed to Targa’s positioning in the Permian.

Related: 7 Best Schwab ETFs to Buy [Build Your Core for Cheap]

“Targa has billions of dollars of largely fee-based projects in the hopper that we believe will add +1.7 billion cubic feet per day of gas processing capacity in the Permian and more than 1 million barrels per day of NGL transportation, fractionation, and export capacity, boosting earnings and [free cash flow] this year and next,” Truist analyst Neal Dingmann (Buy) recently wrote while upgrading his price target on shares, to $235 from $220 previously. “We believe the company will not only likely continue to accelerate the projects, but most will be highly utilized essentially out of the gate quickly boosting results.”

Energy infrastructure stocks are a different breed. Many of them are master limited partnerships (MLPs), which are required to return a majority of their income to unitholders (shares in MLPs) in the form of distributions (dividend-like payments to shareholders that have different tax consequences). Targa is technically a corporation, so it pays dividends like a traditional stock. But like an MLP, the proper metric for its payout ratio is distributable cash flow (DCF) … and by that gauge, Targa’s quarterly distribution is well-covered, indeed, at less than 20% of DCF projections for 2025, even after the company’s recent 50% hike to 75¢ per share.

Related: The 7 Best Mutual Funds for Beginners

Featured Financial Products

3. VICI Properties

— Sector: Real estate

— Market cap: $34.6 billion

— Dividend yield: 5.3%

— Consensus analyst rating: 1.54 (Buy)

VICI Properties (VICI) is a real estate investment trust (REIT) that specializes in gaming, hospitality, and entertainment properties. While you’re probably most familiar with its Vegas real estate, which includes Caesars Palace Las Vegas, MGM Grand, and the Venetian Resort Las Vegas, VICI actually owns 54 gaming properties and 39 other “experiential” properties—such as golf courses and Bowlero bowling alleys—across roughly two dozen states and Canada.

“Las Vegas continues to be a secular growth market with VICI well positioned in the sports triangle,” say Baird analysts, who are among 21 Buy calls on the stock (versus three Holds and no Sells). “VICI is seeing the upper-income consumer offset any weakness from the lower-income consumer in the market.”

Related: 7 Best High-Dividend ETFs for Income-Minded Investors

VICI and other gaming REITs are a way to invest in gambling/gaming with the potential for less volatility. That’s because their revenues aren’t directly driven by ups and downs in the business—they collect rent. So while a prolonged economic downturn, say, could weigh on operators’ ability to pay their bills, VICI is a bit more insulated from quarter-to-quarter issues.

Indeed, not only does VICI specifically have lease escalators that help ensure steadier growth going forward, but those escalators—at either the rate of inflation (via the consumer price index, or CPI) or 1.7% for non-CPI escalators—are above the industry average.

“We expect VICI to maintain top-tier organic growth in net lease despite moderating CPI,” Baird says.

Related: The 7 Best T. Rowe Price Funds to Buy and Hold

“We think some investor pushback on VICI has centered on it not having large-scale acquisitions in the last year. But as we look at it, the [recent earnings guidance] shows that even without this, its earnings growth stacks up well,” adds JPMorgan’s North American Equity Research team, which rates VICI at Overweight (equivalent of Buy). “We think VICI remains compelling given its 13.2x AFFO multiple, which is a 38% discount to the overall REIT group’s cash flow multiple, and a current dividend yield of 5.6%.”

AFFO, by the way, is short for “adjusted funds from operations.” VICI Properties is a REIT, which is a special type of business structure that receives significant tax breaks, but in return, it must pay out at least 90% of its taxable income back to shareholders in the form of dividends. And unlike regular stocks, with which we use profits or free cash flow to determine payout ratio, REIT dividend coverage is typically gauged by funds from operations, a metric of profitability that falls outside of generally accepted accounting principles (GAAP) standards.

FFO payout ratio standards are somewhat different, with 70% to 80% considered quite healthy. VICI? It has an FFO payout ratio of 77%. That should help it continue its short streak of dividend hikes, which included a 4% bump in the payout in late 2024 to 43.25¢ per share.

Related: 7 High-Quality, High-Yield Dividend Stocks

2. NiSource

— Sector: Utilities

— Market cap: $18.9 billion

— Dividend yield: 2.8%

— Consensus analyst rating: 1.53 (Buy)

It shouldn’t surprise that one of the best dividend stocks for 2025 comes from the utility sector, which is known for steady operations and sustainable dividends.

NiSource (NI) is a natural gas and electric utility company founded in 1847 that serves more than 4 million customers in six states across the Midwest and East Coast.

Related: 7 Best Schwab Index Funds for Thrifty Investors

In early 2025, NiSource hiked its quarterly dividend to 28¢ per share—up about 6% from its previous payout, and 40% better than what it was paying five years ago. That’s good news for investors, who typically buy stocks like NI for their stability and income potential rather than dramatic growth narratives.

Remember: NiSource and many other utilities are regulated, which means they must request permission to raise their prices and usually only do so by a couple percent every year or two. Plus, much of their money tends to be reinvested in infrastructure like electric lines and water pipes, or distributed as dividends to shareholders. So there’s usually not much growth to be had here.

Related: 5 Best Vanguard Dividend Funds [Low-Cost Income]

Still, Wall Street is downright gushing as it pertains to NiSource, with 15 Buys versus one Hold and one Sell.

“Over the past 24 months, NI has quietly had one of the better regulatory and financial execution track records in our coverage and is beginning to build a reputation of consistency and financial conservatism,” says BofA Global Research (Buy), which recently reinstated coverage on NI shares. “We think highly of the revamped senior management team members as they have shown an ability to deliver at the high end of its plan through various environments and events.”

There’s nothing exciting about buying a natural gas company and harvesting the dividends. But investors with little risk tolerance should love the chance to buy a low-priced stock that should net them reliable returns over time. Doubly so when that stock pays a dividend like NiSource’s, which at 60% of this year’s earnings is well-covered, especially compared to other utility names.

Related: The 9 Best Dividend Stocks for Beginners

1. UnitedHealth Group

— Sector: Health care

— Market cap: $478.2 billion

— Dividend yield: 1.6%

— Consensus analyst rating: 1.25 (Strong Buy)

UnitedHealth Group (UNH) is America’s largest health insurer, though its massive health care operations go far beyond typical coverage. In addition to its UnitedHealthcare insurance division, UNH also is the parent of Optum, which provides medical-care coordination, pharmaceutical services, and health data and analytics.

Indeed, while UnitedHealth is the better-known brand, Optum’s businesses actually contribute more to the bottom line.

UNH has underperformed the market for months, dogged by a number of issues, including the possibility of funding cuts for Medicaid, rising medical costs, and a Wall Street Journal article claiming that the U.S. Department of Justice was investigating UnitedHealth’s Medicare billing practices.

Related: Best Fidelity Retirement Funds for an IRA

However, Wall Street apparently views the near-term weakness as yet another reason to scoop up UNH shares. It’s not just the best-rated dividend stock on our list—it currently enjoys unanimous bullishness across the 28 analysts who cover the stock.

“We are bullish on UnitedHealth Group tied to the company’s scale, diversification, attractive growth opportunities across multiple business segments and differentiated business model,” says Truist Managing Director David MacDonald, who rates shares at Buy. “We view the Optum business segment as a key differentiator that helps lower medical cost trend and should be an attractive beneficiary of site of service re-direction. Finally, the company has a sizable balance sheet, drives significant free cash flow and we expect capital deployment to further augment already strong core trends.”

The 1.6% yield is nothing to scream about, but it’s exceedingly well covered, at less than 30% of this year’s projected profits. That should help UNH keep thickening that distribution, which has grown by 14% annually over the past five years.

Want to talk more about your financial goals or concerns? Our services include comprehensive financial planning, investment management, estate planning, taxes, and more! Schedule a call with Riley to discuss what you need, and what we can do for you.

Related: 13 Best Long-Term Stocks to Buy and Hold Forever

As even novice investors probably know, funds—whether they’re mutual funds or exchange-traded funds (ETFs)—are the simplest and easiest ways to invest in the stock market. But the best long-term stocks also offer many investors a way to stay “invested” intellectually—by following companies they believe in. They also provide investors with the potential for outperformance.

So if you’re looking for a starting point for your own portfolio, look no further. Check out our list of the best long-term stocks for buy-and-hold investors.

Related: 10 Best Monthly Dividend Stocks for Frequent, Regular Income

The vast majority of American dividend stocks pay regular, reliable payouts—and they do so at a more frequent clip (quarterly) than dividend stocks in most other countries (typically every six months or year).

Still, if you’ve ever thought to yourself, “it’d sure be nice to collect these dividends more often,” you don’t have to look far. While they’re not terribly common, American exchanges boast dozens of monthly dividend stocks.

Please Don’t Forget to Like, Follow and Comment

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Subscribe to Retire With Riley, our free weekly retirement planning newsletter, and

3. Give the article a Thumbs Up on the top-left side of the screen.

4. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!