Exchange-traded funds (ETFs) are the market’s Swiss Army knife, capable of allowing average Joes and Janes to invest in a wider variety of assets and strategies than virtually any other product out there.

“ETFs are less expensive, more diversified, better performing, and more precise than alternatives investors are likely using, including mutual funds and individual stocks or bonds,” says Todd Rosenbluth, Head of Research at financial consultancy VettaFi.

That versatility also makes them a friend to investors of any skill level. Just getting started? You can assemble a diversified, price-efficient portfolio with just a few clicks. Have a little experience under your belt? Use sector, thematic, and other targeted ETFs to adjust your portfolio’s exposure. Well-seasoned and willing to tinker? ETFs can even be used to aggressively trade.

Let’s look at a group of ETFs that can be particularly useful to people who are either just getting started or need to fill substantial needs in their existing portfolios. We’ll discuss what each ETF holds, how it acts, and what makes it stand out in a crowd.

Disclaimer: This article does not constitute individualized investment advice. Securities, funds, and/or other investments appear for your consideration and not as personalized investment recommendations. Act at your own discretion.

Editor’s Note: The tabular information presented in this article is up-to-date as of Oct. 15, 2025.

Featured Financial Products

Table of Contents

What Are Exchange-Traded Funds?

We’ll start simple. An investment “fund” typically refers to a pool of money that’s invested on behalf of others. When you invest in a fund, you enjoy a share of the gains (and losses) of that fund, and typically any distributions it makes, such as dividends or interest income.

ETFs are one type of fund, and they’re typically explained in relation to their older brothers: mutual funds.

It Helps to Understand Mutual Funds, Too

The modern mutual fund popped into existence roughly 100 years ago. And while they’re losing market share to ETFs, they’re still responsible for more than $28 trillion in assets in the U.S. alone, according to Investment Company Institute data.

With a mutual fund, you (or more likely, your broker) send your money to a fund company, then they in turn buy investments. As those investments rise or fall, so too does the value of the fund. And when you want to sell, the company sells off whatever investments it must to raise the funds to make you whole.

Of course, you don’t get something for nothing. Mutual funds charge annual fees, referred to as the “expense ratio,” expressed as a percentage of your investment. If you have $10,000 invested in a fund, and it charges 1%, you pay $100 per year—taken directly out of the performance—for the management of that fund. Fees differ from fund to fund, and even from one share class—mutual funds often have multiple share classes designed for different investors, such as retail investors, institutional investors, those who invest through a 401(k), and more—to another. And sometimes mutual funds charge other fees, such as “sales loads,” which is a cut of your initial investment.

Speaking of initial investments: Mutual funds often require you to spend a certain amount of money when you first buy in—say, $1,000, $2,000, maybe even more. This too can differ by share class. But some mutual fund companies have small minimum investments, say, a few hundred bucks, and a few funds have no required minimum.

Where mutual funds are a little odd is that, unlike stocks, they don’t trade throughout the day. Instead, all buying and selling of a mutual fund happens once per day, after the trading day is over.

And that brings us to ETFs.

ETFs: Like Mutual Funds, But With Several Big Differences

Exchange-traded funds (ETFs) are similar to mutual funds in that they’re a pool of money that’s invested in various assets—stocks, bonds, commodities, and/or other types of investments.

But the major difference between ETFs and mutual funds (so major, it gives them their name) is that ETFs trade just like stocks, on major exchanges, all throughout normal trading hours. That provides them with liquidity, which is great for traders or just anyone who wants to exit their investment immediately.

ETFs have other advantages, too. Without going into detail, the back-end mechanics of selling ETF shares make them more tax-efficient than mutual funds. The ETF ecosystem is filled with many more niche strategies than mutual funds. ETFs do have annual expenses, like mutual funds, but they don’t have sales loads and many other “extra” fees. And unlike mutual funds, there are no investment minimums—you can buy as little as one share (or less than one share, if your brokerage offers fractional shares).

Lastly, ETF fees—on average—tend to be cheaper than mutual funds, but that’s because most ETFs are index funds.

Related: The 7 Best Fidelity Index Funds for Beginners

The Best ETFs All Newer Investors Should Know

So, what makes an ETF suitable for people just starting on their investing journey?

“I spend a lot of time talking to financial planners, and most of them would advise that the answer would depend on the age and risk profile and where you are in your investing journey,” says Aniket Ullal, VP, ETF Data and Analytics for independent research firm CFRA.

However, generally speaking, “someone starting out typically would be more invested in equity, taking more risk early than someone who’s close to retirement,” he says. The default portfolio might be 60/40 (60% equity, 40% bonds), but Ullal says younger investors would probably go more toward 70/30 or 80/20 to start.

Related: The 10 Best Vanguard Index Funds to Buy

Another consideration can give you a psychological edge as you invest, Rosenbluth says.

“Simple and easy to understand is a great starting point because if you know what you own and why you own it, you will stick with it,” he says.

These are some of the elements we’ll keep in mind as I explore some of the best ETFs for beginners. Below, you’ll find a number of ETFs that can be combined to create a basic starter portfolio. How much of each ETF you hold is largely up to your own preferences, investing goals, and investment horizon.

Related: The 7 Best Dividend ETFs [Get Income + Diversify]

Best Large-Cap ETF: SPDR Portfolio S&P 500 ETF

— Style: Large-cap stock

— Assets under management: $89.7 billion

— Dividend yield: 1.2%

— Expense ratio: 0.02%, or 20¢ per year for every $1,000 invested

The SPDR Portfolio S&P 500 ETF (SPLG) is as simple as it gets. This State Street Investment Management index fund simply tracks the performance of the S&P 500 Index—what many people are really referring to when they say “the market”—for a miserly 2 basis points (a basis point is one one-hundredth of a percentage point).

Related: The 7 Best Closed-End Funds (CEFs)

But why would you want to simply match the market? What about all those YouTube ads and TikTok influencers shouting about how they can beat the market? Well, in most cases, that’s hot air. Consider this: For more than a decade, managers of funds that focus on large-cap stocks (traditionally companies with market capitalizations of $10 billion or more) have, on average, been unable to beat the S&P 500. So, if professional investors who have managed funds for years can’t top the index, you can guess what kind of chance everyday investors have.

Logically, then, one of the best things you can do is simply own the index.

Related: 13 Best Stock & Investment Newsletters for Inbox Alpha

The S&P 500 includes stocks from 500 massive U.S.-listed companies. The vast majority (81%) of the fund’s assets are invested in large-cap stocks, though the remainder is represented by mid-cap stocks (traditionally $2 billion to $10 billion in market cap). The S&P 500 Index is also market cap-weighted, which means the larger the stock, the greater the representation the stock has in the index.

And while the S&P 500 is diversified, spreading its risk across all 11 market sectors, it’s not an equal balance. For instance, technology stocks make up more than a third of the portfolio, while energy, utilities, materials, and real estate investment trusts (REITs) each account for less than 3%.

SPLG specifically is among our best ETFs for beginners because, while it does what most other S&P 500 index funds do, it’s cheaper than the rest.

Related: 5 Best Schwab Retirement Funds [High Quality, Low Costs]

Best Small-Cap ETF: Schwab U.S. Small-Cap ETF

— Style: Small-cap stock

— Assets under management: $19.1 billion

— Dividend yield: 1.4%

— Expense ratio: 0.04%, or 40¢ per year for every $1,000 invested

The point of holding S&P 500 blue chips is that they provide a lot of different things. You get some price appreciation over time. You also get some dividends (cash payouts to investors, often at regular intervals). And you also get some level of stability—big companies often have large reserves of cash and can easily get financing should short-term troubles arise.

Related: 7 Best Schwab ETFs to Buy [Build Your Core for Cheap]

However, when you’re younger, you can afford to take on more risk to chase higher levels of growth than the S&P 500 collectively can provide. And one way of doing that is to buy small-cap companies (typically stocks smaller than $2 billion in market cap).

The idea behind small-cap companies is that it’s simply easier to produce high levels of growth when you’re smaller. The saying goes, “It’s easier to double from $1 million in revenues than it is from $1 billion.” The price you pay for this growth? Well, for one, smaller companies often don’t pay dividends, so you don’t have as much in surer returns. And smaller companies also tend to be more volatile given that their revenue streams are narrower, and access to financing more difficult, than their large-cap brethren. But if you have a long time to invest, they’re worth the indigestion.

Related: 10 Best Stock Picking Services, Subscriptions, Advisors & Sites

“I would generally recommend if you’re [investing in the] S&P 500, the S&P 500 is about 75% of total market cap, so I would recommend doing a small-cap ETF along with an S&P 500,” Ullal says.

I like the Schwab US Small-Cap ETF (SCHA) for the same reason I love SPLG: the low expense ratio. For just 40¢ annually on every $1,000 invested, you get access to roughly 1,750 different small-cap stocks that you’ve almost certainly never heard of. Top holdings include quantum integrated circuit firm Rigetti Computing (RGTI), computer-memory producer Sandisk (SNDK), and mortgage-fintech company Rocket Cos. (RKT).

And unlike S&P 500 Index funds, where large holdings like Apple (AAPL) have massive sway on the fund, SCHA really spreads the wealth around. Rigetti, for instance, is the largest holding at less than 0.5% of assets. So if RGTI (or any holding) suffered a collapse, that one stock’s implosion wouldn’t do much damage to theETF’s overall performance.

Investors should note that another small-company ETF, the iShares Morningstar Small-Cap ETF (ISCB), has an equally low expense ratio of 0.04%.

Related: Best Schwab Retirement Funds for a 401(k) Plan

Featured Financial Products

Best Growth ETF: Vanguard Growth ETF

— Style: Large-cap growth stock

— Assets under management: $183.2 billion*

— Dividend yield: 0.4%

— Expense ratio: 0.04%, or 40¢ per year for every $1,000 invested

You don’t have to rely on small-caps for growth, however. Many large-cap companies are plenty capable of producing aggressive returns while still offering the relative stability of owning shares in bigger companies.

That’s where funds like the Vanguard Growth ETF (VUG) come in.

Related: 10 Best Stock Advisor Websites & Services to Seize Alpha

The Vanguard Growth ETF tracks an index of large-cap companies that exhibit various growth traits, including better-than-average historical growth in sales and earnings, as well as better-than-average expected short- and long-term growth in earnings.

The fund holds 160 predominantly U.S. growth stocks. As should be no surprise, tech stocks such as Nvidia (NVDA), Microsoft (MSFT), and Apple (AAPL) account for the majority (60%) of assets. Consumer discretionary stocks, such as Amazon.com (AMZN) and Home Depot (HD), account for another 20%. The remaining 20% is spread across the other nine market sectors, with several receiving less than 1% of assets.

You’ll notice that my list of the best ETFs includes multiple Vanguard products. That’s because Vanguard index funds typically are among the largest, and cheapest, options around. But several other ETF providers have growth exchange-traded funds with 0.04% expense ratios, including Schwab, SPDR, and iShares. Vanguard’s growth fund gets a slight nod here because you’re able to buy VUG commission-free on more platforms than any of its equally priced competitors, according to ETFdb.

* Only reflects assets invested in the fund’s ETF-class shares.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

Best International Developed Markets ETF: iShares Core MSCI International Developed Markets ETF

— Style: Developed markets stock

— Assets under management: $22.9 billion

— Dividend yield: 2.8%

— Expense ratio: 0.04%, or 40¢ per year for every $1,000 invested

CFRA’s Ullal says every investor should have at least four components in their stock portfolio: U.S. large and mid-cap stocks (which the S&P 500 covers), as well as U.S. small caps (which SCHA tackles). But he also believes beginners should have some exposure to ex-U.S. developed and emerging markets as well.

First, I’ll tackle “developed markets,” which refers to established, typically stable economies and financial markets. The U.S. is a developed market, but you’ll also find these in western Europe, as well as Australia and parts of Asia.

Related: The 7 Best Mutual Funds for Beginners

You can get extremely low-cost access to these types of companies via the iShares Core MSCI International Developed Markets ETF (IDEV), which charges a dirt-cheap 0.04% in annual management fees.

IDEV owns about 2,250 stocks from several developed markets, excluding the U.S., across four continents. Japan is the best-represented country at 21% of assets, followed by the U.K. (13%) and Canada (12%). Like with the S&P 500, this index fund’s benchmark is primarily large-cap (77% of assets), though there’s some mid-cap exposure (20%) and even a few small-cap stocks (3%).

Related: 12 Best Investment Opportunities for Accredited Investors

Some of IDEV’s holdings should be familiar, as they’re foreign multinationals with significant U.S. presences: food giant Nestlé (NSRGY), Big Pharma play AstraZeneca (AZN) and energy titan Shell (SHEL). And all this exposure to large international firms results in a dividend yield of nearly 3%, which puts comparable U.S. large-cap funds to shame.

If you don’t care so much about Canadian exposure, Ullal also likes the iShares Core MSCI EAFE ETF (IEFA)—the lower-cost sister fund of the iShares MSCI EAFE ETF (EFA). IEFA excludes both U.S. and Canadian stocks but otherwise focuses on the same countries as IDEV. “IEFA’s 4 basis points [in expenses] are very competitive for that strategy,” he says.

Best International Emerging Markets ETF: Vanguard FTSE Emerging Markets ETF

— Style: Emerging markets stock

— Assets under management: $102.0 billion*

— Dividend yield: 2.8%

— Expense ratio: 0.07%, or 70¢ per year for every $1,000 invested

That brings me to “emerging markets” (EMs). Emerging markets are considered to be less developed economies and capital markets. The downside here is more risk, ranging from political corruption and possible nationalization of publicly traded companies to less scrutinizing stock markets or economies dependent on just a handful of goods or services. But the upside is far greater growth potential compared to more established countries.

Related: 11 Best Alternative Investments [Options to Consider]

The Vanguard FTSE Emerging Markets ETF (VWO) is a low-cost leader in the space at 7 basis points, and you get a lot for your money. VWO invests in an incredible 6,060 stocks from 23 emerging markets around the globe.

Like many cheaper emerging markets ETFs, Vanguard’s fund is market cap-weighted, so a few big stocks—such as Taiwan Semiconductor (TSM) and China’s Tencent Holdings (TCEHY), which collectively account for about 15% of assets—still have an outsized pull on the ETF’s performance. Certain sectors loom large, too, with technology (22%) and financials (21%) accounting for huge chunks of VWO’s assets.

Related: The Winningest Tech Stocks for 2025

VWO is also heavily concentrated in a few countries, including Taiwan (21%) and India (19%). But looming largest of all is China, at a full third of fund assets. The high Chinese concentration isn’t uncommon—most low-cost EM funds are similarly overweight to China—but it’s still a reasonable concern. In addition to the stock volatility you could expect from any emerging market, China’s domestic policies over the past couple of years have strangled various stock sectors there, rightfully making American investors nervous.

There’s no perfect solution here. Several ETFs have less Chinese exposure, but more by circumstance than design. You could buy an emerging market fund that explicitly excludes China—like the iShares MSCI Emerging Markets ex China ETF (EMXC), at 0.25% in annual fees—but then you’d have to also buy a separate China-specific ETF if you wanted any exposure to the growth in Chinese stocks. But many advisors feel comfortable suggesting the likes of VWO, regardless of the China risk, so perhaps the best strategy for beginners is not to overthink it.

* Only reflects assets invested in the fund’s ETF-class shares.

Related: 5 Best Vanguard Retirement Funds [Save More, for Less]

Best Sector ETF: Fidelity MSCI Information Technology Index ETF

— Style: Sector stock (Technology)

— Assets under management: $16.2 billion

— Dividend yield: 0.4%

— Expense ratio: 0.084%, or $84¢ per year for every $1,000 invested

Occasionally, investors buy an individual stock or two because they want exposure to a particular type of stock. For instance, you might buy Consolidated Edison (ED) because you want exposure to the safety of utility stocks. Or you might buy Nvidia because you know chipmakers will be important to the future of artificial intelligence and machine learning.

If you love the potential of that individual stock, great—stick with it. But if you like the underlying idea, you might be better off with a fund instead.

“For those owning individual stocks for long-term growth potential, sector and thematic ETFs provide more diversified exposure and allow you to target areas of interest,” VettaFi’s Rosenbluth says.

I’ll start with sectors, which are just a way of classifying certain stocks. Banks, insurance companies, and brokerages? They’re part of the financial sector. Pharmaceutical makers, biotech firms, and medical-equipment manufacturers? They’re considered healthcare stocks. Each sector has certain characteristics that some investors value more than others.

Related: 8 Best-in-Class Bond Funds to Buy

So when I say that the Fidelity MSCI Information Technology Index ETF (FTEC) is among the best ETFs for beginners, we’re not saying every portfolio should have it. But if you’re more interested in growth than dividends, and if you’re willing to accept a little more volatility than other sectors, and technology is your preferred sector, FTEC is a great way to express that—and Fidelity sector ETFs more broadly are the cheapest way to get exposure to any sector.

FTEC is pretty straightforward, holding 290 primarily large-cap tech stocks. That means exposure to software developers, internet service providers, semiconductor makers, data processing companies, even IT consultants.

Just be aware that FTEC—not just like many other tech sector competitors, but many sector funds in general—is market cap-weighted, and thus it’s overly beholden to its very large components. Nvidia commands 18% of assets; Microsoft and Apple each have double-digit weightings, too. So a big move in any of these three stocks will have a big effect on the ETF’s performance. Still, this remains a standout tech fund and one of Fidelity’s best ETFs.

You can avoid this with an equal-weight sector fund, which will hold all components in equal amounts, but it’ll typically cost much more in fees. The Invesco S&P 500 Equal Weight Technology ETF (RSPT), for example, charges 0.40% annually—but for some investors, the better diversification is worth it.

Related: 7 Low- and Minimum-Volatility ETFs for Peace of Mind

Best Thematic ETF: iShares Global Clean Energy ETF

— Style: Thematic stock (Clean energy)

— Assets under management: $1.8 billion

— Dividend yield: 1.6%

— Expense ratio: 0.39%, or $3.90 per year for every $1,000 invested

Thematic funds are more specific than sectors, and depending on the theme, these funds might actually incorporate stocks from different sectors. For instance, a fund focused on robotics might include stocks from both the technology and industrial sectors.

And what I said about sector funds goes double for thematic funds: There is no “correct” theme for everyone. There are hundreds of themes out there, covering everything from digital currencies to physical fitness.

Related: 5 Best Vanguard Dividend Funds [Low-Cost Income]

With that said, the iShares Global Clean Energy ETF (ICLN) is a great investment if you’re interested in the development of greener technologies. This index fund’s benchmark holds clean energy-related businesses from around the globe. “Related” is the key word here, and it covers a lot of ground. First Solar (FSLR), for instance, makes utility-scale photovoltaic power plants. Bloom Energy (BE) converts fuels such as natural gas, biogas and hydrogen into electricity. Vestas Wind Systems (VWDRY), based in Denmark, manufactures windmills.

At roughly 100 holdings, ICLN is a more diversified thematic fund than most—many will have just 30 or 40. And while the 0.39% expense ratio is higher than the other best ETFs on this list, that’s also a fairly typical annual charge for themed funds.

Best Bond ETF: Vanguard Total Bond Market ETF

— Style: Core bond

— Assets under management: $139.3 billion*

— SEC yield: 4.1%**

— Expense ratio: 0.03%, or 30¢ per year for every $1,000 invested

A bond is basically a loan you make to some sort of large entity, like a corporation or even the U.S. government. When you buy a bond, that entity promises to pay you back at some point in the future—and for the trouble, they’ll pay you a fixed amount of interest, on a regular basis. Hence, bonds are also referred to as “fixed-income investments.” However, bonds typically don’t lose or gain value as dramatically as stocks, so their primary upside tends to be that interest payment.

Related: 13 Dividend Kings for Royally Resilient Income

This limited upside, but fixed amount of income, makes bonds much more attractive to older investors, who are less interested in growing their investments and more interested in protecting them. But younger investors don’t need much of their portfolio invested in bonds, and they certainly shouldn’t overpay to do it.

Lastly, bonds are both difficult to research and hard to buy, so a bond fund is a far better play.

The Vanguard Total Bond Market ETF (BND) is an “aggregate bond ETF,” which basically means it holds different types of bonds. In this case, BND holds a massive basket of about 11,400 debt issues that have all been issued by entities that the major bond-ratings agencies view as “investment-grade.” (That’s just another way of saying you’re likely to receive your initial investment and all those interest payments.) Roughly two-thirds of BND’s assets are invested in U.S. Treasury bonds and other federal government-related debt. Most of the remainder is in corporate bonds—debt issued by companies ranging from American Express (AXP) to Intel (INTC).

Related: 10 Best ETFs for Beat Back a Bear Market

This conservative portfolio yields more than 4% right now. So, sure, BND will pay you less than you’ll receive from stocks’ annual returns in an average year … but on the flip side, this part of your portfolio should be far less volatile.

* Only reflects assets invested in the fund’s ETF-class shares. ** SEC yield reflects the interest earned across the most recent 30-day period. This is a standard measure for funds holding bonds and preferred stocks.

Best Commodity ETF: Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF

— Style: Commodity futures

— Assets under management: $4.4 billion

— Dividend yield: 4.3%

— Expense ratio: 0.59%*, or $5.90 per year for every $1,000 invested

OK. I’m breaking a couple rules here. This fund, as the name suggests, isn’t simple. And it’s not cheap, either. But it’s an excellent way to buy another major asset class that many investors dive into—some early in their investing careers, some later.

CFRA’s Ullal says another way a young investor could break down their portfolio is 70/20/10—70% in stocks, 20% in bonds, and 10% in alternative investments. Alternative investments, or “alts,” are basically any investments that aren’t stocks or bonds. This can include private equity, real estate, or in this case, commodities.

Related: The 4% Rule Is Outdated. This One Might Be Better.

Commodities are physical assets, like gold or oil, that can provide differentiated returns compared to stocks and bonds. In other words, even if your stocks and bonds are down over a certain period, commodities might still go up, softening the losses to your portfolio.

Buying commodities individually is extremely difficult to downright impossible for your average investor. Buying metals such as gold and silver is doable but requires high costs for safe storage and insurance. And chances are you don’t want a barrel of oil in your basement. You can also invest in commodities through futures contracts, but that’s a complex method typically left to advanced professionals.

The easiest way to get access, then, is through ETFs. And I like the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC) because it makes the process even simpler than other competing funds.

Related: 7 Best Gold ETFs You Can Buy

PDBC invests in futures across energy (like crude oil and natural gas), precious metals (like gold and silver), industrial metals (like copper and aluminum), and agriculture (like sugar and corn). In short, it’s ample exposure to a wide range of commodities. But why PDBC belongs in the best ETFs for beginner investors is that, unlike many other broad commodity funds, it provides this exposure without having to issue a Schedule K-1 tax form. So not only does PDBC make it easier to buy commodities—it also makes your taxes less complicated.

The only drawback is that PDBC is actively managed, so its 0.59% expense ratio makes it the most expensive fund on this list. But only as much as 10% of your portfolio should go toward a fund like this anyways, and if you’re starting to invest with a very small sum, you can even avoid this one until you’re working with a bigger pot.

Related: The 10 Best-Rated Dividend Aristocrats Right Now

Featured Financial Products

Learn More About These and Other Funds With Morningstar Investor

If you’re buying a fund you plan on holding for years (if not forever), you want to know you’re making the right selection. And Morningstar Investor can help you do that.

Morningstar Investor provides a wealth of information and comparable data points about mutual funds and ETFs—fees, risk, portfolio composition, performance, distributions, and more. Morningstar experts also provide detailed explanations and analysis of many of the funds the site covers.

With Morningstar Investor, you’ll enjoy a wealth of features, including Morningstar Portfolio X-Ray®, stock and fund watchlists, news and commentary, screeners, and more. And you can try it before you buy it. Right now, Morningstar Investor is offering a free seven-day trial. You can check out the current deal, as well as discounted rates for students and teachers, on Morningstar Investor’s website.

What Are Index Funds?

We’re glad you asked!

There are two kinds of funds: actively managed funds and index funds.

With an actively managed fund, one or more managers are in charge of selecting all of the fund’s holdings. They’ll likely have a specific strategy to adhere to, and they’ll be tasked with beating a benchmark index, but they’ll be given a lot of discretion about how to achieve that. These managers will identify opportunities, conduct research, and ultimately buy and sell a fund’s stocks, bonds, commodities, and so on.

Related: The 7 Best Index Funds for Beginners

An index fund, on the other hand, is effectively run by algorithm. The fund will attempt to track an index, which is just a group of assets that are selected by a series of rules. The S&P 500 and Dow Jones Industrial Average? Those are indexes with their own selection rules. Index funds that track these indexes will generally hold the same stocks, in the same proportions, giving you equal exposure and performance (minus fees) to those indexes.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

Why Do Expense Ratios Matter?

If you guessed that it’s more expensive to pay a conference room full of fund managers than it is a computer that tracks an index, you’d be right. That’s why actively managed funds tend to cost much more in fees than index funds.

And that’s why ETFs are generally cheaper. Most (but not all) mutual funds are actively managed, while most (but not all) ETFs are index funds.

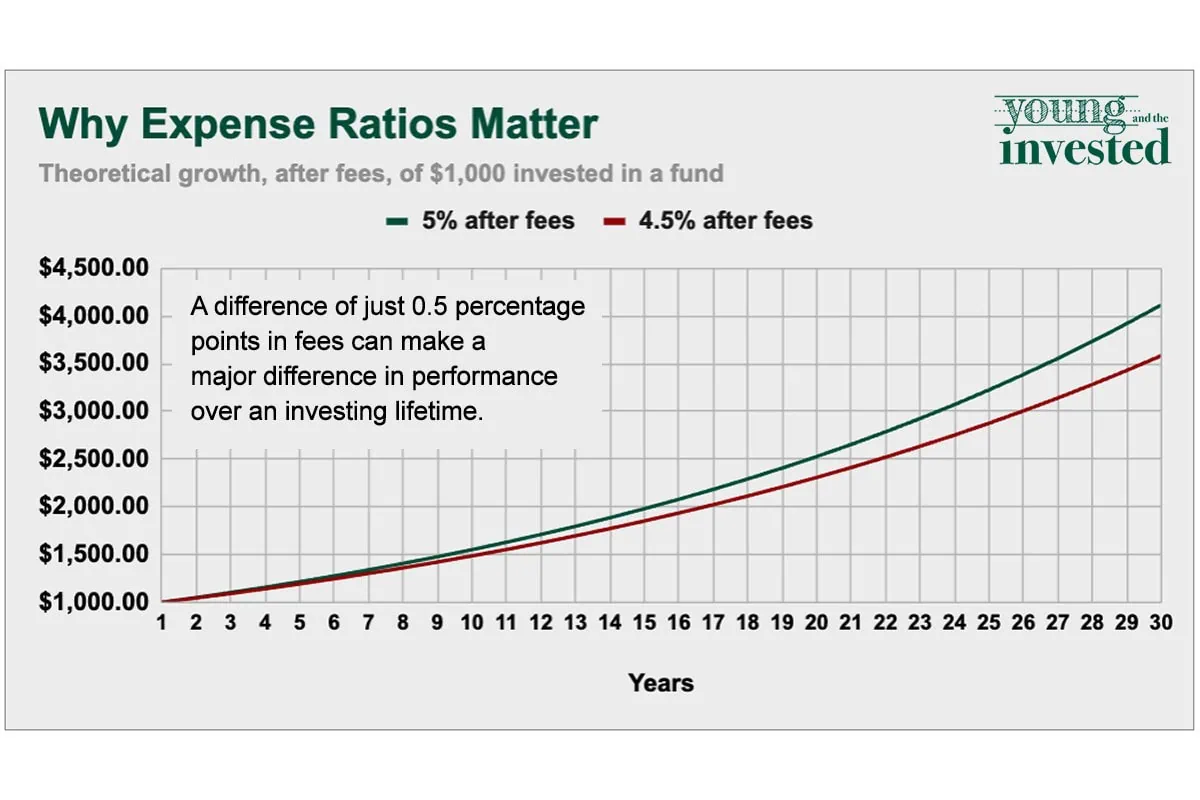

Fee savings are important, especially for long-term investors. Just look at the chart above.

Let’s say you had two identical funds that performed exactly the same over a 30-year period, but one fund charged 0.5 percentage points more in fees than the other. Even an investment of just $1,000 in the cheaper fund would generate hundreds of dollars more in returns.

Related: The 7 Best Vanguard ETFs for 2025 [Build a Low-Cost Portfolio]

What Other Types of ETFs Should I Own?

Most of the major ETF classes are covered above, but not all. Among the other classes worth mentioning are total stock market ETFs (which own all sizes of stock) and dividend ETFs (funds that own companies that regularly pay cash dividends).

I cover each of these in greater detail in the following slides.

Dividend ETFs

Whereas growth funds focus on stocks that dedicate most of their financial resources to improving sales and profits, dividend funds favor stocks that reward investors with regular cash payments (dividends).

While dividends are crucial to investors later in life, 1.) they’re not as important to younger investors, who have many years to absorb the higher risk of “growthier” stocks, and 2.) many of the funds listed above provide some level of dividend income. Thus, a young investor’s beginner portfolio doesn’t necessarily have to start with dividend stocks.

However, two dividend funds stick out more than others:

— The Schwab U.S. Dividend Equity ETF (SCHD, 0.06% expense ratio) holds roughly 100 stocks identified for their high-quality, sustainable dividends. It currently yields 3.8%, which is roughly thrice that of the S&P 500.

— The Vanguard Dividend Appreciation ETF (VIG, 0.05% expense ratio) holds roughly 300 stocks that have a track record of growing their payouts every year. VIG yields 1.6%, which is more than the S&P 500, but less than many other dividend-focused funds. So, why VIG? To some investors, sustained dividend growth is a measure of quality—by that logic, this ETF is a way to hold a bundle of dividend-paying stocks with extremely strong financials.

Total Stock Market ETFs

A total stock market ETF owns all sizes of stocks: large, mid, and small. So if you wanted, you could get all of your U.S. stock exposure in one fund.

But you’ll notice that above, we suggest buying two funds—an S&P 500 index fund and a small-cap ETF—to cover all those different stock sizes.

CFRA’s Ullal explains two advantages to this strategy: “With total market funds, the large caps are so dominant, you might not get enough small-cap exposure,” he says. Also, “the advantage of doing large and small caps separately is you can get a little more calibrated.” In other words, with a total market fund, you can only own whatever percentage of small caps the ETF holds. But if you go the two-fund route, you can always buy more of the small-cap fund if you want to be more aggressive, and less of it if you want to be more conservative.

Want to talk more about your financial goals or concerns? Our services include comprehensive financial planning, investment management, estate planning, taxes, and more! Schedule a call with Riley to discuss what you need, and what we can do for you.

Related: 10 Best Monthly Dividend Stocks for Frequent, Regular Income

The vast majority of American dividend stocks pay regular, reliable payouts—and they do so at a more frequent clip (quarterly) than dividend stocks in most other countries (typically every six months or year).

Still, if you’ve ever thought to yourself, “it’d sure be nice to collect these dividends more often,” you don’t have to look far. While they’re not terribly common, American exchanges boast dozens of monthly dividend stocks.

Related: The 11 Best Vanguard ETFs for a Low-Cost Portfolio

Vanguard’s exchange-traded funds (ETFs) are among the most popular funds out there thanks to their low fees. But there’s more appeal to their ETF lineup than low costs alone.

Vanguard ETFs are big, liquid, and tend to track well-constructed indexes, meaning you’re not just paying low expenses … you’re actually getting some value out of your fees. And these Vanguard ETFs represent the best of the best.

Please Don’t Forget to Like, Follow and Comment

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Subscribe to Retire With Riley, our free weekly retirement planning newsletter, and

3. Give the article a Thumbs Up on the top-left side of the screen.

4. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!