The best Fidelity ETFs include a little something for everyone.

If you want, a few of Fidelity’s exchange-traded funds (ETFs) give you cheap, passive exposure to basic broader market indexes, like the Nasdaq Composite.

However, where Fidelity really shines is by providing more tactical ways of tapping into specific areas of Wall Street. Sometimes, their best ETFs track more selective indexes. But sometimes, they rely on skilled investment managers who dig deep into their research resources to discover the best growth stocks or small-cap companies.

The overall takeaway: Whether you’re looking for plain, value-oriented passive ETFs; aggressive, actively managed ETFs; or something in between, the following list of the best Fidelity ETFs likely has something for you.

Disclaimer: This article does not constitute individualized investment advice. These funds appear for your consideration and not as personalized investment recommendations. Act at your own discretion.

Editor’s Note: Tabular data presented in this article are up-to-date as of March 26, 2025.

Featured Financial Products

Table of Contents

What Is an ETF?

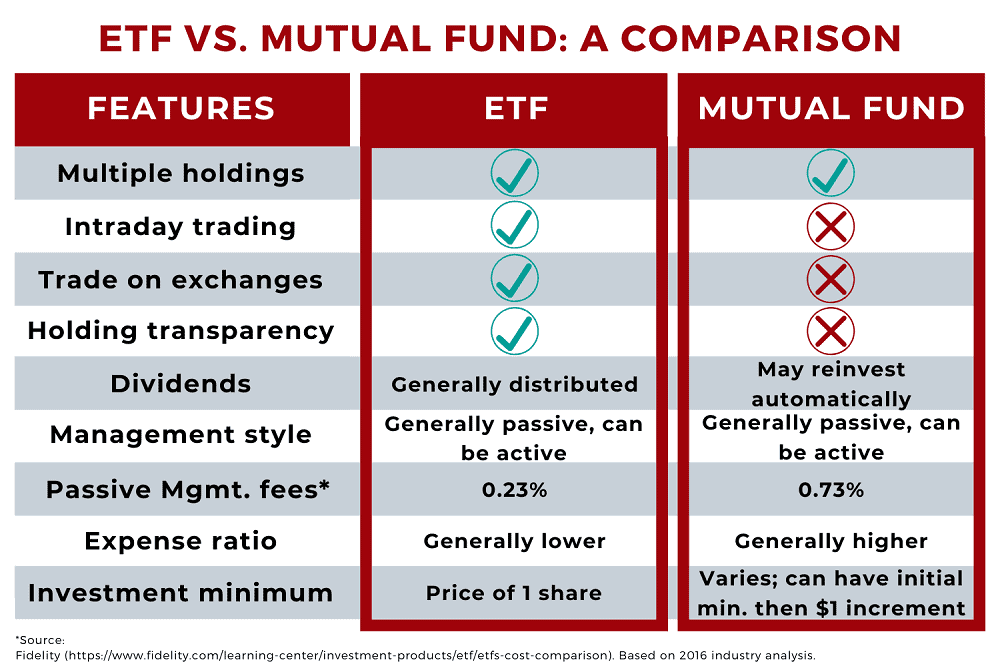

The letters “ETF” stand for “exchange-traded fund.” Those first two words refer to the fact that these investment products are listed on an exchange, just like individual stocks. And as anyone who is even loosely familiar with Wall street should know, the last word—fund—is a grouping of different assets including stocks, bonds, and other investments.

The most exclusive investment funds run by elite firms are definitely not exchange-traded. They’re not even publicly traded. They often have huge investment minimums of $1 million or more, and are by invitation only. Conversely, an ETF is easily tradable and transparent in its returns; it fluctuates in price during a given trading day based on its underlying assets.

Anyone can buy these funds for the price they are listed at, just like your favorite blue-chip stocks.

ETFs vs. Mutual Funds

Mutual funds—ETFs’ older cousins—trade publicly, but they do not trade on an exchange. Investors looking to buy or sell can put in orders any time they’d like, but orders are only executed once each trading day, after the markets close at 4 p.m.

Exchange-traded funds, on the other hand, move up and down just like stocks or other assets during the trading day.

Also unlike mutual funds, ETFs don’t have minimum investment thresholds—the minimum cost is just one share (or less if your broker offers fractional shares). And ETFs are different from both mutual funds and closed-end funds (CEFs)—which also trade on major exchanges—because how they’re structured makes them more tax-efficient to buy and sell.

On top of all of this, most (but not all) ETFs are index funds that are benchmarked to a fixed list of assets, and thus are passively managed. However, most (but again, not all) mutual funds are actively managed by managers based on specific investment strategies. As a result, exchange-traded funds generally have a lower average expense ratio. But this relationship isn’t universally true—some actively managed ETFs can charge more than similar passively managed mutual funds!

In other words: Just like with any other investment, when it comes to buying ETFs, do your homework before buying.

Why Choose Fidelity ETFs?

The best Fidelity ETFs are often very tactical, typically focused on indexes that are not your typical vanilla benchmark like the S&P 500. They also can be actively managed with an eye toward providing investors an edge.

If you’re just looking for vanilla investments, Fidelity funds might not be for you. But if you want to get a little more sophisticated than a plain-Jane index of blue-chip stocks, and instead target certain market subsets such as mid-cap stocks, growth stocks, or small-cap companies, then a Fidelity fund might be the right move.

Related: The 7 Best Fidelity Index Funds for Beginners

The Best Fidelity ETFs

This year, I’ve upgraded the list by only including the best Fidelity ETFs that have earned a Morningstar Medalist rating of at least Bronze or better. Unlike Morningstar’s Star ratings, which are based upon past performance, Morningstar Medalist ratings are a forward-looking analytical view of a fund. Per Morningstar:

“For actively managed funds, the top three ratings of Gold, Silver, and Bronze all indicate that our analysts expect the rated investment vehicle to produce positive alpha relative to its Morningstar Category index over the long term, meaning a period of at least five years. For passive strategies, the same ratings indicate that we expect the fund to deliver alpha relative to its Morningstar Category index that is above the lesser of the category median or zero over the long term.”

As I’ve written in other Young and the Invested articles, a Medalist rating doesn’t mean Morningstar is necessarily bullish on the underlying asset class or categorization. It’s merely an expression of confidence in the fund compared to its peers.

Related: The 7 Best Vanguard ETFs for 2025 [Build a Low-Cost Portfolio]

1. Fidelity Nasdaq Composite Index ETF

— Style: Large-cap growth stock

— Management: Index

— Assets under management: $7.1 billion

— Dividend yield: 0.7%

— Expense ratio: 0.21%, or $2.10 per year for every $1,000 invested

— Morningstar Medalist rating: Silver

Most basic fund lists will start with an S&P 500 index ETF. That makes sense! U.S. large caps are frequently recommended to build a portfolio core, and it’s hard to do better than the S&P 500!

But it can absolutely be done.

Just consider the Nasdaq Composite Index, which is made up of the roughly 2,500 stocks listed on the Nasdaq stock exchange. Over the past 20 years, through the start of 2025, the Nasdaq Composite has outperformed the S&P 500 by more than 350 percentage points on a total-return basis (price plus dividends).

Related: 7 High-Quality, High-Yield Dividend Stocks

The Fidelity Nasdaq Composite Index ETF (ONEQ) is a diversified index fund that holds much of the Nasdaq Composite. But it’s not quite a perfect replica—it uses statistical sampling to come up with a sizable portfolio (roughly 870 holdings) that has a “similar investment profile” to the index.

Like the index, ONEQ is weighted by size, so the larger the company, the more assets are invested in that company’s stock. Thus, the biggest holdings are popular companies you might recognize: Apple (AAPL), Nvidia (NVDA), Microsoft (MSFT).

Just don’t mistake ONEQ for a complete S&P 500 replacement. The Nasdaq Composite, while technically diversified across market sectors, is even more heavily weighted in technology stocks (~50%) than the S&P 500 (~30%) right now. And while both indexes’ sector blends can and will shift over time, the Nasdaq has historically been more tethered to tech.

Related: The 7 Best Vanguard ETFs for 2025 [Build a Low-Cost Portfolio]

2. Fidelity Enhanced Large Cap Growth ETF

— Style: Large-cap growth stock

— Management: Active

— Assets under management: $3.2 billion

— Dividend yield: 0.4%

— Expense ratio: 0.18%*, or $1.80 per year for every $1,000 invested

— Morningstar Medalist rating: Gold

While 2022 and 2023 were characterized by trepidation about a potential economic slowdown and the impact of increased interest rates, 2024 was about harnessing the market’s animal spirits—and 2025 could see much of the same. If you’re interested in pursuing this strategy, you might consider the Fidelity Enhanced Large Cap Growth ETF (FELG).

Related: 10 Best Dividend Stocks to Buy [Steady Eddies]

As the name implies, this Fidelity ETF focuses on the largest growth-oriented names on Wall Street. Managers Anna Mitelman-Lester, Georgie Liu, and Shashi Naik are charged with investing at least 80% of assets in common stocks found in the Russell 1000 Growth Index, which they analyze for valuation, growth, profitability, and other factors to build a portfolio aiming to beat the Russell 1000 Growth Index.

Their current portfolio is a tight 94 names that, much like ONEQ, are overwhelmingly tech-heavy. More than 45% assets are in technology stocks such as Magnificent Seven firms Apple and Nvidia at present; consumer discretionary and communication services stocks are double-digit weights as well. Also worth noting is that the portfolio is almost entirely U.S.-based, though a tiny 2% of assets is invested in international firms.

If the economy takes a tumble, growth could fall out of favor once more. But if you’re looking beyond potential political turbulence and merely want to invest in the continued growth of leading U.S. corporations, Fidelity’s FELG is a simple and effective way to do so.

* 0.19% gross expense ratio is reduced with a 0.01% fee waiver until at least Oct. 31, 2025.

Related: 7 Best Schwab ETFs to Buy [Build Your Core for Cheap]

Featured Financial Products

Best Fidelity ETF #3: Fidelity Enhanced Large Cap Value ETF

— Style: Large-cap value stock

— Management: Active

— Assets under management: $2.2 billion

— Dividend yield: 1.9%

— Expense ratio: 0.18%*, or $1.80 per year for every $1,000 invested

— Morningstar Medalist rating: Gold

On the other side of the large-cap coin, you have value—which you can tap via FELG’s sister funds, Fidelity Enhanced Large Cap Value ETF (FELV).

You might as well call them twin sisters. FELV and FELG have the same management team, and have the same mandate to invest at least 80% of assets in a Russell 1000 index—this time the Russell 1000 Value—with the aim of topping that index.

Related: The 7 Best Dividend ETFs [Get Income + Diversify]

That said, the end result is a completely different portfolio.

Fidelity Enhanced Large Cap Value ETF has a much wider holdings set of 350 stocks at present. The leaders are much different—financials, industrials, and health care top the list—and sector breadth is much better.

You do indeed get value, too—at the very least, relative to growth. Fidelity Enhanced Large Cap Value’s components collectively have a price-to-earnings (P/E) ratio of 16 and price-to-sales (P/S) of 1.8. Fidelity Enhanced Large Cap Growth, meanwhile, has a portfolio P/E of 26 and P/S of 5.

And is common in value-oriented funds, you also get more income—FELV’s nearly 2% dividend yield is well ahead of the S&P 500 Index’s yield, and leaps and bounds better than what you’d earn through the FELG.

* 0.19% gross expense ratio is reduced with a 0.01% fee waiver until at least Oct. 31, 2025.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

4. Fidelity Small-Mid Multifactor ETF (FSMD)

— Style: Small- and mid-cap stock

— Management: Index

— Assets under management: $1.1 billion

— Dividend yield: 1.3%

— Expense ratio: 0.16%, or $1.60 per year for every $1,000 invested

— Morningstar Medalist rating: Gold

While financial experts routinely say to make U.S. large caps the core of your portfolio, they also frequently advise investors seeking out growth to allocate some of their funds to small- and/or mid-cap stocks.

Why? Well, the easiest explanation is the business rule of large numbers, which basically says that it’s a lot easier to double your revenues from $1 million than it is to double them from $1 billion. The smaller the company, then, the easier it is to demonstrate growth. On the flip side, though, small- and mid-cap stocks don’t enjoy some of the benefits their larger brethren do—their cash holdings aren’t as substantial, they have less access to capital, and their product lines often aren’t as diversified—making them riskier to invest in.

Related: The 13 Best Mutual Funds You Can Buy

One way to defray that risk is by spreading your money out across many of these stocks, which you can do through funds such as the Fidelity Small-Mid Multifactor ETF (FSMD). While it’s more common to find funds that invest in either small caps or mid-caps, FSMD is a “SMID” fund that invests in both. And it does so through a “multifactor” lens, which means stocks are selected based on four factors:

1. Value (examples: low P/E, low P/S)

2. Quality (examples: stable earnings, strong balance sheets, low debt)

3. Positive momentum signals (examples: moving average, Relative Strength Index)

4. Low volatility compared to the broader market (examples: low beta, standard deviation)

The end result is a roughly 75/25 small/mid blend of 600 stocks that is well diversified across sectors and attractively valued compared to basic small- and mid-cap indexes. Also, you’re minimally exposed to single-stock blowups; FSMD currently invests less than 1% in each and every one of its holdings.

Related: The 9 Best ETFs for Beginners

5. Fidelity High Dividend ETF

— Style: Dividend stock

— Management: Index

— Assets under management: $4.9 billion

— Dividend yield: 2.9%

— Expense ratio: 0.16%, or $1.60 per year for every $1,000 invested

— Morningstar Medalist rating: Silver

If you want to prioritize dividend stocks, consider the Fidelity High Dividend ETF (FDVV).

Related: The 7 Best Dividend ETFs [Get Income + Diversify]

This index fund holds a focused list of only about 110 or so stocks, but it’s one of the best Fidelity ETFs because of its selectivity. Specifically, FDVV zeroes in on the very best dividend payers based on consistency of distributions, a strong history of payouts, and expectations that they’ll continue to grow those dividends going forward.

Top holdings include tech giant Microsoft (MSFT), consumer staples mainstay Procter & Gamble (PG), and Big Oil titan Exxon Mobil (XOM), among other massive blue chips. And this Fidelity ETF lives up to its name, boasting a yield that’s well more than twice the broader market’s.

Related: 10 Best Stock Picking Services, Subscriptions, Advisors & Sites

6. Fidelity MSCI Information Technology Index ETF

— Style: Sector (Technology)

— Management: Index

— Assets under management: $12.1 billion

— Dividend yield: 0.5%

— Expense ratio: 0.084%, or 84¢ per year for every $1,000 invested

— Morningstar Medalist rating: Bronze

Sector-specific funds are another way to take a step beyond core holdings and truly differentiate your portfolio.

Related: The 15 Best ETFs to Buy for a Prosperous 2025

Among the most popular options is the Fidelity MSCI Information Technology Index ETF (FTEC), a popular technology-sector ETF that includes about 300 different tech stocks. This goes past some tech-sector offerings that limit themselves to only S&P 500 firms; you also get healthy exposure to mid-cap stocks and even small-sized companies.

Naturally, though, this cap-weighted fund is heaviest in Silicon Valley companies. Apple, Nvidia, and Microsoft alone account for around 45% of assets, meaning these three stocks have much more influence than the rest over how the ETF performs. But you can consider these stocks a strong foundation for FTEC to help smooth out some of the volatility that smaller technology names might experience.

Related: 12 Best Investment Opportunities for Accredited Investors

7. Fidelity MSCI Health Care Index ETF

— Style: Sector (Health care)

— Management: Index

— Assets under management: $2.7 billion

— Dividend yield: 1.4%

— Expense ratio: 0.084%, or 84¢ per year for every $1,000 invested

— Morningstar Medalist rating: Bronze

Many investors are drawn to the health care sector because of its lower risk profile and consistency. After all, one of the few certainties in life is that we’ll all get sick eventually, and need care as we age.

Related: Best Schwab Retirement Funds for an IRA

If this approach appeals to you, the Fidelity MSCI Health Care Index ETF (FHLC) is one of the best Fidelity ETFs to buy. The fund holds roughly 370 stocks across the pharmaceutical, biotechnology, medical device, health insurance, and other industries. This Fidelity health care fund is currently led by Big Pharma name (and weight-loss drug leader) Eli Lilly (LLY), insurance giant UnitedHealth Group (UNH), and diversified health care firm Johnson & Johnson (JNJ).

In short, FHLC is a simple and effective way to play the health care sector.

Featured Financial Products

8. Fidelity Enhanced International ETF

— Style: International large-cap stock

— Management: Active

— Assets under management: $2.2 billion

— Dividend yield: 2.8%

— Expense ratio: 0.29%, or $2.90 per year for every $1,000 invested

— Morningstar Medalist rating: Gold

Like with FELG and FELV, Fidelity Enhanced International ETF (FENI) involves a team of human managers investing at least 80% of assets in an index’s components—in this case, the MSCI EAFE index of developed-market stocks—while trying to do better than the index itself.

There are numerous ways to diversify a portfolio, and geographic differentiation is one of them. While U.S. markets have historically done much better than most of the world over time, they’re not bulletproof—and having exposure to the rest of the world’s stocks could prove advantageous should America go through any localized swoons.

Mitelman-Lester, Liu, and Naik also helm this Enhanced Fidelity ETF. Their 280-stock portfolio is roughly 90% large-cap in nature, and virtually all of their holdings are domiciled in either Europe or Asia, with Japan, the U.K., and Germany taking up the largest slices of the spotlight.

Blue chips like Swiss pharmaceutical firm Novartis (NVS) and British bank HSBC (HSBC) help drive a nearly 3% yield that’s well ahead of what similarly built U.S. large-cap index funds have to offer.

9. Fidelity Total Bond ETF

— Style: Core bond

— Management: Active

— Assets under management: $18.5 billion

— SEC yield: 4.8%*

— Expense ratio: 0.36%, or $3.60 per year for every $1,000 invested

— Morningstar Medalist rating: Gold

Another very popular and well-established Fidelity fund is the Fidelity Total Bond ETF (FBND). This is an actively managed bond fund, run by an eight-person team, that holds some 2,000 different debt securities. At present, that portfolio deals out more than four times the S&P 500’s yield.

The title of this Fidelity ETF says it all. FBND holds rock-solid bonds from the U.S. Treasury, as well as a smattering of higher-risk but higher-return “junk” bonds from sub-par companies. Government bonds make up about 35% of assets, providing a firm foundation; however, some 30% of assets are invested in corporate bonds, some of which are loans to distressed companies that offer super-sized yields.

Want to put the wisdom of this asset manager’s experts to work in your portfolio? FBND is one of the best Fidelity ETFs to do just that.

* SEC yield reflects the interest earned across the most recent 30-day period. This is a standard measure for funds holding bonds and preferred stocks.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

Learn More About These and Other Funds With Morningstar Investor

If you’re buying a fund you plan on holding for years (if not forever), you want to know you’re making the right selection. And Morningstar Investor can help you do that.

Morningstar Investor provides a wealth of information and comparable data points about mutual funds and ETFs—fees, risk, portfolio composition, performance, distributions, and more. Morningstar experts also provide detailed explanations and analysis of many of the funds the site covers.

With Morningstar Investor, you’ll enjoy a wealth of features, including Morningstar Portfolio X-Ray®, stock and fund watchlists, news and commentary, screeners, and more. And you can try it before you buy it. Right now, Morningstar Investor is offering a free seven-day trial. You can check out the current deal, as well as discounted rates for students and teachers, by visiting Morningstar’s website.

Do Fidelity ETFs Include Actively Managed Funds?

Yes. Many of Fidelity’s mutual funds made a name for themselves thanks to strong active management. And the Fidelity Total Bond ETF (FBND) is a good example of how this strategy can be put to use in exchange-traded Fidelity funds. As of this writing, Fidelity had 26 actively managed ETFs, including the likes of FBND, Fidelity Blue Chip Growth ETF (FBCG), and Fidelity Small-Mid Cap Opportunities ETF (FSMO).

Related: The 7 Best Mutual Funds for Beginners

Fidelity also has funds like the Fidelity High Dividend ETF (FDVV), which are labeled as “strategic beta” funds. That’s because they take an underlying index but put additional screening methodology on top to provide a more curated list of holdings.

You’ll certainly find passive, indexed ETFs among Fidelity’s funds. But there are certainly actively managed funds, too.

Does Fidelity Have ESG ETFs?

Yes. Several Fidelity funds focus around environmental, social, and governance (ESG) topics, with a heavy lean toward the “E.”

For instance, the Fidelity Sustainable U.S. Equity ETF (FSST) owns companies determined to have proven or improving sustainability practices. The Fidelity Clean Energy ETF (FRNW) holds companies involved in solar, wind, or other renewable resources. And the Fidelity Electric Vehicles and Future Transportation ETF (FDRV) invests in electric-vehicle and EV component makers; however, the fund also homes in on autonomous-vehicle firms, which can (but don’t necessarily have to) focus on environmental friendliness.

Why Does a Fund’s Expense Ratio Matter So Much?

Every dollar you pay in expenses is a dollar that comes directly out of your returns. So, it is absolutely in your best interests to keep your expense ratios to an absolute minimum.

The expense ratio is the percentage of your investment lost each year to management fees, trading expenses and other fund expenses. Because index funds are passively managed and don’t have large staffs of portfolio managers and analysts to pay, they tend to have some of the lowest expense ratios of all mutual funds.

Related: 10 Monthly Dividend Stocks for Frequent, Regular Income

This matters because every dollar not lost to expenses is a dollar that is available to grow and compound. And over an investing lifetime, even a half a percent can have a huge impact. If you invest just $1,000 in a fund generating 5% per year after fees, over a 30-year horizon, it will grow to $4,116. However, if you invested $1,000 in the same fund, but it had an additional 50 basis points in fees (so it only generated 4.5% per year in returns), it would grow to only $3,584 over the same period.

Related: Best Vanguard Retirement Funds for a 401(k) Plan

Want to talk more about your financial goals or concerns? Our services include comprehensive financial planning, investment management, estate planning, taxes, and more! Schedule a call with Riley to discuss what you need, and what we can do for you.

Related: 13 Best Long-Term Stocks to Buy and Hold Forever

As even novice investors probably know, funds—whether they’re mutual funds or exchange-traded funds (ETFs)—are the simplest and easiest ways to invest in the stock market. But the best long-term stocks also offer many investors a way to stay “invested” intellectually—by following companies they believe in. They also provide investors with the potential for outperformance.

So if you’re looking for a starting point for your own portfolio, look no further. Check out our list of the best long-term stocks for buy-and-hold investors.

Related: 10 Best ETFs to Beat Back a Bear Market

Bear markets are relatively rare, and relatively short-lived—U.S. stock markets have spent only about 20% of the past 90-plus years mired in downturns of 20% or more, and on average, they only last a little longer than a year.

But they do happen, and they can be painful.

We say to hope for the best, but always be prepared for the worst. You can do that by checking out our 10 favorite ETFs to stay afloat during a bear market.

Please Don’t Forget to Like, Follow and Comment

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Subscribe to Retire With Riley, our free weekly retirement planning newsletter, and

3. Give the article a Thumbs Up on the top-left side of the screen.

4. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!