Fidelity is one of the world’s largest and best-known providers of mutual funds. The firm offers a dizzying 200 products that collectively command trillions of dollars in assets under management (AUM)—a scale that also allows it to offer some of the lowest fees in the business.

And its affordability proposition goes a set farther than most. That is, whereas many fund providers require investments in the hundreds or even thousands of dollars to get started in their mutual funds, Fidelity has no minimum for most funds. That means, realistically speaking, you could buy most of its mutual funds with as little as $1.

Importantly, you don’t need a Fidelity account to invest in Fidelity funds. Most brokerage and retirement accounts (outside of 401(k)s, which are highly limited and vary from one plan to the next) that allow you to buy mutual funds will let you own Fidelity’s products.

Today, I’ll introduce you to some of Fidelity’s best mutual funds to buy in 2026—a collection of products that showcase both Fidelity’s track record as a haven for smart stock and bond pickers, as well as its ability to provide superior index funds with thin fees. Every Fidelity fund on this list represents the Investor-class shares, which are available to all retail investors and have no investment minimums.

Editor’s Note: Tabular data presented in this article are up-to-date as of Jan. 13, 2026.

Featured Financial Products

Disclaimer: This article does not constitute individualized investment advice. Individual securities, funds, and/or other investments appear for your consideration and not as personalized investment recommendations. Act at your own discretion.

Table of Contents

Why Fidelity Mutual Funds?

Fidelity is a leader in mutual funds (and exchange-traded funds, for that matter) and has been a force in the industry since the launch of its Fidelity Puritan Fund (FPURX) back in 1947.

Today, this premier mutual fund company has more than $17 trillion in assets under administration thanks in large part to the success of its talented fund managers. Most notably, that includes Peter Lynch, the longtime manager of the Fidelity Magellan Fund (FMAGX) who averaged an incredible 29.2% per year between 1977 and 1990.

However, while Fidelity first built its name on actively managed funds, over the past three decades, the firm has built out its low-cost and even no-cost index funds as part of the movement to reduce expense ratios and transaction costs for individual investors.

The end result is a fund lineup that can serve just about every need, and that’s typically competitive on price.

How Were the Best Fidelity Mutual Funds Selected?

Fidelity offers up quite the collection of mutual funds—in the hundreds, in fact, making it easy to succumb to analysis paralysis.

To whittle our way down to a more manageable list of the truly best Fidelity mutual funds, I started the same way I begin most of my reviews: by booting up Morningstar Investor and running a quality screen I customize for each article. In this case, I looked for only Fidelity mutual funds that have earned a Gold Morningstar Medalist rating.

Unlike Morningstar’s Star ratings, which are based upon past performance, Morningstar Medalist ratings are a forward-looking analytical view of a fund. Per Morningstar:

“For actively managed funds, the top three ratings of Gold, Silver, and Bronze all indicate that our analysts expect the rated investment vehicle to produce positive alpha relative to its Morningstar Category index over the long term, meaning a period of at least five years. For passive strategies, the same ratings indicate that we expect the fund to deliver alpha relative to its Morningstar Category index that is above the lesser of the category median or zero over the long term.”

As I’ve written in other Young and the Invested articles, a Medalist rating doesn’t mean Morningstar is necessarily bullish on the underlying asset class or categorization. It’s merely an expression of confidence in the fund compared to its peers.

Fidelity actually has dozens of Gold-rated funds, but several of them are specific share classes that are only available to certain subsets of investors—those enrolled in Fidelity Wealth Services, for instance, or those enrolled in eligible employer-sponsored retirement plans. So I’ve further narrowed the list to only Investor-class funds. Importantly, these funds typically offer no investment minimums, meaning you can get started for as little as one dollar.

From the remaining universe of funds, I selected a range of both indexed and actively managed mutual funds displaying the best Fidelity has to offer. This list includes both core portfolio holdings, as well as satellite products you can use to try to generate alpha.

The Best Fidelity Mutual Funds to Buy

As mentioned before, Fidelity boasts some of the fund industry’s top managers. So while this list of Fidelity’s best mutual funds includes a few dirt-cheap index funds, I’ve highlighted several actively managed products—both core and satellite holdings alike—that demonstrate the firm’s ability to identify the market’s best opportunities.

Also, every fund highlighted on this list boasts annual expenses that are at least below their category average. So while Fidelity’s actively managed funds might be more expensive than your average index fund, you’re still getting good relative value. (That said, if you have access to more inexpensive share classes via your wealth manager, retirement plan, or elsewhere, use those instead!)

One last reminder: Each fund on this list has no investment minimums. So you can get started with as little or as much capital as you’d like.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

1. Fidelity 500 Index Fund

— Style: U.S. large-cap stock

— Management: Index

— Assets under management: $740.0 billion

— Dividend yield: 1.1%

— Expense ratio: 0.015%, or 15¢ per year for every $1,000 invested

If a major mutual fund provider’s lineup includes a cheap S&P 500 index fund, chances are it’ll be one of their best-rated funds, and that’s the case here with Fidelity 500 Index Fund (FXAIX).

The logic goes like this: The S&P 500 Index is commonly used as a performance benchmark for mutual funds that invest in U.S.-based large-cap stocks*. But the majority of fund managers who run these funds typically struggle to beat their benchmark. Indeed, according to S&P Dow Jones Indices, over the past 10 years, 86% of all active large-cap U.S. equity funds have underperformed the S&P 500 … and that number ticks up to 88% over the past 15 years.

Related: How to Rebalance Your Portfolio: A Quick Guide

“I know guys that rate active managers in all these categories, and even they’re like, ‘I’m not buying actively managed large blend; I’m just indexing,'” says Daniel Sotiroff, Senior Analyst for ETF and Passive Strategies at Morningstar. “Because it’s so brutally tough to beat a dirt-cheap index fund in the large blend category.”

So if even the pros can’t beat it, shouldn’t we just join it?

The S&P 500 Index is a collection of 500 of the largest American businesses, and a barometer of the American stock market. The index requires a few other criteria for a company to join, including a market cap of at least $22.7 billion, highly liquid shares (the stock is frequently bought and sold), and more. There’s a bit of a quality check, too: A company must also have positive earnings in the most recent quarter, and the sum of its previous four quarters must be positive. (Note: Once a company becomes an S&P 500 component, it’s not automatically kicked out if it fails to meet all of the criteria. However, the selection committee would take this under consideration and possibly boot the company.)

Related: Best Fidelity Retirement Funds for a 401(k) Plan

People like to consider the S&P 500 a reflection of the U.S. economy. But it’s hardly a perfect representation. For instance, the technology sector accounts for 35% of FXAIX’s assets; however, energy, utilities, real estate, and materials merit less than 3% apiece. This is in no small part because, like many indexes, the S&P 500 is market capitalization-weighted, which means the greater the size of the company, the more “weight” it’s given in the index. Currently, trillion-dollar-plus companies Nvidia (NVDA), Apple (MSFT), and Microsoft (AAPL) sit atop Fidelity 500 Index Fund’s holdings list at weights of 6%-7% apiece, meaning their individual performances have a pretty outsized effect on the fund’s returns compared to the other components.

Turnover, which is how much the fund tends to buy and sell holdings, is always low, given that only a handful of stocks enter or leave the index in any given year. This tamps down (and often eliminates) capital-gains distributions, which receive unfavorable tax treatment. This makes FXAIX an extremely tax-efficient option for taxable brokerage accounts.

It’s this combination of traits—the S&P 500’s excellence as an index, bare-bones costs, and tax efficiency—that earn this Fidelity index fund a Gold Medalist rating from Morningstar. In fact, FXAIX is one of the cheapest ways to buy the S&P 500 across mutual funds and exchange-traded funds (ETFs) alike. That makes FXAIX not just one of the best Fidelity index funds you can buy and one of its best products overall, but one of the best mutual funds on the whole darn market.

* There are different ways to define “cap” levels. We’re adhering to Morningstar’s definition, which says the largest 70% of companies by market capitalization within a fund’s “style” are large caps, the next 20% by market cap are mid-caps, and the smallest 10% by market cap are small caps.

Related: 9 Best Schwab Funds You Can Buy: Low Fees, Low Minimums

Featured Financial Products

2. Fidelity Growth Company Fund

— Style: U.S. large-cap growth stock

— Management: Active

— Assets under management: $81.0 billion

— Dividend yield: <0.1%

— Expense ratio: 0.52%, or $5.20 per year for every $1,000 invested

If you did want to try to beat the index, Fidelity Growth Company Fund (FDGRX) has historically been up for the job.

Fidelity Growth Company is an actively managed large-cap growth fund, helmed since 1997 by Steven Wymer. S&P 500 funds (like FXAIX) are considered large-cap “blend” funds because they hold both growth stocks and value stocks. But FDGRX wants to exclusively hold the former. Specifically, Wymer says he seeks out firms “operating in well-positioned industries and niches that we believe are capable of delivering persistent sales and earnings growth.” He also prefers companies that fund their own growth (through cash, in other words, not debt) and “benefit from management teams focused on creating long-term shareholder value.”

Related: 15 Best Long-Term Stocks to Buy and Hold Forever

FDGRX is predominantly large-cap in nature, with about 75% of its weight in bigger companies, 15% in mid-caps and 5% in small caps. And unlike many actively managed products, which tend to hold fewer stocks (often in the dozens) than broader index funds (in the hundreds or thousands), Wymer has built a nearly 600-company portfolio … albeit one with hallmark overweights to certain stocks. In this case, Wymer is even more exposed to Nvidia (16%), Apple (8%), and Microsoft (8%) than the S&P 500.

Fidelity Growth Company is benchmarked against the Russell 3000 Growth Index, which is more of a total-market benchmark (holding large-, medium-, and small-cap stocks) than the predominantly large-cap S&P 500. Doesn’t matter—Wymer has clobbered both indexes over every meaningful time frame. FDGRX’s average annual returns are also within the top 2% of all category funds over the trailing 10-year period, and within the top 1% over the past 15 years. That’s more than good enough to merit a spot among Fidelity’s best mutual funds.

Related: The 13 Best Mutual Funds You Can Buy for 2026

3. Fidelity Equity-Income

— Style: Large-cap dividend stock

— Management: Active

— Assets under management: $10.4 billion

— Dividend yield: 1.6%

— Expense ratio: 0.53%, or $5.30 per year for every $1,000 invested

Fidelity Equity-Income (FEQIX) is never going to win any popularity contests. This is a boring, dividend income-focused, large-cap value fund—one that will typically lag a little when the market is screaming higher.

But if you find yourself in peril, you’ll love having it in your corner.

Related: The 16 Best ETFs to Buy for a Prosperous 2026

FEQIX invests in 125 large-cap stocks, predominantly U.S.-based blue chips like JPMorgan Chase (JPM) and Exxon Mobil (XOM) that pay out better-than-average dividends. You do get a little international exposure (a little less than 15% currently), but with the same focus on big, dividend-paying firms such as AstraZeneca (AZN) and Dividend Aristocrat Linde (LIN). Technically, manager Ramona Persaud is allowed to invest in debt securities and even trade covered calls to manage the fund’s assets, but right now, the fund’s assets are virtually all in equities, with about 2% in cash.

This kind of portfolio construction lends itself to less upside in bull markets but better protection during bear markets and other downturns. It outperformed the market slightly during the COVID crash and late 2018 downturn, and by a much wider margin during the 2022 bear market and through 2025’s spring turbulence.

Related: Best High-Dividend ETFs for Income-Hungry Investors

“Persaud constantly goes deep in her analysis. She’s trained as an engineer, driving a clear interest in structure, stability, and logic. She strives to wield multiple perspectives and drives for constant improvement,” Morningstar Senior Analyst Todd Trubey says. “Persaud’s focus on downside protection stems from a desire to help shareholders traverse difficult periods successfully. Unlike many investors who stress quantitative rigor, she invokes the art of investing often and consistently demonstrates humility when the market shifts.”

Make Young and the Invested your preferred news source on Google

Simply go to your preferences page and select the ✓ box for Young and the Invested. Once you’ve made this update, you’ll see Young and the Invested show up more often in Google’s “Top Stories” feed, as well as in a dedicated “From Your Sources” section on Google’s search results page.

4. Fidelity Mid Cap Index Fund

— Style: U.S. mid-cap stock

— Management: Index

— Assets under management: $45.8 billion

— Dividend yield: 1.1%

— Expense ratio: 0.025%, or 25¢ per year for every $1,000 invested

Mid-cap stocks are a way to thread the needle between the relative size and stability of large-cap stocks and the high growth potential of small-cap stocks. Indeed, this ideal middle ground has earned mid-caps the nickname of “Goldilocks” stocks.

Related: 9 Best Fidelity ETFs for 2026 [Invest Tactically]

“Since 1978, mid-cap stocks have outperformed small-caps over each of these rolling time periods: five, 10, 20, 30 and 40 years,” says Oregon-based equity manager Jensen Investment Management. “They’ve even bested large-caps over the 30- and 40-year windows. These returns came with lower volatility than small-caps as well, making the evidence even more compelling.

“That means mid-caps haven’t just delivered better performance—they’ve done it more consistently, with fewer drawdowns.”

Fidelity Mid Cap Index Fund (FSMDX) is an exceedingly cost-efficient way to tap this area of the market. FSMDX tracks the Russell MidCap Index, which is made up of the 800 smallest stocks in the Russell 1000 (which is itself an index of the U.S. market’s 1,000 largest stocks). As a result, you’re getting exposure to around 800 mostly mid-cap stocks—the fund usually is 75% weighted in mids, with another 5%-10% in smaller large caps, and another 10%-15% in larger small caps.

Related: 11 Best Vanguard Funds for the Everyday Investor

Why not 100% mid-caps? It’s hard to know for sure; some fund companies define mid-caps differently, while others might want a broader portfolio than what pure mid-caps alone can provide. Regardless, it’s actually common across the fund industry for 15%-30% of a mid-cap fund’s holdings to bleed into small- and/or large-company territory, and some funds invest even more outside of mid-caps. Where FSMDX stands out is that it “tends to go higher up the market-cap ladder than other mid-cap indexes, favoring large-cap stocks that tend to be more established than mid-cap stocks,” Morningstar says.

Sector weights will naturally change over time as certain businesses come into and go out of favor, but right now, industrials are tops at 17%, followed by technology stocks (16%), financials (14%), consumer discretionary (12%), and health care (10%). Also, thanks to both the market cap-weighting of the Russell MidCap Index and the high number of holdings, single-stock risk is minimal—all stocks account for less than 1% of assets.

A sound methodology for Wall Street’s mid-sized companies, dirt-cheap fee, and strong historical performance all make FSMDX one of the best Fidelity funds you can buy.

Related: The 12 Best Vanguard ETFs for 2026 [Build a Low-Cost Portfolio]

5. Fidelity Select Medical Technology and Devices Portfolio

— Style: Sector (Health)

— Management: Active

— Assets under management: $4.1 billion

— Dividend yield: <0.1%

— Expense ratio: 0.63%, or $6.30 per year for every $1,000 invested

Fidelity has roughly 30 “Select” funds—the company’s name for its sector- and industry-specific funds. Several of these funds currently boast Morningstar Gold Medalist ratings and thus deserve a spot among the best Fidelity funds you can buy; I’ll cover a pair of them in this article.

First up is the Fidelity Select Medical Technology and Devices Portfolio (FSMEX).

Related: Best Vanguard Retirement Funds for an IRA

FSMEX is a health care sector fund, and an oddball at that. While most health care sector funds will be highest on pharmaceuticals and biotechnology stocks, manager Eddie Lee Yoon’s 64-holding portfolio, which is 95% invested in domestic firms, is mostly dedicated to health care equipment (50% of assets) and life sciences tools and services (35%). The remaining portfolio is peppered with small holdings in health care technology, health care services, biotech, pharma, and other health care industries.

Fidelity Select Medical Tech and Devices does have something in common with your average health care fund, though: single-stock concentration. Many sector funds are cap-weighted and, as a result, often have a few allocations in the high single digits and even double digits. While FSMEX is hand-selected and not cap-weighted, Yoon holds a few outsized positions—most notably Boston Scientific (BSX, 12%), Danaher (DHR, 12%), Thermo Fisher Scientific (TMO, 10%), and Intuitive Surgical (ISRG, 8%).

Related: Best Schwab Retirement Funds for an IRA

And while FSMEX is certainly more expensive than your typical sector index fund, it has largely been worth it.

Morningstar, in explaining its Gold rating, states that at FSMEX, “Edward Yoon has delivered superior performance, outperforming both the category benchmark and average category peer for the past 10-year period.” Morningstar adds that a personal investment of between $500,000 and $1 million in FSMEX is a positive contributor to the rating: “This effort aligns interests with shareholders by investing alongside them.”

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

6. Fidelity Select Semiconductor Portfolio

— Style: Industry (Semiconductors)

— Management: Active

— Assets under management: $28.7 billion

— Dividend yield: <0.1%

— Expense ratio: 0.62%, or $6.20 per year for every $1,000 invested

While many investors unload their sector-specific needs to basic index exchange-traded funds (ETFs), Fidelity manager Adam Benjamin makes a case for human stewardship with his Fidelity Select Semiconductors Portfolio (FSELX).

The long-term appeal of chips is pretty straightforward: As both our personal and business worlds become increasingly dependent on technology, semiconductor companies—which design and manufacture one of the most essential components of technology—stand to benefit. And some of the greatest opportunities rest within those semiconductor companies powering emergent and high-growth technologies such as data centers, cloud computing, and artificial intelligence.

Related: 9 Best Schwab ETFs to Buy [Build Your Core for Cheap]

Benjamin, who has led the fund for five years, aims to beat the broader semiconductor industry by picking winners and losers within the space. In addition to single-company research, Benjamin also attempts to identify themes that will impact the largest end markets, and determine how technology disruptors might impact incumbent companies.

FSELX’s 59-stock portfolio might seem tight, but it’s pretty standard for a single-industry fund. The same goes for the massive 24% weight in Nvidia—as it goes, so too goes most semiconductor portfolios, not just Benjamin’s pick list.

Kudos to Benjamin and Fidelity Select Semiconductors: In addition to earning a Gold Medalist rating, they have beaten every meaningful benchmark—the S&P 500, the technology sector, the MSCI US IMI Information Technology 25/50 Index—and been within the top 2% of tech-stock funds over the trailing three-, five-, 10-, and 15-year periods.

Related: The 10 Best Dividend ETFs [Get Income + Diversity]

7. Fidelity Total International Index Fund

— Style: International all-cap stock

— Management: Index

— Assets under management: $20.0 billion

— Dividend yield: 2.8%

— Expense ratio: 0.06%, or 60¢ per year for every $1,000 invested

U.S. markets have long been among the most productive in the world, and if you believe in the American economy’s ability to keep growing, that should remain the case—and thus, most experts would tell you to own primarily U.S. stock and bond funds.

But those same experts would tell you that it’s worth having at least some international exposure, and you can do that mighty inexpensively through the Fidelity Total International Index Fund (FTIHX).

Related: The Best Dividend Stocks: 10 Pro-Grade Income Picks for 2026

FTIHX tracks an international index that holds large-, mid-, and small-cap stocks in both developed and emerging markets—basically anywhere that isn’t the U.S. And its passport is covered in stamps. The fund holds nearly 5,100 stocks across a few dozen countries.

Like with most index funds, Fidelity Total International Index Fund hardly does any of this equally. Geographically speaking, this Fidelity mutual fund favors developed markets, including Japan (15%), the U.K. (9%), and Canada (8%). From a company-size perspective, it’s predominantly large-cap in nature—nearly 80% of the portfolio is invested in big, blue-chip international firms such as Taiwan Semiconductor (TSM), Swiss pharma company Roche (RHHBY), and German software provider SAP (SAP). That’s common for international funds, and it tends to result in dividend yields that are much bigger than U.S. large-cap funds—FTIHX’s yield is well more than double the S&P 500’s.

Related: 7 Best High-Yield Dividend Stocks: The Pros’ Picks for 2026

It is worth noting that while Fidelity Total International Index Fund does enjoy a Morningstar Gold medalist rating, a lot of that is shouldered by its dirt-cheap investment fee. FTIHX’s historical performance has been good, but not necessarily excellent.

Are you compelled to build the lowest-fee portfolio possible? Do you have a Fidelity account (or are you willing to open one)? If so, you can own a similar, Silver-rated fund—Fidelity ZERO International Index Fund (FZILX)—for an annual fee of literally nothing.

Related: The 7 Best T. Rowe Price Funds for 2026

Featured Financial Products

8. Fidelity Pacific Basin

— Style: Pacific/Asia stock

— Management: Active

— Assets under management: $960.6 million

— Dividend yield: 4.4%

— Expense ratio: 0.98%, or $9.80 per year for every $1,000 invested

Much like investors augment their core equity holdings with, say, large growth stocks or small-cap companies to generate outperformance, they also try to jazz up their core international holdings with region-specific funds, like our next Gold-rated entry.

The Fidelity Pacific Basin Fund (FPBFX) is an actively managed mutual fund that invests in stocks either located in, or tied economically to, the Pacific Basin. It’s still one of the most expensive Fidelity funds we talk about, but its 0.98% expense ratio still puts its cost well below the 1.15% Morningstar Category average fee for diversified Asian/Japanese funds.

And these fees fuel a solid product. Co-Managers Kirk Neureiter and Stephen Lieu target companies with strong, stable growth characteristics, solid free cash flow, and focused management teams, among other traits.

Related: The 10 Best Index Funds You Can Buy for 2026

Fidelity Pacific Basin is a mix of developed and emerging markets, with established Japan hoovering up the largest chunk of assets (31%), followed by China (25%) and Taiwan (11%). All told, you’re getting exposure to more than a dozen countries, including a small peppering of U.S. exposure. (Remember: Holdings can merely be “tied economically” to the Pacific Basin’s fortunes.)

While not market cap-weighted, the 105-stock portfolio is heaviest in large-cap stocks (75%), though it does hold a fair amount of mid-caps (20%) consists of large-cap stocks (85%), though it does hold some mid-caps (20%) and small firms (5%). Top holdings are the Asian mega-caps you might expect; management has loaded up on names such as Taiwan Semiconductor, Chinese e-commerce firm Tencent (TCEHY), and Japan gaming giant Nintendo (NTDOY).

FPBFX has been wildly successful over the long term. There aren’t many funds in its category, but Pacific Basin has been in the top 5% of its peers over literally every significant time period, beating both the category average and Morningstar index handily during those periods.

Related: 7 Best Schwab Index Funds for Thrifty Investors

9. Fidelity Investment Grade Bond Fund

— Style: Intermediate-term core bond

— Management: Active

— Assets under management: $11.8 billion

— SEC yield: 4.1%*

— Expense ratio: 0.45%, or $4.50 per year for every $1,000 invested

Most investors need some exposure to bonds, which is debt that’s issued by governments, companies, and other entities. Their interest payments and relative lack of volatility make them an excellent tool for providing a portfolio with stability and income. But how much bond exposure you need will vary by age—because they’re better at protecting wealth than growing it, people typically start with little in the way of bond holdings earlier in life, then gradually hold more bonds as they get closer to (and into) retirement. (Purpose-built investment products called target-date funds capture this dynamic automatically for investors.)

Related: The 10 Best Vanguard Index Funds to Buy in 2026

But individual bonds can be a hassle. Data and research on individual issues is much thinner than it is for publicly traded stocks. And some bonds have minimum investments in the tens of thousands of dollars. But you can blunt these problems by purchasing a bond fund, which allows you to invest in hundreds or even thousands of bonds with a single click—and, in many cases, very low fees.

Core bond funds like the Fidelity Investment Grade Bond Fund (FBNDX) are the, ahem, gold standard.

FBNDX’s five co-managers have built a portfolio of more than 4,600 investment-grade securities spanning numerous debt types. The fund’s largest current allocation is to U.S. Treasury bonds, which command 47% of assets. It also has a 24% weight in corporate bonds, 12% in pass-through mortgage-backed securities (MBSes), 9% in asset-backed securities (ABSes), 5% in commercial MBSes, and sprinklings of other debt.

Diversification goes beyond debt categories, too. The fund holds bonds with maturities of between just a few months and more than 20 years, though the biggest slug (~56%) is in medium-term bonds of four to eight years until maturity. Duration, a measure of interest-rate sensitivity, is six years. While the actual calculation is much more complex, this basically implies that for every 1-percentage-point increase in interest rates, FBNDX would suffer a short-term decline of 6%, and vice versa. It’s a moderate amount of risk, but no more.

Related: 8 Best-in-Class Bond Funds to Buy

From a performance standpoint, Fidelity Investment Grade Bond’s management has been up to the task, beating both its category average and index over every meaningful time period. It is particularly productive over the long-term, sitting in the top 10% of funds over the trailing 10- and 15-year periods.

Long story short: Fund shareholders are instantly plugged into a widely diversified and well-selected set of fixed-income assets, and at a very reasonable cost. This makes FBNDX one of the best Fidelity mutual funds to buy for anyone who wants to buy a single core bond product and call it a day.

* SEC yield reflects the interest earned across the most recent 30-day period. This is a standard measure for funds holding bonds and preferred stocks.

Related: The 7 Best Closed-End Funds (CEFs) for 2026

10. Fidelity Total Bond Fund

— Style: Intermediate-term core-plus bond

— Management: Active

— Assets under management: $42.2 billion

— SEC yield: 4.4%

— Expense ratio: 0.45%, or $4.50 per year for every $1,000 invested

Fidelity’s FBNDX is referred to as a “core” bond fund, which means it holds several types of core debt categories, such as U.S. Treasuries and investment-grade corporate bonds. Investors with a little more appetite for risk might also consider a “core-plus” bond fund, which also holds a variety of debt securities—but in addition to core bond categories, they can also hold noncore categories such as below-investment-grade (junk) corporate bonds and emerging-market debt.

One such core-plus fund is the Fidelity Total Bond Fund (FTBFX). A team of eight co-managers spreads the fund’s assets across 6,800 issues in a number of categories. Currently, it invests 39% of assets into U.S. government debt, another 27% in corporate debt, and 16% in pass-through MBSes. The rest is sprinkled across ABSes, commercial MBSes, foreign sovereign debt, and more.

Related: 7 Best Vanguard Dividend Funds [Low-Cost Income]

Sure, the portfolio isn’t a huge deviation from a typical core bond fund. But this isn’t a fully investment-grade portfolio like FBNDX—you’re getting some exposure to high-yield corporate debt (11%) and emerging-market bonds (3%), too.

Credit quality is still high overall. And while management holds bonds with maturities ranging anywhere from 20 years to a few months, the biggest chunk of bonds (50%) sits between zero and five years. Duration, meanwhile, is just a hair below six years.

Performance-wise, Fidelity Total Bond has been in the top quarter of its category peers over every medium- and long-term time frame. And you get that exposure at a below-average 0.45% in annual fees.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

11. Fidelity Freedom Index Funds

— Style: Target-date

— Management: Index

— Assets under management (collectively): $200.0 billion

— Expense ratio: 0.12%, or $1.20 per year for every $1,000 invested

Target-date funds (TDFs) are the ultimate buy-and-hold instrument, meant to stay in your portfolio for literally decades.

In short, TDFs are funds that shift their asset allocation over time to meet investors’ changing needs as they age. A person who turned 25 in 2025 would expect to retire in 2065, so they’d buy a fund with a target retirement date of 2065. That fund will probably start out with a very heavy allocation to stocks (to grow the investors’ wealth), but as the years roll on and the fund approaches its target retirement date, it will start putting more of its assets into bonds (to protect the investors’ wealth).

Many fund providers have at least one target-date series, though larger asset managers sometimes offer more. Fidelity is well outside the norm, however, with a whopping four—and the highest-rated among them are the Fidelity Freedom Index Funds.

Fidelity Freedom Index Funds, which are built exclusively from Fidelity’s lineup of low-cost index funds, are a rarity—few target-date series can boast a Gold Medalist rating. That rating is due in no small part to extremely low costs. Unlike actively managed target-date funds whose management fees tend to be different across the series, all Fidelity Freedom Index Funds charge the same fee (0.12%).

Related: The 7 Best Fidelity Index Funds for Beginners

Here’s a quick look at the full lineup:

— Fidelity Freedom Index 2010 Fund (FKIFX)

— Fidelity Freedom Index 2015 Fund (FLIFX)

— Fidelity Freedom Index 2020 Fund (FPIFX)

— Fidelity Freedom Index 2025 Fund (FQIFX)

— Fidelity Freedom Index 2030 Fund (FXIFX)

— Fidelity Freedom Index 2035 Fund (FIHFX)

— Fidelity Freedom Index 2040 Fund (FBIFX)

— Fidelity Freedom Index 2045 Fund (FIOFX)

— Fidelity Freedom Index 2050 Fund (FIPFX)

— Fidelity Freedom Index 2055 Fund (FDEWX)

— Fidelity Freedom Index 2060 Fund (FDKLX)

— Fidelity Freedom Index 2065 Fund (FFIJX)

— Fidelity Freedom Index 2070 Fund (FRBVX)

— Fidelity Freedom Index Income Fund (FIKFX)

That last product, Fidelity Freedom Index Income Fund, is designed for people who have reached retirement, and it boasts the most conservative asset blend. When a Fidelity Freedom Index target-date fund expires, it merges with Fidelity Freedom Index Income.

For a longer explanation of all of Fidelity’s target-date lineups, check out our Beginner’s Guide to Fidelity Target-Date Funds.

Related: Best Target-Date Funds: Schwab vs. Vanguard vs. Fidelity

Featured Financial Products

Learn More About These and Other Funds With Morningstar Investor

If you’re buying a fund you plan on holding for years (if not forever), you want to know you’re making the right selection. And Morningstar Investor can help you do that.

Morningstar Investor provides a wealth of information and comparable data points about mutual funds and ETFs—fees, risk, portfolio composition, performance, distributions, and more. Morningstar experts also provide detailed explanations and analysis of many of the funds the site covers.

With Morningstar Investor, you’ll enjoy a wealth of features, including Morningstar Portfolio X-Ray®, stock and fund watchlists, news and commentary, screeners, and more. And you can try it before you buy it. Right now, Morningstar Investor is offering a free seven-day trial and a discount on your first year’s subscription when you use our exclusive link.

What Is the Minimum Investment Amount on Fidelity Mutual Funds?

Fidelity’s mutual funds (and ETFs, for that matter) make plenty of sense for investors of all shapes and sizes, but they have a particular appeal among people who don’t have much money to work with. That’s because many Fidelity mutual funds have no investment minimums—you can literally start with as little as $1.

That’s extremely beneficial in self-directed accounts like a brokerage or health savings account (HSA). Many mutual funds from other providers require high minimums in the thousands of dollars, hamstringing investors with little capital to work with.

Actively Managed Funds vs. Index Funds

There are infinite types of mutual funds, but all can be divided into two main camps:

— actively managed funds

— passively managed funds, also known as passive funds or, most commonly, index funds

Actively managed funds have professional managers that use their discretion to buy and sell securities. Whether they are value funds, growth funds, or anything in between, they are all essentially run the same way: A manager or team of managers buys and sells stocks, bonds, or other securities in the pursuit of price returns, dividends/income, or both.

Related: The 7 Best Mutual Funds for Beginners

Index funds, in contrast, are passive. There’s no manager actively looking to “beat the market.” The fund is simply looking to copy an index—which is based on a set of rules that the index automatically applies—enjoying that underlying investment exposure. Actively managed stock funds will try to cherry pick the stocks or bonds they like best. An index fund simply buys whatever its rules say to buy, then lets that portfolio run until it’s time to “rebalance” (apply the rules again).

Related: 6 Best Stock Recommendation Services [Stock Tips + Picks]

The primary advantages of actively managed funds is that a talented manager can potentially outperform over time and may be adept at navigating a difficult period such as a bear market. But with an index fund, you generally get much lower costs in terms of management fees and trading expenses, better tax efficiency and performance that often ends up being better than that of many active managers.

What Are Balanced Mutual Funds?

Balanced mutual funds, sometimes also called “hybrid funds” or “allocation funds,” hold both stocks and bonds. However, while the name might imply that all balanced funds hold an equal amount of stocks and bonds, that’s not quite the case.

Some balanced funds are “aggressive” and dedicate far greater assets to stocks than bonds—say, 80/20 stocks, or 70/30 stocks. Meanwhile, some balanced funds are “conservative” and invest most of their assets in bonds. Still more are much closer to a 50/50 split.

Like Young and the Invested’s content? Be sure to follow us.

How Are Mutual Funds Different From Exchange-Traded Funds?

There is a lot of overlap between traditional mutual funds and their cousins, exchange-traded funds (ETFs). That’s because exchange-traded funds are very similar to mutual funds, but with a few different traits.

Related: 7 Low- and Minimum-Volatility ETFs for Peace of Mind

Like traditional mutual funds, an ETF will hold a basket of stocks, bonds, and other securities. These can be broad and tied to a major index like the S&P 500, or they can be exceptionally narrow and focus on a specific sector or even a specific trading strategy. For the most part, anything that can be held in an exchange traded fund can also be held in a mutual fund.

But there are some major differences. When you invest in a mutual fund, you (or your broker) actually send money to the manager, who in turn uses the cash to buy stocks or other investments. When you want to sell, the manager will sell off a tiny piece of the securities the mutual fund owns and send you the proceeds. Money generally enters or exits the fund once per day.

Related: Buy ‘The Future’: 5 Tech Stock ETFs You Should Own in 2026

Exchange-traded funds, on the other hand, trade on the New York Stock Exchange or another major exchange like a stock. If you want to buy shares, you don’t send the manager money; you just buy shares from another investor on the open market.

There are two advantages here. The first is that ETFs allow for intraday liquidity. If you want to buy or sell in the middle of the trading day—or multiple times throughout the trading day—you can.

The second advantage is tax efficiency. In a traditional mutual fund, redemptions by investors can generate selling by the manager that creates taxable capital gains for the remaining investors who didn’t sell. This doesn’t happen with ETFs, as the manager isn’t forced to buy or sell anything when an investor sells their shares.

Related: The 9 Best ETFs for Beginners

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

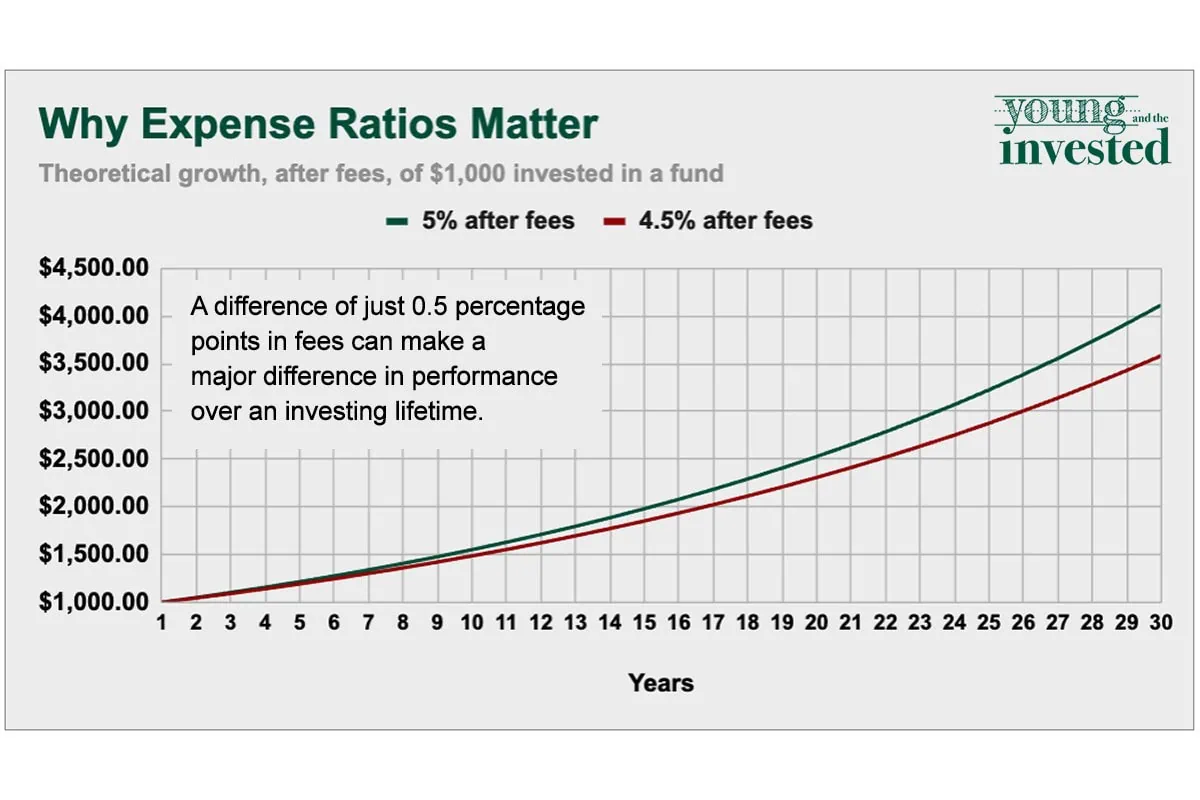

Why Does a Fund’s Expense Ratio Matter So Much?

Every dollar you pay in expenses is a dollar that comes directly out of your returns. So, it is absolutely in your best interests to keep your expense ratios to an absolute minimum.

The expense ratio is the percentage of your investment lost each year to management fees, trading expenses and other fund expenses. Because index funds are passively managed and don’t have large staffs of portfolio managers and analysts to pay, they tend to have some of the lowest expense ratios of all mutual funds.

This matters because every dollar not lost to expenses is a dollar that is available to grow and compound. And over an investing lifetime, even a half a percent can have a huge impact. If you invest just $1,000 in a fund generating 5% per year after fees, over a 30-year horizon, it will grow to $4,116. However, if you invested $1,000 in the same fund, but it had an additional 50 basis points in fees (so it only generated 4.5% per year in returns), it would grow to only $3,584 over the same period.

Want to talk more about your financial goals or concerns? Our services include comprehensive financial planning, investment management, estate planning, taxes, and more! Schedule a call with Riley to discuss what you need, and what we can do for you.

The 10 Best-Rated Dividend Aristocrats Right Now

Dividend growth puts more cash in our pockets and signals that the company we’re invested in is confident in its ability to keep churning out profits. And there’s no more heralded group of dividend growers than the Dividend Aristocrats, which are companies that have paid higher cash distributions each year for at least a quarter-century.

But even Aristocrats aren’t created equally. Check out which dividend growers Wall Street loves the best right now in our list of the top-rated Dividend Aristocrats.

Related: 10 Best Monthly Dividend Stocks for Frequent, Regular Income

The vast majority of American dividend stocks pay regular, reliable payouts—and they do so at a more frequent clip (quarterly) than dividend stocks in most other countries (typically every six months or year).

Still, if you’ve ever thought to yourself, “it’d sure be nice to collect these dividends more often,” you don’t have to look far. While they’re not terribly common, American exchanges boast dozens of monthly dividend stocks.

Please Don’t Forget to Like, Follow and Comment

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Subscribe to Retire With Riley, our free weekly retirement planning newsletter, and

3. Give the article a Thumbs Up on the top-left side of the screen.

4. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!