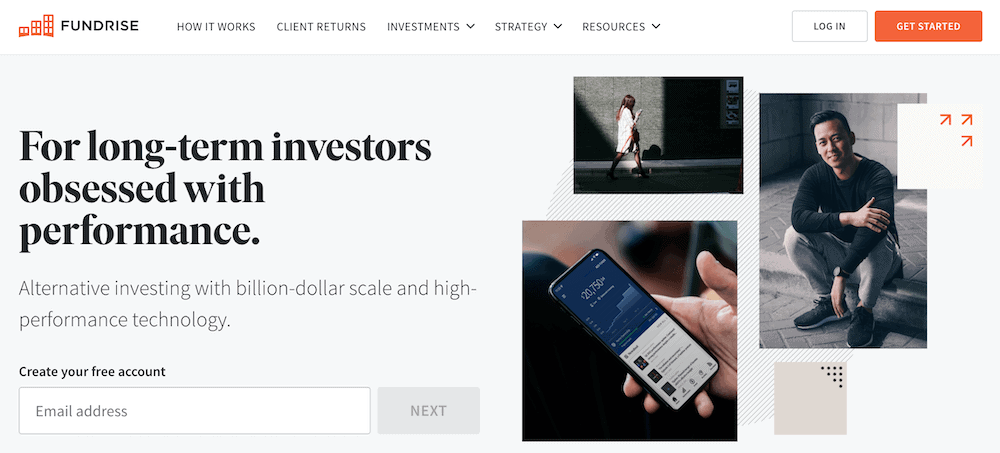

Fundrise has provided a new way for investors to access real estate properties to add to their investment portfolio.

However, when rules changed around how online crowdfunded real estate platforms could avoid registering security listings with the SEC, a flood of new investment opportunities hit the market. These offered investors unprecedented access to residential and commercial properties through real estate loans and equity investments like preferred equity or common equity in notes.

These new real estate fund investment options through an online marketplace provide access to earn interest income and rental income, monthly or quarterly dividends, and even capital gains in a different manner than traditional real estate investing.

If real estate investors want to know how to invest money in rental properties, office buildings, a real estate Growth REIT, Growth, income or other value-oriented investments outside the stock market, this list of Fundrise alternatives is for you.

What is Fundrise?

Fundrise is a popular real estate investing platform that allows you to diversify through its numerous funds. Each fund holds a number of properties and is designed to provide varying levels of risk and income.

Among its options:

- Starter and Basic accounts: Investors can now access Fundrise for as little as $10. People who open a Starter account ($10-plus minimum investment) or Basic account ($1,000-plus) have their money automatically invested in the Flagship Real Estate Fund, which seeks a balanced objective of income and growth.

- Core, Advanced, and Premium accounts: Core ($5,000-plus), Advanced ($10,000-plus), and Premium ($100,000-plus) accounts all have access to more specialized strategies. The four primary funds, from low risk/income to high risk/income, are Fixed Income, Core Plus, Value Add and Opportunistic. These accounts also have varying amounts of access to Fundrise’s “eREITs.” Also, Advanced and Premium accounts may invest in the Fundrise eFund, which is a tax-efficient partnership that can also hold non-REIT-eligible assets with “unique potential.”

- Fundrise iPO: This “internet public offering” allows investors to buy a stake in Fundrise’s parent company, Rise Companies Corp.

- Innovation Fund: This fund does not invest in properties, but rather private high-growth technology companies. While the fund expects to focus primarily on late-stage companies, it can hold early- and late-stage private companies, as well as some public equities. (Fundrise would likely invest in these publicly traded companies prior to their IPO, or initial public offering.)

You do not need to be an accredited investor to invest in Fundrise, but several of its funds are closed to non-accredited investors.

Fundrise does share one thing in common with traditional commercial real estate investing, however: It can be highly illiquid. Fundrise itself states that “the shares you own are intended to be held long-term.” You can incur a penalty for selling any eREIT and eFund shares held for less than five years, for instance. Also, you can’t pick and choose what you sell—Fundrise’s “first in first out” system means that when you liquidate, the first shares sold will be those you’ve held the longest.

Even then, commercial real estate remains one of the best alternative investments you can own, and Fundrise helps people easily reap its rewards. Like with owning shares of publicly held real estate, private CRE price returns will often lag a major index like the S&P 500. But the passive income from real estate investing is nice: Since 2017, Fundrise’s average annual income return of 5.29% dwarfs that of both public real estate investment trusts (REITs, 4.1%) and the S&P 500 (2.0%). That includes a 1.5% total return (price plus dividends) in 2022 compared to double-digit losses for public REITs and the S&P 500.

Most of Fundrise’s real estate funds charge an annual 0.85% flat management fee. The Fundrise Innovation Fund, which provides access to venture capital-style investments, charges 1.85% annually.

Visit Fundrise to learn more about this alternative asset class or sign up today.

- Regardless of your net worth, you can now benefit from real estate’s unique potential for generating consistent cash flow and long-term gains with Fundrise starting as low as $10.

- Enjoy set-it-and-forget-it managed portfolios with standard Fundrise accounts, or actively select the funds you want to invest in with Fundrise Pro.

- Diversify your portfolio with real estate, private tech investing, or private credit.

- Low minimum investment ($10)

- Accredited and non-accredited investors welcome

- IRA accounts available

- Highly illiquid investment

Best Fundrise Alternatives for Accredited Investors

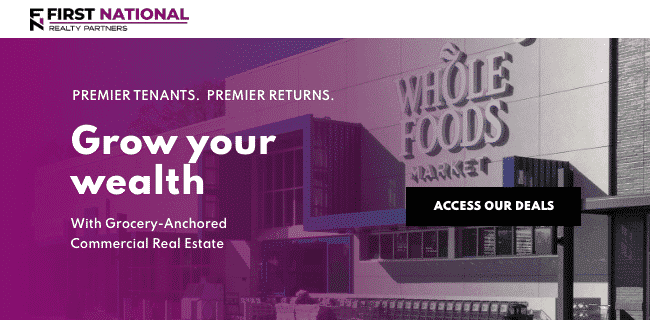

1. First National Realty Partners (Grocery-Anchored Commercial Real Estate)

- Minimum Investment to Start: $50,000

- Type of Real Estate Investment: Grocery-anchored commercial real estate

- Type of Investor: Accredited Investors

First National Realty Partners (FNRP) is one of the fastest-growing vertically integrated commercial real estate investment firms in the United States.

The company’s mission is to provide everyday, accredited investors with access to real estate assets that were originally available only to institutional investors.

Leveraging their team of industry-leading professionals and foundational relationships with top-tier national brand tenants, including Kroger, Walmart, and Wholefoods, they compete directly against these institutions to present investors with deals that achieve superior passive returns.

Specializing in grocery-anchored CRE, FNRP provides partners with exclusive access to institutional-quality commercial real estate investment opportunities both on and off-market.

They’ve helped thousands of investors increase their net worth and diversify their portfolios against market volatility through deals which yield steady cash flow from day one, as well as significant upside through their proven value-add strategies.

By investing with FNRP, you become a partner with a team of real estate professionals in the necessity-based retail space. From acquisition to disposition, their entire investment lifecycle is 100% in-house.

To ensure you’re presented with only the best institutional-quality investments, their team filters through over 1,000 deals and chooses just ONE that they are confident will achieve strong returns.

Unlike a traditional REIT or fund, you have the ability to pick the deals that best align with your investment needs so that you can build your own portfolio within their holdings.

FNRP does this by providing a transparent platform in which you have access to all the information you need to make a confident decision. You will never have to invest blindly.

Starting to invest with First National Realty Partners does carry a high entry fee: a $50,000 minimum. For this, however, you gain access to unique deals no one else on this list provides: combining stability and strong returns.

Sign up to learn more about the opportunity and if it makes sense for your investment goals.

Read more in our First National Realty Partners review.

- FNRP is the leading sponsor for grocery-anchored commercial real estate.

- FNRP has a nationwide focus and leverages relationships with the best national-brand tenants to bring accredited investors exclusive access to institutional-quality deals.

- FNRP provides partners with institutional-quality investments that achieve exceptional, risk-adjusted returns (12%-18% targeted average annual returns, of which, 8% is the targeted average annual cash distribution.)

- Uses the Dragnet Acquisitions Model - strong due diligence. FNRP looks at 1,000 deals and chooses just one. FNRP chooses only the best deals they believe offer the highest return for the absolute lowest risk.

- FNRP's entire investment cycle is 100% in-house and not outsourced like traditional private equity sponsors.

- Strong performance track record

- Unique investment niche (grocery-anchored CRE)

- High total shareholder return

- Only accessible to accredited investors

- High investment minimum ($50,000)

Related: Best Bookkeeping and Accounting Software for Rental Properties

2. EquityMultiple

- Minimum Investment to Start: $5,000

- Type of Real Estate Investment: Commercial Real Estate

- Type of Investor: Accredited Investors Only

Some platforms like EquityMultiple allow you to invest in individual properties, specifically commercial real estate. Others allow you to invest in real estate property portfolios.

EquityMultiple carries a minimum $5,000 initial investment and comes with a limitation on the type of investors who can participate.

Namely, EquityMultiple only allows its individual commercial real estate projects to receive investments from accredited investors.

For those interested in learning more about EquityMultiple, consider signing up for an account and going through their qualification process.

- EquityMultiple is a commercial real estate platform for accredited investors, providing investment opportunities in real estate funds, individual properties, and savings alternatives.

- EquityMultiple has a team boasting decades of real estate transaction experience. Their due diligence process whittles down a large selection of properties, accepting only 5% as target investments that they use to build a variety of portfolios that suit numerous investing objectives.

- The company has made over $425 million in distributions since its founding.

- Makes commercial real estate Investments accessible

- Intuitive website design

- High net total returns and distributions paid to investors

- Only available to accredited investors

- High investment minimum to begin

- Fee structure varies by investment, complex at times

Related: 12 Best Investments for Accredited Investors

3. YieldStreet

- Minimum Investment to Start: $2,500

- Type of Real Estate Investment: Commercial Real Estate

- Type of Investor: All Investors

Alternative investments have become increasingly popular as fintech services open up once closed markets to the individual retail investor. These opportunities have democratized numerous markets and unlocked previously-inaccessible cash flows to pad your income from assets.

Yieldstreet is one such platform leading the charge to provide access to income-generating assets in several asset classes.

Yieldstreet is an alternative investment platform that provides you with income-generating opportunities. These investment opportunities come backed by collateral, typically have low stock market correlation, and span various asset classes.

Such asset classes include:

- art finance

- real estate

- commercial finance

- legal finance, and more.

Yieldstreet has been in business since 2015 and has returned over $600 million to its investors since its founding. Historically, their yields range from 7%-15% and have predefined payment schedules (i.e., monthly or quarterly payments). They may pay principal and interest upon the occurrence of certain events (e.g., case settlement within a legal finance investment).

The durations of investment opportunities range from 6 months to 5 years and have investment opportunities starting as low as $2,500.

Learn more by opening an account now for access to passive income-filled returns on your investments.

- Yieldstreet offers portfolio diversification through building passive income streams with alternative investments

- Typically have low stock market correlation

- Have short durations (6 months to 5 years)

- Low minimums (as low as $2,500)

- Backed by collateral to help protect your principal (over $600m in principal and interest payments returned to investors since 2015)

- Access to several alternative asset classes

- Low stock market correlation

- Low minimums compared to other accredited investment platforms

- Illiquid investments

- Some investments have lost money

- Most investments only available to accredited investors

Related: 15 Best High-Yield Investments [Safe Options Right Now]

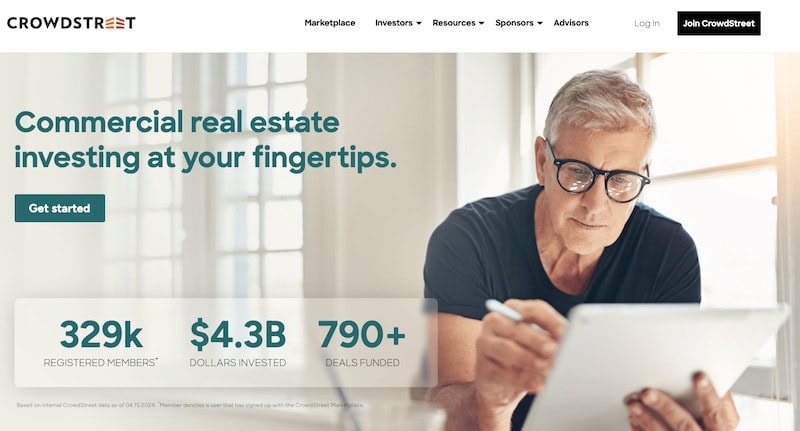

4. CrowdStreet

- Minimum Investment to Start: $25,000

- Type of Real Estate Investment: Commercial Real Estate

- Type of Investor: Accredited Investors Only

CrowdStreet is a real estate investment platform available exclusively to accredited investors looking to invest in commercial real estate for long periods.

The illiquid investments have performed well, but they require you to commit money for a few years, making you leave your money invested in these investments. Further, CrowdStreet comes with a high minimum investment of $25,000, which shouldn’t come as a significant surprise.

The platform caters to accredited investors, whereas platforms that allow non-accredited investors have low minimum investment requirements. Depending on the type of project chosen, you might be receiving a return immediately through quarterly dividends on the commercial rental properties.

Though, you might also choose a project which takes a few years to provide you with money.

Editor’s note: Bloomberg has recently reported that investment funds in CrowdStreet allegedly have gone missing. According to court papers, millions of dollars ended up in accounts owned by Nightingale Properties, which CrowdStreet partnered with on the affected real estate transactions. CrowdStreet alerted regulators and brought in an independent manager to determine how the funds went missing. We are monitoring this developing story and may update our recommendations depending on the outcome.

- CrowdStreet is a real estate investment platform available exclusively to accredited investors looking to invest in commercial real estate for long periods.

- CrowdStreet comes with a high minimum investment of $25,000.

Related: 7 Best Banks for Real Estate Investors + Landlords

5. FarmTogether

- Minimum Investment to Start: $10,000

- Type of Real Estate Investment: Farmland

- Type of Investor: Accredited Investors Only

FarmTogether allows real estate investors to invest in farmland. This largely untapped asset class provides cash flow properties with stable returns.

Investors can invest in shares of entities that hold farmland, generally LLCs managed by FarmTogether. You can receive cash distributions and gains through land appreciation.

The income comes quarterly or annually, depending on the farmland’s harvest schedule and lease agreement with the farmer.

You’d only realize the appreciation value when it came time to sell. This allows you to hold properties for the long-term and realize more favorable capital gains tax treatment.

- FarmTogether is a technology-powered investment platform w/direct access to institutional quality farmland.

- The FarmTogether team sifts through hundreds of opportunities to select only the best ones. Opportunities vary by type, expected return and location.

- Accredited investors can get started with just $10,000.

Best Fundrise Alternatives for Non-Accredited Investors

7. Groundfloor → Investing in Fix and Flips

- Minimum Investment to Start: $1,000

- Type of Real Estate Investment: Residential Real Estate

- Type of Investor: All Investors

Groundfloor offers short-term, high-yield real estate debt investments to the general public.

The service targets fix and flips, better known as fixer-uppers for short-term debt instruments ranging between 3-18 months in length.

If you are interested in fixer-uppers but don’t have the personal expertise to select the right property, nor choose the best contractors for their value, you should consider Groundfloor.

The service aims to make an asset class otherwise inaccessible to the general public and has averaged 10% annual returns. You need $1,000 to begin investing on the platform.

- Groundfloor is a crowdsourced real estate investing platform which offers high-yield, short-term real estate debt investments.

- Offers collateralized, secured real estate debt with 1-month, 3-month, and 12-month terms.

- Has delivered consistent 10%+ returns over past eight years with repayments received in 6-9 months on average.

- Offers after-tax and IRA investment options.

- Special offer: When you fund your account with at least $1,000, you will receive a $50 credit to invest on Groundfloor*.

Related: 33 Best Passive Income Ideas [Income Investments to Consider]

Who Are Fundrise’s Competitors?

The most direct competitors to Fundrise are fellow non-accredited investing platforms offering access to both commercial and residential real estate investment portfolios.

This hybrid asset allocation approach makes Fundrise unique compared to its competitors, providing a differentiated investment offering.

The service doesn’t allow individuals to select individual units unless choosing a residential real estate developer’s project, commercial real estate project or multifamily offering (e.g., apartment buildings).

Can You Get Rich from Fundrise?

Fundrise has achieved competitive yields in their industry, making investors significant profits during their history. The company targets returns between 8-13% per year, offering stable returns that stand to compound well over time if you remain invested in the service.

While not recommended for allocating most of your portfolio to any crowdfunding service, this could serve as an outlet to consider outside of learning how to get rich off stocks or picking stocks for the long-term.

Related: 8 Best Stock Picking Services, Sites, Advisors and Subscriptions

Do Real Estate Crowdfunding Platforms Have a Minimum Investment?

Some Fundrise alternatives for real estate require you to have a minimum investment to participate on their real estate crowdfunding platform.

The minimum investment may vary between non-accredited and accredited investors.

However, you might have different minimum investment requirements based on the type of investment you make.

Private placements might have a higher minimum investment than if you invested in real estate loans as an accredited investor to earn rental income.

Likewise, purchasing equity in real estate crowdfunding investments like residential real estate or commercial properties could require you to meet different minimum investment obligations.

Make sure you check with the Fundrise alternatives in real estate crowdfunding to see if you have interest meeting and maintaining a minimum investment amount as a non-accredited or accredited investor.

Can You Participate in Commercial Real Estate Investing Through Crowdfunding Platforms?

Yes, you can invest in commercial properties through real estate crowdfunding platforms like Fundrise and several Fundrise alternatives.

While services like DiversyFund offer access to multifamily residential real estate investments, Fundrise alternatives like First National Realty Partners, YieldStreet, EquityMultiple, CrowdStreet, RealtyMogul and others offer commercial real estate investments.

These often allow you to earn passive income in private market offerings or participate in several real estate projects through direct investing or opportunity zone investing.

Real estate investors should understand how options like a Growth REIT might affect their taxes.

Considerations include payments toward property taxes, how they can defer capital gains taxes and whether these interest payments can provide the returns they seek.

Commercial real estate carries a different risk profile than residential real estate, so make sure you understand the risks involved.

What are Accredited Investors?

While this definition recently changed, from one which usually meant high-net-worth/high-income individuals, to now one which focuses on investor experience and knowledge, it typically skews more towards investors with financial wherewithal and familiarity.

That said, the new amendments from the SEC allow investors to qualify as accredited investors based on defined measures of professional knowledge, experience or certifications in addition to the existing tests for income or net worth.

These tests for financial resources include having an aggregate net worth of over $1,000,000 and earning over $200,000 in each of the two most recent years or joint income with that person’s spouse over $300,000 in each of those years with a reasonable expectation of reaching the same income level in the current year.

Related: Best Quicken Alternatives