If you want to invest, you’re going to need an investment account. It’s just that simple. And one of the biggest decisions you’ll need to make is whether you’re going to invest through a taxable account, or a tax-advantaged retirement account, or both.

Today, we’re going to talk about taxable investment accounts. These obviously don’t have the same perks as tax-advantaged accounts, but they still have their upsides, and you can still make several tax-efficient investments through these accounts to keep yourself from owing too much to Uncle Sam.

Let’s review what a taxable investment account is, how it differs from a tax-advantaged account, why you might want one, and the best investments to put in your account.

Table of Contents

What Are Taxable Investment Accounts?

A taxable investment account is exactly what it sounds like: It has no special tax treatment, no tax advantages. If you sell assets or collect income within a taxable investment account, you need to pay taxes.

You typically have more flexibility over the investments you can make in these accounts compared to some tax-advantaged accounts–specifically, workplace retirement accounts such as 401(k)s, 403(b)s and 457(b)s. Perhaps more importantly, taxable accounts have no contribution limits nor withdrawal limits.

Brokerage accounts are by far and away the most common type of taxable investment account. And by and large, these accounts are simple to open and allow for a number of investment types, including stocks, bonds, exchange-traded funds (ETFs), mutual funds and options. Some taxable accounts go a step further, allowing you to invest in cryptocurrencies, commodities, and other alternative investments.

In addition to enjoying the profits from price returns, you may also be able to generate passive income through your holdings’ dividends, interest payments or other distributions.

What Are The Tax Impacts of Investing in a Taxable Brokerage Account?

One major thing to know about investments made in taxable brokerage accounts is that they are … well … taxable. Shocker, right? That means when you buy and later sell a holding, receive distributions, interest or other form of income from an investment held inside a taxable account, you’ll be responsible for the tax consequences.

How much tax you will need to pay depends on:

— the amount of your gains and/or losses,

— your income level, and

— the holding period of the asset.

This final factor determines whether your gains and/or losses fall into one of two buckets:

— Short-Term Capital Gains / Losses: You’d recognize a short-term capital gain or loss if you held the taxable investment for one year or less.

— Long-Term Capital Gains / Losses: You’d recognize a long-term capital gain or loss for investments you disposed of after holding for longer than a year.

As a general rule, taxes on short-term capital gains are higher than those on long-term capital gains.

In addition to the holding period, your capital gains taxes are also determined by your income levels. Short-term capital gains taxes are paid entirely at your marginal tax rate (which is based on your federal tax bracket).

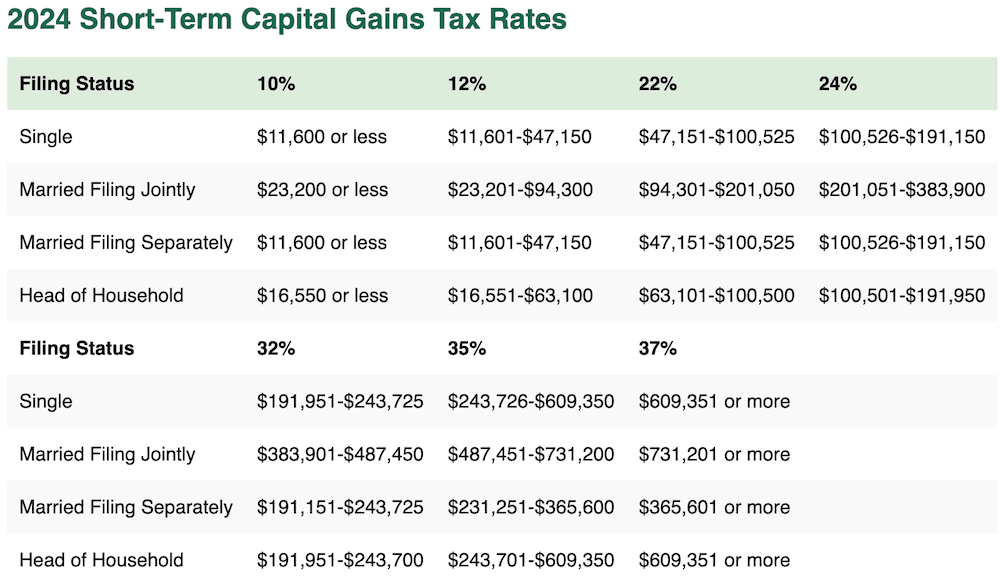

2024 Short-Term Capital Gains Tax Rates

Above are the short-term capital gains tax rates you’ll pay on any gains recognized in 2024 after holding for one year or less. These are the same as your ordinary income tax rates.

Meanwhile, long-term capital gains taxes are paid entirely at one of three levels depending on your income.

Related: 2024 Brings New Federal Tax Brackets and Rates: What Will You Pay on This Year’s Income?

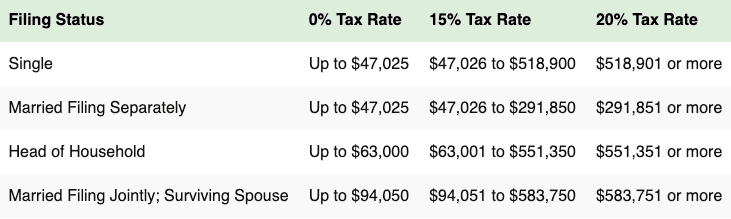

2024 Long-Term Capital Gains Tax Rates

Above are the long-term capital gains tax rates you’ll pay on any gains recognized after holding for longer than a year in 2024.

If you can manage to hold a long-term investment, you will generally pay less on your taxable gains.

However, while you do have to worry about paying taxes, taxable investment accounts do have the upper hand on tax-advantaged accounts in a few respects:

— Invest as much as you want: As mentioned above, taxable investment accounts don’t have contribution limits.

— More flexibility: With taxable accounts, you’re able to withdraw the cash anytime you want before retirement without penalty.

— More ways to invest: You have a much wider range of investment options than in some tax-advantaged accounts, namely workplace retirement accounts such as 401(k)s where you must invest in the small selection of funds your plan allows.

— No forced distributions: No matter your age, you’re never required to take distributions.

— You can still get around taxes: You can actually offset some of your taxes through “tax-loss harvesting.” Let’s say you sell one short-term investment for a $3,000 loss, and another short-term investment for a $3,000 gain. In that event, you wouldn’t owe any taxes on your investments. Even better: If you realize more losses than gains, you can offset up to $3,000 of ordinary income when calculating your taxes. And better still: Any unused losses rollover to subsequent years to offset future gains or up to $3,000 of ordinary income per year. These tax benefits help investors keep more of their money.

Related: What is Your Capital Gains Tax Rate?

What Are the Best Investments for Taxable Accounts?

Investors with taxable accounts must always consider the tax man when they’re buying and selling—so much so that even market experts constantly drop reminders about this point.

“For those that did lock in their gains, Uncle Sam is likely to come knocking on their door to collect what is known as a capital gains tax,” Lindsey Bell, Ally Invest Chief Money & Markets Strategists, said in a recent market missive. “That is, unless the trades were made in a tax shielded type of account, like a 401(k), IRA or HSA.”

Remember: If you sell, you’ll have to pay taxes. If you receive dividends, interest income or distributions, you’ll have to pay taxes. And taxes are a significant expense that eats away at your returns—a pain that becomes increasingly sharp over time if you climb into higher tax brackets. So, if you invest through a taxable account, such as a brokerage, you want to make tax-efficient investments.

In general, investments that tend to lose minimal amounts of their returns to taxes are smart choices for taxable accounts. You also want to avoid the types of investments you’ll be tempted to buy and sell after short holding periods, and instead focus on longer-term investments.

Let’s go over some of the best investments you can hold in a taxable account.

1. Stocks

Individual stocks are a great investment in any type of account, taxable or tax-advantaged. However, what type of stock investment you’re looking to make will determine which account you’ll want to use.

Stocks that you plan on holding for at least a year are one of the best investments you can make in a taxable account.

Remember: You’re not taxed for gains in a taxable account until you sell the stock, and if you sell it after a year, you are only taxed at the more favorable long-term capital gains rate.

Conversely, if you plan on being a more active trader, buying stocks and selling them in less than a year, you should make those trades in a tax-advantaged account, where you won’t take the hit of the higher short-term capital gains rate.

And if you want the most tax-efficient investing outcome, when it is time to sell your stocks, you can employ a couple of simple strategies to lower your tax bill.

One strategy is locking in taxable gains during a year in which you know you will otherwise owe relatively little in federal income tax. (As opposed to selling in a year in which you will owe lots in federal income tax, effectively doubling down on your burden!)

Another strategy is to sell some stocks for gains during the same year in which you have also sold some assets at a loss.

Remember: When you sell a stock at a lower price than you bought it for, you generate a capital loss, which you can use to offset the tax impact of selling a stock for a higher price than you bought it for (a capital gain).

Just understand that there’s nothing you can really do about dividends you receive from stocks. You will be taxed on dividends during the year in which you receive them–you cannot delay them, nor can you offset them with capital losses.

Related: 11 Best Commission-Free Stock Trading Apps & Platforms

2. Exchanged-Traded Funds (ETFs)

Financial advisors also frequently suggest holding exchange-traded funds in taxable accounts.

ETFs are beloved by investors of all stripes because they provide instant diversification: access to tens, hundreds or even thousands of stocks, bonds or other assets through a single purchase.

Better yet, because ETFs deliver that diversification for almost any imaginable strategy–from broad market exposure to hyper-specific themes–many successful investors actually prefer to fill their taxable accounts with ETFs rather than individual stocks.

Don’t mutual funds provide similar exposure? Sure, but ETFs have a leg up when it comes to dealing with Uncle Sam.

Related: The 24 Best ETFs to Buy for a Prosperous 2024

Specifically, because of ETFs’ underlying infrastructure, they rarely have to distribute capital gains–unlike mutual funds–making them far more tax-efficient and a better fit in taxable accounts. (Just note that ETFs dealing in certain assets, such as master limited partnerships, commodities, currencies and futures, might have special tax rules.)

Otherwise, the same guidance applies for stocks and ETFs. If you plan on holding an ETF for more than a year, hold it in a taxable account where you’ll only have to deal with lower long-term capital gains taxes when you eventually sell.

However, if you’re using ETFs to make short-term trades, you’re better off doing that within a tax-advantaged account. In fact, ETFs are such a good fit for long-term buy-and-holding that robo-advisors frequently build ETF-only portfolios for their clients.

Robo-advisor Betterment, for instance, exclusively uses exchange-traded funds, citing the same advantages we mentioned above.

“Betterment uses ETFs in both our stock and bond portfolios because of the low management fees and tax-efficiency they offer,” the firm says.

Consider using Betterment for your tax-efficient investing through a diversified portfolio of ETFs.

Related: 7 Best Schwab ETFs to Buy [Build Your Core for Cheap]

3. Real Estate Investment Trusts (REITs)

For a long time, investment professionals advised investors to hold real estate investment trusts, or REITs, in tax-advantaged accounts.

However, a change made by the 2017 Tax Cuts and Jobs Act made holding REITs in taxable accounts more tax-efficient than before.

Most regular stock dividends are what are called “qualified” dividends, which are taxed at the same amount as the more favorable long-term capital gains rates.

However, REIT distributions can be made up of several things–the majority is often “ordinary” income, which is taxed at the higher marginal tax rate, and they can also include capital gains and return of capital.

However, with the passage of the TCJA, investors can now deduct up to 20% of their ordinary REIT dividends.

That means investors at the highest marginal tax rate (37%) now effectively pay 29.6% on their REIT dividends (and investors in lower tax brackets pay even less).

Thanks to this change, REITs–and their typically much-better-than-market-average dividends–are perfectly suitable for taxable accounts.

Related: Best Investment Opportunities for Accredited Investors

4. Municipal Bonds

Municipal bonds (or “munis” if you’re into the whole brevity thing) are issued by government entities to fund infrastructure projects, services and other projects that serve the public interest.

Related: Best Cash Alternatives [Get Yield on Short-Term Investments]

Like any other bond, when you buy a muni, you will receive a set number of predetermined payments (“interest income”) until the bond matures, at which point your original investment amount (the “principal”) will be returned.

Unlike other bonds or taxable bond funds, however, income from municipal bonds are exempt from federal taxes, and depending on where the muni is issued and where you live, they will be exempt from state and local taxes, too.

Related: Best Savings Account Alternatives [9 Other Ways to Save]

This tax break is especially powerful if you’re in a higher tax bracket. Consider this: A municipal bond yielding 3% has a tax-equivalent yield (what a taxable bond would have to yield to deliver the same amount of after-tax income) of 4.76%!

In short: Municipal bonds and municipal bond funds are a great investment for taxable accounts given their tax efficiency and largely tax-free nature, and it only gets better as your tax bracket goes higher.

Related: Best Money Market Account Alternatives [Low-Risk Yields]

5. Tax-Managed Funds

Tax-managed funds (which are almost always mutual funds) are run by professional money managers and are designed to reduce shareholders’ tax burdens, in contrast to actively managed stock funds which have high turnover rates and generate high rates of capital gain distributions.

Related: Best Vanguard Retirement Funds for IRAs

Among the ways tax-managed funds minimize taxes:

— They avoid dividend stocks.

— They limit capital gains by holding investments for the long term.

— They utilize tax-loss harvesting.

Like with stocks, you also have to pay capital gains taxes if you sell mutual fund shares at a profit. However, you can also be strategic here and wait to sell shares until a year in which your tax rate might be lower (or even zero).

While many mutual funds are poor fits for taxable accounts, tax-managed funds can be worthwhile.

Related: 9 Best Portfolio Analysis Tools [Portfolio Analyzer Options]

What Are Tax-Advantaged Accounts?

Tax-advantaged accounts are typically either tax-exempt (you don’t pay any taxes on the money) or tax-deferred (you pay taxes on the money at a later time).

Tax-exempt accounts include Roth IRAs, Roth 401(k)s and health savings accounts (HSAs). With these accounts, you invest money that you have already been taxed on.

However, you don’t pay any taxes on gains in, and withdrawals from, tax-exempt accounts.

Tax-deferred accounts include traditional IRAs and 401(k) plans. With these accounts, you typically get an upfront tax break by contributing pre-tax money.

Like with tax-exempt accounts, you aren’t taxed on gains inside of the account, but you will have to pay taxes when you withdraw money.

The expectation is that when you withdraw money in retirement, you’ll be in a lower tax bracket than when you contributed.

As a result, you pay less in income taxes since you’re in a lower tax bracket. (Conversely, with tax-exempt accounts, you are betting that you will be in a higher tax bracket at retirement than when you contributed the money.)

Like Young and the Invested’s content? Be sure to follow us.

Tax-Advantaged Accounts Have Contribution Limits

Tax-advantaged accounts do have some limitations, however.

One is contribution limits. For instance, in 2023, the contribution limit for IRAs is $6,500 ($7,000 in 2024). (If you have multiple IRAs, including both a traditional IRA and a Roth IRA, this limit applies for all accounts combined.)

If you’re 50 or older, you may invest an extra $1,000 in “catch-up” contributions for a total of $7,500 ($8,000 in 2024).

For 401(k) accounts, the 2023 contribution limit is $22,500 ($23,000 in 2024). If you’re 50 or older, you may invest an extra $7,500 in “catch-up” contributions for a total of $30,000 ($30,500 in 2024).

If you have an employer match for your 401(k), your combined 2023 contributions can’t exceed $66,000 ($69,000 in 2024), or $73,500 if you’re age 50 or older ($76,500 in 2024).

The 2023 limit for HSA contributions is $3,850 if you have self-only health insurance coverage and $7,750 if you have family coverage ($4,150 and $8,300, respectively, for 2024).

Many financial experts recommend that, when it’s financially feasible, you max out your contributions to tax-advantaged accounts.

Just beware: The money you store in tax-advantaged accounts will be significantly less accessible.

You can trigger hefty penalties (and in the case of tax-deferred accounts, taxes) if you make non-qualified withdrawals from your tax-advantaged accounts. So only contribute money you can afford to be without until retirement.

Related: Best Brokerage Account Sign-Up Bonuses, Promotions and Deals

What Are Capital Gains?

A capital gain is the profit you earned when selling an investment. You can calculate a capital gain by taking how much you sold an asset for and subtracting what you originally paid for it.

Here’s an easy example: If you bought a stock for $10 per share, and you sold it for $20, you have locked in a $10 (or 100%) capital gain.

And if you sell a stock for less than you bought it for, you will recognize a capital loss.

Importantly, capital gains are not realized until the sale. If an asset rises in value while you hold it, you are not realizing capital gains.

Capital gains are taxable, but you can avoid them by holding the investment in a tax-advantaged account.

If you choose to invest in a taxable account, you can minimize your tax burden by not selling investments until you have held them for more than one year—doing so ensures you will be taxed at the lower long-term capital gains rate, rather than the higher short-term capital gains rate.

You can also offset capital gains with capital losses.

Is a Taxable Brokerage Account Worth It?

A brokerage account or another taxable vehicle is absolutely worthwhile for several reasons.

A taxable account is a great place to save for large purchases you want to buy before retirement age.

That’s because you can make withdrawals at any time without facing penalties. (You still have to pay taxes on gains, but again, you can use several strategies to minimize your tax burden.)

For example, if you’re saving for a down payment on a house, you might consider putting that money in a taxable brokerage account.

That would allow your money to grow thanks to the magic of compounding returns, potentially getting you to your savings goal more quickly. Just keep in mind that you’re also taking on some risk.

Even the Securities and Exchange Commission warns that “it’s important that you understand before you invest that you could lose some or all of your money.”

A volatile market downturn could reduce the value of your nest egg just when you need it most, so as a general rule, don’t use money that you’ll need in the next five years to invest in stocks and other riskier assets.

Taxable accounts are also great for investors who want to aggressively save and want to contribute more than the caps on their 401(k)s, IRAs and other tax-advantaged accounts.

Other people choose to invest in a taxable account because they have far more options at their disposal than a workplace retirement account.

Like Young and the Invested’s content? Be sure to follow us.

Related: 15 Best Investing Research & Stock Analysis Websites

Being a discerning investor is, for better or worse, all about the homework. If you’re “doing it right,” you’re culling through useful information regularly on stock analysis websites, stock news apps, research reports and other valuable information.

Being data-driven investors ourselves, we love these kinds of tools. So let us share with you our favorite investment research software, stock research websites and informational apps.

Related: 12 Best Long-Term Stocks to Buy and Hold Forever

As even novice investors probably know, funds—whether they’re mutual funds or exchange-traded funds (ETFs)—are the simplest and easiest ways to invest in the stock market. But the best long-term stocks also offer many investors a way to stay “invested” intellectually—by following companies they believe in. They also provide investors with the potential for outperformance.

So if you’re looking for a starting point for your own portfolio, look no further. Check out our list of the best long-term stocks for buy-and-hold investors.

Related: The Best Fidelity ETFs for 2024 [Invest Tactically]

If you’re looking to build a diversified, low-cost portfolio of funds, Fidelity’s got a great lineup of ETFs that you need to see.

In addition to the greatest hits offered by most fund providers (e.g., S&P 500 index fund, total market index funds, and the like), they also offer specific funds that cover very niche investment ideas you might want to explore.

Related: 9 Best Monthly Dividend Stocks for Frequent, Regular Income

The vast majority of American dividend stocks pay regular, reliable payouts—and they do so at a more frequent clip (quarterly) than dividend stocks in most other countries (typically every six months or year).

Still, if you’ve ever thought to yourself, “it’d sure be nice to collect these dividends more often,” you don’t have to look far. While they’re not terribly common, American exchanges boast dozens of monthly dividend stocks.

Like Young and the Invested’s content? Be sure to follow us.