Your age plays a significant role in the type of investment accounts you should open or decisions you make. The best investment accounts for young adults have low (or no!) fees and no minimums.

Further, the investment horizon matters because not all investing goals for young adults involve thinking over the long-term. Specifically, young adults have competing investment timelines requiring them to consider both the best short-term and long-term investments based on these different needs.

Once decided on how to prioritize their investing goals, Millennials and Generation Z tend to gravitate towards investment accounts with easy-to-use mobile stock trading platforms for beginners and top customer service through multiple channels. In fact, it’s becoming less important for banks and other financial institutions to have physical locations. Instead, young investors find it more crucial that their investing services are affordable and mobile-friendly.

Finally, the earlier you can learn how to start investing money, the better prepared you will be financially in the future.

Keep reading to learn about the best investment accounts for young adults and how to invest in your 20s. Afterward, you will read about the most common questions young investors must answer before choosing their investment strategies.

Best Investment Accounts for Young Adults—Top Picks

Best Long-Term Investments for Young Adults

For young adults, time is on their side in terms of investing. They can take advantage of compound interest and tax-advantaged investments when they invest long-term.

Young investors can take advantage of aggressive investing in their 20s and 30s and hold some of the best investments for the future.

Read below for the best long-term investment for young investors, including debt elimination, property ownership, contributing to tax-advantaged accounts and then some common investments these accounts hold.

1. Debt Elimination

Coming out of college, many young adults face sizable debt loads today compared to prior generations. These new college-attendees now must face the difficult decision of choosing between paying off student loans or beginning to invest in earnest.

The $1.6 trillion student loan debt burden only continues to grow, forcing many to make this tough choice. Some may qualify for the Public Service Loan Forgiveness program or other federal loan forgiveness programs, but not all will.

Instead, many must begin navigating how to budget for these sometimes large monthly expenses and account for them against their income.

To bring down the costs of these loans, many have sought using refinancing options.

Once young adults can get a handle on their student loans responsibly, they should look to invest money in their retirement accounts to grow for the long-term.

2. Best Retirement Investment Accounts for Young Adults

It’s never too early to start saving for retirement. Individual retirement accounts (IRAs) and company retirement accounts, such as 401(k), 403(b) and 457 plans are some of the most popular ways to save for retirement.

Traditional retirement accounts are tax-deferred so you do not pay tax until you withdraw the funds during retirement (when you’re likely in a lower tax bracket and will pay less in taxes on it).

Contributions to these accounts are one of the few tax breaks available for young adults. The best part is that many employers offer to match your contributions up to a certain percentage, which many refer to as “free money.”

Some employers offer matching contributions on both 401(k) (or 403(b) and 457 plans) as well as on health savings accounts.

A common option offered by most employers to their employees as Qualified Default Investment Alternatives (QDIA) are target date funds. These assets offer a mix of underlying investments which take into account the individual’s age or retirement date and invests accordingly.

The best target date funds have low expense ratios and transition “through” retirement and not “to” retirement.

As you can see below, these “through” retirement target date funds continue to transition their holdings as part of a glide path toward a more conservative mix, even after retirement age.

This provides for more time to hold money in the stock market, something our generation will need to do to grow our wealth sufficiently to compensate for lower lifetime earnings and longer expected life spans.

Target Date Fund with a Glide Path “Through” Retirement

Regardless of the funds available to you in your employer-sponsored retirement account, you should consider investing money in it.

This account, alongside the many other best investment account types for young investors, will put you on a safer path to retirement. This is especially the case if you contribute as much as you can early in your career.

On this site, I strongly advise all to “max out” your contributions to these accounts so you get as much “free money” and defer as much tax as possible. This investing strategy can yield a major impact on building wealth.

Roth IRAs, unlike traditional retirement accounts, have you pay tax the year in which you contribute. This allows the contributions to grow tax-free until you retire and then avoid paying taxes when you withdraw these funds in retirement.

For young adults, this can be the superior option because they have so many years to grow tax-free returns and grow generational wealth.

3. Health Savings Account (HSA)

Health savings accounts offer a unique tax benefit not seen in other tax-advantaged investment accounts: a triple tax benefit. These benefits include:

- No tax liability on contributions made into the account (deductible from your income)

- No tax liability on gains recognized from investments made in the account (excluded from income)

- No tax liability on withdrawals made for qualified health expenses

As for the mechanics of how these plans work, some have these accounts offered through an employer-sponsored account.

In this situation, your contributions come straight from your paycheck pre-tax but you retain the ability to contribute to your health savings account directly as well. You claim these contributions on your tax return, thereby reducing your taxable income.

However, if you do not have an account available to you through your employer, you can set up your own HSA and deduct your contributions on your tax return.

As touched upon above, when you invest money in these accounts, you receive tax benefits to encourage you to grow your money over long periods of time. When you use a service like those from Lively, you can invest your savings in mutual funds or other types of investments.

When the times comes that you may need to withdraw money for qualified medical expenses, these funds will come to you tax-free. However, if you withdraw funds and do not not use them for medical expenses before age 65, you will face a stiff 20% penalty.

Be aware that after age 65, you can withdraw money for any purpose without triggering a harsh penalty. Further, unlike IRAs, you do not need to take required minimum distributions (RMDs).

These funds exist in perpetuity and do not have the “use-it-or-lose-it” character of Flexible Spending Accounts (FSAs).

Restrictions do exist for opening and contributing to these accounts. To be eligible, you need to receive health insurance through a high deductible insurance plan (HDHP) and also not receive Medicare.

You also cannot be covered under any disqualifying health coverage or claimed as a dependent on another person’s tax return.

As a word of warning, make sure you enroll in a high-deductible health plan / HSA combo for the right reasons, and not to skimp out on healthcare needs.

4. Exchange-Traded Funds (ETFs)

An ETF is a collection of securities, such as stocks, that usually tracks an underlying index (though they can invest in any number of industry sectors). An ETF is similar to a mutual fund, but it’s listed on exchanges like stocks. They contain several types of investments, including stocks, bonds, commodities, or a combination of investment types.

Advantages of ETFs for young adults include automatic diversification, lower costs, tax efficiency, and liquidity.

While it’s possible to make short-term gains with ETFs, they’re generally safer as a long-term investment so young investors have time for an ETF to “bounce back” from possible negative market volatility.

Best ETFs for Young Investors

Charles Schwab, Fidelity, Invesco, State Street and Vanguard index ETFs are all great options for new investors because they have some of the lowest investment costs for their index funds.

Consider the following options, deemed best funds for young investors for their growth potential, diversification and low expense ratios:

- Fidelity Nasdaq Composite Index (ONEQ, one of the best Fidelity ETFs)

- PowerShares (QQQ, an index focused largely on tech stocks),

- SPDR S&P 500 ETF (SPY), and

- Vanguard Total Stock Market ETF (VTI)

Stock ETFs make a great cornerstone for any long-term investment portfolio. As a young investor, you’re likely focused more on the long-term potential of your investments appreciating in value. You also want to learn more about investing as you go. That’s why one of the best investment apps for beginners is Robinhood, an specifically designed to allow for recurring investments and teach you valuable investing know how. We discuss this investment app more below.

5. Mutual Funds

Like ETFs, mutual funds act as collections of securities, such as stocks and bonds, which usually track an underlying index or trade based on targeted investing styles (e.g., growth vs. value).

Mutual funds are similar to ETFs by investing in several securities with one purchase and having expense ratios associated with the fund’s management and administrative expenses.

However, mutual funds differ from ETFs in many ways with some notable exceptions including:

- Purchase & redemption fees.

- In some instances, mutual funds may charge a percentage of the transaction value every time you buy or sell. These purchase fees, paid directly to the fund, can eat away at your overall return but should diminish as a percentage of your overall return as you experience greater returns. Redemption fees, on the other hand, typically apply only for a certain period of time.

- For example, you may face a redemption fee if you choose to sell your mutual fund shares if you have owned them for less than 3 months. Funds justify these fees by collecting them to offset trading costs for buying and selling assets held in the mutual fund on your behalf.

- However, with trading commissions dropping to zero across the board, these fees have become harder to justify with many prominent mutual fund companies eliminating them.

- Loads. Not to be confused with purchase and redemption fees some mutual funds charge, loads are similar such that funds charge them when you buy (front-end load) and/or sell (back-end load) certain mutual funds. Where these differ, however, is that investors pay relevant front-end and back-end loads directly to the investment company, not the fund as you would with purchase and redemption fees.

- 12b-1 fees. These fees do not appear for buying and selling ETFs. 12b-1 fees are unique to mutual funds and represent charges the fund company must pay to market and distribute the fund to potential investors.

- Commissions. Like stocks and bonds where you must pay a trading commission to buy or sell securities, trading commissions can also apply to mutual funds. These trading commissions go directly to the online discount broker used to buy or sell your mutual fund shares.

Best Mutual Funds for Young Investors

Some of the best mutual funds offer widely-diversified holdings and offer extremely low costs. Further, because investors can easily research mutual funds, they make great options for young investors.

Choices like VTSAX and VFIAX from Vanguard provide diversified, low-expense options and have performed very well over long periods of time. These mutual funds allow a young investor to purchase one or two funds and hold hundreds or even thousands of other securities in one or two funds.

Investing for Young Adults (Apps to Consider for Getting Started)

You can’t beat the convenience of monitoring your investments straight from your phone. In a move to be more competitive, many investment apps geared toward young adults have removed most types of fees and minimums.

They have also made it easy to invest small sums of money and keep up-to-date on stock news, which is excellent for young professionals who want to invest but don’t want to wait until they have an expansive cash reserve to do so.

To understand better how you can begin investing in the stock investments listed above, consider reviewing the following investment platforms to see which best fits your needs. I have labeled each with their intended use and what young adults can expect to get out of the platform.

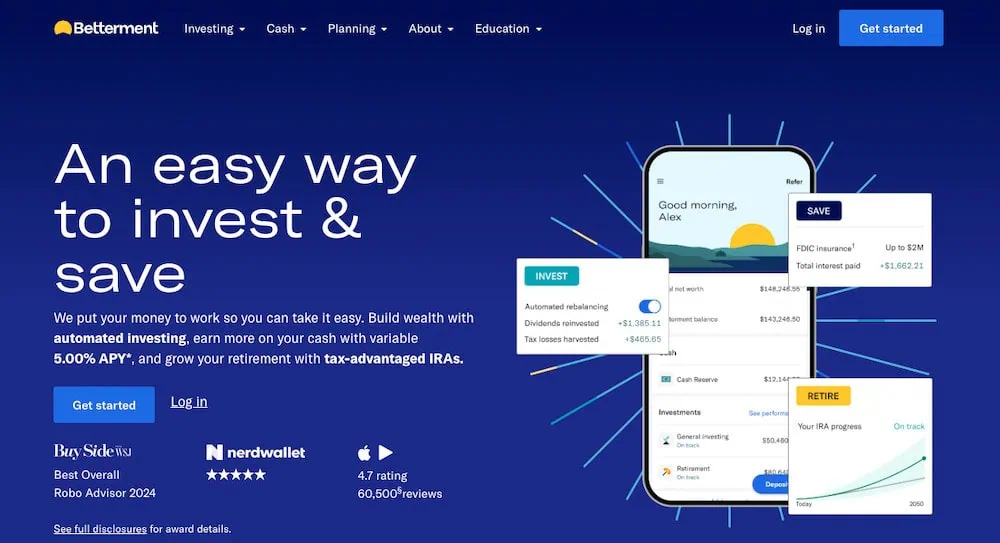

→ Betterment: Best for Tax-Loss Harvesting

- Platforms: Desktop web app, Apple iOS and Google Android.

- Account Minimum: $10.

- Price: $4/mo., or 0.25% annual fee*. Premium: Additional 0.15% annual fee.**

- Available: Click “Get Started” Below

If you’re a fan of diversifying your portfolio with ETFs, a Betterment account could be a good choice. This robo-advisor platform allows you to invest in a narrow series of low-cost ETFs with different themes and purposes. For instance, you could choose to invest in its Social Impact or Climate Impact portfolios if you care deeply about social justice or the environment. Betterment also offers crypto-focused ETFs for investors interested in decentralized finance, including an ETF specifically focused on the metaverse.

Although Betterment is a robo-advisor, it does offer access to human advisors, too. This is a big plus to me—I’m a self-directed investor, but even if I convinced myself to lean on a robo-investor, I’m the kind of person who wants to learn what I can, and I’d prefer to be able to receive guidance from a financial pro. This sets Betterment apart from many other competing robo-advisors.

Alternatively, though, Betterment is primarily a robo-advisor, so this isn’t the best choice for hands-on investors.

While Betterment accounts (individual and joint taxable brokerage accounts, and Traditional, Roth, Inherited, and SEP IRAs) do have a minimum required deposit, it’s tiny, at just $10. Betterment does charge fees, however. Its accounts start at $4 a month, but that changes to a 0.25% annual fee if your balance is more than $20,000, or if you set up recurring monthly deposits that total $250 or more. Also, you can upgrade to Betterment Premium for an additional 0.15% add-on fee to receive on-demand support from a Certified Financial Planner™. Upgrading requires a $100,000 minimum balance required in cash, stocks, bonds, or crypto holdings.

The assets under management (AUM) fee might justify itself in taxable brokerage accounts through Betterment’s tax-loss harvesting feature. It works by selling positions with losses to lock in short-term capital losses and can both offset realized capital gains and potentially lower your taxable income up to $3,000 per year (any unused loss rolls over to future years indefinitely) while taking your proceeds and placing them into a similar investment. As you can see, by lowering your tax impact, the service can pay for itself.

Betterment led the way for robo-advisor services, growing from a small business to what now represents a significant book of business. Using Betterment has become a popular choice for people looking to invest toward specific goals without the need for any investing experience for a reasonable fee.

Visit Betterment’s site by clicking “Get Started” below to see if it’s the right fit for you.

- The Betterment app gives you the tools, inspiration, and support you need to become a better investor.

- Start with as little as $10 and use the top-rated mobile app to set up automatic investing into diversified ETF portfolios.

- You can also invest in diversified preset cryptocurrency portfolios.

- Customize your risk tolerance and investment goals with guidance available at any time.

- By upgrading to Premium, you can unlock unlimited financial guidance from a Certified Financial Planner™.

- Hands-off investment management

- Diversified portfolio that automatically rebalances

- Low-cost investment selection

- Limited investment selections

- Limited crypto diversification in cryptocurrency portfolios

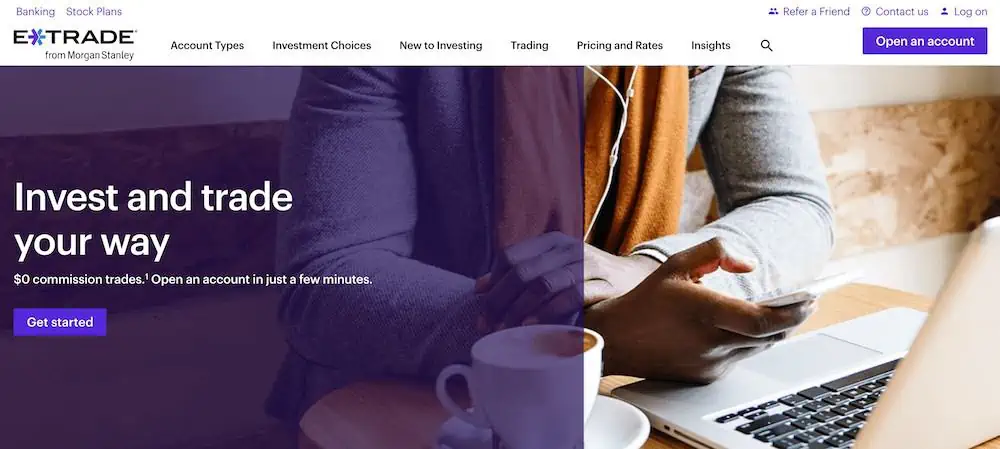

→ E*Trade’s Core Portfolios (Best for Smart Beta Investing)

- Platforms: Desktop web app, Apple iOS and Google Android.

- Account Minimum: $500.

- Price: 0.30% annual fee*.

- Available: Click “Open Account” Below

E*Trade has long been seen as a leading stock trading app for retail investors. They’ve done so not only by equipping retail traders with the tools they need and access to numerous asset classes, they also provide investors access to educational resources that assist you with conducting investment research and analysis and diversifying your portfolio.

E*Trade, like most of the best stock trading apps, offers zero-commission stock, ETF, and options trading. It also has a leg up on some platforms by offering $0-commission mutual fund trading. Options still incur a 50- to 65-cent contract fee, however. Meanwhile, bond trades are $1 apiece, and future trades are $1.50 per contract per side, plus other fees.

But if you’re interested in E*Trade’s robo-advisory product, called Core Portfolios, you’ll face a different pricing structure that’s more in line with other robo-advisors. You pay 0.30% of your assets under management (AUM) with the platform on all balances $500 or more (you’ll need at least $500 to open a Core Portfolios account with E*Trade).

E*Trade’s Core Portfolios uses a simple account setup process with a straightforward planning questionnaire that asks for the type of savings goal you intend to achieve with the robo-advisory product. The majority of the questions are used to determine your risk tolerance and investment time horizon.

The product offers three different portfolios that exclusively invest in ETFs, all based on the principles of modern portfolio theory:

- Core Portfolios ETF asset allocation based on your risk profile (built with responses to your questionnaire) without any additional considerations

- Socially responsible investing ETFs that emphasize environmental, social, and governance (ESG) concerns

- Smart beta ETFs that have more active management in an effort to increase portfolio performance relative to other ETFs

Lastly, E*Trade’s acquisition by Morgan Stanley also equipped the service with tax-loss harvesting capabilities. The potential reduction in tax-drag on your returns and income could easily negate the AUM fee paid for the platform.

For a limited time, E*Trade offers a new account funding bonus when you use reward code “OFFER24” in the following amounts:

- $1,000-$4,999 earns $50

- $5,000-$19,999 earns $150.

- $20,000-$49,999 earns $200.

- $50,000-$99,999 earns $300.

- $100,000-$199,999 earns $600.

- $200,000-$499,999 earns $800.

- $500,000-$999,999 earns $1,000.

- $1,000,000-$1,499,999 earns $3,000.

- $1,500,000-$1,999,999 earns $5,000.

- $2,000,000 or more earns $6,000.

To learn more about E*Trade’s Core Portfolios product, click “Open Account” below.

- E*Trade is one of the best online and mobile trading platforms among discount brokers, offering a full range of investments (including professionally managed accounts). It allows you to invest in stocks, ETFs, mutual funds, options, bonds, futures, micro futures, and futures options.

- $0 commission trading for online U.S.-listed stocks, ETFs, options, mutual funds, and Treasuries. (Options do have a 65¢ contract fee.)

- Opening an account is easy and only takes a couple of minutes.

- Bonus: Get between $100 and $5,000* when you open and fund a new investment account using promo code "OFFER24."

- Excellent selection of available investments

- Commission-free mutual funds and Treasuries

- Automated portfolio builders and prebuilt mutual fund and ETF portfolios

- Separate apps for power users and casual users

- Limited availability of fractional shares (only in DRIP plans or robo-created portfolio)

- No direct cryptocurrency trading

6. Real Estate

Owning your own home can be a rewarding investment. It builds equity as opposed to paying rent to a landlord, gives you your own space, offers tax benefits, among many other benefits.

If you can save money for a down payment on a house which looks to appreciate in value, you should consider setting aside money in a high-yield savings account or other riskless account which still pays a respectable level of interest.

I discuss this more in the section below focused on the best short-term investments for young adults.

Investing in real estate as a long-term asset is also a popular way to diversify investment portfolios. For many of the reasons touched upon above, real estate investing comes with a relatively easy-to-understand investing proposition:

- inflation hedge,

- long-term capital appreciation,

- generates income and

- tax-advantaged asset.

Furthermore, investing in real estate places your money in a tangible asset you can see and feel. You can choose to invest directly by purchasing rental properties outright, or, thanks to the growth of fintech options, real estate investing now includes more options for young adults and other interested investors.

Notably, crowdfunding services like Fundrise offer the opportunity to commit as little as $10 to start investing in real estate.

The service, considered the first online site with real estate investing opportunities, acts as the largest platform and is the leading service for helping people to start investing in real estate.

Fundrise acts similarly to a real estate investment trust (REIT) where you get to invest in real estate portfolios. With Fundrise’s Starter Portfolio, the minimum to invest is only $10. They also have higher initial investment options through their Core, Advanced and Premium portfolios.

If investing in real estate for passive income and capital appreciation sounds like something you’d like to explore more, consider signing up for an account to learn more.

- Regardless of your net worth, you can now benefit from real estate’s unique potential for generating consistent cash flow and long-term gains with Fundrise starting as low as $10.

- Enjoy set-it-and-forget-it managed portfolios with standard Fundrise accounts, or actively select the funds you want to invest in with Fundrise Pro.

- Diversify your portfolio with real estate, private tech investing, or private credit.

- Low minimum investment ($10)

- Accredited and non-accredited investors welcome

- IRA accounts available

- Highly illiquid investment

Related: 11 Best Fundrise Alternatives [Accredited & Non-Accredited Apps]

Best Short-Term Investments for Young Adults

There are many reasons for young adults to have short-term investments. These typically won’t have as high of an overall return compared to a long-term investment, but the money will be available sooner. If you want to save for an emergency fund, wedding or a down payment for a house, short-term investments are wise.

Read below for some suitable investment ideas for young adults looking to make low-risk investments with higher-than-average returns.

7. High-Yield Savings Account

High-yield savings accounts are a type of federally-insured savings account which aim to earn interest rates much higher than the national average.

Depending on where you look and the prevailing market interest rates overseen by the Federal Reserve, high-yield accounts can earn around 5.00% APY or more. As a comparison, the national savings account average interest rate comes to 0.47% APY—a far cry from the most competitive offers in the market.

All things equal, if you hold your money in an account which pays a higher interest rate, your balance will grow faster without any additional effort on your part. Certainly a favorable way to make money while you sleep.

To illustrate the effect of holding money in a high-yield savings account compared to one offering a far lower rate, consider the following comparison. After one year, a savings account balance of $10,000 would earn $10 in an account with a 0.10% APY. If this money had instead been placed in a high-yield savings account offering 5.00% APY, your money would have earned 50x more, or a total of $500.

As no depositor has lost a single cent in federally-insured funds since 1933, balances of up to $250,000 are encouraged to be held in high-yield savings accounts or one of the following two short-term investments for young investors, depending on your liquidity needs.

Consider placing your money in one of the most competitive high-yield savings accounts available on the market through Axos Bank’s Axos ONE checking and savings bundle.

High-Yield Savings Account Highlights:

- The best high-yield savings accounts typically come from online-only banks and can pay 15-20x more than the national average for regular savings accounts

- Usually come with only 6 monthly withdrawals due to Federal Reserve Board Regulation D and result in charges if exceeded or transforming your account

- Almost all retail banking institutions offer these products

- Some high-yield savings accounts charge fees, eating into your interest. Shop around because opening a new account can take only 10 minutes to open

8. Money Market Accounts

Money market accounts are similar to savings accounts, except they can offer higher interest rates due to the ability of financial institutions to invest your account balance in certificates of deposit (CDs), government securities, and commercial paper. None of these are able to be done with your savings account. In exchange for the slightly higher risk, your interest rate is generally a bit higher with money market accounts.

Money market accounts can also sometimes be referred to as money market deposit accounts (MMDA). Different than CDs, which can charge penalties or surrender charges for early withdrawals, you can close a money market account at any time. You can usually even withdraw money each month, with limits to how many withdrawals within a specified period.

Further, money market accounts can allow check writing and debit card features. Financial institutions like banks and credit unions often require customers to deposit a minimum amount of money in order to open a money market deposit account and then maintain a minimum balance going forward. If the account holder goes below this threshold, the financial institution will often impose monthly fees.

Typically, if you want to earn the best rate on a money market account, you will encounter these minimum balance requirements.

Money Market Account Highlights:

- Best-in-market money market accounts pay higher or comparable interest rates as savings accounts but less than CDs

- Money market accounts are federally-insured and represent safer short-term investments than stocks and bonds

- Many retail banking institutions and brokerages offer money market accounts to their customers

- These accounts often come with debit cards and limited check writing features

- CIT Bank is an online bank that offers competitive interest rates on its various products.

- CIT's money market accounts current yield roughly 3x the national average.

- CIT Bank's money market accounts feature no monthly service fees, 24/7 banking, mobile app access, and FDIC insurance of up to $250,000.

9. Certificates of Deposit (CDs)

When you set up a certificate of deposit (CD) with a bank, you agree to keep a set amount of money in the account for the term agreed upon—usually anywhere from 90 days to 5 years. The interest rate is higher than a typical savings account because you agree to keep your money with the bank for an extended period of time. In exchange, the banks agree to award you a higher interest rate to compensate you for your loss of liquidity and the use of your funds.

Nearly all retail financial institutions like banks, credit unions and thrifts offer these products to their depositors. To receive the best rates on CDs, you will want to shop around as you will find a wide variety of rates offered by brick-and-mortar only institutions and online-only banks. Typically, the latter tend to offer higher rates because they do not need to finance the costs of maintaining a network of bank branches and can pass these savings through to depositors like you in the form of higher rates.

Online banks like CIT Bank can offer competitively-priced CDs because of this corporate strategy.

You will often find this bank offers special promotions to compete with the best offers in the market, though may come with unusual durations like 11 months, rather than the standard 3, 6, or 18 months or full-increments you will likely see from traditional brick-and-mortars.

CDs are FDIC-insured up to $250,000 so there is minimal risk involved. Some great options are available in this low-interest rate environment.

As called out above, one particular CD to highlight comes from CIT Bank, an online-only bank which aims to offer some of the most competitive rates in the market to attract potential depositors.

CD Highlights:

- Best-in-market CDs pay higher interest rates than savings accounts or MMAs due to the time commitment required

- CDs are federally-insured and represent safer, more conservative investments than stocks and bonds

- Almost all retail banking institutions offer these products and offer a variety of options and rates

- Even if you lock into a longer duration than you originally intended, you may break the agreement and exit early, often by foregoing a certain amount of interest as an early withdrawal penalty (EWP) or surrender charge

- CIT Bank is an online bank which offers competitive interest rates on its multiple products

- Earn many times more than the national average interest rate by keeping your cash and other savings in one of CIT Bank's banking products

10. Short-Term Bond Funds

The first two short-term investments for young adults primarily rely on doing business directly with a bank like CIT Bank or one of its competitors. If you want to move a bit farther along the risk/reward curve but remain conservative overall, you might consider investing in short-term bond funds through a brokerage.

Short-term bonds have maturities of less than one year and carry less interest rate risk and sensitivity to movements in the market. Just because of their interest rate less-sensitive nature, this does not mean the short-term bond funds will not lose value. However, they do tend to move less in relative price than longer maturity bonds.

Overall, U.S. domestic bonds fall into one of the three following categories:

- U.S. Government-Issued Bonds (Treasury Bills, Notes and Bonds)

- Corporate Bonds

- Municipal Bonds

The first bond category, government bonds, act as an investment safe haven and are universally seen as a risk-free investment. These bonds come backed by the full faith and credit of the United States government and carry lower interest rates than corporate or municipal bonds as a result.

For corporate and municipal bonds, these come backed by companies and states or municipalities, respectively. This represents a higher level of risk and you should expect higher returns to compensate.

One thing to note about investing in a bond fund like a bond ETF or bond mutual fund is that the principal invested can go up or down significantly. However, this could also be a good way to diversify your bond investments with one purchase.

![8 Best Seeking Alpha Alternatives [Competitors' Sites to Use] 36 best seeking alpha alternative](https://wealthup.com/wp-content/uploads/best-seeking-alpha-alternatives.webp)

![How to Invest in Your 20s [Best Ways to Start Investing Money] 38 how to invest in your 20s](https://wealthup.com/wp-content/uploads/how-to-invest-in-your-20s-600x403.jpg.webp)