Mutual funds might not be the new hotness anymore. Exchange-traded funds (ETFs) clearly have stolen their thunder.

But the best mutual funds for 2026 prove that these long-held investment tools still have plenty of utility left.

Mutual funds still take a lot of bricks off your shoulders. They carry the responsibility for researching and/or selecting stocks and bonds. They’re a far more cost-effective way of buying the hundreds or thousands of components they hold—even “high” minimum initial investments in the thousands beat the pants off the six digits or so you’d have to spend buying those securities individually. And rather than managing that portfolio yourself, mutual funds do all the work for you.

The big knocks on mutual funds is that they’re more expensive than ETFs, and they’re often less tax-efficient. On the first count, many mutual funds are still competitive from a fee perspective (and the best mutual funds more than justify their higher expense ratios). On the second count, tax-inefficiency only applies to some mutual funds, not all … and you can always nullify those tax consequences by holding tax-inefficient funds in a tax-advantaged plan like an individual retirement account (IRA) or health savings account (HSA).

That’s why mutual funds still command trillions of dollars in assets today.

So, which mutual funds have me so positive on the investment class? Read on as I shine a light on the best mutual funds for 2026. This list reviews 13 different mutual funds with 13 different strategies, so it should have something for every reader.

Editor’s Note: Tabular information in this article is up-to-date as of Feb. 9, 2026.

Disclaimer: This article does not constitute individualized investment advice. Individual securities, funds, and/or other investments appear for your consideration and not as personalized investment recommendations. Act at your own discretion.

Table of Contents

How Were the Best Mutual Funds Selected?

According to the Investment Company Institute’s most recent annual Fact Book, investors have plowed $25.5 trillion in assets into nearly 8,600 U.S. mutual funds. But according to that same Fact Book, the median number of mutual funds that a given household owns is … three.

Selecting the three (or two or four or however many mutual funds you personally need) best mutual funds for you from a universe of thousands is awfully unrealistic. So I’ve whittled that list down into a more digestible group numbering in the teens.

I start virtually every review of investment funds by booting up Morningstar Investor and running a quality screen I customize for each article. Here, I began my search by seeking out only mutual funds that have earned a Gold Morningstar Medalist rating*. Morningstar has two ratings systems—the Star ratings and the Medalist ratings. The latter are a forward-looking analytical view of a fund. Per Morningstar:

“For actively managed funds, the top three ratings of Gold, Silver, and Bronze all indicate that our analysts expect the rated investment vehicle to produce positive alpha relative to its Morningstar Category index over the long term, meaning a period of at least five years. For passive strategies, the same ratings indicate that we expect the fund to deliver alpha relative to its Morningstar Category index that is above the lesser of the category median or zero over the long term.”

As I’ve written in other Young and the Invested articles, a Medalist rating doesn’t mean Morningstar is necessarily bullish on the underlying asset class or categorization. It’s merely an expression of confidence in the fund compared to its peers.

That’s the starting piece of criteria. Now let’s look at other features each fund must have.

Additional Criteria Our Best Funds Had to Meet

To narrow the list further, I also required the following:

— No loads: In addition to annual expenses, some funds charge additional fees, including “loads.” For instance, if you invested $10,000 in a mutual fund with a 5% front-end load, the mutual fund provider would immediately take $500 out in fees. So, you’d already be starting behind the 8-ball, investing just $9,500 to start with. The funds here have no sales charges.

— Reasonable investment minimums. The maximum investment minimum for inclusion is $5,000. But only one fund on this list requires that much to start. Most require between $1,000 and $2,500, and a few funds have zero investment minimums. Also, some fund providers explicitly lay out lower investment minimums for specific accounts, such as individual retirement accounts (IRAs). T. Rowe Price, for instance, has $2,500 minimum initial investments on many of its funds, but lowers that minimum to $1,000 when investing through an IRA.

— Broad availability: Many mutual funds have several share classes, many of which are limited to certain types of accounts, like, say, only for 401(k)s or only for wealth management clients. All funds here are Investor-class or other shares that are generally considered to be widely available to retail investors.

From the much more manageable resulting list, I’ve selected a group of mutual funds that provide a wide array of core and tactical strategies, ensuring there’s at least one fund, if not many funds, for just about everyone.

* Mutual funds selected for 2026 all had Gold Medalist ratings as of the original writing of this story in December 2025. Funds will remain on the list throughout 2026 as long as they maintain a minimum of Silver. Funds that fall below this threshold will be replaced.

The Best Mutual Funds to Buy Now

The following represent some of the best mutual funds you can buy at the moment—and they’re priced quite reasonably too.

While annual expense ratios weren’t used explicitly in the selection process, the vast majority of these funds sport below-category-average fees. It makes sense, too: Fees eat into a fund’s performance, so providers that charge onerous management expenses are, in a way, handicapping their fund’s returns. Meanwhile, providers with lower fees get a bit of an intrinsic performance edge.

A few final notes to keep in mind as you’re reading this list:

— All of these funds have no loads, but brokerage commission fees might apply; check your brokerage before purchasing.

— Your brokerage might require a larger minimum initial investment for mutual funds than the fund itself requires.

— Some brokerage accounts might not let you purchase certain funds, even if they’re generally available to retail investors. (For instance, you might be able to buy the completely made-up Woodley Investments Large-Cap Fund at Schwab, but not at Fidelity.)

Lastly, this isn’t a ranking of the best funds. Every fund on here rates as excellent already. This is just listed in a natural progression of various portfolio needs, starting broadly with different stock flavors and ending with a few bond funds.

With all that out of the way, let’s look at the best mutual funds you can buy.

Related: 8 Best-in-Class Bond Funds to Buy

1. Fidelity 500 Index Fund

— Style: U.S. large-cap stock

— Assets under management: $740.0 billion

— Dividend yield: 1.1%

— Expense ratio: 0.015%, or 15¢ per year for every $1,000 invested

— Minimum initial investment: None

Investors are frequently told to start building their portfolio’s foundation with an equity fund that invests in large, American companies. These stocks provide a relatively high amount of stability while still offering some upside potential—and in many cases, returns from dividends, too.

One of the most common ways of getting this exposure is through an S&P 500 Index fund like the Fidelity 500 Index Fund (FXAIX).

The S&P 500 Index is a collection of 500 of the largest American businesses, and a barometer of the American stock market. The index requires a few other criteria for a company to join, including a market cap of at least $22.7 billion, highly liquid shares (the stock is frequently bought and sold), and more. There’s a bit of a quality check, too: A company must also have positive earnings in the most recent quarter, and the sum of its previous four quarters must be positive. (Note: Once a company becomes an S&P 500 component, it’s not automatically kicked out if it fails to meet all of the criteria. However, the selection committee would take this under consideration and possibly boot the company.)

Related: The 10 Best Index Funds You Can Buy for 2026

The S&P 500 is considered a reflection of the U.S. economy, but it’s not perfectly representative, nor is the U.S. economy evenly split among certain types of business. Right now, for instance, technology makes up 35% of FXAIX’s assets, but real estate, energy, materials, and utilities only account for 3% apiece. That’s because the S&P 500 is market capitalization-weighted—a common weighting system in which the greater the company’s size by market cap (share price times outstanding shares), the more “weight” it’s given in the index. That’s why this Fidelity index fund currently has the largest percentages of its assets invested in multitrillion-dollar companies Nvidia (NVDA), Apple (AAPL), and Microsoft (MSFT).

Meanwhile, turnover (how much the fund tends to buy and sell holdings) is always low, given that only a handful of stocks enter or leave the index in any given year. This tamps down and sometimes even eliminates capital-gains distributions, which can receive unfavorable tax treatment, making FXAIX an extremely tax-efficient option for taxable brokerage accounts.

Now that you understand what the S&P 500 is, you’re probably wondering: Why should we unload such a core part of our portfolio to a brainless index fund?

The S&P 500 Index is commonly used as a performance benchmark for mutual funds that invest in U.S.-based large-cap stocks.* But most fund managers who run these products typically struggle to beat this benchmark. Indeed, according to S&P Dow Jones Indices, the vast majority (86%) of active large-cap U.S. equity funds failed to beat the S&P 500 over the trailing 10-year period, and that number is 88% when looking at the past 15 years.

“I know guys that rate active managers in all these categories, and even they’re like, ‘I’m not buying actively managed large blend; I’m just indexing,'” says Daniel Sotiroff, Senior Analyst for ETF and Passive Strategies at Morningstar. “Because it’s so brutally tough to beat a dirt-cheap index fund in the large blend category.”

And if you’re buying an S&P 500 fund, it might as well be Fidelity 500 Index Fund. It has one of the cheapest expense ratios for any mutual fund period, it has no minimum initial investment, and it’s widely available. That makes FXAIX not just one of the best Fidelity mutual funds to buy—but one of the best mutual funds across all providers.

* There are different ways to define the different “cap” levels. We’re going by Morningstar’s definition, which says the largest 70% of companies by market capitalization within a fund’s “style” are large-caps, the next 20% by market cap are mid-caps, and the smallest 10% by market cap are small caps.

Related: 7 Best Fidelity Retirement Funds [Low-Cost + Long-Term]

2. T. Rowe Price Dividend Growth Fund

— Style: U.S. large-cap dividend-growth stock

— Assets under management: $24.0 billion

— Dividend yield: 0.9%

— Expense ratio: 0.64%, or $6.40 per year for every $1,000 invested

— Minimum initial investment: $2,500

If you’d prefer a large-cap “blend” fund (a mix of value and growth, like the S&P 500) that’s actively managed, you can look to one of T. Rowe Price’s best mutual funds:

T. Rowe Price Dividend Growth Fund (PRDGX).

If you saw a fund with “dividend” in its name, and guessed that the goal was superior yield, you’d be correct more often than not, but you wouldn’t be right all the time. Some of the time, you’d be looking at a dividend-growth fund like PRDGX, which focuses more on payouts that increase over time and less on current yield.

What’s the appeal? Well, even dividend stocks with a low yield right now can deliver a higher “yield on cost” down the road. Yield on cost is what you’re actually earning based on the price at which you bought the stock. (Example: A $100 stock paying $1 in annual dividends yields 1%. But because you bought the stock at $50, your yield on cost is 2%.)

Also, dividend-growth stocks tend to be high-quality equities. After all, you can’t sustainably increase how much cash you’re shelling out to shareholders if you’re unable to turn a profit—you need strong financials and excellent cash flows. So dividend growth is often considered a quality screen of sorts that ensures the fund owns a higher grade of company.

Related: 7 Best High-Yield Dividend Stocks: The Pros’ Picks for 2026

That’s what you get with PRDGX. “Manager Tom Huber focuses on financially healthy companies that can sustain above-average payout growth as he believes dividend growers offer outperformance with lower volatility,” Morningstar Senior Analyst Stephen Welch says about this Gold-rated fund.

But one thing to note: Huber is tasked with building a portfolio of companies “that have a strong track record of paying dividends or that are expected to increase their dividends over time.” I emphasize “or” because it’s … well, different.

Many dividend-growth index funds are required, thanks to the rules that govern the index, to own companies that have improved their payouts without interruption for some set period of time. That’s not the case with T. Rowe Price Dividend Growth. Huber has full discretion here. For instance, holding Ross Stores (ROST) actually suspended its distribution for a few quarters in 2020—and was booted from the Dividend Aristocrats as a result. However, it resumed payouts in 2021 at its previous level and has raised each year since then, so it’s certainly a dividend grower once more.

For the most part, however, this U.S.-centric portfolio of about 100 stocks is full of blue-chip stocks such as Visa (V), Walmart (WMT), and Chubb (CB) with solid dividend-growth histories.

The actively managed T. Rowe Price Dividend Growth ETF (TDVG) offers similar exposure and charges 0.50% annually.

Related: The 10 Best Dividend ETFs [Get Income + Diversify]

3. Vanguard Strategic Small-Cap Equity Fund Investor Shares

— Style: U.S. small-cap value stock

— Assets under management: $2.0 billion

— Dividend yield: 1.0%

— Expense ratio: 0.21%, or $2.10 per year for every $1,000 invested

— Minimum initial investment: $3,000

Naturally, you don’t need to limit yourself to just the market’s largest companies—you can (and often should) invest in companies of all sizes.

As a general rule, smaller companies (usually considered to be those with market capitalizations of $2 billion or less) have more growth potential than larger firms. For one, as they say, it’s much easier to double your revenues from $1 million than $1 billion. And as these stocks become noticed by institutional investors and fund managers, or begin qualifying for certain indexes, they can begin to enjoy large-scale investments that drive their prices even higher.

The rub is that smaller stocks tend to be more volatile. A smaller company’s revenues might be dependent on just one or two products or services—meaning a single disruption could have massive financial consequences. Small caps also have less access to capital than their larger peers, so they’re less likely to get a lifeline should they suffer from broader economic headwinds.

Related: 11 Best Vanguard Funds for the Everyday Investor

Buying these kinds of stocks individually is a high-risk, high-reward proposal—a company could feasibly double or get cut in half overnight. But if you wanted to harness some of the upside potential of small caps while tamping down risk, you could invest in a small-company fund like the Vanguard Strategic Small-Cap Equity Fund (VSTCX).

VSTCX, managed by Cesar Orosco, invests in roughly 630 small-cap equities that can be found within the MSCI US Small Cap 1750 Index. Orosco selects stocks that have similar risk to the index, but that he believes will provide better performance. The result is a diversified portfolio blending value stocks and growth stocks that have produced much better earnings growth as a whole than the benchmark index’s average.

Toss in top-90th-percentile performance over the trailing three-, five-, 10-, and 15-year periods, as well as exceedingly low management fees compared to its peers, and Strategic Small-Cap Equity easily rates among the best Vanguard mutual funds I’ve reviewed.

Just note that, like with many small-cap funds, turnover is on the high side at nearly 65%, so this is best held in tax-advantaged accounts like an individual retirement account (IRA), health savings account (HSA), or, if available, a 401(k).

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

4. Fidelity Mid Cap Index Fund

— Style: U.S. mid-cap stock

— Assets under management: $45.8 billion

— Dividend yield: 1.1%

— Expense ratio: 0.025%, or 25¢ per year for every $1,000 invested

— Minimum initial investment: None

I frequently refer to mid-cap stocks—companies worth $2 billion to $10 billion by market cap—as “Goldilocks” stocks. That’s because they enjoy some qualities of their large-cap brethren (some size, some stability, revenue stream diversity, some access to capital) and some qualities of smaller firms (they’re nimble and have more upside potential). That combination of traits is what Goldilocks would call “just right.”

Related: 9 Best Schwab Funds You Can Buy: Low Fees, Low Minimums

“Since 1978, mid-cap stocks have outperformed small-caps over each of these rolling time periods: five, 10, 20, 30 and 40 years,” says Oregon-based equity manager Jensen Investment Management. “They’ve even bested large-caps over the 30- and 40-year windows. These returns came with lower volatility than small-caps as well, making the evidence even more compelling.

“That means mid-caps haven’t just delivered better performance—they’ve done it more consistently, with fewer drawdowns.”

Fidelity Mid Cap Index Fund (FSMDX) is an exceedingly cost-efficient way to tap this area of the market. FSMDX tracks the Russell MidCap Index, which is made up of the 800 smallest stocks in the Russell 1000 (which is itself an index of the U.S. market’s 1,000 largest stocks). As a result, you’re getting exposure to about 800 mostly mid-cap stocks—the fund typically is 75% weighted in mids, with another 5%-10% in smaller large caps, and another 10%-15% in larger small caps.

Related: 5 Best Tech Dividend Stocks [According to the Pros]

That might seem odd. But it’s pretty commonplace for 20%-30% of a mid-cap fund’s holdings to bleed into small- and/or large-company territory, largely because different fund providers and indexes have different definitions for market-cap ranges. Where FSMDX stands out is that “the index selects larger stocks than most,” Morningstar says. “Larger stocks are generally less volatile, so the portfolio could exhibit lower volatility than its peers.”

Sector weights will naturally change over time as certain businesses come into and go out of favor, but right now, industrials are tops at 18%, followed by financials (15%), consumer discretionary (12%), and information technology (12%). Also, thanks to both the market cap-weighting of the Russell MidCap Index and the high number of holdings, single-stock risk is minimal; currently, every stock is weighted at less than 1%.

A sound methodology for Wall Street’s mid-sized companies, dirt-cheap fee, and strong historical performance all make FSMDX one of the best index funds you can buy, and one of the best mutual funds period.

Make Young and the Invested your preferred news source on Google

Simply go to your preferences page and select the ✓ box for Young and the Invested. Once you’ve made this update, you’ll see Young and the Invested show up more often in Google’s “Top Stories” feed, as well as in a dedicated “From Your Sources” section on Google’s search results page.

5. Primecap Odyssey Aggressive Growth Fund

— Style: U.S. all-cap growth stock

— Assets under management: $6.6 billion

— Dividend yield: 0.3%

— Expense ratio: 0.66%, or $6.60 per year for every $1,000 invested

— Minimum initial investment: $2,000

Primecap Odyssey Aggressive Growth Fund (POAGX) is a supreme example of the advice to “look under the hood” before you buy a mutual fund.

This is a fund that has the words “aggressive growth” in the name, and that is categorized as a mid-cap growth fund. However …

1. POAGX isn’t an “aggressive growth” fund—at least not right now. While it’s true that POAGX’s management aims to own companies with “prospects for rapid earnings growth,” its actual holdings aren’t as aggressively “growthy” as comparable products. “The fund has recently tilted more toward the core column of the Morningstar Style Box as many of its holdings’ growth rates and valuation ratios have declined in recent years, and the managers have been unwilling to chase benchmark stocks they think are overvalued,” says Morningstar Principal Robby Greengold.

Related: 8 Best Schwab Index Funds for Thrifty Investors

2. POAGX isn’t really a mid-cap growth fund, either. The fund’s page itself says the company “has historically invested significant portions of its assets in mid- and small-capitalization companies,” and “may invest in stocks across all market sectors and market capitalizations.” There’s nothing strictly tethering this fund to mid-caps. In fact, it currently boasts a pretty balanced 40/30/30 blend of large-, mid-, and small-cap stocks.

Fortunately, you’re still left with an awfully useful fund.

Primecap Odyssey Aggressive Growth and its team of managers own nearly 200 stocks across the market-cap spectrum, with an eye for growth. Each manager oversees a separate “sleeve” of selections, while a few picks are made by other analysts.

Related: 9 Best Fidelity ETFs for 2025 [Invest Tactically]

As is common with actively managed funds, size isn’t everything when it comes to allocations. Yes, top holdings include mega-caps like multitrillion-dollar Nvidia, Alphabet (GOOGL), and Nvidia … but they also include companies like $43 billion BeOne Medicines (ONC) and $7 billion Rhythm Pharmaceuticals (RYTM) that would never see daylight in a cap-weighted index fund.

The proof is in the performance pudding. POAGX is in the top 15% of all category funds by performance over the trailing three- and five-year periods, top 8% over the trailing 10 years, and top 3% over the trailing 15 years.

Again, past performance isn’t indicative of future returns, but management has a track record of going anywhere within the U.S. market-cap spectrum and finding gold. And that makes Primecap’s product one of the best mutual funds to buy in 2026.

Related: 7 Best Closed-End Funds (CEFs) That Yield Up to 11%

6. Fidelity Select Semiconductors Portfolio

— Style: Industry (Semiconductors)

— Assets under management: $28.7 billion

— Dividend yield: < 0.0%

— Expense ratio: 0.62%, or $6.20 per year for every $1,000 invested

— Minimum initial investment: None

Fidelity has roughly 30 “Select” funds—the company’s name for its sector- and industry-specific funds. Several of these funds currently boast Morningstar Gold Medalist ratings. However, given that many investors have a heightened interest in the technology sector, I figured a tech-focused offering was the top fit for our best mutual funds list.

Related: The 12 Best Vanguard ETFs for 2026 [Build a Low-Cost Portfolio]

Fidelity Select Semiconductors Portfolio (FSELX) is an actively managed industry fund focused on semiconductor stocks, which have a pretty straightforward bull case: As both our personal and business worlds become increasingly dependent on technology, semiconductor companies—which design and manufacture one of the most essential components of technology—stand to benefit. And some of the greatest opportunities rest within those semiconductor companies powering emergent and high-growth technologies such as data centers, cloud computing, and artificial intelligence.

Adam Benjamin, who has led FSELX for six years, aims to beat the broader semiconductor industry by picking winners and losers within the space. In addition to single-company research, Benjamin also attempts to identify themes that will impact the largest end markets, and determine how technology disruptors might impact incumbent companies.

Related: The 9 Best ETFs for Beginners

Fidelity Select Semiconductors’ 55-stock portfolio might seem tight, but it’s pretty standard for a single-industry fund. The same goes for the massive 25% weight in Nvidia—as it goes, so too goes most semiconductor portfolios, not just Benjamin’s pick list.

Kudos to Fidelity Select Semiconductors: In addition to its Gold Medalist rating, it has beaten every meaningful benchmark—the S&P 500, the technology sector, the MSCI US IMI Information Technology 25/50 Index—over every meaningful time period. And over the trailing three-, five-, 10- and 15-year periods, it has been in either the top 2% or 1% of products in its Morningstar category: tech-stock funds.

Morningstar, in explaining its Gold Medalist rating, also points out that “Benjamin has invested between $100,000 and $500,000 in the strategy, making an effort to align interests with shareholders and establish a proper incentive structure.” To be clear: Fund managers virtually always have investors’ best interests in mind, but when a manager actually has tangible skin in the game, that often provides additional confidence and comfort in the product.

7. Fidelity Real Estate Investment Portfolio

— Style: Sector (Real estate)

— Assets under management: $3.1 billion

— Dividend yield: 2.2%

— Expense ratio: 0.64%, or $6.40 per year for every $1,000 invested

— Minimum initial investment: None

It’s with no small amount of shame that I must introduce our first replacement fund of the year … just more than one month into the year.

Fidelity Pacific Basin (FPBFX), which has been booted from our list, remains an excellent fund. But it wasn’t cheap to begin with, and its early 2026 fee hike, from 0.87% before to 0.98% currently, was enough for Morningstar to double-downgrade it, from Gold to Bronze. With that, Pacific Basin exits, and Fidelity Real Estate Investment Portfolio (FRESX) takes its place.

Fidelity Real Estate Investment Portfolio, as the name implies, doesn’t exactly replace Pacific Basin’s strategy. Instead, it fills a different hole this list has long suffered due to a dearth of qualifying attributes: the real estate sector.

FRESX owns real estate investment trusts (REITs)—a specially structured type of company that owns and sometimes operates real estate. REITs enjoy a special tax status that allows them to avoid corporate taxation so long as they distribute at least 90% of their net profits as dividends. Because of this tax incentive, REITs tend to be one of the highest-yielding sectors and a perennial favorite among income investors.

Related: 7 Best Vanguard Dividend Funds [Low-Cost Income]

By the way: This tax status was built in by Congress when it created REITs as part of the Cigar Excise Tax Extension of 1960. REITs were brought to life to give regular Joes and Janes like us to invest in real estate. After all, most of us don’t have the six or seven digits it takes to buy investment properties, but we probably have the $20 or $30 it takes to buy a share of a REIT.

And we almost certainly have the lonely dollar it takes to make an initial purchase in the Fidelity Real Estate Investment Portfolio.

Manager Steve Buller, who has been with the fund since 1998, has built a tight portfolio of 43 REITs representing a variety of industries. Top holdings right now include the likes of logistics specialist Prologis (PLD), datacenter landlord Equinix (EQIX), and telecommunications infrastructure REIT American Tower (AMT).

FRESX’s most noteworthy weakness is a low yield (2.2%) compared to similar funds. But it’s nonetheless a rare real estate sector product that simultaneously boasts respectable returns, accessibility to all investors, and a Gold Morningstar rating—one that Morningstar chalks up to low relative costs, a strong process, and the fact that Buller has invested more than $1 million in the strategy, “demonstrating a commendable effort to align interests with shareholders.”

Just note that REITs are very tax-inefficient. As mentioned above, they tend to pay nonqualified dividends, which are taxed as ordinary income (thus as high as 37%, depending on your bracket). So if at all possible, you’ll want to hold REITs and REIT funds like FRESX in a tax-advantaged plan like a 401(k) or IRA to negate those tax consequences.

Related: 9 Best Vanguard Retirement Funds [Save More in 2026]

8. MoA International Fund

— Style: International large-cap value stock

— Assets under management: $2.3 billion

— Dividend yield: 3.2%

— Expense ratio: 0.33%*, or $3.30 per year for every $1,000 invested

— Minimum initial investment: $1,000

The U.S. has been one of the world’s most fruitful stock markets for decades. So if you believe in the American economy’s ability to keep growing, naturally, you should continue to invest the lion’s share of your money in U.S. assets.

Still, many advisors will tell you it’s important to diversify geographically, too. It’s a little hedging of bets, sure—while U.S. stocks tend to outperform international, 2025 was a year in which the rest of the world outdid America. But also, there are hundreds of high-achieving companies scattered across the globe, and it makes sense to have a little exposure to those firms, too.

Related: Best Fidelity Retirement Funds for a 401(k) Plan

MoA International Fund (MAIFX) managers Jamie Zendel and Eric Lockenvitz have selected roughly 150 stocks across a number of “developed” markets—countries with well-established economies and safe, regulated stock markets, like those found in western Europe. For instance, Japan, the U.K., and France feature prominently in this portfolio.

Management uses quantitative models “focused on company valuation, earnings quality, and capital deployment,” so while MAIFX does indeed fall within the value category, it still has some growth elements. Its top 10 holdings are a “who’s who” of traditional international fund holdings, including German software firm SAP (SAP) and Swiss pharmaceutical names Novartis (NVS) and Roche (RHHBY).

Related: Best Schwab Retirement Funds for a 401(k) Plan

“This strategy tends to hold larger, more growth-oriented companies compared with its average peer in the Foreign Large Value Morningstar Category,” Morningstar says, adding that it has also “favored high-quality stocks, including those with low financial leverage and solid returns on equity, compared with Morningstar Category peers during recent years.”

MAIFX struggled in 2024 but has a stellar track record otherwise, beating its category and index in most meaningful long-term time periods. It’s in the top 20% of funds over the trailing 10- and 15-year periods, and within the top 10 over the trailing three- and five-year periods. A good chunk of its returns come from an oversized dividend—international blue-chip dividend stocks tend to pay more than their U.S. counterparts, resulting in a 3%-plus yield that’s nearly thrice what you’d collect from an S&P 500 fund.

* 0.48% gross expense ratio is reduced with a 15-basis-point fee waiver until at least April 30, 2026.

Related: 15 Dividend Kings for Royally Resilient Income

9. Artisan Sustainable Emerging Markets Fund Investor Class

— Style: Emerging markets

— Assets under management: $454.1 million

— Dividend yield: 1.4%

— Expense ratio: 1.15%, or $11.50 per year for every $1,000 invested

— Minimum initial investment: $1,000

If you’re a little more adventurous, you might eschew developed markets for “emerging markets” (EMs).

Emerging markets are considered to be less developed economies and capital markets. The downside here is more risk, ranging from political corruption and possible nationalization of publicly traded companies to less scrutinizing stock markets or economies dependent on just a handful of goods or services. But the upside is far greater growth potential compared to more established countries—and Wall Street is generally favorable on them heading into 2026.

“EM stocks have benefited from capital flight out of the U.S. while the global economy is benefiting from easing trade tensions and rising fiscal stimulus,” T. Rowe Price says in its 2026 equity outlook. “A weaker U.S. dollar offers a further tailwind.”

Related: 9 Best Schwab ETFs to Buy [Build Your Core for Cheap]

Artisan Sustainable Emerging Markets Fund Investor Class (ARTZX) is one of only a very few EM funds to earn Morningstar’s Gold Medalist rating, and the only one currently that’s accessible to your average investor.

Manager Maria Negrete-Gruson brings 34 years of investment experience to this strategy, in which she’s looking for not just the growth potential typical of emerging markets—but companies that boast “sustainability” in more ways than you’d expect. Some of that sustainability involves assessing environmental, sustainability, and governance (ESG) issues, sure. But the fund also focuses on companies with sustainable earnings, analyzing potential picks’ historical drivers of sustainable return on equity (RoE) and companies’ competitive advantages.

Most emerging-markets funds have a large allocation to Chinese equities, and ARTZX is no different, at a 20% weight currently. Taiwan is slightly higher, at 21%, and South Korea is the only other double-digit country weight at 14%. The rest of the portfolio is largely allocated to countries from South America, southeast Asia, and Eastern Europe.

Historical performance hasn’t been as dominant as some of the other funds on this list, but it boasts a great 10-year return that’s within the top 15% of category funds, and Negrete-Gruson has been downright excellent in recent years.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

10. Dodge & Cox Income Fund

— Style: Intermediate-term core-plus bond

— Assets under management: $104.3 billion

— SEC yield: 4.2%*

— Expense ratio: 0.41%, or $4.10 per year for every $1,000 invested

— Minimum initial investment: $2,500

Most investors need some exposure to bonds, which is debt that’s issued by governments, companies, and other entities. Their interest payments and relative lack of volatility make them an excellent tool for providing a portfolio with stability and income.

But how much bond exposure you need will vary by age—because they’re better at protecting wealth than growing it, people typically start with little in the way of bond holdings earlier in life, then gradually hold more bonds as they get closer to (and into) retirement. (Purpose-built investment products called target-date funds capture this dynamic automatically for investors.)

Individual bonds can be a hassle. Data and research on individual issues is much thinner than it is for publicly traded stocks. And some bonds have minimum investments in the tens of thousands of dollars. But you can blunt these problems by purchasing a bond fund, which allows you to invest in hundreds or even thousands of bonds with a single click—and, in many cases, very low fees.

Bond funds like Dodge & Cox Income Fund (DODIX) are, ahem, the gold standard.

Related: 5 Best Stock Recommendation Services [Stock Tips + Picks]

DODIX is referred to as a “core-plus” bond fund, which means it can hold not only several types of core debt categories, but also noncore categories such as below-investment-grade (aka junk) corporate bonds and emerging-market debt.

While this Dodge & Cox fund is allowed to pursue “below-investment-grade debt, debt of non-U.S. issuers, and other structured products,” it’s not doing much of that at the moment. Currently, the portfolio is roughly half invested in securitized debt, another 28% in mostly investment-grade corporates, about 15% in Treasuries, and the rest in other government-related bonds. Across all of that, DODIX does hold a little international debt, and about 5% of the portfolio is junk-rated, but past that, it’s more “core” than “core-plus”—but it’s an opportunistic fund, so that could change at any time.

Duration, a measure of interest-rate sensitivity, is 6.1 years. While the actual calculation is much more complex, this basically implies that for every 1-percentage-point increase in interest rates, DODIX would decline by 6.1% in the short term, and vice versa. It’s a moderate amount of risk, nothing more.

Past that, Dodge & Cox Income has beaten its category average and its benchmark index—the Bloomberg U.S. Aggregate Bond Index (the “Agg”), arguably the market’s most prominent broad bond index—in every meaningful time period. It’s also among the top 20% or better of all category funds over the trailing one-, five-, 10-, and 15-year periods.

* SEC yield reflects the interest earned across the most recent 30-day period.

Related: The 9 Best Dividend Stocks for Beginners

11. Vanguard Massachusetts Tax-Exempt Fund

— Style: Municipal bond

— Assets under management: $3.4 billion

— SEC yield: 3.5%

— Expense ratio: 0.09%, or 90¢ per year for every $1,000 invested

— Minimum initial investment: $3,000

Municipal bonds are typically issued by states, counties, cities, and other sub-federal government agencies. They’re sometimes used to fund general obligations and are backed by the municipality, though some are backed by the revenue a project would generate—say, a toll road. Muni bonds’ quality usually isn’t as high as similar federal debt but higher than comparable corporates.

But the glitziest trait of “munibonds” is their tax treatment. Municipal bonds’ interest is exempt from federal income taxes and net investment income tax (NIIT) … and if you live in the municipality in which it was issued, state and possibly even local income taxes. So whatever headline yield you see on a municipal bond, you’re probably earning much more once you factor in taxes.

Related: 9 Best Alternative Investments [Options to Consider]

Here’s a hypothetical example: You live in Maryland and make $275,000 per year. That puts you in the 35% federal tax bracket and the 5.75% Maryland state tax bracket, plus it requires you to pay an additional 3.8% in NIIT, for a total tax rate of 44.55%. You buy a Maryland municipal bond with a 3% yield, so your income isn’t subject to any of those taxes. Your “tax-equivalent yield” would be 5.4%. That means if you wanted to buy a normal taxable bond and get the same amount of post-tax yield as the muni, that taxable bond would have to yield 5.4%!

Vanguard Massachusetts Tax-Exempt Fund (VMATX), which yields 3.7% right now, holds nearly 950 Massachusetts munibonds, and it does so for a song—just 9 basis points annually. (A basis point is one one-hundredth of a percentage point.)

You do not have to live in Massachusetts to invest in this fund. If you’re a resident of another state, you could still buy VMATX and enjoy interest income free of federal taxes and NIITs, which would be up to 40.8% if you’re in the highest tax bracket. But obviously, Massachusetts residents get the maximum benefit from this fund, as they also get to back out their 5% state income tax) and the 4% surcharge for really high earners). In fact, Massachusetts residents paying the highest rates would need a whopping 7% from a taxable bond fund to break even with VMATX on a tax-equivalent basis.

Related: The 11 Best Fidelity Funds You Can Own

12. Vanguard Wellington Fund Investor Shares

— Style: Moderate allocation

— Assets under management: $120.4 billion

— Dividend yield: 2.1%

— Expense ratio: 0.25%, or $2.50 per year for every $1,000 invested

— Minimum initial investment: $3,000

It’s possible to get both your stock and bond exposure in a single fund. These funds are known by many names, including “balanced” or “allocation” funds, though I prefer to refer to them as “portfolios in a can.”

One of the best such funds—Vanguard Wellington Fund Investor Shares (VWELX)—is Vanguard’s oldest mutual fund, a product that debuted back in 1929. It’s managed by Wellington Management, an investment management company with nearly a century of operational experience.

Wellington, which is considered a moderate allocation fund, invests about two-thirds of assets in stocks, and the other third in bonds. The stock portion of the portfolio currently holds about 80 predominantly large-cap stocks with a median market cap of more than $500 billion. It’s a “who’s who” of blue chips such as Nvidia, Microsoft, Apple, Google parent Alphabet (GOOGL), and Amazon (AMZN). It also includes a little exposure to international stocks—predominantly developed-country names like Unilever (UL) and AstraZeneca (AZN).

Related: The 10 Best-Rated Dividend Aristocrats Right Now

The bond portfolio is much more broadly diversified, at 1,550 investment-grade issues. Two-thirds of that is invested in corporate bonds, with another 20% or so in Treasuries and agency bonds. The rest is peppered across mortgage-backed securities (MBSes), foreign sovereign bonds, and other debt.

Put more succinctly: Wellington is a one-stop shop for your core large-cap stock and bond needs, and its 0.25% in annual expenses is very inexpensive for the skilled management and strong performance track record you’re getting in return. It’s one of the best Vanguard funds you can buy, and in our view, one of the best mutual funds you can buy.

Just make sure you’re considering your specific investment needs with this fund. If you don’t want a third of your portfolio to be in bonds, you’ll want to put additional money into individual stocks, equity funds, and/or alternative investments.

13. T. Rowe Price Capital Appreciation

— Style: Aggressive allocation

— Assets under management: $70.6 billion

— Dividend yield: 1.8%

— Expense ratio: 0.71%*, or $7.10 per year for every $1,000 invested

— Minimum initial investment: $2,500

T. Rowe Price Capital Appreciation (PRWCX) comes at the tail end of this list—very much out of order—because of its status. Specifically, PRWCX is closed to most new investors. This is very much an exception to the rules I laid out above. However, I’m still including it among the best mutual funds you can buy both because of its extremely high quality and because this T. Rowe fund still might be available to some investors via select registered investment advisory (RIA) firms.

Related: Best Vanguard Retirement Funds for an IRA

T. Rowe Price Capital Appreciation is another allocation fund—this one designed to invest at least half its assets in stocks, with the rest socked into various debt securities, including corporate bonds, government debt (Treasuries, MBSes, asset-backed securities), and bank loans. It’s primarily a domestic fund, but it can hold at least a quarter of its assets in foreign equities and debt. PRWCX, which currently holds around 170 securities, places 55% of assets in domestic shares and a little more than than 30% in domestic bonds, sprinkling the rest around foreign bonds, foreign stock, preferred stock, convertible securities, and cash.

Morningstar Analyst Jason Kephart says David Giroux, who has managed the fund since June 2006, and his team “have earned a well-deserved reputation as one of the leading investment teams managing money for individual investors.”

“Giroux has helmed T. Rowe Price Capital Appreciation since mid-2006,” Kephart says. “Over that time, he’s displayed an innate ability to invest opportunistically across equities and bonds, capturing pockets of value through strong stock selection and impressively timed shifts between stock and bond exposure. His execution of this strategy’s nimble, contrarian approach has delivered topnotch returns for its investors.”

Related: Best Fidelity Retirement Funds for an IRA

During his tenure, Giroux has beaten all of his category peers on both an absolute and risk-adjusted basis. He has also bested 90% of peers over the trailing five-year period, 97% over the trailing 10 years, and all peers over the past 15 years.

T. Rowe Price Capital Appreciation also has a couple of critical sticking points.

One is the nature of its returns. The lion’s share of PRWCX’s returns come not as price appreciation, but year-end distributions of dividends and capital gains. That adds a layer of tax complexity, and as such, PRWCX is best held in tax-advantaged accounts like 401(k)s and IRAs.

The other is, as mentioned above, availability. PRWCX is largely closed to new investors, so most of us can’t just log into our browsers and buy this fund. But again, if your money is managed through certain registered investment advisers, you might actually be able to buy shares of this gem.

* 0.74% gross expense ratio is reduced with a 3-basis-point fee waiver until at least April 30, 2026.

Related: 15 Best Stock Research & Analysis Apps, Tools and Sites

Learn More About These and Other Funds With Morningstar Investor

If you’re buying a fund you plan on holding for years (if not forever), you want to know you’re making the right selection. And Morningstar Investor can help you do that.

Morningstar Investor provides a wealth of information and comparable data points about mutual funds and ETFs—fees, risk, portfolio composition, performance, distributions, and more. Morningstar experts also provide detailed explanations and analysis of many of the funds the site covers.

With Morningstar Investor, you’ll enjoy a wealth of features, including Morningstar Portfolio X-Ray®, stock and fund watchlists, news and commentary, screeners, and more. And you can try it before you buy it. Right now, Morningstar Investor is offering a free seven-day trial and a discount on your first year’s subscription when you use our exclusive link.

Why Does a Fund’s Expense Ratio Matter So Much?

Every dollar you pay in expenses is a dollar that comes directly out of your returns. So, it is absolutely in your best interests to keep your expense ratios to an absolute minimum.

The expense ratio is the percentage of your investment lost each year to management fees, trading expenses and other fund expenses. Because index funds are passively managed and don’t have large staffs of portfolio managers and analysts to pay, they tend to have some of the lowest expense ratios of all mutual funds.

Related: The 7 Best Index Funds for Beginners

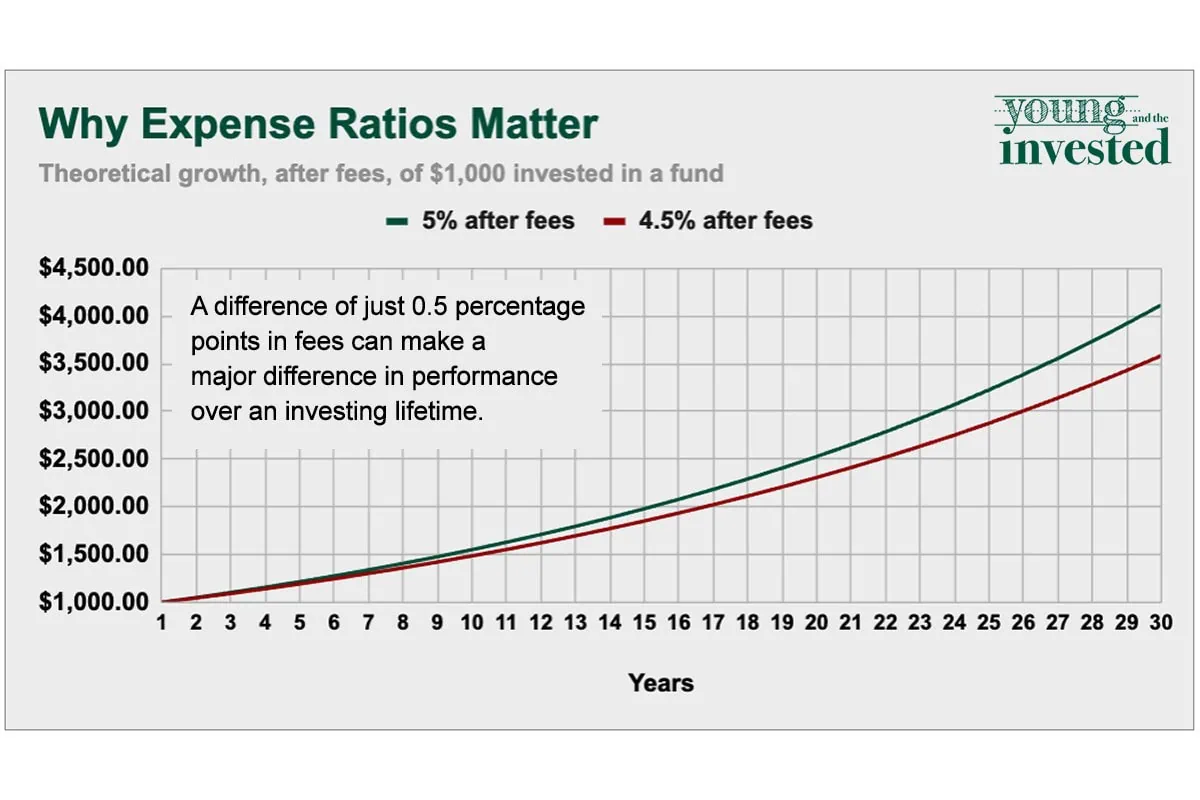

This matters because every dollar not lost to expenses is a dollar that is available to grow and compound. And over an investing lifetime, even a half a percent can have a huge impact. If you invest just $1,000 in a fund generating 5% per year after fees, over a 30-year horizon, it will grow to $4,116. However, if you invested $1,000 in the same fund, but it had an additional 50 basis points in fees (so it only generated 4.5% per year in returns), it would grow to only $3,584 over the same period.

Why Should I Buy No-Load Funds?

You should buy no-load funds for the same reason you should look to buy funds with lower expenses: The less money that goes to the provider, the more money that goes into your pocket.

Let’s say you have $20,000, so you invest $10,000 into two different mutual funds. Mutual Fund A has no sales charge. Mutual Fund B has a 5% front-end sales charge. Both funds gain 7% annually over the next 30 years. And for the sake of simplicity in this example, we’ll say both funds don’t charge any annual expenses.

— Mutual Fund A will earn you $76,123 at the end of those 30 years.

— Mutual Fund B will earn you $72,317 at the end of those 30 years. You see, when you buy Mutual Fund B, that 5% front-end sales charge means the provider takes 5% out of your initial investment. So rather than investing $10,000 to start, you’re actually just investing $9,500. But you don’t lose just that $500—you also lose another $3,806 in “opportunity cost,” which is the additional money that $500 would have earned had it not been lost to fees!

Sales charges are a significant handicap to a fund’s performance, so it’s only worth buying funds with loads if they produce much superior performance compared to the other funds you’re considering.

Want to talk more about your financial goals or concerns? Our services include comprehensive financial planning, investment management, estate planning, taxes, and more! Schedule a call with Riley to discuss what you need, and what we can do for you.

Related: 7 High-Quality, High-Yield Dividend Stocks

It’s difficult to resist the charm of high-yield dividend stocks. Their ability to generate outsized amounts of cash makes them the stuff of dreams for those living on a fixed income—as well as for any investors who simply want a little performance ballast during periods of rough stock-price returns.

But we prefer quantity and quality. For instance, our favorite high-yield dividend stocks deliver much sweeter yields than the average stock, show more signs of fundamental quality than most, and have the confidence of Wall Street’s analyst community.

Related: The 12 Best Vanguard ETFs for a Low-Cost Portfolio

Vanguard’s exchange-traded funds (ETFs) are among the most popular funds out there thanks to their low fees. But there’s more appeal to their ETF lineup than low costs alone.

Vanguard ETFs are big, liquid, and tend to track well-constructed indexes, meaning you’re not just paying low expenses … you’re actually getting some value out of your fees. And these Vanguard ETFs represent the best of the best.

Please Don’t Forget to Like, Follow and Comment

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Subscribe to Retire With Riley, our free weekly retirement planning newsletter, and

3. Give the article a Thumbs Up on the top-left side of the screen.

4. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!