Round-Up Apps—Our Top Picks

|

3.6

|

4.5

|

4.1

|

|

Personal: $3/mo. Personal Plus: $5/mo. Premium: $9/mo.

|

Commission-free trading. Robinhood Gold: Free 30-day trial, then $5/mo.

|

Free (no monthly fees).

|

Best Round-Up Apps

1. Acorns (Best for Using Round-Ups to Invest)

- Function(s): Saving, spending, investing

- Available: Sign up here

Acorns is an investing app geared toward minors, young adults, and millennials, that pioneered round-up capabilities. Acorns’ Round-Ups feature rounds up purchases made on linked debit and credit cards to the nearest dollar, investing the difference on your behalf. On average, Acorns users invest over $30 each month from Round-Ups.

With Acorns, once your Round-Ups reach at least $5, they can be swept into your Acorns Invest account. You can choose to round up manually, deciding which transactions will be invested, or use Automatic Round-Ups to simplify the process. And if you have Automatic Round-Ups selected, these Real-Time Round-Ups will be invested as soon as your transaction clears.

Want to save faster? Take advantage of Round-Ups Multiplier, which lets you choose to multiply the amount that would normally be rounded up by 2x, 3x, or 10x. You can turn Multiplier on and off whenever you want.

Not sure what to do if the transaction is an even dollar amount? (Say, $1.00 or $2.00.) Whole-Dollar Round-Ups let you select how much to round up whenever this happens.

The Acorns investment account itself is an automated platform that uses pre-built portfolios of exchange-traded funds (ETFs) to keep investors exposed to stocks and bonds—ideal for younger, less experienced investors, as well as people who just want to keep things simple. Learn more or sign up today.

- Acorns allows you to sign up for investment, retirement, and checking accounts for you and your family, learn how to earn more money, and grow your investing knowledge.

- Famous for investing spare change automatically through Round-Ups, this all-in-one financial app helps younger generations start investing earlier.

- Invest in expert-built portfolios made up of diversified ETFs.

- Silver tier includes perks such as a 25% match on Acorns Earn rewards (up to $200/mo.), generous APYs on Checking and Emergency Fund, and live Q&As with investing experts.

- Gold tier includes perks such as a 50% match on Acorns Earn rewards (up to $200/mo.), $10,000 in life insurance, picking individual stocks for your portfolio, a free Acorns Early account, and Acorns Early Invest custodial accounts for children with 1% contribution matches.

- Earn even more with Later Match: Acorns will match up to 1% (Silver) or 3% (Gold) of all new IRA contributions in your first year.*

- Special offer: Get a free $20 bonus investment when you sign up with our link and start making recurring investments.**

- Robo-advisor with affordable fees (on larger portfolios)

- Fixed fee model

- Round-ups

- FDIC/SIPC insurance

- IRA match (Personal Plus and Premium)

- High fixed fees for small balances

- Limited investment selections

- Must subscribe to Premium for any self-directed investing options

2. Robinhood Cash Management (Best for APY on Round-Ups)

- Function(s): Saving, spending, investing

- Available: Sign up here

Robinhood is best known for entering the market over a decade ago and changing the retail brokerage market by eliminating trading commissions on stocks and exchange-traded funds (ETFs). Lowering this hurdle brought down the cost of investing for small investors and by extension gave broader access to the stock market than any point in history.

The company continued to add features to its stock trading app that give their customers the power to earn on their money. One such product is the Robinhood Gold Cash Sweep account, a way to earn up to 5% on your idle cash and do so while enjoying up to $2.25m in FDIC-coverage on your money held there. That amounts to many multiples more than what the average savings account pays and they’re even sweetening the deal with a promotional unlimited 1% deposit boost bonus. (Editor’s Note: Getting this APY rate and deposit bonus requires enrolling in a Robinhood Gold subscription for $5 per month after a free 30-day trial.)

But what’s even better isn’t just earning this competitive APY, is pairing it with Robinhood’s Round-Ups. You can round up your Robinhood Cash card transactions to the next dollar, and set aside the spare change to invest in your choice of stock, ETF, crypto, or brokerage cash balance to earn interest. Your round-ups will deposit each week.

After you’ve turned on round-ups and selected an investment, Robinhood will automatically round up completed eligible transactions to the nearest dollar, and set aside the rounded-up change in your spending account. (If you’re not yet ready to invest in a stock, ETF, or crypto, you can select brokerage cash as your round-up option. Your weekly round-ups total will go into your brokerage cash balance and earn interest via the brokerage cash sweep program.)

So, if you’re looking for a place to stash your cash with a healthy yield with the added boost of Round-Ups and also with the flexibility to invest it in the market, consider opening a Robinhood account, funding it and earning interest on your automatic savings. On top of the competitive interest rate and deposit boost bonus, they also offer free stock for opening and funding an investment account.

- Robinhood is a pioneer in the investing app world, offering commission-free trades on stocks, ETFs, options, and cryptocurrency, as well as one of the deepest libraries of investing educational content.

- Investing for retirement? Robinhood will match 1% of any IRA transfers or 401(k) rollovers, as well as any annual contributions*, made to your Robinhood Retirement account—and you can get a 3% match on any new contributions if you subscribe to Robinhood Gold.

- Want more advanced trading tools? Download Robinhoold Legend—a desktop trading platform with real-time data, customizable layouts, deeper asset analysis, and more—for free.

- Robinhood's robo-advisory service, Robinhood Strategies, will build you a custom portfolio of stock and bond ETFs (and individual stocks for accounts with at least $500), for a low 0.25% in AUM, which is capped at $250 annually for Robinhood Gold members.

- Robinhood Gold also includes Level II market data provided by Nasdaq, higher interest rates on uninvested brokerage cash, lower margin trading rates, bigger Instant Deposits, and access to the Robinhood Gold Card (a 3% cash-back Visa credit card).

- Special offer: Sign up for Robinhood, link a bank account, and fund your account with at least $10, and receive a randomly selected cash amount between $5 and $200 to put toward certain fractional shares.

- Very good selection of available investments in brokerage accounts

- 1% match on rollovers, IRA transfers, and new contributions to IRAs and Roth IRAs (3% new-contribution match with Robinhood Gold)

- Automated recommended portfolios

- Intuitive interface

- Robo-advisory service (Robinhood Strategies)

- Extensive educational library

- No mutual funds in brokerage or IRAs

- Match doesn't apply to Robinhood Strategies accounts

3. SoFi Checking and Savings Account (Up to $300 in Free Cash)

- Function(s): Saving, spending

- Available: Sign up here

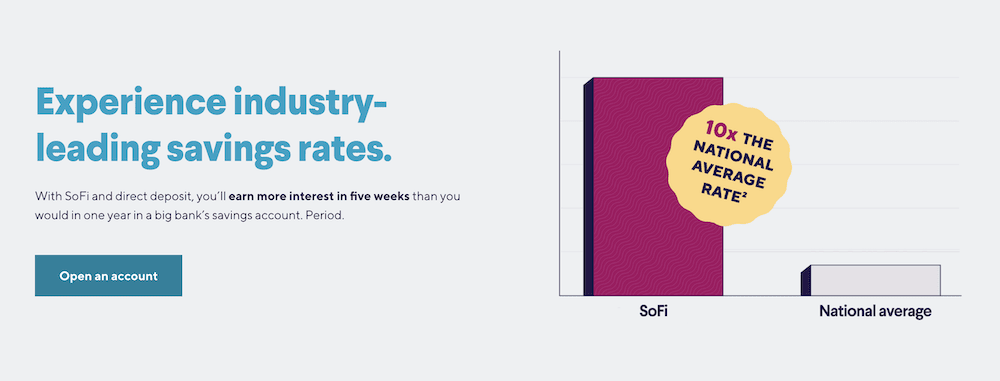

The SoFi Checking and Savings Account sounds like your run-of-the-mill bank account, but it’s more: It’s also a high-yield savings account that earns 10 times the national average percentage yield (APY) and more than the average high-yield account. Better still, it boosts your ability to save right off the bat by rewarding you with $50 to $300 upon sign-up.

Sofi Checking and Savings covers all of the basics: No monthly account fees, no minimum balances, and website and mobile app access. But it also has several perks that match or top the competition. Features include:

- Early paycheck reception when you sign up for direct deposit

- FDIC insurance of up to $2 million (vs. $250,000 for most bank accounts)

- Up to 15% cash back when you spend with local retailers

- No-fee overdraft coverage up to $50

- Round-ups on debit card purchases, which are deposited into your savings “Vault”

And right now, you can get a head-start on your savings with qualifying direct deposits. You’ll receive $50 in bonus cash if $1,000.00 to $4,999.99 is sent to your bank account within a 25-day period, starting from when you receive the first direct deposit. That number jumps to $300 when you receive $5,000 or more. The higher cash bonus requires you to hit an admittedly high threshold, but the $50 is a reasonable bonus for a much more manageable threshold.

Want to get started on your cash bonus? Sign up with SoFi today.

- SoFi's Checking and Savings Account is a free, no-monthly fee account that offers an above-average yield on the savings side, and up to 15% cash back when using your checking account's debit card.

- SoFi's high-yield savings account currently pays 4.30% APY, which is 10x the national average savings rate, and higher than the average high-yield rate.

- Available FDIC insurance of up to $2 million is 8x the typical insured amount at most financial institutions.*

- Round up debit card purchases, and the excess is automatically sent to your savings Vault.

- Special Offer: If you set up a qualifying direct deposit within the promotion period, you can earn up to a $300 cash bonus.**

- No account fees

- Above-average yield (4.60% APY) on its high-yield savings account

- Offers up to $50 of overdraft coverage with minimum monthly direct deposits in place

- Round-ups

- Up to $2 million in FDIC insurance

- Not as competitive yield as other banking institutions

- High direct deposit threshold for maximum cash bonus

Best Round-Up Apps

Round-up apps are the modern-day coin jar.

For younger readers who aren’t as familiar: Tossing spare coins into a jar used to be one of the most popular forms of saving. It stopped your pockets from jingling, you didn’t miss the money, and once the jar was full, you could exchange all of the money at the bank or a coin machine.

Assuming you weren’t living paycheck to paycheck, this was “fun” money you could spend however you wanted—you might head out to a restaurant or pick up a new pair of shoes.

Paying with cash is becoming less common by the year, however, as people increasingly use more convenient methods: credit cards, debit cards, and money apps. Plastic and digital spending are in … and jingling pockets are out.

But that doesn’t mean “spare change” is gone completely—it, like spending, has simply evolved, becoming the “round-up.”

What Are Round-Ups?

With round-ups, your purchase prices are rounded up to the nearest dollar.

If this sounds familiar, that’s because you see it all the time at grocery stores and other retailers. The cashier will ask you if you’d like to round up your total, say, to donate to a charity.

But this kind of roundup involves a financial app rounding up your purchase, with the “spare change” put into a savings account or invested for you.

How Do Round-Ups Work?

Let’s say you’re heading to work, and you decide to grab breakfast. You get a coffee and a sandwich, and it sets you back $9.69. You go to pay with a normal debit or credit card or money app, you pay the $9.69, and the transaction is over.

However, now let’s say you have a card or app with a round-up feature. Instead, your card is charged for $10, then the extra 31 cents is added to a spillover fund like a savings account or investing account. And this happens with every purchase you make with the card or app—a seamless process that makes saving automatic.

But which app does it the best?

Frequently Asked Questions (FAQs)

Do savings app round-up plans work?

Absolutely. A round-up app works in the background to set aside more money than you typically would. Every purchase you make suddenly becomes a new opportunity to save money.

But let’s be clear: If you have lofty savings goals—say, a child’s college fund or your retirement—you need to save and invest more substantial amounts than what a round-up program can provide. That said, some savings apps will also let you send over regular payments from a savings account or checking account, so you can augment your savings that way.

Are round-up apps safe?

Round-up apps aren’t inherently safe or unsafe. Features matter.

For one, you want to make sure that your savings are FDIC-insured. And all of the round-up apps listed above offer FDIC insurance up to $250,000 on savings. If your app has an investing component, you’ll also want to ensure there’s insurance on that—Stash Invest, for instance, offers $500,000 worth of insurance on investments through the Securities Investor Protection Corporation (DIPC). Just note that insurance only protects investments from an institutional failure—not from losses if your investments simply lose value.

Past that, you’ll want to make sure your round-up app has other types of security, such as account verification, identity protection, encryption, etc.

Are round-up savings apps worth it?

If you want a way to incrementally save without having to think about it, round-up savings apps are excellent tools that are worth the time and energy. They automatically transfer money to your savings with each transaction, letting your savings slowly build up over time. They’re especially useful if they can double as standard banking and investment accounts.

Do be mindful of fees, however. If you’re paying a few dollars a month for an app and only end up saving a few dollars per month, you’re still where you started before. So make sure if you’re paying for a round-up savings account, that your savings progress—and the app’s other features—are worth the cost.

Why should I use round-up apps?

We can think of several good reasons to use round-up apps, including (but not limited to):

- They’re easy to use. Setup is typically simple, and saving is even easier. Just make your regular purchase, and money will trickle into your savings account without you lifting another finger.

- Little amounts add up. Several of the round-up apps we’ve talked about claim that their users can save hundreds if not thousands of dollars each year. Yes, 30 cents here and 45 cents here doesn’t seem like much. But add those amounts up across dozens of transactions each month, and you’re generating real savings.

- They keep you focused on your goals. Round-up apps typically center around financial goals. That’s good! Vaguely saving can be difficult for people. But when you start to see real, tangible progress toward a stated goal, that can act as motivation to keep up what you’re doing and even find other ways to save.

Put simply: Round-up apps are easy to use and can help you reach savings goals more quickly than you’d think.