If you ever feel a little spare change rattling around in your pocket, you can thank the humble index fund, which for decades now has ensured that investors aren’t being squeezed out of every possible penny.

Actively managed mutual funds were once the only game in town. A manager or a team of managers would research, buy, evaluate, and sell every holding, and investors would be paying for that time. Obviously, there are still plenty of those around (and for some slices of the stock and bond markets, actively managed funds remain the best way to invest), but rules-based index funds simplified all that, reducing costs while still producing solid returns across many broad swaths of the investment world.

However, Schwab index funds keep investing cheap in not one but two ways: In addition to low annual expenses, many Schwab funds also have razor-thin investment minimums. While some fund providers require you to pony up $500, $1,000, $3,000, or more when you make your initial investment, all it takes to get started in most of Schwab’s popular funds is one measly buck.

Today, I’ll introduce you to seven Schwab index funds that feature both of these low-cost traits while also delivering high-quality coverage of their particular corner of the investment universe. This list includes both core holdings you can build a portfolio around, as well as satellite holdings you can use to chase growth or reduce risk.

Disclaimer: This article does not constitute individualized investment advice. These securities appear for your consideration and not as personalized investment recommendations. Act at your own discretion.

Editor’s Note: Tabular data presented in this article are up-to-date as of Aug. 8, 2025.

Featured Financial Products

Table of Contents

But First, Why Schwab?

Charles Schwab is a U.S.-based brokerage and banking company founded in 1971 as a traditional brokerage company and then as a discount brokerage service in 1974. It’s the largest publicly traded investment services firm with more than $10 trillion in client assets. And it offers a wide range of financial services, such as investment advice and management, trading services, financial planning, banking services, workplace and individual retirement plans, annuities, and more.

It also offers very low-cost and extremely low-minimum mutual funds. Annual expenses on its mutual funds are well below the industry average. And Schwab really stands out from a nominal-expense perspective. Many providers’ mutual funds require minimum initial investments in the thousands of dollars. But most Schwab mutual funds require a mere $1—an ideal situation for investors who don’t have much capital to put to work.

In short: Schwab offers a nice variety of mutual funds, some of which are among the best on the market, and they won’t leave your wallet in tatters.

And Second, Why Index Funds?

For most of their history, investment funds (like mutual funds) were entirely run by human managers, who would research, select, buy, and sell securities on the fund’s behalf.

That changed in the mid-1970s with the advent of the index fund.

An index measures the performance of a group of assets, and those assets are determined by the index’s rules. An index fund “tracks” the index by actually investing in all (or in some cases, a representative sampling of) the underlying assets. An index’s strategy can be broad, like the S&P 500, which measures a wide assortment of American companies. Or the focus can be as narrow as, say, holding only below-investment-grade bonds issued by chip and cookie makers in the Asia-Pacific.

While I don’t recommend buying my hypothetical APAC Junk Food Index Fund, I do recommend buying index funds in general, for a few reasons.

They’re typically cheaper. An actively managed index fund has one or more managers, all of whom need to be paid. An index fund technically has a manager overseeing the fund, but they’re not performing stock research and deciding on trades—the index’s rules determine those actions. Thus, fund providers can afford to charge (often much) lower expenses on index funds.

Index funds tend to perform well, too, compared to comparable actively managed funds. I’ll provide a pretty stark example later, but just know that human managers often struggle to beat the benchmark indexes. So, if you have a fund that cheaply tracks a benchmark index, and many human managers can’t even beat that benchmark index … that index fund starts to look awfully good.

How Were the Best Schwab Index Funds Selected?

Unlike other mutual fund giants, Schwab’s assets are concentrated in a tight roster of just a few dozen mutual funds. So, investors sorting through Schwab’s index mutual funds won’t have nearly as bad a case of analysis paralysis.

Still, a little filtering is necessary to get us down to a more manageable list. So I’ve started with a quality screen, including only Schwab index funds that have earned a Morningstar Medalist rating.

Unlike Morningstar’s Star ratings, which are based upon past performance, Morningstar Medalist ratings are a forward-looking analytical view of a fund. Per Morningstar:

“For actively managed funds, the top three ratings of Gold, Silver, and Bronze all indicate that our analysts expect the rated investment vehicle to produce positive alpha relative to its Morningstar Category index over the long term, meaning a period of at least five years. For passive strategies, the same ratings indicate that we expect the fund to deliver alpha relative to its Morningstar Category index that is above the lesser of the category median or zero over the long term.”

As I’ve written in other Young and the Invested articles, a Medalist rating doesn’t mean Morningstar is necessarily bullish on the underlying asset class or categorization. It’s merely an expression of confidence in the fund compared to its peers.

From the remaining universe of funds, I selected a range of products that invest in various core and satellite strategies, with a distinct focus on the absolute lowest annual expenses. To be fair, the overall best Schwab funds to buy are pretty cheap in their own right, and include a couple funds from this list. But here, the most expensive fund charges 0.25%, or $2.50 annually on a $1,000 investment—and all of the other index funds here charge far less than that.

The Best Schwab Index Funds to Buy

Below are some great Schwab index mutual funds—most of which one would consider core holdings, though a couple are better used as satellite positions to help you either generate a little more alpha or get more defensive.

And good news: Indexing is where Schwab excels. Its highest-rated funds are all indexed products, so you’re getting an ideal combination of high quality and very, very low costs.

And every Schwab fund on this list has a minimum initial investment of just $1. Typically, when I’m writing about mutual funds, I try to also list ETF share classes or equivalent ETFs for investors who might have less capital to put to work. But in this case, there’s no need—even if your liquidity is limited to a single greenback, you’ve got enough to get started.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

1. Schwab S&P 500 Index Fund

— Style: U.S. large-cap stock

— Assets under management: $114.5 billion

— Dividend yield: 1.2%

— Expense ratio: 0.02%, or 20¢ per year for every $1,000 invested

— Morningstar Medalist rating: Gold

Fund managers who run large-cap funds (funds that invest in larger companies) are typically tasked with beating the S&P 500 Index. Unfortunately, the majority of these stock pickers are unable to do so, particularly after accounting for fees. According to S&P Dow Jones Indices, in 2024, “65% of all active large-cap U.S. equity funds underperformed the S&P 500, worse than the 60% rate observed in 2023 and slightly above the 64% average annual rate reported over the 24-year history of our SPIVA Scorecards.”

So, as I typically say when confronted with an S&P 500 fund: If you can’t beat it, join it.

Related: The 7 Best Vanguard Index Funds for Beginners

The Schwab S&P 500 Index Fund (SWPPX) isn’t just a cheap way to get access to the S&P 500—it’s one of the cheapest ways across both mutual funds and ETFs alike, charging a razor-thin expense ratio of just 0.02%. It ain’t free, but it’s mighty close.

The S&P 500 is made up of 500 of the largest American companies, but it’s not necessarily the 500 largest American companies. Among criteria for this index: A company must have a market capitalization of at least $20.5 billion, its shares must be highly liquid (shares are frequently bought and sold), and at least 50% of its outstanding shares must be available for public trading. But the criterium that tends to weed out more large companies than the rest is that, to be added to the S&P 500, a company must also have positive earnings in the most recent quarter, and the sum of its previous four quarters must be positive.

However, once a company becomes an S&P 500 component, it’s not automatically kicked out if it fails to meet all of the criteria. The selection committee would take this under consideration, though; it might boot the company, it might not.

Related: 9 Best Schwab ETFs to Buy [Build Your Core for Cheap]

The S&P 500 is considered a reflection of the U.S. economy—but that doesn’t mean all industries are represented equally. For instance, the technology sector accounts for nearly a third of SWPPX’s assets, but utilities, real estate, and materials merit less than 3% apiece. This is in no small part because, like many indexes, the S&P 500 is market capitalization-weighted, which means the greater the size of the company, the more “weight” it’s given in the index. For instance: Currently, trillion-dollar-plus companies Nvidia (NVDA), Microsoft (MSFT), and Apple (AAPL) are Schwab S&P 500 Index Fund’s top three holdings.

Turnover (how much the fund tends to buy and sell holdings) tends to be low, as only a handful of stocks enter or leave the index in any given year. That’s good for you and me because it minimizes (and in some years, eliminates) capital gains generated by trading throughout the year, which in turn reduces or eliminates the unfavorably taxed capital-gains distributions SWPPX must make to us at the end of each year. This makes Schwab S&P 500 Index Fund an extremely tax-efficient option for taxable brokerage accounts.

A combination of the S&P 500’s excellence as an index, as well as SWPPX’s bare-bones costs and tax-efficiency, merit a Gold Medalist rating from Morningstar. It’s just one of three Schwab products to earn that coveted ranking, making it easily one of the best Schwab index funds you can buy.

Related: 7 Low- and Minimum-Volatility ETFs for Peace of Mind

2. Schwab U.S. Large-Cap Growth Index Fund

— Style: U.S. large-cap growth stock

— Assets under management: $3.9 billion

— Dividend yield: 0.5%

— Expense ratio: 0.035%, or 35¢ per year for every $1,000 invested

— Morningstar Medalist rating: Silver

The stock market can be sliced in any number of ways, but one of the broadest and most commonly used categorizations is growth vs. value.

Generally speaking, growth stocks are expected to produce higher-than-average growth—typically in metrics like revenues and profits—which should lead to better-than-average stock performance. Meanwhile, value stocks are considered to be underappreciated by investors based on metrics such as price-to-earnings (P/E) or price-to-sales (P/S), among others. The idea is that once the market gets wise, they’ll buy up shares, driving the stock’s price higher as it reaches a fairer value. (These stocks also are more likely to pay dividends.)

It’s not a perfect dichotomy—some stocks can both have growth characteristics and be undervalued, and some stocks can be neither “growthy” nor underpriced. But growth and value are nonetheless two primary “stock types” that investors tend to gravitate toward.

Investors who would like to stuff their portfolio with growth stocks can do so through the Schwab U.S. Large-Cap Growth Index Fund (SWLGX).

Related: The 7 Best Fidelity Index Funds for Beginners

SWLGX tracks the Russell 1000 Growth Index, which consists of any Russell 1000 companies that sport higher I/B/E/S forecast two-year earnings growth, higher five-year historical growth in sales per share, and relatively higher price-to-book (P/B) ratios. (The high P/B is interesting because that’s not a growth metric, but a valuation metric—one that indicates a stock is potentially expensive, no less. However, it illustrates the commonly held idea that growth exists opposite of value, even though you can absolutely find companies that simultaneously exhibit growth characteristics and are undervalued. But I digress.)

The index is float-adjusted market cap-weighted. Traditional market cap-weighting accounts for all of a company’s shares—even those that might be privately held and non-transferable. (Owners, directors, and insiders sometimes hold these kinds of shares.) But float-adjusted market cap weighting accounts only for market capitalization based on the “float,” which is shares available for public trading.

Like many growth funds, the roughly 400-stock SWLGX is all-in on tech, which accounts for more than half of the fund’s assets. Consumer discretionary is another 14%, largely because of big holdings in tech-esque Amazon (AMZN) and Tesla (TSLA). And the tech-adjacent communication services sector accounts for another 12%.

And like many growth-oriented funds, a richly valued portfolio is table stakes. SWLGX’s P/E, price-to-cash flow (P/CF), and other valuation ratios are all higher than the broader market. But since inception in 2017, it has provided the outperformance investors seek from growth stocks, leading the S&P 500 in all meaningful time periods since then. That, as well as a Silver Medalist rating, gives U.S. Large-Cap Growth Index a place among the best Schwab index funds you can buy.

Related: The 7 Best Dividend ETFs [Get Income + Diversify]

Featured Financial Products

3. Schwab U.S. Large-Cap Value Index Fund

— Style: U.S. large-cap value stock

— Assets under management: $855.3 million

— Dividend yield: 1.9%

— Expense ratio: 0.035%, or 35¢ per year for every $1,000 invested

— Morningstar Medalist rating: Silver

On the other side of the coin, we have the Schwab U.S. Large-Cap Value Index Fund (SWLVX).

Schwab’s value index fund addresses value in a strange way, effectively seeking out the inverse of the SWLGX. It tracks the Russell 1000 Value Index, which is made up of Russell 1000 companies with “relatively lower price-to-book ratios, lower I/B/E/S forecast medium term (2-year) [earnings] growth and lower sales per share historical growth (5 years).”

Put differently: While SWLGX does use P/B, it otherwise avoids valuation metrics and instead tries to define value through relatively low growth. The use of price-to-book is also odd in and of itself—it’s very helpful when trying to value capital-intensive businesses (manufacturers, energy companies, banks), but not very useful when trying to value companies with a lot of intangible assets like patents and intellectual property (tech firms). Even more curious? Despite effectively being the inverse of Russell 1000 Growth, which holds 400 of the Russell 1000’s stocks, Russell 1000 Value is made up of some 860 of the Russell 1000’s stocks.

These head-scratching facts aside, Schwab U.S. Large-Cap Value Index Fund’s resulting portfolio does end up being value-priced across a range of metrics—not just P/B, but also P/E and P/CF as well. And as you’d expect, the portfolio also sports a much lower average return on equity.

Related: Best Target Date Funds: Vanguard vs. Schwab vs. Fidelity

SWLVX is much more balanced from a sector perspective than its growth-stock cousin, though it still has some high concentrations—currently financials (23%), industrials (13%), and health care (12%). There’s far less single-stock risk, too. Warren Buffett’s Berkshire Hathaway (BRK.B) garners about 3% of assets, and only two other stocks—JPMorgan Chase (JPM) and Amazon (AMZN)—are weighted at more than 2%.

Lastly, this concentration in value stocks also results in a higher-than-average yield. SWLVX currently yields 1.9%, compared to just 1.1% for the S&P 500.

Performance comparisons aren’t really that helpful, though. Both SWLGX and SWLVX started in December 2017. The large-growth fund has delivered an average annual return of roughly double its value brother since then, but it’s through no fault of SWLVX’s construction—you can credit a prolonged outperformance from growth stocks in general for that.

Related: 5 Best Schwab Retirement Funds [High Quality, Low Costs]

4. Schwab Fundamental U.S. Small Company Index Fund

— Style: U.S. small-cap stock

— Assets under management: $1.7 billion

— Dividend yield: 1.7%

— Expense ratio: 0.25%, or $2.50 per year for every $1,000 invested

— Morningstar Medalist rating: Silver

Investors who want more explosive returns (and who can deal with higher risk) can typically find that kind of action in small-cap stocks.

As a general rule, smaller companies (usually considered to be those with market capitalizations of $2 billion or less) have more growth potential than larger firms. For one, as they say, it’s much easier to double your revenues from $1 million than $1 billion. And as these stocks become noticed by institutional investors and fund managers, or begin qualifying for certain indexes, they can begin to enjoy large-scale investments that drive their prices even higher.

Related: Best Schwab Retirement Funds for an IRA

But smaller stocks are riskier. A smaller company’s revenues might be dependent on just one or two products or services—meaning a single disruption could have massive financial consequences. They also have less access to capital than their larger peers, so they’re less likely to get a lifeline should they suffer from broader economic headwinds.

It’s a high-risk, high-reward proposition—a small company could feasibly double in short order … or get cut in half overnight.

You can, however, harness some of these firms’ upside potential while tamping down on risk by investing in a small-stock fund like Schwab Fundamental U.S. Small Company Index Fund (SFSNX). This Schwab product differs from your traditional small-cap index fund in that, rather than weighting its components by size, SFSNX effectively weights its roughly 1,000 holdings by quality. It tracks the RAFI Fundamental High Liquidity US Small Index, which both selects and weights stocks by fundamental metrics including adjusted sales, retained operating cash flow, and dividends plus buybacks.

In short: The better the fundamental quality, the more assets a stock will command.

For what it’s worth, most broad small-cap funds have very little single-stock risk to begin with. Even SFSNX’s greatest holdings command weights of roughly half a percent or less, and that’s par for the course. But how the fund assigns those weights makes a huge difference—SFSNX has solidly outperformed its basic-index counterpart, the Schwab Small Cap Index Fund (SWSSX), over every meaningful medium- and long-term trailing time period.

Related: How to Get Free Stocks for Signing Up: 8 Apps w/Free Shares

5. Schwab Total Stock Market Index Fund

— Style: U.S. all-cap stock

— Assets under management: $29.5 billion

— Dividend yield: 1.1%

— Expense ratio: 0.03%, or 30¢ per year for every $1,000 invested

— Morningstar Medalist rating: Gold

Who says you can’t have it all?

That’s the idea behind total-market funds like the Schwab Total Stock Market Index (SWTSX), which is designed to “track the total return of the entire U.S. stock market.” OK, OK. If we’re splitting hairs, SWTSX’s 3,100-stock portfolio doesn’t technically equate to the “entire U.S. stock market.” But it’s about as close as you’d ever reasonably need to get.

Related: The 7 Best Closed-End Funds (CEFs) That Yield Up to 11%

A total-market fund typically won’t give you equal exposure to all the different stock sizes—they’re typically market cap-weighted, which means they’re heavily tilted toward large caps. And so it is with SWTSX, which currently has roughly 90% of its assets wrapped up in large caps (like with the S&P 500 fund, Nvidia, Microsoft, and Apple are top weights here), nearly 8% in mid-caps, and the remaining 2% in smalls.

The point of a total-market fund like SWTSX is simplicity. One fund gets you exposure to most of the U.S. stock market—and it overloads you in the largest, most stable firms while providing only modest exposure to smaller, more volatile firms. Better still? You can get all this for just 0.03% in annual expenses. It’s a one-two punch of coverage and price that has been recognized with a Morningstar Gold Medalist rating, and inclusion on my list of Schwab’s top index funds.

Related: 7 Best Vanguard Dividend Funds [Low-Cost Income]

How (or whether) you use it is a matter of preference.

If you like the exact breakdown of SWTSX’s large-, mid-, and small-cap exposure, you could make it the core of your portfolio and not have to bother with any other broad U.S. stock funds. Or, if you like the idea of owning all these different-sized stocks (but would want to do so in different ratios), you could either hold SWTSX and augment with the funds above, or buy your ideal mixture of large-, mid-, and small-cap funds.

Related: 13 Dividend Kings for Royally Resilient Income

6. Schwab International Index Fund

— Style: International large-cap stock

— Assets under management: $11.6 billion

— Dividend yield: 2.8%

— Expense ratio: 0.06%, or 60¢ per year for every $1,000 invested

— Morningstar Medalist rating: Silver

You’ve probably noticed by now that this list of funds, like many, is loaded with U.S.-centric options. That’s for good reason. U.S. markets have long been among the most productive in the world, and if you believe in the American economy’s ability to keep growing, that should remain the case. Thus, most financial experts here will direct you to gobble up U.S. stock funds.

But those same experts would tell you that it’s worth having at least some international exposure. And you can do that for a song through the Schwab International Index Fund (SWISX).

Related: The 9 Best ETFs for Beginners

Among the best Schwab index funds listed here, SWISX is technically the most expensive—but still a roaring bargain at just 0.06% annually. This measly cost gets you invested in 720 stocks across primarily developed markets in Europe and Asia. Japan is tops at 22% of assets, though you also get double-digit exposure to the U.K., France, Germany, and Switzerland.

About 85% of SWISX’s holdings are large-cap stocks, while the rest are mid-caps. Top holdings are full of blue-chip multinationals such as German software firm SAP (SAP), Swiss foods giant Nestlé (NSRGY), British pharmaceutical company AstraZeneca (AZN), and Dutch semiconductor firm ASML Holding (ASML). And like with most international funds with a heavy bent toward large firms, SWISX has an outsized dividend yield that’s currently near 3%.

Related: The 9 Best Dividend Stocks for Beginners

Like with Schwab’s small-cap index fund above, Schwab has a more expensive but more productive “fundamental” alternative, the Schwab Fundamental International Large Company Index Fund (SFNNX), that’s worth looking into. It’s not a perfect one-for-one—even though SFNNX has an explicit goal of holding large caps, it ends up actually holding more mid-caps than SWISX—but it’s a better-performing fund with similar enough exposure that it’s worth considering.

But if your goal is to invest as cheaply as possible, Schwab International Index is no slouch. It provides some of the most inexpensive international coverage you’ll find, and it has historically produced better-than-average returns.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

7. Schwab U.S. Aggregate Bond Index

— Style: U.S. intermediate-term bond

— Assets under management: $5.3 billion

— SEC yield: 4.2%*

— Expense ratio: 0.04%, or 40¢ per year for every $1,000 invested

— Morningstar Medalist rating: Bronze

Most investors need some exposure to bonds, which is debt that’s issued by governments, companies, and other entities. Their interest payments and relative lack of volatility make them an excellent tool for providing a portfolio with stability and income.

But how much bond exposure you need will vary by age. They’re not great for generating wealth, which is your prime concern when you’re younger, but they’re outstanding for protecting wealth, which becomes increasingly pivotal as you age. So generally speaking, when you’re younger, you’ll want to be primarily invested in stocks … and as you get older, you’ll want to go lighter on stocks and start buying more bonds.

Related: 11 Best Alternative Investments [Options to Consider]

You might not want to buy individual bonds, however. Data and research on individual issues is much thinner than it is for publicly traded stocks. And some bonds have minimum investments in the tens of thousands of dollars. So, your best (and most economical) bet is to buy a bond fund, which allows you to invest in hundreds or even thousands of bonds with a single click.

One of the best Schwab mutual funds you can buy for this access is the Schwab U.S. Aggregate Bond Index Fund (SWAGX), which holds a whopping 10,750 debt issues. At the moment, 45% of assets are invested in U.S. government and agency bonds, while mortgage-backed securities (MBSes) and corporate bonds each account for another 25% or so. The slim remainder is peppered around other government-related bonds, municipal bonds, and other debt.

Related: 12 Best Investment Opportunities for Accredited Investors

SWAGX’s maturities range from less than a year to more than 20 years. Meanwhile duration—a measure of interest-rate sensitivity—is 5.9 years, implying that a 1-percentage-point hike in interest rates would result in a short-term decline of 5.9% in the fund, and vice versa. Put differently: This is moderate interest-rate risk, which is perfectly acceptable for a basic core bond holding like this.

* SEC yield reflects the interest earned across the most recent 30-day period. This is a standard measure for funds holding bonds and preferred stocks.

Featured Financial Products

Learn More About These and Other Funds With Morningstar Investor

If you’re buying a fund you plan on holding for years (if not forever), you want to know you’re making the right selection. And Morningstar Investor can help you do that.

Morningstar Investor provides a wealth of information and comparable data points about mutual funds and ETFs—fees, risk, portfolio composition, performance, distributions, and more. Morningstar experts also provide detailed explanations and analysis of many of the funds the site covers.

With Morningstar Investor, you’ll enjoy a wealth of features, including Morningstar Portfolio X-Ray®, stock and fund watchlists, news and commentary, screeners, and more. And you can try it before you buy it. Right now, Morningstar Investor is offering a free seven-day trial. You can check out the current deal, as well as discounted rates for students and teachers, on the Morningstar Investor website.

What Is the Minimum Investment Amount on Schwab Mutual Funds?

Schwab is one of the most friendly fund companies for beginners. That’s not just because both its mutual funds and ETFs sport below-industry-average expense ratios, but because you don’t need much money to invest in them in the first place. Most Schwab mutual funds have a negligible investment minimum—you can literally start with as little as $1.

That’s extremely beneficial in self-directed accounts like an IRA. Many mutual funds from other providers require high minimums in the thousands of dollars, hamstringing investors with little capital to work with.

Why Does a Fund’s Expense Ratio Matter So Much?

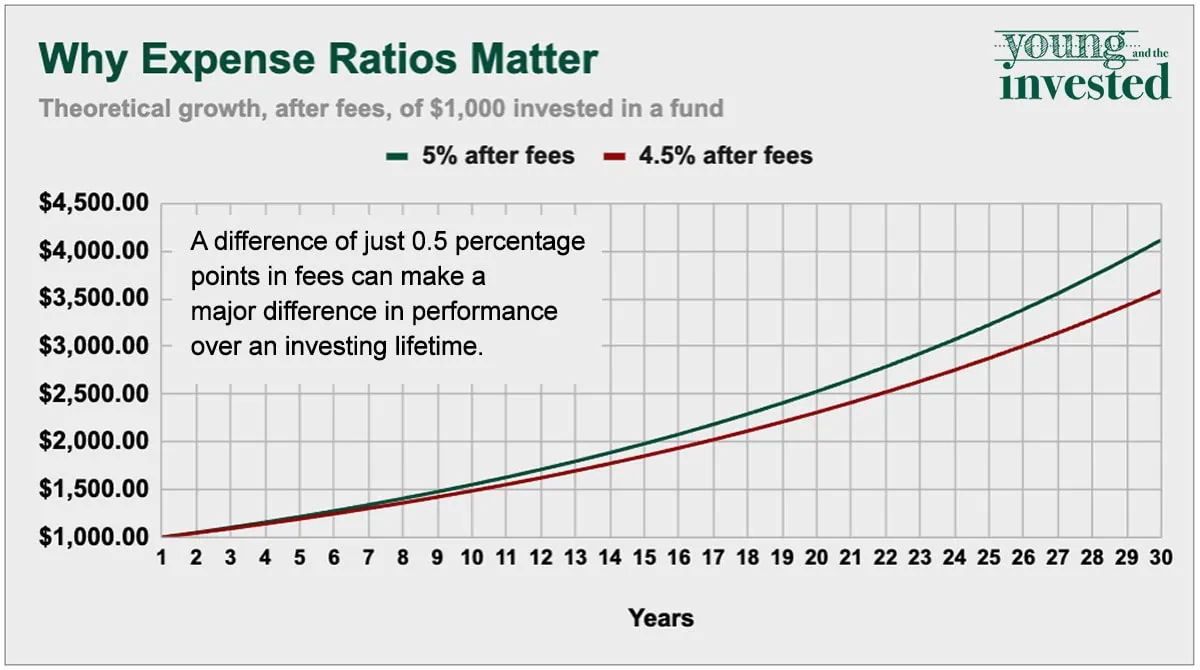

Every dollar you pay in expenses is a dollar that comes directly out of your returns. So, it is absolutely in your best interests to keep your expense ratios to an absolute minimum.

The expense ratio is the percentage of your investment lost each year to management fees, trading expenses and other fund expenses. Because index funds are passively managed and don’t have large staffs of portfolio managers and analysts to pay, they tend to have some of the lowest expense ratios of all mutual funds.

This matters because every dollar not lost to expenses is a dollar that is available to grow and compound. And over an investing lifetime, even a half a percent can have a huge impact. If you invest just $1,000 in a fund generating 5% per year after fees, over a 30-year horizon, it will grow to $4,116. However, if you invested $1,000 in the same fund, but it had an additional 50 basis points in fees (so it only generated 4.5% per year in returns), it would grow to only $3,584 over the same period.

Want to talk more about your financial goals or concerns? Our services include comprehensive financial planning, investment management, estate planning, taxes, and more! Schedule a call with Riley to discuss what you need, and what we can do for you.

Related: The 11 Best Vanguard ETFs for a Low-Cost Portfolio

Vanguard’s exchange-traded funds (ETFs) are among the most popular funds out there thanks to their low fees. But there’s more appeal to their ETF lineup than low costs alone.

Vanguard ETFs are big, liquid, and tend to track well-constructed indexes, meaning you’re not just paying low expenses … you’re actually getting some value out of your fees. And these Vanguard ETFs represent the best of the best.

Related: 10 Best Monthly Dividend Stocks for Frequent, Regular Income

The vast majority of American dividend stocks pay regular, reliable payouts—and they do so at a more frequent clip (quarterly) than dividend stocks in most other countries (typically every six months or year).

Still, if you’ve ever thought to yourself, “it’d sure be nice to collect these dividends more often,” you don’t have to look far. While they’re not terribly common, American exchanges boast dozens of monthly dividend stocks.

Please Don’t Forget to Like, Follow and Comment

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Subscribe to Retire With Riley, our free weekly retirement planning newsletter, and

3. Give the article a Thumbs Up on the top-left side of the screen.

4. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!