Nobody wants a tenant who will steal their copper pipes or appliances and smear peanut butter over the electrical outlets and walls. But bad tenants are a real risk when you own a rental property.

Fortunately, landlords have options when it comes to the tenant screening process. Numerous services allow you to gain insight into prospective tenants’ credit, financial history, legal history, and more. This insight could help lower the risk that you’ll end up with a tenant that costs you thousands of dollars in repairs (not to mention countless headaches), and improve the chances that your passive income will keep rolling in.

Here are some of the best ways to screen tenants, some insight into how the tenant screening process works, and what information you can expect to receive when you screen potential renters.

Best Ways to Screen Tenants—Top Picks

|

Primary Rating:

4.2

|

Primary Rating:

4.4

|

Primary Rating:

4.5

|

|

Tenant screening starts at $24.99 (paid by tenant). No frees to use Baselane's bank account, accounting software, or rent collection features.

|

Unlimited Plan: Free, Unlimited Plus: $9/mo/unit

|

14-day free trial. All plans have a $28/mo. base fee. Basic: Additional $2/unit/mo. Essential: Additional $20/unit/mo. Complete: Additional $68/unit/mo.*

|

Best Tools for Screening Potential Tenants

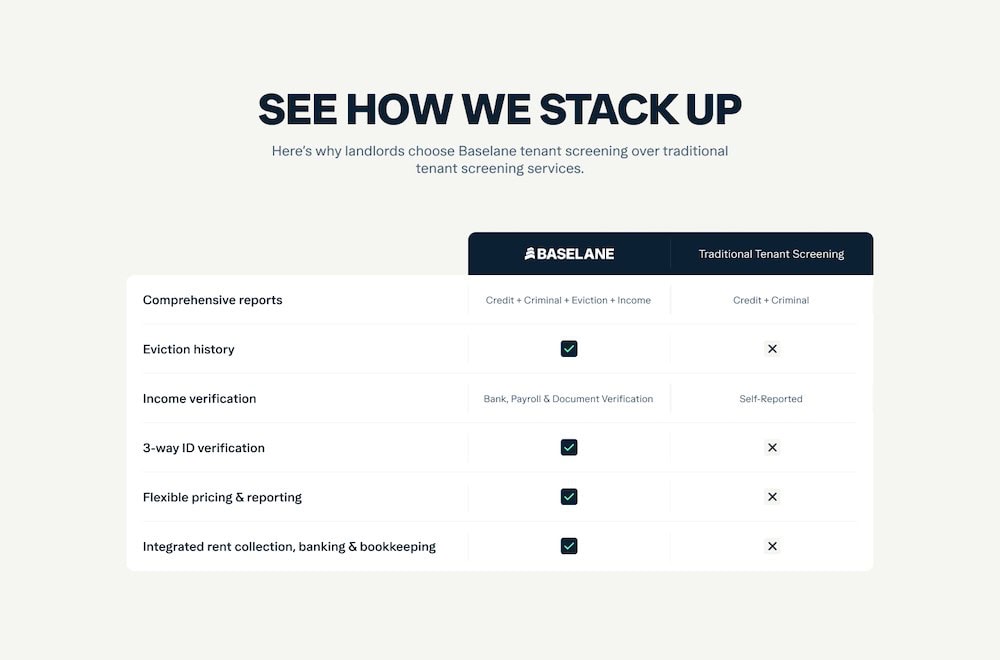

1. Baselane

- Available: Sign up here

Baselane is one of the most comprehensive real estate platforms you’ll find—both a powerhouse real estate finance and accounting product paired with some property management tools such as its all-new tenant screening.

Baselane’s tenant screening suite includes:

- Full Equifax credit report with payment history and balance across credit accounts

- Criminal report that checks national and local databases with 1.8 billion records across more than 2,500 jurisdictions

- Eviction report providing eviction history from the largest database of U.S. housing court records, updated daily

- Income verification that verifies actual bank transaction data, providing you with reliable info about a prospective tenant’s ability to pay rent, and helping you avoid fake income document fraud

- Daily updated housing court records to identify eviction histories

- Identity verification with live selfie photos to validate that the applicant is exactly who they say they are—something other tenant screening services often struggle to perform.

Tenant screening is free for landlords—instead, fees are charged to the prospective tenant during their rental application. Basic reporting (which includes the ID verification and credit report, as well as the rental application itself) is $24.99; the eviction report ($10), criminal report ($5), and income verification report ($5) require additional fees.

Interested in learning more? Sign up with Baselane today and learn how you can earn a $150 bonus, too.

2. Avail

Avail offers three tenant screening services, two of which include a TransUnion credit report. The “Renter Profile” tenant screening report only includes job history, rental history, and income verification.

The Credit Plus report includes all of that, plus a credit score, adverse items, and credit history. The Full Screening contains everything from the other reports, as well as evictions, criminal history, OFAC Terrorist Watchlist, and the Sex Offender List.

Landlords choose which report to use in their tenant screening process and decide to pay for the report or pass the costs onto the prospective tenant. Prices vary by state.

Avail provides other useful services for landlords, such as syndicating property listings, letting tenants pay rent online, state-specific lease templates, and more.

Avail is a free service. Those who want additional features can sign up for the Unlimited Plus tier for $9/unit per month.

- Avail offers free landlord software that allows you to syndicate listings on rental property sites, conduct credit and criminal screenings, execute state-specific leases, process online rent payments and perform maintenance tracking.*

- Premium version offers next-day rent payments, waived ACH fees, custom applications and leases, custom lease cloning for reuse, and creating a property website.*

- Tenants pay application fees, screening fees and payment fees ($2.50 per bank transfer w/Unlimited Plan).*

- Free plan with useful features

- Tenant screening

- Listing syndication with dozens of sites

- State-specific lease creation

- Online rent payments

- Next-day rent payments only come with Premium

- No chat features within the app, must rely on email for communicating with tenants

Related: Best Rent Collection Apps, Platforms and Services

3. SmartMove

TransUnion’s SmartMove report includes an applicant’s ResidentScore, which not all reports do. SmartMove claims that the ResidentScore can predict eviction risk 15% better than credit scores.

Besides the comprehensive credit report, SmartMove’s tenant screening process includes a criminal background check. It looks at millions of criminal records, including Most Wanted databases and the National Sex Offender Public Registry.

Landlords also receive a detailed eviction history report with tenant judgments for rent, failure to pay rent, unlawful detainers, and much more.

The Income Insights Report tells you if an applicant’s income is fully verified or if additional verification is needed.

You can sign up for a SmartMove account for free and pay as you order screenings. Alternatively, you can pass the costs onto each prospective tenant. Pricing starts at $24.99 per screening.

- SmartMove is a tenant screening solution designed for independent landlords with 1-10 properties.

- The service provides a legal and convenient portal for independent landlords to perform tenant background checks.

- Backed by TransUnion, the tenant screening process can be completed in a matter of minutes for $40

- Provides tenant scoring system (ResidentScore™)

- Pulls tenant credit, eviction and background reports in minutes

- Landlord can choose to pay fee or pass it along to prospective tenant(s)

- Only uses TransUnion credit information

Related: Best Banks for Real Estate Investors and Landlords

4. Hemlane

Available: Sign up here

Hemlane is a holistic property management software that lets you do everything from screening tenants to coordinating repairs to collecting rent. It can come in handy whether you own one rental property or several. Property managers can use its tenant screening tool to review TransUnion credit reports, criminal and sex offender records, court case details and more. Comprehensive tenant screening costs $30.

Hemlane also makes customized rental recommendations based on a prospective tenant’s background. It might, for example, suggest a tenant isn’t qualified based on the financial history or income information they’ve provided. Ultimately, you’ll have the final say in whether you choose to rent to a prospective tenant or not, but these recommendations can still be useful.

- Hemlane offers property management services in three packages using per unit pricing with no unit minimum.

- The service offers leasing tools to find qualified tenants, local support to connect you with agents, repair coordination with 24/7 US-based support for tenant requests and management tools for property management.

- Free 14-day trial to start. Afterward, pricing starts at $30/month, allowing landlords to structure their management of 1-100 units flexibly.

- Clear and transparent pricing, no nickel and diming

- Access to nationwide local leasing agent partner network

- Listing syndication with dozens of sites

- Tenant screening

- 24/7 repair coordination

- Not designed for landlords seeking full-service property management

- Not suitable for short-term/vacation rentals

- Not meant for portfolios over 100 units

Related: 12 Best Investment Opportunities for Accredited Investors

How Does the Tenant Screening Process Work?

Before you screen any tenants, it’s a good idea to familiarize yourself with state laws and federal fair housing laws.

Fair housing laws are in place to help prevent housing discrimination. They state, for instance, that you cannot refuse to rent to a tenant based on their race, color, national origin, religion, sex, familial status, or disability.

Understanding fair housing laws is essential if you own rental property. You can visit the U.S. Department of Housing and Urban Development to learn more about the federal Fair Housing Act; state government websites should have information on their own fair housing laws.

To screen tenants, you can turn to a tenant screening company, or you can run credit reports through the major credit bureaus. Tenant screening services let you evaluate prospective renters. These services offer detailed background on everything from a potential renter’s credit and financial history to any past criminal record, evictions, liens, and more. The screening process does cost money, but the expense is typically nominal and the peace of mind they provide is often worth it.

While free tenant screening isn’t an option, landlords might pay for the cost of screening or pass that cost on to rental applicants, generally in the form of an application fee. Once the tenant submits a rental application, that information is shared with the tenant screening service. The service will use the info to evaluate prospects, and while the length of time it takes to generate reports varies, the entire process from application to reporting generally takes between 48 and 72 hours.

Depending on the service used, property owners may choose to customize which reports they receive. For instance, you might simply want to look at an applicant’s credit history. In that case, you could order a credit check. Those who want a more comprehensive picture might also order a rental history report or a criminal background check.

Once you receive the reports, you can use them to help determine whether or not you’d like to rent to a particular individual or family. Some services will also send a copy of the reports directly to potential tenants for full transparency. This can help you avoid any disputes with potential renters, as they have the same information you’ve received.

Related: Best Video Intercom Systems for Apartments and Office Buildings

What Information Do You Learn About a Prospective Tenant Using Tenant Screening Services?

Credit Report

Accessing a tenant’s credit score and credit report can give you a useful glimpse into their financial history. For instance, with access to their credit information, you’ll be able to see how much debt a prospective tenant has and whether they might be able to comfortably afford monthly rental payments in addition to other financial obligations.

Criminal History Report

Many services let you perform criminal background checks, often providing options to look into state, county and national history. You also might be able to determine whether a potential tenant is a registered sex offender, depending on the screening service you use and the reports you choose to run.

Eviction Report

As a landlord, you’ll likely want to know whether a possible renter has been evicted in the past. Tenant screening services typically let you view eviction records and may also provide insight into the reason behind the eviction. In general, a past eviction could be a major red flag, depending on the reason the tenant was evicted.

Income Report

You’ll also want to know whether a tenant can comfortably afford to pay their rent, which is why you’ll want a report to verify income. In addition to the information about debt history you’ll get from their credit report, an income insights report lets you view how much your prospective tenant currently makes.

Employment History

Consistent employment history is a big plus for a new tenant. It signals that they’ll likely have reliable income, which could mean they’re more likely to pay their monthly rent. (Good news if you’re looking for consistent rental income!) If you’re wondering if they’ve been employed consistently or what their line of work is, you’ll generally see that info on an employment report.

Public Records

Curious about a prospective tenant’s bankruptcies, foreclosures, liens, and lawsuits? With a public records report, you’ll be able to see whether they’ve filed for bankruptcy, had a home go into foreclosure, or if they have any past or pending liens or lawsuits. This can provide a comprehensive picture of their financial status, which is valuable info for landlords.

Related Questions on Screening Tenants

Can you screen tenants for free?

Tenant screening services generally cost money; however, some allow you to pass the cost of the screening process onto prospective renters. For instance, with SmartMove and Avail, you can choose to have a rental applicant pay the screening fee.

However, the rules and limits around application and screening fees can vary based on the state where you live, so it’s important to research before you pass this cost onto your prospects. Landlords in Massachusetts, for example, can only charge first and last months’ rent, a security deposit, and a fee to change the locks. It’s illegal for them to charge any other fees.

Can you screen tenants online?

Yes, you can screen tenants online using a tenant screening company. Either you or the prospective tenant can submit their personal information online, and the service will offer insight into that person’s credit, criminal history, rental background, liens, and more. Note that the report options vary based on the tenant screening service you use, and some will let you customize which reports you’d like. For instance, you might be able to get a credit report, criminal background check, employment history report, and more, depending on your needs. Compare options to find a service that makes sense for your situation.

Does screening tenants affect their credit?

It depends on what service you use and how you choose to run a prospective tenant’s credit. Many tenant screening services will only conduct a soft credit pull, which is a basic inquiry that’s common during background checks. For instance, SmartMove, Avail, TenantCloud and Hemlane do a soft inquiry when you check a prospective tenant’s credit. Soft credit pulls do not appear on credit checks or impact credit scores.

Some services may do a hard credit pull, which will appear on a prospective tenant’s credit report and can cause their credit score to dip slightly—generally around five points. A hard credit inquiry can stay on their credit history for up to two years, though their credit score will likely recover more quickly than that, assuming they’re using credit responsibly.

How do property managers screen tenants?

A property manager can screen a potential tenant in a couple of different ways. The easiest option may be a tenant screening service. These services can help simplify the process of tenant screening and allow you to get different types of reports in one place. For instance, if you want a credit report, insight into a prospect’s job history, and a criminal background report, you might opt for a service like Avail or TenantCloud.

You can also get credit checks on prospective renters through the three major credit bureaus, Equifax, Experian, and TransUnion. Equifax and Experian offer direct tenant screening, and TransUnion offers it through its SmartMove brand.

Can you screen tenants for previous rental property damage?

Some tenant screening companies let you look into the rental and/or eviction history of a prospect. You might even be able to see why previous landlords evicted a renter—and the ‘why’ could include property damage. Under the law, landlords can evict tenants who’ve caused damage to a rental unit beyond typical wear and tear, which may include minor scuffs on the floor or stains on the carpet. If you want insight into a prospective renter’s past evictions, be sure to choose a service that lets you access this information.

Related:

![13 Apps That Put Earning on Autopilot [Passive Income Apps] 35 man investing on smartphone](https://wealthup.com/wp-content/uploads/young-man-looking-intently-on-smartphone-600x403.webp)