Seeking Alpha is a market leader for news and market-moving analysis. The service boasts a community with millions of members—making it the world’s largest investing community. The platform relies on a diversity of opinion crowdsourced from thousands of passionate contributors, active discussion forums and thoughtful investor commentary.

The service is written for investors by investors and uses advanced charting, data visualizations, technical and fundamental analysis to enable informed data-driven decision-making.

Learn more about Seeking Alpha below as well as Seeking Alpha’s top competitors.

- Seeking Alpha Premium and Pro help you find profitable investing ideas, improve your portfolio, research stocks better and faster, track the news to find investing opportunities, and connects you to the world's largest investing community.

- A Premium subscription provides access to Seeking Alpha's stock and ETF ratings, including Seeking Alpha Quant Strong Buy recommendations, which have greatly outperformed the stock market over time.

- Premium also gives you access to Seeking Alpha's portfolio health check, which will analyze your portfolio's quality, risk level, and performance.

- Advanced and professional investors can sign up for Pro, where they'll get everything from Premium, as well as instant access to ideas from SA's top 15 analysts, the PRO Quant Portfolio (for active traders), short-selling ideas, and more.

- Special offer on Premium: New subscribers through our link receive a $30 discount off the price of Seeking Alpha Premium in their first year.*

- Special offer on Pro: New subscribers through our link receive one month of Pro for $89, then get $250 off their first full year's subscription.**

- Active community of engaged investors and analysts

- Stock screeners, quantitative tools for stock analysis

- Strong track record of market outperformance on stock ratings

- Minimal mutual fund coverage

Table of Contents

What is Seeking Alpha?

- Available: Sign up for Premium | Sign up for Pro

Seeking Alpha Premium and Seeking Alpha Pro are all-in-one investing research and recommendation services that offer insightful analysis of financial and business news, stocks, and more—all designed to help you make better investing decisions.

Premium best caters to the needs of beginner and intermediate investors looking for an affordable but all-inclusive one-stop research-and-picks stop.

Seeking Alpha Premium gives you unlimited access to thousands of active authors who deliver stock analysis, which is vetted by in-house editors before they’re read and discussed by millions of users. Seeking Alpha also provides you with stock research tools, real-time news updates, crowdsourced debates, and market data. Users can create their own portfolio of favorite stocks, see how they perform, and receive email alerts or push notifications about their investments.

Pro, meanwhile, is an even more powerful stock subscription service that includes everything in Premium, as well as numerous other sources of stock ideas and investor tools.

What do I get from Seeking Alpha Premium?

A Seeking Alpha Premium subscription can help you manage your portfolio with a large investing community so you can better understand the stock market and manage your financial life.

Whether you’re looking to invest on the go or dedicate time for more in-depth research and analysis, Seeking Alpha Premium provides a wealth of features that meet your needs:

- Unlimited access to expert investor content

- Seeking Alpha Quant Ratings (including S&P 500-beating “Strong Buy”-rated stocks)

- ETF and stock screeners

- A portfolio “health check”

- Earnings calls transcripts

- 10 years’ worth of financial statements

- The ability to compare stocks side-by-side with peers

- Access to dividend and earnings forecasts

- And much, much more

In addition to being able to read anything published on Seeking Alpha, you’ll also see authors’ ratings. That lets you know when you’re reading a piece written by someone with top marks or a poor track record.

How has Seeking Alpha Premium performed?

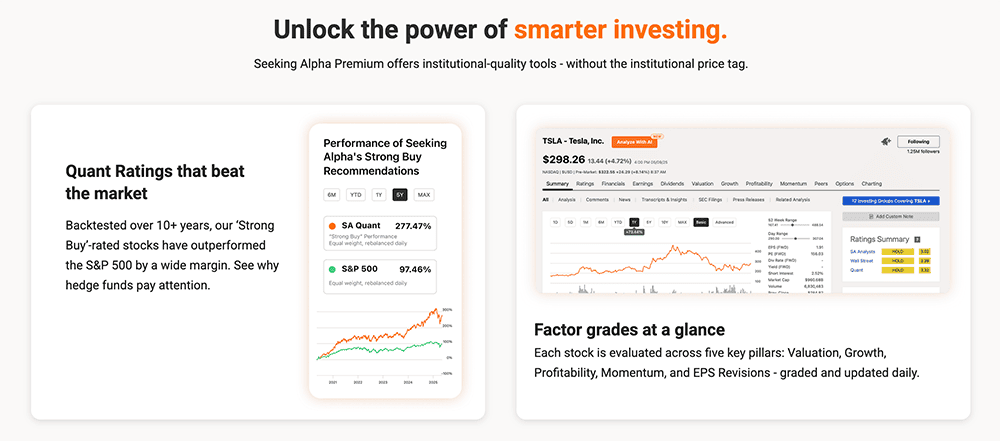

Among other things, a Seeking Alpha Premium subscription provides access to the service’s Stock Quant Ratings. The Quant Ratings involve an evaluation of each stock based on data such as financial statements, price performance, and analysts’ estimates of future profits and sales. All told, SA looks at 100 metrics for each stock, uses those metrics to compare it to all other stocks in the sector, then assigns ratings and associated scores. It also provides letter grades for five factors (value, growth, profitability, momentum, and earnings-per-share revisions).

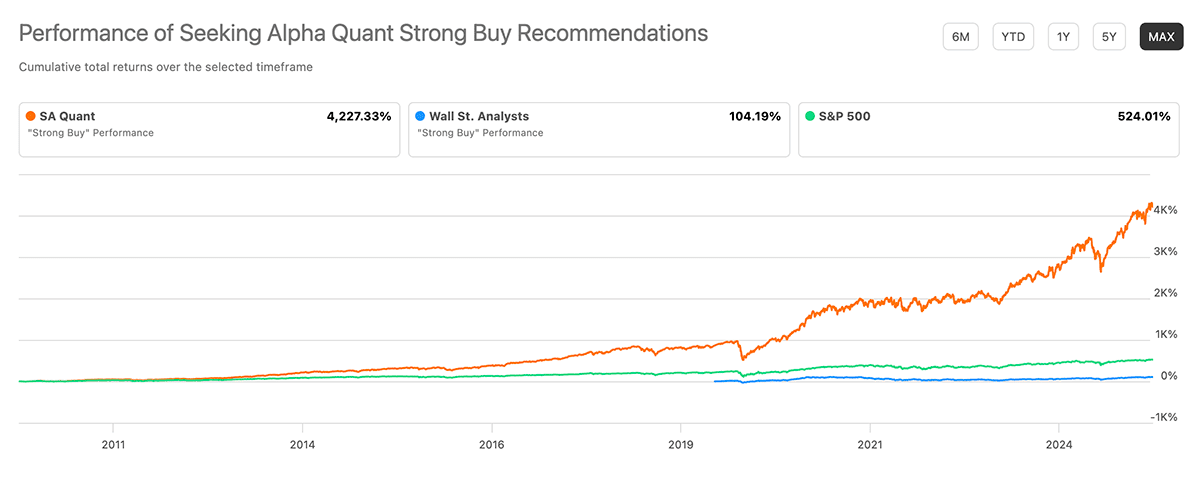

Have a look at the dramatic market outperformance seen by Seeking Alpha’s Quant “Strong Buy” recommendations compared to the S&P 500, as well as to stocks that enjoy “Strong Buy” ratings from Wall Street analysts:

What is Seeking Alpha Pro?

A Seeking Alpha Pro subscription comes with all the features of Seeking Alpha Premium, as well as additional features including:

- Instant access to investment ideas from Seeking Alpha’s top 15 analysts

- The PRO Quant Portfolio for active traders (delivers new high-conviction ideas weekly)

- Exclusive coverage of stocks that have no Wall Street analyst coverage

- Short-selling ideas from SA analysts

- Easy, real-time access to the day’s upgrades and downgrades

The Pro Plan, as the features indicate, targets more advanced and professional investors. Premium is a better fit for most investors (and it’s much less expensive, too).

Why subscribe to Seeking Alpha?

You can read more in our Seeking Alpha review, but in short: Seeking Alpha distills down the relevant financial information for you, so you don’t have to—making it easy for anyone interested in self-directed investments to have a chance at outperforming the market.

Want to try it out? If you use our exclusive links, you can enjoy a free seven-day trial and a discount on your first year’s subscription when you sign up for Premium, or a discount on your first year’s subscription when you sign up for Pro.

- Seeking Alpha Premium and Pro help you find profitable investing ideas, improve your portfolio, research stocks better and faster, track the news to find investing opportunities, and connects you to the world's largest investing community.

- A Premium subscription provides access to Seeking Alpha's stock and ETF ratings, including Seeking Alpha Quant Strong Buy recommendations, which have greatly outperformed the stock market over time.

- Premium also gives you access to Seeking Alpha's portfolio health check, which will analyze your portfolio's quality, risk level, and performance.

- Advanced and professional investors can sign up for Pro, where they'll get everything from Premium, as well as instant access to ideas from SA's top 15 analysts, the PRO Quant Portfolio (for active traders), short-selling ideas, and more.

- Special offer on Premium: New subscribers through our link receive a $30 discount off the price of Seeking Alpha Premium in their first year.*

- Special offer on Pro: New subscribers through our link receive one month of Pro for $89, then get $250 off their first full year's subscription.**

- Active community of engaged investors and analysts

- Stock screeners, quantitative tools for stock analysis

- Strong track record of market outperformance on stock ratings

- Minimal mutual fund coverage

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

Why Might You Consider Alternatives to Seeking Alpha?

Seeking Alpha delivers significant value to its subscribers. The instant access to breaking stock news stories, help with developing investing strategies and access to robust discussion forums and article comment sections bring significant insight and competing opinions—all helpful to harness for your trading.

However, Seeking Alpha might not provide everything you need, or you’d like a diversity of information and tools to improve your investment game.

If you’d like to consider some Seeking Alpha competitors to see what else might be out there, we’ve created a list of alternatives to Seeking Alpha.

Featured Financial Products

Best Seeking Alpha Alternatives & Competitors

1. Motley Fool Stock Advisor (Best for Buy-and-Hold Investors)

- Available: Sign up here

One of the alternatives to Seeking Alpha worth considering is Motley Fool’s signature product, Stock Advisor.

Stock Advisor is an online investment service that espouses my favorite, plain-vanilla trading style: buy-and-hold. Fool analysts provide recommendations for both “Steady Eddies” and potential high-flying stocks with sound fundamentals—an ideal combination of holdings if you want to generate strong performance without risking extremely high volatility.

Importantly, Stock Advisor doesn’t just give you a list of tickers and call it a day—it also provides investment rationales and research for each pick to help educate you before you buy.

And now, Stock Advisor membership provides access to Motley Fool GamePlan: a hub for retirement and financial planning content and tools to improve not just your portfolio, but your entire financial life. GamePlan outlines three portfolio strategies—Cautious, Moderate, and Aggressive—with picks for mutual funds, exchange-traded funds (ETFs), and stocks, including allocation recommendations. It also hosts a library of content about financial planning, including topics such as everyday finances, health and wellness, and estate planning. And it boasts tools including a variety of calculators, such as credit card interest and mortgage calculators.

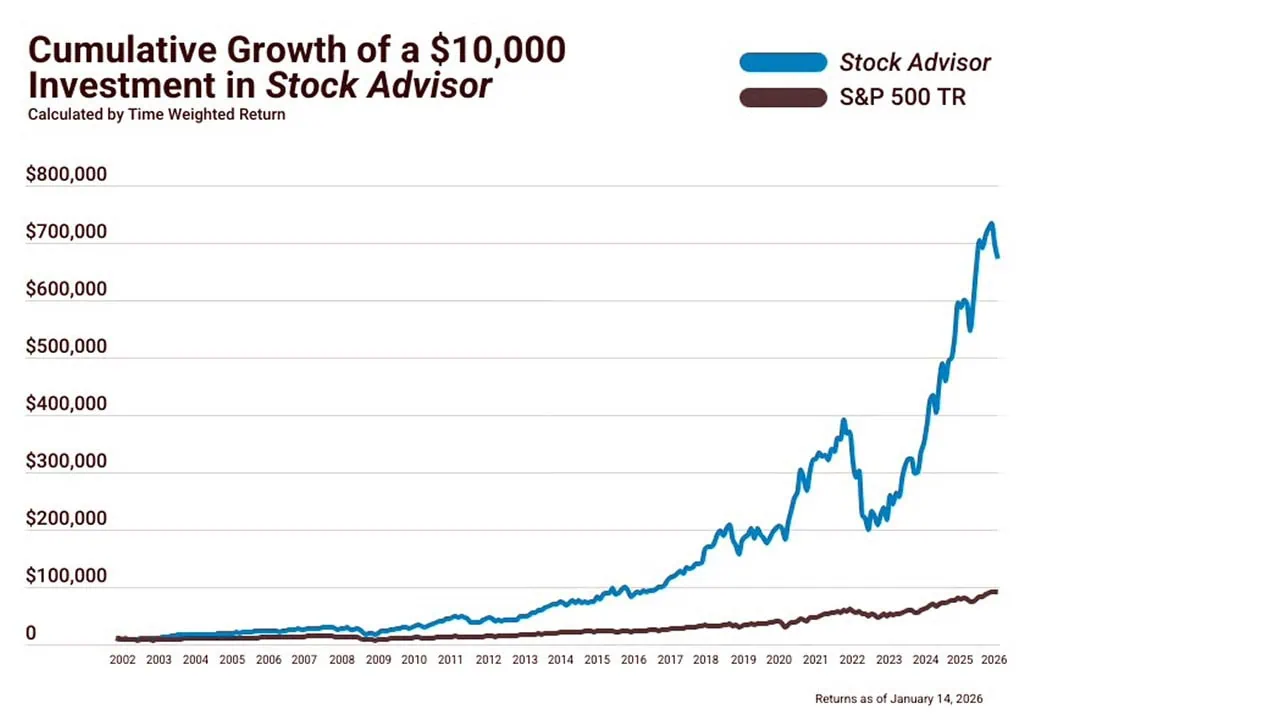

How has Motley Fool Stock Advisor performed?

Stock Advisor stock picks have performed exceptionally well over the service’s roughly 24-year existence. The service has made 190 stock recommendations that have historically delivered 100%+ returns.

Overall, the Motley Fool Stock Advisor stock subscription service has more than quadrupled the return of the S&P 500 since Stock Advisor’s inception in February 2002 through Jan. 14, 2026. This number is calculated by averaging the return of all stock recommendations it has made over the past ~24 years.

What to expect from Motley Fool Stock Advisor

The Motley Fool Stock Advisor service provides a lot of worthwhile resources to members:

- “Foundational Stocks”: 10 stocks that can serve as the foundation of your portfolio, whether you’re a new investor or experienced

- Two new stock picks each month

- Monthly analyst rankings of the service’s top 10 stocks based on their potential to beat the market over a five-year span

- A list of all the service’s active picks, “hold” recommendations, and closed positions

- Recommendations for stock and fixed-income exchange-traded funds (ETFs) you can use to build a diversified portfolio core

- Access to the GamePlan financial planning hub

- Access to Fool IQ, which provides essential financial data and news summaries about all U.S.-listed publicly traded stocks

- Access to a community of investors engaged in outperforming the market and talking shop

The service charges a discounted rate for the first year and has a 30-day membership-fee-back period. Read more in our Motley Fool Stock Advisor review, or sign up for Stock Advisor today.

- Motley Fool Stock Advisor is a stock service that provides recommendations for both "steady Eddie" and high-flying stocks, as well as a few ETFs for investors who want diversified holdings, too.

- Just getting started? Stock Advisor provides 10 "Foundational Stocks" you can use to anchor your portfolio.

- You're not alone! Stock Advisor membership also gives you access to a community of investors who also want to outperform the market and love talking shop.

- Enjoy access to GamePlan: Motley Fool's financial planning hub, which includes advice on personal finances, taxes, retirement, and more, as well as calculators and other financial tools.

- Limited-Time Offer: Get your first year with Stock Advisor for $99 (vs. $199 usual value)—a 50% discount for new members!—by clicking our link.*

- Discounted introductory price

- Strong outperformance compared to the S&P 500

- High overall average return for stock picks

- High renewal price

- Not every stock is a winner

Related: Motley Fool’s Rule Breakers vs. Stock Advisor

2. Motley Fool Epic (Best Multi-Strategy Stock Picking Service)

- Available: Sign up here

Motley Fool Epic isn’t itself a stock-picking service—instead, it’s a bundled selection of four popular Motley Fool stock recommendation products, three of which you can only enjoy by becoming an Epic member:

- Stock Advisor: Buy-and-hold stock picks designed to deliver consistent performance with less volatility. Stock Advisor is the only one of these services you can subscribe to individually. (See our Stock Advisor review.)

- Rule Breakers: Stocks that have massive growth potential, whether they’re at the forefront of emerging industries or disrupting the status quo in long-established businesses. (See our Rule Breakers review.)

- Hidden Gems: Stocks of medium-to-large businesses, selected by Fool CEO and co-founder Tom Gardner for their “all-in, visionary leadership teams.” More so than the other services, Hidden Gems is mindful of macroeconomic and market environments—and how they might dictate how aggressively you should invest.

- Dividend Investor: This recommendation service revolves around producing equity income. Fool analysts target companies that deliver above-average yields and dividend growth, with the hope of producing both competitive total returns and an income stream that should carry you through retirement.

Epic members will get five new picks per month across the various services, can access all active recommendations, and also view Cautious, Moderate, and Aggressive strategies including specific stock allocations.

But Epic makes this list because it’s more than just a pile of recommendation services. Epic membership also unlocks access to a number of stock research and analysis tools, as well as other informational products, including:

- Fool IQ+: Fool IQ, which comes with Stock Advisor, provides essential financial data and news summaries about all U.S.-listed publicly traded stocks. With Epic, you get Fool IQ+, which includes all the features in Fool IQ, as well as a much wider variety of financial analysis data (earnings coverage, insider trading data, analyst opinions, and more) and advanced charting options.

- GamePlan+: GamePlan is a hub for retirement and financial planning. It includes exchange-traded fund (ETF) rankings; portfolio strategies (including stock, ETF, and mutual fund picks) with allocation recommendations; content about a variety of financial topics such as taxes, estate planning, and everyday finances; and a variety of tools, such as credit card interest and mortgage calculators. GamePlan is available when you sign up with Stock Advisor. However, GamePlan+, which you get through Epic, delivers a wider array of articles and tools, as well as more in-depth coverage.

- Epic Opportunities: A members-only podcast from Motley Fool.

You can learn more by reading our Epic review, or sign up today at Motley Fool.

- Motley Fool's Epic is a discounted combination of four foundational stock-investing services rolled up into one membership.

- Get access to more than 300 recommendations, reports, and analyses across the Stock Advisor, Rule Breakers, Hidden Gems, and Dividend Investor services.

- Get at least five new stock recommendations every month,

- Membership also unlocks GamePlan+ financial planning content and tools, Fool IQ+ stock research tool, a members-only podcast, and more.

- Limited-Time Offer: Get your first year with Epic for $299 (vs. $499 usual value)—a 40% discount for new members!—by clicking our link.*

- Discounted introductory price

- Strong outperformance compared to the S&P 500

- High overall average return for stock picks

- Diversified array of recommendations for investors targeting growth, income, or both

- Additional value from GamePlan financial planning content and tools

- High renewal price

- Not every stock is a winner

3. Trade Ideas (Best for Finding Day Trading Opportunities)

- Available: Sign up here

Trade Ideas is a powerful and versatile stock scanner with one of the most innovative top-tier plans among the research tools we review.

The free, basic version of the service offers features such as PiP charts, technical indicators, “Stock Racing,” and trading tournaments, while a paid TI Basic plan adds on real-time data, up to 10 charts on-screen at once, real-time paper trading, in-app trading, and more.

But where Trade Ideas really shines is its Premium tier, which opens up access to an exclusive artificial intelligence virtual research assistant (Holly) that constantly sifts through technicals, fundamentals, social media, earnings, and more to provide real-time stock trade recommendations. The AI assistant runs more than 1 million simulated trades each night and morning before the markets open with more than 60 proprietary algorithms to find you the highest-probability, most risk-appropriate opportunities to invest in stocks.

Trade Ideas also allows you to build your own scanners and screeners with over 500 data points and indicators to choose from. You can backtest your trading strategies, and also forward-test them in the real-time trade simulator. This allows you to learn, test, and optimize, without risking your own money. It also provides access to real-time streaming trading ideas on simultaneous charts to learn how to trade into risk-reward balanced trades. Translation: You can invest and learn at the same time.

Where Trade Ideas excels

Where Trade Ideas excels is not only giving you the data and ideas you haven’t seen elsewhere, but also showing you how to manage your money. The AI-powered “smart risk” levels on every chart are suitable for both long-term investors and active traders. As the stock market evolves, TI’s software adjusts levels and the trading plan to match.

The best part? You can learn how to do all of this without risking your principal through a real-time simulated trading environment.

After you’ve grown comfortable with the service and trading, you can choose to go live with the trade ideas and start investing real money by connecting directly through a brokerage like Interactive Brokers or E*Trade. (The full list of available brokers you can use through the service is available on Trade Ideas’ site.)

I’m a newsletter and alert aficionado, so I should point out a couple of Trade Ideas products. For one, it has a standalone alert service in the form of a weekly Swing Picks newsletter. This gives you five new trade ideas in your inbox from the company’s model portfolio every Monday. Trade Ideas’ Standard and Premium subscriptions include these stock picks. Trade Ideas also has a free Trade of the Week newsletter highlighting one stock pick TI has identified for members.

Trade Ideas is among the pricier products we review, but it offers exceptional value, especially in the Premium tier. Sign up for any of Trade Ideas’ tiers through our exclusive link, and you can enjoy a significant discount on paid tiers by using the code mentioned in the box below.

- Trade Ideas is a powerful stock market scanner app that teaches you how to trade and invest, and boasts features such as technical indicators, PiP charts, alerts, even trading tournaments.

- Use Trade Ideas' simulated trading platform to learn how to trade without risking actual money.

- Trade Ideas' TI Premium tier opens up access to the platform's AI investment research assistant, Holly, as well as backtesting, "smart risk" levels, channel bar, and more.

- Special offer 1: Save an additional 22% off the above listed price on any annual subscription when you sign up with our link and enter code YATI22.

- Special offer 2: Save an additional 28% off the above listed price on a Premium subscription when you sign up with our link and enter code YATI28.

- Free live trading room that delivers actionable guidance

- In-browser and desktop interface functionality

- Automated trading capabilities

- AI-powered trade suggestions

- No mobile app

- Pricey subscriptions for some traders

4. TradingView (Best Site for Technical Stock Analysis and Charting)

- Available: Sign up here

TradingView is an invaluable data-and-charts platform with highly customizable charting tools; 400-plus built-in indicators and strategies; and real-time data on stocks, foreign exchange, cryptocurrency, and more. But it’s more than just information and analysis: It also boasts a community of millions of traders, allowing you to share trading ideas, learn from experts, and connect with fellow investors.

The free stock screener software, TradingView Basic, is pretty robust for not costing a cent. You can screen stocks, ETFs, closed-end funds (CEFs), bonds, cryptocurrency and other assets, as well as view heatmaps for equities, ETFs, and crypto. Charts and screens use real-time data. You also enjoy access to several years’ worth of annual and quarterly financial data, more than 100,000 community-powered indicators, 110-plus smart drawing tools, and more.

Paid plans naturally unlock access not just to new features, but greater numbers of certain features such as charts per tab, indicators per chart, historical bars, parallel chart connections, price alerts, and technical alerts. Here’s a quick look at what you get with each paid plan:

- Essential: Ad-free experience, volume profile, custom timeframes, custom range bars, multiple watchlists, bar replay, indicators on indicators.

- Plus: Everything in Essential, as well as chart data export; intraday Renko, Kagi, Line Break and Point & Figure charts; and charts based on custom formulas.

- Premium: Everything in Plus, as well as time price opportunity, volume footprint, volume candles, watchlist alerts, auto chart patterns, publishing invite-only scripts, second-based intervals, and more.

- Ultimate: Everything in Premium, as well as tick-based intervals; first-priority support; greater numbers of charts, indicators, alerts, and more; and the ability to buy professional market data.

Past that, TradingView allows you to track interest rate shifts across government bonds, build options strategies, view financial events around the world via its event calendar, and even evaluate and compare corporate fundamentals in graph mode. You don’t have to use it alone, either—many traders pair TradingView with platforms like TradeStation, Interactive Brokers, or Webull.

Use our exclusive link to sign up for TradingView and you’ll typically enjoy a free trial and a bonus toward your first year’s subscription, though seasonal promotions tend to involve deeper discounts but no free trial. Check out our current offer in the box below.

- TradingView provides an easy and intuitive stock charting experience, as well as tools that allow you view and share trade ideas.

- Use this stock analysis app to leverage real-time data and browser-based charts to do your research anywhere.

- Collaborate with 100 million TradingView investors.

- Free Plan (Basic): $0 forever.

- Non-Professional Plans (Essential, Plus, Premium): 30-day free trial, then $12.95/mo. for Essential, $28.29/mo. for Plus, or $56.49/mo. for Premium.*

- Professional Plan (Ultimate): 7-day free trial, then $199.95/mo.*

- Special offer: Sign up using our link and you'll get $15 toward your first subscription.

- Fast, powerful charting software

- Ease of use

- Extensive built-in indicators library (400+)

- Crowd-sourced indicator library (100,000+)

- Chart on 1.3 million+ securities listed on 150+ exchanges from 50+ countries

- Massive user base (70 million+ globally)

- Limited free plan

- Experience can be overwhelming for new users

Related: 10 Best Investments for Roth IRA Accounts [Target High Growth]

5. TrendSpider (Best for Refining Trading Strategies)

- Available: Sign up here

TrendSpider offers a comprehensive platform for traders to create, backtest, and refine trading strategies, scan and analyze the market, and time trades with precision. With its advanced tools and features, TrendSpider is designed to make trading more efficient for both novice and experienced traders.

Among the platform’s powerful tools:

- Robust technical charting and pattern recognition features, such as native multi-timeframe analysis, automatic trendlines, and Smart Checklists

- Raindrop Charts®, which provide a new way to visualize market data, focusing on trading volume at each price level

- Alternative data offerings including information on options flow, analyst actions, market breadth, insider trades, and more

- Data Flow, which enables real-time tracking of market data for all symbols, including analyst estimates, earnings, news, and unusual options flow

- Strategy Tester, which allows users to quickly develop and test trading strategies without any coding required; users can configure entry and exit rules and explore the performance of their strategies directly on the price chart

- Backtesting capabilities for technical, non-technical, and event-based strategies; once a winning strategy is identified, users can deploy it as a trading bot with just one click

Of particular note for traders is TrendSpider’s Scanner feature, which allows you to instantly test any strategy on any market and search for ideal trading opportunities. The stock scanner supports searching through watchlists, indexes, and more than 700 smart lists. Users can mix and match conditions and timeframes, allowing them to express any view in a single scan. The platform also provides a range of pre-made scanners to help users get started.

TrendSpider’s mobile app ensures traders are always connected to their charts and scanners, while the Chrome extension allows users to access real-time charts while browsing the web. The platform also offers extensive educational resources through TrendSpider University and detailed documentation for its features.

The platform also supports integration with external systems using webhooks, enabling traders to build custom alerts and bots that interact with social media channels, private chat servers, email, or order routers connected to brokerage accounts. TrendSpider’s SignalStack service can turn any signal or alert on TrendSpider into a live order in a trader’s account.

Learn more about the platform’s capabilities or sign up for TrendSpider today.

- Hone your trading skills and strategies with the TrendSpider platform, where you can use advanced tools to test trade ideas, scan for opportunities, and perfect your timing.

- Enjoy robust tools including technical charting and pattern recognition features, alternative data, backtesting, and Raindrop Charts.

- TrendSpider's stock scanner supports searching through watchlists, indexes, and more than 700 smart lists.

- Special offer: TrendSpider is offering up to 50% off certain tiers right now.

- Automated order execution

- Intuitive interface

- Chrome extension

- Reasonable pricing

- Mobile app is a companion app, not standalone

- Charts sometimes load sluggishly

Related: Best Quicken Alternatives

6. Stock Rover (Best for Market Data and Fundamental Research)

- Available: Sign up here

Stock Rover helps you keep track of your portfolio with detailed performance information, emailed performance reports, in-depth portfolio analysis tools, correlation tools, trade planning and re-balancing facilities. You can also create real-time research reports that provide a complete fundamental and technical overview of the company’s performance for the last 10 years.

This service works as a web-based applet and offers several valuable services and applications, depending on your research and analysis needs.

Stock Rover provides a comprehensive alerting facility, a real-time stock screener for instances where companies trade below their perceived fair value and signaling opportunities to buy stocks with a built-in margin of safety.

One of the best features of the web-based app is Stock Rover’s “Brokerage Connect.” This provides you with a read-only data feed of your portfolio holdings, giving investors access to a real-time, comprehensive view of their total portfolio. This shows you a comprehensive view of your portfolios, whether they’re in one brokerage account or spread across numerous investment accounts. After syncing your online brokerage accounts to Stock Rover, details for each portfolio get populated in your Stock Rover dashboard for in-depth analytics and tracking purposes.

Use our link to sign up for a 14-day free trial of Stock Rover Premium, or to start any one of Stock Rover’s paid plans today.

- Stock Rover is a complete service for investors looking to use screeners, investment comparisons, real-time research reports, model portfolios, charts and more.

- Use this top-rated investment analytics service to identify stocks worth buying and outperforming the market.

- Create an account for free, and you can start a 14-day Premium trial subscription with no credit card needed.

- Hundreds of screening metrics

- Proprietary scoring systems

- Real-time executive summary research reports

- No mobile app

- No crypto or forex data

- US markets only

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

7. Zacks Investment Research

- Available: Sign up here

Zacks Investment Research also sits among the best stock market research websites, delivering a subscription-based service that you can use to improve your own due diligence or lean on for stock selection.

The investment research site has a free service that provides general market data and information about the financial markets and business news. One of its popular features is the Bull and Bear of the Day, where the service selects two stocks and rates them as a Bull (strong buy) or Bear (strong sell) pick.

However, the Zacks Premium service unlocks access to:

- The Zacks #1 Rank List to develop your investment strategies

- Focus List portfolio of long-term stocks

- Custom stock screener

- Equity research reports and more

The Portfolio Tracker provides constant monitoring of your stocks to help you decide if you should buy, hold, or sell.

If you want even more firepower, Zacks Investor Collection provides access to Zacks Premium and other services, including ETF Investor and Stocks Under $10. You can try the service for 30 days for just $1. After that, it’s $59/mo. or discounted to $495/yr. if paid upfront.

Investors who desire even more information can get Zacks Ultimate. This plan provides even more exclusive services, including Black Box Trader, Blockchain Innovators, Marijuana Innovators, Options Trader, and more. After a $1 30-day trial, Zacks Ultimate costs $299 per month.

- Zacks Investment Research offers several research products to provide the information subscribers want to know about market opportunities

- Features include: Zacks #1 Rank List, Industry Rank List, Premium Screens, Focus List, Research Reports, Earnings ESP Filter, Zacks #5 Rank List

Related: Zacks vs Motley Fool: Which Stock Picking Service is Better?

Related Questions About Sites Like Seeking Alpha

Is there a free version of Seeking Alpha?

Seeking Alpha offers a Basic plan, which provides:

- stock analysis email alerts

- real-time news updates

- investing newsletters

- access to free stock quotes and charts

- Wall Street ratings for every stock

- limited access to in-depth financial news and analysis.

Make Young and the Invested your preferred news source on Google

Simply go to your preferences page and select the ✓ box for Young and the Invested. Once you’ve made this update, you’ll see Young and the Invested show up more often in Google’s “Top Stories” feed, as well as in a dedicated “From Your Sources” section on Google’s search results page.

Who competes with Seeking Alpha?

Several companies offer competing services to Seeking Alpha, with some specializing in different areas.

For stock picking, The Motley Fool offers several services to select stocks to hold in your portfolio, including Stock Advisor and Epic.

For standalone research and data services, you have a Seeking Alpha competitor like Stock Rover. And you have TradingView, the social platform for traders and investors to improve investing skills and profits for charting and technical analysis.

In all, have several competitors to consider for Seeking Alpha.

Related: Best Motley Fool Alternatives

What is the best advisor website?

Seeking Alpha has performed remarkably well on stocks it assigns “Very Bullish” as a stock rating. Since 2010, the Top Quant Performance rating (or Triple Rated Stocks Collection) has returned an annualized 28% return.

Few services can replicate or beat this level of performance over this long period.

Is Seeking Alpha Premium Worth It?

Seeking Alpha Premium provides several valuable features to inform your investment theses and stay updated on your portfolio. The service unlocks one million investing ideas and valuable features such as Author, Quant and Dividends Ratings, all of which can deliver compelling investment rationales for your consideration.

Consider starting a subscription to take advantage of SA’s Premium services and see if they make sense for your needs.

- Seeking Alpha Premium and Pro help you find profitable investing ideas, improve your portfolio, research stocks better and faster, track the news to find investing opportunities, and connects you to the world's largest investing community.

- A Premium subscription provides access to Seeking Alpha's stock and ETF ratings, including Seeking Alpha Quant Strong Buy recommendations, which have greatly outperformed the stock market over time.

- Premium also gives you access to Seeking Alpha's portfolio health check, which will analyze your portfolio's quality, risk level, and performance.

- Advanced and professional investors can sign up for Pro, where they'll get everything from Premium, as well as instant access to ideas from SA's top 15 analysts, the PRO Quant Portfolio (for active traders), short-selling ideas, and more.

- Special offer on Premium: New subscribers through our link receive a $30 discount off the price of Seeking Alpha Premium in their first year.*

- Special offer on Pro: New subscribers through our link receive one month of Pro for $89, then get $250 off their first full year's subscription.**

- Active community of engaged investors and analysts

- Stock screeners, quantitative tools for stock analysis

- Strong track record of market outperformance on stock ratings

- Minimal mutual fund coverage