Discovering, evaluating and choosing which stocks to buy can take a significant amount of time. For this reason, many people choose to use stock picking services, newsletters, subscriptions and sites.

Using these services doesn’t mean you’re off the hook for doing any of your own due diligence, but they can save you a lot of time. Plus, stock picks from an expert stock advisor are likely more accurate than yours if you’re only a novice or intermediate trader.

There are many options for stock advice, so let’s go over what to look for in a stock picking service and the top choices you should consider.

Best Stock Picking Service, Subscription & Sites—Top Picks

|

Primary Rating:

4.7

|

Primary Rating:

4.8

|

Primary Rating:

4.5

|

Primary Rating:

4.3

|

|

$89 for 1st year; $199 renewal

|

Premium: 7-day free trial, then $269/yr. ($30 discount)* Pro: $89 for 1 mo., then $2,149/yr. ($250 discount)**

|

$99 for first year; $299 renewal

|

$449/yr. ($50 discount)*

|

Best Stock Picking Services

1. Motley Fool Stock Advisor (Best for Consistent Market Outperformance)

- Available: Sign up here

Motley Fool’s signature product, Stock Advisor, aims to provide investors with one thing: top picks for market-beating stocks from the site’s co-founders.

Stock Advisor is an online investment service that espouses my favorite, plain-vanilla trading style: buy-and-hold. Fool analysts provide recommendations for both “Steady Eddies” and potential high-flying stocks with sound fundamentals—an ideal combination of holdings if you want to generate strong performance without risking extremely high volatility.

Importantly, Stock Advisor doesn’t just give you a list of tickers and call it a day—it also provides investment rationales and research for each pick to help educate you before you buy.

And now, Stock Advisor membership provides access to Motley Fool GamePlan: a hub for retirement and financial planning content and tools to improve not just your portfolio, but your entire financial life. GamePlan outlines three portfolio strategies—Cautious, Moderate, and Aggressive—with picks for mutual funds, exchange-traded funds (ETFs), and stocks, including allocation recommendations. It also hosts a library of content about financial planning, including topics such as everyday finances, health and wellness, and estate planning. And it boasts tools including a variety of calculators, such as credit card interest and mortgage calculators.

How has Motley Fool Stock Advisor performed?

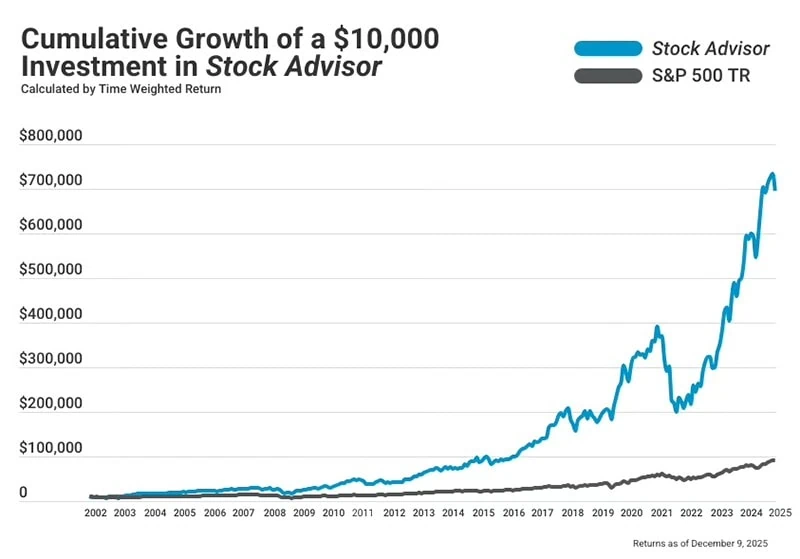

Stock Advisor stock picks have performed exceptionally well over the service’s 22-year existence. The service has made 190 stock recommendations that have historically delivered 100%+ returns.

Overall, the Motley Fool Stock Advisor stock subscription service has more than quadrupled the return of the S&P 500 since Stock Advisor’s inception in February 2002 through Dec. 9, 2025. This number is calculated by averaging the return of all stock recommendations it has made over the past 23 years.

What to expect from Motley Fool Stock Advisor

The Motley Fool Stock Advisor service provides a lot of worthwhile resources to members:

- “Foundational Stocks”: 10 stocks that can serve as the foundation of your portfolio, whether you’re a new investor or experienced

- Two new stock picks each month

- Monthly analyst rankings of the service’s top 10 stocks based on their potential to beat the market over a five-year span

- A list of all the service’s active picks, “hold” recommendations, and closed positions

- Recommendations for stock and fixed-income exchange-traded funds (ETFs) you can use to build a diversified portfolio core

- Access to the GamePlan financial planning hub

- Access to Fool IQ, which provides essential financial data and news summaries about all U.S.-listed publicly traded stocks

- Access to a community of investors engaged in outperforming the market and talking shop

The service charges a discounted rate for the first year and has a 30-day membership-fee-back period. Read more in our Motley Fool Stock Advisor review, or sign up for Stock Advisor today.

- Motley Fool Stock Advisor is a stock service that provides recommendations for both "steady Eddie" and high-flying stocks, as well as a few ETFs for investors who want diversified holdings, too.

- Just getting started? Stock Advisor provides 10 "Foundational Stocks" you can use to anchor your portfolio.

- You're not alone! Stock Advisor membership also gives you access to a community of investors who also want to outperform the market and love talking shop.

- Enjoy access to GamePlan: Motley Fool's financial planning hub, which includes advice on personal finances, taxes, retirement, and more, as well as calculators and other financial tools.

- Limited-Time Offer: Get your first year with Stock Advisor for $99 (vs. $199 usual value)—a 50% discount for new members!—by clicking our link.*

- Discounted introductory price

- Strong outperformance compared to the S&P 500

- High overall average return for stock picks

- High renewal price

- Not every stock is a winner

Related: Motley Fool’s Rule Breakers vs. Stock Advisor

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

2. Seeking Alpha (Best Stock Analysis Website for Investment Research + Stock Recommendations)

- Available: Sign up for Premium | Sign up for Pro

Seeking Alpha Premium and Seeking Alpha Pro are all-in-one investing research and recommendation services that offer insightful analysis of financial and business news, stocks, and more—all designed to help you make better investing decisions.

Premium best caters to the needs of beginner and intermediate investors looking for an affordable but all-inclusive one-stop research-and-picks stop.

Seeking Alpha Premium gives you unlimited access to thousands of active authors who deliver stock analysis, which is vetted by in-house editors before they’re read and discussed by millions of users. Seeking Alpha also provides you with stock research tools, real-time news updates, crowdsourced debates, and market data. Users can create their own portfolio of favorite stocks, see how they perform, and receive email alerts or push notifications about their investments.

Pro, meanwhile, is an even more powerful stock subscription service that includes everything in Premium, as well as numerous other sources of stock ideas and investor tools.

What do I get from Seeking Alpha Premium?

A Seeking Alpha Premium subscription can help you manage your portfolio with a large investing community so you can better understand the stock market and manage your financial life.

Whether you’re looking to invest on the go or dedicate time for more in-depth research and analysis, Seeking Alpha Premium provides a wealth of features that meet your needs:

- Unlimited access to expert investor content

- Seeking Alpha Quant Ratings (including S&P 500-beating “Strong Buy”-rated stocks)

- ETF and stock screeners

- A portfolio “health check”

- Earnings calls transcripts

- 10 years’ worth of financial statements

- The ability to compare stocks side-by-side with peers

- Access to dividend and earnings forecasts

- And much, much more

In addition to being able to read anything published on Seeking Alpha, you’ll also see authors’ ratings. That lets you know when you’re reading a piece written by someone with top marks or a poor track record.

How has Seeking Alpha Premium performed?

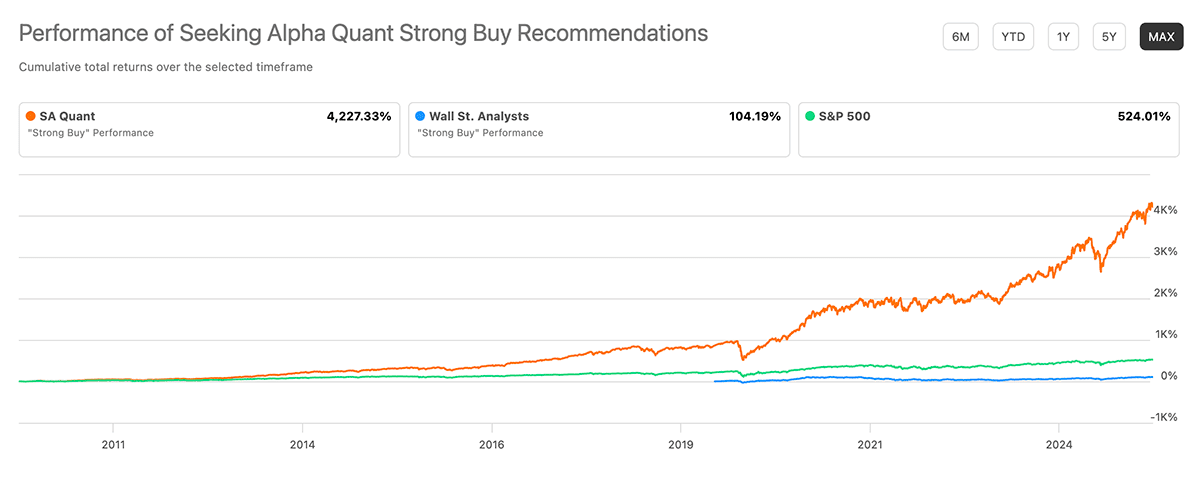

Among other things, a Seeking Alpha Premium subscription provides access to the service’s Stock Quant Ratings. The Quant Ratings involve an evaluation of each stock based on data such as financial statements, price performance, and analysts’ estimates of future profits and sales. All told, SA looks at 100 metrics for each stock, uses those metrics to compare it to all other stocks in the sector, then assigns ratings and associated scores. It also provides letter grades for five factors (value, growth, profitability, momentum, and earnings-per-share revisions).

Have a look at the dramatic market outperformance seen by Seeking Alpha’s Quant “Strong Buy” recommendations compared to the S&P 500, as well as to stocks that enjoy “Strong Buy” ratings from Wall Street analysts:

What is Seeking Alpha Pro?

A Seeking Alpha Pro subscription comes with all the features of Seeking Alpha Premium, as well as additional features including:

- Instant access to investment ideas from Seeking Alpha’s top 15 analysts

- The PRO Quant Portfolio for active traders (delivers new high-conviction ideas weekly)

- Exclusive coverage of stocks that have no Wall Street analyst coverage

- Short-selling ideas from SA analysts

- Easy, real-time access to the day’s upgrades and downgrades

The Pro Plan, as the features indicate, targets more advanced and professional investors. Premium is a better fit for most investors (and it’s much less expensive, too).

Why subscribe to Seeking Alpha?

You can read more in our Seeking Alpha review, but in short: Seeking Alpha distills down the relevant financial information for you, so you don’t have to—making it easy for anyone interested in self-directed investments to have a chance at outperforming the market.

Want to try it out? If you use our exclusive links, you can enjoy a free seven-day trial and a discount on your first year’s subscription when you sign up for Premium, or a discount on your first year’s subscription when you sign up for Pro.

- Seeking Alpha Premium and Pro help you find profitable investing ideas, improve your portfolio, research stocks better and faster, track the news to find investing opportunities, and connects you to the world's largest investing community.

- A Premium subscription provides access to Seeking Alpha's stock and ETF ratings, including Seeking Alpha Quant Strong Buy recommendations, which have greatly outperformed the stock market over time.

- Premium also gives you access to Seeking Alpha's portfolio health check, which will analyze your portfolio's quality, risk level, and performance.

- Advanced and professional investors can sign up for Pro, where they'll get everything from Premium, as well as instant access to ideas from SA's top 15 analysts, the PRO Quant Portfolio (for active traders), short-selling ideas, and more.

- Special offer on Premium: New subscribers through our link receive a $30 discount off the price of Seeking Alpha Premium in their first year.*

- Special offer on Pro: New subscribers through our link receive one month of Pro for $89, then get $250 off their first full year's subscription.**

- Active community of engaged investors and analysts

- Stock screeners, quantitative tools for stock analysis

- Strong track record of market outperformance on stock ratings

- Minimal mutual fund coverage

Related: Best Seeking Alpha Alternatives [Competitors’ Sites to Consider]

3. Zacks Investment Research (Best for Fundamental Analysis and Earnings Activity)

- Available: Sign up here

Zacks Investment Research also sits among the best stock market research websites, delivering a subscription-based service that you can use to improve your own due diligence or lean on for stock selection.

The investment research site has a free service that provides general market data and information about the financial markets and business news. One of its popular features is the Bull and Bear of the Day, where the service selects two stocks and rates them as a Bull (strong buy) or Bear (strong sell) pick.

However, the Zacks Premium service unlocks access to:

- The Zacks #1 Rank List to develop your investment strategies

- Focus List portfolio of long-term stocks

- Custom stock screener

- Equity research reports and more

The Portfolio Tracker provides constant monitoring of your stocks to help you decide if you should buy, hold, or sell.

If you want even more firepower, Zacks Investor Collection provides access to Zacks Premium and other services, including ETF Investor and Stocks Under $10. You can try the service for 30 days for just $1. After that, it’s $59/mo. or discounted to $495/yr. if paid upfront.

Investors who desire even more information can get Zacks Ultimate. This plan provides even more exclusive services, including Black Box Trader, Blockchain Innovators, Marijuana Innovators, Options Trader, and more. After a $1 30-day trial, Zacks Ultimate costs $299 per month.

- Zacks Investment Research offers several research products to provide the information subscribers want to know about market opportunities

- Features include: Zacks #1 Rank List, Industry Rank List, Premium Screens, Focus List, Research Reports, Earnings ESP Filter, Zacks #5 Rank List

Related: Zacks vs Motley Fool: Which Stock Picking Service is Better?

4. AAII Dividend Investing (Best Income Investing Stock Picking Subscription)

- Available: Sign up here

American Association of Individual Investors is a leading financial services publication with a monthly journal, thousands of online articles covering everything from behavioral finance to financial planning, and access to a Shadow Stock Portfolio. (This latter feature has beaten the stock market by a nearly 4-to-1 margin since inception.)

All of these items come included with the AAII Basic plan. But if you’d like to go with a more advanced stock research software option, you should consider AAII’s A+ Investor subscription.

This provides the membership benefits included with the AAII Basic plan but also includes access to a robust data suite that allows you to screen tens of thousands of stocks, mutual funds, and ETFs to consider for your portfolio. It also includes more than 60 prebuilt screens based on famous investor personalities and fundamental factors.

- AAII is in independent non-profit organization helping individual investors achieve their financial goals

- The service allows access to a Shadow Stock Portfolio, outperforming the market 4:1 in the last 20 years

- Gain access to AAII's Monthly Journal and live weekly webinars

Related: Best Dividend Stocks for Beginners to Buy

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

5. Trade Ideas (Best Stock Analysis Site for Active Traders)

- Available: Sign up here

Trade Ideas is a powerful and versatile stock scanner with one of the most innovative top-tier plans among the research tools we review.

The free, basic version of the service offers features such as PiP charts, technical indicators, “Stock Racing,” and trading tournaments, while a paid TI Basic plan adds on real-time data, up to 10 charts on-screen at once, real-time paper trading, in-app trading, and more.

But where Trade Ideas really shines is its Premium tier, which opens up access to an exclusive artificial intelligence virtual research assistant (Holly) that constantly sifts through technicals, fundamentals, social media, earnings, and more to provide real-time stock trade recommendations. The AI assistant runs more than 1 million simulated trades each night and morning before the markets open with more than 60 proprietary algorithms to find you the highest-probability, most risk-appropriate opportunities to invest in stocks.

Trade Ideas also allows you to build your own scanners and screeners with over 500 data points and indicators to choose from. You can backtest your trading strategies, and also forward-test them in the real-time trade simulator. This allows you to learn, test, and optimize, without risking your own money. It also provides access to real-time streaming trading ideas on simultaneous charts to learn how to trade into risk-reward balanced trades. Translation: You can invest and learn at the same time.

Where Trade Ideas excels

Where Trade Ideas excels is not only giving you the data and ideas you haven’t seen elsewhere, but also how to manage your money. The AI-powered smart risk levels on every chart are suitable for both long-term investors and active traders.

As the stock market evolves, TI’s software adjusts levels and the trading plan to match. The best part? You can learn how to do all of this without risking your principal through a real-time simulated trading environment.

After you’ve grown comfortable with the service and trading, you can choose to go live with the trade ideas and start investing real money by connecting directly through a brokerage like Interactive Brokers or E*Trade. (The full list of available brokers you can use through the service is available on Trade Ideas’ site.)

I’m a newsletter and alert aficionado, so I should point out a couple of Trade Ideas products. For one, it has a standalone alert service in the form of a weekly Swing Picks newsletter. This gives you five new trade ideas in your inbox from the company’s model portfolio every Monday. Trade Ideas’ Standard and Premium subscriptions include these stock picks. Trade Ideas also has a free Trade of the Week newsletter highlighting one stock pick TI has identified for members.

How does Trade Ideas find stock picks?

Trade Ideas finds its Strength Alerts by focusing on a unique approach that emphasizes relative strength. They start by identifying the most effective indicators and chart setups, based on their top-performing algorithms. They proceed by applying statistical analysis to assign weighted values to each indicator and chart setup, allowing for a quantitative evaluation of their significance. Advanced server technology allows TI to evaluate every stock in the market using these weights and then sort them based on which achieved the highest score. Their team of experts curates these findings to ensure subscribers receive only the most promising trade recommendations.

While Trade Ideas offers exceptional value, it’s important to note that there’s a considerable investment required. Note that you must sign up for Premium to receive full access to the Holly experience. However, you can enjoy a big discount by using the code mentioned below.

Consider starting your Trade Ideas subscription with no contract involved. Cancel anytime.

- Trade Ideas is a powerful stock market scanner app that teaches you how to trade and invest, and boasts features such as technical indicators, PiP charts, alerts, even trading tournaments.

- Use Trade Ideas' simulated trading platform to learn how to trade without risking actual money.

- Trade Ideas' TI Premium tier opens up access to the platform's AI investment research assistant, Holly, as well as backtesting, "smart risk" levels, channel bar, and more.

- Special offer 1: Save an additional 22% off the above listed price on any annual subscription when you sign up with our link and enter code YATI22.

- Special offer 2: Save an additional 28% off the above listed price on a Premium subscription when you sign up with our link and enter code YATI28.

- Free live trading room that delivers actionable guidance

- In-browser and desktop interface functionality

- Automated trading capabilities

- AI-powered trade suggestions

- No mobile app

- Pricey subscriptions for some traders

What Is a Stock Picking Service, Advisor, Subscription or Site?

Stock picking services give their subscribers specific stock recommendations. The services compile and analyze extensive stock data sets such as quarterly earnings, market share and more. By analyzing and providing suggestions of what to buy, they take much of the work out of strategic stock buying.

Often, the terms “stock picking service,” “stock picking subscription,” and “stock picking site” are used interchangeably. Newsletter often implies emails or physical mail, such as a magazine or newspaper. Subscriptions may range from smartphone apps, to private website access, or also refer to newsletters. Focus less on the terms and more on what different services offer.

Stock picking services and newsletters provide general advice, not personalized advice for individual subscribers. If you want individualized advice, seek out a financial advisor. Materials should be impartial, rather than promotional.

Finally, these services shouldn’t make guarantees that any stock will rise.

Make Young and the Invested your preferred news source on Google

Simply go to your preferences page and select the ✓ box for Young and the Invested. Once you’ve made this update, you’ll see Young and the Invested show up more often in Google’s “Top Stories” feed, as well as in a dedicated “From Your Sources” section on Google’s search results page.

What Makes a Good Stock Picking Service or Advisor?

Take into account the following factors when choosing a stock picking service.

→ Proven Track Record.

Choose a stock picking service that outperforms across long periods. You want a service that chooses investments that earn a great return, meaning better than similar companies or a comparable benchmark index. Stocks fluctuate, so it’s essential they choose growth stocks that continue to perform over time.

Transparency is key, both in how the stock picking service works and how they are choosing stocks. Avoid any services with hidden fees or those that seem to have secret sponsors. The stock picking services shouldn’t just be telling you what stocks are likely to rise, but why they are likely to rise as well.

Recommendations should be backed up with facts. Services should mention actionable signals, which tell us why a price will move.

→ Replicable Trading Capabilities.

The recommendations made must be replicable by you. Suggested stocks shouldn’t be ones only available to institutional investors and you should be able to pay roughly the same prices as the stock picking service. Otherwise, returns won’t be the same.

Consider an Initial Public Offering (IPO), which is a stock that recently became publicly traded or will be shortly. Institutional investors may have access to the stock at a lower price right before it hits the market. If so, they will have superior overall returns than someone who buys it a few days later at a higher price.

→ Low / Worth the Cost.

At minimum, a good investment service should pay for itself. You should recoup your subscription costs based on the recommendations the stock picking service provides. Ideally, you make a profit and the higher the profit the better. The lower the price of the stock picking service, the greater your overall profit margin.

Quality of recommendations is more important than cost, but if recommendation quality is equal, the service that costs less will net you more. This lets you buy low and sell high with profit in mind.

→ Educational.

In addition to sending investment picks, the best stock picking services also provide educational resources that teach you how to research and analyze stocks on your own. With the right educational materials, you won’t have to be completely reliant on a stock advisor and will be capable of doing your own research.

It’s unlikely you have the funds to purchase every recommendation. They provide a shortlist of investment picks and you can teach yourself how to be even more selective.

Should You Buy Recommendations From These Services?

If you have serious interest in investing with these stock picking services, I suggest starting small and cautiously with their recommendations.

Consider following along with a paper trading account available through free stock apps. These accounts allow you to place trades without placing actual trades and putting your money at risk. Apps like Webull, a trading app like Robinhood, offer this functionality for free.

By using a free paper trading service, you can test the recommendations of the stock picking service and how they perform relative to the market.

Always Perform Your Own Due Diligence

I recommend several services here because you should never let one single source represent your stock investing choices. If you find an interesting stock pick, research it more on your own.

Only after performing your own due diligence should you invest. Consider pairing an investment research service like Stock Rover to your subscription to get more in-depth and objective views of the stocks recommended.

Best Stock Picking Services, Newsletters, Subscriptions & Sites

The best stock picking service for you will depend on whether you’re a day trader or long-term investor, your level of trading expertise, and your budget for services.

You aren’t limited to one service. It’s common for investors to choose multiple services to fit different needs. If you’re unsure which service(s) is best for you, take advantage of free trial offers.

No matter what service you use, always remember to do your due diligence after reading stock recommendations.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.