Stock recommendation services are popular shortcuts that help millions of investors make educated decisions without having to spend hours of time doing research.

But just like, say, a driving shortcut, the quality of stock recommendations can vary widely—and who you’re willing to listen to largely boils down to track record and trust.

If you knew someone had a bad sense of direction, you wouldn’t heed their advice on getting to the store, and all you’d be risking there is a few extra minutes of your time. So you certainly shouldn’t entrust your entire retirement to services that can’t recommend their way out of a paper bag.

The natural question, then, is “Which services are worth a shot?”

Today, we’re going to explore some of the best (and best-known) stock recommendation services. Our goal today is highlighting not just quality, but variety—after all, some investors might be looking for stock tips and nothing else, while other investors want to receive recommendations but also use tools to find their own opportunities.

Should You Use Expert Stock Picks?

Signing up to receive expert stock picks can be a worthwhile use of your money, as long as you know what you’re getting into.

I’ve worked in the financial publishing space, in one role or another, for more than a decade now. And I can tell you from my experiences studying the competitive landscape: Stock recommendation services in general have an image problem—for pretty good reason.

At their low points, marketing for stock-picking newsletters and services blurs the line between reality and fiction. Promises of impossible short-term gains and/or vanishingly thin risks. Cherry-picked returns to cover up long-term underperformance. Customers, thankfully, are smart enough not to put up with it for long—poor products rack up hours of angry calls and sky-high cancellation rates.

Still, even a few mere months with a poor stock picking service can severely dent your nest egg. So, if you can, it’s better to avoid the hucksters outright and home in on services that have already proven their worth over time.

Who Should Use Stock Picking Services?

In short: Stock recommendation services are ideal for people who want to invest in individual stocks but might not have the time to do all of the requisite research themselves.

If I’m being honest, the high-percentage play for most people is to buy a few index funds and keep buying until you retire. They’re cheap. They’re diversified. And more often than not, they beat professional stock pickers.

But owning individual stocks has some merit, too.

For one, if you want to outperform the market, individual stocks give you the best shot at doing it. You could try to beat the S&P 500 by investing in a different index, but ultimately, any index is just a group of stocks—where the best performers are weighed down by the returns of the worst performers. But if, against the odds, you make the right pick, you’ll generate far better returns by holding a much larger position in that stock than you could by owning a smaller percentage through mutual funds or exchange-traded funds (ETFs).

Also, individual stocks keep people mentally invested. I’ve written about ETFs for 12 years now, and while I love them, I know they’re boring. They do their job, nothing more, nothing less. But individual stocks are tied to individual companies, and companies excite people. Think about how many stories you’ve read about companies like Apple (AAPL), Amazon (AMZN), and Tesla (TSLA) because of the exciting products they produce.

Heck, even boring companies can whip up people’s heart rates—I can’t tell you how many emails I fielded back at InvestorPlace from people who just wanted to vent about their hatred for General Electric (GE).

Point is: Even if your portfolio is mostly diversified funds, owning a few individual stocks might keep you more interested in investing. And if that gets you to pile more money into your IRA or brokerage account, that’s a win.

Stock Recommendation Services—Our Top Picks

|

Primary Rating:

4.7

|

Primary Rating:

4.8

|

Primary Rating:

4.7

|

Primary Rating:

4.3

|

|

$99/yr.*

|

Premium: 7-day free trial, then $269/yr. ($30 discount)* Pro: $89 for 1 mo., then $2,149/yr. ($250 discount)**

|

$299/yr.*

|

$449/yr. ($50 discount)*

|

Best Stock Recommendation Services

Now, let’s do a service-by-service look at some of the best values in stock-picking subscriptions:

1. Motley Fool Stock Advisor (Best Buy-and-Hold Stock Recommendations)

- Available: Sign up here

- Best for: Investors who want long-term stock picks

Motley Fool’s signature product, Stock Advisor, aims to provide investors with one thing: top picks for market-beating stocks from the site’s co-founders.

Stock Advisor is an online investment service that espouses my favorite, plain-vanilla trading style: buy-and-hold. Fool analysts provide recommendations for both “Steady Eddies” and potential high-flying stocks with sound fundamentals—an ideal combination of holdings if you want to generate strong performance without risking extremely high volatility.

Importantly, Stock Advisor doesn’t just give you a list of tickers and call it a day—it also provides investment rationales and research for each pick to help educate you before you buy.

And now, Stock Advisor membership provides access to Motley Fool GamePlan: a hub for retirement and financial planning content and tools to improve not just your portfolio, but your entire financial life. GamePlan outlines three portfolio strategies—Cautious, Moderate, and Aggressive—with picks for mutual funds, exchange-traded funds (ETFs), and stocks, including allocation recommendations. It also hosts a library of content about financial planning, including topics such as everyday finances, health and wellness, and estate planning. And it boasts tools including a variety of calculators, such as credit card interest and mortgage calculators.

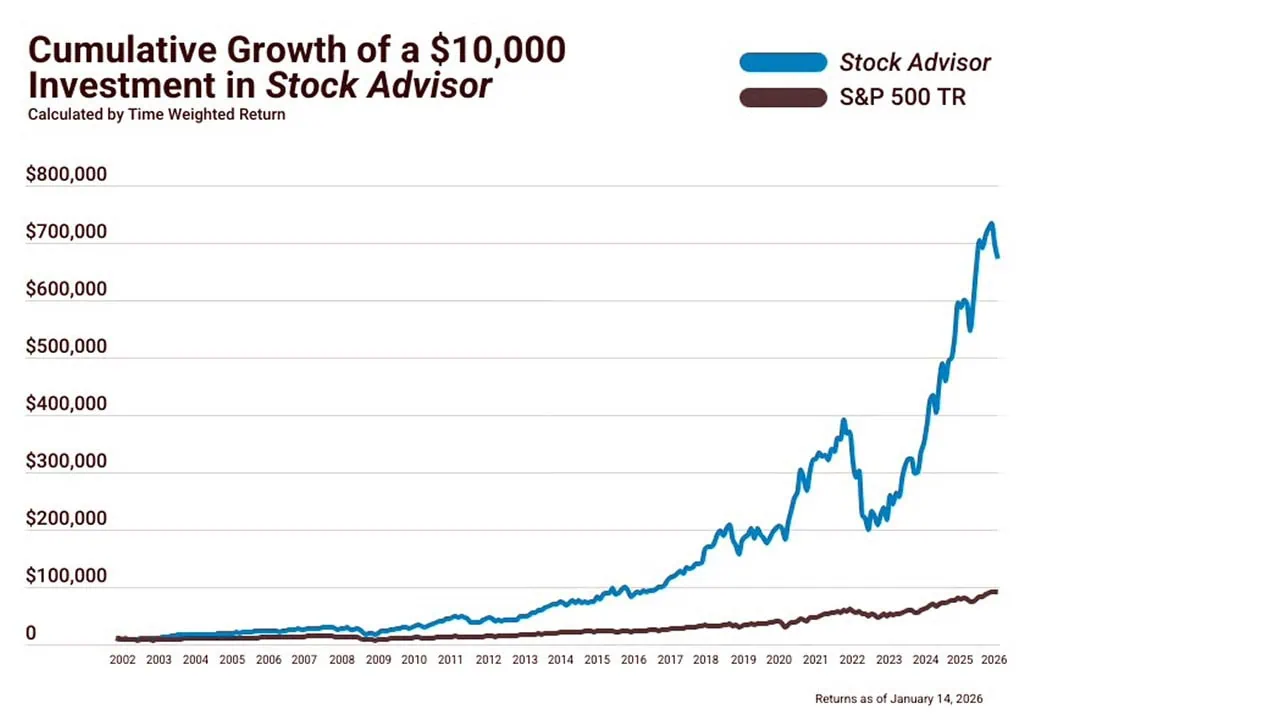

How has Motley Fool Stock Advisor performed?

Stock Advisor stock picks have performed exceptionally well over the service’s roughly 24-year existence. The service has made 190 stock recommendations that have historically delivered 100%+ returns.

Overall, the Motley Fool Stock Advisor stock subscription service has more than quadrupled the return of the S&P 500 since Stock Advisor’s inception in February 2002 through Jan. 14, 2026. This number is calculated by averaging the return of all stock recommendations it has made over the past ~24 years.

What to expect from Motley Fool Stock Advisor

The Motley Fool Stock Advisor service provides a lot of worthwhile resources to members:

- “Foundational Stocks”: 10 stocks that can serve as the foundation of your portfolio, whether you’re a new investor or experienced

- Two new stock picks each month

- Monthly analyst rankings of the service’s top 10 stocks based on their potential to beat the market over a five-year span

- A list of all the service’s active picks, “hold” recommendations, and closed positions

- Recommendations for stock and fixed-income exchange-traded funds (ETFs) you can use to build a diversified portfolio core

- Access to the GamePlan financial planning hub

- Access to Fool IQ, which provides essential financial data and news summaries about all U.S.-listed publicly traded stocks

- Access to a community of investors engaged in outperforming the market and talking shop

Stock Advisor offers a discounted rate for the first year and has a 30-day membership-fee-back period. Read more in our Motley Fool Stock Advisor review, or sign up for Stock Advisor today.

- Motley Fool Stock Advisor is a stock service that provides recommendations for both "steady Eddie" and high-flying stocks, as well as a few ETFs for investors who want diversified holdings, too.

- Just getting started? Stock Advisor provides 10 "Foundational Stocks" you can use to anchor your portfolio.

- You're not alone! Stock Advisor membership also gives you access to a community of investors who also want to outperform the market and love talking shop.

- Enjoy access to GamePlan: Motley Fool's financial planning hub, which includes advice on personal finances, taxes, retirement, and more, as well as calculators and other financial tools.

- Limited-Time Offer: Get your first year with Stock Advisor for $99 (vs. $199 usual value)—a 50% discount for new members!—by clicking our link.*

- Discounted introductory price

- Strong outperformance compared to the S&P 500

- High overall average return for stock picks

- High renewal price

- Not every stock is a winner

Related: How to Get Free Stocks for Signing Up: 8 Apps w/Free Shares

2. Seeking Alpha Premium (Best for Stock Recommendations + Data Services)

- Available: Sign up here

- Best for: Investors who want picks and data

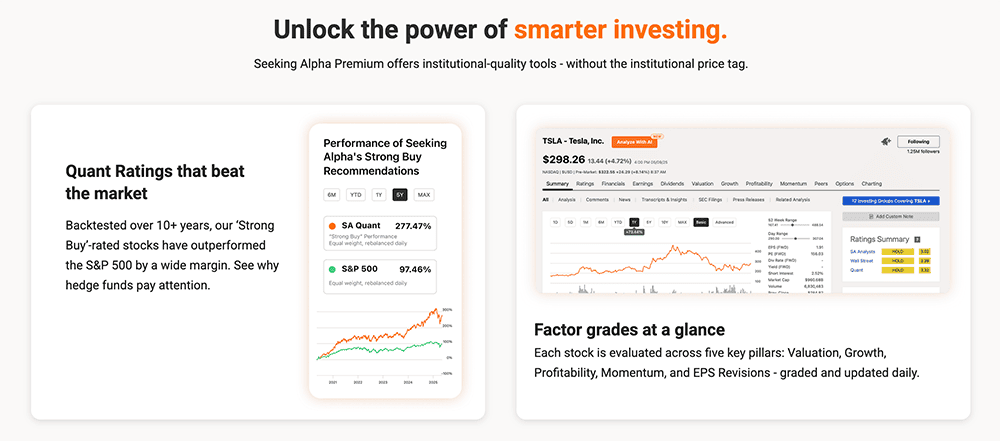

Seeking Alpha Premium is an all-in-one investing research and recommendation service that offers insightful analysis of financial and business news, stocks, and more—all designed to help you make better investing decisions.

Seeking Alpha Premium best caters to the needs of beginner and intermediate investors looking for an affordable but all-inclusive one-stop research-and-picks stop. It gives you unlimited access to thousands of active authors who deliver stock analysis, which is vetted by in-house editors before they’re read and discussed by millions of users. Seeking Alpha also provides you with stock research tools, real-time news updates, crowdsourced debates, and market data. Users can create their own portfolio of favorite stocks, see how they perform, and receive email alerts or push notifications about their investments.

What do I get from Seeking Alpha Premium?

A Seeking Alpha Premium subscription can help you manage your portfolio with a large investing community so you can better understand the stock market and manage your financial life.

Whether you’re looking to invest on the go or dedicate time for more in-depth research and analysis, Seeking Alpha Premium provides a wealth of features that meet your needs:

- Unlimited access to expert investor content

- Seeking Alpha Quant Ratings (including S&P 500-beating “Strong Buy”-rated stocks)

- ETF and stock screeners

- A portfolio “health check”

- Earnings calls transcripts

- 10 years’ worth of financial statements

- The ability to compare stocks side-by-side with peers

- Access to dividend and earnings forecasts

- And much, much more

In addition to being able to read anything published on Seeking Alpha, you’ll also see authors’ ratings. That lets you know when you’re reading a piece written by someone with top marks or a poor track record.

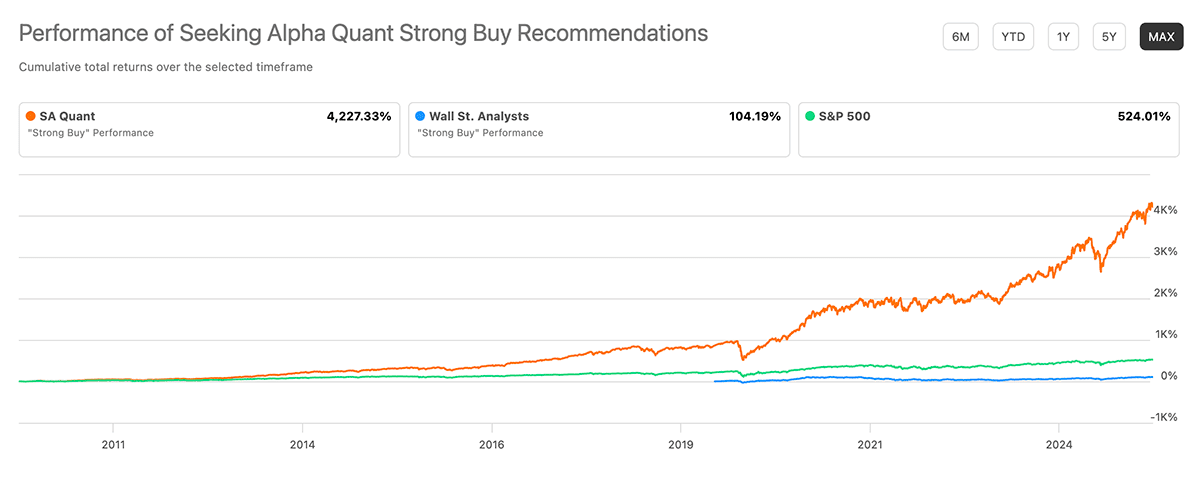

How has Seeking Alpha Premium performed?

Among other things, a Seeking Alpha Premium subscription provides access to the service’s Stock Quant Ratings. The Quant Ratings involve an evaluation of each stock based on data such as financial statements, price performance, and analysts’ estimates of future profits and sales. All told, SA looks at 100 metrics for each stock, uses those metrics to compare it to all other stocks in the sector, then assigns ratings and associated scores. It also provides letter grades for five factors (value, growth, profitability, momentum, and earnings-per-share revisions).

Have a look at the dramatic market outperformance seen by Seeking Alpha’s Quant “Strong Buy” recommendations compared to the S&P 500, as well as to stocks that enjoy “Strong Buy” ratings from Wall Street analysts:

Why subscribe to Seeking Alpha?

You can read more in our Seeking Alpha review, but in short: Seeking Alpha distills down the relevant financial information for you, so you don’t have to—making it easy for anyone interested in self-directed investments to have a chance at outperforming the market.

Want to try it out? If you use our exclusive links, you can enjoy a free seven-day trial and a discount on your first year’s subscription when you sign up for Premium.

- Seeking Alpha Premium and Pro help you find profitable investing ideas, improve your portfolio, research stocks better and faster, track the news to find investing opportunities, and connects you to the world's largest investing community.

- A Premium subscription provides access to Seeking Alpha's stock and ETF ratings, including Seeking Alpha Quant Strong Buy recommendations, which have greatly outperformed the stock market over time.

- Premium also gives you access to Seeking Alpha's portfolio health check, which will analyze your portfolio's quality, risk level, and performance.

- Advanced and professional investors can sign up for Pro, where they'll get everything from Premium, as well as instant access to ideas from SA's top 15 analysts, the PRO Quant Portfolio (for active traders), short-selling ideas, and more.

- Special offer on Premium: New subscribers through our link receive a $30 discount off the price of Seeking Alpha Premium in their first year.*

- Special offer on Pro: New subscribers through our link receive one month of Pro for $89, then get $250 off their first full year's subscription.**

- Active community of engaged investors and analysts

- Stock screeners, quantitative tools for stock analysis

- Strong track record of market outperformance on stock ratings

- Minimal mutual fund coverage

Related: Best Seeking Alpha Alternatives [Competitors’ Sites to Consider]

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

3. Motley Fool Epic (Best for Investors of All Stripes)

- Available: Sign up here

- Price: Discounted price for the first year (shown below)

Motley Fool Epic isn’t itself a stock-picking service—instead, it’s a bundled selection of four popular Motley Fool stock recommendation products, three of which you can only enjoy by becoming an Epic member:

- Stock Advisor: Buy-and-hold stock picks designed to deliver consistent performance with less volatility. Stock Advisor is the only one of these services you can subscribe to individually. (See our Stock Advisor review.)

- Rule Breakers: Stocks that have massive growth potential, whether they’re at the forefront of emerging industries or disrupting the status quo in long-established businesses. (See our Rule Breakers review.)

- Hidden Gems: Stocks of medium-to-large businesses, selected by Fool CEO and co-founder Tom Gardner for their “all-in, visionary leadership teams.” More so than the other services, Hidden Gems is mindful of macroeconomic and market environments—and how they might dictate how aggressively you should invest.

- Dividend Investor: This recommendation service revolves around producing equity income. Fool analysts target companies that deliver above-average yields and dividend growth, with the hope of producing both competitive total returns and an income stream that should carry you through retirement.

Epic members will get five new picks per month across the various services, can access all active recommendations, and also view Cautious, Moderate, and Aggressive strategies including specific stock allocations.

But Epic makes this list because it’s more than just a pile of recommendation services. Epic membership also unlocks access to a number of stock research and analysis tools, as well as other informational products, including:

- Fool IQ+: Fool IQ, which comes with Stock Advisor, provides essential financial data and news summaries about all U.S.-listed publicly traded stocks. With Epic, you get Fool IQ+, which includes all the features in Fool IQ, as well as a much wider variety of financial analysis data (earnings coverage, insider trading data, analyst opinions, and more) and advanced charting options.

- GamePlan+: GamePlan is a hub for retirement and financial planning. It includes exchange-traded fund (ETF) rankings; portfolio strategies (including stock, ETF, and mutual fund picks) with allocation recommendations; content about a variety of financial topics such as taxes, estate planning, and everyday finances; and a variety of tools, such as credit card interest and mortgage calculators. GamePlan is available when you sign up with Stock Advisor. However, GamePlan+, which you get through Epic, delivers a wider array of articles and tools, as well as more in-depth coverage.

- Epic Opportunities: A members-only podcast from Motley Fool.

You can learn more by reading our Epic review, or sign up for Epic at a significant discount when you use our link.

- Motley Fool's Epic is a discounted combination of four foundational stock-investing services rolled up into one membership.

- Get access to more than 300 recommendations, reports, and analyses across the Stock Advisor, Rule Breakers, Hidden Gems, and Dividend Investor services.

- Get at least five new stock recommendations every month,

- Membership also unlocks GamePlan+ financial planning content and tools, Fool IQ+ stock research tool, a members-only podcast, and more.

- Limited-Time Offer: Get your first year with Epic for $299 (vs. $499 usual value)—a 40% discount for new members!—by clicking our link.*

- Discounted introductory price

- Strong outperformance compared to the S&P 500

- High overall average return for stock picks

- Diversified array of recommendations for investors targeting growth, income, or both

- Additional value from GamePlan financial planning content and tools

- High renewal price

- Not every stock is a winner

Related: Motley Fool Epic Review

4. Seeking Alpha’s Alpha Picks (Best Data-Driven Stock Recommendation Service)

- Available: Sign up here

Are you looking for a way to beat the market consistently? Seeking Alpha’s Alpha Picks might be a great option to consider.

Alpha Picks is a stock selection service that provides you with two of the best stock picks each month that SA determines have the greatest chance for price upside. They base their selections on fundamentals such as valuation, growth, profitability, and momentum—not hype.

The stock selection process relies on Seeking Alpha’s proprietary, data-driven computer Seeking Alpha Quant scoring system (available to Premium and Pro users) to screen and recommend stocks for more conservative “buy-and-hold” investors, but with a bit of modification. Namely, all recommendations must meet the following criteria:

- Hold a Strong Buy Quant rating for a minimum of 75 days

- Market cap greater than $500 million

- Stock price greater than $10

- Is a publicly traded common stock (no American Depository Receipts [ADRs])

- Be the highest-rated stock at the time of selection that has not been previously recommended within the past year (Alpha Picks releases one pick at the start of the month, another in the middle).

So far, so good: Since the service’s launch on July 1, 2022, Alpha Picks has outperformed the S&P 500 by 170 percentage points.

If you sign up for the service, you can expect the following:

- Access to all Alpha Picks on Day 1

- Two new long-term stock picks to buy and hold delivered every month

- Detailed explanations from Seeking Alpha behind why they rate each stock pick so highly

- Notifications when new picks are added, and when a recommendation changes to Sell

- Regular updates on current Buy recommendations

This service is designed for busy professionals interested in building a portfolio that outpaces the market but without the time to commit to finding these opportunities. If you’re interested, you can use our exclusive link to sign up for a discounted first-year price.

- Seeking Alpha's Alpha Picks is a stock picking service designed for busy professionals who might not have the time needed to select stocks for their own portfolio.

- Using a proprietary computer-scoring model, Alpha Picks makes "buy-and-hold" picks that last at least two years.

- Since its launch in 2022, Alpha Picks has delivered market-beating performance, with a remarkable 180% increase compared to the S&P 500's 61%.

- Rigorous backtesting also has shown Alpha Picks' methodology would have strongly outperformed the S&P 500 index between 2010 and 2022 (+470% vs. +290%).

- Special offer: Receive $50 off the first year's subscription price by signing up via our link.*

- Data-driven, computer-generated stock selection process

- Avoids human bias

- Strong backtest performance vs. S&P 500 index

- Competitive price point

- Not enough actual performance data

- No frills, just stock picks and info about them

Related: 15 Best Investment Apps and Platforms [Free + Paid]

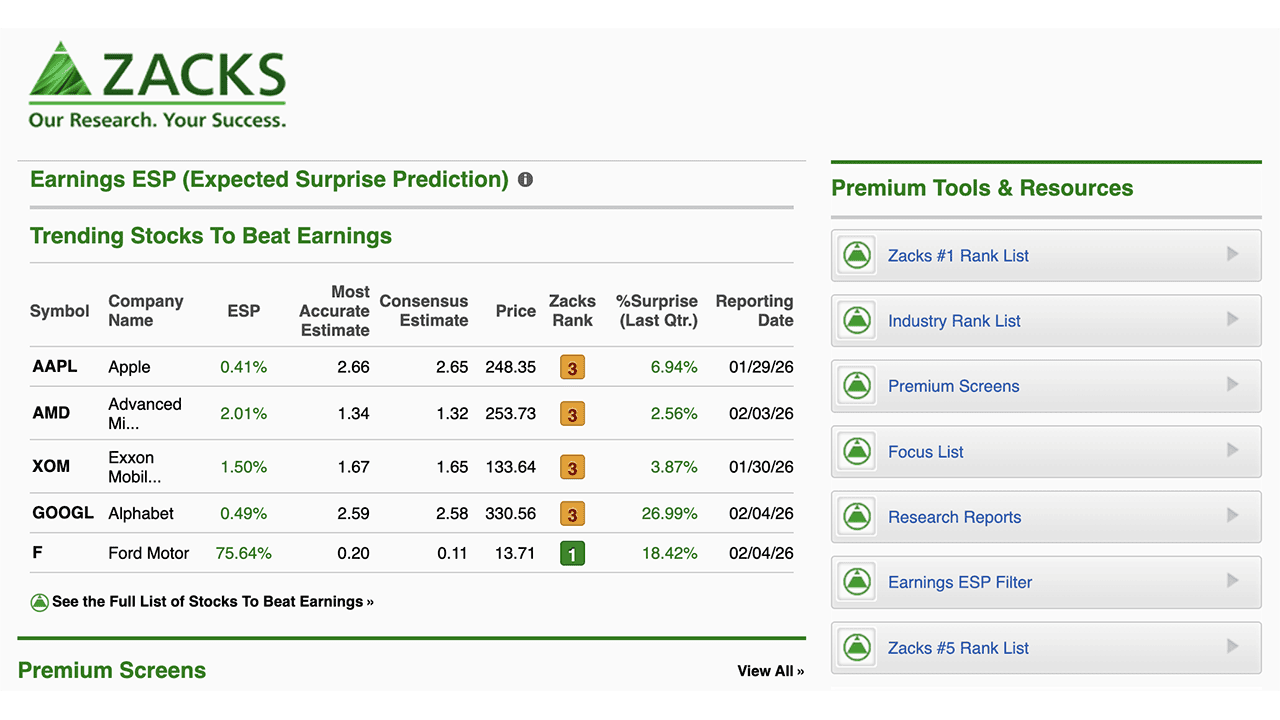

5. Zacks Investment Research (Stock Picks, Rankings + Data)

- Available: Sign up here

- Best for: Investors who want picks and data

Zacks Investment Research also sits among the best stock market research websites, delivering a subscription-based service that you can use to improve your own due diligence or lean on for stock selection.

The investment research site has a free service that provides general market data and information about the financial markets and business news. One of its popular features is the Bull and Bear of the Day, where the service selects two stocks and rates them as a Bull (strong buy) or Bear (strong sell) pick.

However, the Zacks Premium service unlocks access to:

- The Zacks #1 Rank List to develop your investment strategies

- Focus List portfolio of long-term stocks

- Custom stock screener

- Equity research reports and more

The Portfolio Tracker provides constant monitoring of your stocks to help you decide if you should buy, hold, or sell.

If you want even more firepower, Zacks Investor Collection provides access to Zacks Premium and other services, including ETF Investor and Stocks Under $10. You can try the service for 30 days for just $1. After that, it’s $59/mo. or discounted to $495/yr. if paid upfront.

Investors who desire even more information can get Zacks Ultimate. This plan provides even more exclusive services, including Black Box Trader, Blockchain Innovators, Marijuana Innovators, Options Trader, and more. After a $1 30-day trial, Zacks Ultimate costs $299 per month.

- Zacks Investment Research offers several research products to provide the information subscribers want to know about market opportunities

- Features include: Zacks #1 Rank List, Industry Rank List, Premium Screens, Focus List, Research Reports, Earnings ESP Filter, Zacks #5 Rank List

Related: Zacks vs Motley Fool: Which Stock Picking Service is Better?

Make Young and the Invested your preferred news source on Google

Simply go to your preferences page and select the ✓ box for Young and the Invested. Once you’ve made this update, you’ll see Young and the Invested show up more often in Google’s “Top Stories” feed, as well as in a dedicated “From Your Sources” section on Google’s search results page.

How to Pick a Stock That Aligns With Your Investing Goals

When you start investing, you need to have a little psychological self-check. Think about why you’re investing, and what kind of investor you want to be.

So, ask yourself: Are you investing your money to grow it a little before you buy a car next year, or are you saving for your retirement decades down the road? Does the thought of risk make you want to vomit and stop investing entirely, or are you OK with knowing that you could face big ups and downs. Answers to questions like these will help determine what kinds of stocks you’ll be most comfortable with.

A few big, broad categories of stocks you’ll need to know:

Growth Stocks

Growth stocks are companies that are expanding their profits and sales at a steady clip. Typically, growth stocks are firms that have either an attractive product they are bringing to new markets or a steady drumbeat of new items they can sell to existing customers to open up new revenue streams. Technology companies are typically the most common example of growth stocks, as they bring new gadgets to market that are better or faster than previous products.

Growth stocks are best suited for investors who want high capital appreciation (stock gains) and are OK with some risk.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

Value Stocks

Value stocks, on the other hand, are companies that might not be expanding rapidly but have a strong underlying business. Think of a local bank or a utility company that might have trouble doubling in size over the next few years, but doesn’t face a lot of competition or disruption to its business model. These kinds of companies are often more stable thanks to the underlying value of their businesses.

Value stocks tend to be less volatile than their more growth-oriented counterparts, though their potential for growth is generally smaller.

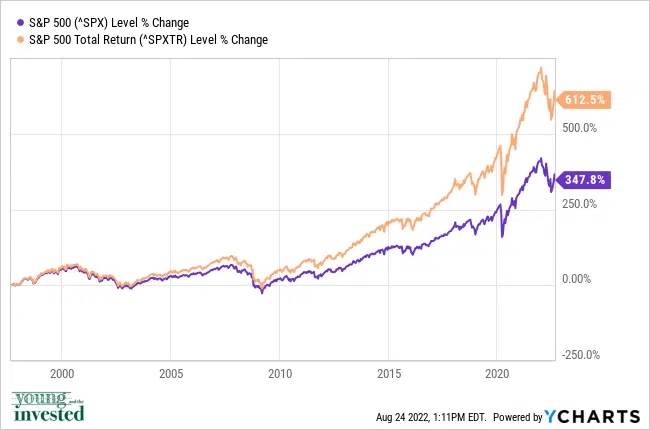

Dividend Stocks

Dividend stocks (which commonly are value stocks, but can be growth stocks) are a great way to drive high long-term performance. These companies pay a regular flow of their profits directly back to shareholders, meaning you receive some sort of return regardless of the ebb and flow of share prices.

Over a long period of time, that one-two punch of dividends and capital appreciation is a powerful builder of wealth.

Here’s a look at the return someone could expect if they received just the price returns from the S&P 500 over the past 25 years:

Now look at how much better the return is when you factor in dividends (had you had reinvested those dividends back into the S&P 500):

The price return is about 4.5x. The total return (price plus dividends) is more than 7x!

Market Capitalization

For some investors, size matters, too.

Company size is typically measured by “market capitalization,” which is the number of outstanding shares multiplied by the share price. So, for instance, a company with 1 billion shares worth $10 each would be worth $10 billion. And, broadly speaking, companies of certain sizes have certain characteristics:

- Small-cap stocks ($2 billion or less): Small companies tend to either be very young, or if they’ve been around for a while, serve very niche markets. A small-cap stock might derive most if not all of its revenue from just one product or service, meaning any disruption to that offering can materially affect the business. Because of that risk, these companies can struggle to get financial backing when it’s needed—and if they succeed, it could be expensive to pay off. This all makes smaller stocks riskier and more volatile. The tradeoff? High growth potential. The company’s offerings typically haven’t reached full saturation, and they have the potential to bring many more products and services to life.

- Large-cap stocks ($10 billion or more): Large companies tend to be more established, mature companies with multiple revenue streams—thus, if one of their products or services sees weak demand, they might struggle, but other products and services should keep them afloat. Bigger companies typically have better and cheaper access to capital (say, taking out a loan or issuing bonds). As a result, their stock prices are more stable. However, large-cap stocks also have less growth potential. As the saying goes: “It’s easier to double from $1 million in sales than it is to double from $1 billion.” And it’s true.

- Mid-cap stocks ($2 billion-$10 billion): Like with Goldilocks and the three bears, the middle is just right for many investors. Mid-cap stocks typically enjoy characteristics of their larger and smaller cousins. They have more growth potential than larger companies, but less risk and better access to capital than small-cap stocks. Just consider this nugget from Hennessy Funds (emphasis ours):

“In any given 1-year rolling period since 2000, small-, mid-, and large-cap stocks have outperformed 33%, 31%, and 36% of the time. However, the longer mid-cap stocks are held, the more often they outperformed. In fact, 64% of the time, mid-caps outperformed small- and large-cap stocks over any 10-year rolling period in the past 20 years.“

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

Do Stock Recommendations Include Advice to Buy and Sell Stocks?

Yes, indeed, they do. Stock picking services typically don’t just tell you when to buy stocks—they tell you when to sell them, too.

You’d expect this from short-term trading services, where the goal is to lock in gains after a few months, weeks, or even days. But even long-term stock recommendation services discuss not just when to buy, but when to sell. That’s because even great companies—those you might plan on holding for decades—can take material turns for the worse, and blindly holding on to them will cripple your returns.

Do Stock Recommendation Services Only Suggest Publicly Traded Companies?

Largely speaking, yes. Stock-picking services, as the name suggests, specialize in stocks—and by and large, most people can only buy and sell publicly traded stocks.

Some alternative investment platforms will help investors pick out privately held assets, but those aren’t stock recommendation services.