If you prefer to own mutual funds who are run by skilled human managers, T. Rowe Price is among the first fund providers you should explore.

T. Rowe Price has accumulated roughly $1.8 trillion in investor assets over the better part of the past century. Most of that can be attributed to the firm’s ably managed products. Indeed, that’s where T. Rowe has made its name.

That makes T. Rowe something of a rarity. Nowadays, fund providers like Vanguard and BlackRock have built reputations on (and collected massive assets because of) their extensive index-fund lineups. There’s hardly anything wrong with that; they certainly make investing cheaper. But most of T. Rowe Price’s offerings have always been led by human managers and analysis teams picking stocks and bonds, they still are today, and the company has done little to suggest it will ever be any other way.

Let’s look at some of the best T. Rowe Price funds to buy for 2026. Each fund represents a distinct strategy catering to a typical investor need, and each fund, though actively managed, still charges competitive fees.

Editor’s Note: Tabular data shown in this article is up-to-date as of Jan. 30, 2026.

Featured Financial Products

Disclaimer: This article does not constitute individualized investment advice. Individual securities, funds, and/or other investments appear for your consideration and not as personalized investment recommendations. Act at your own discretion.

Table of Contents

Why Invest With T. Rowe Price?

Thomas Rowe Price, Jr., founded his namesake company in 1937 as a wealth management firm. The firm launched its first mutual fund in 1950—and 75 years later, the company had exploded into a financial giant commanding well more than $1 trillion in assets, boasting nearly 8,000 associates worldwide, and offering more than 150 funds here in the U.S. alone.

That growth has come largely on the back of stellar managers—stars like former T. Rowe Price Health Sciences head Kris Jenner and current T. Rowe Price Capital Appreciation Manager David Giroux. But it’s also worth noting that while T. Rowe isn’t really known for skinflint fees, its expenses tend to be quite competitive, helping to attract investor money, too.

A few stats help tell the tale:

— More than 85% of T. Rowe Price funds charge expenses lower than the average price of comparable active funds in their Morningstar category.

— T. Rowe Price funds beat comparable passive peer funds 71% of the time (measured in 10-year periods over the past 20 years), which is better than the average across all active managers (50%) and the five largest active managers (62%).

— More than 90% of T. Rowe retirement funds with a minimum 10-year track record beat their Lipper average for the period.

Put simply: T. Rowe offers productive, cost-effective investment products across numerous core and satellite strategies. And it does so while keeping human managers front and center.

How Were the Best T. Rowe Price Funds Selected?

T. Rowe Price boasts more than 150 mutual funds across a number of strategies—stock, bond, allocation, target-date, and more. That’s many, many more than any one investor would ever need, but given their generally high overall quality, whittling it down to a few select choices isn’t exactly easy.

I start virtually every review of investment funds by booting up Morningstar Investor and running a quality screen I customize for each article. Here, I began by singling out T. Rowe funds that have earned a Morningstar Medalist rating of Gold or Silver. Whereas Morningstar’s Star ratings are based upon past performance data, Morningstar Medalist ratings are a forward-looking analytical view of a fund. Per Morningstar:

“For actively managed funds, the top three ratings of Gold, Silver, and Bronze all indicate that our analysts expect the rated investment vehicle to produce positive alpha relative to its Morningstar Category index over the long term, meaning a period of at least five years. For passive strategies, the same ratings indicate that we expect the fund to deliver alpha relative to its Morningstar Category index that is above the lesser of the category median or zero over the long term.”

A Medalist rating doesn’t mean Morningstar is necessarily bullish on the underlying asset class or categorization. It’s merely an expression of confidence in the fund compared to its peers. Screening for Gold- and Silver-rated funds helps to find high-quality products across a number of categories.

Unlike some of the other big-name fund providers, T. Rowe Price hasn’t made a name for itself by pushing fees to the floor. So I’ve limited the list to T. Rowe mutual funds with costs that are at least considered average within their category, if not below average.

From the remaining universe of several dozen funds, I selected a range of products that address various core portfolio goals, have good-to-great track records, and are generally accessible to most investors (reasonable investment minimums, can be bought in most accounts).

Note: Mutual funds selected for 2026 all had Gold or Silver Medalist ratings as of January 2026. Funds will remain on the list throughout 2026 as long as they maintain a minimum of Bronze. Funds that fall below that threshold will be replaced.

T. Rowe Price’s Best Mutual Funds

Below are seven great T. Rowe Price funds best suited as core portfolio holdings.

All of the T. Rowe Price funds listed here have a $2,500 minimum initial investment unless otherwise indicated (after that, additional purchase minimums are just $100) and are open to new investors. If you purchase these funds within an IRA, you can typically do so at smaller minimums, often just $1,000. And if any of these T. Rowe Price funds are available in your 401(k), you can buy them with no investment minimum.

Also worth noting: All but one of these funds are actively managed. While T. Rowe does have a solid lineup of index funds, managed funds earn an overwhelming majority of the firm’s Morningstar Gold Medalist ratings.

In no particular order …

1. T. Rowe Price Equity Index 500

— Style: U.S. all-cap growth stock

— Assets under management: $37.9 billion

— Dividend yield: 1.0%

— Expense ratio: 0.18%, or $1.80 per year for every $1,000 invested

— Morningstar Medalist Rating: Silver

I’ll start with the lone index fund on this list.

While T. Rowe Price’s managers are generally excellent, when it comes to large-cap stocks, it’s tough to beat the S&P 500. Human managers in the “large blend” space (funds, like S&P 500 products, that hold large-cap growth stocks and value stocks) have historically struggled to consistently eclipse the index.

“I know guys that rate active managers in all these categories, and even they’re like, ‘I’m not buying actively managed large blend; I’m just indexing,'” says Daniel Sotiroff, Senior Analyst for ETF and Passive Strategies at Morningstar. “Because it’s so brutally tough to beat a dirt-cheap index fund in the large blend category.”

Warren Buffett himself—considered by many to be the greatest investor in history—has said on multiple occasions that most investors most of the time should simply invest in an S&P 500 index fund and be done with it.

Related: 11 Best Vanguard Funds for the Everyday Investor

So if you’re going to go with one of T. Rowe Price’s index funds, I’d argue it should be the T. Rowe Price Equity Index 500 (PREIX).

PREIX holds a collection of the largest and most dominant U.S. companies. Like many indexes, the S&P 500 is what’s called “market-cap weighted,” which means the larger the company, the more weight the stock has in the index (and thus the more impact it has on returns). Thus, right now, PREIX dedicates the largest portions of its assets to companies like Nvidia (NVDA), Apple (AAPL), and Microsoft (MSFT) whose market caps are measured in trillions of dollars.

Turnover—how much the fund tends to buy and sell holdings—is extremely low, too, because only a handful of stocks enter or leave the index in any given year. As a result, PREIX typically makes little to no capital gains distributions at the end of the year, making it a very tax-efficient investment for taxable brokerage accounts.

Financial experts frequently suggest using an S&P 500 fund as the core of your portfolio given its exposure to hundreds of larger, more financially stable companies across all sectors—from tech to health care to real estate. Because of this diversity of holdings, the S&P 500 not only provides access to the growth of the American economy, but a modest level of dividend income, too. PREIX’s yield might not seem like much right now. However, reinvested over time, the S&P 500’s dividends make up roughly 35% to 50% of the index’s returns over the very long term (depending on the time period and study you’re looking at).

One weakness we can’t ignore: Its expenses. At 0.18%, Equity Index 500 is much more expensive than not just S&P 500 ETFs, but other S&P 500 mutual funds. Indeed, I’ll note that while PREIX earns a Silver Morningstar Medalist rating, less expensive S&P 500 funds from other providers garner Gold ratings. However, it’s still a dominant strategy that’s worth examining if you invest solely in T. Rowe Price funds.

Related: 15 Dividend Kings for Royally Resilient Income

Featured Financial Products

2. T. Rowe Price Dividend Growth Fund

— Style: U.S. large-cap dividend-growth stock

— Assets under management: $24.0 billion

— Dividend yield: 0.9%

— Expense ratio: 0.64%, or $6.40 per year for every $1,000 invested

— Morningstar Medalist rating: Gold

All dividend funds aren’t created equally. If you see a fund with “dividend” in its name and assume it’s trying to deliver a superior dividend yield, chances are you’ll be right more often than you’ll be wrong. But that’s not the case with T. Rowe Price Dividend Growth Fund (PRDGX).

PRDGX is a dividend-growth fund. This kind of strategy involves owning companies that regularly improve their payouts over time, which accomplishes a couple of things. For one, while it might not score you high current yield, it can generate a higher “yield on cost” down the road. Yield on cost is what you’re actually earning based on the price at which you bought the stock. (Example: A $100 stock paying $1 in annual dividends yields 1%. But because you bought the stock at $50, your yield on cost is 2%.)

Also, dividend-growth stocks tend to be high-quality equities. After all, you can’t sustainably increase how much cash you’re shelling out to shareholders if you’re unable to turn a profit—you need strong financials and excellent cash flows. So dividend growth is often considered a quality screen of sorts that ensures the fund owns a higher grade of company.

Related: The 10 Best Dividend ETFs [Get Income + Diversify]

That’s what you get with PRDGX.

“Manager Tom Huber focuses on financially healthy companies that can maintain above-average payout growth,” Morningstar analyst Stephen Welch says. “He believes dividend growers offer outperformance with lower volatility.”

Specifically, Huber is tasked with building a portfolio of companies “that have a strong track record of paying dividends or that are expected to increase their dividends over time.” I emphasize “or” because it’s … well, different. Many dividend-growth index funds are required, thanks to the rules that govern the index, to own companies that have improved their payouts without interruption for some set period of time. That’s not the case with T. Rowe Price Dividend Growth. Huber has full discretion here.

For instance, holding Ross Stores (ROST) actually suspended its distribution for a few quarters in 2020—and was booted from the Dividend Aristocrats as a result. However, it resumed payouts in 2021 at its previous level and has raised each year since then, so it’s certainly a dividend grower once more.

But ROST is an outlier. The fund’s 90-stock portfolio is chock-full of blue-chip serial dividend raisers such as Visa (V), Chubb (CB), and Walmart (WMT).

I’ll also note that the actively managed T. Rowe Price Dividend Growth ETF (TDVG) offers similar exposure and charges 0.50% annually.

Related: The Best Dividend Stocks: 10 Pro-Grade Income Picks for 2026

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

3. T. Rowe Price Global Stock Fund

— Style: Global large-cap growth stock

— Assets under management: $7.4 billion

— Dividend yield: 0.2%

— Expense ratio: 0.81%, or $8.10 per year for every $1,000 invested

— Morningstar Medalist rating: Gold

The U.S. has been one of the world’s most fruitful stock markets for decades. So if you believe in the American economy’s ability to keep growing, naturally, you should continue to invest the lion’s share of your money in U.S. assets.

Related: The 13 Best Mutual Funds You Can Buy

Still, many advisors will tell you it’s important to diversify geographically, too—a little hedging of bets, sure, but also, there are hundreds of high-achieving companies scattered across the globe, and it makes sense to have a little exposure to those firms, too.

You can get the best of both worlds with the T. Rowe Price Global Stock Fund (PRGSX).

An important note about fund terminology. The word “international” in a fund’s name implies its holdings come from anywhere but America. However, the word “global” implies that the fund holds both U.S. and international stocks. PRGSX is the latter. This 125-stock portfolio, which is overwhelmingly large-cap in nature and has a clear bent toward growth stocks, is split roughly 55% domestic/45% foreign. The international portion of the portfolio is most heavily tilted toward the U.K., Taiwan, Japan, and the Netherlands right now. Top 10 holdings are thick in U.S. stocks, but Unilever (UL), Adyen (ADYEY), Taiwan Semiconductor (TSM), and Samsung make the cut for the away team.

Related: 9 Best Fidelity ETFs for 2026 [Invest Tactically]

Manager David Eiswert and his team of global analysts home in on companies capable of generating above-average earnings growth over time.

“Many investment managers prefer a stable market environment, but this strategy’s skipper is always on the hunt for change,” Morningstar’s Sabban says. “Manager David Eiswert has built a great track record on the back of strong stock selection, timely trades, and the mental flexibility to pivot away from profitable trends before they sour.”

Even at its worst, PRGSX still tends to top the category average. But when it shines—which it does over most medium- and long-term time frames—it’s not just one of the best T. Rowe Price mutual funds you can buy, but one of the best funds period.

Make Young and the Invested your preferred news source on Google

Simply go to your preferences page and select the ✓ box for Young and the Invested. Once you’ve made this update, you’ll see Young and the Invested show up more often in Google’s “Top Stories” feed, as well as in a dedicated “From Your Sources” section on Google’s search results page.

4. T. Rowe Price Dynamic Credit Fund

— Style: Nontraditional bond

— Assets under management: $1.2 billion

— SEC yield: 7.7%*

— Expense ratio: 0.63%**, or $6.30 per year for every $1,000 invested

— Morningstar Medalist rating: Silver

Most investors will want some exposure to bonds, but how much will largely be determined by your age. Bonds have little growth potential but produce a dependable stream of income, so they’re not great for generating wealth (your prime concern when you’re younger), but they’re outstanding for protecting wealth (increasingly pivotal as you age). That said, buying individual bonds is difficult because of a dearth of data and research on single issues; bond funds are a more practical solution for most people.

Many bond products must stay within certain parameters—they can only hold these kinds of bonds, they have to have this percentage of investment-grade bonds, maturities must be at least this long. But nontraditional bond funds’ restraints are typically few and far between, with managers given not just a long leash on the types of bonds they can carry, but sometimes also permission to use derivatives.

Related: 7 Best High-Yield Dividend Stocks: The Pros’ Picks for 2026

Or as Morningstar beautifully puts it, “nontraditional bond funds are like the grade-school kids that liked to color outside the lines.”

But freedom doesn’t necessarily mean every nontraditional bond fund will be full of exotic holdings. The Silver-rated T. Rowe Price Dynamic Credit Fund (RPIDX), for instance, is currently about 55% invested in corporate bonds, 17% in collateralized debt, and 10% in government bonds. It also has a little bit of corporate junk (4%) and a high (8%) amount of cash reserves; the rest is scattered across varied debt types. This is also very much a “global” fund, as about a third of the portfolio is ex-U.S. in nature; nothing too out of the ordinary.

That said, managers Kenneth Orchard and Steeve Boothe have a fairly aggressive portfolio right now. The majority of holdings (60%) are junk-rated, and about half of that is B or worse. Only 20% of the portfolio is investment-grade. The remainder (that isn’t cash reserves) is “not rated,” which simply means they’re not rated by Moody’s or Standard & Poor’s—it doesn’t imply anything about quality one way or another. Investors with the stomach for it are earning well more than 7% for their trouble, though.

RPIDX hit the markets in January 2019, so it’s not a terribly old fund. But so far, so good. It has beaten the category and Morningstar’s performance benchmark index over every meaningful time period, and its returns are within the top 15% of nontraditional bond funds over the trailing-five-year period. Indeed, RPIDX rates among the best bond funds you can buy.

* SEC yield reflects the interest earned across the most recent 30-day period. This is a standard measure for funds holding bonds and preferred stocks.

** 0.84% gross expense ratio is reduced with a 21-basis-point fee waiver until at least Feb. 28, 2027.

Related: 7 Best High-Yield Dividend ETFs for Income-Hungry Investors

5. T. Rowe Price Balanced Fund

— Style: Moderate allocation

— Assets under management: $5.1 billion

— Dividend yield: 2.1%

— Expense ratio: 0.60%*, or $6.00 per year for every $1,000 invested

— Morningstar Medalist rating: Gold

If you want a simpler portfolio solution that covers multiple assets in a single fund, you might want to look for an “allocation fund” (aka “balanced fund,” aka “portfolio in a can”), which invests in both stocks and bonds … and occasionally other assets as well.

Naturally, different investors will want different blends of stocks and bonds. “Moderate” allocation funds, for instance, will have 50% to 70% of assets invested in stocks, with the rest in fixed income and cash.

T. Rowe Price Balanced Fund (RPBAX) managers Charles Shriver, Christina Noonan, and Toby Thompson aim for a 65/35 blend of stocks and bonds.

Related: How Much Is My RMD If I’ve Saved $1 Million for Retirement?

RPBAX holds individual stocks and bonds, sure—holdings include the likes of Nvidia, Microsoft, and Amazon (AMZN), as well as U.S. Treasury bonds. But it also holds agency debt, municipal bonds, corporate debt, and even a few of T. Rowe’s bond funds. And its top holding right now is T. Rowe Price Real Assets Fund I Shares (PRAFX), which holds companies that deal in “real assets” like real estate and metals—in other words, real estate investment trusts (REITs), mining companies, and other firms.

“Seasoned managers helm T. Rowe Price Balanced with support from robust investment teams,” Morningstar Senior Analyst Greg Carlson says. “Strong and stable underlying strategies form a well-diversified portfolio.”

Performance has largely been good across its history; RPBAX has beaten its category average and inded over every meaningful time frame.

* RPBAX must permanently waive a portion of its management fee to offset any acquired fund fees and expenses related to investments in other T. Rowe Price mutual funds. Currently, the 0.65% gross expense ratio is reduced with a 5-basis-point fee waiver.

Related: The 10 Best-Rated Dividend Aristocrats Right Now

6. T. Rowe Price Retirement Blend Funds

— Style: Target-date

— Assets under management (collectively): $1.7 billion

— Expense ratio: 0.34%-0.44%, or $3.40-$4.40 per year for every $1,000 invested

— Morningstar Medalist rating: Silver

One of the issues in building an appropriate allocation allocation is that your ideal mix of stock and bond funds will evolve over time based on your age and stage of life. An ideal portfolio for a 20-year-old is likely going to be very different from that of a 40-year-old, and both those portfolios will be different from what’s ideal for a 60-year-old.

This is where a target date fund can really be a lifesaver. A target-date fund—also called a life-cycle fund—is a type of mutual fund that is designed to change its asset allocation over time.

Related: 7 Best Fidelity Retirement Funds [Low-Cost + Long-Term]

The typical target-date fund is an actively managed fund—one that will start out with a heavy allocation to stocks and then slowly transition to a heavier allocation to bonds as it approaches its target retirement date, following a glide path.

The target retirement date is intended to be a rough estimate and doesn’t need to be precise. You’re generally not going to know the precise year you plan to retire decades in advance. Fidelity, like most mutual fund families, creates its target-date funds in five-year increments of target retirement date (say, 2025, 2030, 2035, etc.).

While T. Rowe Price has multiple target-date lines, one—T. Rowe Price Retirement Blend Funds—actually merits a qualifying Medalist rating for the accessible-to-all Investor-class shares.

The T. Rowe Price Retirement Blend Fund series is made up of 14 funds with target dates ranging from 2005 to 2070. They’re called “blend” to refer to the mix of index funds and actively managed funds they hold, which results in lower costs compared to T. Rowe’s Retirement Fund series. Retirement Blend 2025, for instance, currently has a 55/45 stock/bond mix, which it gets through holdings in funds such as T. Rowe Price Equity Index 500 Fund Z Class (TRHZX) and T. Rowe Price QM U.S. Bond Index Fund Z Class (TSBZX). (T. Rowe’s Z-class shares are largely used in T. Rowe Price “funds-of-funds,” advisory clients, and other institutional investors.)

Related: The 7 Best Closed-End Funds (CEFs) for 2026

Featured Financial Products

7. T. Rowe Price Capital Appreciation

— Style: Moderate allocation

— Assets under management: $70.6 billion

— Dividend yield: 1.8%

— Expense ratio: 0.71%*, or $7.10 per year for every $1,000 invested

— Morningstar Medalist rating: Gold

T. Rowe Price Capital Appreciation (PRWCX) comes at the tail end of this list—very much out of order—because of its status. Specifically, PRWCX is closed to most new investors. This is very much an exception to the rules I laid out above. However, I’m still including it among the best mutual funds you can buy both because of its extremely high quality and because this T. Rowe fund still might be available to some investors via select registered investment advisory (RIA) firms.

Related: The 10 Best Fidelity Funds You Can Own

T. Rowe Price Capital Appreciation is another allocation fund—this one designed to invest at least half its assets in stocks, with the rest socked into various debt securities, including corporate bonds, government debt (Treasuries, MBSes, asset-backed securities), and bank loans. It’s primarily a domestic fund, but it can hold at least a quarter of its assets in foreign equities and debt. PRWCX, which currently owns around 165 securities, places 60% of assets in domestic equities and a little more than 35% in domestic debt, sprinkling the rest around foreign bonds, foreign stock, preferred stock, convertible securities, and cash.

Morningstar Analyst Jason Kephart says David Giroux, who has managed the fund since June 2006, and his team “have earned a well-deserved reputation as one of the leading investment teams managing money for individual investors.”

“Giroux has helmed T. Rowe Price Capital Appreciation since mid-2006,” Kephart says. “Over that time, he’s displayed an innate ability to invest opportunistically across equities and bonds, capturing pockets of value through strong stock selection and impressively timed shifts between stock and bond exposure. His execution of this strategy’s nimble, contrarian approach has delivered topnotch returns for its investors.”

Related: 9 Best Vanguard Retirement Funds [Save More in 2026]

During his tenure, Giroux has beaten all of his category peers on both an absolute and risk-adjusted basis. He has also bested 93% of peers over the trailing five-year period, 97% over the trailing 10 years, and all peers over the past 15.

However, T. Rowe Price Capital Appreciation has a couple of critical sticking points, too:

One is the nature of its returns. The lion’s share of PRWCX’s returns come not as price appreciation, but year-end distributions of dividends and capital gains. That adds a layer of tax complexity, and as such, PRWCX is best held in tax-advantaged accounts like 401(k)s and IRAs.

The other is, as mentioned above, availability. PRWCX is largely closed to new investors, so most of us can’t just log into our browsers and buy this fund. But again, if your money is managed through certain registered investment advisers, you might actually be able to buy shares of this gem.

* 0.74% gross expense ratio is reduced with a 3-basis-point fee waiver until at least Feb. 28, 2027.

Related: 9 Best Schwab Funds You Can Buy: Low Fees, Low Minimums

What Is a Mutual Fund?

A mutual fund is an investment company that pools money from many investors to buy stocks, bonds or other securities. The investors get the benefits of professional management and certain economies of scale. A pool of potentially millions or even billions of dollars is large enough to diversify and might have access to investments that would be impractical for an individual investor to own.

Here’s an example: An investor wanting to mimic the S&P 500 Index (an index made up of 500 large, U.S.-listed companies) would generally have a hard time buying and managing a portfolio of 500 individual stocks, especially in the exact proportions of the S&P 500 Index. Another example: An investor wanting a diversified bond portfolio might have a hard time building one when individual bond issues can have minimum purchase sizes of thousands (or tens of thousands!) of dollars.

Equity funds or bond funds will generally be a far more practical solution.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

How to Invest in a Mutual Fund

To invest in a mutual fund, you’ll need to open an account with the fund sponsor or open a brokerage account with a broker that has a selling agreement in place with the fund sponsor. As a general rule, most large, popular mutual funds will be available at most brokers, so if you open a traditional investment account (like an IRA or brokerage), you’ll have access to most of the mutual funds you’d ever want to invest in.

Actively Managed Funds vs. Index Funds

There are infinite types of mutual funds, but all can be divided into two main camps:

— actively managed funds

— passively managed funds, also known as passive funds or, most commonly, index funds

Actively managed funds have professional managers that use their discretion to buy and sell securities. Whether they are value funds, growth funds, or anything in between, they are all essentially run the same way: A manager or team of managers buys and sells stocks, bonds, or other securities in the pursuit of price returns, dividends/income, or both.

Related: The 7 Best Mutual Funds for Beginners

Index funds, in contrast, are passive. There’s no manager actively looking to “beat the market.” The fund is simply looking to copy an index—which is based on a set of rules that the index automatically applies—enjoying that underlying investment exposure. Actively managed stock funds will try to cherry pick the stocks or bonds they like best. An index fund simply buys whatever its rules say to buy, then lets that portfolio run until it’s time to “rebalance” (apply the rules again).

The primary advantages of actively managed funds is that a talented manager can potentially outperform over time and may be adept at navigating a difficult period such as a bear market. But with an index fund, you generally get much lower costs in terms of management fees and trading expenses, better tax efficiency and performance that often ends up being better than that of many active managers.

Related: 6 Best Stock Recommendation Services [Stock Tips + Picks]

How Are Mutual Funds Different From Exchange-Traded Funds?

There is a lot of overlap between traditional mutual funds and their cousins, exchange-traded funds (ETFs). That’s because exchange-traded funds are very similar to mutual funds, but with a few different traits.

Related: The 16 Best ETFs to Buy for a Prosperous 2026

Like traditional mutual funds, an ETF will hold a basket of stocks, bonds, and other securities. These can be broad and tied to a major index like the S&P 500, or they can be exceptionally narrow and focus on a specific sector or even a specific trading strategy. For the most part, anything that can be held in an exchange traded fund can also be held in a mutual fund.

But there are some major differences. When you invest in a mutual fund, you (or your broker) actually send money to the manager, who in turn uses the cash to buy stocks or other investments. When you want to sell, the manager will sell off a tiny piece of the securities the mutual fund owns and send you the proceeds. Money generally enters or exits the fund once per day.

Related: 11 Best Investment Opportunities for Accredited Investors

Exchange-traded funds, on the other hand, trade on the New York Stock Exchange or another major exchange like a stock. If you want to buy shares, you don’t send the manager money; you just buy shares from another investor on the open market.

There are two advantages here. The first is that ETFs allow for intraday liquidity. If you want to buy or sell in the middle of the trading day—or multiple times throughout the trading day—you can.

The second advantage is tax efficiency. In a traditional mutual fund, redemptions by investors can generate selling by the manager that creates taxable capital gains for the remaining investors who didn’t sell. This doesn’t happen with ETFs, as the manager isn’t forced to buy or sell anything when an investor sells their shares.

Related: The 9 Best ETFs for Beginners

What Are Balanced Mutual Funds?

Balanced mutual funds, sometimes also called “hybrid funds” or “allocation funds,” hold both stocks and bonds. However, while the name might imply that all balanced funds hold an equal amount of stocks and bonds, that’s not quite the case.

Some balanced funds are “aggressive” and dedicate far greater assets to stocks than bonds—say, 80/20 stocks, or 70/30 stocks. Meanwhile, some balanced funds are “conservative” and invest most of their assets in bonds. Still more are much closer to a 50/50 split.

Like Young and the Invested’s content? Be sure to follow us.

Why Does a Fund’s Expense Ratio Matter So Much?

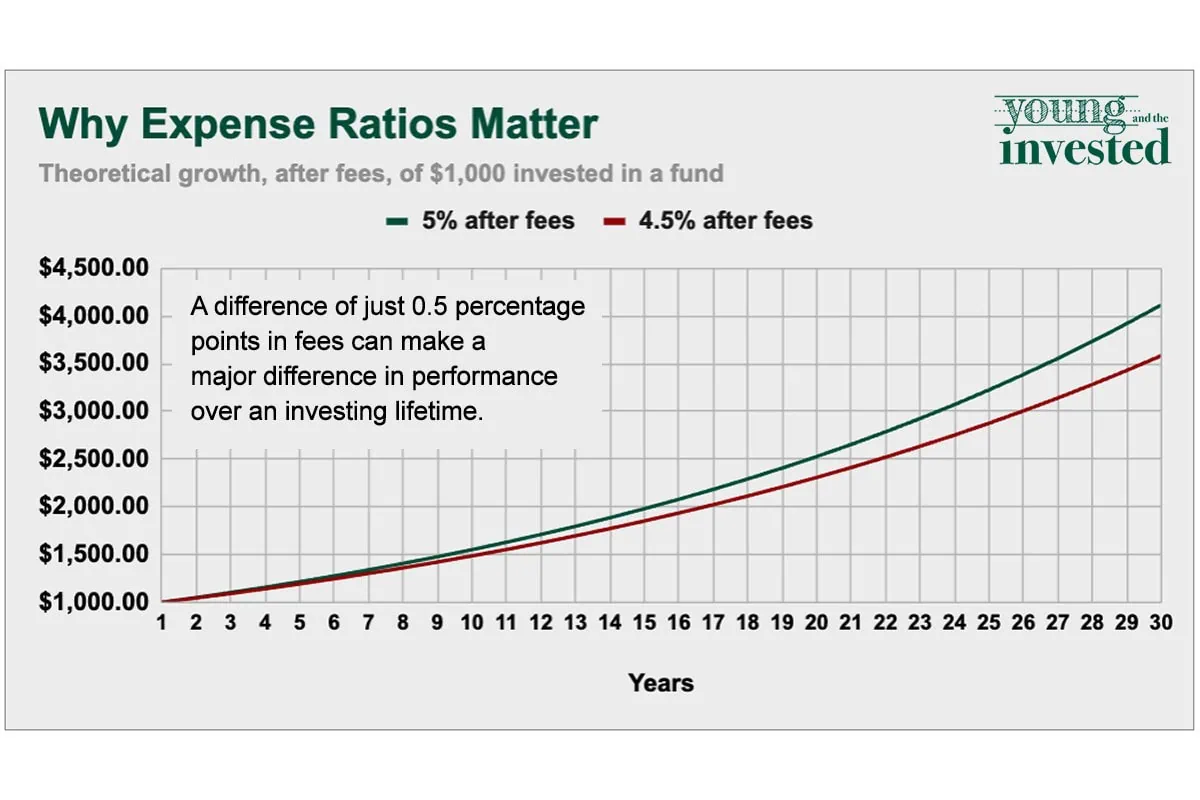

Every dollar you pay in expenses is a dollar that comes directly out of your returns. So, it is absolutely in your best interests to keep your expense ratios to an absolute minimum.

The expense ratio is the percentage of your investment lost each year to management fees, trading expenses and other fund expenses. Because index funds are passively managed and don’t have large staffs of portfolio managers and analysts to pay, they tend to have some of the lowest expense ratios of all mutual funds.

This matters because every dollar not lost to expenses is a dollar that is available to grow and compound. And over an investing lifetime, even a half a percent can have a huge impact. If you invest just $1,000 in a fund generating 5% per year after fees, over a 30-year horizon, it will grow to $4,116. However, if you invested $1,000 in the same fund, but it had an additional 50 basis points in fees (so it only generated 4.5% per year in returns), it would grow to only $3,584 over the same period.

Want to talk more about your financial goals or concerns? Our services include comprehensive financial planning, investment management, estate planning, taxes, and more! Schedule a call with Riley to discuss what you need, and what we can do for you.

Related: 10 Best Monthly Dividend Stocks for Frequent, Regular Income

The vast majority of American dividend stocks pay regular, reliable payouts—and they do so at a more frequent clip (quarterly) than dividend stocks in most other countries (typically every six months or year).

Still, if you’ve ever thought to yourself, “it’d sure be nice to collect these dividends more often,” you don’t have to look far. While they’re not terribly common, American exchanges boast dozens of monthly dividend stocks.

Related: 7 Best Vanguard Dividend Funds for 2026 [Low-Cost Income]

DepositPhotos

DepositPhotos

What’s better than a smart, sound dividend income strategy? How about a smart, sound dividend income strategy with very little money coming out of your pocket?

If that sounds good to you, you need look no farther than low-cost pioneer Vanguard, which offers up a number of payout-oriented products. Find out what you need to know in our list of seven top-notch Vanguard dividend funds.

Please Don’t Forget to Like, Follow and Comment

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Subscribe to Retire With Riley, our free weekly retirement planning newsletter, and

3. Give the article a Thumbs Up on the top-left side of the screen.

4. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!