Vanguard’s exchange-traded funds (ETFs) are a favorite choice among investors, offering a diverse range of investment strategies encapsulated in straightforward, budget-friendly ETFs.

Key highlights of the best Vanguard ETFs include their significant size and high liquidity, ensuring ease in trading. These ETFs are pivotal for cost-effective investment approaches, primarily because they are often the most affordable index funds in the market.

For those keen on constructing a portfolio while minimizing fee impact, this guide will delve into some of the top Vanguard ETFs for 2024. Catering to varied interests, whether it’s an inclination towards emerging or developed markets, a preference for growth-driven small-cap stocks, or a focus on stable, dividend-yielding blue-chip stocks, Vanguard offers an ETF suited for every investment style.

We’ll start with a little ETF education, then move on to the picks.

Disclaimer: This article does not constitute individualized investment advice. These funds appear for your consideration and not as personalized investment recommendations. Act at your own discretion.

Editor’s Note: Tabular data shown in this article is up-to-date as of Oct. 31, 2024.

Table of Contents

What Is an ETF?

We’ll start with the most basic of basics: “ETF” is an acronym for an “exchange-traded fund.” In plain English, that means it’s a grouping of different assets (stocks, bonds, etc.) into a fund—one that’s listed on an exchange, just like individual stocks. As such, an ETF can fluctuate in price across the trading day according to the value of those underlying assets.

Why Vanguard?

Vanguard is the No. 2 asset manager in the world with $8.0 trillion in assets under management, only trailing peer BlackRock ($9.4 trillion), according to data from the Sovereign Wealth Fund Institute. And with that size comes a massive breadth of investment options, as well as efficiencies of scale that are difficult for smaller investment companies to match.

It’s also worth noting that the best Vanguard ETFs are often low-cost, passive index funds. That means they are not aggressive vehicles that depend on overpaid managers to outperform the market, but rather “set it and forget it” funds tied to a fixed index of assets. This less flashy but more consistent approach has generally been shown to provide better long-term results.

The Best Vanguard ETFs

There is a massive universe of exchange-traded funds out there. So what makes the best Vanguard ETFs stand out over other ETFs?

A few factors include:

— Relative fees, not just low fees. After all, just because a fund only costs you several dollars per year doesn’t mean there isn’t an even cheaper alternative out there.

— Long-term potential. For the purpose of this article, we’re not talking about tactical or short-term bets, but rather foundational investments for the long haul.

— Different approaches for different investors. Also for the purpose of this article, we’re not looking for a single one-size-fits-all Vanguard ETF. Instead, the list is intended to be a menu of differentiated options that you can pick and choose from, based on your personal goals.

One final word of caution: Every investment carries risk, and even the best funds can lose you money if Wall Street suffers widespread declines.

With that disclaimer out of the way, let’s jump into the first Vanguard ETF on our list:

1. Vanguard Total Stock Market ETF

— Style: Total stock market

— Assets under management: $440.3 billion

— Expense ratio: $0.03%, or 30¢ per year for every $1,000 invested

— Dividend yield: 1.3%

As the name implies, the Vanguard Total Stock Market ETF (VTI) is a one-stop shop for investors who want exposure to the totality of the U.S. stock market in a single investment. All told, there are nearly 3,800 different stocks that make up this fund to represent all sectors and all sizes of companies.

One important factor to point out, however, is that the Vanguard Total Stock Market ETF does not treat every component equally. It’s weighted most heavily toward the largest stocks, with multi-trillion-dollar tech giants Apple (AAPL) and Microsoft (MSFT) each representing almost 6% of the entire fund by themselves (12% combined).

Related: The 7 Best Vanguard Index Funds for Beginners

But while it’s a bit top-heavy, that’s common among the cheapest index funds, regardless of the index they track. And it remains an elegantly simple solution for investors who just want to buy … well, the total stock market!

You’d also be in good company. This is one of the top five exchange-traded funds in the U.S. by assets. So while it’s not particularly sophisticated, it’s still a favorite of investors who think long-term, buy-and-hold strategies are preferable to more complex options.

Related: 7 Best Fidelity ETFs for 2024 [Invest Tactically]

2. Vanguard Dividend Appreciation ETF

— Style: Dividend-growth stock

— Assets under management: $86.1 billion

— Expense ratio: 0.06%, or 60¢ per year for every $1,000 invested

— Dividend yield: 1.8%

One of the popular ways for investors to reduce their risk profile in the stock market is to lean on dividend stocks. Some companies pay a portion of their profits back to shareholders in the form of cash distributions, called “dividends.” Dividends can provide another source of income aside from price returns.

Related: 12 Best Investment Opportunities for Accredited Investors

But also, stocks that pay dividends regularly tend to produce significant, reliable profits that they can afford to share. That implies a certain level of quality. For investors who want to take that level of quality one step further, there’s the Vanguard Dividend Appreciation ETF (VIG), which is composed of dividend stocks with track records of growing those payments over time.

Dividend growth is an important measure of health, but it’s also an important factor in compound returns over time. Your initial investment might be fixed, but the dividends should get larger and larger over time, meaning you could find yourself reaping a massive payday years down the road if you’re patient enough to buy and hold.

Related: 11 Best Alternative Investments [Options to Consider]

VIG’s focused list of about 300 total stocks includes insurance giant UnitedHeath Group (UNH), pharmaceutical company Johnson & Johnson (JNJ), and mega-bank JPMorgan Chase (JPM), to name a few.

If you want to focus on rock-solid companies like this in 2024, this Vanguard ETF is worth a look.

3. Vanguard Real Estate ETF

— Style: Sector (Real estate)

— Assets under management: $38.0 billion

— Expense ratio: 0.13%, or $1.30 per year for every $1,000 invested

— Dividend yield: 3.9%

You might have noticed that while VIG’s holdings might offer lower risk and growing payouts, the current dividend yield isn’t particularly impressive. Some investors prefer more yield up front; for those, one option is the Vanguard Real Estate ETF (VNQ).

This is the best Vanguard ETF for investing in real estate. VNQ holds real estate investment trusts, or REITs—a special class of company that enjoys operational tax breaks to accommodate the capital-intensive nature of real estate and property management. However, in exchange for those tax breaks, REITs must deliver 90% of taxable income back to their shareholders. This typically results in greater-than-average dividends. And the best REITs, which are able to produce the most regular and growing cash flows from their properties, are as consistent an investment as you’ll find on Wall Street.

Related: The 10 Best Vanguard Index Funds You Can Buy

The Vanguard Real Estate ETF currently holds about 170 REITs, including everything from industrial warehouse giant Prologis (PLD) to telecom tower operator American Tower (AMT) to mall operator Simon Property Group (SPG). And best of all, this portfolio collectively delivers a yield that is more than twice that of the previous fund, and nearly thrice the broader market.

Most of us can’t afford to buy a second home or an office building to rent out to tenants directly. But ETFs like VNQ allow us to tap into the big income potential of the real estate market.

Like Young and the Invested’s Content? Be sure to follow us.

4. Vanguard Information Technology ETF

— Style: Sector (Technology)

— Assets under management: $77.5 billion

— Expense ratio: $0.10%, or $1.00 per year for every $1,000 invested

— Dividend yield: 0.6%

The flip side of low-risk dividend stocks and REITs are high-growth companies that are focused on investing in future opportunities rather than sweeping their profits back to shareholders.

That’s what the Vanguard Information Technology ETF (VGT) has to offer.

VGT’s portfolio is composed of roughly 320 different technology stocks, ranging from the big names you know and love like Microsoft (MSFT) and Nvidia (NVDA) to smaller software developers, chipmakers, and other growth-oriented technology firms.

Tech had a heck of a year in 2023 and has continued that momentum into 2024, but keep in mind the sector doesn’t always come out on top. In 2022, even the biggest and most established names in Silicon Valley facing serious headwinds.

If you’re taking a long view, it’s difficult to imagine a future where high-tech stocks are not among the biggest winners—and this Vanguard ETF plays into this trend.

Related: The 10 Best Fidelity Funds You Can Own

5. Vanguard Total International Stock ETF

— Style: International stock

— Assets under management: $79.8 billion

— Expense ratio: 0.08%, or 80¢ per year for every $1,000 invested

— Dividend yield: 3.0%

So far we’ve only covered different ways to slice up the U.S. stock market. However, there’s a great big universe of companies out there beyond our borders.

That’s where the Vanguard Total International Stock ETF (VXUS) comes in.

Related: 10 Best Vanguard Funds for the Everyday Investor

This Vanguard ETF is an “ex-U.S.” offering, meaning it is designed to exclude companies in the United States to ensure the holdings don’t overlap with any domestic stock ETFs. However, VXUS’s massive portfolio of nearly 8,500 stocks still includes plenty of familiar names, including Japanese automaker Toyota (TM), Swiss consumer products giant Nestlé (NSRGY), British integrated oil firm Shell (SHEL), and Korean electronics giant Samsung, to name a few.

In an interconnected global economy, it’s a bit naive to think that multinational companies only rise and fall based on their local economies. That’s true for big U.S. names as well as the international giants that lead this Vanguard ETF. So if you want international diversification to truly play broad economic trends in 2024, consider layering VXUS into your portfolio.

Related: 12 Best Long-Term Stocks to Buy and Hold Forever

6. Vanguard FTSE Emerging Markets ETF

— Style: Emerging markets

— Assets under management: $84.5 billion

— Expense ratio: 0.08%, or 80¢ per year for every $1,000 invested

— Dividend yield: 2.6%

One potential downside to VXUS is that it’s heavy in so-called developed markets—more established but also slower-growth economies.

However, if you’re looking for a way to invest in higher-growth international names in markets like China and South America, the best Vanguard ETF for you would likely be the Vanguard FTSE Emerging Markets ETF (VWO).

This exchange-traded fund is a simple option that allows investors to tap into emerging markets in one simple, diversified holding. All told, there are some 5,600 stocks in VWO at present. The top regions represented are China (30% of assets), India (20%), Taiwan (19%), and Brazil (7%).

Related: 9 Best Real Estate Crowdfunding Sites + Platforms

A few of VWO’s holdings—blue chips like Asia e-commerce giant Alibaba Group (BABA), for instance—are accessible to most investors. But many smaller components only trade “over the counter” in the U.S., or worse, only on foreign exchanges, creating a lot of headaches for self-directed investors. This Vanguard ETF patches you into all of these stocks in one efficient, inexpensive bundle.

Related: 5 Best Fidelity Retirement Funds [Low-Cost + Long-Term]

7. Vanguard Total Bond Market ETF

— Style: Fixed income

— Assets under management: $118.8 billion

— Expense ratio: 0.03%, or 30¢ per year for every $1,000 invested

— SEC yield: 4.3%*

It wouldn’t be fair to just focus on Vanguard ETFs that hold stocks, given the massive rising interest rates we’ve seen over the last year or so. The U.S. Federal Reserve has steadily ratcheted up rates to right inflation, and while the central bank could be done hiking, the once-sleepy bond market has enjoyed renewed interest given much more attractive bond yields.

Related: The 7 Best Dividend ETFs [Get Income + Diversify]

Of course, bonds come in all shapes and sizes—from U.S. government bonds, to high-quality corporate bonds from top blue-chip companies, to riskier “junk” bonds from borrowers who are facing real challenges to operations. So if you’re already confused by the thousands of options in the stock market, looking into bonds on top of that would probably be downright overwhelming.

Thankfully, Vanguard Total Bond Market ETF (BND) is the best Vanguard ETF for diversified exposure to all these categories (except for the riskiest bonds out there). BND has a gigantic portfolio of nearly 18,000 “investment-grade” bonds that boast high credit quality, so you get a ton of diversification as well as a ton of peace of mind.

Related: The 7 Best Closed-End Funds (CEFs)

Bonds don’t deliver the quick gains that stocks can. But they offer steady and reliable income—which for many investors, is worth the lower potential reward to provide a lower overall risk profile to their portfolio.

* SEC yield reflects the interest earned across the most recent 30-day period. This is a standard measure for funds holding bonds and preferred stocks.

Like Young and the Invested’s Content? Be sure to follow us.

Learn More About These and Other Funds With Morningstar Investor

If you’re buying a fund you plan on holding for years (if not forever), you want to know you’re making the right selection. And Morningstar Investor can help you do that.

Morningstar Investor provides a wealth of information and comparable data points about mutual funds and ETFs—fees, risk, portfolio composition, performance, distributions, and more. Morningstar experts also provide detailed explanations and analysis of many of the funds the site covers.

With Morningstar Investor, you’ll enjoy a wealth of features, including Morningstar Portfolio X-Ray®, stock and fund watchlists, news and commentary, screeners, and more. And you can try it before you buy it. Right now, Morningstar Investor is offering a free seven-day trial. You can check out the current deal, as well as discounted rates for students and teachers, by visiting Morningstar’s site.

Are ETFs the Same Thing as Index Funds?

Not always. Most ETFs are index funds, meaning they are tied to a fixed “index” or list of securities. However, mutual can also be tied to indexes and thus be categorized as index funds, too. Similarly, both ETFs and mutual funds can instead follow a more dynamic or “active” list of investments. It can be confusing sometimes, but the bottom line is you should always read the investment materials an asset manager provides and look for a description. In the case of Vanguard, you’ll find a heading labeled “investment style” at the top of most ETF pages that will clearly identify whether funds are index funds, or active funds.

Like Young and the Invested’s Content? Be sure to follow us.

What Is a Mutual Fund?

A mutual fund is an investment company that pools money from many investors to buy stocks, bonds or other securities. The investors get the benefits of professional management and certain economies of scale. A pool of potentially millions or even billions of dollars is large enough to diversify and might have access to investments that would be impractical for an individual investor to own.

Here’s an example: An investor wanting to mimic the S&P 500 Index (an index made up of 500 large, U.S.-listed companies) would generally have a hard time buying and managing a portfolio of 500 individual stocks, especially in the exact proportions of the S&P 500 Index. Another example: An investor wanting a diversified bond portfolio might have a hard time building one when individual bond issues can have minimum purchase sizes of thousands (or tens of thousands!) of dollars.

Equity funds or bond funds will generally be a far more practical solution.

ETFs vs. Mutual Funds

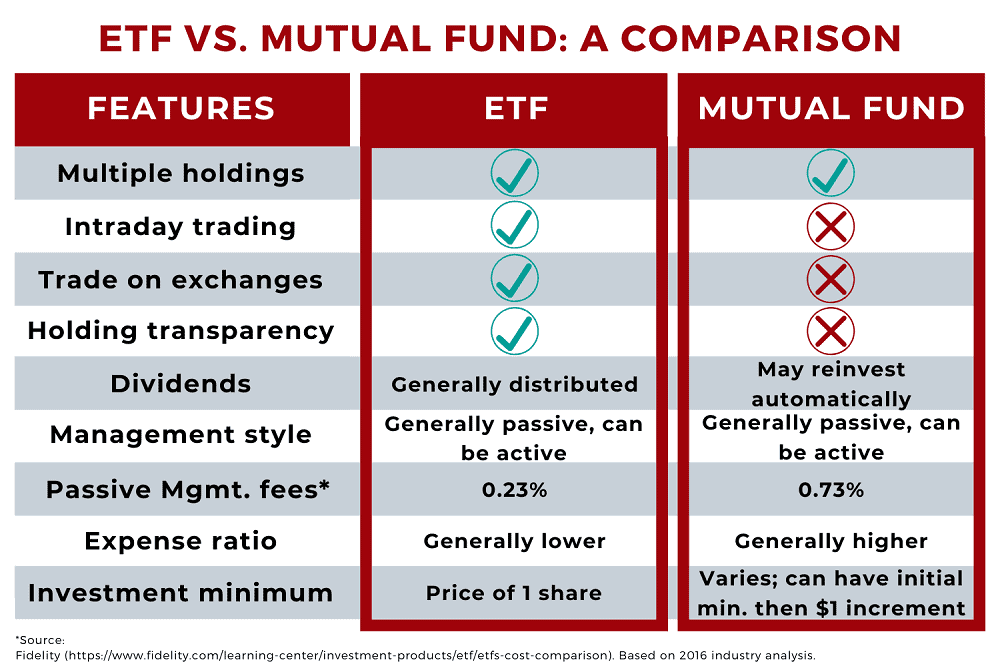

You might be familiar with this concept of bundled assets because that’s how traditional mutual funds work. But with mutual funds, all buying and selling happens just once each trading day, after the markets close at 4 p.m. ETFs, on the other hand, are available to buy and sell across the trading day.

ETFs are also structured differently than mutual funds and their other cousins, closed-end funds (CEFs), which tends to make them a little more tax-efficient. Also, unlike mutual funds, ETFs don’t have minimum investment thresholds—the minimum cost is just one share (or less if your broker offers fractional shares).

Lastly, ETFs tend to have cheaper fees than mutual funds, on average, but that’s because most ETFs are passively managed index funds, whereas most mutual funds are run by one or more human managers. But there are more expensive actively managed ETFs and cheap index mutual funds.

Does Vanguard Offer a Minimum-Volatility ETF?

Yes: The Vanguard U.S. Minimum Volatility ETF (VFMV). But investors should note two things about this ETF:

1. This is not an index fund. VFMV is actively managed by the Vanguard Quantitative Equity Group. Despite that, it does charge a fairly low fee of just 0.13%, or $1.30 annually for every $1,000 invested.

2. This is a minimum-volatility ETF, which is different than a low-volatility ETF. Min-vol funds typically try to reduce volatility while still maintaining some similarity to an underlying index–in this case, VFMV management will try to pick stocks they expect will have lower volatility than the market, but still hold stocks of varying sizes (large, mid, and small), from different industries and groups. Low-vol ETFs, however, typically invest in stocks based on backward-looking measures of volatility, and often aim for the lowest volatility possible without trying to mimic an index. For instance, a min-vol market ETF might be required to hold at least a 5% weight in all 11 sectors; a low-vol market ETF might hold the lowest-volatility stocks within the market, and as a result, some sectors simply might not be included.

Related: The 7 Best Fidelity Index Funds for Beginners

Why Does a Fund’s Expense Ratio Matter So Much?

Every dollar you pay in expenses is a dollar that comes directly out of your returns. So, it is absolutely in your best interests to keep your expense ratios to an absolute minimum.

The expense ratio is the percentage of your investment lost each year to management fees, trading expenses and other fund expenses. Because index funds are passively managed and don’t have large staffs of portfolio managers and analysts to pay, they tend to have some of the lowest expense ratios of all mutual funds.

This matters because every dollar not lost to expenses is a dollar that is available to grow and compound. And over an investing lifetime, even a half a percent can have a huge impact. If you invest just $1,000 in a fund generating 5% per year after fees, over a 30-year horizon, it will grow to $4,116. However, if you invested $1,000 in the same fund, but it had an additional 50 basis points in fees (so it only generated 4.5% per year in returns), it would grow to only $3,584 over the same period.

Like Young and the Invested’s Content? Be sure to follow us.

Related: The Best Fidelity ETFs for 2024 [Invest Tactically]

If you’re looking to build a diversified, low-cost portfolio of funds, Fidelity’s got a great lineup of ETFs that you need to see.

In addition to the greatest hits offered by most fund providers (e.g., S&P 500 index fund, total market index funds, and the like), they also offer specific funds that cover very niche investment ideas you might want to explore.

Related: Best Target-Date Funds: Vanguard vs. Schwab vs. Fidelity

Looking to simplify your retirement investing? Target-date funds are a great way to pick one fund that aligns with when you plan to retire and then contribute to it for life. These are some of the best funds to own for retirement if you don’t want to make any investment decisions on a regular basis.

We provide an overview of how these funds work, who they’re best for, and then compare the offerings of three leading fund providers: Vanguard, Schwab, and Fidelity.

Related: 9 Best Monthly Dividend Stocks for Frequent, Regular Income

The vast majority of American dividend stocks pay regular, reliable payouts—and they do so at a more frequent clip (quarterly) than dividend stocks in most other countries (typically every six months or year).

Still, if you’ve ever thought to yourself, “it’d sure be nice to collect these dividends more often,” you don’t have to look far. While they’re not terribly common, American exchanges boast dozens of monthly dividend stocks.

Please Don’t Forget to Like, Follow and Comment

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Subscribe to The Weekend Tea, our weekly newsletter to read more about investing, spending, taxes, and more, and

3. Give the article a Thumbs Up on the top-left side of the screen.

4. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!