Some things just belong together. Peanut butter and jelly. Spaghetti and meatballs. Vanguard and low fees.

Vanguard’s name has become synonymous with thin investment expenses. Indeed, if you’re seeking out the best Vanguard funds—which, I don’t know why else you’d be reading this article—you almost certainly expect to read about not just great products, but great, cost-effective products.

Vanguard has earned that expectation. The fund provider has built its reputation in large part by innovating a product (the index fund) that could drastically lower fees, but also in part by continuing to find ways to grind all fund expenses, index and actively managed alike, to the bone.

But I’ll be real with you: Cheap, by its lonesome, is crap. Investors have funneled trillions of dollars into Vanguard Group because Vanguard’s mutual funds and exchange-traded funds (ETFs) charge low expense ratios for high-quality strategies. That potent combination drives outperformance in many Vanguard funds while ensuring investors get to keep more of those returns.

Today, I’m going to explore some of the best Vanguard mutual funds to buy for 2026—a collection of passive and active products that are built for success without breaking the bank. This group of funds also fills multiple needs, with some serving as core portfolio holdings, and others acting as satellite positions you can use to focus on specific opportunities.

Editor’s Note: Tabular data presented in this article are up-to-date as of Dec. 24, 2025.

Disclaimer: This article does not constitute individualized investment advice. Securities, funds, and/or other investments appear for your consideration and not as personalized investment recommendations. Act at your own discretion.

Table of Contents

Why Vanguard?

Vanguard Group is one of the largest asset managers in the world, currently boasting nearly $12 trillion in assets under management (AUM).

Again, one of the primary drivers of that success is Vanguard’s dirt-cheap expenses. The average asset-weighted expense ratio for U.S. mutual funds and ETFs is 0.44%, or $4.40 annually for every $1,000 invested. Vanguard’s average, across 400-plus funds, is a scant 0.07%, or a mere 70¢ annually per $1,000 invested. That’s an astoundingly low number—one that means even when a Vanguard fund isn’t the absolute cheapest in its category, it’s still going to be one of your most cost-effective options.

These numbers are tiny, measured in mere basis points (a basis point is one one-hundredth of a percentage point). But they add up to massive savings. Christine Benz, Morningstar’s Director of Personal Finance and Retirement Planning, wrote in 2023 that in the previous year alone, “Vanguard’s cost advantage saved its investors collectively about $26 billion compared with what they would have shelled out if they had invested in funds with average expenses.”

And in early 2025, Vanguard announced its largest fee cut in history—a drop in price on 168 share classes across 87 funds that the firm predicts will save its investors $350 million in the first year alone.

Much of Vanguard’s success on the fee-fighting front can be chalked up to founder Jack Bogle, who created the first index mutual fund and helped proliferate this fund type. Now, low-cost index funds can be found the world over, bringing costs down for millions of investors—even those who don’t buy Vanguard’s products.

But Bogle, too, was responsible for more than just cheap investing. His investment philosophies helped shape Vanguard into the titan it is today, and sparked a group (the Bogleheads) who energetically follow in his footsteps.

How Were the Best Vanguard Mutual Funds Selected?

Vanguard currently boasts more than 300 mutual funds—not exactly the easiest number to whittle down to a handful.

So, as I normally do, I’ve started by booting up Morningstar Investor and running a quality screen that I customize for every search. In this case, I began by including only Vanguard mutual funds that have earned the top Morningstar Medalist rating of Gold. Unlike Morningstar’s Star ratings, which are based upon past performance, Morningstar Medalist ratings are a forward-looking analytical view of a fund. Per Morningstar:

“For actively managed funds, the top three ratings of Gold, Silver, and Bronze all indicate that our analysts expect the rated investment vehicle to produce positive alpha relative to its Morningstar Category index over the long term, meaning a period of at least five years. For passive strategies, the same ratings indicate that we expect the fund to deliver alpha relative to its Morningstar Category index that is above the lesser of the category median or zero over the long term.”

As I’ve written in other Young and the Invested articles, a Medalist rating doesn’t mean Morningstar is necessarily bullish on the underlying asset class or categorization. It’s merely an expression of confidence in the fund compared to its peers.

Also, because one of the primary draws of Vanguard funds is low fees, I am only considering funds whose expense ratios are well below their category average. Honestly, this didn’t do much to narrow the list, as most Vanguard mutual funds are … well, you get the point.

From the remaining universe of several dozen Vanguard funds, I selected a range of products that fit various portfolio goals, are directed by respected fund managers (active) or productive benchmark indexes (passive), and have good to great track records.

Lastly, note that all Vanguard funds listed here have a $3,000 minimum initial investment. If that’s too high for you, read on anyways, as many of these products have ETF-class shares you can purchase for the price of one share.

* Vanguard funds selected for 2026 all had Gold Medalist ratings as of late December 2025. Funds will remain on the list throughout 2026 as long as they maintain a minimum of Silver. Funds that fall below that threshold will be replaced.

1. Vanguard 500 Index Fund Admiral Shares

— Style: U.S. large-cap stock

— Management: Index

— Assets under management: $1.5 trillion*

— Dividend yield: 1.1%

— Expense ratio: 0.04%, or 40¢ per year for every $1,000 invested

The Vanguard 500 Index Fund Admiral Shares (VFIAX) is the very first index fund, and today it remains a gold standard in the U.S. mutual fund industry.

The Vanguard 500 Index Fund tracks the S&P 500—a collection of 500 of America’s largest companies that have met certain size, liquidity, and earnings criteria. This index, which has been around since the 1950s, is considered a reflection of the U.S. economy. But it’s not a perfect representation, nor is the U.S. economy perfectly balanced. Consider that the technology sector accounts for a third of FXAIX’s assets, while real estate, materials, energy, and utilities are weighted at less than 3% apiece.

The S&P 500 is “market-cap weighted,” which means the larger the company, the more weight the stock has in the index and thus the more impact it has on returns. Right now, VFIAX dedicates the largest portions of its assets to large-cap stocks** like Nvidia (NVDA), Apple (AAPL), and Microsoft (MSFT) whose market caps are measured in trillions of dollars.

VFIAX is also considered to be a “blend” fund, which means it has relatively even exposure to value stocks and growth stocks. Because of this diversity of holdings, the S&P 500 also offers a modest level of dividend income. The yield might not seem like much, but reinvested over time, the S&P 500’s dividends have made up roughly 35% to 50% of the index’s returns over the very long term (depending on the time period and study you’re looking at).

Related: The 13 Best Mutual Funds You Can Buy

Turnover—how much the fund tends to buy and sell holdings—is extremely low, too, because only a handful of stocks enter or leave the index in any given year. Turnover generates capital gains that funds must distribute to shareholders, and those gains distributions are taxable events. Fortunately, VFIAX’s capital gains distributions at the end of the year are typically small if not zero, making it a very tax-efficient investment for taxable brokerage accounts.

I’ll also note that, like many Vanguard mutual funds, VFIAX also trades as an ETF: the Vanguard S&P 500 ETF (VOO, 0.03% expense ratio), which currently trades at around $630 share.

VFIAX currently garners a Gold Medalist rating from Morningstar, and for that matter, so do several other fund providers’ low-cost S&P 500 funds. But why?

The S&P 500 serves as benchmark for large-cap fund managers, who simply can’t beat that benchmark on a consistent basis, particularly after fees. According to data from S&P Dow Jones Indices’ SPIVA (S&P Indices versus Active), a whopping 86% of actively managed large-cap funds have failed to beat the S&P 500 during the trailing 10-year period, and that number rises to 88% when looking at the past 15 years.

So if the pros can’t beat it, we might as well join it.

* Many Vanguard funds have multiple share classes, including ETFs. Listed net assets for Vanguard funds in this story refer to assets under management across all of a given fund’s share classes.

** There are different ways to define “cap” levels. We’re adhering to Morningstar’s definition, which says the largest 70% of companies by market capitalization within a fund’s “style” are large-caps, the next 20% by market cap are mid-caps, and the smallest 10% by market cap are small caps.

Related: Best Vanguard Retirement Funds for a 401(k) Plan

2. Vanguard Dividend Growth Fund Investor Shares

— Style: U.S. large-cap dividend-growth stock

— Management: Active

— Assets under management: $43.9 billion

— Dividend yield: 1.5%

— Expense ratio: 0.22%, or $2.20 per year for every $1,000 invested

If you say to yourself, “I’d like a Vanguard dividend fund because I’d like a higher level of yield,” surprisingly, it doesn’t exactly work like that. Some will provide a considerably higher yield—but not all.

I’ll provide examples of both.

First, a Vanguard dividend fund that delivers a pretty shrugworthy yield right now is the Vanguard Dividend Growth Investor Shares (VDIGX). But you shouldn’t write it off.

Vanguard says the actively managed VDIGX “focuses on high-quality companies that have both the ability and the commitment to grow their dividends over time.” In other words, the fund might not have a great yield now, but owners of this fund should enjoy a higher “yield on cost” (the yield you’re actually earning based on the price you bought the stock) as the years roll on. Also, dividend-growth stocks tend to be high-quality companies; only firms with strong financials and excellent cash flows can afford to keep paying shareholders more every year.

So, in a way, dividend growth acts like a quality screen, of sorts, ensuring you’re owning a higher grade of stock.

Related: The 16 Best ETFs to Buy for a Prosperous 2026

Portfolio Manager Peter Fisher has a tight holding set of 44 predominantly mega-cap equities with bulletproof balance sheets. All of them have raised their payouts for at least a few years, but some have long histories of uninterrupted dividend growth. VDIGX holds not only Dividend Aristocrats (companies that have raised their dividends annually for at least 25 consecutive years), but even a few Dividend Kings (50 years) such as Procter & Gamble (PG) and Colgate-Palmolive (CL).

It’s worth noting that Fisher has only had sole control over the fund since Jan. 1, 2024. That’s when longtime manager Donald Kilbride stepped down, leaving the reins of VDIGX to his comanager. But Kilbride will continue to provide ideas for the portfolio.

“Fisher maintains the long-standing process. The strategy rests on the core tenet that compounding capital via companies that grow their dividends will produce strong long-term returns,” says Morningstar Senior Analyst Todd Trubey. “Fisher, like Kilbride, holds that growing cash dividends also serves as the most dependable measurement of continuous sound operation. They prefer to buy firms at reasonable prices, so they often add companies with temporary troubles.”

Again, it’s worth noting turnover is modest here, too, at 16%, which means in a given year, it trades 16 out of every 100 holdings. So VDIGX is fairly tax-efficient.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

3. Vanguard High Dividend Yield Index Fund Admiral Shares

— Style: U.S. large-cap dividend stock

— Management: Index

— Assets under management: $84.5 billion

— Dividend yield: 2.4%

— Expense ratio: 0.08%, or 80¢ per year for every $1,000 invested

If you’re more interested in securing a higher yield now, the Vanguard High Dividend Yield Index Fund Admiral Shares (VHYAX) is going to be one of the best Vanguard funds you can find.

As the name implies, Vanguard High Dividend Yield Index is focused on delivering more income. It does so through a list of 565 total components that are picked based on their current income potential—not hopes of bigger future paydays. (However, many VHYAX holdings grow their dividends, too.)

Related: 9 Best Schwab Funds You Can Buy: Low Fees, Low Minimums

That means this Vanguard index fund excludes companies like Apple that pay dividends but offer only modest yield, and instead is biased toward companies such as JPMorgan Chase (JPM) and Exxon Mobil (XOM) that pay significantly more than the average large-cap stock.

Vanguard High Dividend Yield Index’s focus on income results in a different sector mix than the above funds. For instance, financial companies make up more than 20% of holdings, followed by double-digit weightings in the industrial, technology, health care, and consumer staples sectors.

VHYAX is offered in ETF form, too: The Vanguard High Dividend Yield ETF (VYM, 0.06% expense ratio) trades around $145 per share.

Related: 7 Best High-Dividend ETFs for Income-Hungry Investors

4. Vanguard Strategic Small-Cap Equity Fund

— Style: U.S. small-cap stock

— Management: Active

— Assets under management: $2.2 billion

— Dividend yield: 0.8%

— Expense ratio: 0.21%, or $2.10 per year for every $1,000 invested

If your primary investing concern is growth, and you have a pretty healthy risk appetite, you might get more bang for your buck by investing in small-cap stocks.

As a general rule, smaller companies have more growth potential than larger firms. For one, as they say, it’s much easier to double your revenues from $1 million than $1 billion. And as these stocks become noticed by institutional investors and fund managers, or begin qualifying for certain indexes, they can begin to enjoy large-scale investments that drive their prices even higher.

Related: The 7 Best Fidelity Index Funds for Beginners

The rub is that smaller stocks tend to be more volatile. A smaller company’s revenues might be dependent on just one or two products or services—meaning a single disruption could have massive financial consequences. Small caps also have less access to capital than their larger peers, so they’re less likely to get a lifeline should they suffer from broader economic headwinds.

Buying these kinds of stocks individually is a high-risk, high-reward proposal—a company could feasibly double or get cut in half overnight. But if you wanted to harness some of the upside potential of small caps while tamping down risk, you could invest in a small-company fund like the Vanguard Strategic Small-Cap Equity Fund (VSTCX).

VSTCX, managed by Cesar Orosco, invests in roughly 600 small-cap equities that can be found within the MSCI US Small Cap 1750 Index. Orosco selects stocks that have similar risk to the index, but that he believes will provide better performance. The result is a diversified portfolio blending value stocks and growth stocks that have produced much better earnings growth as a whole than the benchmark index’s average.

Toss in top-90th-percentile performance over the trailing three-, five-, 10-, and 15-year periods, as well as exceedingly low management fees compared to its peers, and Strategic Small-Cap Equity easily rates among the best Vanguard mutual funds I’ve reviewed.

Just note that, like with many small-cap funds, turnover is on the high side at nearly 65%, so this is best held in tax-advantaged accounts like an individual retirement account (IRA), health savings account (HSA), or, if available, a 401(k).

Related: The 10 Best Dividend ETFs [Get Income + Diversify]

5. Vanguard Mid-Cap Index Fund Admiral Shares

— Style: U.S. mid-cap stock

— Management: Index

— Assets under management: $199.6 billion

— Dividend yield: 1.5%

— Expense ratio: 0.05%, or 50¢ per year for every $1,000 invested

Mid-cap stocks are the “Goldilocks” holding of the investment world. They’re bigger, more stable, and have better access to capital than their small-cap brethren, but they tend to be nimbler and have more upside potential to their big brothers in the large-cap space. Unfortunately, they often go ignored by people who gravitate either toward big, “safe” blue chips or potent small-caps … to their detriment.

Big mistake.

Related: 9 Best Fidelity ETFs for 2026 [Invest Tactically]

Here’s what Oregon-based equity manager Jensen Investment Management found in a study of mid-caps: “Since 1978, mid-cap stocks have outperformed small-caps over each of these rolling time periods: five, 10, 20, 30 and 40 years. They’ve even bested large-caps over the 30- and 40-year windows. These returns came with lower volatility than small-caps as well, making the evidence even more compelling. That means mid-caps haven’t just delivered better performance—they’ve done it more consistently, with fewer drawdowns.”

If you’d like to inject your portfolio with some mid-cap exposure, you can do so cost-effectively with the Vanguard Mid-Cap Index Fund Admiral Shares (VIMAX).

This Gold-rated fund owns almost 300 stocks. It’s not a pure mid-cap fund, with roughly 10% to 15% of assets veering into large-cap territory. VIMAX also boasts less concentration among top holdings than similar funds. Only a handful of stocks—energy producer Constellation Energy (CEG), miner Newmont (NEM), and investing app Robinhood Markets (HOOD)—are weighted above 1%.

Again, as is common among Vanguard index mutual funds, VIMAX has a sister ETF: the Vanguard Mid-Cap ETF (VO, 0.04% expense ratio), which trades at $295 per share.

Related: 9 Best Schwab ETFs to Buy [Build Your Core for Cheap]

6. Vanguard Strategic Equity Fund Investor Shares

— Style: U.S. small- and mid-cap stock

— Management: Active

— Assets under management: $9.8 billion

— Dividend yield: 1.0%

— Expense ratio: 0.17%, or $1.70 per year for every $1,000 invested

Another way to go about getting your small and mid-cap (“SMID”) exposure in one place is the Vanguard Strategic Equity Fund Investor Shares (VSEQX), also managed by VSTCX’s Orosco.

Related: The 10 Best Index Funds You Can Buy for 2026

Orosco takes a quantitative approach here. He uses a computer-driven stock selection process, hunting down attractive stocks within an MSCI index of SMID companies that he believes is capable of above-average growth. His system evaluates other variables, too, including improving fundamentals and attractive valuation.

VSEQX currently holds about 590 positions, split roughly 65/35 between small caps and mid-caps. Sector weights are largely in line with the category—technology, financials, and industrials enjoy the greatest slices of assets. And despite VSEQX’s focus on smaller-sized companies, there are still numerous recognizable names, including State Street (STT), eBay (EBAY), and Expedia (EXPE).

Orosco has only managed the fund since 2021 but has largely kept up the fund’s outstanding track record of performance. VSEQX sits within the top 15% of category funds over the trailing three-year period; the fund is around there or better in the trailing five-, 10-, and 15-year periods.

Related: The 7 Best Vanguard Index Funds for Beginners

“Orosco joined Vanguard’s QEG in April 2020 after a decade as a principal running systematic models at quant value firm AJO. He became a named manager here in February 2021 and a solo skipper later that year after managers James Stetler and Binbin Guo retired in June and September, respectively. Because he hadn’t spent a lot of time in QEG, Orosco brought a fresh, new perspective. And he brings a rare combination of computer expertise and investment acumen. Plus, he’s sensibly maintained what was working and adjusted what wasn’t.”

“Clearly, portfolio manager Orosco has been the driving force since his arrival nearly five years ago,” Morningstar analyst Todd Trubey says. “Long-term, it’s a great choice for smaller-cap U.S. equities.”

VSEQX does a fair bit of trading, with turnover of more than 60%. You can snuff out the tax liability of the resulting capital gains by stuffing this Vanguard fund into an IRA.

Make Young and the Invested your preferred news source on Google

Simply go to your preferences page and select the ✓ box for Young and the Invested. Once you’ve made this update, you’ll see Young and the Invested show up more often in Google’s “Top Stories” feed, as well as in a dedicated “From Your Sources” section on Google’s search results page.

7. Vanguard International Dividend Appreciation Index Fund Admiral Shares

— Style: Foreign large-cap dividend-growth stock

— Management: Index

— Assets under management: $9.4 billion

— Dividend yield: 1.8%

— Expense ratio: 0.16%, or $1.60 per year for every $1,000 invested

You might have noticed that all of the above funds have had a specifically U.S.-centric bent. That’s good—U.S. markets have long been among the most productive in the world, and if you believe in the American economy’s ability to keep growing, that should remain the case.

But most experts would tell you that it’s worth having at least some international exposure, and years like 2025 (in which international equities outperformed American stocks). One way to do that is through the Vanguard International Dividend Appreciation Index Fund Admiral Shares (VIAAX).

Vanguard International Dividend Appreciation Index has a similar thrust to Vanguard Dividend Growth in that it’s interested in owning high-quality companies, which it does by identifying and holding companies with a history of increasing their dividends. VIAAX tracks the S&P Global Ex-U.S. Dividend Growers Index, which consists of international firms that have improved their payouts on an annual basis for at least seven consecutive years. As an additional quality screen, the index excludes the 25% highest-yielding eligible companies from the index. Without getting too far into the weeds, high dividends can sometimes be the result of significant price drops and in some cases might not be sustainable.

Related: Best Vanguard Retirement Funds for an IRA

VIAAX is most heavily invested in developed European and Asian markets such as Japan, Switzerland, and the U.K., though it also has a high concentration in Canadian stocks, as well as some exposure to emerging markets such as India and China. But many of its roughly 335 holdings will be plenty familiar to Americans—it’s loaded with blue-chip multinational firms like German software company SAP (SAP), Swiss food giant Nestlé (NSRGY), and Japanese tech titan Sony (SNE). Also, as is common with developed-country funds, VIAAX’s yield is higher than comparable U.S. funds.

What you won’t find are real estate investment trusts (REITs). Why exclude what is typically the market’s highest-yielding sectors? One possible explanation is that most common stocks, such as those held in this Vanguard fund, pay qualified dividends, which enjoy favorable tax treatment at the long-term capital gains tax rate. Most REIT dividends, however, are non-qualified and are taxed as ordinary income at federal income tax rates. By excluding REITs, VHYAX can pay out 100% qualified dividend income, helping shareholders avoid a potential tax headache.

You can get this Vanguard fund as an ETF, too: the Vanguard International Dividend Appreciation ETF (VIGI, 0.10%), which you can buy for around $90 per share.

Related: Best Schwab Retirement Funds for an IRA

8. Vanguard Intermediate-Term Corporate Bond Index Fund Admiral Shares

— Style: Intermediate-term corporate bond

— Management: Index

— Assets under management: $61.1 billion

— SEC yield: 4.8%*

— Expense ratio: 0.06%, or 60¢ per year for every $1,000 invested

Most investors will want some exposure to bonds—debt issued by governments, companies, and other entities that pay interest to bondholders. But how much will largely depend on your age.

Bonds tend to be much less volatile than stocks, for better or worse; it limits downside, yes, but it also limits upside. Instead, most of the return from bonds comes from the steady stream of interest income they produce. They’re not great for generating wealth, which is your prime concern when you’re younger, but they’re outstanding for protecting wealth, which becomes increasingly pivotal as you age.

But it’s tough to go out and buy a single bond. Data and research on individual issues is much thinner than it is for publicly traded stocks, plus, some bonds have minimum investments in the tens of thousands of dollars. So, your best (and most economical) bet is to buy a bond fund, which can provide you with access to hundreds if not thousands of bonds.

For instance, the Vanguard Intermediate-Term Corporate Bond Index Fund Admiral Shares (VICSX) allows you to invest in more than 2,200 investment-grade corporate bonds with maturities of between five and 10 years.

Related: The 7 Best Closed-End Funds (CEFs) for the Rest of 2025

Investment-grade corporates are a little riskier than similar-maturity Treasuries, but you get a bit more yield as a result … and they’re not exactly poor-quality bonds. VICSX’s portfolio is split roughly 50/50 between BBB-rated bonds (the lowest investment-grade rating) and A-rated or above. Meanwhile, the focus on intermediates provides a fair blend of risk and income.

Duration (a measure of interest-rate risk) is 6.0 years, which implies that a 1-percentage-point increase in market interest rates would lead to a 6.0% short-term decline in the fund, and vice versa.

VICSX’s ETF version is the Vanguard Intermediate-Term Corporate Bond ETF (VCIT, 0.03% expense ratio), which goes for about $85 per share.

* SEC yield reflects the interest earned across the most recent 30-day period. This is a standard measure for funds holding bonds and preferred stocks.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

9. Vanguard Short-Term Treasury Index Fund Admiral Shares

— Style: Short-term U.S. Treasury bond

— Management: Index

— Assets under management: $30.0 billion

— SEC yield: 3.5%

— Expense ratio: 0.06%, or 60¢ per year for every $1,000 invested

Investors who want to significantly reduce risk might prefer the Vanguard Short-Term Treasury Index Fund Admiral Shares (VSBSX), which focuses on a subset of bonds that have very low risk for two reasons: they have short maturities, and they’re issued by the U.S. Treasury.

Maturity helps determine risk. Generally speaking, the longer the bond, the greater the risk that the bond might not be repaid. Interest rates come into play, too. When rates go higher, new bonds pay more, which tempt people to sell their old bonds for the new, higher-paying bonds. But the temptation is much greater when you’re dealing with longer-term bonds with lots of payments remaining—and not so great for short-term bonds with one or just a couple payments left.

Related: 7 Best Schwab Index Funds for Thrifty Investors

Meanwhile, U.S. Treasury bonds, which are backed by the full faith and credit of the U.S. government, are some of the highest-rated bonds on the planet. Is there 100% certainty they’ll be repaid? No. But is there a higher likelihood of repayment than the vast majority of issuers out there? You betcha.

VSBSX invests in more than 90 Treasury bond issues with maturities of between one and three years. And the lower risk is reflected in the averaged duration, which currently sits at just 1.9 years—thus, a 1-percentage-point hike in interest rates would knock VSBSX just 1.9% lower, versus a roughly 6% hit for the corporate bond fund VICSX. The flip side? VSBSX wouldn’t rise as much if interest rates declined.

That’s OK, as long as you know what you’re buying. If all you want is portfolio protection that can still generate some yield (at well more than 3% currently), VSBSX is one of the best Vanguard mutual funds you can buy. Or, if you prefer ETFs, you can purchase the Vanguard Short-Term Treasury ETF (VGSH, 0.03%), which goes for roughly $60 per share.

Related: 12 Best Investment Opportunities for Accredited Investors

10. Vanguard Wellington Fund Investor Shares

— Style: Moderate allocation

— Management: Active

— Assets under management: $119.5 billion

— Dividend yield: 1.9%

— Expense ratio: 0.25%, or $2.50 per year for every $1,000 invested

Vanguard Wellington Fund Investor Shares (VWELX) is Vanguard’s oldest mutual fund—a “balanced” or “allocation” product (read: stocks and bonds) that has been around since 1929. It’s managed by Wellington Management, an investment management company with nearly a century of operational experience.

Wellington, which is considered a moderate allocation fund, invests about two-thirds of assets in stocks, and the other third in bonds. The stock portion of the portfolio currently holds about 80 predominantly large-cap stocks with a median market cap of around $500 billion. It’s a “who’s who” of blue chips such as Microsoft, Apple, Amazon (AMZN), and Wells Fargo (WFC). It also includes a little exposure to international stocks—predominantly developed-country names like UBS Group (UBS) and Haleon (HLN).

Related: The 7 Best T. Rowe Price Funds for 2026

The bond portfolio is much more broadly diversified, at almost 1,600 investment-grade issues. The majority of that (roughly two-thirds) is invested in corporate bonds, with another 20% in Treasuries and agency bonds, and the rest peppered across mortgage-backed securities (MBSes), foreign sovereign bonds, and other debt.

Put more succinctly: Wellington is a one-stop shop for your core large-cap stock and bond needs, and its 0.25% in annual expenses is very inexpensive for the skilled management and strong performance track record you’re getting in return. Just make sure you’re considering your own investment needs with this fund—if you don’t want a third of your portfolio to be in bonds, you’ll want to put additional money into individual stocks, equity funds, and/or alternative investments.

Wellington has a fair bit of turnover (61%) and generates a decent chunk of interest income from its bond portfolio. So, if you’re going to invest in VWELX, it makes sense to do so in a tax-advantaged account.

Related: 10 Best Alternative Investments [Options to Consider]

11. Vanguard Wellesley Income Fund Investor Shares

— Style: Moderately conservative allocation

— Management: Active

— Assets under management: $49.3 billion

— SEC yield: 3.6%*

— Expense ratio: 0.23%, or $2.30 per year for every $1,000 invested

Another term for Wellington is a “portfolio in a can.” You see, because it holds most of what you’d want in an investment portfolio—mostly U.S. stocks and bonds, with a little international exposure—you theoretically could invest your entire nest egg in the fund and call it a day.

However, what if you wanted a portfolio in a can like Wellington but thought that its 66/33 stock-bond split was just too aggressive?

Related: Best Target-Date Funds: Vanguard vs. Schwab vs. Fidelity

Enter Vanguard Wellesley Income Fund Investor Shares (VWINX), a “moderately conservative” allocation fund that’s much more defensively positioned. Here, bonds make up more than 60% of the portfolio. VWINX holds about 1,350 bonds—primarily corporate debt, but also Treasury and agency bonds, and even sprinklings of foreign debt and MBSes. The remaining equity portion is spread across 75 stocks or so, with a distinct value tilt and with a little exposure to developed international markets.

VWINX performance has been mixed in nearer-term time frames, but its long-term track record is excellent. The fund’s trailing 15-year return is ahead of 80% of its peers.

“Vanguard Wellesley Income’s experienced managers wield a proven process rooted in fundamental research,” says Morningstar Analyst Stephen Margaria. “Paired with low fees, this fund is an excellent choice for investors seeking an income-focused allocation fund.”

* SEC yield is used instead of dividend yield here because of the fund’s bond-heavy allocation.

Related: 9 Best Vanguard Retirement Funds [Save More in 2026]

Learn More About These and Other Funds With Morningstar Investor

If you’re buying a fund you plan on holding for years (if not forever), you want to know you’re making the right selection. And Morningstar Investor can help you do that.

Morningstar Investor provides a wealth of information and comparable data points about mutual funds and ETFs—fees, risk, portfolio composition, performance, distributions, and more. Morningstar experts also provide detailed explanations and analysis of many of the funds the site covers.

With Morningstar Investor, you’ll enjoy a wealth of features, including Morningstar Portfolio X-Ray®, stock and fund watchlists, news and commentary, screeners, and more. And you can try it before you buy it. Right now, Morningstar Investor is offering a free seven-day trial and a discount on your first year’s subscription when you use our exclusive link.

- Morningstar Investor offers expert research, investing analysis, and advisor-grade portfolio management tools that are tailor-made for buy-and-hold investors.

- Morningstar is one of the most prized sources of mutual fund and exchange-traded fund (ETF) data in the world.

- How does your portfolio stack up? Put it through Morningstar's Portfolio X-Ray, which will provide insights such as whether you have too many overlapping holdings or whether you're paying too much in fees.

- Special Offer 1: Click our sign-up link to receive $50 off your first year of Morningstar Investor. (Annual plan only.)

- Special Offer 2: Students receive one year of Morningstar Investor access for just $25!

- Special Offer 3: Teachers receive a 60% discount on Morningstar Investor access.

- Top-flight fund research and analysis

- Portfolio management tool

- Powerful screener

- Watchlists

- Tailored news and commentary

- Below-average charting

- High monthly billing rate

What Is the Minimum Investment Amount on Vanguard Mutual Funds?

Vanguard funds are known for being shareholder-friendly. The Vanguard mutual fund company blazed new trails with the index fund, and Vanguard has done more than any other investment firm to keep costs to a minimum for investors.

But there is one hitch. Many of Vanguard’s cheapest funds in terms of fees have initial investment minimums of around $3,000.

If that is a problem for you, don’t sweat it. Most popular Vanguard index funds are also available as ETFs. Most self-directed HSAs will allow you to buy as little as one share, and some even allow for fractional shares. And if you use a commission-free brokerage, you can buy those ETFs without incurring additional fees. ETF prices vary, of course, but many cost less than $100, and they rarely exceed $400 per share.

What Is a Mutual Fund?

A mutual fund is an investment company that pools money from many investors to buy stocks, bonds or other securities. The investors get the benefits of professional management and certain economies of scale. A pool of potentially millions or even billions of dollars is large enough to diversify and might have access to investments that would be impractical for an individual investor to own.

Here’s an example: An investor wanting to mimic the S&P 500 Index (an index made up of 500 large, U.S.-listed companies) would generally have a hard time buying and managing a portfolio of 500 individual stocks, especially in the exact proportions of the S&P 500 Index. Another example: An investor wanting a diversified bond portfolio might have a hard time building one when individual bond issues can have minimum purchase sizes of thousands (or tens of thousands!) of dollars.

Equity funds or bond funds will generally be a far more practical solution.

Actively Managed Funds vs. Index Funds

There are infinite types of mutual funds, but all can be divided into two main camps:

— actively managed funds

— passively managed funds, also known as passive funds or, most commonly, index funds

Actively managed funds have professional managers that use their discretion to buy and sell securities. Whether they are value funds, growth funds, or anything in between, they are all essentially run the same way: A manager or team of managers buys and sells stocks, bonds, or other securities in the pursuit of price returns, dividends/income, or both.

Related: The 7 Best Mutual Funds for Beginners

Index funds, in contrast, are passive. There’s no manager actively looking to “beat the market.” The fund is simply looking to copy an index—which is based on a set of rules that the index automatically applies—enjoying that underlying investment exposure. Actively managed stock funds will try to cherry pick the stocks or bonds they like best. An index fund simply buys whatever its rules say to buy, then lets that portfolio run until it’s time to “rebalance” (apply the rules again).

Related: 6 Best Stock Recommendation Services [Stock Tips + Picks]

The primary advantages of actively managed funds is that a talented manager can potentially outperform over time and may be adept at navigating a difficult period such as a bear market. But with an index fund, you generally get much lower costs in terms of management fees and trading expenses, better tax efficiency and performance that often ends up being better than that of many active managers.

What Are Balanced Mutual Funds?

Balanced mutual funds, sometimes also called “hybrid funds” or “allocation funds,” hold both stocks and bonds. However, while the name might imply that all balanced funds hold an equal amount of stocks and bonds, that’s not quite the case.

Some balanced funds are “aggressive” and dedicate far greater assets to stocks than bonds—say, 80/20 stocks, or 70/30 stocks. Meanwhile, some balanced funds are “conservative” and invest most of their assets in bonds. Still more are much closer to a 50/50 split.

Like Young and the Invested’s content? Be sure to follow us.

How Are Mutual Funds Different From Exchange-Traded Funds?

There is a lot of overlap between traditional mutual funds and their cousins, exchange-traded funds (ETFs). That’s because exchange-traded funds are very similar to mutual funds, but with a few different traits.

Like traditional mutual funds, an ETF will hold a basket of stocks, bonds, and other securities. These can be broad and tied to a major index like the S&P 500, or they can be exceptionally narrow and focus on a specific sector or even a specific trading strategy. For the most part, anything that can be held in an exchange traded fund can also be held in a mutual fund.

But there are some major differences. When you invest in a mutual fund, you (or your broker) actually send money to the manager, who in turn uses the cash to buy stocks or other investments. When you want to sell, the manager will sell off a tiny piece of the securities the mutual fund owns and send you the proceeds. Money generally enters or exits the fund once per day.

Exchange-traded funds, on the other hand, trade on the New York Stock Exchange or another major exchange like a stock. If you want to buy shares, you don’t send the manager money; you just buy shares from another investor on the open market.

Related: The 9 Best ETFs for Beginners

There are two advantages here. The first is that ETFs allow for intraday liquidity. If you want to buy or sell in the middle of the trading day—or multiple times throughout the trading day—you can.

The second advantage is tax efficiency. In a traditional mutual fund, redemptions by investors can generate selling by the manager that creates taxable capital gains for the remaining investors who didn’t sell. This doesn’t happen with ETFs, as the manager isn’t forced to buy or sell anything when an investor sells their shares.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

Why Does a Fund’s Expense Ratio Matter So Much?

Every dollar you pay in expenses is a dollar that comes directly out of your returns. So, it is absolutely in your best interests to keep your expense ratios to an absolute minimum.

The expense ratio is the percentage of your investment lost each year to management fees, trading expenses and other fund expenses. Because index funds are passively managed and don’t have large staffs of portfolio managers and analysts to pay, they tend to have some of the lowest expense ratios of all mutual funds.

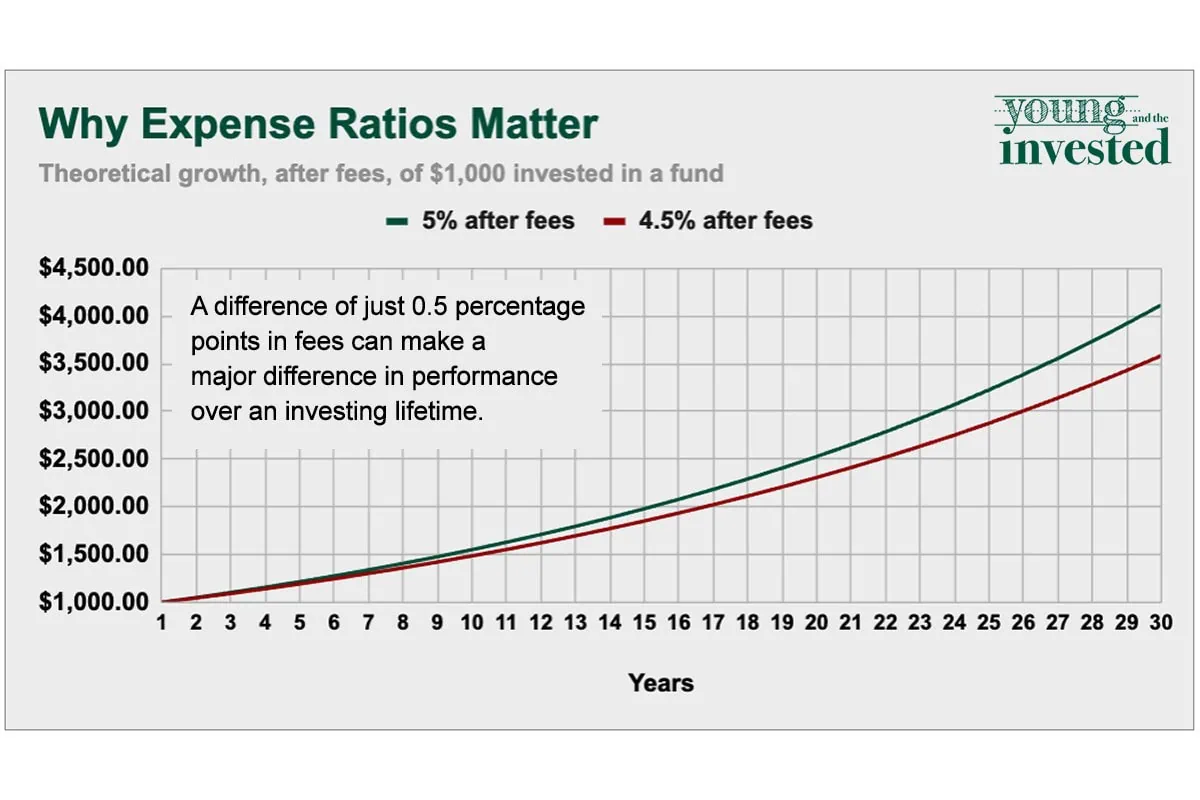

This matters because every dollar not lost to expenses is a dollar that is available to grow and compound. And over an investing lifetime, even a half a percent can have a huge impact. If you invest just $1,000 in a fund generating 5% per year after fees, over a 30-year horizon, it will grow to $4,116. However, if you invested $1,000 in the same fund, but it had an additional 50 basis points in fees (so it only generated 4.5% per year in returns), it would grow to only $3,584 over the same period.

Want to talk more about your financial goals or concerns? Our services include comprehensive financial planning, investment management, estate planning, taxes, and more! Schedule a call with Riley to discuss what you need, and what we can do for you.

Related: 13 Best Long-Term Stocks to Buy and Hold Forever

As even novice investors probably know, funds—whether they’re mutual funds or exchange-traded funds (ETFs)—are the simplest and easiest ways to invest in the stock market. But the best long-term stocks also offer many investors a way to stay “invested” intellectually—by following companies they believe in. They also provide investors with the potential for outperformance.

So if you’re looking for a starting point for your own portfolio, look no further. Check out our list of the best long-term stocks for buy-and-hold investors.

Related: The 10 Best-Rated Dividend Aristocrats Right Now

Dividend growth puts more cash in our pockets and signals that the company we’re invested in is confident in its ability to keep churning out profits. And there’s no more heralded group of dividend growers than the Dividend Aristocrats, which are companies that have paid higher cash distributions each year for at least a quarter-century.

But even Aristocrats aren’t created equally. Check out which dividend growers Wall Street loves the best right now in our list of the top-rated Dividend Aristocrats.

Please Don’t Forget to Like, Follow and Comment

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Subscribe to Retire With Riley, our free weekly retirement planning newsletter, and

3. Give the article a Thumbs Up on the top-left side of the screen.

4. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!