It’s certainly not a stretch to suggest that Vanguard’s mere existence has improved retirement saving and investing as we know it.

Under founder Jack Bogle, Vanguard pioneered the low-cost index fund: a product run not by a team of investment managers, but an index with specific rules about what can and cannot be included. Half a century later, that index fund doesn’t just still exist—it’s one of the largest such funds in the world. That’s a testament not just to that strategy’s popularity, but the fee-friendly index approach that has proliferated far and wide … bringing fund costs ever lower across the world.

Understandably, then, Vanguard remains one of the top choices for Americans looking to put their hard-earned money to work in accounts meant to grow those funds so they can be used in retirement. And today, we’re going to look at some of the company’s best such products.

Read on as I highlight 11 of the best Vanguard mutual funds for retirement savers. These funds have been selected because of their low fees, intelligent strategies, and in many cases, their ability to take advantage of the tax-deferred or -exempt nature of retirement accounts such as 401(k)s, individual retirement accounts (IRAs), and health savings accounts (HSAs).

Also, many Vanguard funds have ETF share classes, which are handy in case you use a broker that doesn’t allow for mutual funds, so where applicable, I’ll point you toward those ETF options, too.

Editor’s Note: The tabular data presented in this article is up-to-date as of Jan. 15, 2026.

Featured Financial Products

Disclaimer: This article does not constitute individualized investment advice. Individual securities, funds, and/or other investments appear for your consideration and not as personalized investment recommendations. Act at your own discretion.

Table of Contents

What Should You Want in a Retirement Fund?

Here are some of the most critical factors to consider when you start investing your retirement savings:

— Costs: Let’s say you paid $5 in expenses for every $100 a mutual fund earned you. That would be $5 that wouldn’t grow and compound for you over time. So if all else is equal, the lower the cost, the better. However, occasionally, a fund justifies its higher fees. Vanguard rarely has to justify its fees, however, as the best Vanguard retirement funds’ fees typically sit near or at the bottom of their category.

— Taxes: A taxable account (like a standard brokerage account) is better suited to take advantage of certain tax-advantaged investments, such as municipal bonds. For tax-advantaged accounts, such as 401(k)s, some of the best investments include bond funds (where the interest income won’t be taxed) and actively managed stock funds (where the capital gains distributions from heavy trading won’t be taxed).

— Diversification: You’ve likely always been told that you should hold a diversified portfolio, which means that you hold a variety of investments, not just one or two. That could mean holding multiple assets (stocks, bonds, commodities), but that could also mean holding, say, stocks from different countries, or stocks from different sectors. And investment funds, which can own any number of stocks, bonds, or other holdings all at once, can help you achieve that diversification. But every fund has its own level of built-in diversification. Some funds hold dozens of stocks while others hold thousands. Some funds invest heavily in their biggest stocks while others spread their assets out more evenly. So always consider how diversified a fund really is, as well as whether that level of diversification suits your needs.

— Income: You ideally want your retirement portfolio to produce regular income—in the form of both bond interest and dividend income. Stock prices can suffer during nasty corrections and bear markets, but income-generating funds can help provide for your living expenses without forcing you to sell at an inopportune time.

— Turnover: Turnover refers to the percentage of a fund’s holdings that “turn over” (are bought and sold) in a given year. Why does this matter? Buying and selling can rack up trading costs, for one. They can also result in capital gains, which funds must distribute to their shareholders. These distributions are taxable at a rate of up to 20% (for long-term capital gains) or 37% (for short-term capital gains). So, should you avoid funds with high turnover? Not necessarily. You can avoid these tax consequences if you own the fund in a tax-advantaged account like a 401(k) or IRA. In other words: Turnover might educate your decision about which account(s) you hold certain funds in.

Why Vanguard Mutual Funds?

Vanguard Group is a leader in index mutual funds. Vanguard founder Jack Bogle launched the first Vanguard index fund for U.S. retail investors—the Vanguard First Index Investment Trust, which is now the Vanguard 500 Index Fund Admiral Shares (VFIAX)—in 1976, and in the subsequent half-century or so, Vanguard Funds have grown to become the dominant force in index investing.

As I mentioned above, one of the primary reasons behind its success is Vanguard’s dirt-cheap expenses. The average asset-weighted expense ratio for U.S. mutual funds and ETFs is 0.44%, or $4.40 annually for every $1,000 invested. Vanguard’s average, across 400-plus funds, is a scant 0.07%, or a mere 70¢ annually per $1,000 invested. That’s an astoundingly low number—one that means even when a Vanguard fund isn’t the absolute cheapest in its category, it’s still going to be one of your cheapest options.

In fact, Vanguard is still cutting the bottom line. In early 2025, Vanguard announced its largest fee reduction in history—a sweeping drop in price on 168 share classes across 87 funds (including several on this list) that the firm predicts will save its investors $350 million in the first year alone.

And Vanguard index funds cover every conceivable pocket of the investable universe, including individual sector funds and emerging markets.

Vanguard grew into the powerhouse mutual fund company it is today by taking care of its clients and genuinely looking after their interests. Vanguard funds really started and continue to accelerate the trend of fee compression. But it’s not only the best Vanguard retirement funds that benefit. We all collectively pay less in fees and expenses and enjoy better returns because of the index revolution started and led by Vanguard’s founder Jack Bogle.

Vanguard’s Best Retirement-Focused Funds for 2026

With all that out of the way, let’s dig into some of the best Vanguard retirement funds to consider diving into as you plan for the coming year.

The choices we highlight below encompass a wide variety of asset classes available through Vanguard’s fund lineup, so you’ll need to consider the appropriate allocation (if any) make sense for your specific circumstances.

And where applicable, we mention whether the mutual fund has an exchange-traded fund share class.

In no particular order …

Related: The 16 Best ETFs to Buy for a Prosperous 2026

1. Vanguard 500 Index Fund Admiral Shares

— Style: U.S. large-cap stock

— Management: Index

— Assets under management: $1.5 trillion*

— Dividend yield: 1.1%

— Expense ratio: 0.04%, or 40¢ per year for every $1,000 invested

— Minimum initial investment: $3,000

The Vanguard 500 Index Fund Admiral Shares (VFIAX) is Vanguard’s oldest index strategy, and it remains one of the very best Vanguard retirement funds. It’s insanely popular, too, boasting roughly $1.5 trillion in assets under management across its various share classes—a scale that allows it to offer a skinflint expense ratio of just 0.04%. That’s not free, but it’s awfully close.

So why has everyone piled into this fund?

Related: The 10 Best Vanguard Index Funds You Can Buy

The S&P 500 Index is ludicrously difficult to beat, especially over longer-term time frames, and even more so once funds’ fees are factored in. According to S&P Dow Jones Indices data, 86% of actively managed large-cap funds** failed to beat the S&P 500 over the trailing 10-year period, and that number ticks up to 88% when looking at the trailing 15-year period.

If even professional investment managers can’t beat it, the average investor might be better off joining it.

One of the cheapest ways to do that is via Vanguard 500 Index Fund, which tracks the S&P 500 Index—the ubiquitous barometer of America’s stock market. It’s a collection of 500 of the largest American businesses that meet a few criteria, such as having a market cap of at least $22.7 billion and highly liquid shares (the stock is frequently bought and sold). There’s a quality check, too: A company must also have positive earnings in the most recent quarter, and the sum of its previous four quarters must be positive. (Note: Once a company becomes an S&P 500 component, it’s not automatically kicked out if it fails to meet all of the criteria. However, the selection committee would take this under consideration and possibly boot the company.)

Related: 7 Best Vanguard Dividend Funds [Low-Cost Income]

Turnover is very low, so VFIAX is an extremely tax-efficient option, which means you can safely hold it in a taxable account. But then, why would you hold it in a tax-advantaged account? Well, typically, your ultimate goal within a 401(k) or IRA is to grow your money, and S&P 500 trackers have proven better able to do that than fund managers who use the index as a benchmark. So even if you can’t take much advantage of your account’s tax shielding with VFIAX, you’re still putting your money into one of Vanguard’s best mutual funds.

A final note: If the $3,000 minimum is a problem, the exact same strategy is available via the Vanguard S&P 500 ETF (VOO), which charges an even cheaper 0.03% in annual expenses. At time of writing, a single share can be purchased for around $635.

* Many Vanguard funds have multiple share classes, including ETFs. Listed net assets for Vanguard funds in this story refer to assets under management across all of a given fund’s share classes.

** There are different ways to define “cap” levels. We’re adhering to Morningstar’s definition, which says the largest 70% of companies by market capitalization within a fund’s “style” are large caps, the next 20% by market cap are mid-caps, and the smallest 10% by market cap are small caps.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

2. Vanguard Equity Income Fund Investor Shares

— Style: U.S. high-yield dividend stock

— Management: Active

— Assets under management: $62.4 billion

— Dividend yield: 2.3%

— Expense ratio: 0.27%, or $2.70 per year for every $1,000 invested

— Minimum initial investment: $3,000

Yes, I just got done extolling the virtues of index funds, but Vangaurd’s actively managed funds aren’t exactly pushovers.

Take Vanguard Equity Income Fund Investor Shares (VEIPX) for instance. Fund co-managers Matthew Hand and Sharon Hill are tasked with providing investors with an above-average level of dividend income. They split the assets, with Hand overseeing two-thirds, and Hill the rest, using two different strategies to achieve the same goals:

“Using traditional qualitative analysis, [Hand] assembles a portfolio of 60-70 dividend-paying stocks that have solid growth prospects,” says Todd Trubey, Senior Analyst at Morningstar, which gives VEIPX a Bronze Medalist rating. “He takes modest sector differences from its benchmark and also invests abroad, typically about 10% or more of assets. The strategy will considerably overweight favored stocks versus the index.

Related: 10 Monthly Dividend Stocks for Frequent, Regular Income

“Hill has revamped [Vanguard Quantitative Equity Group’s] highly quantitative approach for this fund. It closely tracks the FTSE High Dividend Yield Index’s sector weightings, sticks to U.S. stocks, and only modestly overweights top stocks.”

The resulting portfolio of 195 dividend stocks is predominantly large-cap in nature. Top holdings are full of cash-distributing blue chips such as JPMorgan Chase (JPM), Merck (MRK), and UnitedHealth Group (UNH).

If you have a lot of money to invest, you can get this same fund at a lower cost. Specifically, the Admiral Shares (VEIRX) charge just 0.18% in annual expenses, though you need $50,000 to get started, versus just $3,000 for the VEIPX Investor Shares. Most smaller-money investors might prefer to shoulder the high fees rather than put all their eggs in a cheaper basket.

VEIPX has a fair bit of turnover, at more than 40%, so it’s turning over well more than a third of its portfolio every year. As a result, the fund can and does make capital gains distributions in addition to its dividend payments, making this a fine fit for a tax-advantaged retirement account.

Related: The 9 Best Dividend Funds You Can Buy Now

3. Vanguard Dividend Appreciation Index Fund Admiral Shares

— Style: U.S. dividend-growth stock

— Management: Index

— Assets under management: $120.0 billion

— Dividend yield: 1.6%

— Expense ratio: 0.07%, or 70¢ per year for every $1,000 invested

— Minimum initial investment: $3,000

Investment fund names can give you a broad idea of what a mutual fund does, but they certainly won’t tell you everything, and they can occasionally be confusing or misleading. So you should always “look under the hood” so you know exactly what you’re buying.

For instance, you might assume that the Vanguard Dividend Appreciation Index Fund Admiral Shares (VDADX), by virtue of having the word “dividend” in the title, would provide a significant amount of income. You’d technically be correct—VDADX at least produces a little more income than the S&P 500—but it’s not an income-first fund, and it’s certainly not a high-yield fund.

Related: 10 Dividend-Growth Stocks That Wall Street Loves Now

VDADX is, however, one of the very best Vanguard retirement funds precisely because high current income isn’t the point.

Vanguard Dividend Appreciation Index Fund tracks the performance of the S&P U.S. Dividend Growers Index, which is made up of U.S. companies that have increased their dividend payout every year for at least 10 consecutive years. A long history of rising dividends is often a signal of both steady and rising profits. And as the old Wall Street maxim goes: The safest dividend is the one that was just raised. Company boards only raise the dividend when they are confident they will have the cash to back it up.

Related: The 10 Best Dividend ETFs [Get Income + Diversify]

The index also excludes the top 25% highest-yielding eligible companies from the index, as exceptionally high-yielding stocks can sometimes be at risk for dividend cuts. It also excludes real estate investment trusts (REITs). This might seem odd given that real estate is usually the market’s highest-yielding sector. One possible reason? While most typical stocks pay “qualified” dividends that are taxed at favorable rates, REITs often pay “nonqualified” dividends that are taxed at your ordinary income rate. Excluding them allows VDADX to pass along only tax-friendlier qualified dividends.

VDADX is currently heaviest in tech stocks and financials, which don’t always produce the largest current yields, but which are chock-full of dividend growers. Industrials and health care enjoy double-digit weightings, too.

The same strategy is available via the Vanguard Dividend Appreciation ETF (VIG), which charges 0.05% in annual expenses and trades for around $225 per share.

Related: 15 Dividend Kings for Royally Resilient Income

Featured Financial Products

4. Vanguard Explorer Fund Investor Shares

— Style: U.S. small-cap growth stock

— Management: Active

— Assets under management: $20.2 billion

— Dividend yield: 0.4%

— Expense ratio: 0.44%, or $4.40 per year for every $1,000 invested

— Minimum initial investment: $3,000

Vanguard Explorer Fund Investor Shares (VEXPX) is an actively managed mutual fund that invests in predominantly American small- and midsized stocks with growth potential.

Explorer’s 730-stock portfolio has an average market cap of $7.7 billion, which is well within the traditional mid-cap range of $2 billion to $10 billion. Holdings right now include the likes of insurance software firm Guidewire Software (GWRE), mid-cap investment bank Houlihan Lokey (HLI), and website creation software provider Wix.com (WIX).

Related: 9 Best Fidelity Index Funds to Buy for 2026

While larger companies also have the potential for outsized growth, smaller companies, as a group, tend to be more explosive—for better or worse. They benefit from investing’s rule of large numbers (effectively, doubling your revenues from $1 million to $2 million is a lot easier than doing so from $1 billion to $2 billion). And when institutional investors become interested in these stocks, large influxes of new investment money can send their stocks skyward.

But they’re riskier. Smaller firms have fewer and narrow revenue streams, meaning if a core product line struggles, it can more easily lead to stock turbulence and losses. They also have less access to capital than larger companies, so if times get tight, it’s harder for them to survive.

Funds like VEXPX help defray that risk by allowing you to buy many smaller companies at once, so one stock’s failure doesn’t torpedo your portfolio’s worth. That risk is further reduced by Explorer’s management style—holdings are selected by five different investment advisors that manage independent subportfolios, allowing them to use their specialities to generate outsized returns while preventing any one manager’s strategy from upending the entire fund’s performance.

Turnover is elevated, too, at about 35%, but you can snuff out that liability by holding VEXPX in a tax-advantaged account.

Make Young and the Invested your preferred news source on Google

Simply go to your preferences page and select the ✓ box for Young and the Invested. Once you’ve made this update, you’ll see Young and the Invested show up more often in Google’s “Top Stories” feed, as well as in a dedicated “From Your Sources” section on Google’s search results page.

5. Vanguard Primecap Fund Investor Shares

— Style: U.S. large-cap stock

— Management: Active

— Assets under management: $75.7 billion

— Dividend yield: 0.9%

— Expense ratio: 0.35%, or $3.50 per year for every $1,000 invested

— Minimum initial investment: $3,000

Vanguard Primecap Fund Investor Shares (VPMCX) has long been one of the most popular Vanguard funds in 401(k) plans.

VPMCX holds 170 positions right now, at a roughly 80/20 blend of large- and medium-sized companies. VPMCX’s five portfolio managers currently are most bullish on the technology and health care sectors, which represent 30% and 24% of assets, respectively. Its biggest bet at the moment is a 6% holding in weight-loss drug leader Eli Lilly (LLY); other top positions, between 3% and 4% each, include computer memory and data storage firm Micron Technology (MU), Microsoft, Google parent Alphabet (GOOGL), and semiconductor process control specialist KLA Corp. (KLAC).

Vanguard Primecap has been advised by Primecap Management Company since its inception in 1984, and for years, it was one of Vanguard’s hottest products. Indeed, the fund grew so large that management felt it couldn’t use additional assets as effectively, and Vanguard was forced to close the fund to new investors in 2004, limiting existing shareholders to $25,000 in additional purchases per year. (It did the same with its sister fund, Vanguard Primecap Core (VPCCX), in 2009). But in more recent years, some of their picks fizzled out, and both funds reopened in 2024 amid a flight in assets.

Related: The Best T. Rowe Price Funds for 2026

So, why buy VPMCX? While management occasionally gets stung for its loyalty to some positions, it still has a phenomenal long-term track record, performing better than 95% and 98% of its category peers over the trailing 10 and 15 years, respectively.

“Patience has been a double-edged sword for Primecap, whose convictions have sometimes hardened into obstinacy even as investment theses flopped,” Morningstar Principal Robby Greengold says. “Corporate executives can prove themselves poor stewards; rivals sometimes erode once-mighty franchises; companies’ sales slide; debt piles up; or a bargain-basement takeover ends the growth story that Primecap was banking on. … Mistakes like these explain much of the firm’s lackluster returns over the past five years.

“Even so, the firm’s longer-term track record is admirable, helped by its research-focused culture and Vanguard’s low expense ratio. For investors seeking a differentiated approach to large-cap investing, this fund remains a worthy holding.”

Vanguard Primecap doesn’t have a high stated turnover nor much dividend income, but it still has a history of occasionally making very large capital gains distributions, so it’s best held in a tax-advantaged account.

Related: 15 Best Investing Research & Stock Analysis Websites

6. Vanguard Global Minimum Volatility Fund Investor Shares

— Style: Global large-cap stock

— Management: Index

— Assets under management: $1.9 billion

— Dividend yield: 2.3%

— Expense ratio: 0.21%, or $2.10 per year for every $1,000 invested

— Minimum initial investment: $3,000

Vanguard Global Minimum Volatility Fund Investor Shares (VMVFX) checks off a lot of boxes. It invests in U.S. stocks. It invests in international stocks. It provides an above-average level of yield. And it’s designed to reduce volatility.

If you want to diversify your portfolio to also hold non-U.S. stocks, you’ll need a quick terminology lesson. An “international” fund invests only in companies outside the U.S., while a “global” fund invests in both U.S. and international companies. VMVFX is the latter.

Like many global funds, Vanguard Global Minimum Volatility dedicates the largest chunk of its assets to the U.S., which sits around 60% of the portfolio right now. The rest of its assets are spread across 23 other countries, including the U.K. (6%), Taiwan (5%), and India (4%). In general, this roughly 205-stock portfolio is chock-full of dividend-paying large caps that power a fund yield of 2.3%—not massive, and in fact less than your typical blue-chip international-stock fund, but still more than you’re getting out of America’s blue-chip S&P 500 Index.

Related: The Best Dividend Stocks: 10 Pro-Grade Income Picks for 2026

Manager Scott Rodemer has built this portfolio to deliver less volatility than your average global equity fund. He uses a rules-based strategy that’s similar to what an index would provide, but he’s not forced to rebalance the portfolio on a set schedule, and he also uses contracts to hedge against currency risk.

Low- and minimum-volatility strategies are generally a trade-off: You sacrifice some upside potential in bull markets to get portfolio protection when markets decline. And in VMVFX’s case, the downside protection is quite good. According to Morningstar Analyst Ryan Jackson, “Investors shouldn’t expect this fund to keep pace when the market rallies or excel every time it wobbles, but its risk-adjusted returns should stack up well in the long run.”

Between its above-average dividend income and decent amount of turnover (35% currently), VMVFX is right at home in a tax-advantaged retirement account.

Related: Best Vanguard Retirement Funds for a 401(k) Plan

7. Vanguard Total Bond Market Index Fund Admiral Shares

— Style: Intermediate-term core bond

— Management: Index

— Assets under management: $384.6 billion

— SEC yield: 4.1%*

— Expense ratio: 0.04%, or 40¢ per year for every $1,000 invested

— Minimum initial investment: $3,000

No retirement asset allocation is complete without bond funds. As an asset class, bond funds play an important role in lowering volatility and providing regular income.

Within the world of Vanguard bond funds, the Vanguard Total Bond Market Index Fund Admiral Shares (VBTLX) stands out as one of the very best Vanguard retirement funds for its combination of competitive yield and rock-bottom fees and expenses. With an expense ratio of just 0.04%, it’s all but free to own. No wonder, then, that VBTLX has racked up a massive $380 billion in assets across all of its share classes.

Related: 9 Best Schwab ETFs to Buy [Build Your Core for Cheap]

The Vanguard Total Bond Market Index Fund provides broad exposure to the universe of bonds. A little less than half of its portfolio is Treasury or agency debt backed by the U.S. government, 25% of assets are invested in corporate debt, and another 20% is invested in government mortgage-backed securities (MBSes). The rest is spread across foreign bonds, commercial mortgage-backed securities (CMBSes), and other issues.

One of the most critical metrics to consider when considering bond funds is duration, which is a measure of interest-rate sensitivity. As an example, a bond with a duration of two years would see its price rise by 2% if interest rates fell by 1% (or conversely, would see its price fall by 2% if interest rates rose by 1%). The actual calculation of duration is fairly complex; it’s the weighted average of the bond’s cash flows. But the key takeaway is that, all else equal, the longer a bond’s time to maturity, the higher its duration—and thus the higher the interest-rate risk.

Related: The 7 Best Fidelity Index Funds for Beginners

The Vanguard Total Bond Market Index Fund, with a duration of 5.8 years, has a medium-term duration. That’s moderate interest-rate risk—if rates keep falling, VBTLX could struggle. But if the Federal Reserve largely stays put, investors will collect a 4%-plus yield with little issue.

If the $3,000 minimum is a problem, the exact same strategy is available via the Vanguard Total Bond Market ETF (BND), which charges an even cheaper 0.03% in annual expenses. At time of writing, a single share can be purchased for around $75.

* SEC yield reflects the interest earned across the most recent 30-day period. This is a standard measure for funds holding bonds and preferred stocks.

Related: The 12 Best Vanguard ETFs for 2026 [Build a Low-Cost Portfolio]

8. Vanguard Inflation-Protected Securities Fund Investor Shares

— Style: Treasury Inflation-Protected Securities

— Management: Active

— Assets under management: $27.6 billion

— SEC yield: 1.5%

— Expense ratio: 0.20%, or $2.00 per year for every $1,000 invested

— Minimum initial investment: $3,000

The next retirement fund on this list focuses on a small but useful niche within the debt market: inflation-linked bonds.

Treasury Inflation-Protected Securities, or TIPS, are government bonds whose returns are connected to changes in the consumer price index—specifically, the “Non-seasonally Adjusted Consumer Price Index for All Urban Consumers” (CPI-U). As the CPI (and thus inflation) increases, so too do TIPS. Here’s an example to help you out:

You buy $50,000 in U.S. TIPS with a 4% coupon. Inflation in the first year is 5%. The face value of your TIPS would be adjusted higher by 5% ($2,500), to $52,500. The 4% coupon would remain the same, but it would be based on the adjusted face value. So instead of receiving $2,000 in annual interest, you would receive $2,100. (Note: Like other Treasury-issued bonds, TIPS pay semiannually.)

Related: The 7 Best Mutual Funds for Beginners

Just understand that TIPS have their downsides, too. They not only face the same interest-risk issues of regular bonds, but expectations for low inflation (and even deflation) can weigh on their value.

The Vanguard Treasury Inflation-Protected Securities Fund Investor Shares (VIPSX) owns 62 different TIPS issues. Individual TIPS come in maturities of five, 10, and 30 years, so it’s no surprise that most of the fund’s assets is invested in TIPS with remaining maturities of either one to five years (50%) or five to 10 years (35%), with the rest scattered across longer-term maturities. The fund’s duration at the moment is 6.7 years.

TIPS, like other Treasuries, are exempt from local and state taxes, so a retirement account blunts some of that advantage. Still, a 401(k) or IRA shields you from federal taxation on that income, as well as the high level of turnover (75% in VIPSX’s case) that’s common among bond funds.

Related: 9 Best Dividend Stocks for Beginners

9. Vanguard Federal Money Market Fund

— Style: Money market

— Management: Active

— Assets under management: $380.8 billion

— SEC yield: 3.6%*

— Expense ratio: 0.11%, or $1.10 per year for every $1,000 invested

— Minimum initial investment: $3,000

As we head into 2026, it seems unlikely that interest rates will go higher, but it’s possible—and if that happens, higher-duration bond funds would experience capital losses. That was certainly the case in 2022, when very long-term bonds actually saw greater declines than common stock indexes like the S&P 500.

Related: 7 Low- and Minimum-Volatility ETFs for Peace of Mind

If you are looking for a competitive yield with essentially no duration or interest rate risk at all, the Vanguard Federal Money Market Fund (VMFXX) is a solid option and one of the very best Vanguard retirement funds at today’s prices. This income fund consists entirely of U.S. Treasury bills and other U.S. government obligations and repurchase agreements.

Money market funds are somewhat unique among mutual funds in that they specifically target a net asset value of $1 per share. Any earnings that cause the net asset value to go higher than $1 get distributed as dividends. This means that, unless you reinvest your dividends, the value of your money market mutual fund will not grow over time. And that makes VMFXX an extremely conservative option with extremely limited possibility of loss.

Money market funds’ yields are very sensitive to Federal Reserve policy moves, though. It was barely three years ago that money market funds in general offered virtually nothing in yield. But after the most aggressive string of rate hikes in history, VMFXX is a legitimate income fund with a yield well north of 3%.

Related: Best Fidelity Retirement Funds for a 401(k) Plan

Vanguard Federal Money Market’s yield started to decline alongside the Federal Reserve’s reductions in their target benchmark interest rate during 2024, then 2025. So if you require a certain level of income, you might want to keep close eye on both the Fed and the fund and be aware of other options should the central bank’s easing continue.

But until then, the Vanguard Federal Money Market Fund remains one of the very best Vanguard retirement funds for its low risk and competitive yield.

* SEC yield for money market funds reflects the interest earned across the most recent 7-day period.

10. Vanguard Wellington Fund Investor Shares

— Style: Moderate allocation

— Management: Active

— Assets under management: $120.4 billion

— Dividend yield: 2.1%

— Expense ratio: 0.25%, or $2.50 per year for every $1,000 invested

— Minimum initial investment: $3,000

Vanguard’s oldest mutual fund, Vanguard Wellington Fund Investor Shares (VWELX) is a “portfolio in a can.”

While stock funds allow you to hold hundreds or thousands of individual stocks, and bond funds allow you to hold hundreds or thousands of bonds, “balanced” or “allocation” funds like VWELX allow you to get all of that exposure in just one fund.

Related: 5 Best AI ETFs for the Artificial Intelligence Era

Vanguard Wellington, which came to life in 1929, is managed by Wellington Management: an investment management company with nearly a century of operational experience. It’s a moderate allocation fund that invests roughly two-thirds of its assets in stocks, and the other third in bonds. The stock portion of the portfolio currently holds about 80 predominantly large-cap stocks with a median market cap of almost $500 billion—a “who’s who” of mega-cap blue-chip firms such as Microsoft (MSFT) and Nvidia (NVDA), with a little exposure to international names such as UBS Group (UBS) and British American Tobacco (BTI).

The bond portfolio is much more broadly diversified, at nearly 1,500 investment-grade issues. The majority of that (roughly two-thirds) is invested in corporate bonds, with another 25% in Treasuries and agency bonds, and the rest peppered across mortgage-backed securities (MBSes), foreign sovereign bonds, and other debt.

Related: How Does the 4% Rule Work? [And Why Did It Change?]

This one-stop shop for your large-cap stock and bond needs charges just 0.25% in annual expenses—very inexpensive for the skilled management and strong performance track record you’re getting in return. Just make sure you’re considering your own investment needs with this fund. If you don’t want a third of your portfolio to be in bonds, you’ll want to put additional money into individual stocks, equity funds, and/or alternative investments.

Wellington has a high amount of turnover (61%) and generates a decent chunk of interest income from its bond portfolio. So, if you’re going to invest in VWELX, it makes sense to do so in a tax-advantaged account.

Like Young and the Invested’s Content? Be sure to follow us.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

11. Vanguard Target Retirement Funds

— Style: Target-date

— Management: Index

— Expense ratio: 0.08%, or 80¢ per year for every $1,000 invested

— Minimum initial investment: $1,000

One of the challenges in retirement planning is getting the asset allocation right, or having an asset class mix that is appropriate for an investor at your age and stage of life. An ideal portfolio for a 20-year-old is likely going to be very different from that of a 40-year-old, and both those portfolios will be different from what’s ideal for a 60-year-old.

This is where Vanguard Target Retirement Funds can really add value.

Related: Beginner’s Guide to Schwab Target-Date Funds

Target-date funds—also called life-cycle funds—are a type of mutual fund that are designed to change their asset allocation over time. Target-date funds start out invested heavily in stocks, then slowly reduce their stock exposure and replace it with bond exposure as they approach their target retirement date, following a glide path.

The target retirement dates are intended to be estimates; they don’t have to be super precise. Generally, most mutual fund families will create target-date funds in five-year increments (say, 2030, 2035, 2040, etc.).

Vanguard Target Retirement Funds hold varying blends of both U.S. and international stocks of various sizes, as well as U.S. and international bonds. They’re unsurprisingly dirt-cheap, at just 0.08% annually, and the entire series earns a respectable Silver Medalist rating from Morningstar.

For a longer primer on Vanguard Target Retirement Funds, take a look at our Beginner’s Guide to Vanguard Target-Date Funds.

Related: 13 Best Stock Screeners & Stock Scanners

Featured Financial Products

What Is the Minimum Investment Amount on Vanguard Mutual Funds?

Vanguard funds are known for being shareholder-friendly. The Vanguard mutual fund company blazed new trails with the index fund, and Vanguard has done more than any other investment firm to keep costs to a minimum for investors.

But there is one hitch. Many of Vanguard’s cheapest funds in terms of fees have initial investment minimums of around $3,000.

If that is a problem for you, don’t sweat it. Most popular Vanguard index funds are also available as ETFs. Most brokers will allow you to buy as little as one share, and some even allow for fractional shares. And if you use a commission-free brokerage, you can buy those ETFs without incurring additional fees. ETF prices vary, of course, but many cost less than $100, and they rarely exceed $400 per share.

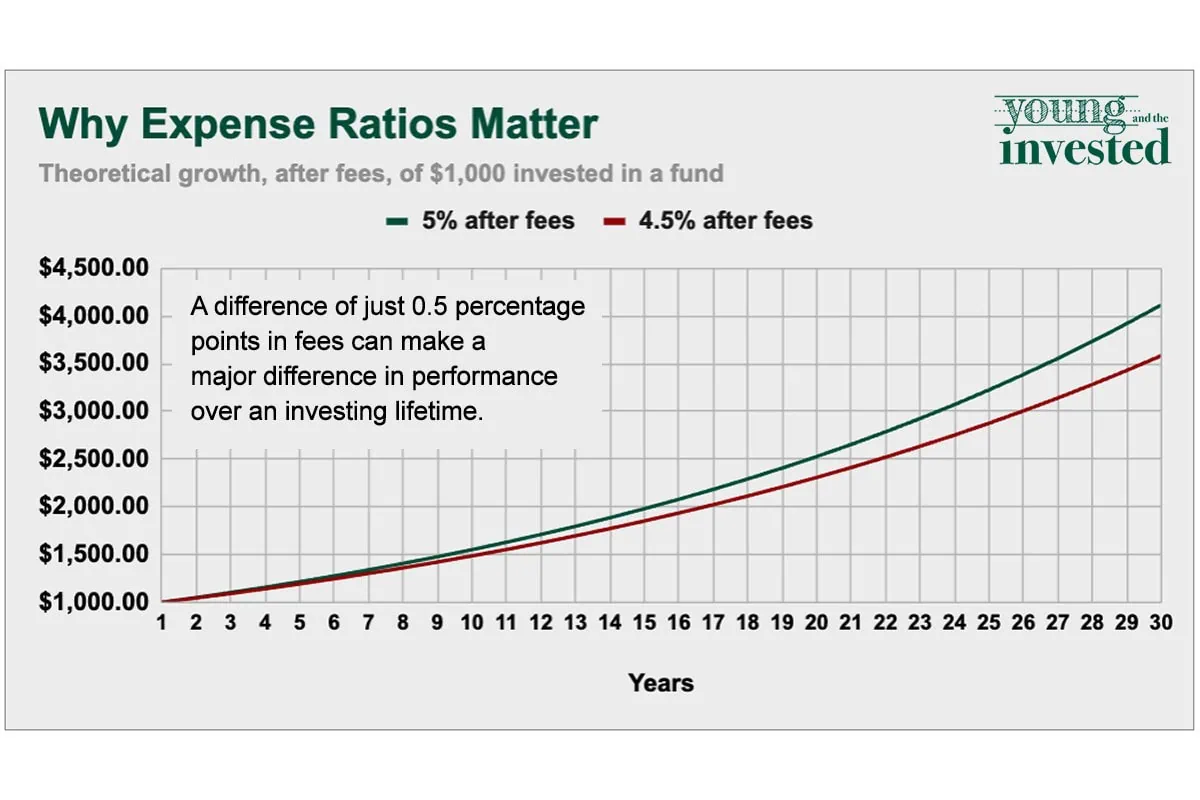

Why Does a Fund’s Expense Ratio Matter So Much?

Every dollar you pay in expenses is a dollar that comes directly out of your returns. So, it is absolutely in your best interests to keep your expense ratios to an absolute minimum.

The expense ratio is the percentage of your investment lost each year to management fees, trading expenses and other fund expenses. Because index funds are passively managed and don’t have large staffs of portfolio managers and analysts to pay, they tend to have some of the lowest expense ratios of all mutual funds.

This matters because every dollar not lost to expenses is a dollar that is available to grow and compound. And over an investing lifetime, even a half a percent can have a huge impact. If you invest just $1,000 in a fund generating 5% per year after fees, over a 30-year horizon, it will grow to $4,116. However, if you invested $1,000 in the same fund, but it had an additional 50 basis points in fees (so it only generated 4.5% per year in returns), it would grow to only $3,584 over the same period.

Like Young and the Invested’s Content? Be sure to follow us.

Want to talk more about your financial goals or concerns? Our services include comprehensive financial planning, investment management, estate planning, taxes, and more! Schedule a call with Riley to discuss what you need, and what we can do for you.

Related: 9 Best Fidelity ETFs You Can Buy [Invest Tactically]

Investors often look to exchange-traded funds (ETFs) for cheap, passive exposure to basic broader market indexes like the S&P 500.

But Fidelity’s ETF suite really shines because in addition to some of those plain-vanilla offerings, Fidelity also provides more tactical ways of tapping into specific corners of Wall Street. See what we mean by checking out our list of the best Fidelity ETFs.

Related: 15 Best Long-Term Stocks to Buy and Hold Forever

As even novice investors probably know, funds—whether they’re mutual funds or exchange-traded funds (ETFs)—are the simplest and easiest ways to invest in the stock market. But the best long-term stocks also offer many investors a way to stay “invested” intellectually—by following companies they believe in. They also provide investors with the potential for outperformance.

So if you’re looking for a starting point for your own portfolio, look no further. Check out our list of the best long-term stocks for buy-and-hold investors.

Please Don’t Forget to Like, Follow and Comment

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Subscribe to Retire With Riley, our free weekly retirement planning newsletter, and

3. Give the article a Thumbs Up on the top-left side of the screen.

4. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!