When you’re looking for a retirement fund, there’s no set strategy that’s “right” for every investor. Younger folks saving up for retirement can afford to be aggressive and put a lot of money into stocks, while older folks who are near or in retirement might want more income. A lot of your decisions are going to come down to the types of assets you need for your particular situation.

But no matter your age or situation, there are certain qualities that make a fund more suited to be held in a retirement account, like a 401(k) or individual retirement account (IRA), with special tax advantages. Tax-inefficiency is a big one: If a fund does a lot of portfolio trading, or it generates a lot of taxable income, that could lead to significant tax consequences for you if you hold that fund in a taxable brokerage—but inside a tax-deferred or tax-exempt account, you get all the perks without the responsibility to the IRS.

Combine that kind of benefit with traditional mutual fund “green flags,” such as low fees and solid management (or index construction), and you have yourself a decent retirement fund.

Today, I’ll show you some of Vanguard’s best retirement funds, including a new addition to our list that speaks to the rising threat of inflation. These products feature the positive traits mentioned above. And while they’re most appropriate for 401(k)s, IRAs, and health savings accounts (HSAs), a couple can do just fine in brokerage accounts, too. On top of that, several of these funds are available in ETF form if that’s your preferred type of fund.

Disclaimer: This article does not constitute individualized investment advice. These securities appear for your consideration and not as personalized investment recommendations. Act at your own discretion.

Editor’s Note: The tabular data presented in this article is up-to-date as of Oct. 8, 2025.

Featured Financial Products

Table of Contents

What Should You Want in a Retirement Fund?

When investing your retirement savings, you need to consider a few critical factors.

First, a robust retirement portfolio should provide diversification across multiple asset classes—stocks and bonds at the very least, as well as possibly real estate and commodities, all of which you can typically get through mutual funds and ETFs. Diversifying your retirement portfolio across these asset classes helps spread risk and smooth your returns.

Second, you should keep an eye on costs. Every dollar spent on fees and expenses is a dollar no longer available to grow and compound over time, so keeping expenses cut to the bone is vital. And that’s exactly why Vanguard is so popular: The best Vanguard retirement funds will generally have some of the lowest fees and expenses in the business.

And finally, you ideally want your retirement portfolio to produce regular income—in the form of both bond interest and dividend income. Stock prices can suffer during nasty corrections and bear markets, but income-generating funds can help provide for your living expenses without forcing you to sell at an inopportune time.

Why Vanguard Mutual Funds?

Vanguard Group is a leader in index mutual funds. Vanguard founder Jack Bogle launched the first Vanguard index fund for U.S. retail investors—the Vanguard First Index Investment Trust, which is now the Vanguard 500 Index Fund Admiral Shares (VFIAX)—in 1976, and in the subsequent half-century or so, Vanguard Funds have grown to become the dominant force in index investing.

As I mentioned above, one of the primary reasons behind its success is Vanguard’s dirt-cheap expenses. The average asset-weighted expense ratio for U.S. mutual funds and ETFs is 0.44%, or $4.40 annually for every $1,000 invested. Vanguard’s average, across 400-plus funds, is a scant 0.07%, or a mere 70¢ annually per $1,000 invested. That’s an astoundingly low number—one that means even when a Vanguard fund isn’t the absolute cheapest in its category, it’s still going to be one of your cheapest options.

In fact, Vanguard is still cutting the bottom line. In early 2025, Vanguard announced its largest fee reduction in history—a sweeping drop in price on 168 share classes across 87 funds (including several on this list) that the firm predicts will save its investors $350 million in the first year alone.

And Vanguard index funds cover every conceivable pocket of the investable universe, including individual sector funds and emerging markets.

Vanguard grew into the powerhouse mutual fund company it is today by taking care of its clients and genuinely looking after their interests. Vanguard funds really started and continue to accelerate the trend of fee compression. But it’s not only the best Vanguard retirement funds that benefit. We all collectively pay less in fees and expenses and enjoy better returns because of the index revolution started and led by Vanguard’s founder Jack Bogle.

Vanguard’s Best Retirement-Focused Funds for the Rest of 2025

With all that out of the way, let’s dig into some of the best Vanguard retirement funds to consider diving into this year.

The choices we highlight below encompass a wide variety of asset classes available through Vanguard’s fund lineup, so you’ll need to consider the appropriate allocation (if any) make sense for your specific circumstances.

And where applicable, we mention whether the mutual fund has an exchange-traded fund share class.

Related: The Best ETFs to Buy for a Prosperous 2025

1. Vanguard 500 Index Fund Admiral Shares

— Style: U.S. large-cap stock

— Management: Index

— Assets under management: $1.4 trillion*

— Dividend yield: 1.1%

— Expense ratio: 0.04%, or 40¢ per year for every $1,000 invested

— Minimum initial investment: $3,000

The majority of fund managers who run large-cap funds (funds that invest in larger companies) fail to consistently beat the S&P 500 Index, particularly after fees. According to S&P Dow Jones Indices, in 2024, “65% of all active large-cap U.S. equity funds underperformed the S&P 500, worse than the 60% rate observed in 2023 and slightly above the 64% average annual rate reported over the 24-year history of our SPIVA Scorecards.” And at least as of 2025’s midpoint, the picture for human managers isn’t looking any better this year.

If they can’t beat it, I say we join it.

Related: The 7 Best Vanguard Index Funds for Beginners

The Vanguard 500 Index Fund Admiral Shares (VFIAX) is Vanguard’s oldest index strategy, and it remains one of the very best Vanguard retirement funds. It’s insanely popular, too, boasting roughly $1.4 trillion in assets under management across its various share classes—a scale that allows it to offer a skinflint expense ratio of just 0.04%. That’s not free, but it’s awfully close.

To be included in this index, a company must have a market capitalization of at least $22.7 billion, its shares must be highly liquid (shares are frequently bought and sold), and at least 50% of its outstanding shares must be available for public trading, among other criteria. A company must also have positive earnings in the most recent quarter, and the sum of its previous four quarters must be positive—two traits that weed out at least a few massive firms that would otherwise be included.

(Note: If a company is already an S&P 500 component, but then it suddenly fails to meet some or all of the criteria, it’s not automatically kicked out of the index. But the selection committee could take this under consideration and possibly boot the company.)

Related: The 7 Best Vanguard Dividend Funds to Buy

One thing to look at is turnover, which is how much the fund tends to buy and sell its holdings. High turnover can generate a lot of capital gains, which mutual funds must distribute to shareholders … and those distributions are taxable. Fortunately, only a handful of stocks enter or leave the index in any given year, so VFIAX is an extremely tax-efficient option for taxable accounts.

Why hold it in a tax-advantaged retirement account, then? Ultimately, if your goal within a 401(k) or IRA is to grow your money, S&P 500 trackers have proven better able to do that than fund managers who use the index as a benchmark. Sure, you can’t take much advantage of your account’s tax protection with VFIAX, but you’re still putting your money into one of Vanguard’s best funds period.

Lastly: If the $3,000 minimum is a problem, the exact same strategy is available via the Vanguard S&P 500 ETF (VOO), which charges an even cheaper 0.03% in annual expenses. At time of writing, a single share can be purchased for around $615.

* Many Vanguard funds have multiple share classes, including ETFs. Listed net assets for Vanguard funds in this story refer to assets under management across all of a given fund’s share classes.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

2. Vanguard Equity Income Fund Investor Shares

— Style: U.S. high-yield dividend stock

— Management: Active

— Assets under management: $61.7 billion

— Dividend yield: 2.2%

— Expense ratio: 0.27%, or $2.70 per year for every $1,000 invested

— Minimum initial investment: $3,000

Vanguard Equity Income Fund Investor Shares (VEIPX) is an actively managed fund that aims to provide investors with an above-average level of dividend income. In this case, fund co-managers Matthew Hand and Sharon Hill split the assets, with Hand overseeing two-thirds, and Hill the rest, using two different strategies to achieve the same goals:

“Using traditional qualitative analysis, [Hand] assembles a portfolio of 60-70 dividend-paying stocks that have solid growth prospects,” says Todd Trubey, Senior Analyst at Morningstar, which gives VEIPX a Bronze Medalist rating. “He takes modest sector differences from its benchmark and also invests abroad, typically about 10% or more of assets. The strategy will considerably overweight favored stocks versus the index.

Related: 10 Monthly Dividend Stocks for Frequent, Regular Income

“Hill has revamped [Vanguard Quantitative Equity Group’s] highly quantitative approach for this fund. It closely tracks the FTSE High Dividend Yield Index’s sector weightings, sticks to U.S. stocks, and only modestly overweights top stocks.”

The resulting portfolio of nearly 200 dividend stocks is predominantly large-cap in nature. Top holdings are full of cash-distributing blue chips such as JPMorgan Chase (JPM), Merck (MRK), and ConocoPhillips (COP).

If you have a lot of money to invest, you can get this same fund at a lower cost. Specifically, the Admiral Shares (VEIRX) charge just 0.18% in annual expenses, though you need $50,000 to get started, versus just $3,000 for the VEIPX Investor Shares. Most smaller-money investors might prefer to shoulder the high fees rather than put all their eggs in a cheaper basket.

VEIPX has a fair bit of turnover, at more than 40%, so it’s turning over well more than a third of its portfolio every year. As a result, the fund can and does make capital gains distributions in addition to its dividend payments, making this a fine fit for a tax-advantaged retirement account.

Related: The 9 Best Dividend Funds You Can Buy Now

3. Vanguard Dividend Appreciation Index Fund Admiral Shares

— Style: U.S. dividend-growth stock

— Management: Index

— Assets under management: $115.1 billion

— Dividend yield: 1.7%

— Expense ratio: 0.07%, or 70¢ per year for every $1,000 invested

— Minimum initial investment: $3,000

A vital rule of investment funds: Always “look under the hood.”

It’d be easy to read the name Vanguard Dividend Appreciation Index Fund Admiral Shares (VDADX), note the inclusion of the word “dividend,” and assume that you’ll be enjoying a significantly high level of dividend income. And you’d even be technically be correct—VDADX at least produces a little more income than the S&P 500.

But this is not an income-first fund, and it’s certainly not a high-yield fund.

Related: 10 Dividend-Growth Stocks That Wall Street Loves Now

That said, VDADX is one of the very best Vanguard retirement funds precisely because income takes a back seat.

Vanguard Dividend Appreciation Index Fund tracks the performance of the S&P U.S. Dividend Growers Index, which is made up of U.S. companies that have increased their dividend payout every year for at least 10 consecutive years. There is no better sign of company health than a long history of rising dividends. As the old Wall Street maxim goes: The safest dividend is the one that was just raised. Company boards only raise the dividend when they are confident they will have the cash to back it up.

Related: The 8 Best Dividend ETFs [Get Income + Diversify]

As an additional filter, the index excludes the top 25% highest-yielding eligible companies from the index, as exceptionally high-yielding stocks can sometimes be at risk for dividend cuts.

VDADX is currently heaviest in tech stocks and financials, which don’t always produce the largest current yields, but which are chock-full of dividend growers. Health care, industrials, and consumer staples all enjoy double-digit weightings, too.

If the $3,000 minimum is a stretch on your budget, the same strategy is available via the Vanguard Dividend Appreciation ETF (VIG), which charges 0.05% in annual expenses and trades for around $215 per share.

Related: 13 Dividend Kings for Royally Resilient Income

Featured Financial Products

4. Vanguard Explorer Fund Investor Shares

— Style: U.S. small-cap growth stock

— Management: Active

— Assets under management: $20.6 billion

— Dividend yield: 0.4%

— Expense ratio: 0.44%, or $4.40 per year for every $1,000 invested

— Minimum initial investment: $3,000

Vanguard Explorer Fund Investor Shares (VEXPX) is an actively managed mutual fund that invests in predominantly American small- and midsized stocks with growth potential.

VEXPX’s portfolio currently spans roughly 740 stocks with an average market cap of $7.6 billion—around the midpoint of the mid-cap range ($2 billion to $10 billion), though the majority of its holdings fall into the small- ($500 million to $2 billion) and micro-cap ($500 million or less) ranges. Holdings right now include the likes of insurance software firm Guidewire Software (GWRE), Texas tank barge operator Kirby Corp. (KEX), and mid-cap investment bank Houlihan Lokey (HLI).

Related: 9 Best Fidelity Index Funds to Buy

While larger companies also have the potential for outsized growth, smaller companies, as a group, tend to be more explosive—for better or worse. They benefit from investing’s rule of large numbers (effectively, doubling your revenues from $1 million to $2 million is a lot easier than doing so from $1 billion to $2 billion). And when institutional investors become interested in these stocks, large influxes of new investment money can send their stocks skyward.

But they’re riskier. Smaller firms have fewer and narrow revenue streams, meaning if a core product line struggles, it can more easily lead to stock turbulence and losses. They also have less access to capital than larger companies, so if times get tight, it’s harder for them to survive.

Funds like VEXPX help defray that risk by allowing you to buy many smaller companies at once, so one stock’s failure doesn’t torpedo your portfolio’s worth. That risk is further reduced by Explorer’s management style—holdings are selected by five different investment advisors that manage independent subportfolios, allowing them to use their specialities to generate outsized returns while preventing any one manager’s strategy from upending the entire fund’s performance.

Turnover is elevated, too, at about 35%, but you can snuff out that liability by holding VEXPX in a tax-advantaged account.

5. Vanguard Primecap Fund Investor Shares

— Style: U.S. large-cap stock

— Management: Active

— Assets under management: $76.4 billion

— Dividend yield: 0.8%

— Expense ratio: 0.37%, or $3.70 per year for every $1,000 invested

— Minimum initial investment: $3,000

Vanguard Primecap Fund Investor Shares (VPMCX) has long been one of the most popular Vanguard funds in 401(k) plans.

VPMCX holds 170 positions right now, at a roughly 80/20 blend of large- and medium-sized companies. VPMCX’s five portfolio managers currently are most bullish on the technology and health care sectors, which represent 28% and 25% of assets, respectively. Its biggest bet at the moment is an 8% holding in weight-loss drug leader Eli Lilly (LLY); other top positions, around 3% each, include Microsoft, semiconductor process control specialist KLA Corp. (KLAC), medical equipment manufacturer Boston Scientific (BSX), and memory and data storage firm Micron Technology (MU).

As the name suggests, Vanguard Primecap has been advised by Primecap Management Company since its inception in 1984, and for years, it was one of Vanguard’s hottest products. Indeed, the fund grew so large that management felt it couldn’t use additional assets as effectively, and Vanguard was forced to close the fund to new investors in 2004, limiting existing shareholders to $25,000 in additional purchases per year. (It did the same with its sister fund, Vanguard Primecap Core (VPCCX), in 2009). But in more recent years, some of their picks fizzled out, and both funds reopened in 2024 amid a flight in assets.

Related: 7 Best T. Rowe Price Funds to Buy

So, why buy VPMCX? While management occasionally gets stung for its patience (indeed, that’s why the fund started the year with a Gold rating but was recently downgraded to Silver), it still has a phenomenal long-term track record, performing better than 91% and 97% of its category peers over the trailing 10 and 15 years, respectively.

“Patience has been a double-edged sword for Primecap, whose convictions have sometimes hardened into obstinacy even as investment theses flopped,” Morningstar Principal Robby Greengold says. “Corporate executives can prove themselves poor stewards; rivals sometimes erode once-mighty franchises; companies’ sales slide; debt piles up; or a bargain-basement takeover ends the growth story that Primecap was banking on. … Mistakes like these explain much of the firm’s lackluster returns over the past five years.

“Even so, the firm’s longer-term track record is admirable, helped by its research-focused culture and Vanguard’s low expense ratio. For investors seeking a differentiated approach to large-cap investing, this fund remains a worthy holding.”

Vanguard Primecap is one of the tax-friendlier options on this list, with low turnover of 4% and not much in the way of dividend income.

Related: 15 Best Investing Research & Stock Analysis Websites

6. Vanguard Global Minimum Volatility Fund Investor Shares

— Style: Global large-cap stock

— Management: Index

— Assets under management: $2.1 billion

— Dividend yield: 1.7%

— Expense ratio: 0.21%, or $2.10 per year for every $1,000 invested

— Minimum initial investment: $3,000

Vanguard Global Minimum Volatility Fund Investor Shares (VMVFX) checks off a lot of boxes. It invests in U.S. stocks. It invests in international stocks. It provides an above-average level of yield. And it’s designed to reduce volatility.

If you want to diversify your portfolio to also hold non-U.S. stocks, you’ll need a quick terminology lesson. An “international” fund invests only in companies outside the U.S., while a “global” fund invests in both U.S. and international companies. VMVFX is the latter.

Like many global funds, Vanguard Global Minimum Volatility dedicates the largest chunk of its assets to the U.S., which sits around 60% of the portfolio right now. The rest of its assets are spread across 23 other countries, including the U.K. (6%), Canada (4%), and India (4%). In general, this roughly 215-stock portfolio is chock-full of dividend-paying large caps that power a fund yield of 1.7%—not massive, and in fact less than your typical blue-chip international-stock fund, but still more than you’re getting out of America’s blue-chip S&P 500 Index.

Related: 10 Best Dividend Stocks to Buy [Steady Eddies]

Managers John Ameriks and Scott Rodemer have built this portfolio to deliver less volatility than your average global equity fund. They use a rules-based strategy that’s similar to what an index would provide, but they’re not forced to rebalance the portfolio on a set schedule, and they also use contracts to hedge against currency risk.

Low- and minimum-volatility strategies are generally a trade-off: You sacrifice some upside potential in bull markets to get portfolio protection when markets decline. And in VMVFX’s case, the downside protection is quite good. According to Morningstar Analyst Ryan Jackson, “Investors shouldn’t expect this fund to keep pace when the market rallies or excel every time it wobbles, but its risk-adjusted returns should stack up well in the long run.”

Between its above-average dividend income and decent amount of turnover (35% currently), VMVFX is right at home in a tax-advantaged retirement account.

Related: Best Vanguard Retirement Funds for a 401(k) Plan

7. Vanguard Total Bond Market Index Fund Admiral Shares

— Style: Intermediate-term core bond

— Management: Index

— Assets under management: $374.3 billion

— SEC yield: 4.1%*

— Expense ratio: 0.04%, or 40¢ per year for every $1,000 invested

— Minimum initial investment: $3,000

No retirement asset allocation is complete without bond funds. As an asset class, bond funds play an important role in lowering volatility and providing regular income.

Within the world of Vanguard bond funds, the Vanguard Total Bond Market Index Fund Admiral Shares (VBTLX) stands out as one of the very best Vanguard retirement funds for its combination of competitive yield and rock-bottom fees and expenses. With an expense ratio of just 0.04%, it’s all but free to own. No wonder, then, that VBTLX has racked up a massive $360 billion-plus in assets across all of its share classes.

Related: 9 Best Schwab ETFs to Buy

The Vanguard Total Bond Market Index Fund provides broad exposure to the universe of bonds. A little less than half of its portfolio is Treasury or agency debt backed by the U.S. government, and another 20% is invested in government mortgage-backed securities (MBSes). Industrial-sector corporate bonds make up a little less than 15%, banks and financial institutions make up 9%, and the rest is spread across foreign bonds, utilities, and commercial mortgage-backed securities (CMBSes).

One of the most critical metrics to consider when considering bond funds is duration, which is a measure of interest-rate sensitivity. As an example, a bond with a duration of two years would see its price rise by 2% if interest rates fell by 1% (or conversely, would see its price fall by 2% if interest rates rose by 1%). The actual calculation of duration is fairly complex; it’s the weighted average of the bond’s cash flows. But the key takeaway is that, all else equal, the longer a bond’s time to maturity, the higher its duration—and thus the higher the interest-rate risk.

Related: The 7 Best Fidelity Index Funds for Beginners

The Vanguard Total Bond Market Index Fund, with a duration of 5.8 years, has a medium-term duration. That’s moderate interest-rate risk—if rates keep falling, VBTLX could struggle. But if the Federal Reserve largely stays put, investors will collect a 4%-plus yield with little issue.

If the $3,000 minimum is a problem, the exact same strategy is available via the Vanguard Total Bond Market ETF (BND), which charges an even cheaper 0.03% in annual expenses. At time of writing, a single share can be purchased for around $75.

* SEC yield reflects the interest earned across the most recent 30-day period. This is a standard measure for funds holding bonds and preferred stocks.

Related: The 9 Best Vanguard ETFs for 2025 [Build a Low-Cost Portfolio]

8. Vanguard Inflation-Protected Securities Fund Investor Shares

— Style: Treasury Inflation-Protected Securities

— Management: Active

— Assets under management: $27.6 billion

— SEC yield: 1.2%

— Expense ratio: 0.20%, or $2.00 per year for every $1,000 invested

— Minimum initial investment: $3,000

The next retirement fund on this list focuses on a small but useful niche within the debt market: inflation-linked bonds.

Treasury Inflation-Protected Securities, or TIPS, are government bonds whose returns are connected to changes in the consumer price index—specifically, the “Non-seasonally Adjusted Consumer Price Index for All Urban Consumers” (CPI-U). As the CPI (and thus inflation) increases, so too do TIPS. Here’s an example to help you out:

You buy $50,000 in U.S. TIPS with a 4% coupon. Inflation in the first year is 5%. The face value of your TIPS would be adjusted higher by 5% ($2,500), to $52,500. The 4% coupon would remain the same, but it would be based on the adjusted face value. So instead of receiving $2,000 in annual interest, you would receive $2,100. (Note: Like other Treasury-issued bonds, TIPS pay semiannually.)

Related: The 7 Best Mutual Funds for Beginners

Just understand that TIPS have their downsides, too. They not only face the same interest-risk issues of regular bonds, but expectations for low inflation (and even deflation) can weigh on their value.

The Vanguard Treasury Inflation-Protected Securities Fund Investor Shares (VIPSX) owns 64 different TIPS issues. Individual TIPS come in maturities of five, 10, and 30 years, so it’s no surprise that most of the fund’s assets is invested in TIPS with remaining maturities of either one to five years (52%) or five to 10 years (34%), with the rest scattered across longer-term maturities. The fund’s duration at the moment is 6.5 years.

TIPS, like other Treasuries, are exempt from local and state taxes, so a retirement account blunts some of that advantage. Still, a 401(k) or IRA shields you from federal taxation on that income, as well as the high level of turnover (75% in VIPSX’s case) that’s common among bond funds.

Related: 9 Best Dividend Stocks for Beginners

9. Vanguard Federal Money Market Fund

— Style: Money market

— Management: Active

— Assets under management: $366.0 billion

— SEC yield: 4.1%*

— Expense ratio: 0.11%, or $1.10 per year for every $1,000 invested

— Minimum initial investment: $3,000

In the current environment, it seems unlikely that interest rates will go higher, but it’s possible—and if that happens, higher-duration bond funds would experience capital losses. That was certainly the case in 2022, when very long-term bonds actually saw greater declines than common stock indexes like the S&P 500.

Related: 7 Low- and Minimum-Volatility ETFs for Peace of Mind

If you are looking for a competitive yield with essentially no duration or interest rate risk at all, the Vanguard Federal Money Market Fund (VMFXX) is a solid option and one of the very best Vanguard retirement funds at today’s prices. This income fund consists entirely of U.S. Treasury bills and other U.S. government obligations and repurchase agreements.

Money market funds are somewhat unique among mutual funds in that they specifically target a net asset value of $1 per share. Any earnings that cause the net asset value to go higher than $1 get distributed as dividends. This means that, unless you reinvest your dividends, the value of your money market mutual fund will not grow over time. And that makes VMFXX an extremely conservative option with extremely limited possibility of loss.

Related: Best Fidelity Retirement Funds for a 401(k) Plan

Money market funds’ yields are very sensitive to Federal Reserve policy moves, though. It was barely three years ago that money market funds in general offered virtually nothing in yield. But after the most aggressive string of rate hikes in history, VMFXX is a legitimate income fund with a yield above 4%.

VMFXX’s yield started to decline alongside the Federal Reserve’s reductions in their target benchmark interest rate during 2024. The Fed has resumed its cuts, which could eventually reduce the amount VMFXX pays. So if you require a certain level of yield, you might want to keep close eye on the fund and be aware of other options.

But until then, the Vanguard Federal Money Market Fund remains one of the very best Vanguard retirement funds for its low risk and competitive yield.

* SEC yield for money market funds reflects the interest earned across the most recent 7-day period.

10. Vanguard Wellington Fund Investor Shares

— Style: Moderate allocation

— Management: Active

— Assets under management: $119.5 billion

— Dividend yield: 1.9%

— Expense ratio: 0.25%, or $2.50 per year for every $1,000 invested

— Minimum initial investment: $3,000

Vanguard’s oldest mutual fund, Vanguard Wellington Fund Investor Shares (VWELX) is a “portfolio in a can.”

While stock funds allow you to hold hundreds or thousands of individual stocks, and bond funds allow you to hold hundreds or thousands of bonds, “balanced” or “allocation” funds like VWELX allow you to get all of that exposure in just one fund.

Related: 5 Best AI ETFs for the Artificial Intelligence Era

Vanguard Wellington, which came to life in 1929, is managed by Wellington Management: an investment management company with nearly a century of operational experience. It’s a moderate allocation fund that invests roughly two-thirds of its assets in stocks, and the other third in bonds. The stock portion of the portfolio currently holds about 80 predominantly large-cap stocks with a median market cap of over $265 billion—a “who’s who” of mega-cap blue-chip firms such as Microsoft (MSFT) and Nvidia (NVDA), with a little exposure to international names such as Unilever (UL) and British American Tobacco (BTI).

The bond portfolio is much more broadly diversified, at nearly 1,500 investment-grade issues. The majority of that (roughly two-thirds) is invested in corporate bonds, with another 25% in Treasuries and agency bonds, and the rest peppered across mortgage-backed securities (MBSes), foreign sovereign bonds, and other debt.

Related: How Does the 4% Rule Work? [And Why Did It Change?]

This one-stop shop for your large-cap stock and bond needs charges just 0.25% in annual expenses—very inexpensive for the skilled management and strong performance track record you’re getting in return. Just make sure you’re considering your own investment needs with this fund. If you don’t want a third of your portfolio to be in bonds, you’ll want to put additional money into individual stocks, equity funds, and/or alternative investments.

Wellington has a high amount of turnover (61%) and generates a decent chunk of interest income from its bond portfolio. So, if you’re going to invest in VWELX, it makes sense to do so in a tax-advantaged account.

Like Young and the Invested’s Content? Be sure to follow us.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

11. Vanguard Target Retirement Funds

— Style: Target-date

— Management: Index

— Expense ratio: 0.08%, or 80¢ per year for every $1,000 invested

— Minimum initial investment: $1,000

One of the challenges in retirement planning is getting the asset allocation right, or having an asset class mix that is appropriate for an investor at your age and stage of life. An ideal portfolio for a 20-year-old is likely going to be very different from that of a 40-year-old, and both those portfolios will be different from what’s ideal for a 60-year-old.

This is where Vanguard Target Retirement Funds can really add value.

Related: Beginner’s Guide to Schwab Target-Date Funds

Target-date funds—also called life-cycle funds—are a type of mutual fund that are designed to change their asset allocation over time. Target-date funds start out invested heavily in stocks, then slowly reduce their stock exposure and replace it with bond exposure as they approach their target retirement date, following a glide path.

The target retirement dates are intended to be estimates; they don’t have to be super precise. Generally, most mutual fund families will create target-date funds in five-year increments (say, 2030, 2035, 2040, etc.).

Vanguard Target Retirement Funds hold varying blends of both U.S. and international stocks of various sizes, as well as U.S. and international bonds. They’re unsurprisingly dirt-cheap, at just 0.08% annually, and the entire series earns a respectable Silver Medalist rating from Morningstar.

For a longer primer on Vanguard Target Retirement Funds, take a look at our Beginner’s Guide to Vanguard Target-Date Funds.

Related: 11 Best Stock Screeners & Stock Scanners

Featured Financial Products

What Is the Minimum Investment Amount on Vanguard Mutual Funds?

Vanguard funds are known for being shareholder-friendly. The Vanguard mutual fund company blazed new trails with the index fund, and Vanguard has done more than any other investment firm to keep costs to a minimum for investors.

But there is one hitch. Many of Vanguard’s cheapest funds in terms of fees have initial investment minimums of around $3,000.

If that is a problem for you, don’t sweat it. Most popular Vanguard index funds are also available as ETFs. Most brokers will allow you to buy as little as one share, and some even allow for fractional shares. And if you use a commission-free brokerage, you can buy those ETFs without incurring additional fees. ETF prices vary, of course, but many cost less than $100, and they rarely exceed $400 per share.

Why Does a Fund’s Expense Ratio Matter So Much?

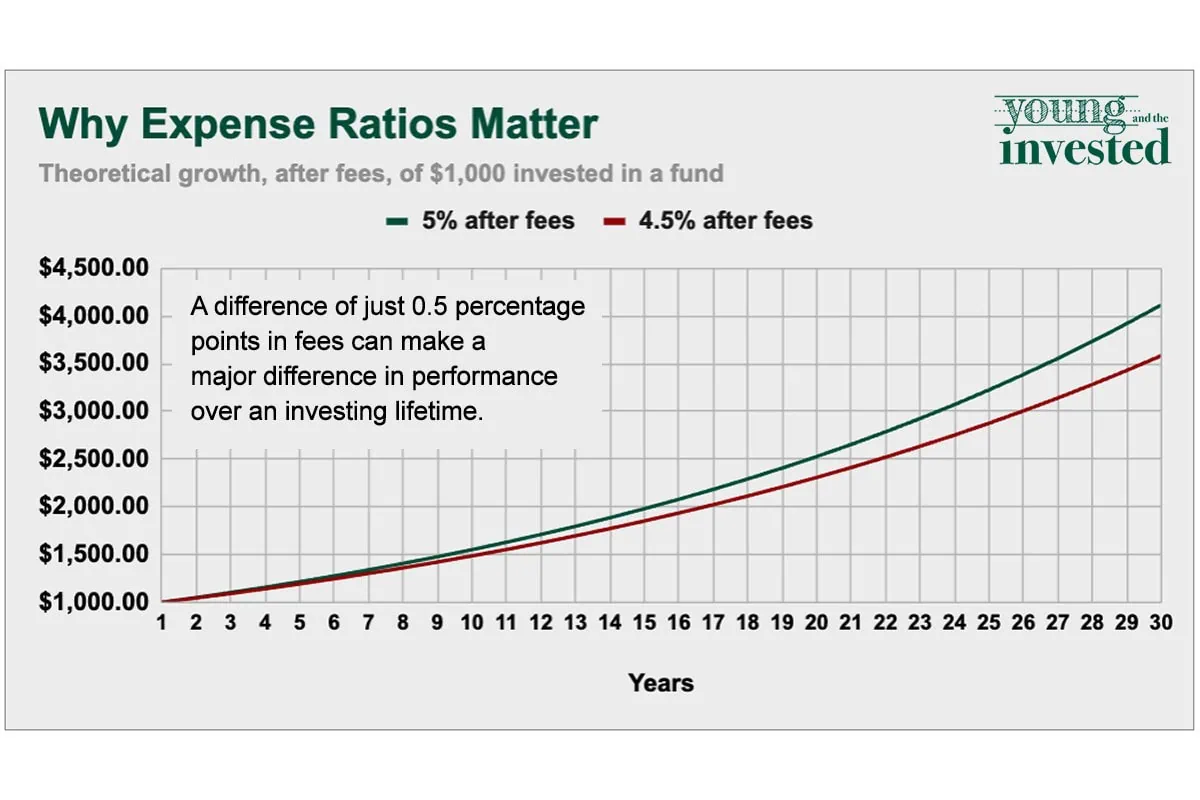

Every dollar you pay in expenses is a dollar that comes directly out of your returns. So, it is absolutely in your best interests to keep your expense ratios to an absolute minimum.

The expense ratio is the percentage of your investment lost each year to management fees, trading expenses and other fund expenses. Because index funds are passively managed and don’t have large staffs of portfolio managers and analysts to pay, they tend to have some of the lowest expense ratios of all mutual funds.

This matters because every dollar not lost to expenses is a dollar that is available to grow and compound. And over an investing lifetime, even a half a percent can have a huge impact. If you invest just $1,000 in a fund generating 5% per year after fees, over a 30-year horizon, it will grow to $4,116. However, if you invested $1,000 in the same fund, but it had an additional 50 basis points in fees (so it only generated 4.5% per year in returns), it would grow to only $3,584 over the same period.

Like Young and the Invested’s Content? Be sure to follow us.

Want to talk more about your financial goals or concerns? Our services include comprehensive financial planning, investment management, estate planning, taxes, and more! Schedule a call with Riley to discuss what you need, and what we can do for you.

Related: 9 Best Fidelity ETFs You Can Buy [Invest Tactically]

Investors often look to exchange-traded funds (ETFs) for cheap, passive exposure to basic broader market indexes like the S&P 500.

But Fidelity’s ETF suite really shines because in addition to some of those plain-vanilla offerings, Fidelity also provides more tactical ways of tapping into specific corners of Wall Street. See what we mean by checking out our list of the best Fidelity ETFs.

Related: 13 Best Long-Term Stocks to Buy and Hold Forever

As even novice investors probably know, funds—whether they’re mutual funds or exchange-traded funds (ETFs)—are the simplest and easiest ways to invest in the stock market. But the best long-term stocks also offer many investors a way to stay “invested” intellectually—by following companies they believe in. They also provide investors with the potential for outperformance.

So if you’re looking for a starting point for your own portfolio, look no further. Check out our list of the best long-term stocks for buy-and-hold investors.

Please Don’t Forget to Like, Follow and Comment

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Subscribe to Retire With Riley, our free weekly retirement planning newsletter, and

3. Give the article a Thumbs Up on the top-left side of the screen.

4. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!