If you sell stock, cryptocurrency, real estate, precious metals, or any other capital asset, there’s a good chance you’ll have to pay capital gains tax on any profits. However, the capital gains tax rate you’ll pay isn’t always crystal clear.

For instance, you might have heard that there are three capital gains tax rates: 0%, 15% or 20%. However, the tax rate that applies to your capital gain very well might not be one of those three rates. Plus, you might also have to pay an additional surtax on your profits.

So, how do you determine the proper capital gain tax rate? When you drill down a bit, you’ll see that the actual capital gains tax rate that applies to your profits depends on several different factors, such as how long you held the asset before selling it, the type of property sold, your taxable income, and the filing status used for your federal tax return.

But don’t worry—I’ll walk you through the process. Read on to see how all the factors listed above play a role in determining the tax rate that applies to your capital gains in 2025.

Table of Contents

What You Need to Know About Capital Gains

Before exploring the different capital gains tax rates, it’s probably a good idea to cover a few capital gains tax basics.

As implied above, the federal capital gains tax is imposed on any gain (i.e., profit) from the sale of capital assets. The tax is typically paid when you file your federal income tax return for the year the asset is sold.

The profit subject to the capital gains tax is generally equal to the amount you receive from the sale of an asset minus your adjusted basis in the property. (You have a capital loss if you sell a capital asset for less than your adjusted basis.) So, the higher your adjusted basis, the lower your capital gains tax.

Young and the Invested (YATI) Tip: Up to $250,000 of gain from the sale of your home is generally not subject to capital gains taxes if you owned the home and used it as your primary residence for at least two of the five years immediately preceding the sale (up to $500,000 of gain is excluded for married couples filing a joint tax return).

If you sell a capital asset for a loss, you can use the capital loss to offset capital gains (if any), which will reduce the amount of gain for which you owe capital gains taxes. Plus, if you have a net capital loss after offsetting gains with losses, you can use up to $3,000 of the net loss to reduce your “ordinary” taxable income. Anything over the $3,000 limit is carried forward and applied against gains or deducted from ordinary income in future years.

What’s a Capital Asset?

Capital assets include stocks, bonds, mutual funds, cryptocurrency, precious metals, and similar investment properties. But personal items—such as your car, home, furniture, stamp collections, jewelry, and so on—are also capital assets for which you can incur capital gains taxes when they’re sold.

What’s an Asset’s Adjusted Basis?

Basically, your adjusted basis in an asset is the amount you have invested in the property. Start with your cost basis, which in most cases is your purchase price, plus sales tax, broker commissions, legal fees, and various other expenses related to your purchase. That amount is then increased by the cost of items that add value to the property, such as improvements to real estate. It’s then decreased by certain property-related benefits you previously received, such as stock splits or tax deductions for depreciation.

In some cases, an alternative basis is used. For instance:

— The basis of inherited property is generally the property’s fair market value (FMV) at the date of the previous owner’s death (this is known as “stepped-up basis”).

— If you receive property as a gift, your initial basis can either be the donor’s adjusted basis or the property’s FMV when you received the gift, and your basis can be increased by any gift tax paid.

— If you replace destroyed property with similar property (e.g., property lost in a natural disaster), the old property’s basis generally becomes the replacement property’s basis.

— For property received in exchange for services, the property’s FMV is your basis (if a price is agreed upon before services are provided, that price will generally be accepted as the property’s FMV).

Related: 30 Tax Statistics and Facts That Might Surprise You

“Netting” Rules for Offsetting Capital Gains With Capital Losses

You must follow a certain sequence when offsetting capital gains with capital losses. This is known as “netting” capital gains and losses.

The order is as follows:

1. First, you must offset short-term gains with short-term losses.

2. Second, long-term gains are offset with long-term losses.

3. Last, if there are any net losses of either variety, they can then be used to offset any gains remaining of the opposite type.

Like Young and the Invested’s Content? Be sure to follow us.

Long-Term Capital Gains vs. Short-Term Capital Gains

Now let’s get back to the capital gains tax rates. Since it’s often the most important factor for determining which capital gains tax rate applies, I want to start with the difference between long-term capital gains and short-term capital gains.

Generally speaking, if you sell a capital asset for a profit, you have a long-term capital gain if you held the asset for more than one year before selling it. On the other hand, you have a short-term capital gain if you held the asset for one year or less.

If you end up with a net capital gain after netting gains and losses, the tax rate that applies usually depends on whether the net gain is long-term or short-term capital gain. In most cases, the tax rate on your net capital gains will be lower for long-term gains, which creates an incentive to hold on to investments and other assets for more than a year if possible.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

Calculating Your Holding Period

To determine how long you held an asset, start counting on the day after the day you acquired the property, and then count the day you disposed of the property as part of your holding period.

For example, if you bought stock on Nov. 15, 2024, the clock started running on Nov. 16, 2024. If you sold the stock for a profit on Nov. 16, 2025, you didn’t hold it for more than one year, so you have short-term capital gain. However, if you sold the stock on Nov. 17, 2025, you have a long-term capital gain because you held it for more than a year.

Related: How to Give Stocks as a Gift in a Tax-Efficient Way

2025 Long-Term Capital Gains Tax Rates

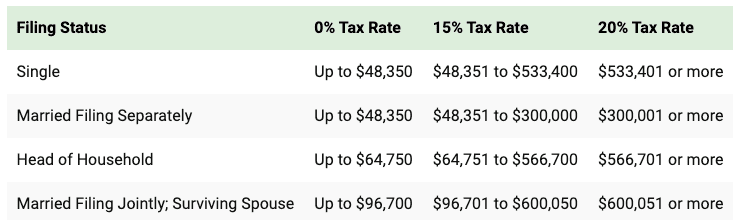

The Internal Revenue Service (IRS) adjusts the taxable income ranges each year to account for inflation. As a result, your long-term capital gains tax rate might not be the same as the rate you’ve paid in the past.

The 2025 long-term capital gains tax rates and brackets are shown in the table above (again, dollar amounts are for your taxable income).

Related: Child Tax Credit FAQs [What Every Parent Needs to Know]

2025 Short-Term Capital Gains Tax Rates

As with the long-term rates, the IRS adjusted the income ranges for the short-term capital gains tax rates each year to account for inflation.

So, if you’re already planning ahead for this year, the short-term capital gains tax rates for the 2025 tax year are the same same rates that apply to ordinary income.

Alternative Capital Gains Tax Rates

As mentioned earlier, the type of property is also a factor in determining the tax rate applied to a capital gain. This is because there are special capital gains tax rates for certain types of assets.

The following special capital gains tax rates apply for the 2025 tax year:

— 28% for the taxable portion of a gain from selling qualified small business stock (a.k.a., “Section 1202 stock”)

— 28% for collectibles (e.g., art, coins, stamps, historic artifacts, etc.)

— 25% for unrecaptured gain from selling certain real estate (“Section 1250 property”) subject to depreciation

Each special capital gains rate is a maximum rate. As a result, your ordinary income tax rate might still apply to short-term capital gains on the sale of qualified small business stock, collectibles, or Section 1250 property if it’s higher than the special maximum capital gains tax rate.

Related: 11 Education Tax Credits and Deductions

State Capital Gains Tax Rates

Let’s not forget about state taxes, since state capital gains taxes apply in most states that impose an income tax. Generally, the capital gains included in your state taxable income are treated and taxed at the same rate as other income, regardless of whether they’re long-term capital gains or short-term capital gains.

YATI Tip: Washington State, which doesn’t have an income tax, also levies a separate 7% capital gains tax.

For more information on state taxes on capital gains, check with the state tax agency where you live.

Related: States That Tax Social Security Benefits

Net Investment Income Tax

In addition to paying capital gains taxes when you sell profitable assets, you might also have to pay what’s called the net investment income tax. This 3.8% surtax is imposed on your “net investment income” if your modified adjusted gross income (AGI) exceeds a certain amount.

Among other things, your net investment income generally includes interest, dividend income, capital gains, rental and royalty income, and non-qualified annuities. It doesn’t include wages, unemployment compensation, Social Security benefits, alimony, and most self-employment income. Net investment income also doesn’t include any gain on the sale of a personal residence that’s excluded from gross income for regular income tax purposes.

Income Thresholds for Net Investment Income Tax

The income thresholds, which are based on your filing status, are as shown above.

For purposes of the net investment income tax, modified adjusted gross income means the adjusted gross income reported on your federal income tax return, plus any excluded foreign earned income.

The thresholds aren’t adjusted annually for inflation, so the 2025 amount is the same as it was for 2025.

Related: IRS Delays 1099-K Rules: What PayPal, Venmo, StubHub Users Need to Know

How to Reduce or Avoid Capital Gains Taxes

As with any other type of tax, you want to lower or even avoid capital gains taxes if you can. There are several ways to whittle down your capital gains tax bill and cut your overall tax liability in the process. Some methods take advance planning, while others can be implemented relatively quickly. And, of course, some might not be practical or even feasible for you.

To get you thinking about ways to slash your capital gains taxes, here are some quick-hit capital gains tax strategies that might be right for you:

1. Hold assets for more than one year before selling for a profit.

With a long-term gain, you’ll qualify for a lower capital gains tax rate. These long-term capital gains rates are generally more advantageous than the applicable short-term capital gains rate (ordinary income tax rates).

2. Sell investments or other assets that have declined in value to generate capital losses.

When you sell investments or other assets that have declined in value, they generate capital losses that you can then use to offset capital gains. This approach is commonly referred to as “tax loss harvesting.” Be mindful of one provision that can affect your timing of taking advantage of this strategy called the “wash sale rule,” which prohibits you from deducting capital losses from the sale of an asset if you buy it (or a very similar asset) back within a 30-day period before or after the sale.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

3. Place assets that are likely to increase significantly in value in tax-advantaged retirement accounts

To minimize how much you pay in capital gains, you can place assets likely to appreciate in value inside a tax-advantaged retirement account, such as a traditional IRA. If you sell assets in these accounts, you don’t have to pay capital gains taxes. However, withdrawals from these accounts will be taxed at ordinary income tax rates regardless of how long you held the asset.

4. Donate the appreciated property to charity

Consider donating appreciated property to charity to receive a tax deduction for the property’s FMV. Under certain circumstances, the FMV is reduced by any long-term capital gain you would have realized had you sold the property. Your charitable tax deductions might also be limited to up to 50% of your adjusted gross income.

5. Use a Section 1031 exchange

If you’re selling investment real estate, defer capital gains taxes with a Section 1031 like-kind exchange. If you use the profits from the sale to purchase real estate of the same nature or character, then any gain or loss generally won’t be recognized until you sell or otherwise dispose of the new property.

6. Stay put in your primary residence for a little while longer

Delay selling your home if you haven’t lived there very long. If you expect to owe capital gains taxes on the sale, you definitely don’t want to leave the $250,000 exclusion ($500,000 if married filing jointly) on the table. If you currently don’t meet the ownership or residency requirements, consider postponing the sale until you do.

7. Consider Investing in Qualified Opportunity Funds

You can defer or eliminate capital gains taxes if you invest profits from the sale of property in a Qualified Opportunity Fund, which then invests in economically distressed communities. Your capital gains tax liability can be deferred until 2027. In addition, if you hold your investment in a QOF for 10 years, your basis is increased to 100% of the investment’s FMV (other basis increases are available if you hold the investment for five or seven years).

Check with your tax advisor to see if any of these strategies can provide tax advantages for you and reduce your overall tax burden.

Want to talk more about your financial goals or concerns? Our services include comprehensive financial planning, investment management, estate planning, taxes, and more! Schedule a call with Riley to discuss what you need, and what we can do for you.

Related: IRA Contribution Limits

Saving for retirement is one of the primary goals of financial planning … and IRAs are one of the most important vehicles for achieving your retirement saving goals. However, you can only put so much in IRAs each year (and the amount is subject to change on an annual basis).

Want to know how much you can stuff in an IRA this year? Check out the current IRA contribution limits before you plan your retirement savings goals for the year.

Related: What Tax Bracket Are You In?

Perhaps the best way to lower your federal income tax bill is push yourself down into a lower tax bracket to reduce your tax rate. On the flip side, you certainly want to avoid getting kicked into a higher bracket and increasing your tax rate.

But, of course, under either scenario you need to have a good feel for where you are right now. For that purpose, check out the federal tax brackets and rates that will apply for your next federal tax return.

Please Don’t Forget to Like, Follow and Comment

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Subscribe to Retire With Riley, our free weekly retirement planning newsletter, and

3. Give the article a Thumbs Up on the top-left side of the screen.

4. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!