Much like some people in the dating pool, the best dividend stocks you can buy don’t exactly have a “type.”

Some elite dividend payers boast prolific distribution growth. Others have extremely stable dividends that are easily covered by earnings several times over. And still others have massive yields. Of course, in an ideal world, the best dividend stocks would have elements of all of the above.

And that’s what I want to explore today: Top-quality companies paying well-covered dividends with above-average yields that have shown at least some signs of growth.

Today, I’m going to look at the best dividend stocks for 2026 as rated by Wall Street’s analyst community. After all: Crowded “Buy” camps don’t just signal optimism about their dividends, but the direction of their shares, too.

Editor’s Note: Tabular data presented in this article are up-to-date as of Feb. 9, 2026.

Featured Financial Products

Disclaimer: This article does not constitute individualized investment advice. Individual securities, funds, and/or other investments appear for your consideration and not as personalized investment recommendations. Act at your own discretion.

Table of Contents

Why Dividend Stocks?

Dividend stocks can do wonders for the long-term performance of your portfolio. These companies pay a regular flow of their profits directly back to shareholders, meaning you receive some sort of return—even when share prices aren’t cooperating.

Stocks that can both grow and pay dividends are the ultimate long-term stocks given just how much in additional returns they can generate over the long term.

The Importance of Dividends

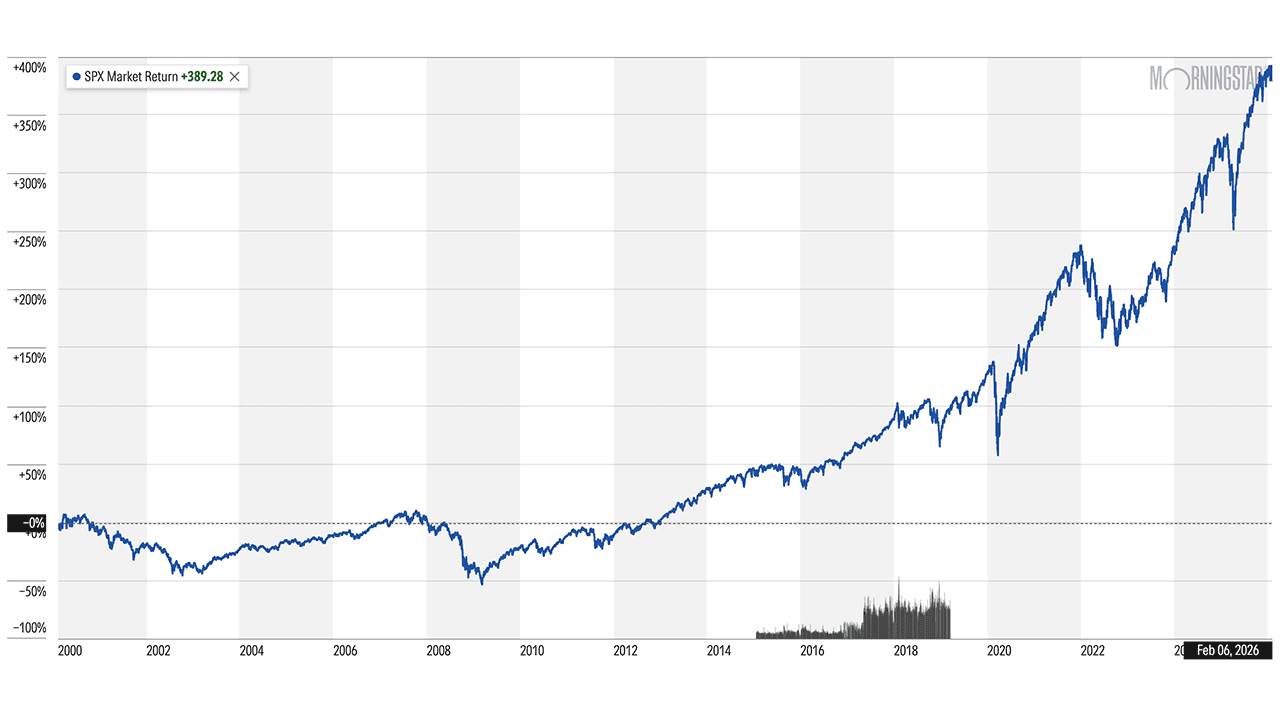

The image above shows a look at the return someone could expect if they received just the price returns from the S&P 500 over the past 25 years.

Next, we’ll look at what your returns might look like in comparison when you reinvest those dividends.

But What If I Reinvested My Dividends?

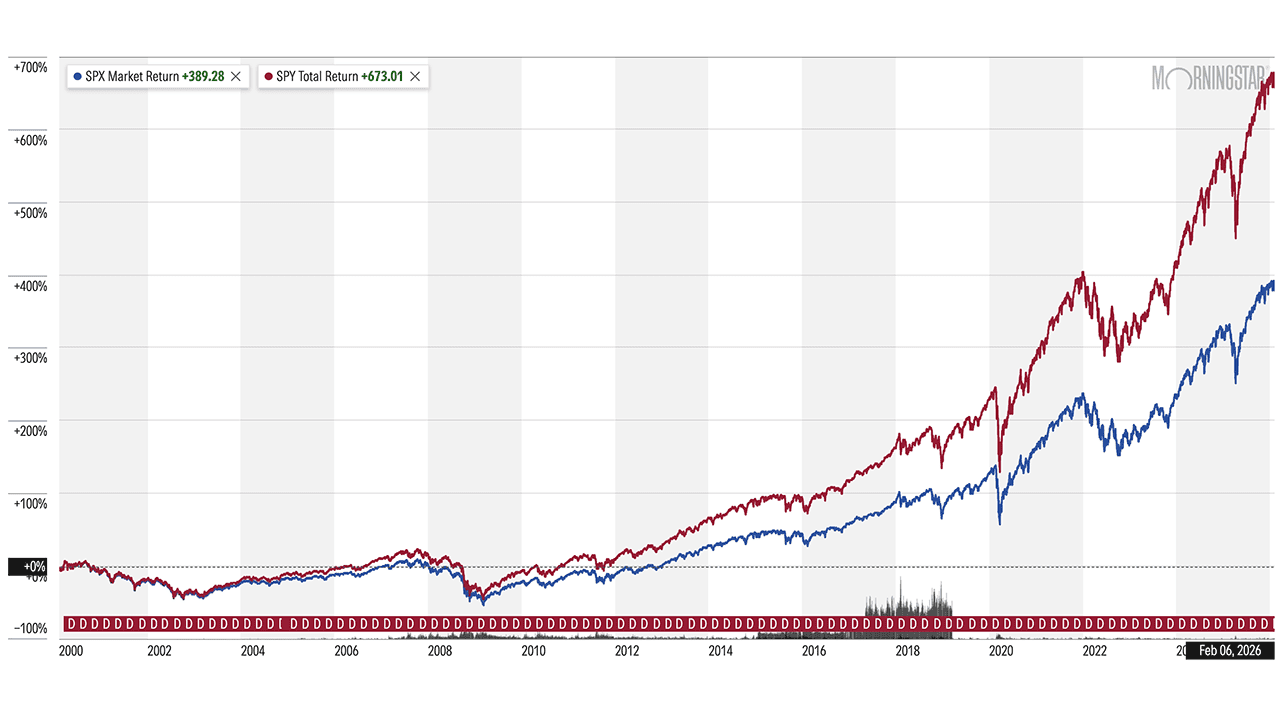

Now look at the chart above to see how much better the return is when you factor in dividends had you had reinvested those dividends back into the S&P 500 (returns illustrated by an S&P 500-tracking ETF; note that expenses are included in performance).

The price return is right around 390%. The total return (price plus dividends) is 670%!

Just like price return on stocks can be improved upon with dividends, though, a stock that pays dividends but doesn’t go anywhere isn’t exactly ideal, either. Thus, the best dividend stocks will provide both a steady baseline of income and provide you with the potential for meaningful price upside.

Dividend Yields (And Dividend Safety)

Dividend yield is a simple calculation—annual dividend / price x 100—that can mean a world of difference for investors, especially those reliant on income.

But dividend yield isn’t everything. Sometimes, stocks with high yields can look more attractive, but they’re actually flashing a warning signal that the dividend isn’t sustainable. You see, a company can get a very high annual dividend yield in two very different ways: the dividend growing very rapidly, or the share price falling very quickly.

For example, Alpha Corp., which trades for $100 per share, pays a 75¢-per-share quarterly dividend, or $3 across the whole year. It yields 3.0%. In a month, however, it yields 6.0%. Here are two ways that could have happened:

1. Alpha Corp. doubled its dividend to $1.50 per share quarterly, good for a $6-per-share annual dividend. The share price stays the same. ($6 / $100 x 100 = 6.0%)

2. Alpha Corp. kept its dividend at 75¢ quarterly ($3 annually), but its share price plunged in half to $50 per share. ($3 / $50 x 100 = 6.0%)

In one of those scenarios, Alpha Corp. has a very safe dividend. In the other one, Alpha’s dividend could be ready to implode.

So, if you’re sniffing out the best dividend stocks to buy for 2026, make sure you’re not just looking at yield, but also gauging a dividend’s safety. Among other things, you’ll want to look at payout ratio, which determines what percentage of a company’s profits, distributable cash flow, and other financial metrics (depending on the type of stock) are being used to finance the dividend. Generally speaking, the lower the payout ratio, the more sustainable the payout.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

How We Chose the Best Dividend Stocks to Buy for 2026

Before I started this article, I was video calling a colleague and joked, in a pseudo-philosophical voice, “What is a good dividend stock, anyways?”

But I was only partly kidding. What’s ideal to one investor might not fit the bill for another. Ultimately, though, I coalesced around safe dividends, with some capacity to grow, sporting above-average yields, paid by larger (and thus likelier to be more stable) companies. Specifically, they have to …

— Be in the S&P 500.

— Have a yield greater than 1.5%, to ensure they’re better than the overall market. Most of the stocks on this list yield more than 2%, some north of 3%,and one yields more than 5%. (If that’s too low a baseline yield for you, I suggest you instead read our list of high-yield dividend stocks, where 5%-plus yields are the norm.)

— Have an earnings payout ratio below 70%. This is a generally safe level where there’s still at least some room for dividend growth, and the lower the payout ratio, typically the more growth potential there is. (Note: Free cash flow payout ratio is an even better metric, but screening data for this tends to be unreliable.)

— Have at least a consensus Buy rating according to analysts tracked by S&P Global Market Intelligence. S&P boils down consensus ratings down to a numerical system where anything less than 1.5 is a Strong Buy, 1.5 to 2.5 is a Buy, between 2.5 and 3.5 is a Hold, 3.5 to 4.5 is a Sell, and anything greater than 4.5 is a Strong Sell. In this case, I only included stocks with a 2.0 rating or less—so at least a pretty firm consensus Buy rating, if not an outright Strong Buy.

I also limited the energy sector to just two stocks. Energy companies were extremely overrepresented in the screen; most problematic is that several sport variable dividends that rise and fall based on available cash flow, which is largely tethered to the motion of energy prices. So a 3% yield today could be 1% in a year, 2% the year after, and so on. The rest of the list is populated with stocks that have more traditional dividend programs—regular payouts that typically only change when the company announces a hike.

The equities here are listed in reverse order of their consensus analyst rating, starting with the worst-rated stock and ending with the best-rated stock.

Related: 15 Dividend Kings for Royally Resilient Income

10. BlackRock

— Sector: Financials

— Market cap: $167.5 billion

— Dividend yield: 2.1%

— Consensus analyst rating: 1.71 (Buy)

BlackRock (BLK) is one of the world’s largest asset management firms, boasting more than $14 trillion in assets across its many lines of business. Individual investors know it well for both its BlackRock mutual funds and closed-end funds (CEFs), as well as its iShares exchange-traded funds (ETFs). But it also manages money for institutional clients, including pension plans, foundations, charities, and insurance companies, among others.

With the exception of a few understandable hiccups (COVID, for instance), BlackRock has been in a broader consistent uptrend since the depths of the Great Recession. That has come alongside similar progression in both the company’s top and bottom lines.

Related: 7 Best High-Yield Dividend ETFs for Income-Minded Investors

It’s difficult to find any Wall Street pros with something negative to say about BLK. Shares currently enjoy 13 Buy calls versus four Holds and no Sells, and the analysts’ consensus for long-term earnings growth sits at an encouraging 12% annually.

“We believe that BLK remains well positioned to deliver above-peer organic growth given its unmatched product breadth and distribution footprint (helped by its iShares franchise),” say Keefe, Bruyette & Woods analysts Aidan Hall and Kyle Voigt, who rate BLK at Outperform (equivalent of Buy). “Also, its scale and demonstrated ability to generate operating leverage bodes well for future earnings growth and operating leverage. The firm’s increasing alternatives presence and growing technology revenue stream add further breadth to what is already a diverse product/solutions offering.”

BlackRock has been a fount of dividend growth since the Great Recession, too. In the past decade alone, BLK has managed to average 10% annual dividend growth. Its most recent hike, announced in early February 2026, was a stout 10% bump to $5.73 per share. Still, a payout ratio around 40% of 2026 profit estimates should keep investors plenty confident in the dividend’s health and its ability to keep growing.

Featured Financial Products

9. VICI Properties

— Sector: Real estate

— Market cap: $31.1 billion

— Dividend yield: 6.1%

— Consensus analyst rating: 1.71 (Buy)

VICI Properties (VICI) is a real estate investment trust (REIT) that specializes in gaming, hospitality, and entertainment properties. A reminder: REITs are structured differently than regular businesses. They receive significant tax breaks, but in return, they must pay out at least 90% of their taxable income back to shareholders in the form of dividends.

While you’re probably most familiar with its Vegas real estate, which includes Caesars Palace Las Vegas, MGM Grand, and the Venetian Resort Las Vegas, VICI actually owns 54 gaming properties and 39 other “experiential” properties—such as golf courses and Bowlero bowling alleys—across roughly two dozen states and Canada.

VICI and other gaming REITs are a way to invest in gambling/gaming with the potential for less volatility. That’s because their revenues aren’t directly driven by ups and downs in the business—they collect rent. So while a prolonged economic downturn, say, could weigh on operators’ ability to pay their bills, VICI is a bit more insulated from quarter-to-quarter issues. Also helping VICI’s stability is that roughly 90% of its contractual rent is subject to CPI-linked escalators over the full lease term, which is well above the industry average.

Related: 10 Best Alternative Investments [Options to Consider]

“We believe VICI can outperform given attractive valuations relative to traditional triple-net REITs, although more challenged capital markets have weighed on acquisition activity,” says Citi Research Analyst Nick Joseph (Buy). “Current dividend yield is ahead of REITs, and we note nearly all contractual rent is subject to CPI escalators, providing some protection against inflation.”

“Its investment activity has been more varied as it diversifies into other areas of experiential real estate (i.e., youth sports, golf, wellness, bowling), and while these deals tend to be smaller than gaming transactions, they create more of a ‘flow’ of transactions,” adds JPMorgan’s North American Equity Research team, which rates VICI at Overweight (equivalent of Buy). “When combined with free cash flow, VICI should have the ability to drive about 2% in external growth annually.”

Citi and JPMorgan are among 18 Buy-equivalent ratings on VICI shares, which also sports six Holds and zero Sells. That doesn’t just put it among the pros’ best dividend stocks for 2026; it’s also among the best REITs to buy.

Unlike regular stocks, with which we use profits or free cash flow to determine payout ratio, REIT dividend coverage is typically gauged by funds from operations (FFO), a metric of profitability that falls outside of generally accepted accounting principles (GAAP) standards. FFO payout ratio standards are somewhat different, with 70% to 80% considered quite healthy. VICI? It pays out about 65% of adjusted FFO (AFFO) estimates for 2026. That should help it continue its short streak of dividend hikes, which included a 4% bump in the payout in late 2025 to 45¢ per share.

Make Young and the Invested your preferred news source on Google

Simply go to your preferences page and select the ✓ box for Young and the Invested. Once you’ve made this update, you’ll see Young and the Invested show up more often in Google’s “Top Stories” feed, as well as in a dedicated “From Your Sources” section on Google’s search results page.

8. Abbott Laboratories

— Sector: Health care

— Market cap: $193.1 billion

— Dividend yield: 2.3%

— Consensus analyst rating: 1.69 (Buy)

Abbott Laboratories (ABT) is a large health care firm that develops, makes, and sells medical devices, diagnostic products, nutritional products, and generic pharmaceuticals. Among other things, it’s responsible for FreeStyle (and FreeStyle Libre) glucose monitors, Pedialyte hydration products, Similac formulas, PediaSure children’s nutritional products, and BinaxNow COVID-19 antigen tests.

Medical devices are Abbott’s biggest breadwinner at almost half of revenues, and has been a key driver of growth of late. The company has reported eight consecutive quarters of double-digit growth in medical devices; diabetes and structural heart products delivered growth in the teens last quarter, too.

Related: The 10 Best Dividend ETFs [Get Income + Diversify]

That’s among the many reasons Argus Research is in a crowded bull camp of 22 Buys (versus seven Holds and no Sells) on ABT shares.

“We believe Abbott’s growth drivers (including the FreeStyle Libre, electrophysiology products, leadless pacemakers, and cardiovascular devices) as well as its ability to develop and launch new products could lead to continued growth in sales and earnings,” says analyst David Toung, who rates the stock at Buy. “We note that Abbott plans to expand the FreeStyle portfolio beyond the diabetic market to the consumer market.”

More recently, a potential issue with the Freestyle Libre knocked ABT shares lower in January. The FDA disclosed a warning letter to the diabetes-care business alleging, among other things, that Abbott didn’t include clear/consistent instructions for third-party manufactures to ensure devices are built properly. Still, the analyst set appears undeterred.

“It appears that management is working on rectifying issues in the FDA warning letter and is suggesting there should not be any material headwinds to the business, though we acknowledge warning letters can add some uncertainty from the investor perspective,” says a William Blair analyst team (Outperform). “We wait for more clarity and details on remediation timelines and potential impacts to the segment in the coming weeks/months, but for now Abbott feels comfortable it will not see material impacts to supply or pipeline timelines, which is an encouraging update from the company.”

Abbott is a Dividend King—an elite subset of Dividend Aristocrat that boasts at least 50 consecutive years of payout growth. It has posted 54 years of distribution hikes that continued even after it spun off biopharma unit AbbVie (ABBV) at the start of 2013. The dividend itself dates back a full century, to 1924. For now, a safe payout ratio of 45% of 2026’s projected earnings provides little reason to think both streaks won’t continue.

Related: The 10 Best Dividend Mutual Funds You Can Buy Now

7. NiSource

— Sector: Utilities

— Market cap: $21.0 billion

— Dividend yield: 2.7%

— Consensus analyst rating: 1.64 (Buy)

NiSource (NI) is a natural gas and electric utility company founded in 1847 that serves more than 4 million customers in six states across the Midwest and East Coast.

It shouldn’t surprise that one of the best dividend stocks for 2026 comes from the utility sector, which is known for steady operations and sustainable dividends. Remember: NiSource and many other utilities are regulated, which means they must request permission to raise their prices and usually only do so by a couple percent every year or two. Plus, much of their money tends to be reinvested in infrastructure like electric lines and water pipes, or distributed as dividends to shareholders. So there’s usually not much growth to be had here.

Related: The 10 Best Vanguard Index Funds to Buy in 2026

Still, NiSource is coming off its fourth consecutive quarter of double-digit year-over-year revenue growth, and a 2025 that saw shares deliver a 17% total return (price plus dividends). That’s a sizable gain for a utility stock, and it actually prompted a couple analysts to tone down their optimism about NI shares in the short term. Still, Wall Street remains bullish on the stock, at 11 Buys versus two Holds and one Sell.

“This Midwestern utility has streamlined operations and has been outpacing peers in terms of cost savings,” says Argus Research analyst Marie Ferguson (Buy). “The region has growing residential and manufacturing demographics. Management is optimistic that its capital plans can boost its base rate 9%-11% through 2033, including 8%-10% annualized growth through 2030.”

NiSource’s dividend is well-covered at less than 60% of 2026’s projected earnings. That distribution was last raised in February 2026, to 30¢ per share—up about 7% from its previous payout, and 36% better than what it was paying five years ago.

There’s nothing exciting about buying a natural gas company and harvesting the dividends, but stability and income are nonetheless important aspects of many investors’ portfolios … and NiSource serves those needs.

Related: The 12 Best Vanguard ETFs for 2026 [Build a Low-Cost Portfolio]

6. Bank of America

— Sector: Financials

— Market cap: $406.9 billion

— Dividend yield: 2.0%

— Consensus analyst rating: 1.62 (Buy)

Bank of America (BAC) is one of the world’s largest banks, serving roughly 69 million Americans through 3,800 branches and 15,000 ATMs across 39 states. However, BofA is much, much more than its consumer business—it also provides financial products and services for small and midsized businesses, large corporations, institutional investors, and even governments. Its offerings range from checking and savings accounts to commercial loans, trade finance, treasury management, and securities clearing.

Related: 11 Best Vanguard Funds for the Everyday Investor

BAC shares enjoyed a market-beating 28% total return in 2025. Relatively volatile markets have helped push trading revenues higher, loans are growing, and the company’s net interest income continues to improve.

“BAC’s 2025 Investor Day, its first since 2011, made us more convinced that BAC has entered a new period of consistent, sustained positive operating leverage after eight straight quarters of negative operating leverage in 3Q23-2Q25,” says Morgan Stanley analyst Betsy L. Graseck, who rates the stock at Overweight and calls Bank of America her “top pick” in big banks heading into 2026.

Related: 7 Best Vanguard Dividend Funds [Low-Cost Income]

“Investor Day goals outlined for the company at large over the medium term included deposit growth of 4%, loan growth of 5%, operating leverage of 200-300 basis points leading to an efficiency ratio of 55%-59%, EPS growth of at least 12%, and a return on tangible common equity of 15% in the near term and 16%-18% in the medium term,” adds Argus Research analyst Stephen Biggar (Buy). “We believe the targets are achievable given the company’s breadth of products and investment capabilities, and are competitive enough to push BAC into the upper range on these metrics in the peer group.”

Analysts are broadly bullish on the Big Four bank, with 21 Buys against just five Holds and no Sells. As for the dividend? Bank of America has raised its cash distribution by 55% between 2020 and today. Most recently, it announced a roughly 8% hike, to 28¢ per share, effective as of the September 2025 payout. That dividend is very well-covered at just 25% of 2026’s expected earnings.

Related: The 7 Best Mutual Funds for Beginners

5. Cigna

— Sector: Health care

— Market cap: $77.6 billion

— Dividend yield: 2.3%

— Consensus analyst rating: 1.58 (Buy)

Cigna Group (CI) is perhaps best known for the Cigna brand, which is one of America’s largest health insurers, offering health, dental, and other plans. But Cigna actually makes up less than half of Cigna Group’s revenues—60% come from its Evernorth Health Services unit, which includes its Express Scripts pharmacy and pharmacy benefit management businesses, Accredo specialty pharmacy, MDLive telehealth, and more.

“Cigna’s managed care portfolio targets strong growth business lines, and is highly diversified, with a relative concentration in the stable [administrative services only] business,” says Oppenheimer, which rates shares at Outperform. “We believe the market is undervaluing the opportunity from the highly accretive Express Scripts deal, which should pay strong long-term returns for shareholders given the diversification, opportunity to cross-sell its services, and a more equity-friendly capital structure. Furthermore, Cigna typically trades at a discount to its peers, leaving upside from multiple expansion.”

Related: 9 Best Schwab Funds You Can Buy: Low Fees, Low Minimums

Oppenheimer is among 20 Buy-equivalent calls on the stock, which compares nicely to just four Holds and no Sells. Also among the bulls is BofA Global Research analyst Kevin Fischbeck, who believes the company’s pharmacy benefit manager (PBM) business is misunderstood.

“The market appears to be concerned about a race to the bottom on PBM margins, but we haven’t seen any evidence of margin compression outside of the largest accounts,” he says. “Meanwhile, CI screens cheap even assuming the implementation costs don’t go away over time and despite what we see as an improved PBM business (extended contracts, derisked legislatively, PBM a smaller part of earnings).”

Unlike many of the dividend stocks on this list, Cigna doesn’t have a particularly illustrious dividend history. In 2004, the company cut its quarterly payout by 92%, to 2.5¢ per share (adjusted for its 3-for-1 stock split in 2007). Then in 2008, the company transitioned to 4¢ annual dividends, which lasted until 2021, when Cigna announced a new quarterly dividend of $1 per share. Since then, the company has raised its payout by another 56%, to $1.56 per share.

Cigna certainly has more headroom for higher dividends going forward—the company’s current payout represents just 20% of 2026’s expected earnings.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

4. Citizens Financial Group

— Sector: Financials

— Market cap: $29.1 billion

— Dividend yield: 2.7%

— Consensus analyst rating: 1.52 (Buy)

Citizens Financial Group (CFG) is the holding company behind Citizens Bank, a large regional bank with roughly 1,000 branches serving 14 East Coast and Midwest states as well as Washington, D.C. It provides a wide variety of consumer and commercial banking services, including deposits, mortgages, credit cards, business loans, wealth management, foreign exchange, corporate finance, and more.

Related: 11 Best Investment Opportunities for Accredited Investors

One noteworthy area of growth for CFG is Citizens Private Bank, which offers personal banking, wealth management, and other services to people with at least $10 million in net worth and at least $5 million in liquid assets. Since launching near the end of 2023, Private Bank has accumulated $12.5 billion in deposits, $5.9 billion in loans, and $7.6 billion in investments.

“CFG also reported that Citizens Private Bank continues to grow, reporting $14.5 billion in deposits, $10 billion in investments, and $7.2 billion in loans since the launch in 4Q23,” says Argus Research analyst Kevin Heal, who rates Citizens’ shares at Buy. “Management has remained confident that Private Bank will deliver 20% to 25% return on equity for FY26.”

Related: 8 Best Stock Picking Services, Subscriptions, Advisors & Sites

“CFG has among the strongest [return on tangible common equity] improvement stories among large regional banks, supported by net interest income/net interest margin improvement, Private Bank buildout, balance sheet optimization efforts, and a capital markets recovery,” add Keefe, Bruyette & Woods analysts, who have the stock at Outperform. “Overall, we continue to believe CFG has among the most attractive risk/reward setups for super regional banks.”

All told, CFG has a broad bull camp of 19 Buys versus two Holds and no Sells.

Citizens Financial has paid a dividend every year since its initial public offering (IPO) in 2014. Its dividend-growth history is less consistent; nonetheless, the quarterly payout has improved by 360% since its initial 10¢ payout. Most recently, in October 2025, it announced a 9.5% improvement to the dividend, to 46¢ per share. It’s a very well-covered payout that represents about 35% of Citizens’ anticipated profits for 2026.

Featured Financial Products

3. Bunge Global

— Sector: Consumer staples

— Market cap: $22.9 billion

— Dividend yield: 2.3%

— Consensus analyst rating: 1.50 (Strong Buy)

Bunge Global (BG) is a leading agribusiness and food company, operating across the entire agricultural supply chain through its many subsidiaries. All told, its operations span roughly 23,000 employees across more than 300 facilities in over 40 countries.

The U.S.-headquartered but Switzerland-incorporated firm is a leading global oilseed processor and producer of vegetable oils and protein meals. It sources, processes, and distributes grains such as soybeans, wheat, and corn. It produces agricultural products such as fertilizers and sugars. And that’s just some of what this ag giant does.

Related: 8 Best Schwab Index Funds for Thrifty Investors

Bunge has been a “patience stock” for years thanks to lower margins on crush (the process that produces soybean oil and protein meal), as well as delays to its proposed mega-acquisition of Canadian grain handling business Viterra. However, investors who have had patience are finally seeing the payoff, with the stock up more than 40% over the past six months amid optimism over renewable volume obligation (RVO) and the closing of its Viterra deal.

“We estimate post-RVO 2H26 guidance still implies an ~$9.50 EPS run-rate. This supports our view BG can realize $10+ EPS run-rate post-RVO from which it can grow,” BMO Capital Markets Analyst Andrew Strelzik, who rates the stock at Outperform, said after the company’s fourth-quarter earnings report. He’s one of nine analysts with a Buy-equivalent rating on Bunge, versus one Hold and no Sells.

Bunge, meanwhile, can pay investors at least a modest sum for their patience. The 2%-plus yield, on a quarterly dividend of 70¢ per share, is about a percentage point better than what you’ll get from the S&P 500. That dividend has also grown by a decent 33% over the past four years, and it’s as safe as you could want it, with Bunge maintaining a conservative payout ratio of 35% of 2026 profit estimates.

Related: 9 Best Vanguard Retirement Funds [Save More in 2026]

2. Diamondback Energy

— Sector: Energy

— Market cap: $47.6 billion

— Dividend yield: 2.4%

— Consensus analyst rating: 1.39 (Strong Buy)

Energy businesses are typically referred to by their “stream.” Upstream companies search for and extract oil, gas, and other raw energy resources; midstream companies transport, store, and sometimes process those resources; and downstream companies refine these resources into final products such as gasoline, diesel, and natural gas liquids (NGLs).

Diamondback Energy (FANG) is an upstream firm—an independent oil and natural gas exploration and production (E&P) firm that operates “unconventional” onshore reserves in West Texas’ Permian Basin.

Related: 5 Best Stock Recommendation Services [Stock Tips + Picks]

E&P companies are more beholden to commodity prices than the other “streams,” so as oil and nat gas prices go, so go their shares. Their differences boil down to operational efficiency, and FANG is among the best, according to Wall Street analysts, who as a group have a whopping 29 Buys on the stock, versus two Holds and no Sells.

“We not only forecast Diamondback to once again hit quarterly estimates and guidance, but also remain positioned well this year despite oil price pressure,” says William Blair analyst Neil Dingmann, who recently initiated coverage at FANG with an Outperform rating. “While the company remains financially and operationally strong, we anticipate no change to the maintenance plan. The company’s industry-leading breakevens continue to improve as various operational efficiencies continue to be realized, driven even by nuances such as higher spec equipment. We believe Diamondback will also continue to be one of the more opportunistic E&Ps should the share price fall below appropriate midcycle prices.”

Related: 7 Best T. Rowe Price Funds to Buy for 2026

“We recognize that the consensus view on WTI crude prices is quite dour in 2026, calling for a 25% reduction from projected 2025 levels,” adds CFRA analyst Stewart Glickman, who has a Strong Buy rating on shares, “but we think the bearishness is overdone and that commodity markets may surprise to the upside.”

Diamondback, like a growing number of energy companies, has a base-plus-variable dividend that provides a combination of flexibility for the company and security for investors. Specifically, it pays $1 per share quarterly in base dividends (a little more than 30% of 2026 earnings estimates), and it will distribute additional variable dividends as cash flow allows. The current yield reflects no special dividends over the past year, however.

Related: 9 Best Schwab ETFs to Buy [Build Your Core for Cheap]

1. Targa Resources

— Sector: Energy

— Market cap: $46.7 billion

— Dividend yield: 1.8%

— Consensus analyst rating: 1.33 (Strong Buy)

Targa Resources (TRGP) deals in the midstream energy market segment—alongside its subsidiary, Targa Resource Partners LP, it owns a wide array of gathering, processing, logistics, and transportation assets across numerous natural resource plays, including the Permian Basin, Bakken Shale, Anadarko Basin, and the Gulf of Mexico, among others. The Permian Basin is arguably Targa’s biggest growth driver; roughly 3 in 5 lower-48 U.S. shale rigs are located there, and about 80% of Targa’s natural gas inlet volumes are sourced from there.

Targa went public in 2010, peaked in 2014, cratered, then largely hovered for a few years after that. But after bottoming out during COVID, the stock has roared back to life and nearly doubled in 2024 to hit all-time highs. Despite basically flatlining n 2025, the analyst community remains wildly bullish: 20 Buys dwarf a single Hold call and no Sells, making TRGP one of the market’s best dividend stocks for 2026.

Related: The 9 Best Dividend Stocks for Beginners

Much of this can be attributed to Targa’s positioning in the Permian.

“Targa’s dominant Permian G&P footprint and well head to water strategy place it in a favorable position given rising [gas-oil ratios] and heightened gas demand,” say Stifel analysts, who rate shares at Buy. “We expect 2027 capex to decline, allowing for a more aggressive return-of-capital strategy.”

“Management indicated that it is tracking to the high end of FY 2025 guidance range and likely has a degree of conservatism baked in,” adds BMO Capital Markets’ Ameet Thakkar, who recently initiated Targa’s stock at Outperform. “More significantly, we think TRGP’s comments expecting FY 2026 double-digit volumetric growth and confidence in FY 2027 may help improve investor sentiment despite crude/[natural gas liquids] pricing.”

Energy infrastructure stocks are a different breed. Many of them are master limited partnerships (MLPs), which are required to return a majority of their income to unitholders (shares in MLPs) in the form of distributions (dividend-like payments to shareholders that have different tax consequences). Targa is technically a corporation, though, so it pays dividends like a traditional stock.

Its most recent dividend was $1 per share, but the company recently said it plans to recommend a 25% increase to $1.25 per share for the first fiscal quarter of 2026 that would be payable in May 2026. That would be about 55% of 2026 earnings projections.

Related: Best Vanguard Retirement Funds for a 401(k) Plan

Want to talk more about your financial goals or concerns? Our services include comprehensive financial planning, investment management, estate planning, taxes, and more! Schedule a call with Riley to discuss what you need, and what we can do for you.

Related: 15 Best Long-Term Stocks to Buy and Hold Forever

As even novice investors probably know, funds—whether they’re mutual funds or exchange-traded funds (ETFs)—are the simplest and easiest ways to invest in the stock market. But the best long-term stocks also offer many investors a way to stay “invested” intellectually—by following companies they believe in. They also provide investors with the potential for outperformance.

So if you’re looking for a starting point for your own portfolio, look no further. Check out our list of the best long-term stocks for buy-and-hold investors.

Related: 10 Best Monthly Dividend Stocks for Frequent, Regular Income

The vast majority of American dividend stocks pay regular, reliable payouts—and they do so at a more frequent clip (quarterly) than dividend stocks in most other countries (typically every six months or year).

Still, if you’ve ever thought to yourself, “it’d sure be nice to collect these dividends more often,” you don’t have to look far. While they’re not terribly common, American exchanges boast dozens of monthly dividend stocks.

Please Don’t Forget to Like, Follow and Comment

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Subscribe to Retire With Riley, our free weekly retirement planning newsletter, and

3. Give the article a Thumbs Up on the top-left side of the screen.

4. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!