We’ve all been there: staring at a price tag that makes you do a double take. That moment when the cost simply outweighs the value is a universal shopping experience.

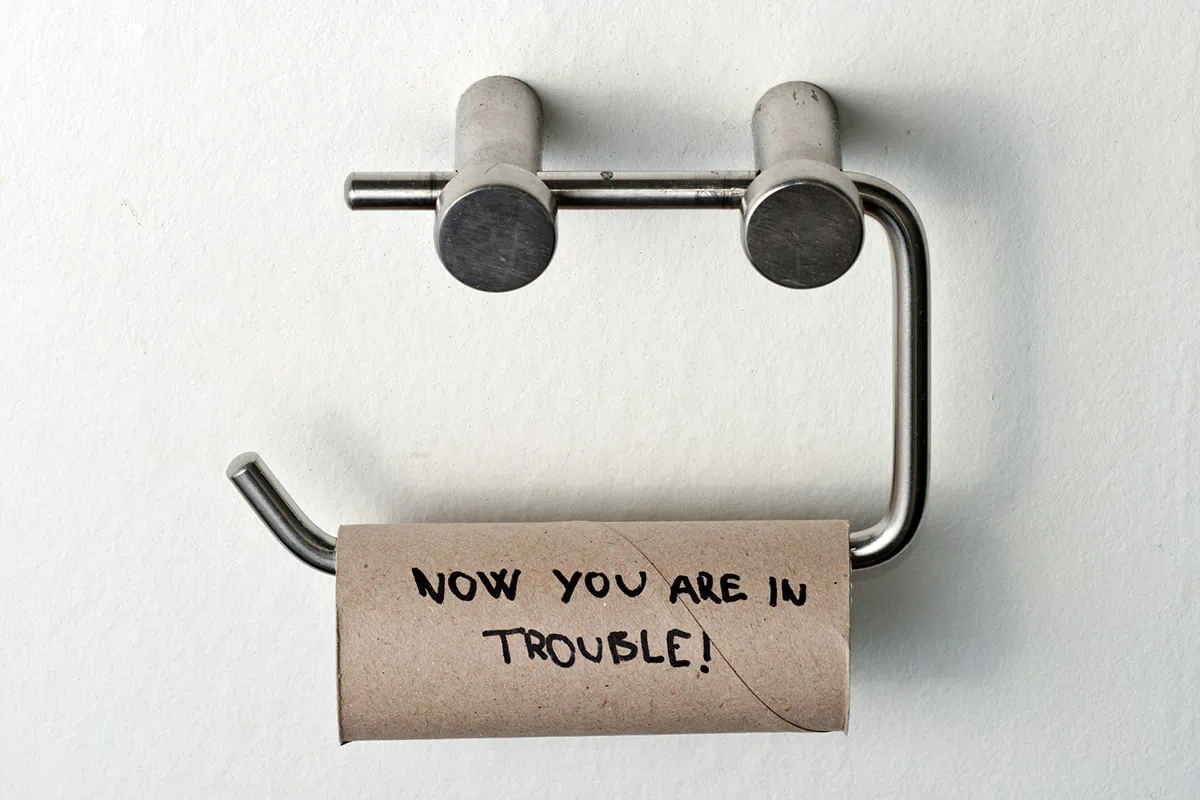

Businesses have capitalized on this by adopting “drip pricing,” a sneaky tactic that adds costs bit by bit, often unnoticed until it’s too late. From online shopping carts to in-store purchases, this pricing strategy is becoming increasingly common, prompting government intervention to protect consumers.

For now, though, you’re on your own—which means you need to learn about how to combat (or at least avoid) deceptive drip pricing tactics companies employ on their customers. So read on as we explain more about how this practice works, where you’re most likely to encounter it, and how to plug this hole in the purchasing process.

Featured Financial Products

Table of Contents

What Is Drip Pricing?

Drip pricing is a business practice where consumers are initially presented with merely a portion of a good’s or service’s price. Then, as they proceed through the buying process, additional charges and fees are gradually introduced.

In many cases, those charges are mandatory costs the consumer would ultimately face anyways—taxes are a prime example. But in some cases, merchants will redistribute part of an item’s cost via their own fees, which are only introduced closer to the final transaction.

Drip pricing, at its core, is a fairly deceptive practice—one that frustrates consumers, makes it more difficult to comparison-shop and find the best value, and compels people to overspend.

Why Do Businesses Use Drip Pricing?

It’s pretty simple: Drip pricing works.

Consumers frequently make purchasing decisions based on securing a low (or the lowest) price. So, if a business knows it will automatically be excluded from consideration for having a too-high price, what can they do (without lowering their price and sacrificing profit margin)?

They can advertise a lower price up front to get people’s attention, then along the way, they tack on a mandatory fee here, a surcharge there, that will add up to an eventually higher final price.

It’s not a perfect strategy—many people back out midway through a purchase process once they realize they’re being nickeled-and-dimed. But some people become invested in the process and end up checking out anyway. Indeed, in some industries, drip pricing has become so commonplace that consumers assume all other competitors are doing the same thing—thus, they believe (sometimes incorrectly) that the lowest upfront price will still end up resulting in the lowest final price.

Drip Pricing Examples

Numerous industries use drip pricing—these are just a sampling of some of the most egregious misbehavers. If you’re shopping for these items and services, never take the headline price as gospel.

1. Hotels

The hospitality and travel markets are notorious for using drip pricing. So let’s start with hotels.

How familiar does this example sound? You’re looking to book a hotel for an upcoming weekend trip. You find a comfortable-looking hotel for $120 per night. You begin to check out, and you learn you’ll need to pay $5 extra per night for internet access and $10 per night for parking. Fine, fine. Click, move on. Then right before you check out, you get the total cost, and suddenly a posse of local hotel taxes and other additional fees have ganged up to tack on another $50 to the bill. Suddenly, your $240 two-night stay has ballooned into $320—33% more than you had planned on spending!

How common is this practice? Consumer Reports says 37% of American adults have reported encountering unexpected or hidden fees when they received a hotel bill.

Related: 10 Best Fidelity Funds to Own

2. Resorts

A hotel, at its most core definition, is simply a business that provides lodging in exchange for money. They’re typically a little more than that, offering amenities such as a breakfast buffet or a business center.

A resort is more than a hotel—it typically offers both fuller and more varied amenities and even experiences, from full-service restaurants and spas to water parks and casinos. Once upon a time, you would simply pay for whatever amenities you wanted to use, and resorts would use that money to maintain those amenities. But increasingly, resorts have taken to charging all-inclusive hotel resort fees—regardless of whether you actually plan on using any of those amenities.

Resort fees are a mandatory part of the purchase process, and they can be pricey. For instance, the Bellagio Resort & Casino in Las Vegas charges a $50 daily resort fee. For any additional “trip enhancements,” you pay more. For instance, the “dog friendly fee” is an additional $150 per night.

While uncommon, some hotels have been caught charging more in resort fees than the price of an actual room.

Related: 11 Best Stock Screeners & Stock Scanners

3. Airlines

Airline prices are the same kettle of dish. You’ll be drawn in by an impossibly low rate, only to find that those costs jump substantially after all of the taxes and fees. A few common fees you’ll get hit with along the way include (but surely aren’t limited to):

— Baggage fees

— Seat selection

— Meals

— Upgrade fees

— Internet + entertainment

— U.S. Passenger Facility Charge

— September 11th Security Fee

If you’re flying internationally, there are usually even more fees and a whole list of taxes. For a recent one-way flight from Costa Rica to the United States, I paid the following taxes:

— U.S. Transportation Tax

— Costa Rica Sales Tax

— Costa Rica Transportation Sales Tax

— International Boarding Tax

Obviously, you can avoid some of these fees by not upgrading your section or only bringing on carry-on luggage. But some of these are costs you’d have to pay no matter what—making it all the more frustrating to be lured in by an unrealistically low price, only to have your budget smashed once you’ve started to book the flight.

Related: 10 Best Vanguard Funds for the Everyday Investor

4. Online Merchants

Online shopping is way more convenient than driving off to the store, and it can be far easier to compare prices among different merchants—seemingly just a few clicks.

But it’s not as easy as it seems. Because sometimes, by the time you’re about to check out, the price of the item might suddenly jump. The hammer you had your eye on might be cheaper online, but once you add in $8.99 for shipping, suddenly the corner-store hammer looks better. You also might be saddled with credit card processing fees that you can’t skip out on because you can’t pay cash online.

Related: 60 Personal Finance Statistics You Might Not Know (But Should!)

Featured Financial Products

5. Ticket Sellers

Ticket sellers are well-known as insidious drip pricers … and Ticketmaster is virtually synonymous with the practice.

Let’s say you wanted 2024 tickets to see Kane Brown. You decide to get yourself a standard ticket for $165 (before fees). Once you add the service fee ($24.35), facility charge ($5.00) and order processing fee ($5.50), your cost has jumped to $199.85.

Want ticket insurance? That’s an additional $16. Need a place to park? It costs $42.50 for unattended self-parking.

This isn’t a hypothetical. I built this order myself.

Like Young and the Invested’s content? Be sure to follow us.

6. Vehicles

At this point, everyone knows when you buy a vehicle, the cost of the car, truck, or SUV itself is just a starting point.

There’s the title fee, sales state tax, local sales tax, loan filing fee (if you finance with an auto loan), license plate fee, counter service fee, and processing fee, among others.

And I mean, that’s if you don’t want to protect your new, shiny baby. You want the extended warranty, right? Maybe some rustproofing, tire and wheel protection, and paint protection while you’re at it?

Your fees will vary depending on where you live and your method for purchasing the vehicle, but it’s unlikely you’ll be able to skip out on most of these fees. The best you can do is try to talk the dealer down on the price of the card to compensate for these costs. And really do the mental calculus on all of those add-ons and protections. If they won’t be worth the cost, or they’ll blow the monthly cost past your budget, skip them.

Related: 7 Best T. Rowe Price Funds to Buy

7. Restaurants

Restaurants are among the many businesses that have started passing payment processing fees onto their customers. But they’re increasingly starting to tack another extra charge onto the check.

According to the National Restaurant Association’s restaurant business conditions survey, in 2023, 15% of restaurant owners added surcharges to help offset rising costs.

Checks are pretty standard—you’ve got your food, whatever taxes you typically pay, and that’s it. You know you’re paying the tip, and you know you’re the one who ultimately decides what you’re going to pay. So suddenly seeing “surcharge,” “service charge,” or some other unfamiliar line item is going to raise a few eyebrows.

That’s in part because you probably don’t know what the fee is paying for. Seeing a “service charge” can lead to both frustration and confusion. Who is the fee even going to? Sometimes it’s the serving staff—some states actually mandate it. But other states don’t, and the fee can be used however management decides. Sometimes it’s for chefs, dishwashers, or restaurant owners. But sometimes it’s just for the restaurant itself. And that’s a problem—if people assume that fee is going to their server, they tend to tip less (or not at all), which hurts the servers, which ultimately drags down the quality of service.

So wait. Whenever the fee isn’t going to the waitstaff, why would they add it later rather than bake it into food prices like they normally do?

Well, you know the answer by now: Drip, drip, drip.

Related: 12 Best Apps That Give You Money for Signing Up [Free Money]

8. Food Delivery Apps

Food delivery apps are among the worst drip pricing offenders.

Let’s look at a mild example. DoorDash sometimes offers to waive the delivery fee, which, hey—you’d figure that’s the only significant fee a food delivery app would levy. So, a person would reasonably think that if the delivery fee is waived, the price they see is the price they’d get (minus tax and tip, of course).

So you go to pay, and it has “Fees & Estimated Tax” combined into one category. But if you click for more information, you see that you’re still responsible for a 15% service fee.

Yes, I’m venting. But while a few extra dollars here and there won’t necessarily break the bank, it’s rarely a case of a few extra dollars. You have the aforementioned fees, and of course, most apps rarely waive delivery fees. Plus, the actual menu prices are higher.

Depending on the study, the average combined markup on a food order is anywhere between 50% and 100% more than the price you’d pay when simply eating at the restaurant. So if your meal normally would cost $20, getting it delivered would be closer to $30 or $40!

Unfortunately, by the time people gather everyone’s orders into a food delivery app, they’re too hungry and have put in too much effort to cancel the order, regardless of how pricey the meal has become.

Related: How to Get Free Stocks for Signing Up: 8 Apps w/Free Shares

9. Rental Cars

Rental car companies sometimes have a substantial amount of built-in drip pricing. The daily car price may be very low, but once you add in all the other costs, you’re paying much more.

The list of rental car fees and other costs is long. Some insurance is mandatory, but rental car companies often offer supplemental insurance. You could end up seeing processing or administrative fees. Younger drivers (typically under 25) are often charged more. If you go through toll booths, rental car companies will charge a convenience fee on top of the toll costs. If you don’t fill up the tank, you’ll pay an extra couple bucks per gallon in refill fees.

And then there are the extras. Rental car companies are happy to tack on everything from child seats to satellite radio … for a few bucks extra, of course.

Related: 9 Best Fidelity Index Funds to Buy

10. Loan Applications

Loan application fees are upfront, typically nonrefundable costs for submitting a loan application. The size of this fee varies substantially by lender—some charge no fee at all, while others charge hundreds of dollars.

Mortgage loans are the ones most likely to charge an application fee. Note that you aren’t guaranteed loan approval by paying this fee—you may still get denied. Rather than a loan application fee, some lenders may charge an origination fee. This fee covers executing a mortgage loan and is quoted as a percentage of the total loan. It’s usually somewhere between a marginal cost to 1% of the loan.

Related: 31 Millennial Spending Habits & Income Statistics to Know

11. Vendors That Accept Credit Card Payments

You’re getting ready to check out, and the cashier asks you whether you’ll be paying with cash or card. You say the latter—credit cards are an extremely convenient payment method, after all—and you notice that in addition to the cost of your items and tax, there’s yet another line: a credit card surcharge.

Well, when you use a credit card, the merchant must pay the credit card network (think Visa or Mastercard), a processor (think Square), and potentially other companies that enabled the transaction. So some merchants, in states where it’s allowed, will add a credit card surcharge to recoup those costs.

These credit card fees usually add up to between 1% and 4% of the purchase cost; nominally, the costs are high enough that some businesses will require a minimum purchase amount to use a card. Others will choose to only accept certain types of credit cards that charge lower transaction fees. And occasionally, some small businesses will opt not to allow credit card payments at all.

Related: 9 Best Credit Cards for Students with No Credit [Building Credit]

Is Drip Pricing Illegal?

Drip pricing has caught the eye of both state and federal politicians.

California is among the states cracking down on this misleading process. California Governor Gavin Newsom signed S.S. 478 into law on Oct. 7, 2023, which prohibits drip pricing. This law will go into effect in California on July 1, 2024, and will make it a violation to “advertis[e], display, or offer a price for a good or service that does not include all mandatory fees or charges.” This excludes shipping and governmental taxes. Financial entities and broadband internet access providers aren’t subject to the law.

On a federal level, the Federal Trade Commission (FTC) issued a Notice of Proposed Rulemaking and Request for Public Comment called “Trade Regulation Rule on Unfair or Deceptive Fees.” This proposed rule would stop companies from omitting mandatory fees from an advertised price.

Prices would include the cost of any additional goods or services that must be bought with the transaction and fees must be disclosed even if rebates or discounts will be applied. Businesses could still exclude showing reasonable shipping and/or government charges upfront.

Related: 9 Best Monthly Dividend Stocks for Frequent, Regular Income

Is There Anything Consumers Can Do About Drip Pricing?

Simply being aware of drip pricing can help consumers avoid it, so always do your research and read the fine print.

In some cases, you might choose to simply avoid making purchases within whole industry segments that are notorious for drip pricing—like, say, food delivery apps. Try to order directly from a restaurant whenever possible; and if they don’t deliver (or if you’re trying to tighten your budget even further), consider takeout instead of delivery.

Sometimes, you can get around these fees by joining loyalty programs. Hotel chains, for instance, allow you to skip travel fees, or they’ll waive resort fees on reward stays, helping you ultimately pay less. Some credit cards will even cover resort fees, too.

If you suddenly realize mid-purchase that you’re being subject to drip pricing, don’t feel obligated to continue—abandon checkout and look at your other options.

Finally, you can make your displeasure with drip pricing known. Junk fees are unnecessary and unavoidable fees, and these are often included in drip pricing models. Consumers can submit junk fee complaints on the Consumer Financial Protection Bureau’s website or by calling (855) 411-2372.

Like Young and the Invested’s content? Be sure to follow us.

Featured Financial Products

Related: Stop Shrinkflation! 14 Products Affected + Tips to Save Money

Shrinkflation is the deceptive practice of making products smaller instead of raising costs to cover any rise in the cost of producing that product. We cover several examples of shrinkflation and tips to save money.

Related: The Best Fidelity ETFs for 2025 [Invest Tactically]

If you’re looking to build a diversified, low-cost portfolio of funds, Fidelity’s got a great lineup of ETFs that you need to see.

In addition to the greatest hits offered by most fund providers (e.g., S&P 500 index fund, total market index funds, and the like), they also offer specific funds that cover very niche investment ideas you might want to explore.

Related: 9 Best Monthly Dividend Stocks for Frequent, Regular Income

The vast majority of American dividend stocks pay regular, reliable payouts—and they do so at a more frequent clip (quarterly) than dividend stocks in most other countries (typically every six months or year).

Still, if you’ve ever thought to yourself, “it’d sure be nice to collect these dividends more often,” you don’t have to look far. While they’re not terribly common, American exchanges boast dozens of monthly dividend stocks.

Please Don’t Forget to Like, Follow and Comment

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Subscribe to The Weekend Tea, our weekly newsletter to read more about investing, spending, taxes, and more, and

3. Give the article a Thumbs Up on the top-left side of the screen.

4. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!