If you don’t measure your financial planning by years or even decades, but by centuries and generations, you’ll want to know a lot more about dynasty trusts.

Americans are largely unprepared for the financial and logistical consequences of their own passing. In a 2025 Caring.com survey, 23% of respondents said they had a will, 13% had a living trust, and only 4% had other estate planning documents. Said differently: If most Americans passed away today, they wouldn’t leave an ordered plan of distributing their assets to their heirs—they’d pass along confusion and unnecessary tax burdens.

Even garden-variety estate planning could vastly improve and smooth the succession process for most American families. But those with notable wealth specifically might want to home in on dynasty trusts—a specialized trust that allows for the passing of wealth across multiple generations while reducing (or outright avoiding) federal transfer taxes, including gift, estate, and generation-skipping transfer taxes.

Let me teach you about dynasty trusts—how they work, what tax advantages they provide, and how to go about setting them up. I’ll also explain why some advisors are urging families to create one before 2026.

Table of Contents

How Do Trusts Work?

A trust is a fiduciary arrangement in which a third party (“trustee”) holds and administers a person’s (“grantor”) assets for the benefit of other individuals, charities, etc. (“beneficiaries”).

While there are many specific types of trusts, most trusts belong in one of two categories:

–Revocable trust (aka revocable living trust or living trust): The grantor generally still owns and controls the assets in the trust. The grantor can amend or revoke the trust at any point.

–Irrevocable trust: The grantor generally gives up control of any assets in the trust. The grantor cannot amend nor revoke the trust without approval of all beneficiaries.

Importantly, when a grantor dies, their revocable trusts typically become irrevocable trusts.

However, many states have a “rule against perpetuities” (RAP), which dictates that an irrevocable trust can’t remain in existence indefinitely, and instead must be closed after a certain period of time—usually 90 years, or up to 21 years after the death of a specified person alive when the interest was created.

This usually isn’t a problem—trusts will typically distribute their assets well before they’d be forced to terminate, making this a moot point. For instance, the person who created the trust might have instructed all assets to be split between their two children upon reaching adulthood. If the person died when his children were ages 22 and 18, the assets could be distributed immediately. If the person died when his children were ages 18 and 14, the 14-year-old might have to wait four years, but that’s well within the 21-year rule.

But what if you want your trust to last a very, very long time—say … generations? Enter the dynasty trust.

What Is a Dynasty Trust?

A dynasty trust (aka qualified perpetual trust, aka perpetual trust) is an irrevocable trust designed to manage and administer wealth assets for multiple generations.

In a dynasty trust, the grantor creates the rules for how funds will be managed and distributed to beneficiaries. Again, it’s an irrevocable trust, so after the trust is funded, the grantor cedes control of the assets and can’t change the trust’s terms. Beneficiaries can’t make any changes, either.

Then, like with other trusts, the dynasty trust is controlled by a trustee—usually a bank or other financial institution—of the grantor’s choice.

What Are the Tax Benefits of Dynasty Trusts?

In addition to their ability to help distribute wealth across numerous generations, dynasty trusts are also favored by those with large estates for their ability to significantly reduce the tax liabilities of future generations. It does so by taking advantage of the lifetime exclusions on three taxes:

–Gift and estate tax: These two taxes share a lifetime exclusion of $13,990,000 in 2025, up from $13,610,000 in 2024. In other words, a person can give and/or leave behind up to $13,990,000 (not including your annual gift exclusions) without triggering gift or estate taxes. Thus, a married couple could enjoy up to $27,980,000 worth of exclusion.

–Generation-skipping transfer tax (GSTT): This tax is separate from, and in addition to, estate tax. GSTT is charged on transfers to your grandchildren (skipping a generation), at a rate equal to the highest gift/estate tax rate at the time of transfer—so, currently, 40%. It has its own separate lifetime exclusion, also set at $13,990,000 per person (not including annual GSTT exclusions). Again, a married couple could enjoy up to $27,980,000 worth of exclusion.

Here’s how it works.

When you set up a dynasty trust, you can fund it all at once or over time. Either way, you can apply some or all of your lifetime gift/estate and GSTT exclusions to your transfers into the trust, protecting up to $13,990,000 per person (or $27,980,000 per married couple) from both sets of taxes.

However, the protection doesn’t apply only to the transferred funds—it also applies to any appreciation of those funds within the trust.

Let’s say you leave $13,990,000 in a dynasty trust, and that sum grows to $30 million by the time you pass it on to your children. Any distributions that come from that $30 million will be free of estate or GSTT tax. Remaining funds (and further appreciation) in the trust continue to be passed on to your grandchildren, and their children, and so on, without estate or GSTT taxes ever touching that money.

Conversely, any initial funds or earnings not protected by the lifetime exemptions would be subject to estate and/or GSTT taxes once distributed to your heirs.

So I say without exaggeration that dynasty trusts, over time, could reduce your heirs’ collective tax obligations by tens, even hundreds of millions of dollars.

Related: Best States for Retirees Who Want to Avoid Taxes

Other Tax Considerations

While dynasty trusts are a considerable shield against taxes, they’re not completely invulnerable. A few tax considerations you’ll want to keep in mind when planning around one of these trusts:

–A dynasty trust is generally required to file a tax return, and it will owe taxes on any income generated within the trust.

–While beneficiaries avoid estate tax and GSTT on distributions from protected assets, they’ll still be subject to income tax and/or capital gains taxes on those distributions.

–Everything discussed so far concerns federal taxes; state and local taxes may apply and will differ based on where you live.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

Are Dynasty Trusts Only for the Very Rich?

There is no legal minimum required dollar amount to fund a dynasty trust, so no, dynasty trusts are not limited to the ultra-wealthy.

However, these trusts do tend to be more useful to wealthy individuals given they’re often a way to avoid taxation on sums above the already-high lifetime gift/estate tax exemption and GSTT exemption (both $13.99 million in 2025). Plus, setting up and administering these funds generally entail considerable costs.

People with substantial taxable assets in their estates benefit far more from dynasty trusts than others. The more wealth you have, the more you may want to ensure it’s passed down properly according to your wishes.

Related: 8 Best Wealth + Net Worth Tracker Apps [View All Your Assets]

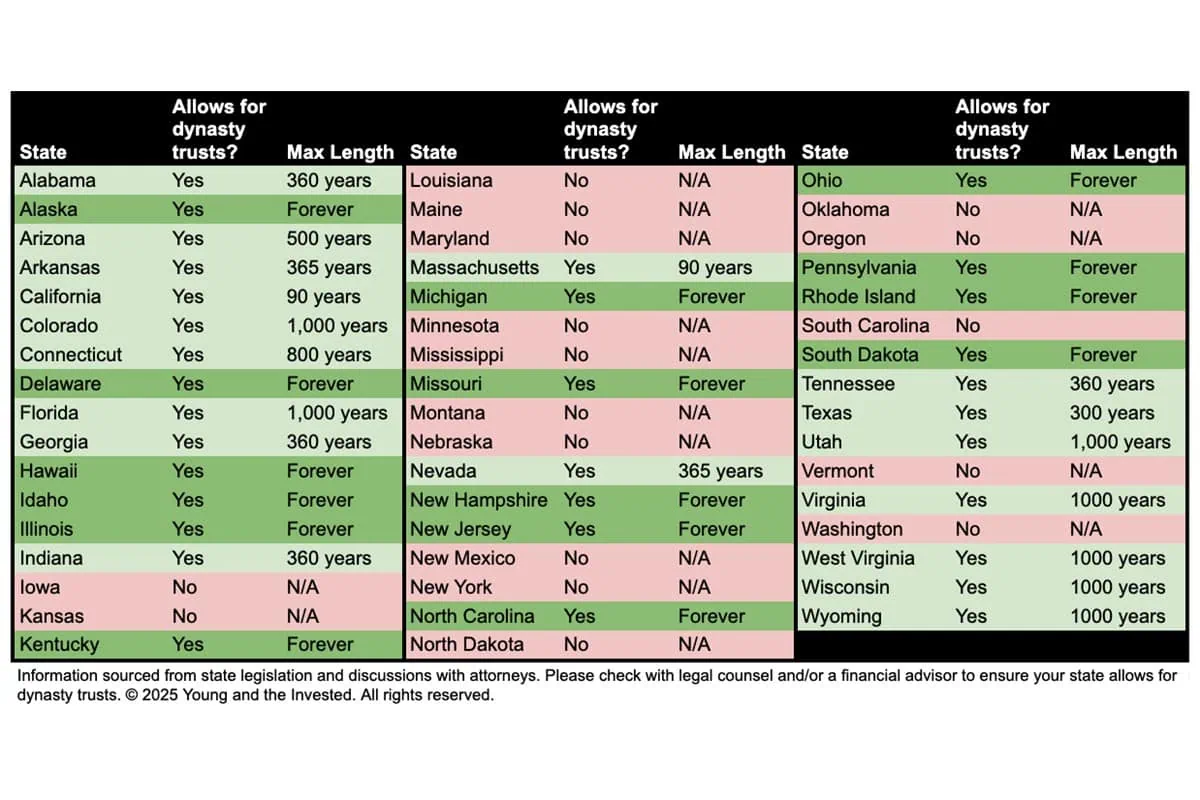

Do All States Allow Dynasty Trusts?

No, not all states allow dynasty trusts.

Generally speaking, any state that still has a rule against perpetuities won’t allow dynasty trusts. Several states allow for dynasty trusts but place a cap on the maximum amount of years the trust can last, albeit well in excess of a typical RAP—300 years, sometimes even 1,000 years.

Here’s a look at dynasty trust rules in each state:

If your state of residence doesn’t allow dynasty trusts, don’t worry—you can open a trust in another state. You’ll want to talk to your legal and financial advisors about the best state for opening your trust.

How Do You Set Up a Dynasty Trust?

Dynasty trusts typically require a team effort between you, a financial advisor, and an estate planning attorney.

Your attorney drafts a document detailing your wishes for both before and after death. The draft process involves you telling your attorney your wishes for the following:

–Current and future beneficiaries

–Trustee(s) and potential successor trustee(s)

–Trustee(s)’ powers

–Who gets what, when, and under what circumstances

You’ll then need to fund your dynasty trust, which can be done in a lump sum or over time.

You can fund a dynasty trust with almost any type of asset—what you choose largely comes down to your goals. If you’re looking to maximize tax benefits for your heirs, you’ll want to stock the trust with tax-efficient assets (such as municipal bonds or stocks that don’t produce dividend income) and even cash. If you’re looking to reduce your taxable estate, you’ll want to fund the trust with assets you expect to appreciate greatly or that generate a high level of income.

If you plan to create a dynasty trust, you might want to sooner rather than later.

The 2017 Tax Cuts and Jobs Act (TCJA) greatly expanded the lifetime gift/estate tax and GSTT exemption limits. However, those limits are currently scheduled to sunset on Jan. 1, 2026, unless tax legislation extending those higher limits (such as the One Big Beautiful Bill Act [OBBBA], which is currently making the rounds in Congress) is passed before then.

If the OBBBA passes, the exemption limits would jump from current levels ($13,990,000 for gift/estate taxes, $13,990,000 million for GSTT) to a record-high $15 million each starting in 2026. If any legislation extending the higher limits fails to pass, however, the limits would revert to 2010 levels ($5 million each, indexed for inflation) at the start of 2026.

Related: How Much to Save for Your Kid’s College [3 Tax-Smart Options]

Should I Create a Dynasty Trust?

Dynasty trusts’ tax benefits, and the financial security these accounts provide for future generations, are clear benefits for people with sufficient means.

But there are downsides to consider.

You have ample control over the trust during its creation, and you can make your wishes as vague or specific as you want. However, the “irrevocable” aspect of a dynasty trust might make some people wary, as neither you nor your beneficiaries can alter the terms of the trust later.

For example, you might plan to hand over more assets to one child who has several children of their own, and less assets to another child with no children—unaware that they will later have several kids, too. Or you might tie receiving funds to a milestone, such as graduating from college, but the child is unable to do so after developing a disability.

Still, drafted correctly, dynasty trusts are an advantageous way to pass down your wealth to numerous generations.

If you want to know more about dynasty trusts and other legacy planning options, consider discussing your needs with a trusted financial advisor.

Want to talk more about your financial goals or concerns? Our services include comprehensive financial planning, investment management, estate planning, taxes, and more! Schedule a call with Riley to discuss what you need, and what we can do for you.

Related: 13 Best Long-Term Stocks to Buy and Hold Forever

As even novice investors probably know, funds—whether they’re mutual funds or exchange-traded funds (ETFs)—are the simplest and easiest ways to invest in the stock market. But the best long-term stocks also offer many investors a way to stay “invested” intellectually—by following companies they believe in. They also provide investors with the potential for outperformance.

So if you’re looking for a starting point for your own portfolio, look no further. Check out our list of the best long-term stocks for buy-and-hold investors.

Related: 10 Best Monthly Dividend Stocks for Frequent, Regular Income

The vast majority of American dividend stocks pay regular, reliable payouts—and they do so at a more frequent clip (quarterly) than dividend stocks in most other countries (typically every six months or year).

Still, if you’ve ever thought to yourself, “it’d sure be nice to collect these dividends more often,” you don’t have to look far. While they’re not terribly common, American exchanges boast dozens of monthly dividend stocks.

Please Don’t Forget to Like, Follow and Comment

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Subscribe to Retire With Riley, our free weekly retirement planning newsletter, and

3. Give the article a Thumbs Up on the top-left side of the screen.

4. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!