While scam artists target anyone and everyone they can if they believe there’s a potential for a payoff, they sadly most often focus heavily on senior citizens. Why? That’s because many retirees have accumulated savings over several years of working, may not be as familiar with technology, and might be more vulnerable to memory lapses due to age.

And make no mistake: elderly fraud is big business, too. Data from the Federal Trade Commission (FTC) Consumer Sentinel Network shows that in 2023, adults aged 60+ reported 289,971 cases of fraud totaling a loss of more than $1.4 billion.

Financial fraudsters have built hundreds of different schemes meant to cheat money and/or sensitive information from people, businesses, even governmental organizations. But the scams sometimes differ depending on who they’re targeting. So today, I’m going to talk about some of the most popular elderly scams—including what the scam is, what the scammer is hoping to obtain, and how to avoid falling victim.

Table of Contents

A Note From the Editors About This Article

One of the biggest challenges surrounding fraud is how people think about susceptibility to scams.

For one, many people regardless of age think they’re too intelligent to fall victim to a scam. That argument might hold water … if scams were just about smarts. Scams are largely about manipulating people’s emotions and catching them off-guard. And everyone has emotional weaknesses. Everyone can get caught off-guard.

Consider this: Charlotte Cowles, a financial advice columnist for New York Magazine—seemingly the kind of person that would be most immune to fraud—recently published a story about how she was scammed out of $50,000. Many people read the article, observed all of the red flags, and asked, “How could this person be so stupid?”

The answer? It has nothing to do with stupid. As Cowles points out, data shows that well-educated people are just as vulnerable to scams as everyone else. The perception that the elderly are more susceptible to fraud is also built on shaky ground; Cowles cites FTC data showing that younger adults are more likely to report losing money to fraud than people over 60.

Regardless, this brings us to the second aspect of people’s views on scams: shame.

You don’t have to go far on the internet to see how virulently people talked about Cowles in the wake of her story. Again, that’s because people believe falling victim to a scam makes you dumb. But it doesn’t. Many scammers are professionals who know how to play peoples’ emotions like a fiddle.

This belief is toxic. It makes people less likely to ask for help when they think they’re about to be scammed, in the process of being scammed, or have already fallen for a scam. And all that does is compounds an already awful problem for would-be and actual victims.

Our advice? When it comes to fraud, don’t judge, and don’t let yourself be judged. Don’t think you’re above being scammed, and don’t be afraid to seek help the second you think you might be a target of fraud.

Scams for Older Adults to Avoid

No age group is immune, but scams targeting the elderly are particularly common.

1. Medicare Scams

Medicare scams can happen any time of the year, but they often increase during the annual Medicare Open Enrollment Period.

What scammers do: A caller pretends to be a Medicare representative. The scammer might offer free items or say there is a problem with your account, such as (ironically) fraudulent activity.

What scammers want: The purpose here is to gather personal information, such as your Social Security number, Medicare number, or other information that can be found on your Medicare card. Occasionally, the person might try to get your bank account details.

How to avoid these scams: The FTC explains that Medicare will never call you out of the blue. Nor will it ever try to call you to sell health products or insurance. If you get a suspicious call claiming to be Medicare, hang up. Call your Medicare provider directly to find out if the call was legitimate. You can also call 1-800-MEDICARE if you think you’ve been involved in a scam.

Related: Retired But Too Young for Medicare? Health Insurance for Early Retirees

2. Counterfeit Prescription Drug Scams

Prescription drugs can be expensive; senior citizens in particular might have several pricey medicines. So, it should be no surprise that people try to find more affordable deals—and sometimes those deals are too good to be true. Literally.

What scammers do: In this ploy, the fraudster creates fake online deals for popular, expensive medications. In all cases, the scammers will take your money—sometimes they will send you nothing in return, and other times, they’ll send a potentially dangerous counterfeit drug.

What scammers want: Simple: The thieves want money.

How to avoid these scams: Always discuss online prescription services you’re considering with your doctor and only purchase prescriptions online from a pharmacy approved by the National Association of Boards of Pharmacy.

Related: How to Negotiate Medical Bills in Collections [13 Steps to Follow]

3. Robocall Voice Recording Scams

Nowadays, many calls require you to respond to automated questions before you can talk to a real person (if you even get to talk to a real person). Scammers have learned how to take advantage of this system through phone scams.

What scammers do: You receive a phone call from an unknown number and answer it. Caller ID might show the number has a local area code, but just know there are ways to make the number appear that way, even if the call isn’t local. In the most popular version of this scam, a voice asks if you can hear them. After you answer “yes,” and sometimes after you confirm your name and other information, the person hangs up.

What scammers want: In this scam, the robocall is recording your voice. The edited recording may be used to authorize purchases in your name over the phone.

How to avoid these scams: In general, don’t answer phone calls from somebody not saved in your phone. (And be aggressive about saving numbers you call or receive calls from frequently so you’re not forced to guess as much.) Usually, if a call is important, the person will leave a message and you can call back. Even then, be careful—if you’re given a call from someone purporting to be with, say, your credit card or local hospital, don’t use the number they’ve given you. Instead, go directly to the provider’s website and find a number where you can call them directly to inquire about whether they called.

By the way, it’s very easy to accidentally pick up these calls. If you ever do, and they ask you questions (especially “whether you can hear them”), either hang up or wait to see if they provide more information showing trustworthiness. Many times, the person on the other line is just a recording and doesn’t actually respond to anything you say.

If you receive a call like this, report the fraudulent call to the Better Business Bureau’s ScamTracker. And if you accidentally respond “yes” during a call you fear is a scam, report the call—then keep an extra-close eye on your bank and credit card statements to watch for unauthorized charges.

Related: 11 Ways to Avoid Taxes on Social Security Benefits

4. Bereavement Scams

Scammers can learn about newly deceased people and the survivors’ names through obituaries and even social media posts. And they often prey on people as they grieve.

Like Young and the Invested’s content? Be sure to follow us.

What scammers do: In some scams, the grifter will pretend the deceased person had outstanding debts with them. In other scams, the thief will pose as a lawyer and say they’re executing the will and testament … and require personal information or payment to do so. And in still other scams, someone will call pretending to be the funeral home and ask for additional money they claim was unpaid.

What scammers want: Money, plain and simple.

How to avoid these scams: It’s important to know your rights regarding a deceased family member’s debts. Even if a legitimate debt collector calls, you usually aren’t responsible for another person’s debts. Instead, debts are paid from a person’s estate, which the executor of the estate handles. Unless you’re confident about a person’s identity, don’t share personal information about yourself or the deceased person with someone online or over the phone. Also, funeral homes are required to provide contracts that state all terms and costs of the funeral; they will never ask for more money than what was originally owed.

Related: 6 Best Ways to Invest an Inheritance

5. Tech Support Scams

Older generations are stereotyped as not being tech-savvy. As a result, they are frequently a target for technical support scams.

What scammers do: This scam often comes in the form of pop-up messages on a computer or text messages on your phone. It says there is something wrong with your device and provides a number you can call for assistance in fixing the problem. Once you call, you may be asked for further information or to provide remote access to your device.

What scammers want: These fraudsters typically want access to either your devices (computer, phone, etc.) and/or bank account. Either way, a plethora of useful information is available to them.

How to avoid these scams: Any time a message provides a phone number purporting to be for a legitimate company, compare the phone number to the one listed on the official website. When in doubt, always call the number listed on the official website.

I once received a fairly convincing-sounding text message on my iPhone that claimed to be Apple. I called Apple support from the official phone number on the website and a representative confirmed my suspicion that it was a scam message. Keep in mind that tech support generally doesn’t contact you to fix an issue—they usually wait for you to contact them if anything is wrong.

Related: How to Get Free Stocks for Signing Up: 10 Apps w/Free Shares

6. Anti-Aging Beauty Scams

Nobody has found and bottled up the Fountain of Youth, but scammers try to convince people otherwise. This scam exploits people’s desires to look younger or even reverse the skin’s aging process.

Like Young and the Invested’s content? Be sure to follow us.

What scammers do: Fraudsters market unproven anti-aging products by either showing photos of real models but lying about their ages, or showing doctored photos.

What scammers want: It’s a money grab. Victims pay for cheap products that can’t provide the claimed results.

How to avoid these scams: If before-and-after images look too good to be true, they almost certainly are. Avoid any products that claim extreme, unrealistic results. The reviews from “real customers” are likely fake as well. Instead, stick to products that advertise more realistic outcomes. If you want to know what works, either seek out legitimate review sites or stick with recommendations from people you know.

Related: How Much to Save for Retirement by Age Group

7. Grandparent Scams

Scammers will send emails or even boldly make phone calls pretending to be someone’s grandchild.

Related: Best Investments for Grandchildren: Ways to Save and Invest

What scammers do: Scammers will prey on your desire to help out your family by posing as a grandchild in need of money. They frequently make up an urgent situation that makes your brain panic and fail to realize the voice (or writing style) is nothing like your grandchild’s. One twist on this scam involves the scammer pretending to be not your grandchild, but instead a doctor, police officer, or another person of authority claiming you must send money for a grandchild’s medical procedure, bail, etc.

What scammers want: Money, money, money—often in the form of a money transfer, but sometimes in the form of gift cards. Again, there will typically be pressure to send this money immediately.

How to avoid these scams: If it’s an email, don’t respond. If it’s a call, tell them you’ll need to call them back and write down the number. Scammers will insist you stay on the phone because the scam relies on your gut reaction to help. In both situations, always contact your grandchild directly with the contact information you already have. (If you don’t have it or know it, reach out to their parents.)

Related: 10 Financial Gifts for Babies, Kids & Grandkids [No More Toys]

8. Investment Scams

You might be nearing retirement, or already in it, and it’s clear your budget needs to be tight. So, wouldn’t it be nice if there were an investment opportunity with extremely high returns available to you? Scammers want you to believe there is and that they hold the key to unlock those returns.

What scammers do: Scammers claim you can make a substantial amount of money quickly, easily, and with little to no risk, if you take part in their investment opportunities. Often, the investment is said to be related to real estate, cryptocurrency, or precious metals and coins.

What scammers want: These thieves want your money. To take part in the investment opportunity, you’ll either have to pay for training or seminars, or give your investment money directly to participate in a “black box” system.

How to avoid these scams: Stick to buying investments through trusted sources, such as big-name brokerage firms. Don’t trust any investment opportunity that promises astronomical returns.

Related: 5 Best Vanguard Retirement Funds [Save More Money for Less]

9. Zoom Phishing Scams

Zoom’s video conferencing software increased in popularity during the pandemic, and scammers took advantage. Because of the stereotype that senior citizens are less knowledgeable about new technology, this scam targets older people more frequently.

Want to learn more about investing, spending, taxes, and more? Sign up for Young and the Invested’s free newsletter: The Weekend Tea.

What scammers do: Fraudsters send an email or text with a Zoom logo stating that your Zoom account has been suspended and you need to click to reactivate it. Or, it might welcome you to the service and ask you to click to activate your account.

What scammers want: The hope here is clearly that you click the link. When you do, the link will download malware on your device unless your device has antivirus or other measures that will prevent it from doing so. Alternatively, the link might lead you to a page where you need to enter your Zoom username and password or create an account. However, because many people reuse usernames and passwords across different platforms, they might use that information to try to log into other accounts (bank, subscription, etc.) you hold.

How to avoid these scams: If the sender’s email information isn’t from Zoom.com or Zoom.us, it isn’t from Zoom. Don’t click the link. Instead, contact Zoom through the official website to ask whether there is a problem with your account.

10. Sweepstakes + Lottery Scams

Congratulations, you’re a winner … or are you? If you enter a lot of contests, it can be challenging to remember all of the ones you’ve entered. And if you’ve been told you’ve won, it can be really easy to assume it was a contest you entered.

Related: What’s The Tax on Lottery Winnings?

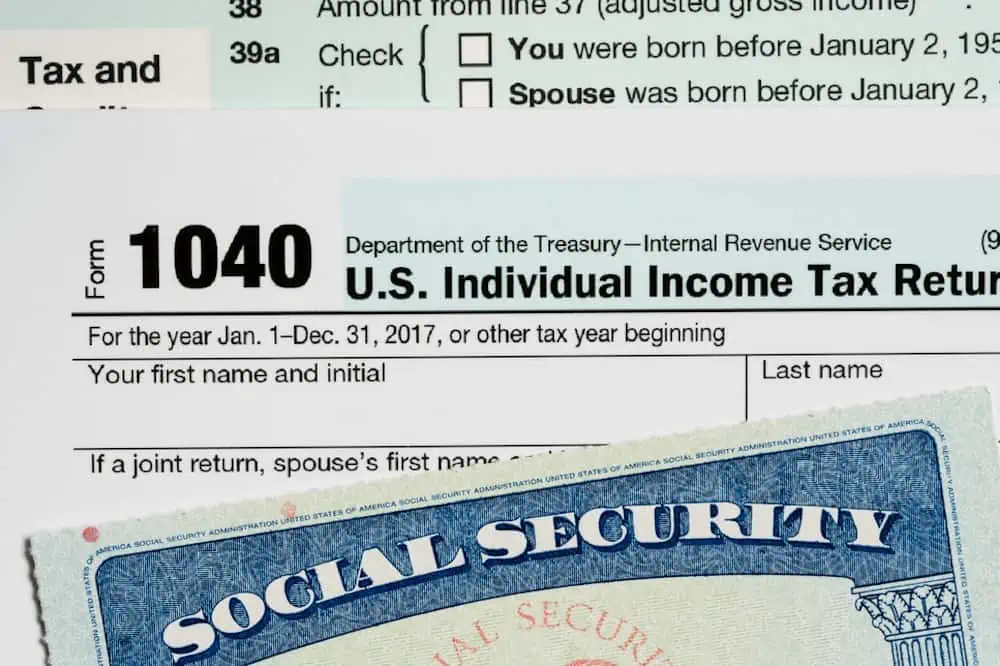

What scammers do: A scammer will tell you via email, physical mail, social media message, or text, that you’ve won a contest—but you must take certain actions before your prize can be released.

What scammers want: Usually personal information, but sometimes money. You’ll often be asked to fill out and return an IRS Form 1099-MISC so your “winnings” are properly reported to the IRS. That form has personal information, including your Social Security number, that you don’t want to give to fraudsters. Occasionally, victims might be asked to send money to unlock the prize.

How to avoid these scams: Ideally, you should track every contest you enter, though that is a lot of work. So the next best thing is to be mindful of the various ways scammers give themselves away.

If you received your notification in an email, look at the sender’s email address. Is it a complicated-looking email with a long stream of random letters? Then it’s almost certainly a scam. Does the email include the company’s name, but it’s slightly misspelled? (Faceboook, for instance.) Is there a zero where the letter “O” should be? (Faceb0ok, for instance.) If so, it isn’t real.

Be wary of emails or physical mail that don’t use your name, spell it wrong, or address you by your email address. Scammers can mass-email people without making it look like it did, but they’re often sloppy and you can tell the email was sent to multiple people. Real companies don’t show you other people’s emails. (And especially for large prizes, it’s unlikely multiple people have won.)

On social media, you’ll be contacted by the company’s official account if you’ve actually won—not some random person. When in doubt, contact the official account (which usually will have a checkmark) independently to ask whether you’ve won a contest.

I can tell you I’ve been personally targeted by this scam. I’ve entered Instagram contests where you leave a comment on a post to enter. Scammers often look through the comments of a real contest, then contact those people in a message to say they’ve won. But because the message didn’t come from the official account, I didn’t reply, and thus I didn’t fall prey to the scam.

Related: 12 Best Apps That Give You Money for Signing Up [Free Money]

11. Romance Scams

Dating is a challenge at any age, and you always risk speaking to someone who has no intention to get in a real relationship. Thus, romance scams tend to target adults of any age—though some scammers focus specifically on older adults who might be unaware of how technological advances have made these scams seem far more realistic.

Want to learn more about investing, spending, taxes, and more? Sign up for Young and the Invested’s free newsletter: The Weekend Tea.

What scammers do: The scammer starts talking to you, usually through a dating app or social media, and pretends to be interested in a romantic relationship. This person likely doesn’t live nearby (or pretends not to). Communication is usually through only messages and phone calls. They might send you pictures and even videos frequently, but the person will shy away from live video.

What scammers want: Romance scams usually target your money. Once you start to develop feelings for the person, they’ll ask for money. The money might purportedly be for a plane ticket to visit you, but it might be for something more dire—they don’t have money for a phone bill or rent. They might even be facing a dire situation. Victims of this scam end up paying anywhere from tens to thousands of dollars believing the person on the other end truly does want a relationship.

How to avoid these scams: Everything a person has said may be a lie. Pictures can be stolen or photoshopped. Videos—even live video!—can be manipulated through filters and other edits. So, make a strict rule for yourself: Don’t send money to somebody you’ve never met in person, even if you feel like you know the person well. Even then, be extremely wary of financially helping a romantic interest until you’ve established a true, longstanding relationship.

Related: 31 Millennial Spending Habits & Income Statistics to Know

12. Social Security Scams

Scams where people pose as Social Security employees are extremely common.

What scammers do: You’re told there is a problem with your Social Security account or your benefits. They pretend to want to help you resolve the issue. In particularly well-designed scams, they might even provide a fake badge number or even a real employee’s name.

What scammers want: Your personal information.

How to avoid these scams: Typically, if the Social Security Administration actually does run into an issue with your Social Security number and/or account, they will mail a letter first. The Social Security Administration itself says “Generally, we will only contact you if you have requested a call or have ongoing business with us.”

But even when a representative does call, they will not threaten you with arrest or legal action, demand any immediate payment, or suspend your Social Security number. They also don’t request payment via gift cards, cash, prepaid debit cards, wire transfers, or internet currency. If any of the above occurs during a call, hang up.

Related: Don’t Believe These 17 Social Security Myths

13. IRS Impersonation Scams

These grifters pose as IRS agents.

What scammers do: Victims are contacted and told they owe back taxes or other penalties. They might threaten you with legal consequences. Alternatively, a scammer might send you a text message about a tax refund or rebate.

What scammers want: Money, though sometimes, also information. Any funds you send back to pay back fake debts don’t go to the government, but instead into scammers’ pockets.

How to avoid these scams: The IRS will never ask you to make any sort of payment via wire transfer services (like MoneyGram), gift cards, or cryptocurrency. They also won’t call, email, text, or contact you on social media to request personal information, such as your SSN. In general, the IRS will almost always try to notify you of any issues via mail first. If you haven’t received mail about a specific issue prior to hearing from someone purporting to be the IRS, chances are, you’re talking to a fraudster.

If you do fall victim of an IRS impersonation scam, report it to the FTC here.

Related: ‘Dirty Dozen’: 12 Tax Scams to Watch Out For [And How to Avoid Them]

14. Online Shopping Scams

Shopping online is convenient, but it also comes with some risks.

Like Young and the Invested’s content? Be sure to follow us.

What scammers do: Fraudsters create fake websites and offer seemingly high-quality products at unrealistically low prices. The website might try to seem more legitimate by including fake reviews and advertisements. It might even steal logos from real brands. However, after purchasing from these websites, you either receive an item that is nothing like the photos or description … or you get nothing at all.

What scammers want: Like with most of these elderly scams, fraudsters keep your money without holding up their end of the bargain. Worse? Some might save your payment information to make unauthorized purchases elsewhere.

How to avoid these scams: There are several red flags to watch out for when buying products online. To start, if a product has an insanely low price, you should probably avoid it. A website without any terms and conditions or privacy policy is likely fake. Also avoid any websites that want you to pay by money order or pre-loaded cards. You might want to check with the Better Business Bureau, but understand that some legitimate businesses are not listed there. In general, play it safe: If you even suspect an ecommerce site is fake, buy from a trusted site instead.

Want to learn more about investing, spending, taxes, and more? Sign up for Young and the Invested’s free newsletter: The Weekend Tea.

15. Charity Scams

These scams prey on your generosity to help those in need.

What scammers do: Someone reaches out asking you to donate to a cause. They might ask you to donate to an organization that doesn’t actually exist, or ask you to donate to a real organization but give you false information. This scam is most popular during the holiday season and after highly publicized tragic events (such as natural disasters).

What scammers want: Your money. You think you’re helping the world, but you’re just helping line a fraudster’s pockets.

How to avoid these scams: If you’re asked to donate to a charity you’ve never heard of, check to see whether it exists on sites like Charity Navigator, which vets U.S. charities. Also, only donate through official means. Even if you’re called by an organization you typically donate from, tell them you’ll call them back at the charity’s official number. (Or donate from official mailers or online at the charity’s website.)

Like Young and the Invested’s content? Be sure to follow us.

Best Practices for Avoiding Scams

In general, if you want to avoid falling prey to any scams—including the ones above—here are a few things you should always keep in mind.

1. Beware anyone asking to be paid in gift cards.

Legitimate businesses and government entities do not want to be paid in gift cards. But scammers love them because they’re impossible to refund and difficult to trace.

2. Beware anyone pressuring you to act right now.

Pressure is one of fraudsters’ top weapons: They want you to act before you think. However, whether it’s an actual official contest award or a government entity trying to get in touch, any legitimate organization is going to give you time to act. If you’re ever being pressured on the phone, tell them you’ll call back using their officially listed number. If the person on the other end tries to keep you on the phone, chances are, you’re dealing with a scam artist.

3. Don’t share personally identifiable information when someone contacts you unsolicited.

This applies whether it’s a call, social media, text, email—you name it. If it’s someone purporting to be a person you know or a company you do business with, don’t share that information. Instead, look up their number, email, etc., on their official company website, and reach out to them to ask whether they called asking for that information.

4. Be familiar with cybersecurity best practices.

Many scammers will try to get you through your computer, tablet, or smartphone. So you’ll want to read up on how to protect yourself from cybercrime, which includes best practices such as using strong passwords, enabling two-factor authentication (2FA), and being careful when dealing with emails and links.

Like Young and the Invested’s content? Be sure to follow us.

Related: 11 Ways To Avoid Paying Taxes on Your Social Security

If you’re looking to minimize the tax bite taken out of your Social Security benefits in retirement, you’ve got several available actions to reduce how much you pay each year. We outline several ways to avoid paying taxes on your Social Security benefits.

Related: How Are Social Security Benefits Taxed?

In many cases, Social Security benefits are subject to federal taxation. To learn how your Social Security benefits are taxed, we’ve got an entire guide to walk you through the calculation.

Related: 10 States That Tax Social Security Benefits

While most states don’t subject Social Security benefits to taxation, at least 10 states do tax Social Security. To see if you live in one of them, or you’re considering a relocation for retirement and taxation of your Social Security is a sticking point, we’ve got you covered with all of the details.

Please Don’t Forget to Like, Follow and Comment

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Subscribe to The Weekend Tea, our weekly newsletter to read more about investing, spending, taxes, and more, and

3. Give the article a Thumbs Up on the top-left side of the screen.

4. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!