The enduring secret to investing success is simple: create a plan and stick to it. This wisdom has been a staple in the promotional materials for mutual funds and ETFs for decades.

Today, let’s delve into a practical approach to this strategy: Fidelity’s target-date funds.

Investing demands your attention, though it need not be complex. It’s vital to periodically review your asset allocation, ensuring it aligns with your age and life stage. In your early career, leaning too heavily on bond funds might hinder keeping up with inflation. With time as an ally, you can afford to embrace more risk, capable of bouncing back from losses over the years. Moreover, your ongoing income allows you to mitigate losses by continuing to save and invest.

Conversely, as you approach retirement, the strategy shifts. A heavy stock mutual fund allocation later in life is risky, given the shorter window to recover from downturns. Once retired, you cannot easily recoup losses through additional savings. Hence, a more cautious investment approach is prudent to safeguard your retirement years.

An effective investment strategy involves a glidepath, gradually transitioning from an aggressive to a conservative investment mix throughout your investing journey.

This isn’t always easy to do on your own; market noise has a way of distracting us. When the market is ripping higher, it’s natural to want to take more risk, regardless of whether you should. And when the market is looking rough, it’s psychologically hard to add risk even when you need to in order to meet your long-term goals.

One of the most efficient ways to build a financial plan and actually stick to it is by buying and holding a target-date fund.

Today, I’m going to talk about one of the most popular target-date lines around: Fidelity Freedom target-date funds. I’ll start by talking about what a target-date fund is and does, discuss why shifting assets is so important, and then delve into specifically what Fidelity’s target-date funds have to offer.

Disclaimer: This article does not constitute individualized investment advice. These funds appear for your consideration and not as personalized investment recommendations. Act at your own discretion.

Editor’s Note: The tabular data is up-to-date as of Nov. 8, 2024.

Table of Contents

What Is a Target-Date Fund?

Target-date funds are a type of mutual fund that have become popular in retirement planning over the past two decades. They go by different names, interchangeably called several things, including:

— lifecycle funds

— age-based funds

— dynamic-risk funds

But the concept at the core is simple: Target-date funds invest in a more aggressive portfolio of mostly equity funds to start, then gradually shift to a more conservative portfolio of mostly bond funds as they approach a target retirement date.

The target retirement dates are intended to be estimates; they don’t have to be super precise. Generally, most mutual fund families will create target date funds in five-year increments (say, 2025, 2030, 2035, etc.).

For the investor, the math here is simple enough.

Target-Date Funds Example

Let’s say you’re 25 years old in 2024, and that you expect to work until age 70. Your expected retirement date would be in the year 2069. So, investing in a target-date fund with a target retirement date of 2065 or 2070 (or even a combination of the two) would make sense.

What if your expected retirement age changes? No problem! Target-date funds are normal mutual funds and can be bought or sold as your needs change.

Note that the target-date fund’s allocation to stocks will generally never go to zero. Retirees need growth too, and most should maintain at least a little exposure to the stock market. The beauty of the target-date fund is that it changes your asset allocation to match your risk tolerance as you age—and it does it automatically without requiring you to actually do anything.

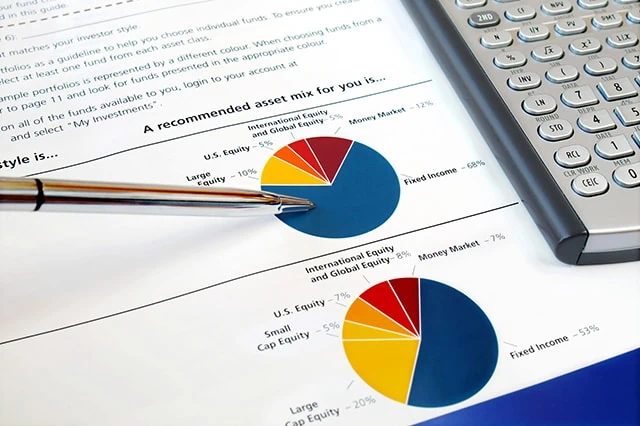

What Is Asset Allocation?

A lot of investors (and particularly young investors) dream of making a killing picking stocks. And that’s fantastic. Stock picking is stimulating and, if done well, can add some zeros to your net worth!

When push comes to shove, however, your asset allocation strategy is far more important than individual stock picking when it comes to meeting your financial goals. Asset allocation sits at the core of target-date funds and, really, at the core of all financial planning.

But what exactly is asset allocation?

Every planner has their own take, but the basic idea is simple. You diversify your portfolio across different asset classes (stocks and bonds, for instance) that, ideally, move at least somewhat independently of each other. A typical asset allocation will include:

— stocks (or stock mutual funds)

— fixed-income investments (bonds, bond funds, or money market funds)

— cash

— alternative assets such as gold, commodities, or real estate

You arrange the parts so that the overall portfolio has a risk and return profile that makes sense for you. And (importantly!) you rebalance the portfolio when the weights to each asset start to divert from your plan.

Asset Allocation Example

Let’s say your ideal asset allocation had you 50% allocated to stocks and 50% allocated to fixed income.

First, let’s say the stock market crashes. Your stock weighting has suddenly dropped to just 35%, and your fixed-income investments have jumped to 65% of your portfolio’s worth! You need to rebalance your portfolio to get back to 50/50. You would do that by selling off some of the fixed-income investments and buying some stock.

Now, let’s say instead that the stock market shoots higher, and you find yourself allocated 60% to stocks and 40% to fixed-income investments. If you wanted to rebalance back to 50/50, you would sell some of your stocks and buy new fixed-income investments.

The idea here is to constantly reduce risk and smooth out your returns by buying low and selling high.

Asset allocation within a target-date fund takes it a step further. Apart from regular rebalancing due to market moves, the target-date fund’s asset allocation decisions involve gradually reducing the risk (buying fewer and less risky stocks, and buying more bonds) as the fund gets closer to its target retirement date and its final asset allocation.

Related: Best Vanguard Retirement Funds for a 401(k) Plan

A Look at Fidelity Target-Date Funds

Fidelity is, of course, one of the largest mutual fund companies in the world. I’ve personally discussed Fidelity’s best index funds for Young and the Invested, and it’s worth noting that Fidelity ETFs can be useful for tactical investors.

Related: Best Target-Date Funds: Schwab vs. Fidelity vs. Vanguard

Fidelity also manages one of the largest target-date fund families. In fact, there’s a good chance your company 401(k) plan has Fidelity target-date funds as an investment option.

There are literally dozens of Fidelity target-date funds, and we will cover each in a moment. But all share certain characteristics. For example, all Fidelity target-date funds hold underlying funds managed by Fidelity. So, essentially, you can think of a Fidelity target-date fund as a portfolio of regular Fidelity mutual funds specifically allocated for a person your age.

That said, there are some significant differences, particularly when it comes to fees and the expense ratio of each particular fund.

Fidelity Freedom Funds

The Fidelity Freedom Funds are a family of 15 target-date funds with target retirement dates currently spanning 2005 to 2070, as well as an income-focused fund, the Fidelity Freedom Income Fund (FFFAX).

Fund managers build the allocations for each up exclusively from underlying Fidelity funds. And each of the Fidelity Freedom Funds are expected to reach their most conservative allocation 10 to 19 years after the target date. At that point, the target asset allocation will include approximately 24% equity funds, 46% bond funds, and 30% cash or short-term funds.

Related: 24 Best ETFs to Buy for a Prosperous 2024

While the process is designed to follow a glidepath, the funds are actively managed and involve a degree of human discretion.

Let’s take a look at some examples.

Fidelity Freedom 2070 Fund (FRBDX)

The most aggressive fund currently in the lineup is the Fidelity Freedom 2070 Fund (FRBDX), which would be appropriate for an investor in their early-to-late 20s who intends to retire around the age of 70. The Fidelity Freedom 2070 is invested 51% in U.S. equities and 42% in non-U.S. equities, meaning this is a very aggressive fund with 93% exposure to stocks. It also has an expense ratio of 0.75%, which is roughly in line for an active mutual fund.

Fidelity Freedom 2035 Fund (FFTHX)

Now, let’s consider the Fidelity Freedom 2035 Fund (FFTHX). The 2035 fund would be appropriate for someone in their late 50s or early 60s that planned to retire around the age of 70. This fund is more conservative than the 2070 fund, but it still has 39% of its portfolio in U.S. equities and another 35% in non-U.S. equities. It has an expense ratio of 0.71%.

Related: How to Start a Retirement Plan [Build Your Retirement Savings]

Remember, Fidelity’s concept of what an ideal asset allocation is for a person at a given age might not exactly line up with yours. By the time you’re 60, you might consider having a 74% allocation to stocks to be far too aggressive. So, while target-date funds are designed to be “set it and forget it,” you still need to periodically check in to make sure you’re comfortable with the risk being taken.

Fidelity Freedom Index Funds

Index funds have been a massive blessing for investors since Vanguard’s John Bogle launched the concept in 1975. Due in large part to their lower fees and lower frictional expenses like brokerage commissions, index funds generally outperform their actively managed counterparts over time.

So, if index funds are good for your stock and bond funds, why not for your target-date funds too?

That’s exactly what the Fidelity Freedom Index Funds offer. It’s the exact same target-date concept as the original Fidelity Freedom funds, but this family of index target-date funds builds its portfolios exclusively from Fidelity’s large selection of low-cost index funds.

Let’s look at an example.

Related: Best Schwab Retirement Funds for a 401(k) Plan

Fidelity Freedom Index 2070 Fund (FRBVX)

We’ll compare the Fidelity Freedom 2070 Fund to its indexed sister fund, the Fidelity Freedom Index 2070 Fund (FRBVX). The index-only Fidelity Freedom fund has an expense ratio of just 0.12% compared to 0.75% for the active target-date fund. Those 63 basis points (a basis point is one one-hundredth of a percentage point) might not sound like much of a difference, but over time it compounds. Over the course of 10 years, if performance is equal, the index fund will make about 6 percentage points more overall due to the lower fees—and the difference will get wider with time.

Related: How Much to Save for Retirement by Age Group [Get on Track]

But understand there can be slight differences in asset allocation between the active Fidelity Freedom funds and their Index Freedom Fund peers.

Fidelity Freedom Index 2070 Fund (FFIJZ) Composition

The active 2070 fund is 51% invested in U.S. stocks and 42% in non-U.S. stocks, whereas the index 2070 fund is invested 54% in U.S. stocks and 36% in non-U.S. stocks. The total allocation to stocks is about the same, but the mix of stocks between U.S. and foreign is very different, owing to the preferences of the fund managers.

So, when choosing between the active and indexed Fidelity Freedom funds, you have to weigh the benefits of manager discretion against the lower cost of going full index.

Related: Retirement Plan Contribution Limits for 2024 + 2025

Fidelity Freedom Blend Funds

Typically, the term “blend fund” actually refers to a type of stock fund that holds both value and growth stocks. But in the case of the Fidelity Freedom Blend Funds, what Fidelity is “blending” is active and passive management.

That is, Fidelity Freedom Blend Funds are target-date funds that hold a combination of actively managed and indexed Fidelity funds to meet their goals.

We cover an example of how this plays out with the Fidelity Freedom Blend 2070 Fund (FRBYX).

Related: Best Mutual Funds for Beginners

Fidelity Freedom Blend 2070 Fund (FRBYX)

Fidelity Freedom Blend 2070 Fund (FRBYX) holds index funds, including the Fidelity Series Large Cap Value Index Fund (FIOOX) and Fidelity Series Long-Term Treasury Bond Index Fund (FTLTX), as well as actively managed funds, such as the Fidelity Series Emerging Markets Opportunities Fund (FEMSX).

Related: 6 Best Stock Recommendation Services [Stock Tips + Picks]

As you might expect, expenses for FRBYX fall in between the purely indexed target-date fund and the fully actively managed fund—at 0.49% currently. It’s too early to judge the performance comparisons of these funds since the fund only launched in June 2024.

Related: Best Stock Charting Apps

Fidelity Sustainable Target Date Funds

In 2023, Fidelity launched its Fidelity Sustainable Target Date lineup, which like the Freedom funds, includes a product specific to every five years, as well as an income fund.

Related: The 7 Best Dividend ETFs [Get Income + Diversify]

In addition to leading investors down the proper glidepath to retirement, these funds also try to invest in assets with positive environmental, social, and governance (ESG) characteristics. It can do so by investing in:

— Actively managed funds that buy securities of issuers that are believed to have good or improving sustainability or ESG characteristics

— Index funds that track an ESG index

— Funds that don’t necessarily have a principal ESG investment strategy, but that have at least 80% of assets in debt securities that the adviser believes have positive ESG characteristics

Like with Fidelity Freedom Blend Funds, Fidelity Sustainable Target Date Funds sport expense ratios falling between their fully passive and fully active brethren. Fidelity Sustainable Target Date 2070 Fund (FRCQX), for instance, charges 0.49% annually. Given the extremely short time since inception, performance numbers here don’t tell us much.

Like Young and the Invested’s Content? Be sure to follow us.

Learn More About These and Other Funds With Morningstar Investor

If you’re buying a fund you plan on holding for years (if not forever), you want to know you’re making the right selection. And Morningstar Investor can help you do that.

Morningstar Investor provides a wealth of information and comparable data points about mutual funds and ETFs—fees, risk, portfolio composition, performance, distributions, and more. Morningstar experts also provide detailed explanations and analysis of many of the funds the site covers.

With Morningstar Investor, you’ll enjoy a wealth of features, including Morningstar Portfolio X-Ray®, stock and fund watchlists, news and commentary, screeners, and more. And you can try it before you buy it. Right now, Morningstar Investor is offering a free seven-day trial. You can check out the current deal, as well as discounted rates for students and teachers, on Morningstar Investor’s website.

How Do Fidelity Freedom Funds Compare to Vanguard Target Retirement Funds?

As a general rule, you’re going to get a very similar experience in both Fidelity Freedom funds and Vanguard Target Retirement funds. Both offer low-cost access to an asset allocation model that glides from more aggressive to more conservative as you reach your targeted retirement date.

But there can be differences, and those differences matter.

Let’s compare the Fidelity Freedom Index 2040 Fund (FBIFX) to the Vanguard Target Retirement 2040 Fund (VFORX). Both have rock-bottom expense ratios of 0.12% and 0.08%, respectively. That’s close enough that fees alone aren’t going to move the needle much in terms of returns.

Related: Everything You Need to Know About Schwab’s Target-Date Funds

But the asset allocations are noticeably different. FBIFX currently has about 50% in U.S. stocks and another 34% in international equities—so, 84% invested in stocks. Meanwhile, VFORX is currently invested 46% in U.S. equities and 29% in international equities, for a total stock exposure of about 75%.

As another example, let’s consider funds that already assume you’re in retirement. The Fidelity Freedom Index 2020 Fund Investor Class (FPIFX) has about 45% of its portfolio in stocks, whereas the Vanguard Target Retirement 2020 Fund (VTWNX) has about 37% of its portfolio in stocks.

The Fidelity target-date funds consistently have more stock exposure than the Vanguard target-date funds of a comparable target date. They’re a little more aggressive, and that’s neither good nor bad. But it’s something you should consider as you choose the right target-date fund for you.

Are Indexed Target-Date Funds Better Than Actively Managed Funds?

This is an eternal debate, and the answer is “it depends.”

Some active managers effectively beat their indexed competition even after the higher fees, trading expenses and tax considerations are taken into account. Most, however, do not. Over the past two decades, there have been only three years—2005, 2007, and 2009—in which a majority of large-cap managers beat the S&P 500. So, as a general rule, it is safe to assume that indexed target-date funds will be your better option over time.

Furthermore, active management can muddle the waters of a target date strategy, particularly if the active manager regularly makes defensive moves, such as going to cash. The percentage of the portfolio you have exposed to stocks is determined by the number of years until the retirement date, and active management can potentially skew your weights outside of the target.

Related: The 9 Best ETFs for Beginners

Why Does a Fund’s Expense Ratio Matter So Much?

Every dollar you pay in expenses is a dollar that comes directly out of your returns. So, it is absolutely in your best interests to keep your expense ratios to an absolute minimum.

The expense ratio is the percentage of your investment lost each year to management fees, trading expenses and other fund expenses. Because index funds are passively managed and don’t have large staffs of portfolio managers and analysts to pay, they tend to have some of the lowest expense ratios of all mutual funds.

This matters because every dollar not lost to expenses is a dollar that is available to grow and compound. And over an investing lifetime, even a half a percent can have a huge impact. If you invest just $1,000 in a fund generating 5% per year after fees, over a 30-year horizon, it will grow to $4,116. However, if you invested $1,000 in the same fund, but it had an additional 50 basis points in fees (so it only generated 4.5% per year in returns), it would grow to only $3,584 over the same period.

Like Young and the Invested’s Content? Be sure to follow us.

What Is The Minimum Investment Amount on a Fidelity Fund?

Every Fidelity fund has its own minimum investment amount specific to that fund. But Fidelity has been a trailblazer in making its funds available to beginning investors with ultra-low minimums, and many Fidelity funds have no minimum investment at all.

Part of our criteria in selecting the best Fidelity index funds was accessibility, and every fund selected here has a minimum investment of zero, meaning you can literally start your investment with any dollar amount.

Related: The Best Fidelity ETFs for 2024 [Invest Tactically]

If you’re looking to build a diversified, low-cost portfolio of funds, Fidelity’s got a great lineup of ETFs that you need to see.

In addition to the greatest hits offered by most fund providers (e.g., S&P 500 index fund, total market index funds, and the like), they also offer specific funds that cover very niche investment ideas you might want to explore.

Related: Best Target-Date Funds: Vanguard vs. Schwab vs. Fidelity

Looking to simplify your retirement investing? Target-date funds are a great way to pick one fund that aligns with when you plan to retire and then contribute to it for life. These are some of the best funds to own for retirement if you don’t want to make any investment decisions on a regular basis.

We provide an overview of how these funds work, who they’re best for, and then compare the offerings of three leading fund providers: Vanguard, Schwab, and Fidelity.

Related: 9 Best Monthly Dividend Stocks for Frequent, Regular Income

The vast majority of American dividend stocks pay regular, reliable payouts—and they do so at a more frequent clip (quarterly) than dividend stocks in most other countries (typically every six months or year).

Still, if you’ve ever thought to yourself, “it’d sure be nice to collect these dividends more often,” you don’t have to look far. While they’re not terribly common, American exchanges boast dozens of monthly dividend stocks.

Please Don’t Forget to Like, Follow and Comment

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Subscribe to The Weekend Tea, our weekly newsletter to read more about investing, spending, taxes, and more, and

3. Give the article a Thumbs Up on the top-left side of the screen.

4. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!