They say nothing in life is free, but I beg to differ. When you earn money through sign-up bonuses and cash back, that extra cash requires no additional effort.

Sometimes you need a quick win. So I’ve compiled several ways you can earn a little money (at least $10) fast—in many cases, by doing things you might have already been planning to do. In most cases, these sign-up bonuses and cash-back offers will make you much more than $10—and in a few cases, you can earn even more money after the initial bonus.

Take advantage of the offers below to make at least $10 fast and give your finances a near-instant boost. The more deals you utilize, the more money you can make.

Editor’s Note: All sign-up bonus offers are as of Aug. 21, 2025.

How to Get $10 (Or Even More) Fast

Below, I’ll go through a number of ways you can easily score $10—or in most cases, even more—pretty quickly, and sometimes even instantly.

1. Investment Account Sign-Up Bonuses

First up: Sign-up bonuses for starting an investment account. This is a very common way for online stock brokers to attract fresh customers—most brokers offer some sort of giveaway or bonus, though they often change over time.

Below are a handful of our favorite brokerage sign-up bonuses.

Robinhood ($5-$200 Toward Fractional Stock)

- Available: Sign up here

- Platforms: Web, mobile app (Apple iOS, Android)

- Promotion: $5-$200 to be spent on fractional shares

Robinhood is a pioneer of commission-free trading, jumping into the investing public’s consciousness in 2013 when they rolled out commission-free trading. They remain a standout option for cost-minded investors thanks to their continued $0 commissions on stocks, ETFs, and options, as well as for its fractional trading, which allows people to invest with as little as $1.

Robinhood’s other noteworthy investing features include IRAs and Roth IRAs (with matching funds no less), advanced charts, options strategy builders, 24/7 commission-free cryptocurrency trading, extended-hours trading, and stock lending.

→ How to get your free money to put toward stock at Robinhood

While several other media outlets refer to Robinhood’s offer as “free stock,” that’s a little oversimplified. The bonus is a randomly selected cash amount of between $5 and $200 that can be put toward fractional shares of certain U.S. stocks. Here’s how to get your bonus:

- Use our link to start the account opening process.

- Link your bank account.

- Fund your account with at least $10.

(Note: You must wait three trading days to sell your gift stock. Once you’ve sold your stock, you can use the money to buy other stocks right away. But if you want to withdraw the funds for cash, you have to wait at least 30 days.)

Related: 15 Best Investing Research & Stock Analysis Websites

Webull ($100 Bonus, 2% Match)

- Available: Sign up here

- Platforms: Desktop app (Windows, Mac, Linux), web, mobile app (Apple iOS, Android)

- Promotion: $100 bonus and 2% match on initial deposit ($2,000 minimum deposit)

Webull is a wallet-friendly brokerage account that offers no-commission stocks, ETFs, and options, $0 contract fees on many options, and requires no deposit minimums.

It also offers fractional-share investing, which allows investors to start buying for as little as $1. In other words: Beginners working with small dollar amounts can still easily diversify their portfolio across numerous investments. Newer investors can also learn trading skills through the courses in Webull’s education center, and even practice their skills via Webull’s paper trading service.

Webull is available across just about every platform, allowing you to research, trade, and track your stocks on your smartphone, tablet, or desktop. Other features include charting tools, customizable screeners, free real-time stock quotes and stock alerts, preset lists, voice commands, and more. It also offers extended trading hours (pre- and after-market trading) and 24/7 online help.

You can also subscribe to the paid Webull Premium tier, which provides a higher APY on uninvested cash, IRA rollover and transfer matches, higher IRA contribution matches, better margin rates, and more.

On top of all that, Webull frequently runs promotions that typically involve earning free stock.

→ How to get Webull’s cash and match bonuses

Currently, Webull is offering new users a litany of bonuses connected to making an initial deposit. Here’s how to collect a $100 cash bonus and 2% deposit match:

- Use our link to sign up with Webull.

- Deposit at least $2,000.

Note: The match is capped at $20,000, which would be awarded if you made a $1 million deposit.

Related: 13 Best Apps That Give You Money for Signing Up [Free Money]

Moomoo (Up to $1,000 in NVDA Stock)

Related: 15 Best Stock Research & Analysis Apps, Tools and Sites

eToro (Get $10 Free)

- Available: Sign up here

- Platforms: Desktop app (Windows, macOS), web, mobile app (Apple iOS, Android)

- Promotion: Get $10 when you deposit $100

Most trading apps keep you in one place: Your account. But eToro wants to change that.

eToro has made investing social by giving you the chance to engage with other traders, creating a social trading network designed to share ideas on the publicly traded markets. You can trade stocks, exchange-traded funds (ETFs), and options commission-free, and you can also get exposure to cryptocurrencies. (In non-U.S. markets, you can also trade currencies, as well as contracts-for-difference, or CFDs.)

eToro is known for its CopyTrader service—a novel product that allows you to copy the trades of experienced investors automatically. No more guesswork on making trades yourself; you simply follow the leader and let the app handle the legwork for you. While this might not interest advanced traders, it’s an appealing feature for beginners looking to replicate the performance of popular traders on the platform. (Editor’s Note: Even though this can make for a fun trading experience, you should still be fully aware of the risks entailed through this feature—namely, the potential for losses.)

Of course, you don’t have to copy anyone—you can trade on your own ideas. This intuitive investing app began with a strong crypto focus, but you can now make self-directed trades across a host of other assets.

Opening an account is quick and simple to do. Simply visit eToro’s website via our link to open and fund an account. From there, you get access to their commission-free trading platform for stocks, ETFs, options, forex and crypto.

→ How to get $10 free with eToro

For a limited time, you can get $10 when you deposit $100 in your eToro account. To get your free $10 bonus, you’ll need to:

- Use our link to sign up for an eToro account.

- Deposit $100.

- Explore stocks, ETFs, and crypto.

You’ll automatically receive $10 directly to your account balance. The deposited funds must remain in your account for a minimum of 90 days following the date of deposit in order to receive the one-time $10 reward deposited in your eToro account.

Related: 15 Best Stock Research & Analysis Apps, Tools and Sites

SoFi Invest® ($5-$1,000 in Bonus Stock)

- Available: Sign up here

- Platforms: Desktop, web, mobile app (iOS, Android)

- Promotion: $5-$1,000 in bonus stock

SoFi is a multi-faceted financial company that offers everything from credit cards and insurance to student loans and mortgages … and they also allow you to trade and invest through its SoFi Invest app.

With SoFi Invest, you can invest as actively or as passively as you’d like. The Active SoFi Invest Brokerage Account has no required minimum balance, charges no commissions on stock, ETF, and options trades, and its options trading has no contract fees, either. Want to put your portfolio on autopilot? SoFi’s robo-advisory services will create a portfolio for you for an annual 0.25% assets under management fee (that can be designed to address one or several goals) and auto-rebalance it for you as necessary over time.

The interface is still very much geared toward younger, less experienced investors—everything is focused on simplicity and ease of use, rather than an expanse of sophisticated tools. SoFi also offers budget-friendly features such as fractional shares, which allow you to invest for as little as $5. And SoFi even provides a social element, such as bringing SoFi members together at exclusive events.

And one thing that sets SoFi apart is your ability to handle many financial tasks within the very same app. SoFi’s app allows you to tackle anything from banking and investing to student loans, insurance, and mortgages. Better still, you can subscribe to SoFi Plus to unlock an additional $1,000 per year in extra value across all of SoFi’s financial arms.

→ How to earn bonus stock from SoFi Invest

SoFi Invest allows you to win a randomly selected dollar amount worth of bonus stock: $5, $10, $25, $100, or $1,000. To qualify:

- Use our link to open a new brokerage account with SoFi.

- Fund your account with $50 or more within 30 days of the account opening.

Your bonus should post to your account in 10 business days.

Related: 29 Best Side Hustles for Teens [In-Person + Online]

Upromise ($5.29 Sign-Up Bonus, $25 Linking Bonus)

- Available: Sign up here

- Platforms: Web, mobile app (Apple iOS, Android)

- Promotion: Get a total of $30.29 ($5.29 for signing up, and $25 for linking a 529 plan)

Upromise makes it easier to save for your child’s future higher education expenses, and has helped families save more than $1 billion for college to date.

After you create a Upromise account, you link it to either your 529 plan, student loan account, or a checking or savings account. You can also apply for a no-monthly-fee Upromise Mastercard that earns you cash rewards when you shop, eat at restaurants, and more, and the service will automatically deposit both your cash rewards and any monthly contributions into your 529 plan or linked bank account. You’ll also earn more in cash-back rewards with the Upromise Mastercard than you will with any other linked debit or credit card.

Also, every month, Upromise gives five families a $529 college scholarship. Every dollar of earned rewards gets you an entry.

→ How to get your free money on Upromise

As soon as you use our link to sign up with Upromise and verify your email, you’ll be awarded $5.29. To receive an additional $25, you must:

- Link a 529 plan account within 30 days.

- Keep the account active through the first cash-back rewards redemption cycle.

- Make sure your cash-back rewards account balance meets the minimum transfer amount to be able to transfer rewards into the linked account.

Related: 24 Summer Jobs for Teens [Start Your Job Search Here]

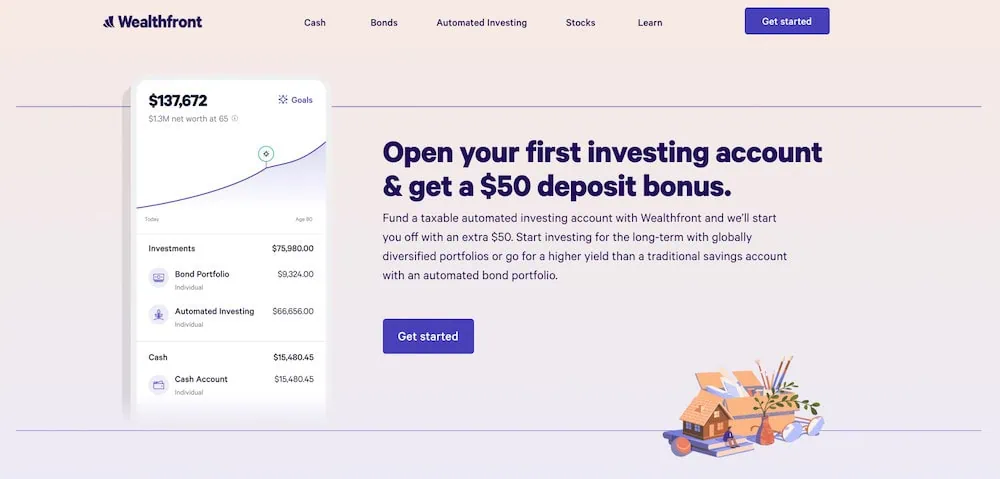

Wealthfront ($50 Deposit Bonus)

- Available: Sign up here

- Platforms: Desktop, web, mobile app (iOS, Android)

- Promotion: $50 deposit bonus

Wealthfront is a popular robo-advisor that offers numerous account types, including individual, joint, and trust taxable brokerage accounts, Traditional, Roth, SEP, and Rollover IRAs and 529 plans.

While some of its robo-advisor competitors have a relatively high minimum balance requirement of a few thousand dollars or much more, Wealthfront requires a fairly small initial deposit of $500 to open an account. (Again, that’s high for an investment account, but low for a robo-advisory product.) So if you don’t have a huge sum invested already to move into the account or to rollover from an existing account like a 401(k) or other IRA, this account might be a good choice.

Wealthfront offers some valuable perks with its accounts, including automatic tax-loss harvesting, automatic rebalancing, automatic trading, and the option to customize your expert-built portfolio. This top robo-advisor also offers access to a 529 plan (or the ability to link an external one to your account) to help with saving for educational expenses. This is an uncommon feature for most standalone robo-advisors outside of a traditional brokerage, so it’s well worth noting.

If you’re considering putting this on your shortlist, just note that Wealthfront does charge a 0.25% annual management fee across the board. It’s not free, but it’s more affordable than many robo-advisors.

→ How to get your $50 deposit bonus on Wealthfront

If you use our link to open a new taxable brokerage account with Wealthfront, fund it with $500 or more within 30 days of account opening, and leave the funds there for at least seven days, you’ll receive a $50 deposit bonus in your account.

2. Completing Surveys

Get cash just for sharing your thoughts through paid survey sites. It’s not exactly the most lucrative side hustle, but it is a way to earn money with virtually zero effort.

Swagbucks ($10 Bonus)

- Available: Sign up here

- Platforms: Web, mobile app (iOS, Android)

- Promotion: $10 sign-up bonus

Making money online through Swagbucks is simple. Swagbucks lets users earn Swagbucks points (SBs) by completing simple tasks—that includes taking surveys, yes, but also shopping online, playing video games, or even just doing web searches.

Users can redeem SBs for gift cards from popular retailers, such as Apple, Amazon, and Target; the website awards more than 7,000 gift cards every day. However, if you just want cash, you can redeem points that way, too, and receive the money in a PayPal account.

You can typically earn a free bonus for signing up for Swagbucks via our link. You can also earn additional money by referring friends to the app.

→ How to get your $10 bonus on Swagbucks

New users receive a $10 bonus for signing up and spending with Swagbucks. Here’s how:

- Use our link to sign up with Swagbucks.

- Spend at least $25 at a store featured in Swagbucks.com/Shop within 30 days of registration. (You must receive a minimum of 25 SB for the purchase.)

You’ll receive a 1,000 SB bonus (equivalent to $10), which should post to your account in 10 business days.

Related: How to Make Money in High School [Earn Your First $1,000]

3. IRA Matches

You might be asking yourself, “Wait, what do you mean an IRA match?”

Individual retirement accounts (IRAs) are a type of retirement account that enjoys certain tax benefits. However, unlike with 401(k)s, which are run through employers and often offer a match, you directly open up an IRA through a broker. So whereas you might very well receive an employer match when you contribute to a 401(k), brokers, generous as they might be, rarely pony up money for your IRA.

Rarely … but it does happen.

Robinhood, which is known for being ahead of the curve in offering new features, now offers a match for users. Robinhood Retirement matches up to 1% of your contributions (or 3%, if you subscribe to Robinhood Gold) on its own—allowing you to save money for retirement even faster!

Robinhood Retirement (1% or 3% IRA Match)

- Available: Sign up here

- Platforms: Web, mobile app (Apple iOS, Android)

- Promotion: 1% match on IRA contributions (3% match with Robinhood Gold)

Robinhood has evolved from a bare-bones app appealing to mostly beginner investors to a fuller-featured account suitable for a wider range of experience levels. For instance, Robinhood now offers individual retirement accounts (IRAs) and Roth IRAs via Robinhood Retirement.

And Robinhood is back to innovating by becoming the first IRA to offer a match on contributions.

→ How to get your free money in an IRA on Robinhood

If you open up an IRA with Robinhood Retirement, Robinhood will match 1% of any IRA transfers, 401(k) rollovers, and annual contributions to your account—and 3% if you pay for the Robinhood Gold service ($5 per month)—typically almost immediately after you make your contribution. Better still: Any matches made on annual contributions don’t count toward your contribution limit. So for instance, if you’re under age 30 in 2025, and contribute the maximum allowable $7,000 …

- If you have a Robinhood Retirement account, Robinhood would match 1%, giving you an additional $65 in IRA funds.

- If you have a Robinhood Retirement account and subscribe to Robinhood Gold, Robinhood would match 3%, giving you an additional $195 in IRA funds. (That’s $130 more than the normal account, more than paying for the $60 per year you’d spend on Robinhood Gold.)

(Friendly message from your Young and the Invested tax expert: The reason the IRA match doesn’t count toward your annual IRA contribution limit is because Robinhood treats it as interest income in your IRA.)

Robinhood’s IRA itself doesn’t offer as many investment options as other brokerages’ IRAs (for instance, you can’t get mutual funds through Robinhood), but if all you need is stocks and exchange-traded funds, it will get the job done. Also, you can choose your investments yourself, but Robinhood’s Portfolio Builder can also provide you with a custom recommended portfolio made up of five to eight ETFs.

Get your free IRA money by signing up for a Robinhood retirement account with our link today.

Related: How to Invest Money: 5 Steps to Start Investing w/Little Money

How to Get Paid $10 Instantly: FAQs

Can I make 10 dollars fast completing paid surveys?

Yes. Online surveys are an easy way to make extra money. The more paid surveys you are qualified to take, the more money you can earn. If you’re looking for two of the highest-paying survey sites, join Branded Surveys and Survey Junkie.

Branded Surveys rewards users with points when they complete surveys. The points convert to cash at a ratio of 100 points to $1. While some of Branded Surveys’ paid surveys only pay out 50 points, longer surveys can pay out several hundred points, and members who are part of the loyalty program can earn even more. Most surveys pay between $1-$3. Branded Surveys offers payment through free PayPal money, direct deposit, gift cards, or nonprofit donations.

According to Survey Junkie, if you complete three online surveys daily, you can earn as much as $40 per month. You’re not going to become rich just from taking surveys, but if you qualify for longer surveys with either company, you definitely have the potential to make 10 dollars fast. Users can get paid with PayPal cash, bank transfers, or free gift cards.

Related: 7 Best Wealth + Net Worth Tracker Apps [View All Your Assets]

How else can I make money online?

You can also earn extra cash if you watch videos, play games, and shop online through specific apps and browsers. These tasks can be done whenever you have a little free time, such as waiting for food in a restaurant or during a commute. If you’re watching videos or playing games every chance you get, you can make $10 fast.

How are you paid when you earn money online?

When you make a little extra money online, you’ll earn either cash prizes or equivalent rewards. Those prizes can come in many forms. Depending on the app, you’ll be paid through one, some, or all of the following methods:

- Direct deposit

- Free PayPal money

- Gift cards

- Stock

- Cryptocurrency

Before you sign up with a site that awards points you then trade in for extra crash, get to know their point conversion systems. Some systems are overly complicated, obscuring how much you’re actually earning.

Related:

- How to Get Free Money Now [15 Ways to Earn Money]

- 5 Best Money Market Funds [Protect Your Savings]

- Free $20 Instantly: 10 Legit Ways to Make $20 Fast

Disclaimers

Moomoo

Moomoo’s parent company is Nasdaq-listed Futu Holdings Ltd (FUTU). Their subsidiaries are licensed and regulated in the United States, Singapore, Australia and Hong Kong.