Most parents want to do everything they can to set their children up for future financial success. One way to help is to save money for a college education, since college graduates typically make more money over their lifetime than those without a university degree.

But college is expensive. And saving enough money for a child’s higher education can place a huge strain on a family’s overall finances. This is particularly true for parents with more than one child under their roof.

As a result, parents usually have a lot of questions when it comes to saving for a child’s college education. How much money do I need to save? Where should I store college savings? Can student loans cover all college expenses?

Saving for college is complicated, but we have answers to these questions, and more, in the discussion below.

Featured Financial Products

Table of Contents

The Current Cost of College

Although the inflation-adjusted average for tuition and fees has dipped a bit over the past couple of years, the cost of college still remains high. According to the College Board, the advertised annual tuition and fees for a full-time undergraduate student at a four-year college during the 2022-23 school year averaged out to:

— $10,940 at a public, in-state college

— $28,240 at a public, out-of-state college

— $39,400 at a private nonprofit college

And that doesn’t include room and board. For students living on campus, tack on an average of $12,310 for a dorm room, meal card, and other related expenses at a public college. Private college costs for room and board averaged 14,030 per year.

When you add it all up, the average combined total for annual tuition, fees, and living expenses for a full-time undergraduate student at a four-year college during the 2022-23 school year was:

— $23,250 at a public, in-state college

— $40,550 at a public, out-of-state college

— $53,430 at a private nonprofit college

No doubt these figures caused sticker shock for parents and students alike. A 2021 survey by Fidelity Investments found that about 25% of high schoolers’ parents and 38% of high school students believed a year of college only costs $5,000 or less. So, you can imagine their reaction when they discovered the actual price.

Parents might also be used to college costs from decades ago. However, those costs are way out of date. According to a recent study by Georgetown University’s Center on Education and the Workforce, the average price for undergraduate education—including tuition, fees, room, and board—rose 169% from 1980 to 2019.

Is College Worth It?

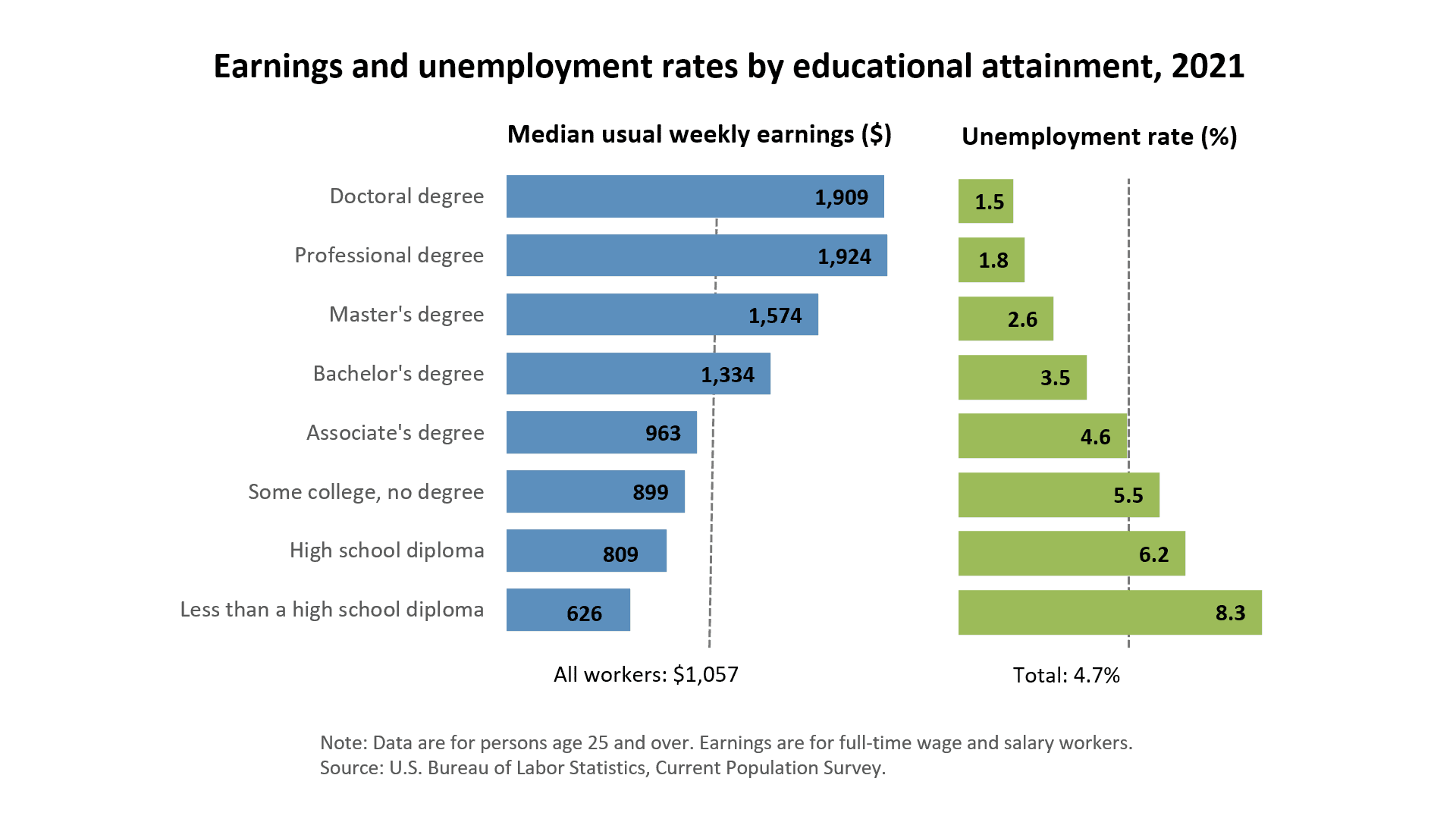

Yes, college costs are high. But don’t let that prevent you from saving for your child’s higher education. While there are always exceptions, people with a bachelor’s degree still tend to make more money than those without one. Next, we cover data from the Bureau of Labor Statistics that shows the importance of going to college and its impact on weekly earnings and unemployment rates.

Earnings and Unemployment Rates by Educational Attainment

According to the most recent data from the Bureau of Labor Statistics, the median weekly earnings of full-time workers with a high school diploma is $809. By comparison, the median weekly earnings of someone with a bachelor’s degree is $1,334. That’s a 65% increase over the wages earned by a high school graduate.

Taking it further, people with a master’s degree have a median weekly paycheck of $1,574, while the mean weekly earnings for someone with a doctoral degree is $1,909. So, in general, the more education you have, the more you’re likely to earn.

There are other financial and work-related benefits of a college education, too. For example, as your level of education rises, your chances of being unemployed decrease.

College also opens up a lot of employment opportunities. Even in fields where a degree isn’t a hard requirement, connections made at college can help secure a better job down the road.

Many college students also discover unknown passions through classes and end up in careers they didn’t even know existed.

As a result of these and other reasons, college is still worth the time and money for most students.

Related: Millennial Spending Habits & Income Statistics to Know

How Much to Save for Your Kid’s College Costs

If you start saving for your child’s college education early, you can help set them up for a better financial future. But that’s usually easier said than done.

Not only is saving for college difficult, but knowing how much to save can be complicated, too. As a result, parents have many questions when it comes to savings goals. For instance, parents often ask if they should try to save enough all by themselves to cover the total cost to obtain a four-year degree. Knowing exactly how much to save is another head-scratcher for most parents. And whether a child should pay some of the costs is another puzzler.

Let’s take a look at these common questions.

Should You Save to Cover the Entire Cost?

Every family’s financial situation is different, so how much of your child’s college costs you should cover is a personal decision. It should also depend on how much you’ve saved for your own retirement, since most financial experts recommend that your first priority should be your own financial security in your golden years. (It’s akin to securing your own airplane oxygen mask first before those of your dependent passengers.)

Featured Financial Products

How Likely Is It For Your Child to Attend College?

When deciding how much to save, we recommend first determining the likelihood of your child attending college. If you aren’t certain about their desire to attend college, squirreling away too much for higher education might not be the smartest choice—especially if you’re contributing to a 529 plan, since in the past you could be hit with a penalty if leftover money in a 529 plan is used for anything other than qualified education expenses.

Now, that decision has gotten easier as a new rule allows you to roll over up to $35,000 in unused 529 plans into Roth IRA for the child.

Public or Private College, In-State or Out-of-State?

Next, consider your child’s interest in going to a public vs. private college, and to an in-state vs. out-of-state school. As noted above, college costs vary widely, and an in-state, public college is usually considerably less expensive than a private university.

Based on which type of school and school location your child is most likely to attend, you should be able to come up with a rough estimate of how much everything will cost.

As a general rule of thumb, we suggest aiming to cover about half the total cost of college as an initial savings goal. That leaves some room for potential scholarships or other financial aid to cover part of your child’s college expenses while lowering the risk of having leftover funds in a 529 plan. (Again, a new rule allows you to roll over up to $35,000 in unused 529 funds into a Roth IRA.)

Another option is to have your child take on some student loans to cover the remaining costs. It will also give them some skin in the game, which might make them take college more seriously and study harder.

You can also encourage them to take core classes at a junior college near home to complete their basic requirements before attending a public or private four-year college. That will likely help bridge the gap between the amount you’ve saved and the total costs of your child’s college education.

Related: 7 Best Fidelity ETFs for 2025 [Invest Tactically]

How Much Should Your Child Contribute?

Having your child contribute to his or her own college fund is another way to reach your overall college savings goal. However, how much your child saves for college (if anything) is completely up to you and based on your family’s financial situation and values.

For example, suppose you’re in an excellent spot financially and want your child to focus entirely on impressing the college board and participating in extracurricular activities. In that case, you might not ask your kid to contribute anything.

However, if you’re not sure you can reach your savings goal, it’s certainly acceptable to ask your child to contribute to their college savings, especially if their heart is set on a particularly expensive school.

Teenagers can have summer jobs, but there are plenty of other ways for teens to make money (including online jobs). Some of the money your kids earn before they’re off to college can be used to pay for college. Student income earned while working during college can also be put toward higher education expenses.

Either way, don’t keep college expenses a secret from your child. Explain the cost differences between a private college and a public college as well as the price differences between an in-state college and an out-of-state college.

If you want them to help save for college, make sure you set clear expectations and don’t give the impression that you’ll cover everything if you actually won’t.

Related: Best Side Hustles for Teens

How Much Should I Be Saving for My Child?

Not every student pays the same amount for college. Some students attend an expensive private school, while others stick to a more affordable public school in their home state. In addition, some kids get scholarships or grants, while others don’t qualify for any financial help.

Plus, not everything always goes according to plan. For instance, a student who expects to get an athletic scholarship might get a severe injury and lose out on the free ride. Therefore, you need to have a backup plan.

To estimate how much you should save for college, try using the “2 for 10” method. With this technique, multiply your child’s age by $2,000 for every $10,000 of college costs you plan to cover per year. The exact formula is:

($2,000 x Child’s Age) x (Annual Costs to Cover ÷ $10,000) = Optimal Savings To Date

So, for example, let’s say Charlie wants to see if his college savings are on track for his son Greyson, who is 14 years old. Greyson wants to attend a private college that currently costs $50,000 per year.

Charlie plans to cover 60% of the total costs for four years of college with his savings, which comes to $120,000 ($200,000 x .6 = $120,000) … or $30,000 per year. Charlie expects scholarships and financial aid to cover the rest. To estimate how much he should have saved by now, Charlie first multiplies $2,000 x 14 (i.e., Greyson’s current age), which equals $28,000. He then multiplies that amount by three (i.e., the amount he plans to pay each year divided by $10,000), which equals $84,000. That’s how much Charlie should have saved for Greyson’s college expenses.

Fidelity Investments has a college savings calculator on its website that uses this model. The online tool will also help you come up with a monthly savings goal if you’re behind where you ought to be and need to catch up.

Related: 7 Best Schwab ETFs to Buy [Build Your Core for Cheap]

Tax-Smart Ways to Save for College

If you’re saving for a child’s college costs, the most important thing is to have a savings goal and plan. But if you’re going to the trouble of planning out a savings strategy, you might as well factor taxes into the equation.

You’ll have to put your college savings in some sort of an account. (Please don’t hide it under your mattress!) Fortunately, certain types of investment accounts come with tax benefits that can save you hundreds or even thousands of dollars while you’re saving for college.

Here are three such tax-advantaged investment accounts that you should consider for your education savings.

Related: 12 Best Long-Term Stocks to Buy and Hold Forever

Featured Financial Products

1. 529 Plans

A 529 plan is designed specifically for college savings (and sometimes K-12 tuition or trade schools). It’s a tax-advantaged investment account you fund with after-tax money. Basically, that means you don’t get any federal tax deductions when you put money in a 529 plan, so you ultimately end up paying income tax on the money before you put it in the account.

However, there are two other tax benefits that you do get with a 529 plan. First, you get tax-free growth on the earnings. Second, when it comes time to make withdrawals, you don’t pay taxes on any of the money as long as you use it for qualified higher education expenses.

Besides tuition, qualified expenses can include fees, books, room and board (must be at least a half-time student), certain technology (such as a computer), special needs equipment, student loan payments (up to $10,000), and more.

Young and the Invested Tip: There are actually two types of 529 plans: investment plans and prepaid tuition plans. With a prepaid tuition plan, you pay tuition and fees at the current rate for college expenses to be incurred years in the future. Our discussion focuses on investment plans, which are by far the most popular type of 529 plan.

Related: 5 Best Vanguard Retirement Funds [Start Saving More, for Less]

You Can Only Use 529 Funds for Qualified Education Expenses

Unfortunately, you can only use 529 plan funds for qualified education expenses. If you use the money for anything else, the earnings (not contributions) withdrawn are subject to income tax at ordinary tax rates and a hefty 10% penalty.

There is no way out of the taxes if you use 529 funds for non-education purposes (unless you meet the new requirements to roll unused 529 funds into a Roth IRA), but the IRS will waive the penalty in some instances. For example, you won’t pay a penalty if the child does any of the following:

— Earns a tax-free scholarship or fellowship grant

— Becomes disabled or dies

— Attends a U.S. military academy

— Receives veterans’ educational assistance, employer-provided educational assistance, or any other tax-free payments as educational assistance

The 10% penalty is also avoided if 529 plan funds are included in income only because qualified education expenses were taken into account in determining the American Opportunity tax credit or Lifetime Learning credit.

Although a 529 account can only be established for one child, you don’t have to use all of the money in an account for the education of the child for which the account was created. So, for example, if there’s still some money remaining after the child’s education is complete, you can transfer the funds to a 529 plan established for a family member (e.g., a sibling).

When is a 529 plan a bad idea?

Using a 529 college savings plan is a bad idea if you aren’t confident your child will attend college. If your kid doesn’t go on to a public or private university, you’ll have to pay taxes on the gains and a 10% penalty.

Related: Best Alternatives to 529 Plans [Other College Savings Options]

2. Roth IRA Accounts

Roth individual retirement accounts (IRAs) are designed primarily for retirement savings, but there are other ways to take advantage of the tax-free growth they offer—including saving for college.

Like 529 plans, a Roth IRA investment account is funded with after-tax money and the earnings grow tax-free in your account. You can take the contributions out at any time, but withdrawing earnings before age 59½ or before you’ve had a Roth IRA for at least five years typically results in a 10% penalty.

However, there are a few exceptions to the penalty rules. One of them allows you to withdraw any amount from a Roth IRA to pay higher education expenses for yourself, your spouse, your child or grandchild, or your spouse’s child or grandchild. For this reason, Roth IRAs are sometimes used to save for college.

As with 529 plans, money from a Roth IRA can be used penalty-free for such things as college tuition, fees, books, room and board (must be at least a half-time student), certain technology (such as a computer), and special needs equipment. It can’t be used for student loan payments or K-12 tuition.

Related: Best Vanguard Retirement Funds for an IRA

Roth IRA Contribution Limits

There are limits on how much money you can put in a Roth IRA each year.

Related: IRA Contribution Limits for 2024 + 2025 [Save for Retirement]

First, contributions for the year can’t exceed the account holder’s “earned income” for the year. According to the IRS, earned income includes “wages, salaries, tips, professional fees, bonuses, and other amounts received for providing personal services.”

There’s also an annual contribution limit based on your age (the limit is adjusted annually for inflation). For 2024, the most you can put in a Roth IRA is $7,000 if you’re under 50 years old at the end of the year (the same limit applies for 2025). If you’re 50 or older by Dec. 31, 2024, you can put in up to $8,000 for the year.

When is a Roth IRA better than a 529 plan?

If you’re not sure your child will attend college, then saving for college with a Roth IRA might make more sense than with a 529 plan. That’s because you can just keep the money in the account and let it continue to grow tax-free for retirement if you don’t end up using the money you saved for your child’s college education.

Related: Roth IRA vs 529 Plans: Which is Better for College Savings?

3. Custodial Accounts

Custodial accounts are run by an adult custodian (often a parent) for a beneficiary (usually a child). While the custodian can invest the money in the account, the funds legally belong to the child. The child gains control of the account once he or she reaches the age of majority for their state, which is typically when they turn 18 or 21 years old.

Withdrawn money must be used in ways that benefit the child, but there are many, many possible uses. One popular use of funds is for the child’s college costs.

However, if the funds don’t go toward paying for college, that’s fine too. There are no penalties for using the money in a custodial account for something else that benefits the child. Then, once the child takes over the account, the funds can be used for any purpose at all.

There are no limits on how much you can contribute to a custodial account, but you might not want to exceed the annual federal gift tax limit. For 2024, the limit is $18,000 ($36,000 for married couples filing a joint tax return) ($19,000 in 2025). If you exceed the limit, you need to tell the IRS and you might have to pay gift tax on the amount (although in most cases you won’t owe any tax at that time). The IRS will also deduct the excess amount from your lifetime estate and gift tax exemption, which is $13.61 million in 2024 ($27.22 million for married couples, and $13.99 million for singles and $27.98 million for married couples in 2025).

Young and the Invested Tip: Both the annual limit and lifetime exemption are adjusted annually for inflation.

You’ll also have to pay capital gains taxes on any assets held in a custodial account if those assets are sold.

Featured Financial Products

Tax Benefits for Using a Custodial Account

While money in a traditional custodial account doesn’t grow entirely tax-free, some of the earnings aren’t subject to income tax and another portion is taxed at the child’s tax rate, which is usually lower than the parent’s rate. Unfortunately, thanks to the “kiddie tax,” the rest is taxed at the parent’s rate.

For the 2024 tax year, earnings in a custodial account are taxed as follows:

— $0 through $1,300 is tax-free ($1,350 in 2025)

— $1,301 through $2,600 is taxed at the child’s marginal tax rate ($1,351 through $2,700 in 2025)

— $2,601 or more is taxed at the parents’ marginal tax rate ($2,701 in 2025)

You can also open a custodial Roth IRA or custodial 529 plan. The tax benefits generally associated with Roth IRAs and 529 plans will generally be available with the custodial versions of those accounts.

Custodial Account’s Impact on Financial Aid

Be warned, however, that using custodial accounts to save for college can have a negative impact on your child’s financial aid eligibility. When applying for financial aid, custodial accounts are considered assets of the child, while 529 plans are typically considered assets of the parent and Roth IRA funds aren’t included in financial aid calculations.

Since students are expected to use a higher percentage of their assets to pay for college (20%) than what their parents are expected to pay (up to 5.64%), the student’s overall expected family contribution will be higher with a custodial account than with a 529 plan or Roth IRA. And as the amount your family is expected to pay rises, the financial aid your child is likely to receive drops. (We discuss expected family contributions in more detail below.)

When Does a Custodial Account Make Sense for College Savings?

There’s a great deal of flexibility when it comes to spending money in a custodial account, which makes it a good choice for educational savings if you’re not sure college is in your child’s future and you can handle the potential negative impact on financial aid.

For example, suppose your child doesn’t need money for college, but does need it for something else—like braces or a car. Unlike 529 plans, there’s no penalty if money in the account is used for something unrelated to education. And unlike Roth IRAs, there are no early withdrawal fees if you take money out of a custodial account for non-educational expenses before a certain age.

What Is the Best Way to Save for Your Child’s Future?

The best way to save for your child’s future is to save early, save regularly, and have the proper amount of risk for your investments.

The earlier you start to save for your child, the more money you can accumulate. The same amount of money saved a few years earlier can be worth far more than saved later because of the power of compounding.

Setting aside money for your child’s future as part of your regular monthly budget helps make saving for college more manageable and steadily raises the funds needed for a college education.

It’s also important to invest some of the savings in ways that will help it grow. Funds sitting in a standard savings account can actually lose value when you factor in inflation. On the other hand, money in high-yield savings accounts or brokerage accounts that are invested in ETFs, mutual funds, or blue-chip stocks have the potential to grow significantly.

Related: Best Schwab Retirement Funds for an IRA

Make College Savings Part of Your Overall Financial Planning

Households function better financially when there’s a budget in place and a plan for covering upcoming major costs, such as the cost of college after your child graduates high school.

The easiest way to save for your child’s college is to make it part of your overall financial planning. To do this, you’ll need to find out approximately how much your child’s education will cost.

As noted earlier, the cost of college can vary greatly depending on whether your child is looking at private schools or public schools, and if he or she is interested in attending an in-state or out-of-state school.

Once you have an estimated total cost in mind, consider how much you can realistically contribute on a regular basis to put toward college expenses.

While completely covering the cost is ideal, it might be financially wiser for you to cover 50%, for example, and have the other half be paid through a combination of scholarships, financial aid, and money your child has saved.

Then, you can calculate a monthly contribution and put that cost in your budget with all of your other usual monthly expenses. Preferably, set up a direct deposit to a 529 account, Roth IRA, or custodial account.

How is the Formula Used to Determine Your Financial Aid Eligibility Changing?

Starting with the 2024-2025 school year, the formula used to determine your financial aid eligibility is changing. The Student Aid Index (SAI) is a calculation used to calculate how much of your college education you are deemed to afford by yourself. It is determined based on information you provide on your Free Application for Federal Student Aid (FAFSA). The SAI will replace the EFC.

Once the school you’re applying to receives your SAI figure, they’ll use it to calculate just how much federal student aid you can receive to attend that school.

Like Young and the Invested’s content? Be sure to follow us.

What Happens to Money Left in a 529 Plan?

You have several options if money is left in a 529 savings account after your child has completed college. If there’s a chance your child will attend grad school, you can keep the money in the account until that decision is made.

One of the most popular ways to use leftover money is to transfer money in the account to another family member. It doesn’t have to be an immediate family member, like a sibling, though that is a popular choice.

Changing the beneficiary to a family member doesn’t count as a distribution. Therefore, you don’t have to pay income tax on the money and the 10% penalty is avoided.

Up to $10,000 can also be used to pay off student loans for the beneficiary or a sibling.

In addition, you can also transfer leftover 529 funds to a family member’s ABLE account, which is a savings account for people with disabilities. Money from a 529 plan can also be transferred to an ABLE account set up for the same beneficiary as the 529 plan. If moving money to an ABLE account, just make sure the transfer doesn’t exceed the ABLE account’s annual contribution limit.

Starting in 2024, a beneficiary can also transfer up to $35,000 of leftover money in a 529 plan into a Roth IRA in his or her name. Any rollover is subject to annual Roth IRA contribution limits, and the 529 account must have been open for at least 15 years.

Of course, you can always withdraw the extra funds and use them for non-qualifying expenses if you’re willing to pay taxes and the 10% penalty on the earnings.

Featured Financial Products