Retirement might be a far-off dream or right around the corner. But one thing’s for certain: No matter where you are on your journey to retirement, it’s easy to get overwhelmed by the planning process. Fortunately, breaking it down into steps, thinking about what you want in retirement, and even simply taking a few deep breaths can help a lot.

While I can’t take those deep breaths for you, I can share some guidance for people of all ages who want to know how to start retirement planning. Hopefully, this information will quell any retirement planning anxiety you might have and help you focus on your retirement goals.

First, I’ll try to motivate you to get moving as soon as possible by pointing out some of the advantages to starting a retirement fund early. After that, we’ll take a look at several factors affecting your retirement savings, how much to save for retirement, potential retirement accounts, and a few retirement investment strategies.

Table of Contents

Why Starting Early Has Its Advantages

If you’re young and haven’t started saving for retirement yet, there’s no better time to start than now. That’s because starting early has its perks, like taking advantage of compound interest, developing a savings habit, and weathering market changes.

1. Compound Interest

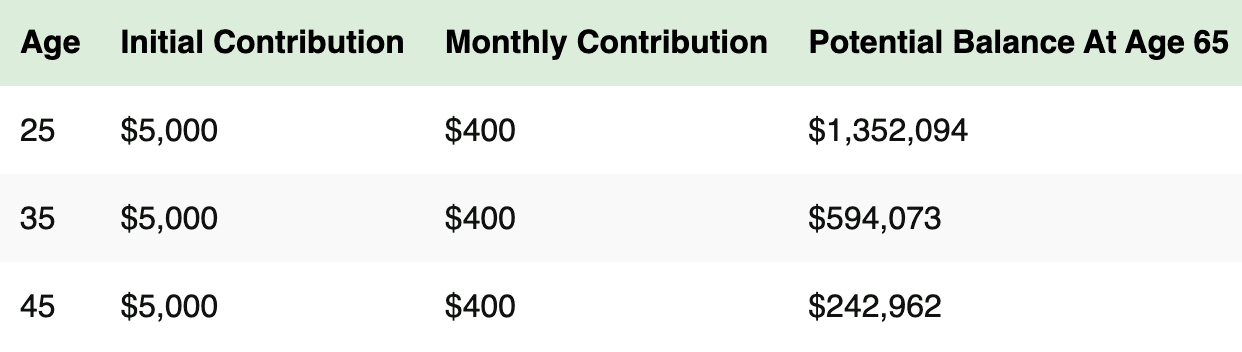

You’ve likely heard about the benefits of compound interest, or interest earned on interest and principal. The table above illustrates how compound interest can play out in practice … and why starting early makes sense. In this example, we’re assuming an average annualized return of 8%.

While setting aside $400 a month might not be feasible for everyone, the saver who started at 25 will have a balance that’s $1,109,132 more by age 65 than the saver who started at 45.

2. Builds Lifelong Saving Habits

Not only will starting early help you take full advantage of compound interest, but you’ll also build good savings habits in general. Consider an automated savings plan: Designate a portion of your paycheck as retirement savings each month and have that amount automatically deposited into a retirement account.

This savings habit will help as you continue to grow in your career and your earning potential increases, and it can also help you keep your savings on track in retirement.

3. More Time to Adjust

When the stock market tanks, it can have a big impact on your retirement savings. Depending on how much you’ve saved, that impact could cost you tens (or even hundreds) of thousands of dollars. Having a long time horizon gives you more time to adjust and can help you rebound more easily after a market crash than someone who’s closer to retirement.

Young and the Invested Tip: Dollar-cost averaging (i.e., investing a specific amount of money at regular intervals despite market performance) can be a smart long-term retirement investment strategy.

Related: 7 Best Fidelity ETFs for 2024 [Invest Tactically]

Factors Affecting How Much Retirement Savings You’ll Need

Whether you’re planning to retire soon or decades from now, several constant factors will impact how much retirement savings you’ll need.

1. Retirement Age

The age at which you plan to retire is a major factor. While many people opt to retire at 65 (i.e., when you qualify for Medicare), you might want to retire early—or even later if you love your work. Obviously, the sooner you retire, the more you’ll likely need to save.

Related: Can I Retire at 60 with $500K? [YES! See Examples of How]

2. Expected Lifespan

Lifespan is also a key consideration. Outliving your savings is a real concern, so keeping this factor in mind can be helpful as you plan for retirement.

According to the most recent CDC data, the average life expectancy in the U.S. dipped slightly in 2021, but it’s still 76.4 years old (down from 77 years of age in 2020).

3. General Health

Medical costs tend to be a larger burden the older you get. So, you should factor your general health and expected medical expenses into your retirement savings plan.

If you have unhealthy habits (e.g., smoking), have a family history of illness, or otherwise expect to be in generally poor health in retirement, you might want to save even more for retirement to cover greater medical expenses.

4. Desired Lifestyle in Retirement

Do you want to live the high life in retirement, travel, and eat takeout five days a week? Or would you prefer a more modest lifestyle? Your desired lifestyle will play an important role in how much you’ll need to save.

5. Where You Want to Live

Where you plan to live also impacts the amount you’ll need to set aside for retirement. Do you plan to move to an area with a lower or higher cost of living? If you decide on the former, you might need to save less. But if you’d like to move somewhere more expensive, plan on padding your savings a bit more.

Related: 10 States That Tax Social Security Benefits

How Much Should You Save for Retirement?

I wish I could tell you that there’s a one-size-fits-all answer to how much you should save for retirement, but unfortunately, there’s no such thing. The magic number will depend on what you want from retirement, as well as the other factors we’ve discussed.

Related: How Much to Save for Retirement by Age Group [Get on Track]

As you start calculating the right amount for you, it often then makes sense to work backwards after you’ve thought about the factors we mentioned above. Consider what defines a successful retirement lifestyle, and from there identify how many years you have until you retire. Research realistic investment returns over past periods that align with your time horizon. (While past performance isn’t a guarantee of future returns, it can offer some insight into how the market generally behaves.)

Once you understand potential returns, it’s time to review your budget and determine how much you can afford to contribute toward retirement savings each month. Also consider any employer matches of 401(k) contributions in your equation, as this perk can help grow your nest egg a little faster. If possible, try to set aside a little more than the minimum you can afford to account for any unexpected market swings or life changes.

Again, the amount of money you’ll need in retirement will depend upon your individual lifestyle goals as well as other factors. But here’s some guidance if you’re struggling to determine how much you’ll need.

Like Young and the Invested’s content? Be sure to follow us.

1. Safe Withdrawal Rate

Another way to evaluate the adequacy of your retirement savings is to see if you can withdraw enough each year to support your desired retirement lifestyle without depleting your nest egg prematurely. As a general rule of thumb, 4.7% is considered a safe withdrawal rate for many retirees.

After you have a sense of how much you’ll be able to save for retirement, and how much you’ll need to pull out of your retirement savings each year, use the following formula to calculate your withdrawal rate:

If your expected withdrawal rate is significantly above 4.7%, consider squirreling away more money for retirement.

Of course, while the 4.7% withdrawal rate can serve as a good rule of thumb, it has some limitations and can vary based on your age at retirement and your retirement portfolio mix.

Related: How Long Will My Savings Last in Retirement? 4 Withdrawal Strategies

2. Expect to Replace 80% of Your Current Income

The 80% rule is another common benchmark for retirement savings. Under this rule, estimate your annual retirement costs at around 80% of your pre-retirement income. So, for example, if your pre-retirement annual income is $100,000, you should expect your annual retirement expenses to be around $80,000. Knowing this amount should help you calculate how much money you need to save for retirement.

Keep in mind that you won’t necessarily spend 80% of your pre-retirement income each year after you retire, but it’s a decent rule of thumb. You could end up spending more or less, depending on your lifestyle goals and where you choose to live.

Related: How to Max Out Your 401(k) and Other Retirement Accounts

What Types of Retirement Accounts Are Available?

When it comes to retirement accounts, there are a few different options. But as I’ll explain in a moment, the best place to start saving retirement money is typically your workplace retirement plan.

Young and the Invested Tip: Working with a certified financial planner or other financial advisor is a good idea for anyone setting up a retirement plan. Not only can financial advisors help you determine how much to save for retirement, but they can also help set up the necessary retirement accounts.

Related: 12 Best Long-Term Stocks to Buy and Hold Forever

Employer-Sponsored Retirement Plans

As its name suggests, an employer-sponsored retirement plan is offered by a business or government agency for the benefit of its employees. However, there are a few types of workplace retirement plans … and each one works a bit differently.

As you’ll see, advantages of employer-sponsored retirement plans include:

— Employer matching possible

— High contribution limits

— Traditional plan contributions reduce taxable income

— Roth plan contributions can be withdrawn tax-free in retirement

— Guaranteed retirement benefits with a pension

On the other hand, disadvantages of employer-sponsored retirement plans include:

— Employer controls often-limited investment choices

— Vesting terms might apply

— Certain plans charge administration fees

Let’s take a brief look at some of the different types of workplace retirement plans.

Related: 5 Best Vanguard Retirement Funds [Start Saving in 2024]

1. 401(k) Plans

For-profit companies often offer 401(k) plans, though they aren’t required to do so. Many employers that offer 401(k) plans also provide a matching benefit to employees, meaning they’ll match your contributions to the plan up to a certain percentage. It’s common for companies to offer matches of 3% to 6%, though certain companies provide a lower or higher percentage match.

For 2023, you can contribute up to $22,500 into a 401(k) as an employee if you’re under 50 years of age ($23,000 in 2024). You can also make additional “catch-up” 401(k) contributions in 2023 of up to $7,500 if you’re 50 or older (for a total of $30,000, or $30,500 in 2024). Combined employee and employer contributions are capped at $66,000 for 2023 ($73,500 for people 50 or older making catch-up contributions). (These numbers jump to $69,000 and $76,500 in 2024, respectively.)

Employers can offer both traditional and Roth 401(k) options. With a traditional 401(k) plan, employee contributions are typically made on a “pre-tax” basis, which means the money you put into a traditional 401(k) account aren’t included in your overall taxable income. Funds in a traditional 401(k) grow tax-deferred, so you won’t be taxed until you start withdrawing money from the plan.

In addition, money taken out of a traditional 401(k) before you turn 59½ years old is typically subject to a 10% early withdrawal penalty (although there are exceptions).

Furthermore, when you turn 73, you must begin taking a certain amount of money out of a traditional 401(k) each year if you haven’t already started. These withdrawals are called required minimum distributions (RMDs).

If you have a Roth 401(k) account, contributions are made on a “post-tax” basis, which means there’s no tax break when you put money into the account. However, withdrawals are tax-free in retirement.

You can withdraw your contributions to a Roth 401(k) plan at any time without having to pay income taxes or the 10% penalty. However, income tax and the 10% penalty generally apply to earnings taken out of the account if you aren’t 59½ years old or the account isn’t at least five years old.

RMDs from a Roth 401(k) account are currently required once you turn 73. However, starting in 2024, RMDs will no longer be required from Roth 401(k) accounts.

Related: Best Vanguard Retirement Funds for a 401(k) Plan

2. 403(b) Plans

403(b) plans, sometimes called tax-sheltered annuities (TSAs), work similarly to 401(k) plans, except they’re typically offered by public schools and some 501(c)(3) tax-exempt organizations. Similar to what you’d see with certain 401(k) plans, some employers offer matching contributions to a 403(b). The matching percentage offered varies by employer.

As with 401(k) plans, employees under 50 can contribute up to $22,500 to a 403(b) in 2023 ($23,000 in 2024). While those 50 and older can make an additional contribution of $7,500. Total employee and employer contributions can’t exceed $66,000 ($73,500 for people 50 or older). (These numbers increase to $69,000 and $76,500 in 2024, respectively.)

Both traditional and Roth 403(b) plans are possible. They work like traditional and Roth 401(k) accounts when it comes to taxes, penalties, and RMDs.

Related: Best Fidelity Retirement Funds for a 401(k) Plan

3. 457(b) Plans

457(b) plans are generally for employees of state or local governments (although non-government tax-exempt organizations can also establish 457(b) plans). While employer matches are relatively common with 401(k) and 403(b) plans, employees are unlikely to see matching benefits with a 457(b) plan.

Contribution limits, taxes, penalties, and RMD rules for 457(b) plans are similar to those for 401(k) plans. Both traditional and Roth 457(b) accounts are possible, too.

Young and the Invested Tip: Federal employees can participate in the Thrift Savings Plan, which also operates much like a 401(k) plan.

4. Pensions

Pensions are a type of retirement plan where employers set aside money into a pooled fund and pay employees a defined benefit for life once they retire. These plans are rare in the private sector, but public pensions from state or local governments are fairly common. If you work in a public service role, such as for a police or fire department, you might receive a pension when you retire.

These plans are typically employer-funded and employer-controlled, though employees can contribute to their pension with certain plans. Pension plans often come with a lengthy vesting term, though these terms can vary by employer. For instance, with certain employers, you might need to stay on the job for seven or 10 years to receive a percentage of your pension.

Something to Note for Employer Plans: At Least Get The Match

As I noted earlier, your workplace retirement plan is often the best place to start saving for retirement. Why? Because of the employer match (if one is available).

Even if you can’t afford to contribute much to your plan right now, contributing enough to get a matching benefit makes sense. An employer match is essentially free money in your retirement account, and leaving that money on the table can be a costly mistake!

Related: How to Get Free Money [Don’t Forget That Employer Match!]

What Happens If You Change Jobs?

The fate of your employer-sponsored retirement plan can vary if you change jobs. With a 401(k), 403(b), or 457(b) plan, you’ll likely be able to roll over your contributions to a new plan of a similar type.

However, vesting periods might apply for employer contributions, though these periods generally aren’t as long as you might see with a pension plan. If you leave before you’re vested, you might also be leaving your employer match behind.

Pension plans work differently. If you leave your employer before you’re vested, you probably won’t get a pension at all. But if you’re vested, you can generally opt to receive your pension as a lump-sum payment or future guaranteed income in retirement. Pension distributions are typically taxed as ordinary income, and you might need to pay an early withdrawal penalty if you take a lump-sum payment before age 59½.

Related: Best Vanguard Retirement Funds for an IRA

Small Business and Self-Employed Retirement Plans

Special retirement plans are also available for small business owners, including self-employed people. Two popular options include a Simplified Employee Pension (SEP) IRA and a Savings Incentive Match Plan for Employees (SIMPLE) IRA.

1. SEP IRAs

With a SEP IRA, small business owners and self-employed people contribute to individual retirement accounts for themselves and any qualified employees. Employees don’t contribute to their own SEP IRA, though.

Per IRS rules, a business owner must contribute an equal percentage to all employees. So, if you set aside 20% of your salary for your retirement as the owner, you’ll also need to set aside 20% of each qualifying employee’s salary for their retirement. Given this, SEPs are generally best for businesses with no employees or very few.

Contribution limits for SEP IRAs are relatively high—up to 25% of compensation or $66,000 for 2023, whichever is less ($69,000 in 2024). Contributions are made on a “pre-tax” basis, which means they’re tax deductible. However, distributions in retirement will be taxed as ordinary income.

RMDs are also required when the account holder turns 73.

Related: Best Schwab Retirement Funds for an IRA

2. SIMPLE IRAs

Like SEP IRAs, SIMPLE IRAs are individual retirement accounts for self-employed people and small business owners. However, these two plans work differently.

With a SIMPLE IRA, both employers and employees can contribute on a tax-deferred basis. Roth-style SIMPLE IRAs aren’t allowed, so contributions and gains will be taxed when they’re withdrawn in retirement.

For 2023, an employer must contribute one of the following to each eligible employee’s SIMPLE IRA account:

— A dollar-for-dollar match of the employee’s contribution, up to 3% of the employee’s compensation

— 2% of the first $330,000 of the employee’s compensation ($345,000 in 2024)

Employees under 50 can contribute up to $15,500 to a SIMPLE IRA, or $19,000 if they’re 50 or older ($16,000 and $19,500 in 2024, respectively).

As with SEP IRAs, RMDs kick in when you turn 73.

Related: SEP IRA vs. Roth IRA: What’s the Difference?

3. Individual Retirement Accounts

Another option for stashing away some money for retirement is an individual retirement account (IRA). You can put money in a traditional or Roth IRA—or both if you’re seeking tax diversification. Both allow you to contribute a little extra toward retirement, but each works a bit differently.

Related: IRA Contribution Limits for 2024

As with traditional and Roth 401(k) plans, the main difference is when you pay tax on contributions and earnings in the account. With a traditional IRA, most people get a tax break when they contribute to their account, but they owe taxes when they take money out of the account. On the other hand, there are no tax breaks when you put money in a Roth IRA, but withdrawals are tax-free.

Also be aware that the total combined contribution limits for these accounts are fairly low. For 2023, you only can contribute up to $6,500 to all your IRAs if you’re under 50, and $7,500 if you’re 50 or older ($7,000 and $8,000 in 2024, respectively).

In addition, there’s an income limit on contributions to Roth IRAs that’s based on the filing status used on your tax return for the year. For 2023, you can’t contribute anything to a Roth IRA if your modified adjusted gross income for the tax year is:

— $228,000 or more if your filing status is married filing jointly or surviving spouse ($240,000 in 2024)

— $153,000 or more if your filing status is single, head of household, or married filing separately and you didn’t live with your spouse at any time during the year ($161,000 in 2024)

— $10,000 or more if your filing status is married filing separately and you lived with your spouse at any time during the year

If your income is below the applicable amount, you still might not be able to contribute the full $6,500 for the year ($7,500 if you’re at least 50 years old). (These figures increase to $7,000 and $8,000 in 2024, respectively.)

Finally, the RMD rules apply to traditional IRAs, but not to Roth IRAs.

Like Young and the Invested’s content? Be sure to follow us.

Advantages and Disadvantages of IRAs

Advantages of IRAs

Some of the most common advantages to traditional IRAs are:

— Contributions might reduce your taxable income

— Growth is tax-deferred

— No income limits for contributors

For Roth IRAs, advantages include:

— Withdrawals are tax-free in retirement

— Contributions can be withdrawn anytime tax- and penalty-free

— RMDs do not apply

Disadvantages of IRAs

Here are some reasons to think twice before opening a traditional IRA:

— RMDs apply starting at age 73

— Withdrawals are taxable in retirement

— Low contribution limits

And here are some disadvantages that come with Roth IRAs:

— No current-year tax benefits

— Low contribution limits

— Income limits apply

Related: Best Fidelity Retirement Funds for a 401(k) Plan

Can You Contribute to an Employer-Sponsored Retirement Plan and an IRA?

Yes, you can contribute to both an employer-sponsored retirement plan and an IRA in the same year. For instance, if you’re maxing out your traditional 401(k) contributions, you might choose to stash some additional retirement savings in a Roth IRA, too. Doing so will not only allow you to build a larger nest egg, but you’ll also get the benefits of tax diversification in retirement.

Related: IRA vs. 401(k): How These Retirement Accounts Differ

Other Savings and Investment Vehicles You Can Use to Save for Retirement

In addition to the retirement accounts discussed above, other savings and investment vehicles exist that can be used to save for retirement. These accounts can be useful to cover medical costs in retirement or avoid tax penalties if you plan to retire early.

1. Health Savings Accounts

If you have a high-deductible healthcare plan, a health savings account (HSA) can be a great way to set aside money for current and future medical costs. HSAs can have both a savings and investment component, and they offer tax-deductible contributions, tax-free withdrawals for qualified medical expenses, and tax-free growth. However, you might have to pay taxes and penalties if you use your HSA funds to pay for non-medical expenses.

As with 401(k) plans and IRAs, there are contribution limits for HSAs, too. For 2023, you can contribute up to $3,850 to an HSA if you have self-only health insurance coverage ($4,150 for 2024). If you have family coverage, you can put in up to $7,750 ($8,300 for 2024). An additional “catch-up” contribution of up to $1,000 is allowed for those 55 and older.

Related: How to Use Your HSA for Retirement

2. Taxable Brokerage Accounts

A taxable brokerage account isn’t a dedicated retirement account, but you can use it to invest for retirement, as well as other large expenses. These accounts offer some valuable flexibility for those who are planning to retire early. Unlike many retirement accounts, you won’t incur an IRS penalty for withdrawing money from a taxable brokerage account before age 59½.

There’s no limit to how much you can contribute to a taxable brokerage account, either. Just keep in mind that you will pay capital gains tax if you sell an investment for a profit through your brokerage account. Profits on investments held for one year or less are typically taxed at a higher rate than profits on investments held more than a year.

Related: Federal Tax Brackets and Rates

How to Invest for Retirement

In addition to having many retirement account options, there are also many investment options available to you if you’re saving for the future. Popular choices include stocks (equities) and bonds (debt), which can be held in mutual funds (including target-date funds) and exchanged-traded funds (ETFs). Your funds might be actively managed, or they might be index funds, which simply track an index like the S&P 500.

1. Stocks and Stock Funds

Investing in stocks can provide the long-term capital appreciation needed to grow your retirement savings, but doing so isn’t without risk. This is especially true if you opt to invest in individual stocks.

Choosing to invest in a stock mutual fund or ETF instead could help you diversify and mitigate some of the risk that comes with investing in individual stocks. These funds are pooled baskets of money invested in several securities, as opposed to investments in a single company.

2. Bonds and Bond Funds

Investing in bonds or bond funds might also be a smart choice. Bonds are debt instruments, and they’re often issued by federal, state, and local governments, as well as companies. When you purchase a bond, you’re essentially providing a loan to the issuer that they repay with interest.

Given that these investments tend to be less risky than investing in equities, they’re often an attractive investment in a turbulent market. That’s because bonds offer a predictable income stream, often paying interest to investors twice annually. Many investors also opt to shift more toward bonds as they get closer to retirement. This allows them to transition from the goal of capital accumulation to capital preservation.

Young and the Invested Tip: In general, equity investments tend to yield higher returns than bond investments. But timing, investment decisions, and time horizon will also play a role in your returns.

3. Index Funds

Index funds are one of the best tools for long-time savers.

An index fund is guided by a rules-based benchmark to meet some sort of strategic goal. Maybe it’s owning growth stocks. Maybe it’s owning dividend stocks. There are literally thousands of index funds out there, all with different approaches. But whether you’re talking about a stock market index fund linked to a popular benchmark (like the Dow Jones Industrial Average) or whether you’re talking about bond index funds tied to U.S. Treasuries, the basic approach is the same: The fund simply holds a group of securities that are tied together by some rules and some common thread.

Index funds are considered to be “passively managed,” versus “actively managed” funds that use one or more managers to select investments. Passively managed funds not only boast lower costs because there are no managers to pay, but in many categories, they have (on average) historically outperformed actively managed funds.

Most ETFs tend to be index funds, though there are several actively managed ETFs. Conversely, most mutual funds tend to be actively managed, but there are several index mutual funds.

Why Low Fees Make A Huge Difference (Index Funds)

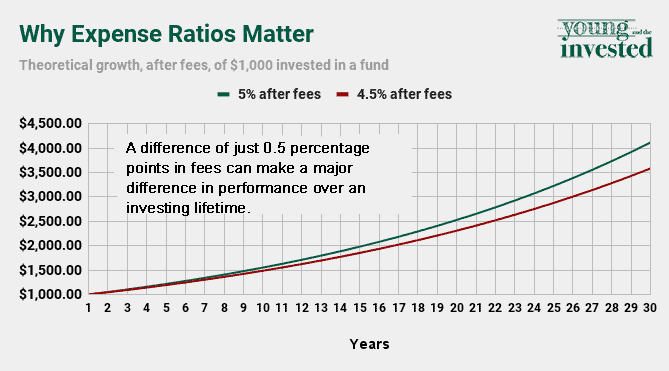

Speaking of fees, every dollar you pay in expenses is a dollar that comes directly out of your returns. So, it’s important to minimize your expense ratio, which is the percentage of your investment lost each year to management fees, trading expenses, and other fund expenses.

The image above provides a quick look at how expense ratios could impact your total investments over a 30-year period.

Also note that mutual funds sometimes charge other fees, such as sales loads (fees taken out of your investment when you first purchase a fund) and redemption fees (fees you pay for selling the fund). So before you buy, always look over a fund’s fee information either on the provider’s website or a fund research site like Morningstar.

I wouldn’t ever select a mutual fund or ETF just because it has the cheapest fees. But if you’re choosing between funds and most everything else is equal, you should consider opting for the one with lower costs.