Rebalancing your portfolio is one of the most fundamental yet often overlooked disciplines in long-term investing.

That’s too bad. Because this vital maintenance task is among the easiest and least time-consuming ways an investor can help themselves. Unlike selecting securities, responding to market events, or forecasting returns, rebalancing doesn’t require painstaking research and analysis. It’s a straightforward, step-by-step process—like changing an air purifier’s filter or emptying out a vacuum—that even the least experienced among us can do with just a little guidance.

And this simple process has a big payoff, keeping your portfolio aligned with your financial objectives, risk tolerance, and time horizon.

Today, I want to walk you through portfolio rebalancings, including why you should rebalance, when and how often you should do it, and how to rebalance your portfolio. And for the visual learners out there, I’ll also include a brief step-by-step guide with screenshots of a basic portfolio rebalance using one of my favorite investing tools.

Featured Financial Products

What Is Portfolio Rebalancing?

Your investments don’t exist in a bubble. As markets go up and down, so too will the worth of your investments. And there’s a very good chance some of your investments will grow faster than others. This causes “portfolio drift,” in which your portfolio moves farther and farther away from your original mix of asset classes (stocks, bonds, alternatives, cash, etc.) and risk profile.

Portfolio rebalancing, then, is the process of adjusting your investments to either return to that original asset mix, or shift to a new asset mix. Here’s a quick example:

Dakota is a mid-career investor who builds herself a diversified portfolio with a target allocation of 80% equities and 20% bonds. At the start of 2026, the stock market takes off, but the bond market stagnates. By the end of 2026, Dakota’s overall portfolio has increased in value—but that blend has shifted to 90% stocks and 10% bonds.

If she were to rebalance her portfolio, she would likely sell some stocks and buy some bonds to return to that original 80/20 blend at the start of 2027.

Why Should You Rebalance Your Portfolio?

You build a portfolio a certain way to achieve goals while taking on a certain amount of risk. Very generally speaking, stocks are considered high-growth but high-risk, while bonds are considered low-growth but low-risk. A 90% stock/10% bond portfolio, then, would be pretty aggressive, while a 10% stock/90% bond portfolio would be pretty conservative.

Well, let’s say you wanted to keep a low risk profile, so you set your portfolio at 10% stocks and 90% bonds. Within a couple of years, your bonds don’t grow very much, but your stocks do, and before you know it, your portfolio is 40% stocks and 60% bonds.

Just like the stock market giveth, it could taketh away, too. A 40/60 portfolio would be much more susceptible to a sudden bear market in equities than a 10/90 portfolio would. However, a portfolio rebalancing back to a 10/90 portfolio would take the additional risk you’ve accumulated off the board (while locking in the gains you’ve made).

How to Rebalance Your Portfolio: A Quick Step-by-Step Guide

To illustrate the process of rebalancing your portfolio, I’ll show you a quick example using Morningstar Investor. I’ve been using Morningstar Investor for years as part of my research process, but investors can also get a lot out of its portfolio tracking feature, which I’ll use to demonstrate a simple rebalance.

Let’s say that a couple years ago, I built a portfolio that’s 60% stocks and 40% bonds, using three funds:

— Vanguard S&P 500 ETF (VOO): 30% of assets

— Invesco QQQ Trust (QQQ): 30% of assets

— Vanguard Total Bond Market Index Fund ETF (BND): 40% of assets

But since then, the gains in the VOO and QQQ stock funds have greatly outstripped BND, leading to a portfolio mix that’s closer to 80/20.

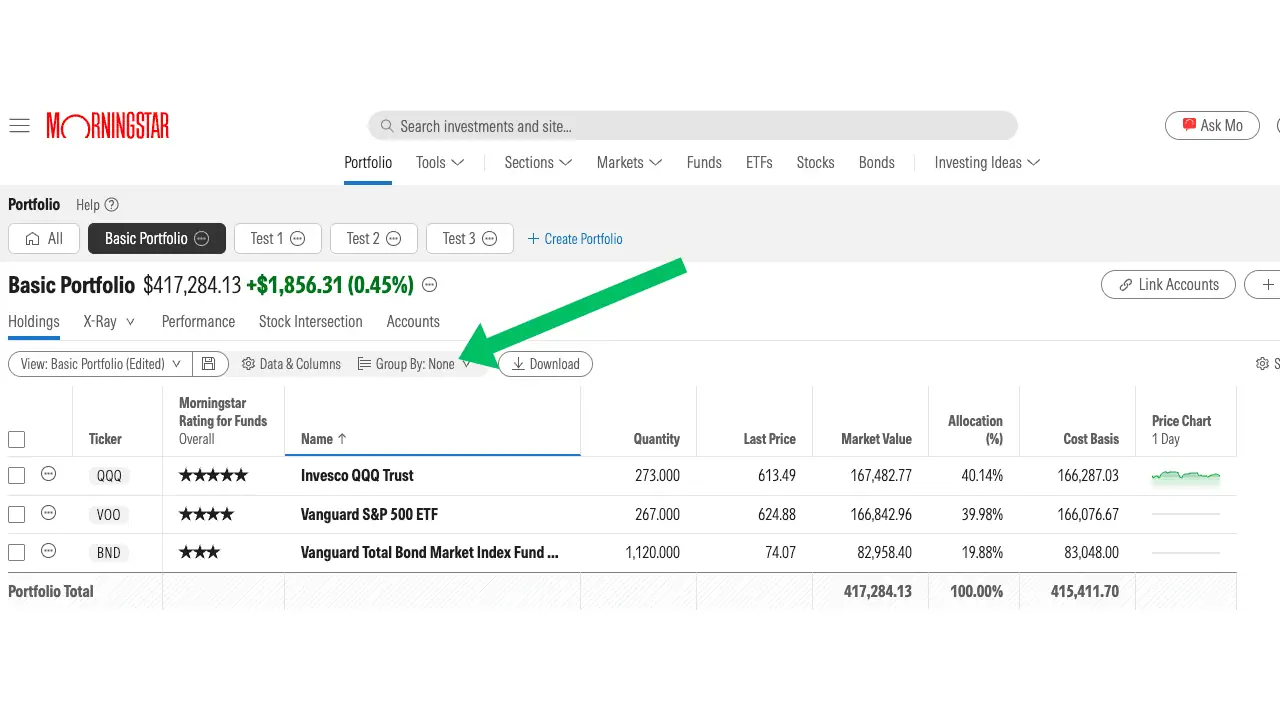

In Morningstar Investor, I’ve created a basic portfolio that I’ve cleverly called “Basic Portfolio” showing what that portfolio might look like:

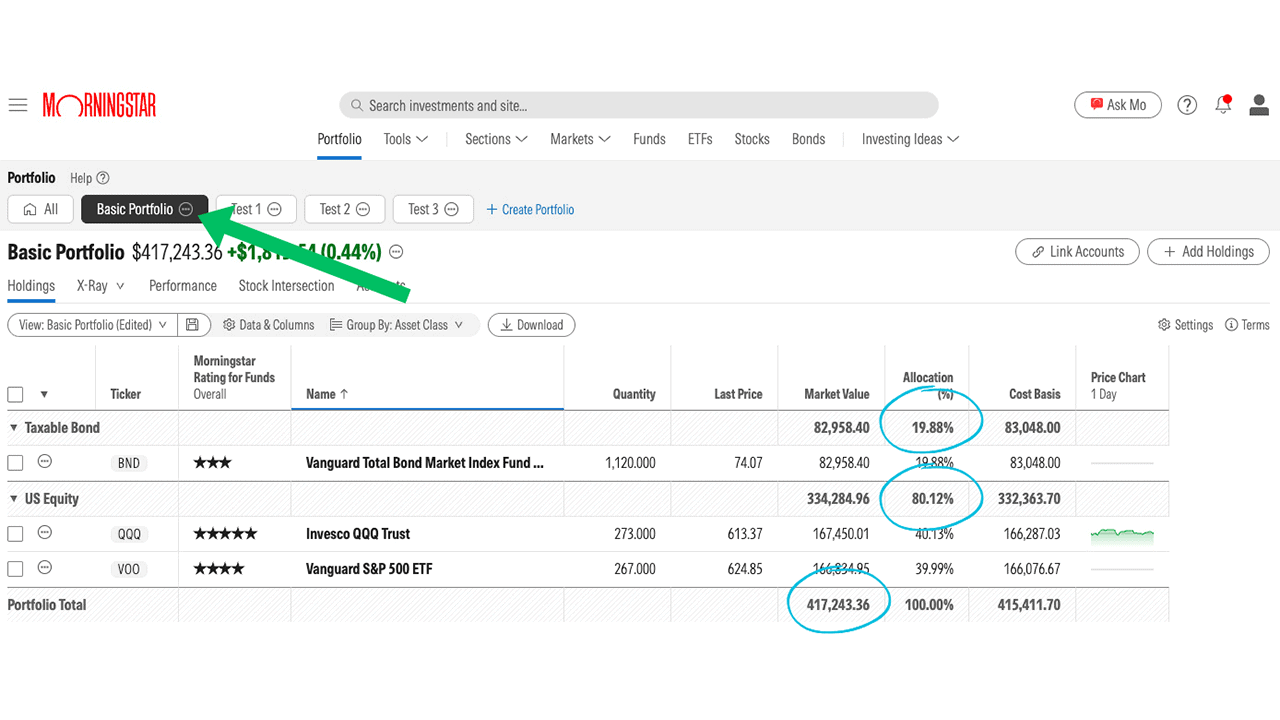

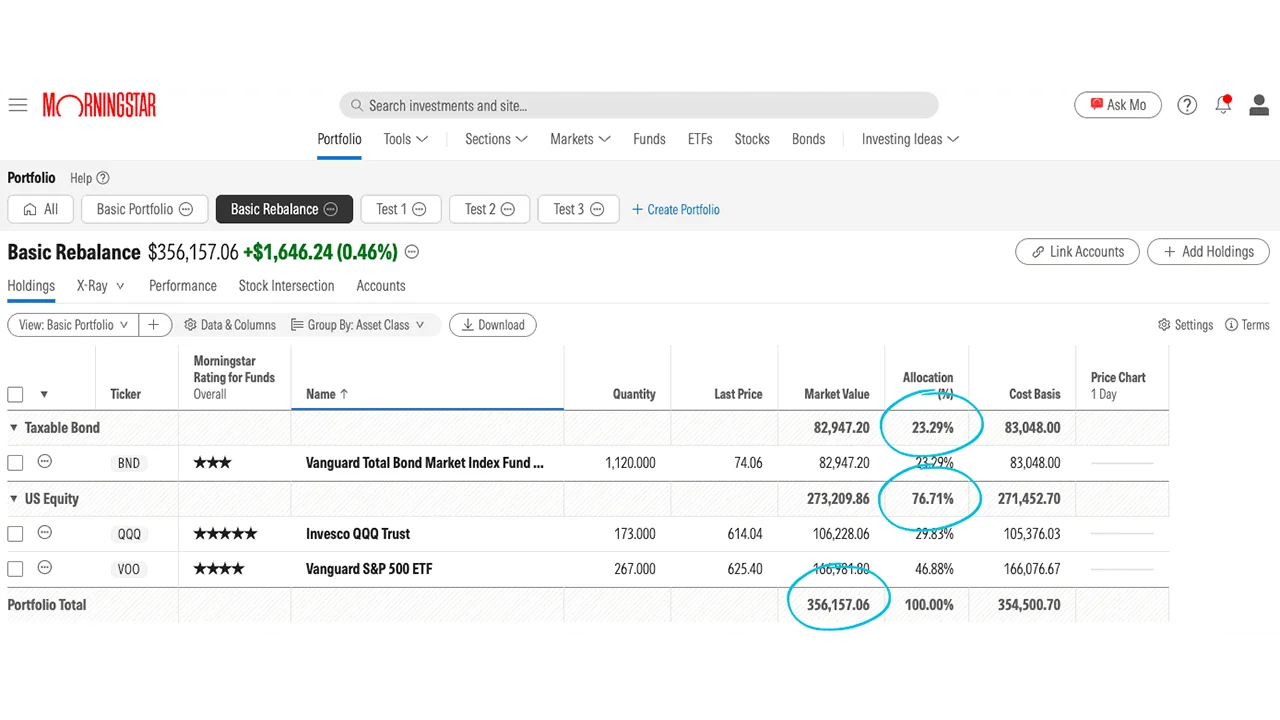

Click “Group By,” then “Asset Class” (not shown) in the drop-down menu. It will group your holdings by asset class.

Here, you can see there’s roughly 80% in U.S. stocks, and 20% in taxable bonds.

Keep your eye on the Portfolio Total, too. When we’re done rebalancing, we’ll want to make sure that number is roughly the same as it was when we started.

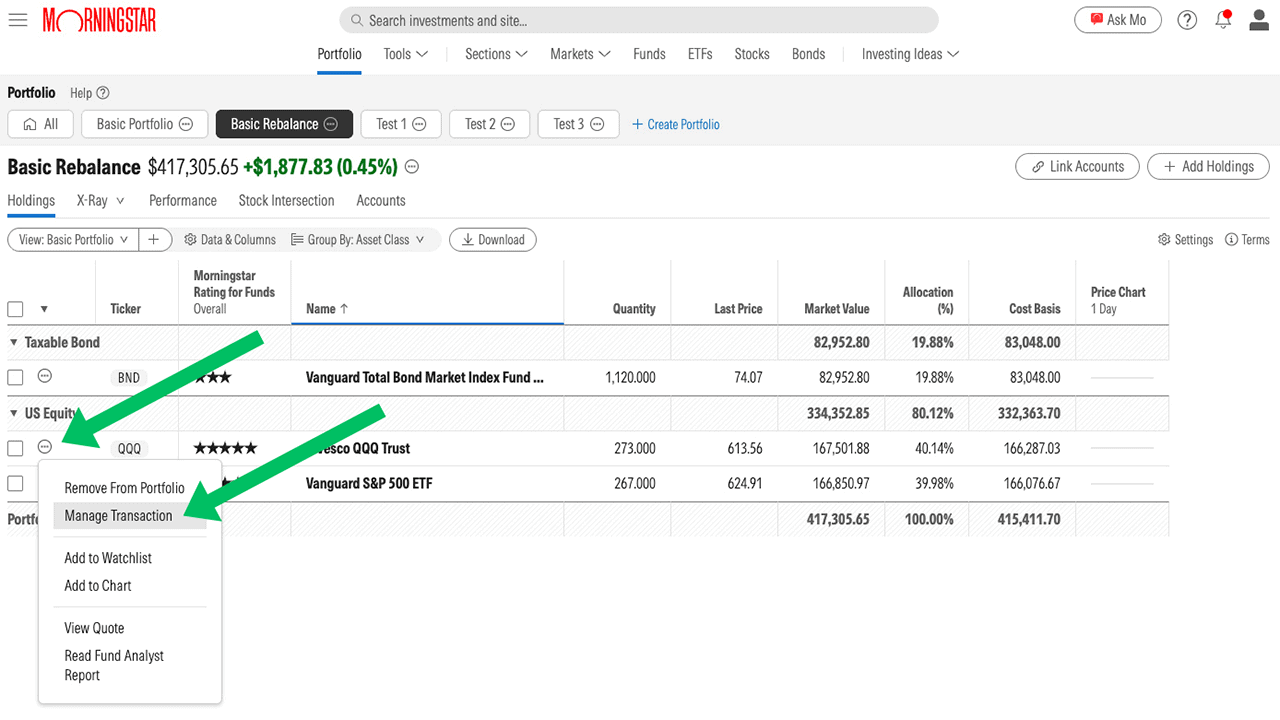

Click the three-dot button next to “Basic Portfolio,” then “Duplicate Portfolio” (not shown). This way, you can experiment with rebalancing but still maintain a copy of your actual portfolio so you don’t lose it. We’ll name the copy “Basic Rebalance.“

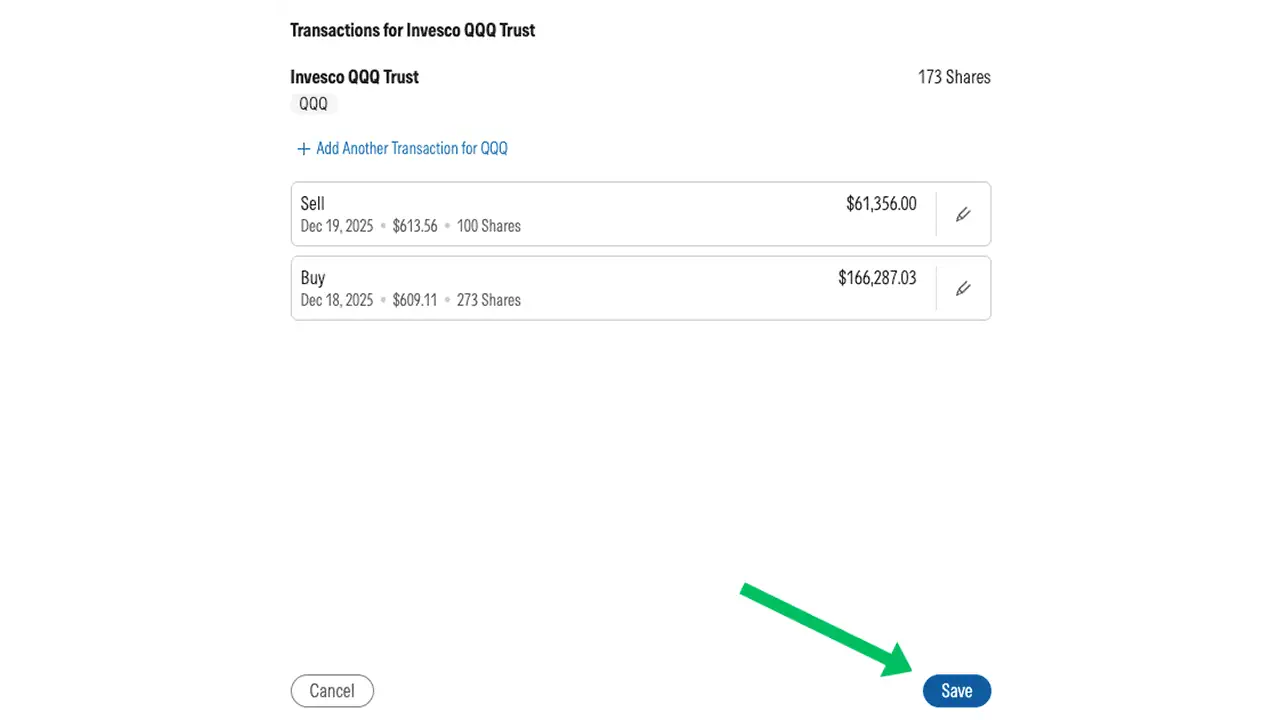

From here, click on the three-dot menu next to any position and click “Manage Transaction.” In this example, I’ll edit our QQQ position.

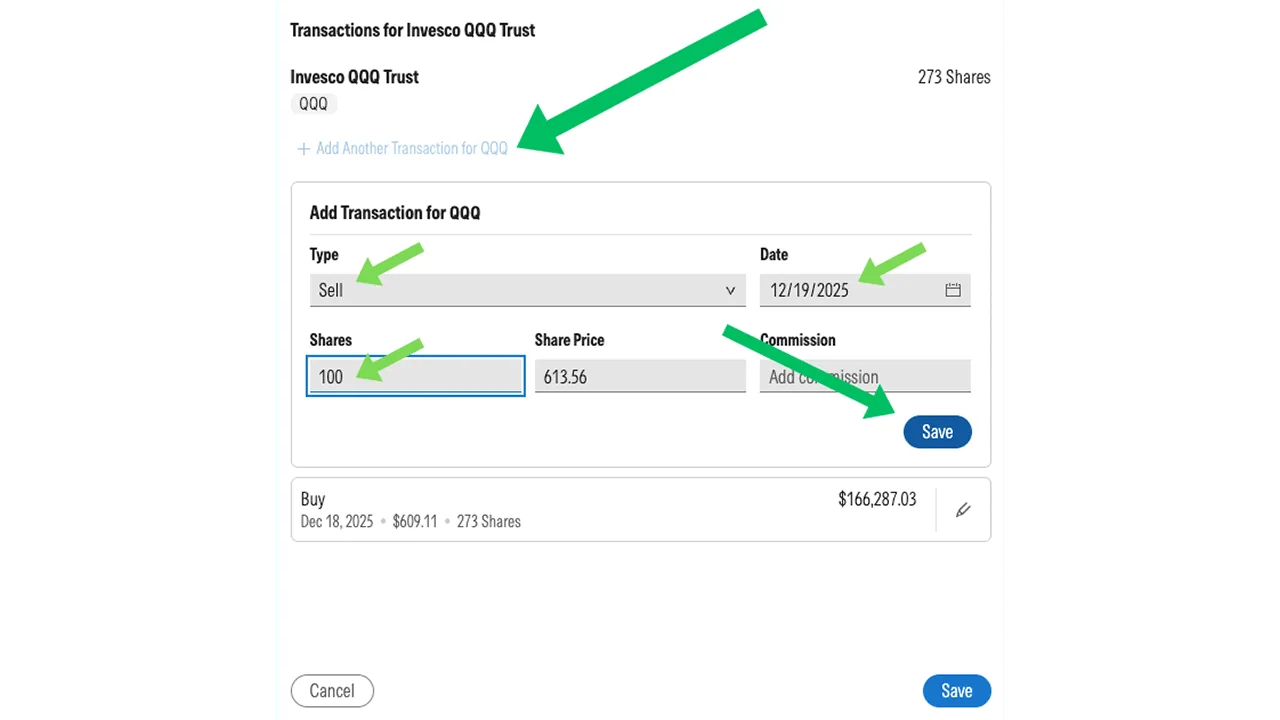

In the window that appears, click “Add Another Transaction.” Then we’ll fill in the information to sell 100 shares of QQQ. The share price should automatically fill for you.

Click “Save.”

Then click “Save” again.

Here, then, you’ll see the final effect of that trade. The stock position has been reduced, but ultimately, we’re just at a 77/23 split. Not to mention, the Portfolio Total is much less than how much we actually want to have invested.

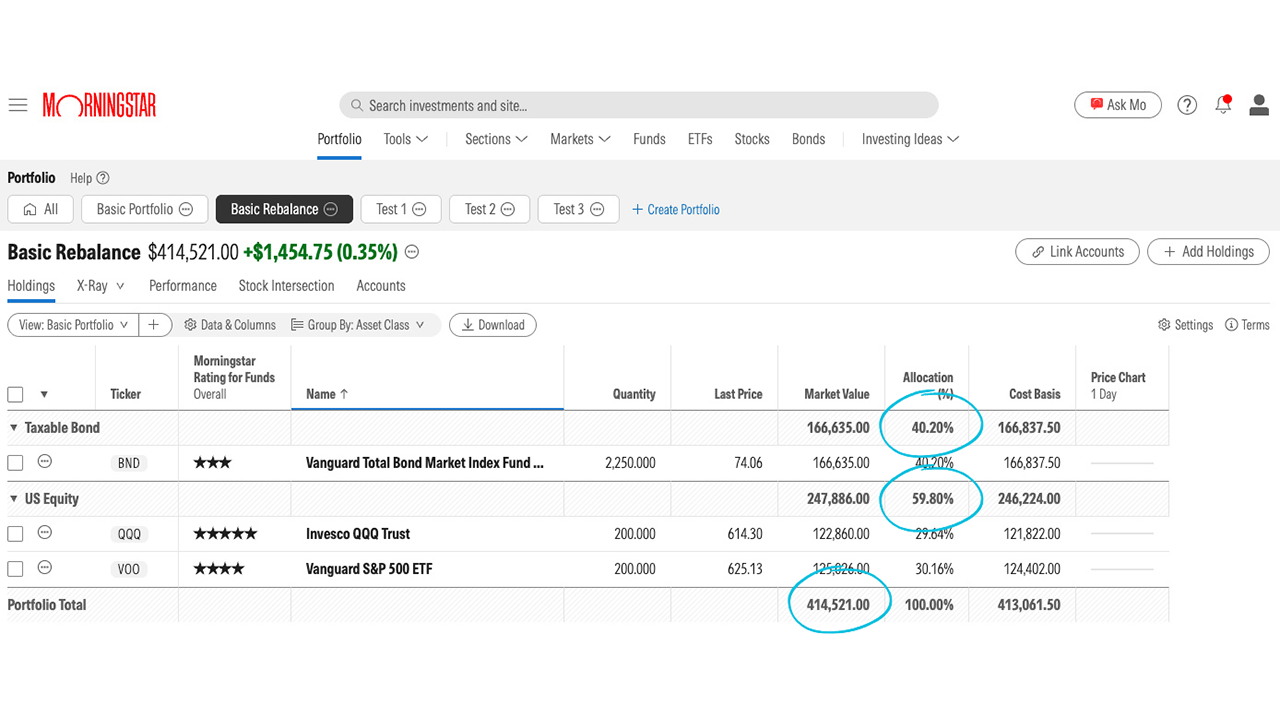

However, once we sell a lot more of QQQ and VOO, and buy more BND …

We come to a final allocation that’s extremely close to the 60/40 blend of stocks and bonds we want, and a final balance that’s also very close to our original balance.

Once we’ve figured out the appropriate trades, we can go into our brokerage accounts to do the actual buying and selling … and our rebalancing is complete!

I’ll also point out that this only scratches the surface of how Morningstar Investor can help you manage your portfolio. The X-Ray tool can do a lot more than help you determine your stock/bond mix—it can analyze your portfolio’s diversification as it pertains to market capitalizations, sector, geography, and more. Not to mention, it comes with a boatload of other research tools, including the fund screeners and research I use both for my own portfolio and my Young and the Invested articles.

In fact, because I’ve been so vocal about Morningstar over the years, they’re currently offering our readers a free seven-day trial and a discounted subscription rate on Morningstar Investor when you sign up using our exclusive link.

- Morningstar Investor offers expert research, investing analysis, and advisor-grade portfolio management tools that are tailor-made for buy-and-hold investors.

- Morningstar is one of the most prized sources of mutual fund and exchange-traded fund (ETF) data in the world.

- How does your portfolio stack up? Put it through Morningstar's Portfolio X-Ray, which will provide insights such as whether you have too many overlapping holdings or whether you're paying too much in fees.

- Special Offer 1: Click our sign-up link to receive $50 off your first year of Morningstar Investor. (Annual plan only.)

- Special Offer 2: Students receive one year of Morningstar Investor access for just $25!

- Special Offer 3: Teachers receive a 60% discount on Morningstar Investor access.

- Top-flight fund research and analysis

- Portfolio management tool

- Powerful screener

- Watchlists

- Tailored news and commentary

- Below-average charting

- High monthly billing rate

When Should You Rebalance?

The rebalancing process is easy, but it can be emotionally challenging. Investors are often hesitant to sell assets that have performed well, or to increase exposure to areas of the portfolio that have lagged.

That’s why it’s best to rebalance your portfolio systematically. It helps you fight your own subjectivity so you can simply press forward with the task.

Here are the two most commonly used approaches to portfolio rebalancing:

- Calendar-based rebalancing: This approach involves reviewing and adjusting the portfolio at predetermined intervals, such as annually, semiannually, or quarterly. Calendar-based rebalancing emphasizes consistency and simplicity, reducing the likelihood of emotionally driven decisions tied to short-term market movements.

- Deviation-based rebalancing: Under this approach, rebalancing occurs only when an asset class deviates beyond a defined threshold from its target allocation. For example, if you have a 50/50 portfolio, you might rebalance when the blend deviates by 5 percentage points (45/55) or 10 percentage points (40/60). Deviation-based rebalancing is more responsive to market movements and focuses on managing risk, but it can be more emotionally difficult to implement.

Related: How Much Money Do You Need to Work With a Financial Advisor?

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

Taxes Matter, Too

Tax considerations are also an important part of the rebalancing process, particularly in taxable brokerage accounts.

Rebalancing typically involves selling, and appreciated assets may trigger capital gains taxes, which reduce your net returns. In some cases, you might rebalance more tax-efficiently by directing new contributions toward underweighted asset classes, or by making some adjustments within tax-advantaged accounts where tax consequences are less immediate.

Make Young and the Invested your preferred news source on Google

Simply go to your preferences page and select the ✓ box for Young and the Invested. Once you’ve made this update, you’ll see Young and the Invested show up more often in Google’s “Top Stories” feed, as well as in a dedicated “From Your Sources” section on Google’s search results page.

Featured Financial Products

Don’t Want to Deal With Portfolio Rebalancing?

Again, rebalancing is a fairly easy process that you only have to tackle a few times a year (at most), and it doesn’t take much time.

But if you’re not confident in your ability to rebalance properly, or you simply don’t want to deal with the hassle, chances are you also won’t want to handle many of the other tasks that come with managing your brokerage and/or retirement accounts.

That’s OK—many people prefer to let a professional financial advisor take the wheel instead. If you’re looking for a more hands-off way to manage your savings (as well as someone who can handle other issues such as retirement, estate, and tax planning), check out the box below.

Want to talk more about your financial goals or concerns? Our services include comprehensive financial planning, investment management, estate planning, taxes, and more! Schedule a call with Riley to discuss what you need, and what we can do for you.

15 Best Long-Term Stocks to Buy and Hold Forever

As even novice investors probably know, funds—whether they’re mutual funds or exchange-traded funds (ETFs)—are the simplest and easiest ways to invest in the stock market. But the best long-term stocks also offer many investors a way to stay “invested” intellectually—by following companies they believe in. They also provide investors with the potential for outperformance.

So if you’re looking for a starting point for your own portfolio, look no further. Check out our list of the best long-term stocks for buy-and-hold investors.

7 Best Vanguard Dividend Funds for 2026 [Low-Cost Income]

What’s better than a smart, sound dividend income strategy? How about a smart, sound dividend income strategy with very little money coming out of your pocket?

If that sounds good to you, you need look no farther than low-cost pioneer Vanguard, which offers up a number of payout-oriented products. Find out what you need to know in our list of seven top-notch Vanguard dividend funds.

Please Don’t Forget to Like, Follow and Comment

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Subscribe to Retire With Riley, our free weekly retirement planning newsletter, and

3. Give the article a Thumbs Up on the top-left side of the screen.

4. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!