Being a successful stock picker isn’t impossible, but it sure ain’t easy.

Professional stock picking and portfolio management are like many other professions: You don’t pick it up in a day. It takes years of education, practice, and experience to become competent at it—and even after all that, you still need to put in the time to keep your skills sharp.

Only a handful of people have the time, aptitude, and interest to become skilled and utterly independent stock pickers. But most of us simply don’t—we either need a helping hand, or a lot more. And that’s why many investors gravitate toward the likes of Seeking Alpha and The Motley Fool.

Seeking Alpha and The Motley Fool are two of the best-known investing resources you’ll come across. They offer a wealth of information for free—but at their hearts are powerful paid subscription products that scores of investors rely on when building their portfolios.

And if you’re here spending a little time with me, that means you’re wondering which of the two services makes the most sense for you.

Today, I’ll pit The Motley Fool vs. Seeking Alpha. I’ll explain what each company’s core services provide to investors, how much they cost, where they fall short—and most importantly, who can get the most out of them. You see, all of the services I’m about to discuss are rated extremely well in my book, but you won’t maximize their value unless you pick the best fit for you.

Table of Contents

What Is Seeking Alpha?

Seeking Alpha is a crowdsourced platform for investors, by investors. Rather than just reading opinions from “sell-side” analysts, the Seeking Alpha website provides access to a variety of views from thousands of professional and amateur contributors alike. It also contains a wealth of other vital information for investors, including fundamental data, stock screeners, breaking news, corporate conference call transcripts, and more.

Seeking Alpha does have a free Basic tier that simply requires an email registration. With that, you get a few perks—the ability to look up stock prices and Seeking Alpha charts, email alerts for stocks, Wall Street equity ratings, and even limited access to some of SA’s contributor content.

I’ve used the free side of Seeking Alpha several times, and if you have no money, it’s better than nothing. But to get the most of Seeking Alpha, you need to dive into one of its core paid plans: Seeking Alpha Premium and Seeking Alpha Pro.

- Seeking Alpha Premium is an economically priced plan that offers just about everything that intermediate and advanced investors could want, whether they prefer to do their own research or receive stock recommendations. If you navigate across our site, you’ll see that Seeking Alpha Premium is among our top choices in several investing service categories.

- Seeking Alpha Pro is a costlier and higher-end product, primarily geared toward advanced investors, that includes everything within Premium, as well as exclusive content and trading ideas.

Let’s dive further into what you get with these two foundational Seeking Alpha plans:

What Comes With a Seeking Alpha Paid Plan?

Here’s what you get from each of Seeking Alpha’s two core plans: Premium and Pro.

Seeking Alpha Premium

Seeking Alpha Premium naturally comes with all the features of the Basic plan, while unlocking all Premium content and adding in a host of other benefits.

With a subscription to Seeking Alpha Premium, you can expect the following:

- Unlimited access to Premium content

- Recordings and transcripts of earnings and other event conference calls

- Financial statements (with multiple views) going back up to 10 years

- Performance tracking

- Alerts about upgrades and downgrades on stocks in your portfolio

- Premium investing ideas

- And more

- Stock Quant Ratings

- Compare a stock’s value, growth, profitability, and more to its peers

- Seeking Alpha Author Ratings

- See what SA contributors think about potential stock picks

- Factor Scorecards for stocks, real estate investment trusts (REITs), and ETFs

- Enjoy easy-to-understand grades (A+ through F) detailing value, profitability, growth, momentum, and EPS (earnings per share) revisions.

- I’ve worked with a number of data providers that only provide net income and EPS figures for REITs, and those figures don’t tell the whole profitability story for real estate stocks. But Seeking Alpha provides data and ratings for funds from operations (FFO) and adjusted funds from operations (AFFO), which are much more appropriate metrics.

- Exclusive stock and ETF Dividend Grades

- Dividend Growth Grade

- Dividend Safety Grade

- Dividend Yield Grade

- Dividend Consistency Grade

- Seeking Alpha author and article performance

- See which authors tend to make the most accurate predictions

- Ad-light experience

- Personalized alerts

- Synchronize with brokerage accounts (Basic members have to manually enter individual stocks to track)

- View holdings across several brokerages to track your total account value and gain useful insights

A Seeking Alpha Premium account has much deeper research capabilities than a Basic account. For instance, Basic members might be able to read the same article as a Premium member—but they might not be able to see how the author rated the stock, nor could they see how dependable the author really is. (Also, that same article will become unavailable after 10 days if you’re a Basic member, whereas Premium members can continue to view them.)

Moreover, if you want to use Seeking Alpha for stock recommendation purposes, you have to go with Seeking Alpha Premium, which includes ratings and grades.

Seeking Alpha Pro

Seeking Alpha Pro doesn’t just give you more—it also helps you sort through the best of what’s already there. So it includes not only Seeking Alpha Premium features, but also:

- Exclusive access to Top Ideas

- Top Ideas are “high-conviction” theses by some of Seeking Alpha’s top in-house experts

- 4-6 hand-picked investing ideas delivered daily

- Exclusive email alerts, newsletters, and interviews

- Seeking Alpha Pro Idea screener to save you time

- Search by industry, theme, company size, investment style, country, and more

- Top-shelf customer service

- Exclusive access to short-selling ideas

- Ad-free experience

Seeking Alpha Pro is a powerful subscription product—one ideal for active, high-net-worth (HNW) investors. If you’re a more casual investor, Seeking Alpha Premium is likely the better fit for you. That’s especially evident when it comes to the cost.

How Much Do Seeking Alpha’s Paid Plans Cost?

As mentioned before, Seeking Alpha has a free Basic plan that gives you limited access to their resources—all you need to do is register with an email address.

- For Seeking Alpha Premium, you’ll get a 7-day free trial, then a discounted first-year rate of $269, then $299 per year thereafter.

- For Seeking Alpha Pro, you can get one month for $99, then $2,400 per year thereafter.

Again, most investors can get more than enough bang out of their buck with Seeking Alpha Premium. However, if you’re looking to put more time in the markets and become a more active investor, consider a Seeking Alpha Pro account.

- Seeking Alpha Premium and Pro help you find profitable investing ideas, improve your portfolio, research stocks better and faster as well as track the news to find investing opportunities.

- Receive up to 15 investing newsletters filled with stock research and analysis, commentary and recommendations.

- Get access to the world's largest investing community.

- Use Seeking Alpha Premium's Seeking Alpha Stock Ratings to find stocks likely to outperform and make you money.

- Seeking Alpha Premium's proprietary quant records have an impressive track record leading to massive market outperformance.

- Special offer on Premium: New subscribers through our link receive a $30 discount off the price of Seeking Alpha Premium in their first year.*

- Special offer on Pro: New subscribers through our link receive one month of Pro for $99.**

- Active community of engaged investors and analysts

- Stock screeners, quantitative tools for stock analysis

- Strong track record of market outperformance on stock ratings

- Minimal mutual fund coverage

Related: Seeking Alpha Premium + Pro Review

What Is The Motley Fool?

The Motley Fool has helped millions of investors outperform the stock market with a variety of investment recommendation services.

The Motley Fool has a long and sterling history within the investment recommendations community. It started out as an investment newsletter in 1993, and a year later, the founders brokered an online content deal with AOL, where The Fool’s content lived until moving to its own site in 1997.

The company has since gained acclaim through Fool.com, its Motley Fool stock picking services (which include Motley Fool’s Stock Advisor and Motley Fool’s Rule Breakers), and even its CAPS Community—a popular message board where people go to share investment ideas.

What Is Motley Fool Stock Advisor?

Motley Fool Stock Advisor, started in 2002, is the company’s flagship stock picking service. It does the grunt work of researching stocks for you. The service’s advisors usually lean on well-known, not-too-volatile companies that they believe can beat the stock market. Each pick has a long term bent, with an expected holding period of at least five years.

The Motley Fool Stock Advisor service provides monthly stock picks from two investing teams: Team Everlasting and Team Rule Breakers. Per Motley Fool, Team Everlasting looks for:

- “High-quality companies that have the sustained potential to keep growing and beat the overall market over extremely long periods”

- “Founder-led companies”

- “Companies employing a strong corporate culture”

- “Businesses that have built a strong enough bond with their customers that they command substantial pricing power and have identifiable proprietary advantages”

- “Cash-rich, low-debt companies”

And Team Rule Breakers looks for:

- “First-mover companies in emerging, but important industries that have become the top dogs in their niches”

- “Companies with sustainable competitive advantages”

- “Sizable past increases in share prices”

- “Companies with good management teams”

- “Businesses with strong consumer appeal that have built up brand awareness”

- “Stocks that are grossly overvalued according to mainstream financial media sources”

What Comes With a Motley Fool Stock Advisor Subscription?

The Motley Fool’s Stock Advisor service offers much more than stock picks—it also provides community and investment resources. The whole package includes:

- “Starter Stocks” recommendations to serve as a foundation to your portfolio for new and experienced investors

- Two new stock picks each month

- 10 “Best Buys Now” chosen from over 300 stocks the service watches

- Investing resources, including the stock picking service’s library of stock recommendations

- Access to a community of investors engaged in outperforming the market and talking shop

How Much Does Motley Fool Stock Advisor Cost?

The Stock Advisor stock picking service offers discounted introductory rates to new users. That discount has varied over time, but typically, it’s substantially lower than what current members paid when they renewed their membership.

Currently, Stock Advisor’s discounted new-member rate is $99 per year. That shifts to $199 annually after the first year.

Also worth noting: All annual Motley Fool Stock Advisor subscriptions come with a full membership-fee-back guarantee.

- Motley Fool Stock Advisor is a stock service that provides recommendations for both "steady Eddie" and high-flying stocks, as well as a few ETFs for investors who want diversified holdings, too.

- Just getting started? Stock Advisor provides 10 "Foundational Stocks" you can use to anchor your portfolio.

- You're not alone! Stock Advisor membership also gives you access to a community of investors who also want to outperform the market and love talking shop.

- Limited-Time Offer: Get your first year with Stock Advisor for $99 (vs. $199 usual value) with code "FOOLISH"—a 50% discount for new members!

- Discounted introductory price

- Strong outperformance compared to the S&P 500

- High overall average return for stock picks

- High renewal price

- Not every stock is a winner

Related: Motley Fool Review: Is Stock Advisor Worth It? [Our Take]

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

What Is Motley Fool Rule Breakers?

Remember “Team Rule Breakers” mentioned above? Well, Motley Fool Rule Breakers only draws from that team’s recommendations, preferring stocks that have massive growth potential. In some cases, these companies are at the forefront of emerging industries—in others, they’re disrupting the status quo in long-established industries.

This stock subscription service doesn’t fixate on what’s currently popular, but instead always looks for the next big stock ahead. That means these Motley Fool picks have the potential to be nauseatingly volatile … but also the potential to rocket higher exponentially.

For example, Rule Breakers delivered several stock picks that tapped the power of e-commerce long before many other outlets did. Nowadays, Rule Breakers’ emerging industries of focus include the likes of artificial intelligence (AI) and robotics.

What Comes With a Motley Fool Rule Breakers Subscription?

Like with Stock Advisor, a Motley Fool Rule Breakers subscription does include stock picks—but also other important resources. All told, you can expect:

- A list of Starter Stocks—including their “essential Rule Breakers”—to begin your investing journey

- Top-10 rankings of timely buys from the entire Rule Breakers portfolio

- Two new stock picks each month

- Investing resources, including the stock picking service’s library of stock recommendations

- Access to a community of investors engaged in outperforming the market and talking shop

How Much Does Motley Fool Rule Breakers Cost?

Similarly to Stock Advisor, Rule Breakers offers a discounted introductory rate to new users.

Currently, you can subscribe to Rule Breakers for $99 for the first year. After that, you’ll renew at the regular $299 annual rate.

And all annual Rule Breakers subscriptions come with a 30-day full membership-fee-back guarantee.

- Motley Fool Rule Breakers, which is now an exclusive part of Motley Fool Epic, puts investors in the heart of innovation, focusing on growth recommendations centered around emerging industries.

- The Motley Fool has discontinued the standalone Rule Breakers service. Now, you can access Rule Breakers as part of Motley Fool's Epic subscription, which also includes Stock Advisor, Hidden Gems, Dividend Investor.

- Through Epic, you will also enjoy access to the Fool IQ+ research and data platform, the GamePlan+ financial planning platform, and the Epic Opportunities podcast.

- Limited-Time Offer: Get your first year with the Epic for $299 (vs. $499 usual value)—a 40% discount for new members!—by clicking our link and using the EPICSALE coupon code.*

- Discounted introductory price

- Strong outperformance compared to the S&P 500

- High overall average return for stock picks

- Diversified array of recommendations for investors targeting growth, income, or both

- Additional value from GamePlan+ financial planning content and tools

- High-growth stocks carry volatility

- High renewal price

- Not every stock has positive returns

Related: Motley Fool Rule Breakers Review [Picking Growth Stocks]

How Have Seeking Alpha’s Stock Picks Performed?

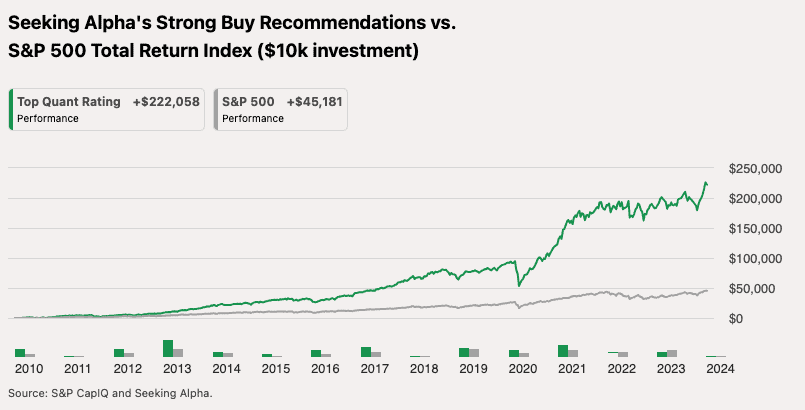

Seeking Alpha’s Premium and Pro services lean much more toward research than stock recommendations. However, Strong Buy picks from its quant ratings—which factor in value, growth, momentum, profitability, and EPS revisions—have greatly outperformed the market over time.

According to Seeking Alpha, $10,000 invested in Top Quant Rating stocks at the start of 2010 would have grown to $222,058 by early January—roughly five times better than the $45,181 sum that would’ve resulted from the S&P 500’s performance.

All told, that comes to an average annualized return of more than 25%!

How Have The Motley Fool Stock Advisor Stock Ideas Performed?

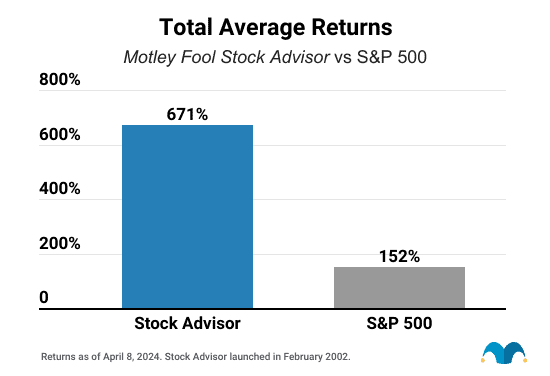

According to Motley Fool, 175 Motley Fool Stock Advisor stock recommendations have historically delivered 100%-plus returns. And since inception in February 2002, the service has returned 671% through April 8, 2024, when you calculate the average return of all its stock recommendations over the past 22 years.

Comparatively, the S&P 500 only had a 152% return during that same timeframe.

Examples of Stock Advisor recommendations include Disney (DIS, +6,123%), Amazon (AMZN, +23,539%), and Netflix (+30,073%). (All returns are from their original recommendation through April 8, 2024.)

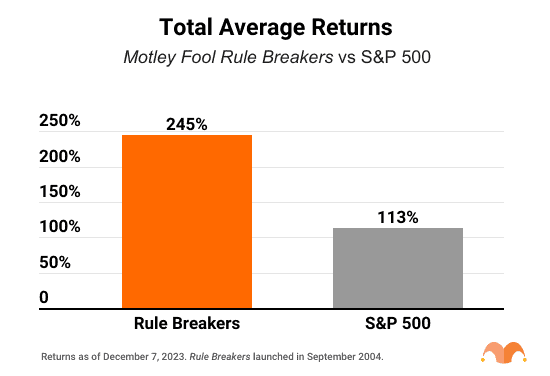

How Have The Motley Fool Rule Breakers Stock Recommendations Performed?

Rule Breakers, since the product’s inception in 2004, has delivered a 245% return through Dec. 7, 2023, more than doubling the S&P 500’s performance since then—and beating many leading money managers on Wall Street. And impressively, 141 of their recommendations have gone on to at least double in value.

Examples of Rule Breakers picks that have taken off include Shopify (SHOP, +3,317%), MercadoLibre (MELI, +10,517%), and Tesla (TSLA, +11,273%). (All returns are from their original recommendation through Dec. 7, 2023.)

And one note about the data for all of these subscription products: Past performance doesn’t guarantee future gains. While Motley Fool and Seeking Alpha both have laudable track records, relying on these or any other stock advisory services ultimately involves some level of risk.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

Is Seeking Alpha Worth the Money?

A Seeking Alpha Premium subscription is absolutely worth the money as long as you have even a modest nest egg to invest.

What do I mean? Well, let’s say you have just $500 to invest. If Seeking Alpha costs $269 a year* ($299 a year thereafter), nearly half your investment funds are going to what I’d call “research and management” costs. That’s simply too high as a percentage.

But if you’re at least dealing with a few thousand dollars—and especially if you already have more or plan to contribute more in the future—Seeking Alpha offers a compelling value proposition, on multiple fronts.

That’s because Seeking Alpha Premium makes it simple to find, evaluate, and monitor stocks in your portfolio—it can do virtually everything except execute trades, which you’ll need a stock app to do. It also has a leg up on many other data platforms in that it includes more REIT-specific data, and you can even evaluate ETF fundamentals through the platform.

But if you’d prefer to just lean on stock recommendations, you can always just screen for Seeking Alpha’s Strong Buy quant picks and rely on them instead. It’s not quite the same as a traditional stock picking service—where one advisor or advisor team explains in narrative form why they’re recommending certain stocks—but Seeking Alpha’s picks still have an admirable track record.

I think intermediate and advanced traders can get the most out of Seeking Alpha’s Premium tools. While Seeking Alpha’s Pro benefits are alluring, most everyday investors can’t foot that bill—it’s only worth it if you have tens if not hundreds of thousands of dollars to invest with and want to take a very active role in your portfolio management.

Is The Motley Fool Legitimate?

In a word: Yes. The Motley Fool is a legitimate business, and both Stock Advisor and Rule Breakers are successful, long-running investment services boasting scores of satisfied subscribers.

In fact, I can tell you a little about Stock Advisor firsthand.

In grad school, I turned roughly $10,000 worth of contributions into $25,000 by investing in stocks either recommended by Stock Advisor, or that I learned about through the Motley Fool’s CAPS Community discussion board—one of the benefits of subscribing to one of the Fool’s services.

I followed the stocks regularly, and I always looked forward to reading the stock analysis for each recommendation. The Fool’s analysts laid out a compelling buy case—and clearly, the market agreed.

Simply subscribing to The Motley Fool kept me more interested in the financial markets more broadly. Even that aspect helped turn me into a more educated, informed investor.

Just note that The Motley Fool’s Stock Advisor and Rule Breakers services are fundamentally different from what you’re getting with Seeking Alpha Premium + Pro. Which brings us to our conclusion …

Which Service Should You Consider for Picking Investments in the Stock Market?

Seeking Alpha and The Motley Fool are both highly respected, trustworthy stock subscription services. And they both offer an abundance of resources to help you choose the best individual stocks to invest in.

Fortunately, they’re also fundamentally different products—making a decision pitting The Motley Fool vs. Seeking Alpha a lot easier than you’d think.

Seeking Alpha Premium and Pro are more geared toward discovering stock ideas on your own and conducting your own due diligence through robust stock research and analysis. While you can use its rankings and grades like recommendations, there’s no single analyst or analyst team providing the theses for these stocks—you’re provided with quantitative grades, and you can read research about these stocks from the Seeking Alpha contributor community. That research, by the way, can include not just bull cases, but bear cases, too, which can be a valuable perspective to have when you’re trying to figure out what kind of risks you’re taking on.

The Motley Fool’s Stock Advisor and Rule Breakers, on the other hand, are recommendation-focused. You are paying primarily for stock picks, which include detailed analyses of the companies that are mentioned. While you do have access to some outside commentary—via The Motley Fool’s CAPS Community—it’s not quite as extensive as the Seeking Alpha network. And most importantly, you’re not buying tools that can help you discover opportunities or conduct research on stocks outside of the Fool’s recommendations.

In a nutshell, Seeking Alpha is a better fit for more self-starting intermediate and advanced investors who want to explore the investment universe and find their own opportunities. The Motley Fool, on the other hand, is better for beginning to intermediate investors who simply want to learn about stocks with market-beating potential so they can put them to use in their own portfolios.

Seeking Alpha offers a true 7-day free trial, whereas you have to pay for The Motley Fool up front but get a 30-day membership-fee-back window to request a refund. Still, both offer a way to sample what each service has to offer before fully committing your money.

Whichever side you choose, though, rest well knowing you’re receiving an honest-to-goodness value.

Related: