Retirees often view their golden years as a golden opportunity to travel.

Senior citizens typically have both the time and money to see the sights they’ve dreamed of for years, even decades. And not only does travel sate one’s wanderlust—it can be a great source of exercise, it’s an amazing way to connect with others, it can reduce stress, and studies suggest it can even substantially decrease seniors’ risk of death.

But travel can be expensive, and especially so for older adults. Seniors can’t assume they can spend as little money as it took to backpack through Asia after college, when you slept in hostels, had zero health issues, and didn’t have a house to think about.

Today, I’ll share with you some of the ways travel can be more expensive for senior citizens compared to younger people. Understanding these costs ahead of time can help you properly budget for trips, so you don’t end up overextending yourself financially. On top of that, I’ll also provide a few easy ways that seniors can lower their travel expenses.

Featured Financial Products

Table of Contents

Why Travel Is More Expensive for Seniors

Recently retired (or semi-retired) and ready to up your travel game? That’s great! But you should know that it might be more expensive than you think.

A 2023 study by InsureMyTrip found that Baby Boomers spend more on vacations than other age groups:

— Baby Boomers: $6,126

— Gen X: $5,060

— Millennials: $4,141

— Gen Z: $2,788

But why do older adults spend more on travel?

Well, for one … because they can. Retired adults are famously flush with time, so much so that many people actually look toward retirement as a time in their lives when they’ll truly be free to travel.

Also, senior citizens tend to prioritize comfort over cost, and even the way that many seniors plan a trip and set up reservations is more expensive than how today’s youth does it.

It’s not always a matter of choice, either—there are some costs, such as travel insurance, that increase as you age.

Now, let’s dive a little deeper into the many reasons a senior citizen’s trip might end up costing more than it would for someone younger.

1. Travel Insurance

Travel insurance can cover a wide variety of expenses. It can cover medical costs that your regular health insurance won’t handle. And it usually also provides compensation for canceled prepaid, nonrefundable trip costs (for acceptable reasons), lost bags, and extensive travel delays.

The cost of travel insurance can vary by destination. But largely because of the medical aspect, travel insurance tends to cost more for older adults. A 2024 USA TODAY report showed that younger adults pay an average of 5% to 6% of the cost of their trip on travel insurance. That number not only gets larger as you age, but it accelerates more rapidly the older you get. For 50-year-olds, the average percent of trip expense is 6%; that’s 8% for 60-year-olds, 11% for 70-year-olds, and a whopping 18% for 80-year-olds.

Here’s an example. Jaclyn (30 years old) goes on a trip with her mother (55) and grandmother (80). Each plans on spending roughly $5,000 on the trip. Jaclyn likely will spend $250 to insure the trip, her mother will spend $350, and her grandmother will spend $900.

This assumes everyone buys insurance independently. However, for group trips, you might be able to insure the entire group on a single travel insurance policy.

If you haven’t traveled in a couple of decades, assume your cost of insurance has gone up and budget accordingly.

Related: 15 Alarming Gen X Retirement Statistics

2. House Sitting

If you own an apartment and go away for a week, you typically don’t need someone to come over and house sit unless you have a pet (or plants that require a lot of care).

But if you own a home, that’s a different story.

It’s wise to hire a house sitter for any long trips. A house sitter can leave a car in the driveway, collect your mail, and make your home seem active to deter criminals. This person can ensure your pipes don’t freeze in the winter and that no other types of damage go unaddressed. And, of course, they can take care of your pets and/or plants.

That brings us to senior citizens, who are much more often homeowners than not. According to the U.S. Census Bureau’s 2924 Current Population Survey/Housing Vacancy Survey, 79% of Americans age 65 or older are homeowners.

In other words, senior citizens are more likely than most to need to pay for house sitting, driving up their vacation costs.

Related: 9 Financial Mistakes That Can Quickly Drain Your Retirement Savings

3. Better/Special Hotel Accommodations

In your 20s, you might be perfectly content sleeping in a room with a bunch of strangers … on a bunk bed … at a hostel. But the older you become, the less appealing some cost-effective options seem. Older adults tend to prefer hotels with more amenities, and those with certain disabilities might need special accommodations.

According to a 2023 AARP survey, adults with disabilities account for 14% of older travelers, and 78% of that cohort needs accommodations for mobility impairments. Despite physical limitations, the survey showed these travelers intend to travel as much in 2024 as people without impairments.

In the U.S., an accessible hotel room typically won’t cost more than a standard room. But accessible accommodations are limited in many parts of the world, accessible accommodations are limited, so people with disabilities often need to book a room far in advance—which can often result in a higher cost than if you booked closer to the travel date.

Even without a disability, older adults might want nicer rooms than they required in their younger years. Hilton’s 2024 Trends Report says that “regardless of generation, the No. 1 reason people want to travel in 2024 is to rest and recharge.” But that’s most prominent in Baby Boomers (67%) and Generation X (68%), and less so in Millennials (60%) and Gen Z (55%).

Older travelers also might also prefer hotels with valet services and other useful—and more costly—features.

Related: How to Invest HSA Funds [Level Up Your Retirement Savings]

4. Use of Travel Agents + Avoiding Online Book Platforms

How you book travel affects the overall cost, too.

More than 2 in 5 Baby Boomers (44%) say they value using a travel agent, according to a 2024 McKinsey survey. Comparatively, just 30% of other respondents agreed. Also, Baby Boomers are less comfortable using technology to book travel, with only 36% using mobile apps (vs. 61% for other generations) and just 38% using online booking platforms (vs. 57% for other generations).

That said, while travel agents might justify their paychecks, they do receive a paycheck.

Travel agents have long been paid with commissions by hotels, airlines, and other businesses in the travel chain. But increasingly, travel agents are charging fees—whether that’s to supplement or replace those commissions. A 2023 Travel Weekly survey found that 71% of agents charge fees to clients, including consultation fees, subscription fees, per-trip service fees, and more.

While travel agents can reduce trip-planning stress, they can also make your trip more expensive. Booking travel with online booking platforms can simplify price comparisons, so by avoiding these platforms, senior citizens might not be getting the best deals.

Related: Should I Pay Off My Mortgage Before I Retire?

5. Direct Flights

Airlines tend to charge more for direct flights because they can. Simple as that.

People will pay good money to avoid having to spend even more time in the air, walking from one gate to another to make a connecting flight, waiting around for a connecting flight, and risking something happening to their bags. According to a 2022 Google Flights analysis of historical data, prices for nonstop flights are, on average, 20% higher than flights with layovers.

And most older adults just don’t want to put up with all of that nonsense. Per the aforementioned McKinsey report, less than a quarter (22%) of Baby Boomers expressed willingness to take a more affordable flight if it meant a stopover or inconvenient flying time.

If you are part of that majority of senior citizens who strongly prefer direct flights, be prepared to pay more for that luxury.

Related: 7 Best Self-Employed Retirement Plans [2025]

Featured Financial Products

6. Booking Hotels in Advance

You might think that the earlier you book a hotel, the cheaper it would be—after all, you represent practically guaranteed income to the hotel.

But often, this isn’t the case.

Hotels want to maximize their occupancy rates, so they’re happy to take reservations well in advance … but to make sure they sell any unsold rooms, they’ll often drop their rates just a few days before check-in. According to travel site Kayak, booking domestic hotels at the last minute can save a person up to 58%—and that number jumps to 73% for international hotels!

Travelers that wait run a significant risk that they won’t be able to book ideal accommodations, however, American Express’s 2024 Global Travel Trends Report found that while 77% of Gen Z and Millennials have booked a last-second trip at some point in their life, only 65% of Gen X and 52% of Baby Boomers can say the same. Clearly, older adults are less willing to take on that risk.

But this could also be a generational phenomenon based on both preference and available tools. AmEx’s stat refers to ever having booked a last-minute trip—which means Boomers and Gen Xers were less likely to have done so, even when they were younger. It’s possible that many in this cohort simply never wanted to. But you have to admit that internet travel tools have made last-minute travel more feasible, and Millennials and Gen Z have had access to these tools during their more impulsive years; Boomers and many Gen Xers didn’t.

Anyways, if the idea of waiting to book your hotel until just a few days before you plan on arriving gives you too much anxiety, you should certainly book it earlier. Just understand that you’ll pay more for that peace of mind.

Related: Pensions Aren’t Dead Yet: 15 Jobs With Pensions

7. Targets for Travel Scams

Older adults are often vulnerable to travel scams.

A great example: Fake taxis. In some cities, drivers will wait outside airports and other tourist areas. Most of these will be licensed cabs with credentialed drivers. But some won’t. And if you get in those cabs, once the ride is completed, the person will charge you an insanely high fee that’s much more expensive than an actual city cab or rideshare service would have been.

(By the way: To avoid this scam, always look for taxi rate disclosures and taxi driver credentials, which should be posted somewhere within the taxi. You can even ask the driver to disclose this up front. Also, watch out for shoddy exterior branding and busted meters—these are physical signs of a scam taxi.)

Older adults are more likely to be victims of taxi scams because they are less likely to use rideshare apps. According to Zippia, the older a person, the less likely they are to use rideshare services—more than half of young adults (ages 18 to 29) use these services, but less than a quarter of adults over 50 say they’ve used a rideshare app before.

Also, watch out for pickpockets. They may target older adults, who they believe either won’t notice their stealthiness or seem too frail to give chase.

Everyone should look up today’s popular travel scams before traveling to a large city, but this is particularly true for senior citizens.

Related: Is Your Retirement on Track? Here Are the Average 401(k) Balances By Age

8. Not Using Reward Credit Cards

Vacationers can save a chunk of money using rewards credit cards, whether it’s a generic card with cash-back rewards, or a specific travel credit card, like an airline rewards card that accumulates miles, or a hotel card that racks up points. Not only do these cards help you pay for things like flights and hotel stays, they can also come with additional cost-savings benefits, like free checked bags or Wi-Fi.

Younger generations frequently take advantage of these perks, but older adults are less likely to do so. Here are the percentages of people in various generations that have a card with travel rewards and/or benefits, according to a 2023 Forbes Advisor survey:

— Gen Z: 74%

— Millennials: 72%

— Gen X: 56%

— Baby Boomers: 45%

Related: 10 Best Fidelity Funds to Buy

How Can Seniors Save Money on Travel?

While travel can be more expensive for seniors, there are plenty of ways to keep those costs down.

To start, older adults should always check for senior discounts for train rides, car rentals, hotels, and other travel expenses. Hertz Car Rental, for instance, offers discounts of up to 20% off base rates for adults who are at least 50 years old. Senior discounts are popular within the travel industry, so don’t be shy to ask about them.

You can also save money by traveling during the offseason. Data from travel site Hopper shows that traveling during the cheapest months, rather than peak months, can save people around 30% on airfare. (The peak months depend on the destination, but are usually when school isn’t in session.)

Short trips midweek, rather than over the weekend, can be more economical, too. Choosing midweek departures for domestic flights can save an average of $45 per ticket, or around 15%, Hopper says. Checking into a hotel on a weeknight often saves you 20% to 23%.

More spontaneous retirees can also save a significant amount of money by taking advantage of flash travel deals.

Related: Do I Need a Financial Advisor? 7 Questions to Ask Yourself

Featured Financial Products

Related: 11 Ways To Avoid Paying Taxes on Your Social Security

If you’re looking to minimize the tax bite taken out of your Social Security benefits in retirement, you’ve got several available actions to reduce how much you pay each year. We outline several ways to avoid paying taxes on your Social Security benefits.

Related: How Are Social Security Benefits Taxed?

In many cases, Social Security benefits are subject to federal taxation. To learn how your Social Security benefits are taxed, we’ve got an entire guide to walk you through the calculation.

Related: 10 States That Tax Social Security Benefits

While most states don’t subject Social Security benefits to taxation, at least 10 states do tax Social Security. To see if you live in one of them, or you’re considering a relocation for retirement and taxation of your Social Security is a sticking point, we’ve got you covered with all of the details.

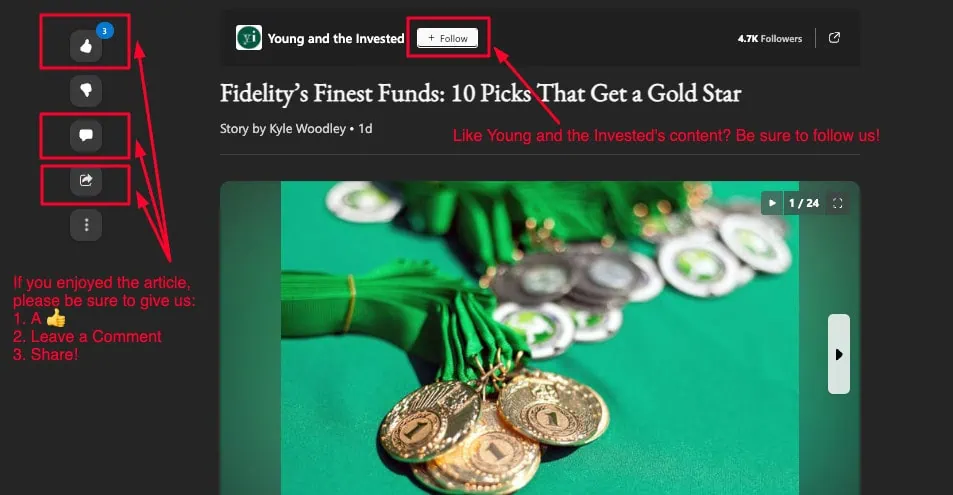

Please Don’t Forget to Like, Follow and Comment

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Subscribe to The Weekend Tea, our weekly newsletter to read more about investing, spending, taxes, and more, and

3. Give the article a Thumbs Up on the top-left side of the screen.

4. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!