Consumer prices grew more slowly than expected last month but still continued a trend of accelerating inflation as tariff costs seep into goods.

The U.S. Bureau of Labor Statistics said Friday that September’s consumer price index (CPI), which measures the change in prices on a variety of consumer goods and services, rose by a seasonally adjusted 0.3% month-over-month—behind consensus expectations for growth of 0.4%, and slower than August’s 0.4% reading.

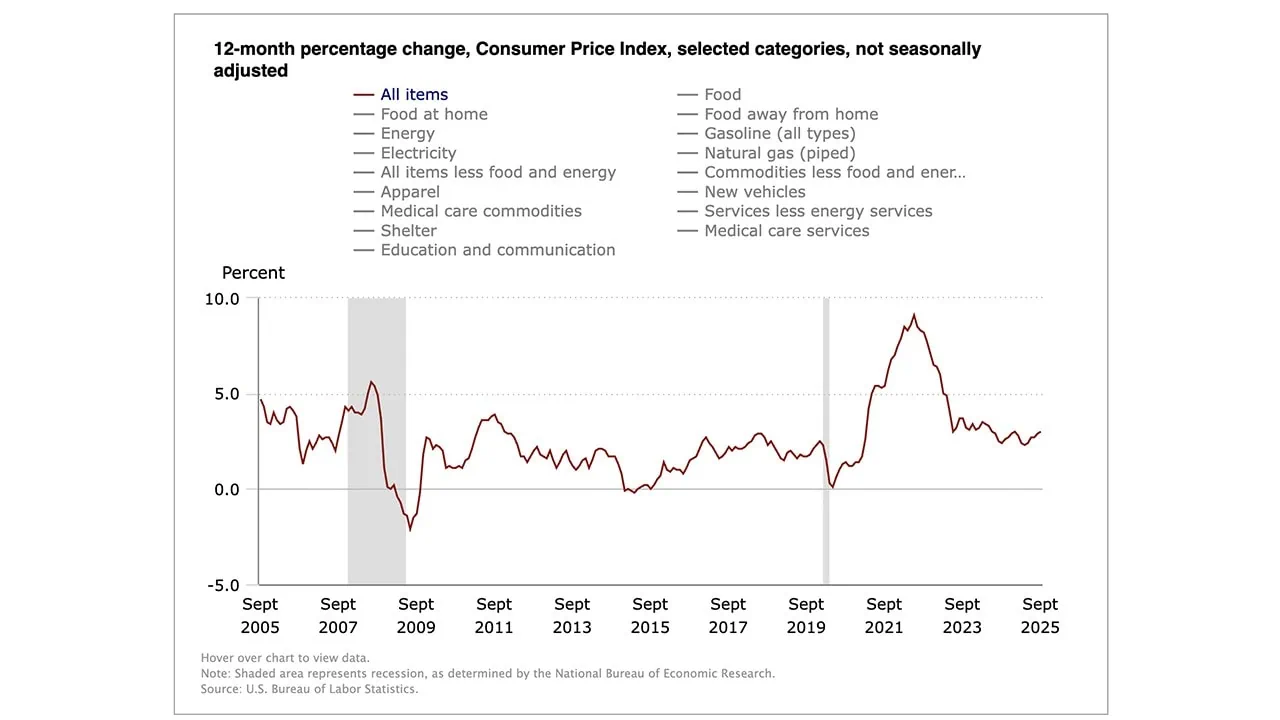

On a year-over-year basis, consumer prices were up 3.0%. While that was behind economists’ expectations for 3.1%, it was still faster than August’s 2.9% and marked an eight-month high.

The CPI report, originally scheduled for release Oct. 15, was delayed due to the U.S. government shutdown. While most other governmental data reports remain in limbo, the CPI report was authorized so the Social Security Administration could calculate cost-of-living adjustments.

“Like an oasis slaking the thirst of a weary desert traveler, today’s CPI number offered investors the first tidbit of information from the barren wasteland of government data that has existed since the shutdown started Oct. 1,” says John Kerschner, Global Head of Securitized Products and Portfolio Manager at Janus Henderson. “Investors were not disappointed. Inflation came in softer than expected, leading to a tepid bond market rally, and ensuring that the Fed will cut rates at next week’s [Federal] Open Market Committee meeting.”

“Core” CPI, which excludes food and energy costs (which are more volatile than the other costs tracked by the Labor Department) came in 0.2% higher, which was slower than both August’s increase and economists’ predictions (both 0.3%). The year-over-year reading of 3.0% was also behind both the consensus and the prior-month’s data.

10 Dividend-Growth Stocks That Wall Street Loves Now

A quick look at September’s key CPI figures:

- MoM CPI: +0.3% (estimate: +0.4%)

- YoY CPI: +3.0% (estimate: +3.1%)

- MoM Core CPI: +0.2% (estimate: +0.3%)

- YoY Core CPI: +3.0% (estimate: +3.1%)

The most noteworthy rise in September’s consumer prices came in energy, which grew 1.5% month-over-month. That was spurred by rapidly rising energy commodity prices (+3.8% MoM), powered primarily by a 4.1% MoM rise in gasoline. decreases in electricity (-0.5% MoM) and natural gas utility prices (-1.2% MoM) helped blunt the energy reading.

Used cars and truck prices declined by 0.4% last month, while medical care commodities edged lower by 0.1% MoM. But several goods prices were still on the rise.

“After several months of subdued readings, goods inflation shows renewed firmness as tariff effects begin to pass through to consumers,” says Gargi Chaudhuri, Chief Investment and Portfolio Strategist, Americas at BlackRock. “Trade-sensitive categories such as household furnishings (+0.4%), apparel (+0.7%), and motor vehicle parts (+0.2%) recorded higher prices.”

Expectations for the Fed

Wall Street remains convinced that the Federal Reserve will cut the target range for its benchmark interest rate at the central bank’s rate-setting meeting next week.

The CME FedWatch Tool, which uses trading in federal-funds futures to determine Wall Street’s expectations for future Federal Reserve actions, now shows an 98.9% chance that the target range for the federal funds rate will be cut by a quarter of a percentage point, to between 3.75% to 4.00%, at the next FOMC meeting, scheduled for Oct. 28-29. That reading is only slightly higher than yesterday’s 98.3% reading.

What Are Required Minimum Distributions (RMDs)

“There was little in today’s benign CPI report to spook the Fed, and we continue to expect further easing at next week’s Fed meeting,” says Lindsay Rosner, head of multi sector fixed income investing at Goldman Sachs Asset Management. “A December rate cut also remains likely with the current data drought providing the Fed with little reason to deviate from the path set out in the dot plot.”

What About BLS Data Accuracy?

This inflation report comes in the wake of August’s sacking of Erika McEntarfer, Commissioner at the Bureau of Labor Statistics. The surprise firing stunned most of the economic community and, combined with the nomination of a partisan replacement (E.J. Antoni of the Heritage Foundation), has many worried about the politicization of American data.

You can look at our August jobs report recap to learn more about the situation at the BLS.

What the Experts Think About September’s CPI Report

Here, we outline more thoughts from the experts on what last month’s CPI numbers mean for consumers, markets, the Federal Reserve’s future actions, and more:

Josh Jamner, Senior Investment Strategy Analyst, ClearBridge Investments

“Today’s soft CPI release locks in a rate cut at the Fed’s meeting next week. While signs of tariff-induced inflation are apparent in select categories such as apparel and furniture, goods prices increased at a slower pace in September than August broadly. This suggests that the pass-through of higher tariffs to consumers has continued to undershoot expectations, which in turn has opened the door for the Fed to lower rates to support a cooling labor market.

3 Best Preferred Stock ETFs to Buy [High Income From ‘Hybrids’]

“Services prices were primarily driven by softer shelter, meaning ‘supercore’ inflation—core services ex-shelter—picked up slightly. This measure accelerated by just 2/100ths of a percent, however, which should be of little concern to Fed officials given even a glass-half-empty interpretation of today’s release is that inflationary trends held steady last month, while a glass-half-full framing is that inflationary trends improved.”

Brad Conger, Chief Investment Officer at Hirtle Callaghan

“We expected a hotter-than-normal reading due to the feed-through of tariffs into consumer prices. The FOMC was also conditioned for an anomalous, temporarily high print. Our base case is for CPI to remain elevated over the next six months as final prices adjust. We believe that the labor market is weakening and housing services remain pressured, such that the underlying trend of dis-inflation will tend to reassert itself gradually.

“We have been long duration all year—mostly in the seven-year tenors—on this premise and feel that the Treasury market has begun to recognize this reality. Recent credit events (Tricolor, First Brands) confirm that corporate credit and especially high-yield spreads are inadequate for the risks.”

David Russell, Global Head of Market Strategy, TradeStation

“Inflation might not be slowing but it’s not surprising to the upside anymore. The details are positive, with shelter and transportation services moderating. Some key parts of the basket are cooling even if tariffs nudge items like apparel higher. This keeps the Fed on track for a cut next week and will likely make policymakers lean more dovish going forward.”

Scott Helfstein, Head of Investment Strategy, Global X

“Markets are fine with 3% inflation, and maybe the Fed should be as well. Concerns about tariffs driving prices higher are still not showing up in most categories. We have a still strong economy with rates coming down. The backdrop remains favorable. Nothing in the inflation print should stop the Fed from cutting rates next week. Yes, prices are higher, but not enough to keep them from helping the economy.”

Jason Pride, Chief of Investment Strategy and Research, Glenmede

“Private datasets helped fill the gap during the delay, but the return of the official CPI report is welcome. Both headline and core CPI came in modestly below expectations, easing some concerns that tariffs were quietly creeping into consumer prices unseen.

“Tariff effects on prices are more of a process than a single event, especially since the duties have been phased in gradually. As companies burn through significant pre-tariff inventories, more costs are likely to trickle down to consumers. That could add roughly 0.5% to 1.0% of one-off inflation on top of the current run rate over the next three to six months.”