Each year, you familiarize yourself with some basic tax provisions that you know you’ll encounter each year when you file your tax return. Which federal tax bracket you’re in is one. Your filing status is another. And don’t forget the most popular tax deduction of them all—your standard deduction.

About 90% of all taxpayers claim the standard deduction on their federal tax return (as opposed to itemizing deductions)—but the standard deduction amounts are changed every year to account for inflation. Therefore, you’ll want to know the standard deduction amounts for the current tax year.

Plus, the standard deduction isn’t the same for everyone. How much you can claim is primarily based on your filing status. However, your age, dependency status, and even your eyesight can also impact your standard deduction amount. So can being the victim of a natural disaster.

But don’t worry about all the various factors … I’ll spell everything out so it’s clear how much lower your taxable income will be when you file your 2024 tax return next year. I’ll also include the 2023 amounts for comparison to see how they looked last year. I’ll even take a peek at what experts expect 2025 amounts to look like.

Table of Contents

How the Standard Deduction Works

When working on your income taxes, the first thing you need to do is calculate your federal adjusted gross income, or AGI. That figure includes all your taxable income, minus any “above-the-line” tax deductions you’re entitled to claim (i.e., deductions taken from your gross income to arrive at your adjusted gross income).

The next step is to subtract either your standard deduction or itemized deductions from your adjusted gross income to arrive at your taxable income. When deciding between the standard deduction and itemized deductions, pick whichever one is higher. (Small business owners and certain other people might also be allowed to deduct up to 20% of their qualified business income.) Once you know your taxable income, calculate the tax due for that dollar amount. If you can claim any tax credits or made previous tax payments, they are subtracted from the tax due.

The higher your standard deduction (or itemized deductions), the lower your taxable income. The lower your taxable income, the lower your tax bill. And if your standard tax deduction is large enough to bring your taxable income down to a lower tax bracket, the impact can be even greater.

We start first with addressing what changes might look like for the 2025 tax year, then look at the 2023 standard deduction amounts and proceed to compare them with the 2024 amounts after.

How Will the Standard Deduction Change for 2025?

Good news: You might see a slight decrease in your federal income taxes next year! Thanks to annual inflation adjustments made each year by the IRS, standard deduction amounts are widely expected to rise—just don’t expect the same big increases taxpayers saw in the past couple of years. Why?

Since standard deduction changes trigger on inflation seen during the year, specifically the chained Consumer Price Index measure from the Bureau of Labor Statistics, standard deduction amounts will change driven by that statistic. And since inflation is slowing down (significantly compared to years past), that means the standard deduction amounts won’t increase as much as they did in 2023 and 2024. According to Bloomberg Tax and Wolters Kluwer, standard deduction amounts and other provisions like tax brackets and more are likely to be adjusted higher by 2.8% for the 2025 tax year. This is the smallest inflation adjustment in at least three years, following a 5.4% increase in 2024 and a 7.1% boost in 2023.

In short: The smaller projected adjustment for 2025 comes amid rapidly cooling inflation, which dropped to a three-year low in August after touching a 40-year high in 2022. Stay tuned for official standard deduction amounts in the coming weeks, but that’s what experts think American taxpayers will see in 2025. Until those figures become official, we’ll take a look at how the standard deduction amounts look for 2023 and 2024.

Standard Deduction For Most People (2023 Tax Year)

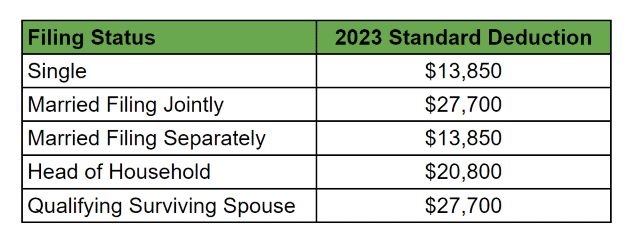

Now that you understand the importance of the standard deduction, let’s take a look at the actual standard deduction amounts for the 2023 tax year. (For most people, tax returns for the 2023 tax year were due April 15, 2024.)

The basic standard deduction, which most people used for their 2023 return, is based on your filing status, as shown in the table above.

Standard Deduction for Dependents (2023 Tax Year)

If you can be claimed as a dependent on someone else’s tax return, your 2023 standard deduction was generally limited to the greater of:

– $1,250

– Your earned income plus $400 (but not more than the applicable basic standard deduction amount)

Like Young and the Invested’s content? Be sure to follow us.

Earned income includes salaries, wages, tips, professional fees, and other compensation for work. It also includes any part of a taxable scholarship or fellowship grant.

Related: 8 Free Tax Filing Options for 2024

Additional Standard Deductions for Age and/or Blindness (2023 Tax Year)

If you’re at least 65 years old or considered legally blind at the end of 2023, you’re entitled to an additional standard deduction for the 2023 tax year in the following dollar amount:

– $1,500 for married couples filing jointly, married taxpayers filing separately, and surviving spouses

– $1,850 for single and head-of-household filers

For married couples who file jointly, both spouses get an additional standard deduction for being at least 65 years old or blind. If you or your spouse is both 65 or older and blind, then the additional deduction for that person is doubled.

Related: When Are Taxes Due? [2023 Tax Deadlines]

If you’re married but filing a separate return, your spouse is eligible for the additional standard deduction on your return only if he or she has no income, isn’t filing a return, and can’t be claimed as a dependent on someone else’s tax return for the tax year. The additional deduction is also doubled for separate filers for either qualifying spouse who is both 65 or older and blind.

Young and the Invested Tip: If you’re not totally blind (i.e., only partially blind) and claim the additional standard deduction for blindness, the IRS requires a statement from an eye doctor certifying that you (1) can’t see better than 20/200 in the better eye with glasses or contact lenses, or (2) your field of vision is 20 degrees or less. The statement should also note if your vision isn’t likely to improve beyond these limits. If your vision can be corrected beyond these limits only by contact lenses that you can wear only briefly because of pain, infection, or ulcers, you can use the standard deduction for blindness if you otherwise qualify.

Related: How to Pick a Tax Preparer (Tips for Finding a Great Tax Pro)

Breakdown of Additional Standard Deduction (2023 Tax Year)

The “additional” standard deduction rules for the elderly and blind are complicated. So, to make it easier to understand, you can use the information below to determine your total 2023 standard deduction amount if you or your spouse was at least 65 years old or blind at the end of 2023.

Related: Do You Have to File Taxes This Year?

The standard deduction amounts are broken down by filing status and include both the “basic” and “additional” standard deductions.

Single Filers

– 65 or Blind = $15,700 standard deduction

– 65 and Blind = $17,550 standard deduction

Like Young and the Invested’s content? Be sure to follow us.

Married Couple Filing a Joint Return

– One Spouse 65 or Blind = $29,200 standard deduction

– One Spouse 65 and Blind = $30,700 standard deduction

– One Spouse 65 or Blind; Other Spouse 65 or Blind = $30,700 standard deduction

– One Spouse 65 and Blind; Other Spouse 65 or Blind = $32,200 standard deduction

– Both Spouses 65 and Blind = $33,700 standard deduction

Like Young and the Invested’s content? Be sure to follow us.

Married Taxpayer Filing a Separate Return

– One Spouse 65 or Blind = $15,350 standard deduction

– One Spouse 65 and Blind = $16,850 standard deduction

– One Spouse 65 or Blind; Other Spouse 65 or Blind = $16,850 standard deduction

– One Spouse 65 and Blind; Other Spouse 65 or Blind = $18,350 standard deduction

– Both Spouses 65 and Blind = $19,850 standard deduction

Head-of-Household Filers

– 65 or Blind = $22,650 standard deduction

– 65 and Blind = $24,500 standard deduction

Want to learn more about investing, spending, taxes, and more? Sign up for Young and the Invested’s free newsletter: The Weekend Tea.

Qualifying Surviving Spouse

– 65 or Blind = $29,200 standard deduction

– 65 and Blind = $30,700 standard deduction

Related: States That Tax Social Security Benefits

Higher Standard Deduction for Qualified Disaster Loss

You can claim a larger standard deduction if you have a net “qualified disaster loss” for the tax year, which is a casualty or theft loss of personal property stemming from:

– A major disaster declared by the president in 2016

– Hurricane Harvey

– Tropical Storm Harvey

– Hurricane Irma

– Hurricane Maria

– The California wildfires in 2017 and January 2018

– A major disaster declared by the president that occurred in 2018 and before Dec. 21, 2019, and continued no later than January 19, 2020 (except those attributable to the California wildfires in January 2018 that received prior relief)

– A major disaster that was declared by the president between Jan. 1, 2020, and Feb. 25, 2021, with an incident period from Dec. 28, 2019, to Dec. 27, 2020 (not including losses attributable to any major disaster declared only by reason of COVID-19)

Like Young and the Invested’s content? Be sure to follow us.

Although these natural disasters all happened in previous tax years, you might not be able to increase your standard deduction until well after the disaster if there’s an insurance claim for reimbursement in the year of the loss. That’s because the loss is not deductible until you know with “reasonable certainty” whether you’ll actually be reimbursed for your loss. If you aren’t sure whether the loss (or even part of the loss) will be reimbursed, then wait until the tax year when you become reasonably certain that it won’t be reimbursed to claim the increased standard deduction.

Related: IRS Erases $1 Billion In Back Tax Penalties

Use Form 4684 to calculate your net qualified disaster loss. However, you don’t report the standard deduction increase with your other standard deduction amounts. Instead, report the loss as “Net Qualified Disaster Loss” on Schedule A (Form 1040). Also report your standard deduction amount as “Standard Deduction Claimed With Qualified Disaster Loss” on Schedule A.

Increase In Basic Standard Deduction for 2023 (And for 2024)

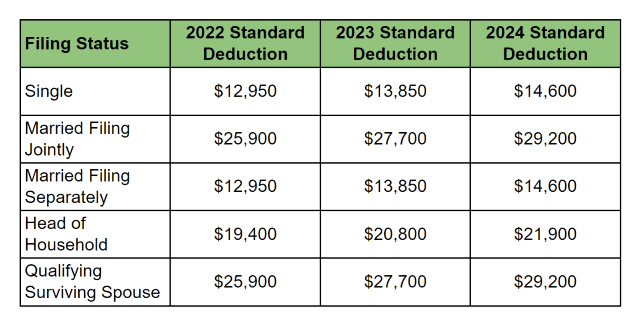

The 2024 basic standard deduction amounts for most people increased by approximately 5.4% when compared to the 2023 amounts (5.3% for head-of-household filers). That rate of increase is higher than what we normally see because the inflation rate is still relatively high.

However, the basic standard deduction jumped a whopping 6.95% from 2022 to 2023 for the majority of people (7.22% for head-of-household filers). That’s because the inflation rate was even higher that year than it was last year.

Young and the Invested Tip: For complete coverage of the 2024 standard deduction amounts, see What’s the Standard Deduction for 2024?

The standard deduction amounts don’t usually rise as swiftly as they have in the past two years, though. That’s because the inflation rate has been unusually high over the past couple of years.

To see and compare the basic standard deduction amounts from 2022 to 2024, check out the table in the image for this slide.

Related: Best Tax Software for 2024

Standard Deduction vs. Itemized Deductions

As I mentioned earlier, when deciding to use the standard deduction or itemize, you can pick whichever one is higher—assuming you’re allowed to take the standard deduction (more on that in a bit).

Related: Federal Tax Brackets and Rates [2023 + 2024]

While wealthier Americans are the ones who typically itemize deductions, ordinary people can also qualify for common itemized deductions that, in total, are greater than their standard deduction. For example, you might want to itemize if you:

– Had large medical expenses that weren’t covered by insurance

– Paid high state and local taxes (up to $10,000)

– Had large uninsured casualty or theft losses

– Made large charitable contributions

– Paid home mortgage interest

The bottom line: If your total itemized deductions exceed your total standard deduction, then you’ll likely want to itemize your deductions.

Your state taxes might also influence your decision. In some states, if you pick the standard deduction for federal income tax purposes, you must also use the state standard deduction on your state income tax return. However, if the overall benefit of itemizing deductions on both returns is greater than the overall benefit of claiming the standard deduction, then you should itemize deductions when filing your federal taxes.

Related: Charitable Tax Deduction: What to Know Before Donating

Who Can’t Claim the Standard Deduction?

You can’t take the standard deduction if:

– You’re married but file separately, and your spouse itemizes deductions on his or her return

– You’re filing a tax return for a short tax year because of a change in your annual accounting period

– You’re a nonresident or dual-status alien during the tax year

A nonresident alien who is married to a U.S. citizen or resident alien at the end of the tax year can choose to be treated as a U.S. resident and, therefore, claim the standard deduction.

If you’re not permitted to take the standard deduction, you can still claim any itemized deduction for which you qualify.

Related: Earned Income Tax Credit: How Much, Eligibility + More

Other Deductions Available If You Claim the Standard Deduction

If you take the standard deduction, you can’t claim any itemized deduction found on Schedule A. So no itemized deduction for medical expenses, state and local taxes, charitable contributions, home mortgage interest, and the like.

However, that doesn’t mean there aren’t other tax deductions you can take. In fact, our federal income tax system offers a long list of additional write-offs to lower your taxes if you choose the standard deduction over itemized deductions. These are commonly referred to as “above-the-line” deductions, since they are taken above the line for adjusted gross income on the federal 1040 form.

While not an exhaustive list, some of the more common above-the-line deductions are those for:

– Classroom expenses for teachers and other educators

– Health savings account (HSA) contributions

– Health insurance for self-employed people

– IRA contributions (although not for Roth IRAs)

– Student loan interest

– Moving expenses for members of the military

– Alimony paid under a divorce or separation agreement entered into on before 2019

– SEP, SIMPLE, and qualified plan contributions for employees (and for yourself if you’re a sole proprietor)

– Jury duty pay handed over to your employer (e.g., if the employer paid your salary while on jury duty)

Related: 11 Ways to Avoid Taxes on Social Security Benefits

Will the Standard Deduction Change In the Future?

Starting in 2018, the standard deduction was nearly doubled by the Tax Cuts and Jobs Act (TCJA) of 2017. However, the dramatic increase is only temporary—it’s scheduled to expire on Jan. 1, 2026.

The higher standard deduction amounts could be extended by Congress, but extending TCJA provisions is a politically charged issue. Right now, it would be difficult to get an extension through Congress and signed by President Biden. So, whether the increased standard deduction will continue or it reverts back to pre-2018 levels will likely depend on who controls Congress and the White House after the 2024 election.

Want to learn more about investing, spending, taxes, and more? Sign up for Young and the Invested’s free newsletter: The Weekend Tea.

Related: What Tax Bracket Are You In?

Perhaps the best way to lower your federal income tax bill is push yourself down into a lower tax bracket to reduce your tax rate. On the flip side, you certainly want to avoid getting kicked into a higher bracket and increasing your tax rate.

But, of course, under either scenario you need to have a good feel for where you are right now. For that purpose, check out the federal tax brackets and rates that will apply for your next federal tax return.

Related: IRA Contribution Limits

Saving for retirement is one of the primary goals of financial planning … and IRAs are one of the most important vehicles for achieving your retirement saving goals. However, you can only put so much in IRAs each year (and the amount is subject to change on an annual basis).

Want to know how much you can stuff in an IRA this year? Check out the current IRA contribution limits before you plan your retirement savings goals for the year.

Please Don’t Forget to Like, Follow and Comment

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Subscribe to The Weekend Tea, our weekly newsletter to read more about investing, spending, taxes, and more, and

3. Give the article a Thumbs Up on the top-left side of the screen.

4. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!