You’ve worked hard all your life, but now it’s time (or almost time) to retire. One of your greatest fears is not having enough money to make ends meet in your golden years. If you don’t have a pension, and your 401(k) or IRA accounts are a bit light, you might have to rely more heavily on your Social Security benefits than you had hoped. So any taxes on your Social Security can be a difficult pill to swallow.

At the federal level, wealthier retirees can have up to 85% of their Social Security benefits taxed. Thankfully, Uncle Sam doesn’t tax that much of everyone’s benefits. In fact, depending on your income, you might not have to pay any federal income tax on your Social Security payments.

But here’s something a lot of people don’t realize (or plan for)—your state might tax your Social Security benefits, too. As it stands right now, 10 states will tax Social Security benefits to one extent or another in 2024. That’s the bad news.

The good news is that states are trending away from taxes on Social Security benefits. In fact, two states completely eliminated their tax on Social Security benefits starting in 2024. Another even passed a law to phase out their tax on Social Security benefits by 2026 in March of this year. Keep reading to see if your state is one of them.

We’ll also touch on other state taxes you might face living in these states, such as state sales taxes, property taxes, and more.

(Sales tax rates are provided by the Tax Foundation. Median property tax rates are based on 2022 data from the U.S. Census Bureau, which is the most recent data available.)

Table of Contents

Missouri Completely Exempts Social Security Benefits In 2024

In July 2023, Missouri Gov. Mike Parson signed legislation that completely exempts Social Security benefits from the Show Me State’s income tax, regardless of the taxpayer’s filing status or income. That law went into effect on Jan. 1, 2024.

However, the old rules still apply for Social Security benefits received last year when you file your 2023 Missouri income tax return, which is due April 15, 2024. Under the law in effect for the 2023 tax year, a complete exemption is only available to retirees with a Missouri adjusted gross income (AGI) of:

— $85,000 or less for taxpayers using the single, head of household, married filing separate, or qualifying widow(er) filing status

— $100,000 or less for taxpayers using the married filing combined filing status

If your 2023 Missouri AGI is above the applicable threshold, some or all of your Social Security benefits taxed by the federal government will also be taxed by Missouri. You can receive a partial exemption on your 2023 return, but it’s reduced on a dollar-for-dollar basis if your Missouri AGI is more than the $85,000 or $100,000 threshold.

Other Missouri State Taxes

Personal Income Tax Rates—For 2023, the Missouri personal income tax rates run from 2.00% to 4.95%. Some local jurisdictions also levy an income tax.

Income Tax on IRA and 401(k) Plan Withdrawals—Missouri taxes withdrawals from IRAs and 401(k) plans as ordinary income, though some exemptions may apply: single filers with a modified adjusted gross income (MAGI) of no more than $25,000 have an exemption while joint filers have an exemption twice as large with MAGI of up to $32,000.

Sales Taxes—Missouri has an average sales tax rate with 4.225% and a max local sales tax rate of 5.763%, combining for a state average of 8.33%.

Property Taxes—Missouri has an average 1.01% paid in property taxes as a percentage of owner-occupied housing value, placing it 22nd lowest in the country.

Estate and Inheritance Taxes—Missouri doesn’t impose an estate nor an inheritance tax.

Nebraska Eliminates Its Tax on Social Security In 2024

The Cornhusker State also helped retirees when Gov. Jim Pillen signed legislation in May 2023 that axed Nebraska’s tax on Social Security benefits. As with the Missouri law, it took effect on Jan. 1, 2024.

However, seniors still might owe tax on their Social Security income reported on their 2023 Nebraska tax return that must be filled by April 15, 2024. Under the old rules in place for the 2023 tax year, Nebraska could tax part of your Social Security income if your federal AGI is above either:

— $66,510 for married couples filing a joint Nebraska tax return

— $49,310 for all other Nebraska taxpayers

If your 2023 federal AGI exceeds the applicable threshold, Nebraska will tax 40% of any Social Security benefits that are taxed at the federal level.

You’re off the hook if your 2023 federal AGI is equal to or less than the applicable $66,510 or $49,310 threshold. In that case, Nebraska won’t touch any of your 2023 Social Security income.

Other Nebraska State Taxes

Personal Income Tax Rates—For 2023, the Nebraska personal income tax rates run from 2.46% to 6.64%.

The top rate drops to 5.84% for 2024, 5.2% for 2025, 4.55% for 2026, and 3.99% for 2027 and thereafter.

Income Tax on IRA and 401(k) Plan Withdrawals—Nebraska has no special tax breaks for IRA or 401(k) plan distributions, so whatever is subject to federal income tax is also subject to Nebraska’s tax.

Sales Taxes—Nebraska residents face a fairly average sales tax burden. The state rate is 5.5%, and local taxes can be as high as 2%. The average combined state and local sales tax rate is 6.971%, which is the 24th-lowest in the U.S.

Property Taxes—Real estate taxes are on the high side in Nebraska, with a median property tax rate of 1.51%. That’s the ninth-highest in the country.

Estate and Inheritance Taxes—Nebraska also imposes an inheritance tax, which is paid by your heirs. Depending on your relationship to them, their age, and the value of the property inherited, your heirs could pay inheritance tax at rates ranging from 1% to 15%.

Related: Best Fidelity Retirement Funds for a 401(k) Plan

10 Other States Still Tax Social Security Benefits

Many seniors in Missouri and Nebraska will save hundreds of dollars each year thanks to the repeal of state taxes on Social Security benefits. That’s great news for them.

Unfortunately, however, there are 10 other states that still tax Social Security benefits. In some of those states, there have been recent efforts to get taxes on Social Security payments off the books—but lawmakers just couldn’t get it done. As noted earlier, the trend is definitely toward fewer state taxes on Social Security income, so maybe there’s still hope for retirees in those states.

But for now, here’s a rundown of the 10 states that will still tax Social Security benefits in 2024.

Related: How Are Social Security Benefits Taxed on the Federal Level?

1. Colorado

When it comes to taxes on Social Security benefits, Colorado is a good place to retire … as long as you don’t retire early. That’s because the Centennial State’s tax on Social Security income only applies if you’re 55 to 64 years old.

If that’s the case, you can deduct up to $20,000 of Social Security income that’s taxed at the federal level. Anything above that amount is subject to Colorado income taxes.

If you’re 65 or older, there’s no Colorado tax on your benefits.

Related: 11 Ways to Avoid Taxes on Social Security Benefits

Other Colorado State Taxes

Personal Income Tax Rates—Colorado has a flat state income tax rate of 4.4%.

Income Tax on IRA and 401(k) Plan Withdrawals—If you’re at least 65 years old, you can deduct up to $24,000 of 401(k) or IRA distributions that are taxed at the federal level. If you’re between 55 and 64 years old, you can deduct up to $20,000.

Sales Taxes—Colorado’s statewide sales tax rate is a relatively low 2.9%, but local government rates can be as high as 8.3%. As a result, according to the Tax Foundation, the average combined state and local sales tax rate in Colorado is 7.807%, which is the 16th-highest in the U.S.

Property Taxes—From a statewide perspective, property tax bills are relatively low in Colorado. The median property tax rate for the entire state is only 0.46%, which is the fourth-lowest when compared to the median rates in all 50 states and the District of Columbia.

Estate and Inheritance Taxes—If you live in Colorado, your heirs will be happy to know that there are no state estate or inheritance taxes.

Related: Can I Retire at 60 with $500K? [YES! See Examples of How]

2. Connecticut

My wife and I used to live in Connecticut, so it makes me sad to put the state on this list. But I don’t think we’ll be returning to the Nutmeg State in our golden years, in part because we don’t want to risk having to pay the state’s tax on Social Security income. (Although, as outlined below, Connecticut is cutting income taxes on other types of retirement income starting this year.)

There is some good news for Social Security recipients: You won’t have to pay the Connecticut tax on your benefits if your federal adjusted gross income for the year is below:

— $75,000 if you’re single or a married person filing a separate tax return

— $100,000 if you’re married filing jointly, a head-of-household filer, or a surviving spouse

However, if your income is above the applicable threshold, the state will tax 25% of either your total Social Security income for the year or your Social Security benefits subject to tax at the federal level, whichever is lower.

Related: How Much to Save for Retirement by Age Group

Other Connecticut State Taxes

Personal Income Tax Rates—Connecticut state income tax rates start at 2% and go up to 6.99%.

Income Tax on IRA and 401(k) Plan Withdrawals—For 2024, distributions from a 401(k) account are fully exempt if your federal adjusted gross income is less than:

— $75,000 for single filers, married people filing a separate tax return, or head-of-household filers

— $100,000 for married couples filing jointly

People with income below the $75,000/$100,000 threshold can also deduct 50% of any withdrawals from a traditional IRA in 2024.

A partial exemption (ranging from 2.5% to 85%) for IRA and 401(k) payments is available if your income is between:

— $75,000 and $99,999 for single filers, married people filing a separate tax return, or head-of-household filers

— $100,000 and $149,999 for married couples filing jointly

Going forward, the base deduction for IRA distributions jumps to 75% in 2025, and then to 100% in 2026 and thereafter.

Sales Taxes—Connecticut imposes a 6.35% sales tax. No local sales taxes are permitted, so the combined state and local sales tax rate is 6.35%, which is the 19th-lowest in the nation.

Property Taxes—Plan for a big property tax bill if you move to Connecticut. The median property tax rate in Connecticut is 1.78%, which is the third-highest in the country.

Estate and Inheritance Taxes—Connecticut imposes a 12% estate tax, but for 2024 it only applies to estates worth $13.61 million or more.

Related: How to Use Your HSA for Retirement

3. Kansas

Taxes on Social Security benefits are very simple in Kansas.

If your federal adjusted gross income is greater than $75,000, Social Security benefits taxed at the federal level are also taxed by Kansas.

If your federal adjusted gross income is $75,000 or less, there’s no Kansas tax on your income from Social Security.

Related: 2024 IRA Contribution Limits [Save More in 2024]

Other Kansas State Taxes

Personal Income Tax Rates—The Kansas income tax rates range from 3.1% to 5.7%.

Income Tax on IRA and 401(k) Plan Withdrawals—Under Kansas law, calculation of the state’s personal income tax begins with federal adjusted gross income. Since there are no state deductions from that amount for IRA and 401(k) distributions, withdrawals from those retirement accounts are taxed by Kansas to the same extent they’re taxed by the federal government. So, for example, if your federal adjusted gross income includes $1,000 of IRA or 401(k) distributions, then that same $1,000 is taxed by Kansas.

Sales Taxes—Sales taxes are on the high end in Kansas. There’s a 6.5% statewide sales tax, plus local governments can tack on up to 4.25% more. That pushes the average combined state and local sales tax rate to 8.654%, which is the ninth-highest in the nation.

Property Taxes—Property taxes lean high in Kansas, too. The state’s median property tax rate is 1.25%, which is the country’s 13th-highest rate.

Estate and Inheritance Taxes—No need to worry about an estate or inheritance tax in Kansas. The state doesn’t impose these types of “death taxes.”

Related: IRA vs. 401(k): How These Retirement Accounts Differ

4. Minnesota

The taxation of Social Security payments is a bit more complicated in the North Star State. That’s because there are two separate ways to calculate the Minnesota tax on your benefits. However, for many Minnesota retirees, there’s no state income tax on their Social Security income.

When calculating your Minnesota taxable income, include the amount (if any) of Social Security benefits taxed at the federal level. From that point, you can claim a tax deduction for Social Security income under one of two methods (simplified and alternative)—pick the one that saves you the most money.

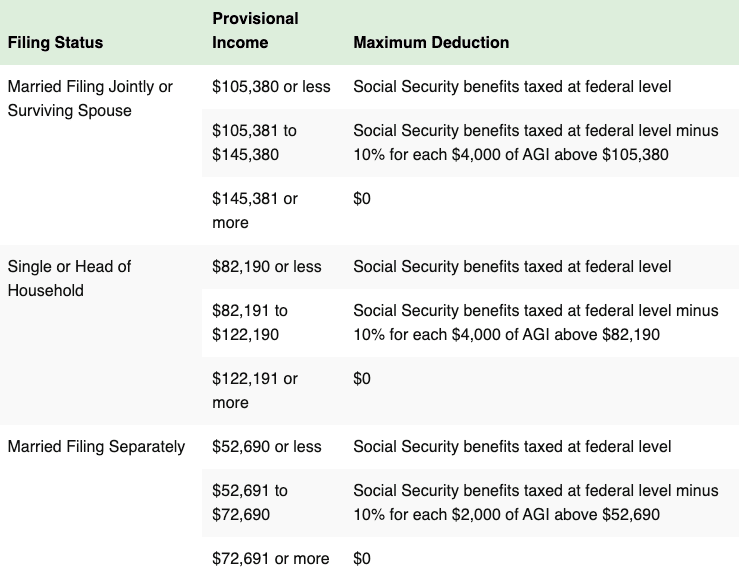

Minnesota’s ‘Simplified’ Method for Social Security Benefits

Under the “simplified method,” you can deduct 100% of your Social Security benefits on your Minnesota income tax return if your federal adjusted gross income is below a certain amount. However, if your federal adjusted gross income is above the applicable threshold, your deduction is phased out by 10% for each $4,000 of income over the threshold amount (10% for each $2,000 over the threshold for married taxpayers filing separate returns).

The federal adjusted gross income thresholds and phaseout ranges for the 2024 tax year are shown in the above table.

Like Young and the Invested’s Content? Be sure to follow us.

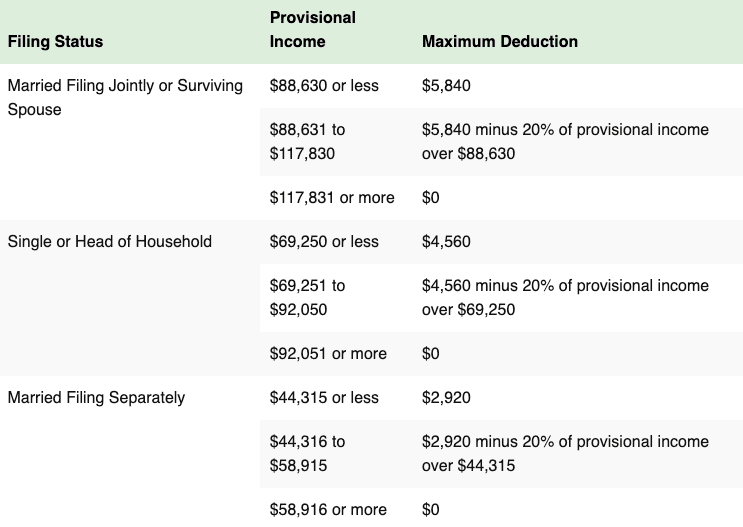

Minnesota’s ‘Alternative’ Method for Social Security Benefits

Under the “alternative method,” you can deduct Social Security benefits on your Minnesota tax return according to the above table.

For this deduction, “provisional income” is equal to modified adjusted gross income, as used for purposes of calculating federal taxes on Social Security benefits, plus one-half of the Social Security benefits taxed at the federal level for the year.

Related: RMDs for Roth 401(k) Accounts No Longer Required

Other Minnesota State Taxes

Personal Income Tax Rates—The lowest Minnesota income tax rate is 5.35%. The highest rate is a comparatively high 9.85%.

Income Tax on IRA and 401(k) Plan Withdrawals—There are no special tax breaks under Minnesota law for withdrawals from an IRA or 401(k) account. As a result, they’re taxed by Minnesota to the same extent they’re taxed under federal law.

Young and the Invested Tip: While there’s no special tax break for IRA or 401(k) distributions, seniors age 65 or older can claim a special deduction of up to $9,600 ($12,000 for joint filers). Income limits apply.

Sales Taxes—Minnesota sales taxes are on the high side. There’s a 6.875% state tax, plus local taxes of up to 2.15%. The average combined state and local sales tax rate for Minnesota is 8.038, which is the 15th-highest in the U.S.

Property Taxes—At 0.98%, Minnesota’s median property tax rate is a little on the high end. That comes in as the 19th-highest amount among all 50 states and the District of Columbia.

Estate and Inheritance Taxes—Minnesota taxes estates valued at $3 million or more. The estate tax rates range from 13% to 16%.

Related: Retirement Saver’s Tax Credit: What Is It, How Much, Who’s Eligible + More

5. Montana

While a house with a view near Flathead Lake sounds nice for a retirement destination, you might have to pay the Montana tax on Social Security benefits if you moved out to Big Sky country.

Before 2024, the calculation of Montana taxes on Social Security income was based on your Montana adjusted gross income, not your federal adjusted gross income. As a result, the Montana tax didn’t always match up perfectly with the federal tax.

However, starting this year, Montana taxpayers won’t have to calculate Montana adjusted gross income anymore. Instead, the calculation of Montana income tax will be based on your federal adjusted gross income. Since there are no adjustments to that amount for Social Security benefits, the same amount of Social Security income subject to federal tax is also subject to Montana tax for the 2024 tax year.

Related: 7 Best Fidelity ETFs for 2024 [Invest Tactically]

Other Montana State Taxes

Personal Income Tax Rates—There are only two Montana tax rates: 4.7% and 5.9%.

Income Tax on IRA and 401(k) Plan Withdrawals—Beginning with the 2024 tax year, the former deduction for pension and other retirement income (including IRA and 401(k) distributions) is repealed and replaced with a new $5,500 deduction for each Montana taxpayer who is at least 65 years old.

Sales Taxes—There’s no state-level sales tax in Montana. Plus, local governments generally can’t impose their own sales tax, either. However, a few tourist areas (e.g., Whitefish, Big Sky, and West Yellowstone) can impose a “resort tax” of up to 3%.

Property Taxes—Property tax bills are generally on the low side in Montana, too. The state’s median property tax rate is 0.68%, which is the nation’s 19th-lowest rate.

Estate and Inheritance Taxes—Montana does not collect estate or inheritance taxes.

Related: What Tax Bracket Are You In?

6. New Mexico

If you’re a retiree in New Mexico, you won’t owe tax on your Social Security benefits if your adjusted gross income is:

— $150,000 or less if your filing status is married filing jointly, head of household, or qualified widow(er)

— $100,000 or less if your filing status is single

— $75,000 or less if your filing status is married filing separately

However, if you exceed the applicable income threshold, your Social Security income is subject to New Mexico taxes to the same extent it’s subject to federal income taxes.

Related: IRA vs. 401(k): How These Retirement Accounts Differ

Other New Mexico State Taxes

Personal Income Tax Rates—State income tax rates in New Mexico start at 1.7% and rise to 5.9%.

Income Tax on IRA and 401(k) Plan Withdrawals—If you’re at least 65 years old, you can deduct up to $8,000 of income—including IRA and 401(k) withdrawals—on your New Mexico tax return.

Young and the Invested Tip: If you’re at least 100 years old, all your income is exempt from New Mexico taxes.

Sales Taxes—The state sales tax rate in New Mexico is 4.875%, but some local governments tack on an additional 4.06%. According to the Tax Foundation, this results in an average combined state and local sales tax rate of 7.617%, which is the 17th-highest rate in the country.

Property Taxes—The median property tax rate in New Mexico is only 0.67%, which is the 17th-lowest in the country.

Estate and Inheritance Taxes—Estate planning is easier in New Mexico, since the state has no estate or inheritance tax.

Related: 11 Education Tax Credits and Deductions

7. Rhode Island

You won’t owe Rhode Island taxes on your Social Security benefits if your federal adjusted gross income is below a certain amount. The Rhode Island Department of Revenue hasn’t released the 2024 income thresholds yet, but the amounts for the 2023 tax year were:

— $126,250 for married couples filing jointly or qualifying widow(er)s

— $101,025 for married taxpayers filing separately

— $101,000 for single and head-of-household filers

However, if you exceed the applicable income threshold, the Ocean State will tax your Social Security payments to the same extent they’re taxed by the federal government.

Related: Best Retirement Plans for 2024

Other Rhode Island State Taxes

Personal Income Tax Rates—The lowest tax rate in Rhode Island is 3.75%, while the highest rate is 5.99%.

Income Tax on IRA and 401(k) Plan Withdrawals—If you’ve reached your full retirement age (as defined by the Social Security Administration) and don’t exceed certain income thresholds, you can deduct up to $20,000 of 401(k) distributions and other common forms of retirement income (but not IRA withdrawals) from your Rhode Island taxable income.

The 2024 income thresholds haven’t been released yet, but the 2023 thresholds were the same as the 2023 amounts for the Social Security income deduction (i.e., $126,250, $101,025, or $101,000).

Sales Taxes—The Rhode Island sales tax is very average. There’s a 7% state sales tax, but there’s no local sales tax in the state. With a combined state and local rate of 7%, Rhode Island claims the 25th-highest rate in the nation (like I said, very average).

Property Taxes—Like other states in the northeast, Rhode Island has higher-than-average property tax rates. The state’s median property tax rate is 1.23%, which is 14th-highest in the U.S.

Estate and Inheritance Taxes—Rhode Island imposes an estate tax. The rates run from 0.8% to 16%, but for 2024 the tax only applies to estates worth $1,774,583 or more.

Related: Student Loan Interest Deduction: How Much, Eligibility + More

8. Utah

Utah has a unique way of handling its tax on Social Security income. Instead of a tax deduction or exemption, the Beehive State uses a tax credit to reduce or eliminate the state tax on Social Security recipients. But there are income limits restricting who can claim the full tax credit, so some higher-income residents end up paying state income tax on at least some of their Social Security payments.

The full tax credit is equal to the amount of Social Security benefits taxed on the federal level multiplied by the Utah income tax rate (4.65%). However, the credit is reduced if your Utah modified adjusted gross income is above the following applicable amount:

— $37,500 for a married person filing a separate tax return

— $45,000 for single filers

— $75,000 for married couples filing jointly, head-of-household filers, and surviving spouses

Your tax credit is reduced by $0.025 for every dollar over the applicable income threshold.

Related: How to Start a Retirement Plan

Other Utah State Taxes

Personal Income Tax Rates—Utah has a flat state income tax rate of 4.65%.

Income Tax on IRA and 401(k) Plan Withdrawals—There’s a very narrow tax deduction for distributions from a traditional 401(k) plan, but it only applies if, at the time the money was put into the account, the withdrawn funds were taxed by another state, the District of Columbia, or a U.S. possession. Otherwise, there are no other Utah tax breaks for IRA or 401(k) distributions.

Young and the Invested Tip: People born before 1953 qualify for a Utah tax credit of up to $450 if they don’t claim either the credit for Social Security benefits or for military retirement income.

Sales Taxes—Sales taxes are a little on the high side in Utah. There’s a 4.85% state sales tax, 1.25% in mandatory local taxes, and additional local taxes of up to 4.2%. According to the Tax Foundation, this results in an average combined state and local sales tax rate of 7.249%, which is the country’s 20th-highest rate.

Property Taxes—Property taxes are on the low side, though. Utah’s median property tax rate is only 0.48%, which is 8th-lowest rate in the nation.

Estate and Inheritance Taxes—Another plus is that there are no estate or inheritance taxes in Utah.

Related: How to Roll Over 401(k) Accounts [Which Option Is Best?]

9. Vermont

In Vermont, the state won’t tax Social Security benefits if your federal adjusted gross income is:

— $65,000 or less for married couples filing a joint tax return

— $50,000 or less for everyone else

If your income is above the applicable amount, you might qualify for a partial tax exemption if your federal adjusted gross income is between:

— $65,001 and $74,999 for joint filers

— $50,001 and $59,999 for other people

If your income exceeds the income thresholds for a partial tax break, then Vermont taxes your Social Security benefits to the same extent they’re taxed under federal law.

Related: How to Roll Over 401(k) Accounts [Which Option Is Best?]

Other Vermont State Taxes

Personal Income Tax Rates—Vermont’s state income tax rates start at 3.35% and run as high as 8.75%.

Income Tax on IRA and 401(k) Plan Withdrawals—Since there are no special tax breaks for IRA or 401(k) plan distributions, withdrawals from those types of retirement accounts are taxed by Vermont to the same extent they’re taxed under the federal income tax law.

Sales Taxes—Vermont sales taxes are a little below average. The state imposes a 6% tax, while local governments can add an additional 1% tax. All in all, the average combined state and local sales tax rate in Vermont is 6.359%. That’s the 20th-lowest rate in the country.

Property Taxes—Vermont property taxes, on the other hand, are well above the national average. At 1.57%, the state has the fifth-highest median property tax rate in the nation.

Estate and Inheritance Taxes—Vermont also taxes estates worth $5 million or more at a 16% rate.

Related: The 7 Best Fidelity Index Funds for Beginners

10. West Virginia

I’ve left West Virginia for last as it’s tax on Social Security benefits is officially set to sunset by the end of 2025 and not exist from 2026 onward. The law phasing out the tax passed in March 2024.

Current law has West Virginia still subject your Social Security to taxation if you fall into certain income levels. Specifically, West Virginia will tax your Social Security benefits if your federal adjusted gross income is:

— More than $100,000 for married couples filing jointly

— More than $50,000 for all other taxpayers

If your income is greater than the applicable dollar amount, West Virginia will levy a state income tax on your Social Security payments to the same extent you must pay taxes on that income to the federal government.

Related: The 7 Best Vanguard ETFs for 2024 [Build a Low-Cost Portfolio]

Other West Virginia State Taxes

Personal Income Tax Rates—West Virginia state income tax rates range from 2.36% to 5.12%. However, beginning in 2025, the rates can be lowered each year if certain revenue collection thresholds are exceeded, but no more than 10% per year.

Income Tax on IRA and 401(k) Plan Withdrawals—West Virginia taxes IRA and 401(k) distributions to the same extent they’re taxed at the federal level.

Young and the Invested Tip: If you’re at least 65 years old, you can automatically deduct up to $8,000 from your West Virginia taxable income.

Sales Taxes—West Virginia imposes a 6% state-level sales tax, while local governments can tack on an additional 1%. According to the Tax Foundation, the average combined state and local sales tax rate in West Virginia is 6.567%, which is the 21st-lowest in the country.

Property Taxes—The median property tax rate in West Virginia is only 0.53%, which is the 11th-lowest in the U.S.

Estate and Inheritance Taxes—Residents of West Virginia don’t have to worry about a state-level estate or inheritance tax.

Like Young and the Invested’s Content? Be sure to follow us.

Are Your Social Security Benefits Taxable at the Federal Level?

The first step in determining if your Social Security benefits are taxable at the federal level is to calculate what’s commonly called your “provisional income” (a.k.a., combined income).

For most seniors, your provisional income is equal to the combined total of 50% of your Social Security benefits, modified adjusted gross income, and tax-exempt interest. If you’re filing a joint return, include amounts for both spouses.

— 50% of Social Security Benefits + Modified Adjusted Gross Income (MAGI) + Tax-Exempt Interest = Provisional Income

If your provisional income is low enough, none of your Social Security benefits will be taxed (i.e., 0%). However, this generally isn’t the case if you have taxable income in addition to your Social Security benefits (e.g., taxable distributions from a traditional IRA or pension).

If your provisional income is above the 0% threshold, then up to 50% or up to 85% of your Social Security benefits will be subject to federal income tax.

In all cases, the provisional income thresholds are based on your filing status.

Summary of How Much of Your Social Security Benefits Are Subject to Taxation

Above, we provide a summary table of how much of your Social Security benefits are subject to taxation.

Please Don’t Forget to Like, Follow and Comment

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Subscribe to The Weekend Tea, our weekly newsletter to read more about investing, spending, taxes, and more, and

3. Give the article a Thumbs Up on the top-left side of the screen.

4. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!