What Is the Stock Market?

The stock market is a place where buyers and sellers come together to trade shares in publicly traded companies with one another.

Stock markets essentially act like auctions. Potential buyers name the highest price they’re willing to pay (called “the bid”) and potential sellers name the lowest price they will accept (“the ask”). When you want to purchase stock in a company, you set your bid price by placing an order on an exchange through a stock broker. This broker finds another person interested in selling at a price you wish to pay, or closely matching your bid to their ask. Once the market finds two or more parties interested in filling a trade at the agreed-upon price, the brokers deliver the shares and cash proceeds to the respective accounts. The actual execution of the trade price takes place between the bid and ask prices. Neither the buyer nor the seller receives the full amount of money paid or received in the transaction because the brokers capture a tiny portion through the spread between the bid and ask prices. Think of this bid-ask spread as a price of admission. It’s used to pay online discount brokers and the market exchange for facilitating the transaction. While often small with respect to the single transaction, taken across the entirety of the volume of shares traded on a daily basis, it amounts to serious money. Many free stock trading apps monetize this trading volume through a system called “payment for order flow,” or PFOF. You can learn a little more about that from the links below.Can You Trade Stocks If You’re Younger Than 18?

If you wonder whether teens under 18 can trade stocks, the answer is yes, you can invest as a minor … with an asterisk or two.

While you can start investing while you’re a teenager, it can only be done via certain types of investment accounts. Teenagers can actually trade stocks and other investments themselves via:- a joint brokerage account (you co-own the account with your parent or guardian)

- a regular brokerage account that you have permission to use (your parent or guardian will own the account)

- a custodial account (your parent or guardian invests on your behalf)

- a custodial Roth IRA (your parent or guardian invests on your behalf; when you withdraw in retirement, those withdrawals are tax-free)

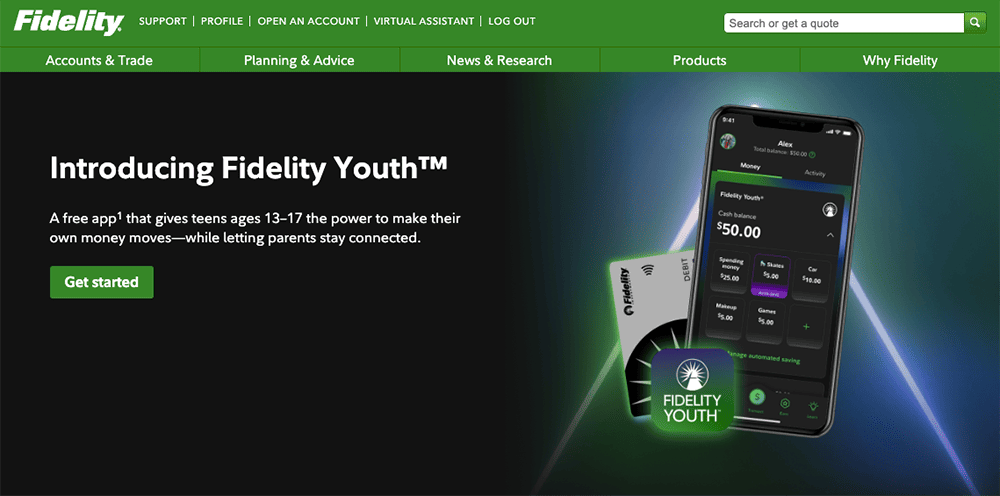

Fidelity Youth™ Account ($50 bonus for teens, $100 bonus for parents)

- Available: Sign up here

- Price: No account fees, no account minimum, no trading commissions*

- Platforms: Web, mobile app (Apple iOS, Android)

- Promotion: Teens get $501 on Fidelity® when they download the Fidelity Youth™ app and activate their Youth Account; parents get $100 when they fund a new account

Controls parents want and need

A parent or guardian must have or open a brokerage account with Fidelity® to open a Fidelity Youth™ Account. For new Fidelity® customers, opening an account is easy, and there are no minimums and no account fees. Parents and guardians have plenty of tools they can use to monitor their teen’s activity: They have online account access, can follow monthly statements and trade confirmations, and can view debit card transactions made in the account. To make it even easier, you can set up alerts to notify you of trades, transactions, and cash management activity, keeping you firmly in the loop on actions your teen takes across the Fidelity Youth™ Account’s suite of products. If your teen has an interest in learning about investing and taking their first steps toward building their financial journey, you should consider downloading the Fidelity Youth™ app and opening a Fidelity Youth™ Account. The account comes custom-built for their needs, which will help them become financially independent and start investing for their future. Read more in our Fidelity Youth™ Account review.- The Fidelity Youth™ Account is a free¹ account where teens can save, spend, and invest their own money.

- No monthly fees or account minimums to open.

- Your teen can learn to save and spend smarter with their own debit card, which features no domestic ATM fees.²

- Teens can invest in stocks for as little as $1 with fractional shares.³

- Parents can set up alerts and monitor their teen's account activity online, and through statements, trade confirmations, and debit card transactions.

- The Fidelity Youth™ app will have a dedicated Youth Learn tab to help jumpstart your teen's financial learning and build better money habits.

- No monthly account fees

- Investing feature

- Fractional shares

- Parental controls

- Comprehensive financial suite for teens

- Parent must be a Fidelity account holder

- Account balance doesn't accumulate interest

- No chore or allowance system

Why Investing Young Is So Important

Some of the wealthiest people in the world built their fortunes by investing in stocks—and starting from an early age. Perhaps most famously, Warren Buffett began investing in his teens and now has over $100 billion in personal wealth. He started young and developed his wealth building habits from his early years. Minors should learn how to invest as a teenager because they bring a unique perspective no other investor older than them can. For example, you are a consumer who sees new offerings and what potential they have. In my case, I saw the growth and rise of online retailers like Amazon and Shopify, social media giants like Facebook and Twitter, major tech companies like Alphabet, Apple and Netflix as well as auto manufacturers like Tesla or even cryptocurrencies like Bitcoin. Because you have dialed in interests with hyper focus on them, you might know about the next great companies entering the market because you interact with them on a regular basis. Choosing to follow through on your projections by investing in these companies’ stocks might show you the power of conviction and even the satisfaction of aligning your money with your interests.

What Is Stock Trading for Teens?

Stocks act as some of the best investments for teenagers because they tend to provide a long-term focus on growth and higher returns. They carry higher risks traditionally than investments like bonds, but young investors can tolerate this volatility due to their long investment horizons.

Starting to invest as early as possible makes complete sense as the practice relies on building sustainable habits to last a lifetime. This means taking time to research stocks, vet different index funds, understand how companies make money and much more. Though, these efforts don’t always fixate on the long-term orientation of investing I tend to favor.

Today’s news headlines rarely take into account long-term views, meaning the most reliable purpose for investing sustainably to build wealth gets lost in the news cycle. Instead, companies like GameStop, cryptocurrencies like Dogecoin or newfangled investment vehicles like SPACs steal the limelight.

While these might be the source of some people who turn money into more money in great quantities, it rarely pans out that way for the retail investor following the herd to take advantage of some passing craze.

My personal investing style might also be the most boring: Investing in low-cost index funds to let your wealth compound in a diversified portfolio over many, many years. However, many teens consider index funds less exciting than individual stocks and want to own shares of companies they know and love.

Stocks act as some of the best investments for teenagers because they tend to provide a long-term focus on growth and higher returns. They carry higher risks traditionally than investments like bonds, but young investors can tolerate this volatility due to their long investment horizons.

Starting to invest as early as possible makes complete sense as the practice relies on building sustainable habits to last a lifetime. This means taking time to research stocks, vet different index funds, understand how companies make money and much more. Though, these efforts don’t always fixate on the long-term orientation of investing I tend to favor.

Today’s news headlines rarely take into account long-term views, meaning the most reliable purpose for investing sustainably to build wealth gets lost in the news cycle. Instead, companies like GameStop, cryptocurrencies like Dogecoin or newfangled investment vehicles like SPACs steal the limelight.

While these might be the source of some people who turn money into more money in great quantities, it rarely pans out that way for the retail investor following the herd to take advantage of some passing craze.

My personal investing style might also be the most boring: Investing in low-cost index funds to let your wealth compound in a diversified portfolio over many, many years. However, many teens consider index funds less exciting than individual stocks and want to own shares of companies they know and love.

Should Teenage Investing Include Individual Stocks?

If you choose to start investing in individual stocks, try to stick to blue-chip stocks. Blue-chip stocks come from established, well-known companies that are generally more stable. Blue-chip stocks might not represent the best choice for aggressive growth, but they do offer a steadier return than other types of stock investments.

Larger companies carry less risk in general because there is already too much money at stake to risk doing something drastically different that could tank your share value—and their company as well! When using a long-term mentality for investing in the best stocks for kids, you can see your account balance grow over time without worrying about the latest tweet from Elon Musk and how it’ll affect any number of investments filling the news headlines.

Investing in individual shares can be an exciting way to increase your wealth and build up appreciating assets over time; however, it’s important to know what you’re getting into before diving right in without any knowledge or understanding.

Consider subscribing to a stock picking service that has performed well over many years and developed a sound track record and investment vetting process. These can easily cut down your investable selection of stocks to focus only on ones that have passed numerous quality criteria from highly-regarded and well-respected stock advisor websites and services.

Once you get these stock selections, and you have done some research on trading practices, you might consider starting to invest. Make sure this active type of investment strategy suits you and then start investing now while you still have years to earn money and save ahead of you.

You might also consider investing in index funds like VTI to see how these investments perform in comparison. If nothing else, it’ll build instant diversification in your portfolio through an all-in-one type of investment.

If you choose to start investing in individual stocks, try to stick to blue-chip stocks. Blue-chip stocks come from established, well-known companies that are generally more stable. Blue-chip stocks might not represent the best choice for aggressive growth, but they do offer a steadier return than other types of stock investments.

Larger companies carry less risk in general because there is already too much money at stake to risk doing something drastically different that could tank your share value—and their company as well! When using a long-term mentality for investing in the best stocks for kids, you can see your account balance grow over time without worrying about the latest tweet from Elon Musk and how it’ll affect any number of investments filling the news headlines.

Investing in individual shares can be an exciting way to increase your wealth and build up appreciating assets over time; however, it’s important to know what you’re getting into before diving right in without any knowledge or understanding.

Consider subscribing to a stock picking service that has performed well over many years and developed a sound track record and investment vetting process. These can easily cut down your investable selection of stocks to focus only on ones that have passed numerous quality criteria from highly-regarded and well-respected stock advisor websites and services.

Once you get these stock selections, and you have done some research on trading practices, you might consider starting to invest. Make sure this active type of investment strategy suits you and then start investing now while you still have years to earn money and save ahead of you.

You might also consider investing in index funds like VTI to see how these investments perform in comparison. If nothing else, it’ll build instant diversification in your portfolio through an all-in-one type of investment.

Apps That Show How Teenagers Can Invest in the Stock Market

The stock market can be a tricky place. It can be really rewarding if you choose wisely and your stocks go up—or devastatingly disappointing if they don’t. That doesn’t mean investing as a minor is off limits though! In fact, investing can be as simple as buying one index fund and letting it sit idle. Though, that’s not always what a teenager wants to save up for and buy.

That’s where individual stock trading for teens comes in! You can still invest for the long-term, meaning without a lot of the risk that comes associated with day-trading, but you can choose stocks individually and see how they perform over time. It’s also less time consuming than day-trading because you only buy and sell the companies you like when it suits your needs. That way you don’t have to worry about being glued to your computer screen all day wondering what stocks to buy.

By beginning with small amounts of money, teenagers can learn how to trade stocks in their portfolio before serious amounts of money get put at risk. There are a few ways to trade individual stocks as a teen without being too risky and still making it fun:

The stock market can be a tricky place. It can be really rewarding if you choose wisely and your stocks go up—or devastatingly disappointing if they don’t. That doesn’t mean investing as a minor is off limits though! In fact, investing can be as simple as buying one index fund and letting it sit idle. Though, that’s not always what a teenager wants to save up for and buy.

That’s where individual stock trading for teens comes in! You can still invest for the long-term, meaning without a lot of the risk that comes associated with day-trading, but you can choose stocks individually and see how they perform over time. It’s also less time consuming than day-trading because you only buy and sell the companies you like when it suits your needs. That way you don’t have to worry about being glued to your computer screen all day wondering what stocks to buy.

By beginning with small amounts of money, teenagers can learn how to trade stocks in their portfolio before serious amounts of money get put at risk. There are a few ways to trade individual stocks as a teen without being too risky and still making it fun:

- You can open custodial accounts through apps like M1 Finance to trade along with parents or family members. This will let you learn how to trade stocks as a teen under close supervision.

- Likewise, you can trade exchange-traded funds (ETFs) like passively-managed index funds to diversify your portfolio with a single purchase.

- You can also invest in actively-managed exchange-traded funds which come managed by professionals who have more experience investing than you do.

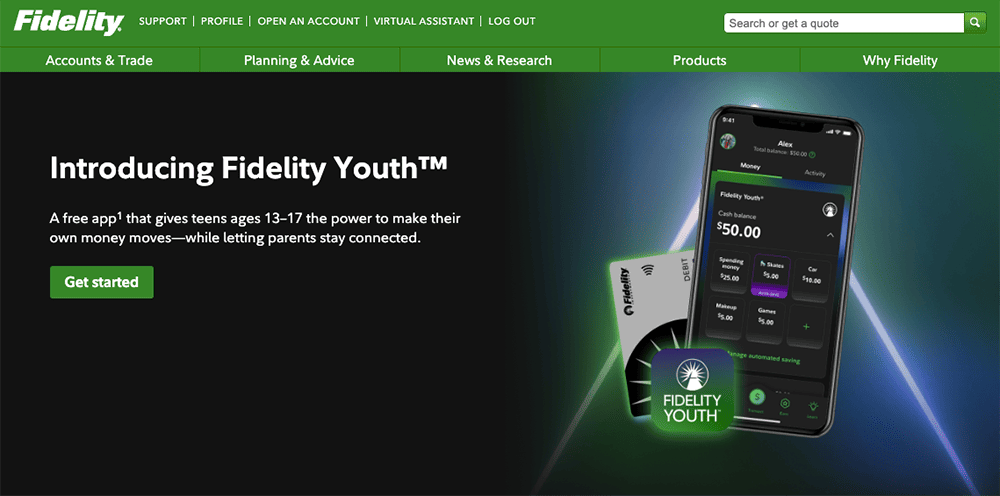

1. Fidelity Youth™ Account ($50 bonus for teens, $100 bonus for parents)

- Available: Sign up here

- Price: No account fees, no account minimum, no trading commissions*

- Platforms: Web, mobile app (Apple iOS, Android)

- Promotion: Teens get $501 on Fidelity® when they download the Fidelity Youth™ app and activate their Youth Account; parents get $100 when they fund a new account

Controls parents want and need

A parent or guardian must have or open a brokerage account with Fidelity® to open a Fidelity Youth™ Account. For new Fidelity® customers, opening an account is easy, and there are no minimums and no account fees. Parents and guardians have plenty of tools they can use to monitor their teen’s activity: They have online account access, can follow monthly statements and trade confirmations, and can view debit card transactions made in the account. To make it even easier, you can set up alerts to notify you of trades, transactions, and cash management activity, keeping you firmly in the loop on actions your teen takes across the Fidelity Youth™ Account’s suite of products. If your teen has an interest in learning about investing and taking their first steps toward building their financial journey, you should consider downloading the Fidelity Youth™ app and opening a Fidelity Youth™ Account. The account comes custom-built for their needs, which will help them become financially independent and start investing for their future. Read more in our Fidelity Youth™ Account review.- The Fidelity Youth™ Account is a free¹ account where teens can save, spend, and invest their own money.

- No monthly fees or account minimums to open.

- Your teen can learn to save and spend smarter with their own debit card, which features no domestic ATM fees.²

- Teens can invest in stocks for as little as $1 with fractional shares.³

- Parents can set up alerts and monitor their teen's account activity online, and through statements, trade confirmations, and debit card transactions.

- The Fidelity Youth™ app will have a dedicated Youth Learn tab to help jumpstart your teen's financial learning and build better money habits.

- No monthly account fees

- Investing feature

- Fractional shares

- Parental controls

- Comprehensive financial suite for teens

- Parent must be a Fidelity account holder

- Account balance doesn't accumulate interest

- No chore or allowance system

2. Greenlight App

- Available: Sign up here

- Price: Free 1-month trial, then $9.98/mo. for Greenlight Max

- Start investing with as little as $1 in your account

- Buy fractional shares of companies you admire (say, kid-friendly stocks)

- No trading commissions beyond the monthly subscription fee

- Teens can only invest in U.S.-listed stocks and ETFs that have either a market capitalization over $1 billion or a three-month average daily dollar volume of more than $500,000

- Parents must approve every trade directly in the app.

- Greenlight offers flexible parental controls for each child and real-time notifications of each transaction.

- Greenlight is the only debit card letting you choose the exact stores where kids can spend on the card.

- Parents can use this app to teach them how to invest with a brokerage account through Greenlight Max and Greenlight Infinity plans

- Best-in-class parental controls (can prohibit specific stores)

- Can add brokerage account to invest in stocks

- Intuitive Parent and Kid apps

- Competitive cash back and interest rates

- High price points

- No cash reload options

- No parent / child lending

Can Teenagers Invest in a Custodial IRA?

A great option for teens to start investing is by opening a custodial Roth IRA (or traditional). This allows teenagers to invest money toward their retirement when they will likely start having earned income. A custodial IRA is a special type of retirement investment account that you can set up for an underage person, especially for one who has earned income. For Roth IRAs, unlike traditional IRAs, the investment contributions are not tax-deductible but will likely get hit with very low taxes because a teenager won’t earn as much money as they will later in life. The teenager can use an investment account to invest in index funds that the parents or family members buy for them with contributions to the account. As the account balance grows and the teenager learns to follow along, they can understand how stock trading for teens can build serious wealth.

E*Trade (Our Top Pick for Custodial IRAs)

- Available: Sign up here

- Best for: Intermediate investors

- Platforms: Web, mobile app (Apple iOS, Android)

- E*Trade is one of the best online and mobile trading platforms among discount brokers, offering a full range of investments.

- E*Trade's IRA for Minors allows children under 18, who have earned income, to start saving for their retirement.

- The platform's custodial IRA allows you to build your own portfolio of stocks, ETFs, mutual funds, bonds, and more, or it can build one for you through its Core Portfolios service.

- $0 commission trading for online U.S.-listed stocks, ETFs, options, mutual funds, and Treasuries.

- Opening an account is easy and only takes a couple of minutes.

- Bonus: Get between $100 and $5,000* when you open and fund a new investment account using promo code "OFFER25."

- Excellent selection of available investments

- Commission-free trading on stocks, ETFs, mutual funds, and Treasuries

- Automated portfolio builders and prebuilt mutual fund and ETF portfolios

- Limited availability of fractional shares (only in DRIP plans or robo-created portfolio)

Why Parents Should Be Involved in Stock Trading for Teens

Stock trading is a risky endeavor if not handled correctly. Investments can quickly sour and turn bad. In order to avoid disaster, parents should be involved in stock trading for teens. Otherwise, you’re likely to have a lot of gunslinging young investors ruining what otherwise could be a fantastic start in equities for teens.

By establishing defined guardrails and clear limits, teens can take that first step to learn a valuable skill early in life. For one, minors shouldn’t be allowed to trade sophisticated assets like options, stock market futures, forwards, commodities, or anything with that level of risk profile. Plain stocks and ETFs should suffice as learning is the primary goal, not unsuitable risk.

In recent history, apps like Robinhood captured headlines not for democratizing access to markets, but by doing so in far too flung a fashion. In fact, one 20-year-old killed himself after seeing some alarming messaging in his app after making what seemed like an innocuous options trade on Amazon stock. Certainly taken to the extreme, but this never should have happened with the easy access to trading options.

Individual stock trading for teens shouldn’t involve fast trading—especially not in volatile types of investments like options or cryptocurrencies—because that can quickly turn into capital losses. But owning a handful of shares in a company you follow or admire is something else entirely. It gives you skin in the game to learn about the company, the broader market and instill good money habits to build wealth.

Stock trading is a risky endeavor if not handled correctly. Investments can quickly sour and turn bad. In order to avoid disaster, parents should be involved in stock trading for teens. Otherwise, you’re likely to have a lot of gunslinging young investors ruining what otherwise could be a fantastic start in equities for teens.

By establishing defined guardrails and clear limits, teens can take that first step to learn a valuable skill early in life. For one, minors shouldn’t be allowed to trade sophisticated assets like options, stock market futures, forwards, commodities, or anything with that level of risk profile. Plain stocks and ETFs should suffice as learning is the primary goal, not unsuitable risk.

In recent history, apps like Robinhood captured headlines not for democratizing access to markets, but by doing so in far too flung a fashion. In fact, one 20-year-old killed himself after seeing some alarming messaging in his app after making what seemed like an innocuous options trade on Amazon stock. Certainly taken to the extreme, but this never should have happened with the easy access to trading options.

Individual stock trading for teens shouldn’t involve fast trading—especially not in volatile types of investments like options or cryptocurrencies—because that can quickly turn into capital losses. But owning a handful of shares in a company you follow or admire is something else entirely. It gives you skin in the game to learn about the company, the broader market and instill good money habits to build wealth.

Custodial Accounts With Safeguards Are the Answer

Parents can help their teenagers start investing with a custodial investment account. It’s easy to start and can be a useful way to teach kids in a low-risk environment how to start investing. There will likely be volatility, even in this environment. After all, it is the stock market and it indeed carries risk—no matter your investment choices.

However, learning how to deal with those swoons in the moment from parents or guardians can teach teens how to react and build these behaviors from an early age. This is much better than filling with dreadful emotion when a stock tanks or filling with exhilaration when one rockets to the moon. These types of emotion don’t relate to sustainable investing strategies—that’s gambling plain and simple.

Parents can use the above investing apps to track stocks and monitor portfolios of their teenagers’ investments while providing guidance. As the account balance grows, so does the teenager’s understanding of how stock trading for teens works. When they are ready to start investing on their own, parents should help them find a broker or advisor who understands this age group’s needs in terms of risk tolerance.

However, the apps highlighted above also grow with the investor, meeting their increasing needs with added features and functionality. And as they grow, they’ll get more comfortable with risk because they’ve seen it before through investing in a custodial account.

As a teen, stock trading allows you to keep score of your decisions with the possibility of feeling pain on the losses, but considerably less so because of the smaller investment account balance than an adult would have. By placing the proper guardrails on investing young, parents can teach teenagers valuable life lessons. Left unchecked and you’re showing kids how to gamble, not how to invest in a secure financial future.

That’s why we recommend the Fidelity Youth™ Account and it’s ability to keep parents directly involved with the investment decision-making.

Parents can help their teenagers start investing with a custodial investment account. It’s easy to start and can be a useful way to teach kids in a low-risk environment how to start investing. There will likely be volatility, even in this environment. After all, it is the stock market and it indeed carries risk—no matter your investment choices.

However, learning how to deal with those swoons in the moment from parents or guardians can teach teens how to react and build these behaviors from an early age. This is much better than filling with dreadful emotion when a stock tanks or filling with exhilaration when one rockets to the moon. These types of emotion don’t relate to sustainable investing strategies—that’s gambling plain and simple.

Parents can use the above investing apps to track stocks and monitor portfolios of their teenagers’ investments while providing guidance. As the account balance grows, so does the teenager’s understanding of how stock trading for teens works. When they are ready to start investing on their own, parents should help them find a broker or advisor who understands this age group’s needs in terms of risk tolerance.

However, the apps highlighted above also grow with the investor, meeting their increasing needs with added features and functionality. And as they grow, they’ll get more comfortable with risk because they’ve seen it before through investing in a custodial account.

As a teen, stock trading allows you to keep score of your decisions with the possibility of feeling pain on the losses, but considerably less so because of the smaller investment account balance than an adult would have. By placing the proper guardrails on investing young, parents can teach teenagers valuable life lessons. Left unchecked and you’re showing kids how to gamble, not how to invest in a secure financial future.

That’s why we recommend the Fidelity Youth™ Account and it’s ability to keep parents directly involved with the investment decision-making.

- The Fidelity Youth™ Account is a free¹ account where teens can save, spend, and invest their own money.

- No monthly fees or account minimums to open.

- Your teen can learn to save and spend smarter with their own debit card, which features no domestic ATM fees.²

- Teens can invest in stocks for as little as $1 with fractional shares.³

- Parents can set up alerts and monitor their teen's account activity online, and through statements, trade confirmations, and debit card transactions.

- The Fidelity Youth™ app will have a dedicated Youth Learn tab to help jumpstart your teen's financial learning and build better money habits.

- No monthly account fees

- Investing feature

- Fractional shares

- Parental controls

- Comprehensive financial suite for teens

- Parent must be a Fidelity account holder

- Account balance doesn't accumulate interest

- No chore or allowance system

Terms and Conditions for Fidelity Youth™ Account