Aging has its benefits. Many people find that as they become older, they become wiser, more resilient, and have developed deeper relationships.

There are a few financial perks, too. Eventually, you can start collecting Social Security, make penalty-free withdrawals from your retirement accounts … and, over time, pick up a few tax benefits.

Some tax perks begin as young age 50, though some don’t kick in until you’ve reached your 70s. Regardless, you’ve worked hard for decades, so you deserve to start reaping some of the rewards once you get older.

Read on as we highlight several tax breaks that are specifically for older adults.

Featured Financial Products

Table of Contents

Age-Based Tax Benefits

Older adults can qualify for these tax advantages based just on their age—you don’t need to be below a certain income threshold or have a disability.

The age you become eligible for each of these tax benefits ranges from age 50 to 70 ½, so the older you are, the more money you could potentially save.

There is no reason to miss out on these benefits if you qualify.

1. Additional Standard Deduction

If you’re at least 65 years old, you automatically qualify for an additional standard deduction, which can be tacked right onto your regular standard deduction.

The additional standard deduction for the 2024 tax year is $1,550 per qualifying individual for married couples filing jointly, married taxpayers filing separately, and surviving spouses ($1,600 in 2025); that figure is $1,950 for single and head-of-household filers ($2,000 in 2025).

Also, if you are age 65 or older and blind, your additional standard deduction is doubled. Thus, your additional standard deduction for the 2024 tax year would be $3,100 per qualifying individual if your status is married filing jointly, married filing separately, or surviving spouse ($3,200 in 2025); and $3,900 if you filed as single or head of household ($4,000 in 2025).

Related: What is Your Standard Deduction?

2. Most States Don’t Tax Social Security Benefits

At the federal level, your Social Security benefits are generally taxable. This is true whether you receive retirement, survivor, or disability benefits from the Social Security Administration. However, you don’t have to pay federal income taxes on Social Security payments if your combined income is below a certain amount. (We cover all the pertinent details in our article discussing how Social Security benefits are taxed.)

The same isn’t always the case at the state level. In fact, 40 states do not tax Social Security benefits, and the needle is pointed in the right direction. That 40 includes two states—Missouri and Nebraska—that halted Social Security taxes in 2024. And one of the current 10 remaining states that do tax Social Security (West Virginia) passed a law that will phase out the tax by 2026.

So, if you’re planning a move in retirement, make sure to consult this list of states that tax Social Security benefits before you finalize your decision. While taxation of your Social Security benefits shouldn’t necessarily be the sole deciding factor, if you’re torn between two or more states as different retirement landing spots, this might help you lean one way or the other.

Related: Should You File Taxes Early? 9 Benefits of Filing Early

3. Free Tax Counseling and Filing Assistance

No matter your age, doing your taxes can be overwhelming. Roughly half (53%) of Americans say the complexity of the federal tax code “bothers them a lot,” according to a Pew Research Center survey.

Fortunately, individuals ages 60 and older can get free tax counseling and filing assistance through the Tax Counseling for the Elderly (TCE) grant program.

Qualified volunteers, who have taken and passed tax law training that meets or exceeds IRS standards, provide “efficient and quality tax assistance” year-round. They also provide tax return preparation assistance during the normal federal filing period (Jan. 1 through April 15) each year.

As an added layer of caution, every return prepared by TCE volunteers undergoes a quality review before it’s filed.

Related: How to Get Your Tax Refund Fast

4. Employer-Sponsored Retirement Plan Catch-Up Contributions

Employer-sponsored retirement plans are an excellent way to save for retirement. They sport tax advantages, and many employers also offer matching contributions (up to a certain percentage or dollar amount). There’s a limit to how much you can contribute in a given year, but if you are age 50 or older, you can make an additional $7,500 in annual “catch-up contributions” to the following plans:

— 401(k) (excluding a SIMPLE 401(k))

— 403(b)

— SARSEP

— Governmental 457(b)

The 2024 contribution limit for employees with a 401(k) or equivalent account is $23,000. The catch-up contribution amount for the year is an additional $7,500, for a total of $30,500. (Note: Elective deferrals aren’t treated as catch-up contributions until they exceed the contribution limit.)

Retirement plans can substantially grow your money over time, so in general, the closer you can get to maxing out one of these plans, the better.

Related: Is Your Retirement on Track? Here Are the Average 401(k) Balances By Age

Featured Financial Products

5. IRA Catch-Up Contributions

Individual retirement accounts (IRAs) and Roth IRAs benefit from a similar rule.

IRAs have a number of limitations. The straight-line 2024 and 2025 IRA contribution limits are $7,000, but individuals age 50 and older may make an additional $1,000 in IRA catch-up contributions, for a total of $8,000. Importantly, IRA contribution limits apply toward all IRAs you might have—in other words, you can’t contribute $7,000 to each of five different IRAs and/or Roth IRAs, but $7,000 across all five IRAs and/or Roth IRAs.

However, people also may only contribute up to their taxable income in a given year, so if you make less than the straight-line contribution limit (say, $5,000), you can only contribute up to what you made.

Also, if you have a Roth IRA, your income may also limit your ability to contribute.

You can contribute to a Roth IRA, up to the straight-line 2024 IRA contribution limit, if you are:

— Single, head of household, or married filing separately (but you didn’t live with your spouse at any time in 2024) with MAGI of less than $146,000

— Married filing jointly or qualifying surviving spouse with MAGI of less than $230,000

You can only make a partial contribution to a Roth IRA if you are:

— Single, head of household, or married filing separately (but you didn’t live with your spouse at any time in 2024) with MAGI of at least $146,000 but less than $161,000

— Married filing jointly or a qualifying surviving spouse with MAGI of at least $230,000 but less than $240,000

— Married filing separately with MAGI of less than $10,000

You can’t contribute to a Roth IRA if you are:

— Single, head of household, or married filing separately (but you didn’t live with your spouse at any time in 2024) with MAGI of $161,000 or more

— Married filing jointly or a qualifying surviving spouse with MAGI of $240,000 or more

— Married filing separately with MAGI of $10,000 or more

You can get more detail in our article on IRA contribution limits.

Related: IRS Erases $1 Billion In Back Tax Penalties

6. Health Savings Account Catch-Up Contributions

Health savings accounts (HSAs) are an incredible way to save for qualified health care expenses; however, some people actually use HSAs as supplemental retirement accounts.

HSAs have a lower contribution limit than a 401(k) or IRA. For 2024, the individual limit is $4,150 for individuals and $8,550 for people with family coverage. The 2025 contribution limits are $4,300 for individuals and $8,550 for family coverage.

The age when you become eligible for HSA catch-up contributions is different as well. Individuals can contribute an additional $1,000 annually in 2024, but beginning at age 55, not age 50 like with 401(k)s and IRAs.

Remember: Only people enrolled in eligible high-deductible health plans (HDHPs) can contribute to these accounts.

Related: The 10 Best Fidelity Funds to Own

Featured Financial Products

7. Qualified Charitable Distributions

This tax trick is for individuals who are at least 70½ years old.

If you are age 70½ or older, you can make a qualified charitable distribution (QCD)—also known as IRA charitable distribution or IRA charitable rollover—from your IRA to a charity, then exclude that amount from your gross income. The QCD limit for 2024 is $105,000 for individuals, or $105,000 for each spouse up to $210,000 for a married couple.

This break may help donors avoid reaching a higher income bracket, which in turn may prevent the phase-out of different tax deductions, such as personal exemption and itemized deductions.

QCDs have another advantage.

People with individual retirement accounts (IRAs) typically must take required minimum distributions (RMDs) beginning at age 72 (or 73 if you reach age 72 after Dec. 31, 2022). These RMDs increase an individual’s total taxable income. However, once you reach age 72 (or 73), QCDs can count against your RMDs for the year.

Just note that QCDs must be made directly from the IRA, whether that’s electronically, directly to the charity, or by check payable to the charity. Also, donations can be made only to certain qualified charitable organizations, which are defined in the tax code.

Related: Charitable Tax Deduction: What to Know Before Donating

8. 14 Days of Tax-Free Rental Income

If you’ve ever thought about renting out your residence for a very short period of time while you’re out of the house, you might not need to report the income on your tax return.

You can thank the residents of Augusta, Georgia, in the 1970s for this tax quirk.

Nicknamed “The Augusta Rule” on account of the people who own and rent out their homes near the Augusta National Golf Club during the annual Master’s Golf Tournament that’s held there, this special income exclusion lets you exclude any rental income that comes from renting your residence for two weeks or less. (However, be aware that if you use the rule to exclude income, you will not be able to deduct any associated rental property expenses.)

So, if you have short-term rental demand for your residence and a desire to have guests pay to use it, you might be able to tap into this tax loophole.

Technically, anyone can use this “rule.” However, older adults are more likely to both have a home as well as flexibility around when they’re able to temporarily leave the home and rent it out.

Related: Retired But Too Young for Medicare? Health Insurance for Early Retirees

Featured Financial Products

Related: 11 Ways To Avoid Paying Taxes on Your Social Security

If you’re looking to minimize the tax bite taken out of your Social Security benefits in retirement, you’ve got several available actions to reduce how much you pay each year. We outline several ways to avoid paying taxes on your Social Security benefits.

Related: How Are Social Security Benefits Taxed?

In many cases, Social Security benefits are subject to federal taxation. To learn how your Social Security benefits are taxed, we’ve got an entire guide to walk you through the calculation.

Related: 10 States That Tax Social Security Benefits

While most states don’t subject Social Security benefits to taxation, at least 10 states do tax Social Security. To see if you live in one of them, or you’re considering a relocation for retirement and taxation of your Social Security is a sticking point, we’ve got you covered with all of the details.

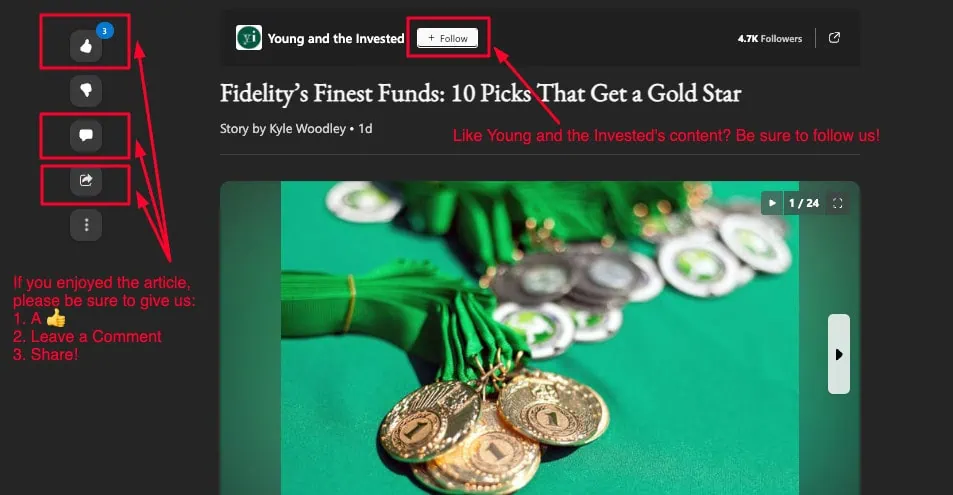

Please Don’t Forget to Like, Follow and Comment

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Subscribe to The Weekend Tea, our weekly newsletter to read more about investing, spending, taxes, and more, and

3. Give the article a Thumbs Up on the top-left side of the screen.

4. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!