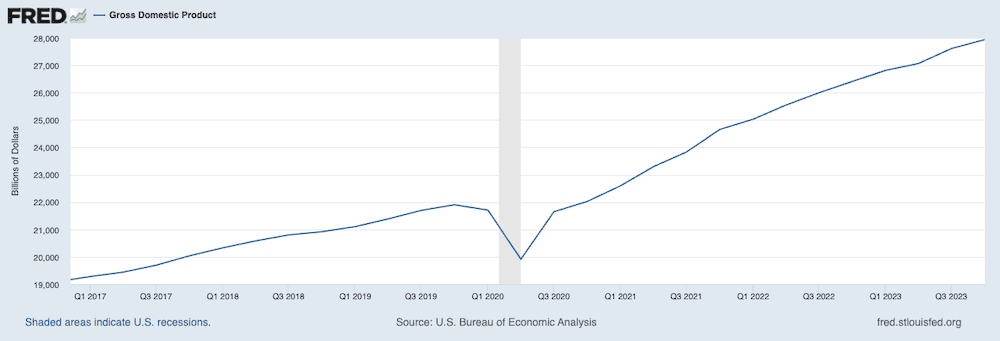

The 2023 recession that many economists considered a foregone conclusion officially never landed, as the Commerce Department confirmed Thursday that the U.S. economy roared ahead in both the final three months of 2023 and across the full year.

The Department of Commerce said Thursday that gross domestic product (GDP), factoring in both seasonality and inflation, climbed at a 3.3% annualized pace during the final three months of 2023. While slower than Q3’s 4.9% annualized growth, it was far better than the 2.0% GDP growth estimate provided by Dow Jones-surveyed economists.

The strong fourth quarter meant U.S. GDP not only improved during 2023, but actually accelerated compared to 2022. For full-year 2023, U.S. GDP expanded by a 2.5% annualized pace, which was quicker than 2022’s 1.9% and a far cry from early-year prognostications that the economy would contract.

The Best ETFs to Buy for a Prosperous 2024

Among the biggest contributors to Q4’s GDP growth were goods such as pharmaceutical products and computer software, and services such as health care, as well as food services and accommodations. State and local government spending was another significant driver.

The personal consumption expenditures (PCE) price index climbed by 2.7% annualized during the fourth quarter, which was slower than Q4 2022’s 5.9%. The “core” PCE price index (excluding food and energy) grew by 3.2% annualized, off from 5.1% in the year-ago quarter.

“Consumers are recovering from the painful shock of inflation,” says David Russell, Global Head of Market Strategy at TradeStation. “Today’s report seems to confirm December’s big improvement in sentiment as Americans start to reap the benefits of tight monetary policy. Jerome Powell can give himself a pat on the back as Goldilocks takes over. Things may get only better from here for the U.S. economy.”

5 Best Vanguard Retirement Funds [Start Saving in 2024]

Naturally, though, experts are looking ahead to whether the economy’s robust growth can continue.

“Consumer spending, as is normally the case, was a large component of the growth with personal consumption rising 2.8%; however, for the second quarter in a row, consumers grew their spending at a rate faster than their income growth,” says Mike Reynolds, Vice President of Investment Strategy at Glenmede. “In aggregate, it appears consumers continue to be increasingly willing to tap their savings streams or borrow more to support spending levels. This is likely unsustainable as savings and lending are finite and should not be able to prop up the consumer in perpetuity.”