Who is the greatest president of all time?

Much like any “GOAT” (greatest of all time) conversation, it depends on who you’re asking and what measurements you’re using. Economic prosperity? Geographic expansion? Noteworthy legislation passed during their term?

In modern times, many people like to chalk up a president’s success (at least in part) to how the stock market is performing. Some consider positive stock performance to be a proxy of sorts for economic growth—not to mention fatter 401(k)s mean better financial security for anyone saving for retirement. Declines in the stock market, meanwhile, don’t just mean smaller investment account balances—they might accompany a period of slower economic growth (or even contraction), higher unemployment, and less financial stability for Americans.

We obviously can’t measure every president based on stock market performance—major exchanges as we know them didn’t come about until the 1790s, and modern stock indexes still used today, like the Dow Jones Transportation Average (DJTA) and the Dow Jones Industrial Average (DJIA), didn’t come about until the 1880s.

But for a little more than half of America’s history, covering roughly two dozen presidents, we can get a good idea of how the stock markets have fared under our country’s leaders. So let’s see which commanders-in-chief stand out!

Table of Contents

Methodology

First, let’s lay the ground rules.

We’re ranking every president since William McKinley, who was the first president to have a term begin after the creation of the Dow Jones Industrial Average. Stock market performance under Presidents McKinley through Calvin Coolidge is calculated using the Dow. Starting with former President Herbert Hoover, performance is based on the returns of the S&P 500 or its precursor indexes, which have all included hundreds of companies, versus the Dow’s mere 30 members.

Returns are based on price performance only—dividends are not included in these calculations. Changes in tax treatment have made dividend programs more attractive to publicly traded companies in more recent times. Returns data also is not adjusted for inflation, which will admittedly favor presidents that presided over periods of higher inflation.

A Final Note Before We Get Started

This is all in the spirit of fun, entertainment, and education. Presidents aren’t the only variable determining the fate of publicly traded companies—oftentimes, they’re not even the greatest variable, and on rare occasions, they have very little impact. Congress, other domestic economic forces, international politics, global economics, technological innovation, and even dumb luck have plenty to say about how the stock market moves.

23. Herbert Hoover

- Party: Republican

- Time in office: March 4, 1929-March 4, 1933

- Average annual market return: -30.8%

Poor Mr. Hoover.

Somebody had to be in office during the Great Depression, and that someone was Mr. Hoover—the 31st president of the United States, and the man with the ignominy of presiding over the worst stock market crash in American history.

Myriad factors helped contribute to the Great Depression—the end of a boom in postwar building, bank speculation in stocks, a glut of consumer goods that demand simply couldn’t keep up with. But Hoover exacerbated the depression, signing the Smoot-Hawley Tariff Act that raised already high tariffs and triggered retaliatory measures by Canada and other nations, drying up international trade.

At its lows, the bear market devoured nearly 90% of stocks’ value under Hoover’s watch.

Related: 7 Best High-Dividend ETFs for Income-Hungry Investors

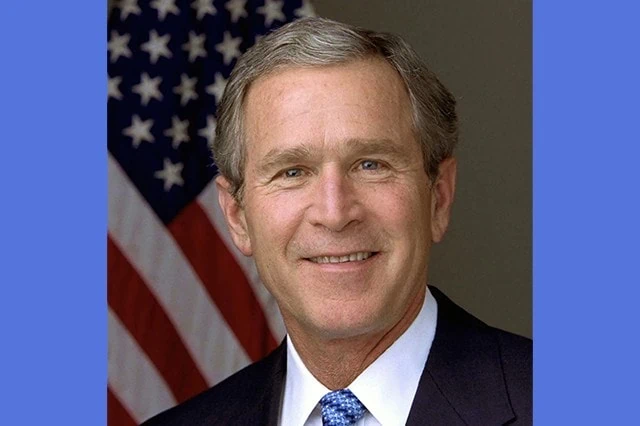

22. George W. Bush

- Party: Republican

- Time in office: Jan. 20, 2001-Jan. 20, 2009

- Average annual market return: -5.6%

No other president has come remotely close to Hoover’s wretched stock market performance, but the silver sombrero belongs to George W. Bush, who served during much of the dot-com bubble burst; the Sept. 11, 2001, terrorist attacks; and the start of the Great Recession.

Among the blame that can be placed on Bush’s shoulders? Extreme federal deficits, the costly war in Iraq, and broad deregulation that in part helped stoke the Great Financial Crisis (GFC) in 2007.

To be fair, the Bush tax cuts, as well as the aforementioned regulatory changes, helped stocks recover to the point that they briefly reclaimed their dot-com peak in 2007. Unfortunately, Bush was in office for not one but two of America’s most notorious bear markets. The GFC and Great Recession soon followed, putting stocks into the ground and putting Bush near the Wall Street caboose.

Related: The 7 Best Gold ETFs You Can Buy

21. Richard Nixon

- Party: Republican

- Time in office: Jan. 20, 1969-Aug. 9, 1974

- Average annual market return: -3.9%

If you put on horse blinders for a moment, you could make a case that “Tricky Dick” wasn’t all that bad. He helped usher in the Environmental Protection Agency and the Consumer Product Safety Commission, and helped open international relations in various parts of Asia.

But those accomplishments hardly make up for the catastrophes that earned him his ill repute: most notably, his administration’s break-in of the Democratic National Committee headquarters (and subsequent cover-up), aka Watergate.

Less ballyhooed but more pertinent to this discussion are the stock market’s losses during his tenure—which actually were worse than they seem given high inflation during his term.

Nixon contributed to that inflation by closing the “gold window,” which had allowed the U.S. dollar to be directly convertible into gold. Doing so effectively killed the Bretton Woods system—an international currency system that followed the end of the gold standard and had ushered in a couple decades of economic expansion. The resulting inflation led to the 1973-74 stock market crash and bear market.

Related: Enough With Deceptive Drip Pricing: How You’re Being Tricked + How to Stop It

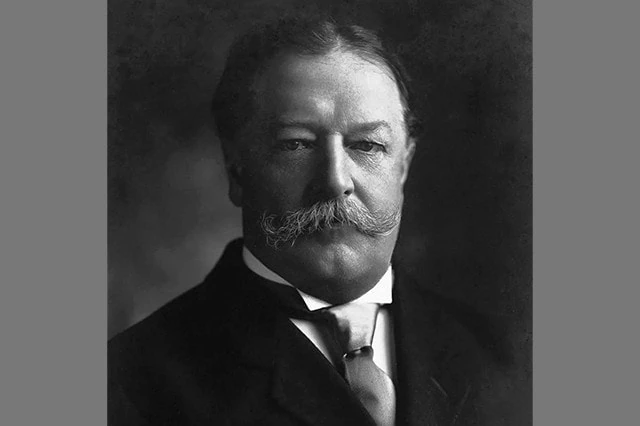

20. William Howard Taft

- Party: Republican

- Time in office: March 4, 1909-March 4, 1913

- Average annual market return: -0.1%

William Howard Taft is best known among Americans for his weight, and for the fact that he also later served as a Supreme Court justice—which tells you something about how unremarkable the rest of his one-term presidency was.

So it’s no surprise that he left virtually no mark on the stock market, which, much like his waistline, hardly budged by the time he exited office.

Still, Taft did leave behind one lasting legacy: the 16th Amendment, which laid the groundwork for our current federal income tax.

Make sure you sign up for The Weekend Tea, WealthUp’s free weekly newsletter that over 10k monthly readers use to level up their money know-how.

Related: The 11 Best Fidelity Funds You Can Own

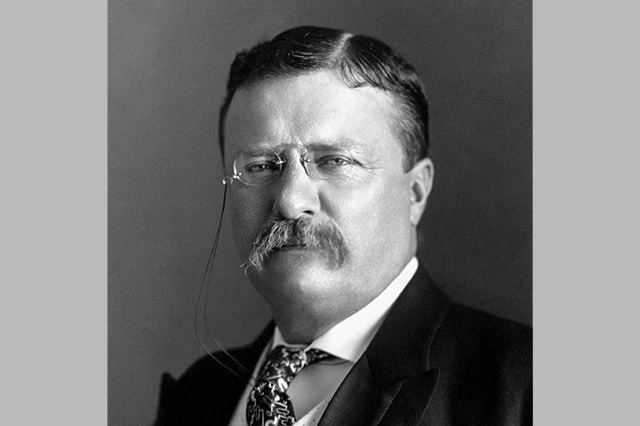

19. Theodore Roosevelt

- Party: Republican

- Time in office: Sept. 14, 1901-March 4, 1909

- Average annual market return: 2.2%

Theodore “Teddy” Roosevelt first entered the White House not with his own election as president, but following the assassination of President William McKinley.

A bold, boastful, and blustery man, Roosevelt was one of America’s most vivid presidents—and quite accomplished, too. He won the Nobel Peace Prize for helping to end the Russo-Japanese War; expanded America’s role in international politics; improved consumer protections by helping bring about several regulatory agencies overseeing railways, food, and drugs; and was one of the nation’s greatest champions for natural conservation, establishing protection for hundreds of millions of acres of public land and creating the Forest Service.

But while Teddy merited inclusion on the actual Mount Rushmore, any thought that he belongs on the Mount Rushmore of stock-friendly presidents is pure “bullfeathers!” He was a renowned “trust buster,” breaking up monopolies in the sugar and rail industries, among many others. This stance in part contributed to very modest stock market returns—just a hair over 2% annually—during his eight-plus years in office.

Related: Stop Shrinkflation! Products Affected + Tips to Save Money

18. Woodrow Wilson

- Party: Democrat

- Time in office: March 4, 1913-March 4, 1921

- Average annual market return: 3.1%

While Taft might have set up the current federal income tax by championing the 16th Amendment, President Woodrow Wilson punched it into the endzone.

Woodrow Wilson, who served during World War I, signed into law the Revenue Act of 1913, which greatly reduced tariffs while establishing both a 1% tax on anyone earning more than $3,000 per year (at the time, just 3% of the population) and a 1% corporate tax. He also presided over a massive expansion in both duties and importance of the Internal Revenue Service, and oversaw the creation of the Federal Reserve System—which, for all its criticisms, improved stability within the country’s banking system.

Wilson also backed anti-competitive practices, helping to establish the Federal Trade Commission and enhancing antitrust laws via the Clayton Antitrust Act of 1914.

His overall impact on the stock market was more muted. Wilson exited his second term with a light average return for stocks of about 3% annually.

Related: 9 Best Fidelity Index Funds to Buy for 2026

17. Franklin Delano Roosevelt

- Party: Democrat

- Time in office: March 4, 1933-April 12, 1945

- Average annual market return: 6.2%

Franklin Delano Roosevelt is one of the most influential presidents in our nation’s history.

That’s in part because he had so much time to work with—he was elected to a total of four terms, though he died in office, cutting his service “short” at just more than 12 years. That’s also in part because he steered America through World War II.

Roosevelt inherited an economy wracked by the Great Depression, which he responded to with the First and Second New Deals. This series of programs include the creation of Social Security, union protections, banking reform, work relief, the United States Housing Authority, and the Farm Security Administration.

While many of his policies helped improve unemployment and economic activity, critics argue that his heavy regulatory reforms also greatly expanded the federal government’s reach and might have blunted the economy’s recovery.

Indeed, the average annual market return was more than 6% during FDR’s tenure—but that feels modest considering his presidency started with stocks in the toilet.

Related: 11 Best Vanguard Funds for the Everyday Investor

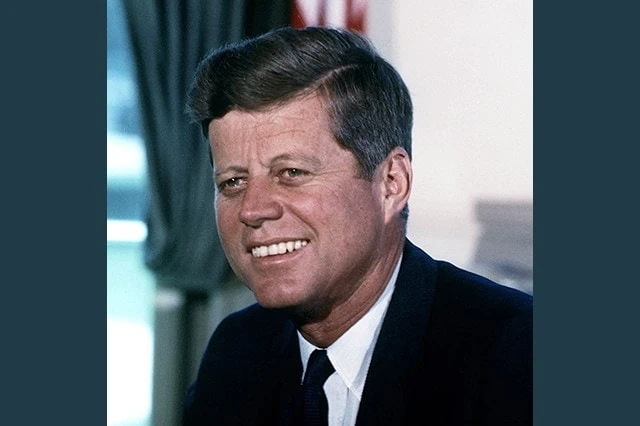

16. John F. Kennedy

- Party: Democrat

- Time in office: Jan. 20, 1961-Nov. 22, 1963

- Average annual market return: 6.5%

John F. Kennedy, who served less than a full term before he was assassinated, is remembered for a great many things, including navigating the Cuban Missile Crisis, turning America into a global leader in space exploration, and proposing the Civil Rights Act of 1964, which failed during his tenure but was pushed into law by President Lyndon B. Johnson.

Another policy that Kennedy championed but that ultimately didn’t pass until after his death was tax reform. Kennedy proposed, among other things, that the U.S. lower the top marginal tax rate from 91% to 65%, and the corporate tax rate from 52% to 47%. He believed these tax cuts would ultimately increase federal revenues by spurring economic growth. Congress blocked the bill initially, but a revised version—the Revenue Act of 1964—was passed by Congress and signed into law by Johnson.

Overall, Kennedy appeared to have minimal impact on the stock market. Still, stocks enjoyed average annual gains of more than 6% while he was in office.

Related: 9 Best Schwab Funds You Can Buy: Low Fees, Low Minimums

15. Jimmy Carter

- Party: Democrat

- Time in office: Jan. 20, 1977-Jan. 20, 1981

- Average annual market return: 6.9%

President Jimmy Carter wasn’t given much to work with when he entered the Oval Office—the U.S. was suffering from both slow economic growth and high inflation (aka “stagflation”).

He primarily attacked the former via the $19 billion tax cut laid out in the Revenue Act of 1978. At first, he largely leaned on the Council on Wage and Price Stability (COWPS) to address the latter, though he eventually helmed the Federal Reserve Board with Paul Volcker, who used tight monetary policy to rein in inflation … but at the cost of an additional headwind on economic growth. Indeed, the U.S. fell into recession under Carter, and it wouldn’t emerge until after Carter had left office.

Despite miserable circumstances, the stock market gained nearly 7% annually while Carter was in office.

Related: 7 Best Schwab Index Funds for Thrifty Investors

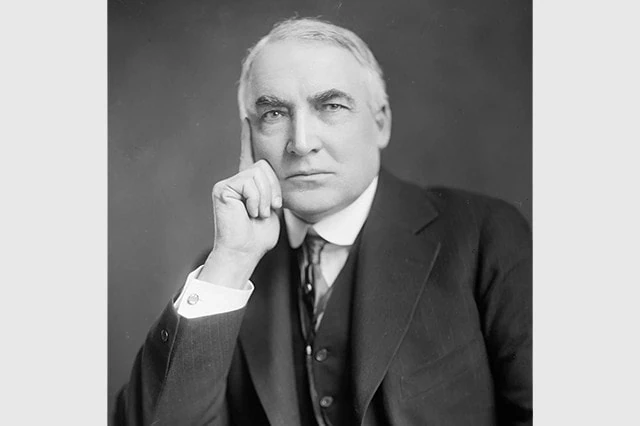

14. Warren G. Harding

- Party: Republican

- Time in office: March 4, 1921-Aug. 2, 1923

- Average annual market return: 6.9%

Warren G. Harding’s stock market performance was historically middling—which, given how the rest of his presidency went, rates among his greatest accomplishments.

Harding only spent a little more than two years in office, with his term cut short by a heart attack that put Calvin Coolidge into the White House. But he did manage to push through a round of tax cuts and deregulation that started to pave the way for the “Roaring Twenties” growth Coolidge would enjoy while in office. But while stock market returns were nowhere near as robust as they were under his successor, Harding still enjoyed nearly 7% annual market growth.

Unfortunately for Harding, that’s not what defined his legacy after death. While he was initially mourned across the world, a number of scandals were revealed after his passing that fundamentally soured public opinion of the 29th president.

Most notable was the Teapot Dome scandal, in which his Secretary of the Interior, Albert Bacon Fall, leased oil production rights at Wyoming’s Teapot Dome Oil Field without competitive bidding—which, while legal, induced illegal gifts from oil companies that would be worth millions of dollars today. While Harding wasn’t directly involved, he suffered a hit to his reputation—a reputation that was further sullied by revelations of his extramarital affairs and claims of support payments to a child born out of wedlock.

Related: The 10 Best Vanguard Index Funds to Buy in 2026

13. Lyndon B. Johnson

- Party: Democrat

- Time in office: Nov. 22, 1963-Jan. 20, 1969

- Average annual market return: 7.7%

Lyndon B. Johnson left behind a mixed legacy.

On the one hand, he expanded America’s role in the Vietnam War and oversaw a period of extreme social unrest—which ultimately weighed on his popularity and led to Johnson declining to run for office again after his first full term.

However, he made great strides domestically, including a renewed push to pass the Civil Rights Act of 1964, passage of the Voting Rights Act, major immigration reform, bills bolstering federal spending on education, laying the groundwork for Public Broadcasting Service (PBS) and National Public Radio (NPR), and the creation of Medicare and Medicaid.

From a stock-market perspective, investors did just fine; stocks grew by a little less than 8% per year on average. But at least in part because of the escalating costs of the Vietnam War, inflation accelerated from low single digits to high single digits by the end of Johnson’s presidency—a weight that would burden several more presidents.

Make sure you sign up for The Weekend Tea, WealthUp’s free weekly newsletter that over 10k monthly readers use to level up their money know-how.

Related: 7 Best T. Rowe Price Funds to Buy for 2026

12. Harry Truman

- Party: Democrat

- Time in office: April 12, 1945-Jan. 20, 1953

- Average annual market return: 8.1%

Truman ascended to the presidency upon the death of Franklin D. Roosevelt. Within a year, he would preside over the Nazis’ surrender, authorize the only recorded use of nuclear weapons in a war—on Hiroshima and Nagasaki—and accept the surrender of the Japanese, ending World War II.

Truman’s economic road was hardly an easy one. He had to navigate the transition into a postwar economy, which included a massive drawdown of military spending, as well as a massive railroad strike that prompted him to call for a law that would see railroad strikers drafted into the military (the bill never became law). And across both his terms, he battled a largely unaccommodating Congress that let few of his initiatives see the light of day.

Regardless, in Truman’s later years, the great rebuilding that followed World War II finally put the U.S. economy into high gear.

Shareholders generally did well, enjoying 8.1% annual price gains on average.

Related: The Best Retirement Plans [Workplace + Personal]

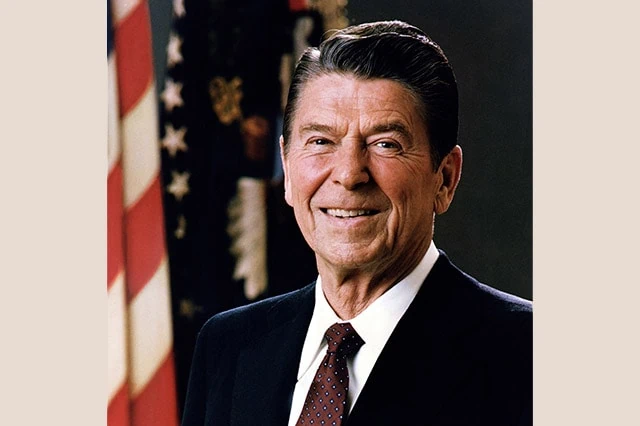

11. Ronald Reagan

- Party: Republican

- Time in office: Jan. 20, 1981-Jan. 20, 1989

- Average annual market return: 10.2%

Ronald Reagan began his first term with a brutal recession brought on by the tight monetary policy of his predecessor’s Fed chair, Paul Volcker. But “Reaganomics” sparked a wild recovery that helped put the 40th president among the top half of U.S. leaders by stock-market performance.

While Reagan made a name for himself as California’s governor by cutting spending and raising taxes to generate a surplus in the state’s budget, he turned tail on half of that formula once he ascended to the presidency. To battle the country’s general malaise, he passed the Economic Recovery Tax Act of 1981, which sharply reduced federal income tax rates. That resulted in spiking national debt, which in turn caused Reagan to raise taxes 11 times across the rest of his time in office.

Even then, Americans’ taxes remained lower at Reagan’s exit than when he was inaugurated. That, as well as a period of business deregulation, produced phenomenal 3.6% average annual growth in GDP during the Reagan presidency. Stocks shared in that prosperity, delivering 10%-plus annualized returns in that time.

Related: The Best Dividend Stocks to Buy

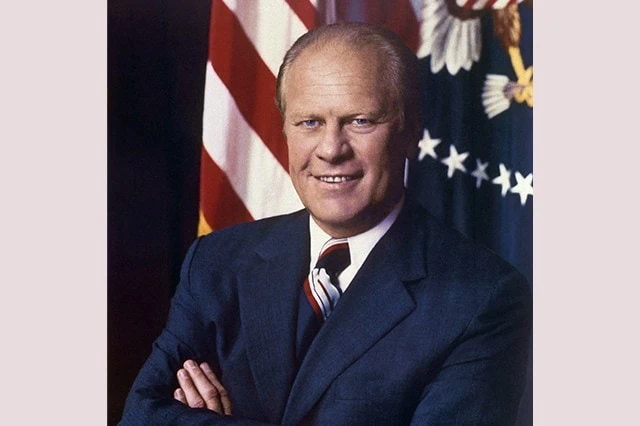

10. Gerald Ford

- Party: Republican

- Time in office: Aug. 9, 1974-Jan. 20, 1977

- Average annual market return: 10.8%

Gerald Ford only served one partial term after assuming the role left open by Richard Nixon’s resignation … and that was after he became vice president thanks to Spiro Agnew’s own departure from office.

Ford inherited a lousy economy that only got worse during his term. He attempted to battle inflation with a one-year, 5% income tax increase on the wealthy and on corporations; but a year after, in response to sky-high unemployment, he tried to stimulate the economy with a one-year, $22.8 billion tax cut. The economy ran a deficit in each year that Ford served.

And yet, annual stock returns on average hit nearly 11% under Ford. Like with a few of the presidents on this list, you can thank fortuitous timing. Specifically, the 1973-74 bear market bottomed just a few months after Ford’s inauguration, providing an easy jumping-off point off which stocks rebounded despite the ongoing economic turmoil.

9. Dwight D. Eisenhower

- Party: Republican

- Time in office: Jan. 20, 1953-Jan. 20, 1961

- Average annual market return: 10.9%

Dwight D. Eisenhower was the Supreme Commander of the Allied Expeditionary Force in World War II, and both planned and carried out Operation Overlord (the Battle of Normandy). He beat back McCarthyism, signed the Civil Rights Act of 1957, established NASA, and both pushed for and signed into law the bill that established the Interstate Highway System.

In addition to these and many other accomplishments, “Ike” also oversaw one of the most prosperous periods in American history that included stellar returns (nearly 11% annually on average) for the S&P 500.

Eisenhower had the good fortune of leading postwar America, which had become the world’s foremost superpower in virtually every measure—including economically. Interestingly, while domestic spending rose considerably during his watch, federal spending as a percentage of GDP actually declined by about 2 percentage points.

8. George H.W. Bush

- Party: Republican

- Time in office: Jan. 20, 1989-Jan. 20, 1993

- Average annual market return: 11.0%

Stock-market performance clearly isn’t the only issue voters care about, or George H.W. Bush would have served two terms—and the younger George Bush would’ve been limited to just one.

Bush was a consequential president that brought the North American Free Trade Agreement (NAFTA) to life; signed the Immigration Act, Americans With Disabilities Act, and Clean Air Act Amendments; invaded Panama; and repelled Saddam Hussein’s Iraqi invasion of Kuwait (the Gulf War).

He also presided over the end of the Cold War—which saw the collapse of the Soviet Union, but also led to his exit from Washington. A resultant drop in defense spending triggered a deep recession that lasted eight months between 1990 and 1991, which ultimately sealed his fate: a 1992 election loss to Bill Clinton.

The stock market, on the other hand, was only temporarily fazed, reclaiming old highs by early 1991 and rising steadily through the end of Bush Sr.’s tenure.

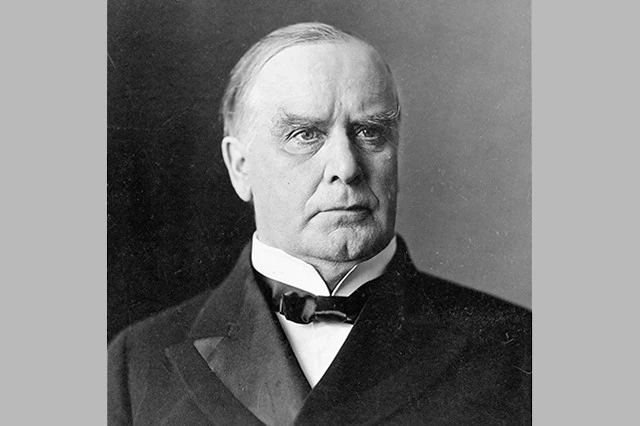

7. William McKinley

- Party: Republican

- Time in office: March 4, 1897-Sept. 14, 1901

- Average annual market return: 11.3%

Charles Dow brought his Dow Jones Industrial Average to life in 1896 as a snug index of just 12 component companies. A year later, William McKinley entered office—great news for the DJIA, which enjoyed some of its greatest historical gains under our 25th president.

Admittedly, McKinley had some help from lady luck. He entered office during the final throes of a depression (the Panic of 1893), so the path of least resistance from the market was up. He was also a strong proponent of protective tariffs—a position that historically has weighed on stock market returns.

McKinley’s greatest exploits were on the international front. During his presidency, the U.S. went to war with Spain—a war it won within months, leading to American control of the Philippines, Puerto Rico, and Guam, and independence for Cuba. McKinley also sent thousands of troops to China to help Europeans during the Boxer Rebellion, and laid the groundwork for the eventual building of the Panama Canal, which Teddy Roosevelt oversaw.

McKinley was assassinated during the first year of his second term. But across four-plus years under his watch, the stock market delivered an average annual gain of more than 11%.

Make sure you sign up for The Weekend Tea, WealthUp’s free weekly newsletter that over 10k monthly readers use to level up their money know-how.

6. Joe Biden

- Party: Democrat

- Time in office: Jan. 20, 2021-Jan. 20, 2025

- Average annual market return: 12.1%

As my colleague Charles Sizemore has pointed out in the past: Former President Joe Biden delivered one of the strongest first-100-days returns in the history of the presidency.

A lot of things have changed dramatically since then, but in both directions—resulting in one of the strongest four-year stints in the history of the presidency.

Biden’s first year was marked by fairly high inflation in housing, gas, and most other major categories. That’s because the nation was recovering from COVID-19’s disastrous effects with stimulus checks in hand and low interest rates on the table. But another factor driving up inflation was COVID-caused global supply-chain disruptions—disruptions that only got worse with the early 2022 Russian invasion of Ukraine. Punitive bans on Russian oil sent energy prices skyward, further compounding the problem.

Inflation ended up accelerating to north of 9% by mid-2022.

The Federal Reserve set out to beat back rocketing prices through a persistent series of interest-rate hikes—from effectively zero at the start of 2022 to a range of 5.25%-5.50% today. For about a year, that weighed heavily on most of the stock market, but especially tech stocks, which have long relied on cheap debt to help finance R&D and make up an outsized portion of the S&P 500.

But as they say, “no pain, no gain.” Inflation has thinned back down to around 2.5%. That, combined with spending from President Biden’s $1 trillion infrastructure bill, resulted in boisterous economic growth and low unemployment. Stocks responded in kind and entered a fresh bull market that kept roaring until the end of his first and only term.

It was a stock-market roller-coaster ride, but a ride well worth taking, as it resulted in a 12%-plus annual price return for the S&P 500.

Related: 7 Best High-Yield Dividend Stocks: The Pros’ Picks for 2026

5. Barack Obama

- Party: Democrat

- Time in office: Jan. 20, 2009-Jan. 20, 2017

- Average annual market return: 13.0%

Democrats might be stereotyped as not being particularly business-friendly—indeed, President Barack Obama oversaw a great deal of regulation across his two terms. Regardless, the Mount Rushmore of stock-market returns is split 50/50 between Democrats and Republicans, and that starts with Obama.

Obama entered office in the midst of the Great Recession. What started with the bursting of a housing bubble quickly bled into investment banks and even commercial banks. Huge cracks formed across the U.S. economy, perhaps most notably among the “Big Three” automakers: Ford (F), General Motors (GM), and Chrysler.

That said, Obama oversaw the American Recovery and Reinvestment Act of 2009—a $787 billion stimulus package that included tax breaks, federal spending, and direct assistance. His administration also provided loans to automakers to get them through the recession, and created a program to buy depreciated real estate assets.

But along with these initiatives came a host of regulations to prevent a repeat of the mistakes that led to the Great Recession and GFC, including the Dodd–Frank Wall Street Reform and Consumer Protection Act.

Like with McKinley, Obama’s outsized stock market returns can partially be chalked up to great timing—he did, after all, become president near the market bottom. Still, Obama proved to be the economic steward that the moment demanded, earning a good portion of the market’s 180%-plus cumulative returns across his eight years in office.

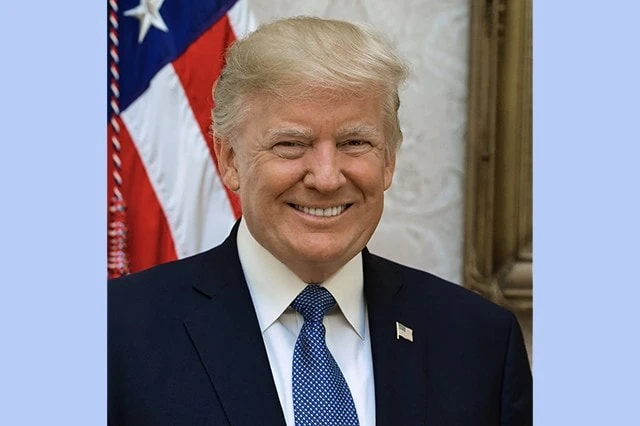

4. Donald Trump (1st Term)

- Party: Republican

- Time in office: Jan. 20, 2017-Jan. 20, 2021

- Average annual market return: 13.8%

The stock market under President Donald Trump ‘s first term was as turbulent as his presidency … but “the Donald,” who was hyper-focused on the market’s performance throughout his years in office, managed to exit that stint with the third-best return average for any president ever.

Trump kicked off an initial burst in both stocks and economic activity with the Tax Cuts and Jobs Act of 2017, which lowered personal tax rates across numerous income levels, increased the standard deduction, drastically reduced the corporate tax rate, and altered other parts of the tax code in mostly business-beneficial ways. However, Trump’s increasingly aggressive tariffs and warring with the Fed were among contributors to a near-bear market in 2018.

Markets rallied again to new highs all the way until February 2020, when COVID threw the world’s economies and markets into a rapid tailspin. The cure, as we all remember, was a flood of governmental spending in the form of stimulus checks, business loans, and other initiatives meant to keep the U.S. economy from completely sinking. Americans didn’t just spend on necessities, however—many put their stimulus checks to work buying the massive market dip, resulting in a lightning-quick rebound that saw stocks claim new highs within half a year. In all, the S&P 500 improved by an average of nearly 14% annually under Trump.

Though admittedly, that performance also included a wild rally after the 2020 elections.

3. Donald Trump (2nd Term)

— Party: Republican

— Time in office: Jan. 20, 2025-present

— Market return: 15.2%*

Will the president outdo his first four years in terms of stock-market success?

So far, he’s on pace … and that’s despite triggering a stock-market decline that missed bear market status by a hair.

Trump’s first 100 days were pockmarked by a deep correction; and unlike the COVID pandemic (which was thrust upon Trump), he only had himself to blame. Trump’s chaotic tariff announcements sent the market into a tailspin, and by April, the S&P 500 came within a little more than a percent of becoming an official bull market (a drop of at least 20% from a peak).

Since then, the tariff landscape has been extremely hazy; “deals” have been announced with a few countries, though those deals still involve some level of tariffs that is greater than when Trump came into office. Trump has also announced item-specific tariffs, though he has since rolled some of those back, too. Recession worries have also come to the fore amid a number of weakening economic metrics, the data for which was temporarily rocked by a long federal government closure.

And yet.

A combination of less-bad-than-expected outcomes of tariff policy, as well as a massive bull market in technology and communication services stocks—particularly those connected to artificial intelligence (AI)—has driven well-above-average gains for Trump as he nears the end of the first year of his second term.

* Returns aren’t annualized until the president has served a full year.

Related: The 10 Best ETFs to Beat Back a Bear Market

2. Bill Clinton

- Party: Democrat

- Time in office: Jan. 20, 1993-Jan. 20, 2001

- Average annual market return: 15.2%

President Bill Clinton resided at 1600 Pennsylvania Ave. NW during one of America’s greatest bull markets: the dot-com bubble boom.

To be fair, Clinton also served during the start of the dot-com bubble burst … but the gains during his entire presidency were so great, he still managed to earn the silver medal of presidential stock-market performance.

Clinton helped pass a wide swath of reforms and generally oversaw one of the healthiest periods for the U.S. economy. He reduced both defense spending and welfare, while raising taxes on high-income taxpayers, leading to a rare few years of surpluses for the federal budget. He reduced taxes on small businesses, and raised the tax deduction for self-employed business owners to 80%, from 30% previously. He helped reduce interest rates on student loans and expanded the Pell Grant program. He even signed into law the bill that established Roth IRAs.

The result was roughly 4% average annual growth in GDP and record job creation.

During this time, American technology companies came into their own, not just fueling wild growth in the stock markets—the S&P 500 rocketed 210% higher across Clinton’s eight years in office—but changing the face of the U.S. economy.

Related: Best Self-Employed Retirement Plans

1. Calvin Coolidge

- Party: Republican

- Time in office: Aug. 2, 1923-March 4, 1929

- Average annual market return: 26.1%

Topping this list by a wide margin is Calvin Coolidge—an extraordinarily business-friendly president who granted U.S. citizenship to Native Americans and supported racial equality.

He also enjoyed the good fortune of not reaping some of what he sowed.

Coolidge, who entered office upon the death of President Harding, presided over the “Roaring Twenties.” He oversaw reductions in both the top marginal tax rate and all personal income taxes (including the elimination of any income taxation whatsoever for roughly 2 million Americans). And in general, he had a hands-off approach toward business—the heads of his regulatory agencies rarely bared their teeth.

This approach was fantastic for the stock market, as the Dow Jones Industrial Average powered ahead by a whopping 266% while Coolidge occupied the White House.

But over time, cracks emerged—he opted against providing federal aid to struggling agricultural businesses, which in turn wreaked havoc on thousands of banks. And easy credit led Americans to purchase their way into deeper and deeper debt.

His views toward small government are summed up nicely here: “The most free, progressive and satisfactory method ever devised for the equitable distribution of property is to permit the people to care for themselves by conducting their own business. They have more wisdom than any government.”

Of course, Coolidge said that in 1931—two years into the Great Depression, which started months after his exit from office.