The Vanguard Total Stock Market ETF (VTI) and the SPDR S&P 500 ETF (SPY) are two of the largest and oldest U.S. stock exchange-traded funds (ETFs) on the market. Combined, these two funds represent more than $1 trillion in investor assets.

But if you had to pick one—that is, if you had to pick VTI or SPY—which should you choose?

VTI and SPY belong to the same investment category, they have similar dividend yields, turnover, and they even share the same top holdings. But while there’s an enormous amount of overlap between these two broad-market ETFs, they have enough differences to make the question a lot more complicated than you might expect.

Let’s look at VTI vs. SPY. I’ll explore the funds’ similarities and differences, their top holdings, their expenses, their dividends, and more. And by the end, you should be able to make a much more educated decision about which (if either) belong in your portfolio.

Disclaimer: This article does not constitute individualized investment advice. These funds appear for your consideration and not as investment recommendations. Act at your own discretion.

Table of Contents

Featured Financial Products

What Is VTI?

Track all markets on TradingView

The Vanguard Total Stock Market ETF (VTI) is the ETF share class of Vanguard Total Stock Market Fund (VTSAX). It was launched on May 24, 2001, and as the name suggests, it’s a “total stock market” fund. In short, it aims to own most or all of the stocks in a country’s stock market—in this case, America’s. To do this, it tracks the performance of the CRSP US Total Market Index, which represents “approximately 100% of the investable U.S. stock market.”

I know “100%” sure sounds like every stock, but it’s not. The index requires certain thresholds for market capitalization, liquidity, and other metrics, and it excludes thousands of U.S.-listed stocks that don’t meet those threshold.

However, given that VTI still holds more than 3,500 stocks, and that most of the stocks that don’t make the cut are extremely small and/or trade very few shares in a given day … pragmatically, VTI covers as much of the stock market as you’d ever really need to own.

Market capitalization (or market cap), by the way, refers to a company’s size as measured by the stock market. Market cap is calculated by taking all the company’s shares outstanding and multiplying that number times the stock price. And VTI includes stocks of all sizes: large caps ($10 billion or more), mid-caps ($2 billion to $10 billion), small caps ($300 million to $2 billion), micro-caps ($50 million to $300 million), and even nano-caps (less than $50 million).

It’s also a “domestic large blend” fund, which means several things:

- Domestic: It holds U.S.-listed stocks.

- Large: While it holds stocks of all sizes, most of its assets are in larger companies.

- Blend: It holds both value stocks and growth stocks.

Why are most of VTI’s assets invested in large-cap companies? Because it’s “weighted” by market cap, which means the larger the company, the more fund assets are invested in that company, and thus the larger the effect that company’s performance has on the fund performance.

(Note: If you’re looking to access this strategy within a 401(k) plan, you can’t do it with VTI. But you can with the mutual fund version, VTSAX, which is commonly found in workplace retirement accounts.)

Related: VTSAX vs VFIAX

What Is SPY?

Track all markets on TradingView

The SPDR S&P 500 ETF Trust (SPY) is an ETF that tracks the S&P 500, one of the best-known stock market indexes in the world. If you ask someone how “the market” performed on a given day, they’ll probably tell you how the S&P 500 did.

The S&P 500 tracks the performance of 500 large companies listed on the U.S. stock exchanges, so that’s significantly fewer stocks than VTI’s portfolio.

Note that I didn’t say “the 500 largest companies.” The S&P 500 has several criteria for inclusion that may eliminate a few massive stocks that would make the list on size alone, which we’ll discuss below. Also, several types of securities are ineligible for inclusion, including master limited partnerships (MLPs), preferred stocks, ETFs, closed-end funds (CEFs), and more.

Lastly, the SPY is the original index ETF, launched by State Street Investment Management (formerly State Street Global Advisors) on Jan. 22, 1993.

What Benchmarks Do These Index Funds Use?

Both of these ETFs are “index funds,” which means that rather than human managers picking which stocks to buy and sell, their holdings are based on rules-based indexes.

VTI uses the Center for Research in Security Prices (CRSP) US Total Market Index as its benchmark.

As I mentioned above, while the index claims to represent “approximately 100% of the investable U.S. stock market,” that doesn’t mean it holds all U.S. stocks.

The index requires certain criteria for inclusion. To be added, the company must:

- Have a market capitalization of $15 million or greater.

- Have a “float” (shares available for public trading) of at least 12% or more of shares outstanding, or at least 10% for a “fast-track” initial public offering (IPO).

- Have no trading gaps (10 or more days with zero volume) since the stock’s last ranking.

- Not be currently suspended by its exchange.

- Have a trading history of at least 20 days, or at least five days for a fast-track IPO.

Different, looser criteria are used when determining whether to drop stocks from the index.

The SPY fund seeks to track the Standard & Poor’s (S&P) 500 Index, containing 504 large-cap U.S.-listed stocks representing 500 companies. The S&P 500 is a standard benchmark and is known to indicate the overall financial health of the economy.

To be part of the S&P 500, a company must:

- Have their primary listing on a U.S. exchange, be subject to U.S. securities laws, and derive at least 50% of its revenues in the U.S.

- Be listed on the New York Stock Exchange (including the NYSE Arca or NYSE American) or Nasdaq.

- Have a market cap of $22.7 billion or more.

- Trade at least 250,000 shares in each of the six months prior to the evaluation date.

- Have an annual dollar value traded to float-adjusted market cap of more than 0.75.

Different, looser criteria are used when determining whether to drop stocks from the index.

Related: The 11 Best Vanguard Funds to Buy for the Everyday Investor

How Has VTI vs. SPY Performed?

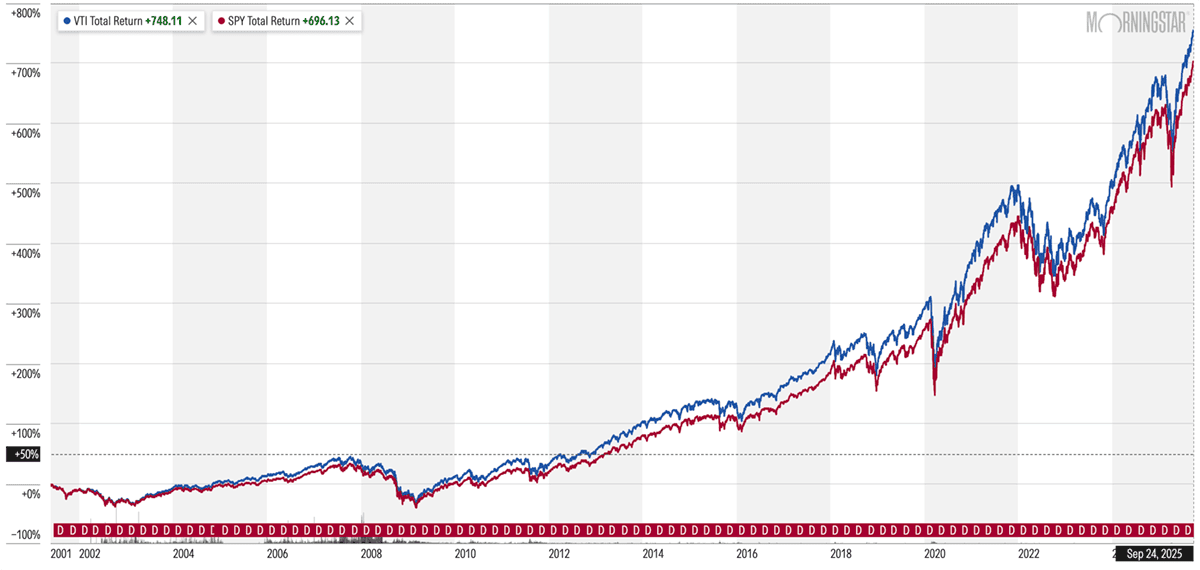

Both funds have enjoyed steady returns over time, but leadership has changed over time. VTI has been the better fund since its inception in 2001, but the SPY has been the better performer across all mid- and short-term time frames.

Just look at the total returns (price plus dividend) shown here:

The starker difference between these ETFs’ returns since the inception of each fund can be chalked up to different inception dates; SPY has been trading for eight more years than VTI, so it’s not an equal time-frame comparison.

I’ll also note that SPY’s performance comes despite a slightly higher expense ratio of 0.0945% versus the VTI’s 0.03%.

Lastly, remember: Past performance can be valuable information when evaluating two funds, but it doesn’t guarantee that future performance will follow suit.

Featured Financial Products

Invest in Individual Stocks or Index Funds?

While it may seem advantageous to start investing money in individual stocks on your own, there are benefits to investing in index funds (whether they be ETFs or mutual funds).

When you purchase a fund such as VTI or SPY, you’re effectively investing your money across hundreds or thousands of stocks all at once. That drastically reduces the ability of a single stock’s collapse to significantly damage your returns. Thus, diversified funds holding stocks or bonds are thought to have much less risk than owning individual stocks or bonds.

In the long run, index funds that follow the S&P 500 return around 10%, the historical annual market return since the 1920s.

While you can’t capture alpha (outperforming the market) like you might with the individual stocks you find using the best stock research apps and software, you also won’t do worse than the market … because you’re simply owning “the market.”

While that’s an attractive proposition, some people still want to try for market outperformance. Stock picking services are a good place to start if you don’t have the time or experience to do your own research.

Related: 15 Best Stock Market Investing Research & Analysis Sites

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

VTI vs. SPY Similarities

Broad Portfolios

While VTI and SPY have vastly different portfolio sizes, of roughly 3,500 and 500 stocks, respectively, both provide broad exposure to U.S. stocks.

Top Holdings

The top 10 holdings for VTI and SPY are identical. They currently include Nvidia (NVDA), Microsoft (MSFT), Apple (AAPL), Amazon (AMZN), Meta Platforms (META), Broadcom (AVGO), Alphabet’s Class A (GOOGL) and Class C (GOOG) shares, Tesla (TSLA), and Berkshire Hathaway (BRK.B).

Their ordering isn’t identical but close. That said, the weights each fund assigns to these stocks are different.

Availability

You can buy either fund through most brokerage firms and online brokers, including Schwab, Fidelity, Vanguard, and more.

Related: Best Commission-Free Stock Trading Apps & Platforms

VTI vs. SPY Differences

Market-Cap Exposure

Because Vanguard Total Stock Market ETF tries to invest in the “whole market” while the SPDR S&P 500 ETF intentionally limits itself to a select number of mostly large-cap firms, exact exposure to the U.S. markets (by size) is different.

VTI has a little more than 70% of its assets invested in large-cap stocks, nearly 20% in mid-caps, and the rest in small-cap stocks.

SPY, however, weights large caps at almost 80%. Mid-caps receive the lion’s share of the remaining assets, at 17%, while smalls inherit the rest.

Performance

While both ETFs have produced respectable performance over their lives, their returns have differed. SPY has a slight performance edge (less than 1% annually on average) over the trailing one-, three-, five-, 10-, and 15-year periods.

Turnover Rates

Turnover is how often the portfolio’s assets are changed over time, expressed as a percentage. This is a significant concern with mutual funds, where the buying and selling of securities generates capital gains that must be paid out to shareholders. Why is it a concern? Because those capital gains distributions are taxable if the fund is held in a taxable brokerage account; thus, heavy turnover can lead to significant tax consequences.

It’s less of an issue with ETFs, which function differently than mutual funds in such a way that they rarely generate capital gains. Even if they did, VTI and SPY both have very low turnover of 2% and 3%, respectively. The difference is negligible, and neither fund has paid out capital gains in years.

Expense Ratios

SPY’s expense ratio of 0.0945% is higher than VTI’s 0.03%.

Dividend Yields

Also, VTI yields almost 1.2%, while SPY yields closer to 1.1%. It’s a relatively small difference, but it’s there.

Related: Best Investments for Children

VTI Top 10 Holdings + Sector Weights

Vanguard Total Stock Market ETF has more than 3,500 holdings, though some have more impact on the ETF than others. A look at VTI’s top 10 holdings as of this writing:

- Nvidia (NVDA), 6.5%: Technology sector

- Microsoft (MSFT), 6.1%: Technology sector

- Apple (AAPL), 5.6%: Technology sector

- Amazon (AMZN), 3.5%: Consumer discretionary sector

- Meta Platforms Class A (META), 2.6%: Communication services sector

- Broadcom (AVGO), 2.3%: Technology sector

- Alphabet Class A (GOOGL), 2.0%: Communication services sector

- Alphabet Class C (GOOG), 1.6%: Communication services sector

- Tesla (TSLA), 1.5%: Consumer discretionary sector

- Berkshire Hathaway (BRK.B), 1.4%: Financials sector

Now, here’s a look at sector weightings across the entire portfolio:

- Technology: 32.5%

- Financials: 13.8%

- Consumer discretionary: 10.7%

- Health care: 9.5%

- Communication services: 9.5%

- Industrials: 9.1%

- Consumer staples: 4.9%

- Energy: 3.2%

- Real estate: 2.5%

- Utilities: 2.3%

- Materials: 2.0%

Note: Sector percentages used here are from Morningstar, which vary slightly from what Vanguard presents due to slightly different categorizations for sectors.

Featured Financial Products

SPY Top 10 Holdings + Sector Weights

The SPDR S&P 500 ETF has just over 500 holdings, with the largest companies accounting for much more of the fund’s performance than the smaller ones. A look at SPY’s top 10 holdings as of this writing:

- Nvidia (NVDA), 7.6%: Technology sector

- Microsoft (MSFT), 6.6%: Technology sector

- Apple (AAPL), 6.6%: Technology sector

- Amazon (AMZN), 3.8%: Consumer discretionary sector

- Meta Platforms Class A (META), 2.9%: Communication services sector

- Broadcom (AVGO), 2.8%: Technology sector

- Alphabet Class A (GOOGL), 2.6%: Communication services sector

- Tesla (TSLA), 2.1%: Consumer discretionary sector

- Alphabet Class C (GOOG), 2.1%: Communication services sector

- Berkshire Hathaway (BRK.B), 1.6%: Financials sector

Now, here’s a look at sector weightings across the entire portfolio:

- Technology: 35.5%

- Financials: 13.2%

- Communication services: 10.7%

- Consumer discretionary: 10.7%

- Health care: 8.8%

- Industrials: 7.5%

- Consumer staples: 4.9%

- Energy: 2.9%

- Utilities: 2.3%

- Real estate: 1.9%

- Materials: 1.6%

Note: Sector percentages used here are from Morningstar, though they will typically be similar to what State Street Asset Management presents (though data reporting times might differ).

What Is the Expense Ratio for VTI?

An “expense ratio” is the fee investors are charged to cover portfolio management, marketing, administration, and more. It’s listed as a percentage and it’s taken directly out of performance (in other words, you don’t have to send in a check).

VTI’s expenses are just 0.03% annually, or 30¢ for every $1,000 invested.

What Is the Expense Ratio for SPY?

SPY has a slightly more pricey expense ratio of 0.0945%, or 94.5¢ for every $1,000 invested.

The expense ratio is still extremely low for this kind of large-cap exposure.

What Are the Dividend Yields for VTI and SPY?

“Dividend yield” is the amount of money that a company pays out in dividends each year relative to its share price. For ETFs, you take dividends per share paid over the past 12 months, then divide that by the stock price.

VTI’s dividend yield is currently 1.17%, while SPY’s is 1.11%. It’s not much of a difference, but technically, VTI pays more.

Both ETFs pay out dividends on a quarterly basis, which is typical of equity funds.

Related: 17 Best Income-Generating Assets [Invest in Cash Flow]

Which Index Fund Should You Buy?

While Vanguard Total Stock Market ETF and SPDR S&P 500 ETF have quite a few differences, they are largely at the periphery … but not entirely.

The biggest difference between the two is the assets they allocate to mid- and small-cap stocks. SPY holds very few mid-cap stocks and no small caps. VTI is still mostly large-cap in nature, but it holds a fair amount of mid-caps and even provides a little small-cap exposure.

Neither is inherently better than the other; it all comes down to what kind of exposure you want in your portfolio, and how you want to go about it:

- If you want a one-stop shop for U.S. equity exposure and you’re OK with the specific blend of large-, mid-, and small-cap stocks that VTI provides, VTI is the better holding.

- If you only want large-cap exposure, SPY is the better fund. Also, if you want to own stocks of all sizes, but in different percentages than VTI, it’s best to buy SPY for your large-cap exposure, then complement it with mid- and small-cap ETFs to get the blend you prefer.

I’ll also point out that in addition to being cheaper from a fee basis, Vanguard Total Stock Market ETF is also cheaper on a nominal basis. That is, it currently costs around $325 per share, whereas you’d have to pony up about $650 per share to buy the SPDR S&P 500 ETF.

If your investment platform lets you buy fractional shares of ETFs, however, this price difference is moot.

VTI also holds an income edge with its slightly higher dividend yield. But people concerned with getting a high level of passive income aren’t getting much from either and should consider dividend funds or bond funds instead.

SPY, meanwhile, has a stability edge. One measure of volatility is called “beta,” and it measures an investment’s volatility against a benchmark; for equities, that’s usually the S&P 500. A beta of 1 means the investment is equally as volatile as the benchmark; a higher beta signals more volatility, while a lower beta signals less volatility.

Unsurprisingly, the S&P 500-tracking SPY has a beta of 1. VTI has a slightly higher beta of 1.03. It’s both a small difference, and one you’d expect given that VTI holds some smaller stocks, which tend to be a little more risky while generally presenting a little more upside potential. But if you really care about minimizing volatility, you won’t do it with either of these funds; instead, you should seek out low- and minimum-volatility ETFs.

If you’re trying to decide between these and other funds, you should strongly consider discussing your portfolio with a professional investment advisor.

Related: Appreciating Assets: 10 Best Things that Appreciate in Value

Featured Financial Products

Track Your Net Worth With Empower

Empower (Personal Capital is now Empower) has 3.3 million users, some of whom use free tools such as the Personal Dashboard, and some of whom use the Wealth Management service.

The free Personal Dashboard makes it easy for people to add all their financial accounts in one place, including credit cards, savings, checking, loans, and tax-advantaged investment accounts.

Empower also provides a free Investment Checkup tool to assess your portfolio risk, analyze past performance, and get a target allocation for your portfolio. The tool will help you identify overweight and underweight sector investments (perhaps you have too much allocated to utilities, and not enough to healthcare, for example) and assess your diversification.

The Wealth Management plan better suits investors who want a fuller advisory experience. The service pairs automated tools with human management.

After you enter your risk tolerance, goals, time frame, and personal preferences, Empower creates a recommended portfolio. The portfolios are diversified across multiple asset classes and rebalanced when necessary. The six asset classes include:

- U.S. stocks

- International stocks

- U.S. bonds

- International bonds

- Alternative investments

- Cash

Investors enjoy access to financial advisors who can help them make various financial decisions, from retirement planning to college savings to stock options and more. Empower’s financial advisors are available 24/7 by phone, live chat, email, or web conference.

Note that the Wealth Management plan has a minimum initial investment of $100,000. Investors with between $100,000 and $250,000 have access to a team of financial advisors. Those with more than $250,000 have access to two dedicated financial advisors. There are extra benefits for people who invest over $1 million, including lower fees.

Regardless of how much money you bring to the table, if you sign up through our exclusive link, you will be given the option to schedule an initial 30-minute financial consultation with an Empower advisor.

- Empower (formerly Personal Capital) offers both a free set of portfolio, net worth, and cash flow tracking tools, as well as paid asset management service.

- Link Empower to your bank and investing accounts, credit cards, and more to see a single view of useful information and data, including your net worth.

- Empower Wealth Management offers unlimited advice and retirement planning help, as well as managed ETF portfolios, for accounts with between $100,000 and $250,000 in assets. Higher asset tiers include access to dedicated financial advisors, retirement specialists, and more investment options (including stocks, options, real estate, and private equity).

- Free portfolio tracker

- Free net worth, cash flow, and investment reporting tools

- Dedicated investment advisor

- Free tax-loss harvesting

- Dividend reinvestment

- Automatic rebalancing

- 5-day-a-week live customer support, 24/7 email support

- High minimum for investment management ($100k)

- High investment management fee (0.89% AUM)