Investors who want to quickly, cheaply, and efficiently own a large number of U.S. stocks have a plethora of options. And many investors with the same goals end up making their way to a pair of Vanguard’s most popular funds: the Vanguard Total Stock Market ETF (VTI) and the Vanguard S&P 500 ETF (VOO).

VTI and VOO are exchange-traded funds (ETFs) that invest in large swaths of American stocks. The former invests across stocks of all sizes, while the latter holds a collection of some of the largest companies on the U.S. stock market.

Why are they so popular?

These ETFs are index funds, which means rather than a human at the helm, all investment decisions are made based upon a rules-based index. Each ETF simply tracks an index, and that index determines what stocks the fund buys and sells. This form of management, while simple, can produce better returns than what human managers can muster—and it also leads to lower costs of running the funds, which results in lower expenses for you and me.

These Vanguard index funds also have a number of similarities, which we’ll get to in a minute. In fact, they’re similar enough that you might only want to hold one or the other in your portfolio. That makes their few key differences all the more important in determining which index fund is a better fit for your portfolio.

So read on as I explore this pair of Vanguard ETFs. I’ll discuss what VTI and VOO do, what they hold, how they’ve performed over time, and more. My goal here: Make sure you have all the information you need to make an informed investment in one, the other, or both.

Disclaimer: This article does not constitute individualized investment advice. These funds appear for your consideration and not as investment recommendations. Act at your own discretion.

Featured Financial Products

What Is VTI?

The Vanguard Total Stock Market ETF (VTI) is the ETF share class of Vanguard Total Stock Market Fund (VTSAX). It was launched on May 24, 2001, and as the name suggests, it’s a “total stock market” fund. In short, it aims to own most or all of the stocks in a country’s stock market—in this case, America’s. To do this, it tracks the performance of the CRSP US Total Market Index, which represents “approximately 100% of the investable U.S. stock market.”

To be clear: That’s not every last stock on U.S. markets. In fact, it’s not even close. By virtue of requiring certain thresholds for market capitalization, liquidity, and other metrics, the index excludes thousands of U.S.-listed stocks, many of which are extremely small and/or trade very few shares in a given day.

Still, if we’re being pragmatic, at more than 3,500 holdings, VTI covers as much of the stock market as you’d ever really need to own.

Market capitalization (or market cap), by the way, refers to a company’s size as measured by the stock market. Market cap is calculated by taking all the company’s shares outstanding and multiplying that number times the stock price. And VTI includes stocks of all sizes: large caps ($10 billion or more), mid-caps ($2 billion to $10 billion), small caps ($300 million to $2 billion), micro-caps ($50 million to $300 million), and even nano-caps (less than $50 million).

It’s also a “domestic large blend” fund, which means several things:

- Domestic: It holds U.S.-listed stocks.

- Large: While it holds stocks of all sizes, most of its assets are in larger companies.

- Blend: It holds both value stocks and growth stocks.

Why are most of VTI’s assets invested in large-cap companies? Because it’s “weighted” by market cap, which means the larger the company, the more fund assets are invested in that company, and thus the larger the effect that company’s performance has on the fund performance.

This ETF also has a mutual fund counterpart: the Vanguard Total Stock Market Index Fund (VTSAX). VTSAX is a great way to access VTI’s strategy within 401(k) plans, which typically don’t allow you to invest in ETFs.

Related: VTI vs. VTSAX: How Do They Compare?

What Is VOO?

The Vanguard S&P 500 ETF (VOO) invests in the S&P 500, one of the best-known stock market indexes in the world. The S&P 500 tracks the performance of 500 large companies listed on the U.S. stock exchanges, and nowadays, if you ask someone how the market performed on a given day, they’ll tell you how the S&P 500 performed.

While the S&P 500 is made up of large companies, it’s not necessarily the 500 largest companies in the U.S. Instead, the S&P 500 has several criteria for inclusion. Stocks must:

- Have their primary listing on a U.S. exchange, be subject to U.S. securities laws, and derive at least 50% of its revenues in the U.S.

- Be listed on the New York Stock Exchange (including the NYSE Arca or NYSE American) or Nasdaq.

- Have a market cap of $22.7 billion or more.

- Trade at least 250,000 shares in each of the six months prior to the evaluation date.

- Have an annual dollar value traded to float-adjusted market cap of more than 0.75.

Several types of securities are ineligible for inclusion, including master limited partnerships (MLPs), preferred stocks, ETFs, closed-end funds (CEFs), and more.

Importantly, the S&P 500 invests in fewer stocks (roughly 500 to VTI’s 3,600) and is mostly made up of large-cap stocks.

VOO also has a mutual fund counterpart: The Vanguard 500 Index Fund Admiral Shares (VFIAX).

Related: 9 Best Stocks for Beginners With Little Money

VTI vs. VOO: Vital Stats

| VTI | VOO | |

|---|---|---|

| Category | US Large Blend | US Large Blend |

| Management | Index | Index |

| Index/Manager(s) | CRSP US Total Market Index | S&P 500 Index |

| Weighting System | Market Capitalization | Market Capitalization |

| Inception | 05/24/2001 | 09/07/2010 |

| Assets Under Management | $528 billion | $734 billion |

| Expense Ratio | 0.03% | 0.03% |

| Dividend Yield | 1.2% | 1.2% |

| Holdings | 3,524 | 504 |

| Top 10 Holdings % of Assets | 33% | 38% |

| Turnover Rate | 2% | 2% |

| Morningstar Medalist Rating* | Gold | Gold |

| Morningstar Star Rating** | 3 (Out of 5) | 5 (Out of 5) |

| Morningstar Risk Rating (3-year) | Average | Average |

| Vanguard Risk Level | 4 (Out of 5) | 4 (Out of 5) |

| * Morningstar’s Medalist rating is a forward-looking analytical view. ** Morningstar’s Star Rating is a backward-looking view that measures risk-adjusted return vs. peers. |

||

VTI vs. VOO: Performance

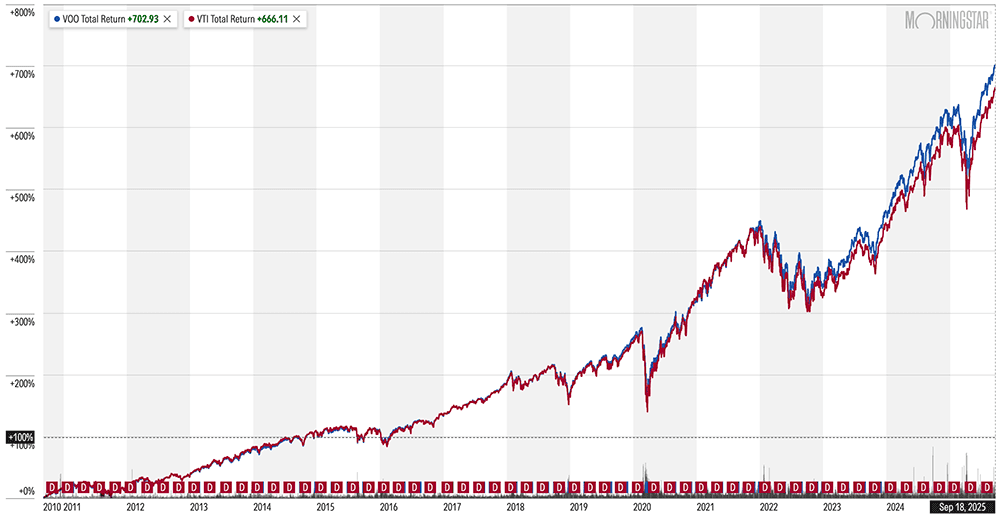

VOO has outperformed VTI throughout its publicly traded life, though with one exception (since inception), that performance has been fairly close.

| Period | VTI Avg. Annual Return | VOO Avg. Annual Return |

|---|---|---|

| 1 Year* | 19.5% | 19.6% |

| 3 Years | 20.7% | 21.4% |

| 5 Years | 15.8% | 16.5% |

| 10 Years | 14.3% | 14.9% |

| Since Inception** | 9.3% | 14.8% |

| * 1-year performance not annualized. ** VTI inception 05/24/2001; VOO inception 09/07/2010. | ||

The stark difference between these Vanguard ETFs since inception can be chalked up to when each fund was launched—that is, VOO came to life more than nine years later than VTI, and thus missed out on several downturns, most notably, the bear market during the Great Recession.

Still, the S&P 500, upon which the VOO is based, has delivered a higher total return (price plus dividends) since VTI’s inception, so it’s safe to say VOO’s record for outperformance would have held up had both funds launched in 2001.

Just remember: Past performance can be valuable information when evaluating two funds, but it doesn’t guarantee that future performance will follow suit.

Featured Financial Products

VTI vs. VOO: Similarities

The Vanguard Total Stock Market ETF and Vanguard S&P 500 ETF are both Vanguard stock market ETFs that invest in publicly traded companies listed in the U.S. Both are popular investments that have accumulated billions of dollars in assets.

Both are broadly diversified. Both perform fairly similarly—despite the fact that VTI holds many more stocks, VTI and VOO both have a large percentage of their assets invested in the same companies. That’s because both funds are market cap-weighted, which means the larger the company, the more assets the fund invests in its stock.

Expense Ratio

A fund’s expense ratio is a percentage of your investment that goes toward paying various expenses, such as managers, administration, marketing, and more.

VTI and VOO have the same expense ratio: 0.03%. Or in other words, you would pay just 30¢ annually for every $1,000 you had invested in each fund. (Note: ETF expenses are taken directly out of performance.)

Dividend Yield

Dividend yield is the percentage of an asset’s share price that it pays out in dividends each year. These funds’ dividend yields are often (and currently) identical, with VTI and VOO both at 1.2%. Also, both ETFs pay their dividends on a quarterly basis.

Holdings

Holdings are the stocks, bonds, or other assets a fund invests in.

Again, both VTI and VOO are market cap-weighted. That means the larger the stock, the greater their “weight” (the greater the percentage of assets that are invested in that stock).

VTI and VOO have the same top 10 largest holdings: Nvidia (NVDA), Microsoft (MSFT), Apple (AAPL), Amazon (AMZN), Meta Platforms (META), Broadcom (AVGO), Alphabet Class A shares (GOOGL), Alphabet Class C shares (GOOG), Tesla (TSLA), and Berkshire Hathaway Class B shares (BRK.B).

Risk

Vanguard evaluates risk on a 1-to-5 scale. It assigns a Risk Level 4 (out of 5) to both VTI and VOO, which means they’re “moderate to aggressive funds.” Says Vanguard:

“Vanguard funds classified as moderate to aggressive are broadly diversified but are subject to wide fluctuations in share prices because they hold virtually all of their assets in common stocks. These funds may be appropriate for investors who have a long-term investment horizon (10 years or longer).”

If you have a shorter-term investing horizon, then, you might want to consider less aggressive funds.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

Related: 5 Best Money Market Funds [Protect Your Savings]

VTI vs. VOO: Differences

The Vanguard Total Stock Market ETF came to life in May 2001; VOO hit the scene a little later on, in September 2010.

The VTI tracks the CRSP US Total Stock Market Index, which includes thousands of stocks across virtually all classes of market capitalizations. The VOO, however, tracks the S&P 500—an index of 500 predominantly large-cap U.S. companies.

Assets Under Management

VTI has accumulated roughly $528 billion in net assets under management, while VOO has accumulated $734 billion. These are both enormous funds … but VOO is still considerably larger.

Turnover

Turnover (how much of the portfolio has changed hands over the past year) is very low on both, standing at 2.2% for each. This is somewhat surprising considering VTI tracks the whole market, so it only needs to add holdings when new stocks join the exchanges, and release holdings when they de-list. VOO, meanwhile, tracks an index that only changes a few constituents every year.

Sector Weightings

While VTI and VOO offer similar exposure to the market’s 11 sectors, there are slight differences in their sector weightings:

| VTI | VOO | ||

|---|---|---|---|

| Sector | Weight | Sector | Weight |

| Technology | 33.1% | Technology | 35.4% |

| Financials | 13.7% | Financials | 13.2% |

| Consumer Discretionary | 10.6% | Consumer Discretionary | 10.6% |

| Communication Services | 9.3% | Communication Services | 9.9% |

| Health Care | 9.2% | Health Care | 8.8% |

| Industrials | 9.2% | Industrials | 7.9% |

| Consumer Staples | 5.0% | Consumer Staples | 5.2% |

| Energy | 3.1% | Energy | 3.0% |

| Real Estate | 2.5% | Utilities | 2.5% |

| Utilities | 2.4% | Real Estate | 2.0% |

| Materials | 1.9% | Materials | 1.6% |

Holdings

VTI, at more than 3,500 holdings, has a significantly higher number of stocks in its portfolio than VOO, which has just more than 500.

Because it covers the whole stock market, VTI has more exposure to smaller stocks. VTI currently offers 92% exposure to large caps, 6% exposure to mid-caps, and a little more than 1% exposure to small caps. However, while VOO focuses on a large-cap index, it doesn’t hold only large-cap stocks—it has more than 99% exposure to large companies, with just a trace amount of assets invested in mid-cap stocks.

Also, while VTI and VOO have the same top 10 holdings, VTI differs from VOO in how much weight it assigns each stock because it has to spread its overall assets around a larger group of equities:

| VTI | VOO | ||||

|---|---|---|---|---|---|

| Company | Ticker | Weight | Company | Ticker | Weight |

| Nvidia | NVDA | 6.49% | Nvidia | NVDA | 7.75% |

| Microsoft | MSFT | 6.05% | Microsoft | MSFT | 6.87% |

| Apple | AAPL | 5.57% | Apple | AAPL | 6.32% |

| Alphabet | GOOG/GOOGL | 3.58% | Alphabet | GOOG/GOOGL | 4.09% |

| Amazon | AMZN | 3.52% | Amazon | AMZN | 3.95% |

| Meta Platforms | META | 2.58% | Meta Platforms | META | 2.93% |

| Broadcom | AVGO | 2.25% | Broadcom | AVGO | 2.55% |

| Tesla | TSLA | 1.47% | Tesla | TSLA | 1.71% |

| Berkshire Hathaway | BRK.B | 1.43% | Berkshire Hathaway | BRK.B | 1.68% |

| Top 10 Total Weight | 32.94% | Top 10 Total Weight | 37.85% | ||

All but a handful of stocks in Vanguard S&P 500 are held within Vanguard Total Stock Market. And the stocks held by VOO account for 87% of VTI’s weight—which means the remaining 13% of VTI’s assets are spread across roughly 3,000 other stocks.

Risk

While Vanguard sees both funds as having equal risk profiles, that’s not necessarily the end of the discussion. Morningstar also evaluates a fund’s risk relative to its Morningstar Category. VTI, for instance, is considered to have above-average risk compared to other Large Blend funds, whereas VOO’s risk is considered just average.

Morningstar Ratings

Two of the most important Morningstar ratings are its Star Rating and Medalist Rating. The Star Rating is a backward-looking measure that evaluates a fund’s risk-adjusted performance over several time periods and compares it to the fund’s peers. (Morningstar awards 1 to 5 Stars, with 5 being the highest rating.)

I believe the Medalist Rating is a more useful system for people deciding whether to buy a fund. That’s because it’s a more forward-looking rating, where Morningstar evaluates traits including a fund’s parent organization, the managers responsible for making decisions, and fund strategies to determine a fund’s ability to outperform its Morningstar Category index. (Morningstar’s Medalist awards are Negative, Neutral, Bronze, Silver, and Gold.)

VOO earns a Gold Medalist Rating and five Morningstar Stars. VTI also earns a Gold Medalist Rating, but just three Morningstar Stars.

Featured Financial Products

Related: 10 Best Long-Term Stocks to Buy and Hold Forever

Which Index Fund Should You Buy?

Vanguard Total Stock Market ETF and Vanguard S&P 500 ETF have two fairly different aims, but because of how they’re built, they’re actually very similar index funds. Both provide heavy exposure to a wide variety of large-cap stocks, and they do so at a very low expense ratio. The biggest difference? VTI offers small-cap exposure, and more mid-cap exposure than VOO.

Because there’s so much overlap—remember: VOO’s holdings account for 87% of VTI’s weight—it would be pretty redundant to hold both index funds.

I look at it this way:

- If you want an ultra-simplified portfolio where you hold one fund to get all of your large-, mid-, and small-cap exposure, Vanguard Total Stock Market ETF is the better of the two funds to hold.

- If you prefer to hold mid- and small-caps at a higher or smaller ratio than what the VTI provides, you’re better off buying Vanguard S&P 500 ETF, then augmenting your portfolio with mid- and small-cap funds.

Either way, you’re getting broad-market exposure at a ludicrously low price. So in my opinion, VTI and VOO both make excellent core holdings for a long-term-oriented portfolio.

VTI vs. VOO: Frequently Asked Questions (FAQs)

Which stock market index fund holds more large-cap stocks?

On a nominal basis, VTI holds a greater number of large-cap stocks than VOO. After all, VTI holds all the large caps within VOO—and it happens to own many more large caps that VOO doesn’t.

However, VOO has a higher percentage of large-cap stocks. VOO is 81% exposed to large caps, while VTI has 71% exposure to large companies.

What are the dividend yields for VTI and VOO?

VTI and VOO have virtually the same dividend yield at the moment, at 1.2%.

What are VOO’s and VTI’s expenses?

VTI and VOO are both extremely cheap Vanguard index funds, charging just 0.03%, or a mere 30¢ for every $1,000 invested.

Also, by virtue of being ETFs, neither VTI nor VOO have a required minimum investment. You can buy as little as one share (or even part of a share, if your brokerage offers fractional shares). However, both funds have equivalent mutual funds—and if you want to invest in either of those, you’d need to pony up at least $3,000 to start.

Related: Best Investment Apps and Platforms

Is VTI market-cap weighted?

Yes, VTI weights its holdings by their market capitalization, as does VOO. This means the larger the stock, the more of the fund’s assets are dedicated to holding the stock.

Editor’s note: Market data from Vanguard, Morningstar, and ETFRC.com, unless otherwise noted.

Related: