High risk, high reward.

If you had to sum up small-cap investing in as few words as possible, that four-word phrase would take the taco. Purchasing shares of smaller companies presents far more risks than buying up large, blue-chip stocks … but it can often result in returns many times more than those established companies could ever provide.

That said, if you only started investing in the past few years, you might be wondering what the heck I’m talking about. That’s because small caps have generated downright miserly returns compared to big ol’ stocks for much of the past decade.

Historically, though, small caps might stay down for a long time, but they don’t stay down forever.

And these diminutive companies have been down so hard, for so long, that market analysts are watching the group closely for signs that they’re finally ready to come up off the mat.

The Tradeoff of Small-Cap Stocks

Small-cap stocks (typically considered to be stocks worth between $500 million and $2 billion by market capitalization) have, over the years, earned a reputation for massive growth potential.

It’s easy to understand why.

Small companies benefit from the business rule of large numbers, for one: Doubling your revenues from $1 million to $2 million is a lot easier than doing so from $1 billion to $2 billion.

Young and the Invested Tip: Small-cap stocks are one way to build growth over time—but if you want a different risk profile, here’s a look at many other options and where they sit on the risk spectrum.

The same nominal dollar amount of share purchases in a small cap will have a much bigger impact on its stock price, too—something that benefits small-cap shareholders if and when their stock’s underlying success story suddenly gets noticed by Wall Street analysts and financial media, encouraging more money to buy and driving the stock northward.

Alas, the catch.

Smaller firms also have a bevy of weaknesses that lend themselves to more volatile behavior and the potential for rapid declines:

–Fewer revenue streams: A small company’s revenues might heavily depend on just one, two, or a handful of products and/or services.

–Less capital on hand: Smaller companies (especially smaller growth companies) tend to plow all their money into research, development, and marketing. You know: all the things that help small businesses turn into big businesses over time. The problem, of course, is that profitability tends to be lean, making it difficult to sock money away. And should a rainy day come—slowdown in the economy, a new product doesn’t take off like they need it to—a lack of cash can make it difficult to meet obligations, continue spending on growth, or pivot to a new strategy. Compare this to large companies, which frequently sport large cash holdings that can be used in a pinch.

–Worse access to capital: If a large, established, highly profitable company needs to access debt, whether that’s to help fund a merger or survive an economic downturn, they can typically issue bonds or take out loans at manageable rates. Smaller companies? Not so much. Small caps will typically need to offer much higher interest on their bonds. On the loan front, many banks aren’t willing to lend to smaller companies, and those that are may charge usurious rates.

Again: High potential reward, but high risk, too.

Small Caps Have Offered a Lot More Risk Than Reward of Late

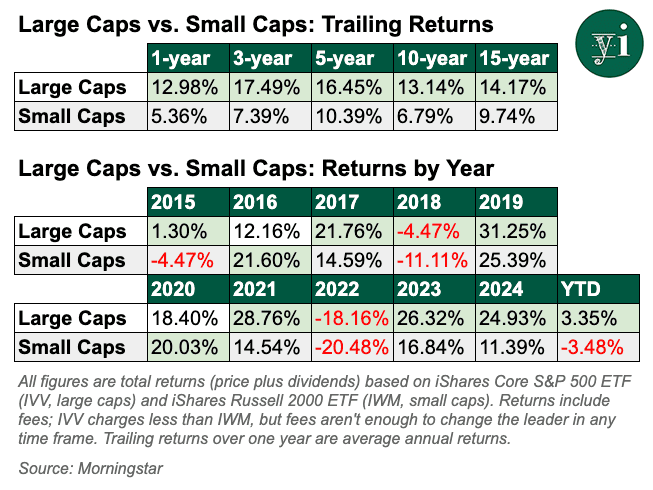

But a growing problem for small caps has been an imbalance in that tradeoff. Risk has remained elevated for years, but the returns simply have not been there:

In other words, small caps have underperformed large caps in every meaningful trailing time period that Morningstar covers. And on a yearly basis, small caps have trailed large caps in nine of the past 11 years (including 2025 year-to-date).

Or, more simply, yuck.

Prolonged underperformance has at least one upside, however … at least for people who aren’t yet invested in small caps: dirt-cheap valuations.

Consider the S&P 500, which despite holding a few mid-caps is still the gold-standard proxy for large-cap stocks. The S&P 500’s current forward price-to-earnings (P/E) ratio—in other words, price vs. expectations for future earnings—is 21.5, which is near highs last seen in 2021, and before that, 2002.

The S&P SmallCap 600, by comparison, trades at a forward P/E of just 15.

That marks the widest such disparity between large- and small-company valuations since the dot-com bubble.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

Is a Small-Cap Renaissance Nigh?

Value investors wouldn’t be blamed for a drop or two of drool. The idea of buying up high-growth companies for a relative song is, in theory, as good as it gets.

Whether it’s time to act on those urges is another question altogether.

Young and the Invested Tip: Depending on your age and risk horizon, small-cap stocks might be a big piece of your retirement investing strategy … or a smaller piece, or nonexistent.

Jason Pride, Chief of Investment Strategy & Research, and Michael Reynolds, Vice President of Investment Strategy, Glenmede, recently put together one of the most straightforward cases for the small-cap set:

- Extreme discount valuations on small caps are starting to look like a fat pitch.

- Small-cap companies are likely to benefit more from corporate tax relief and lower interest rates while also being less exposed to the impact of tariffs.

- Small caps should have an earnings growth edge over large caps in 2025.

Emily Roland and Matt Miskin, Co-Chief Investment Strategists at Manulife John Hancock Investments, expressed a similar interest, favoring smaller American stocks not just against their U.S. large-cap brethren, but versus all stocks worldwide.

“Of the most challenging market dynamics this year has been the multiple expansion of EAFE [Europe, Australasia, and the Far East] markets while similarly cheap U.S. small caps (with similar negative earnings growth) have seen multiple contraction. With that said, now the best place left in global equities markets that we see relative value is in U.S. mid-to small cap stocks.”

Not everyone agrees, however.

Fundamentally, Wells Fargo thinks more recent improvement in small caps have gone about as far as it can go for now. Near the end of May, Edward Lee, Investment Strategy Analyst, wrote:

“It remains the case that tariffs have been more aggressive than we initially thought, while earnings revisions continue to deteriorate on higher-than-expected interest rates and tariff rates. We see these positives and negatives as roughly in balance, hence our neutral tactical rating on the asset class. …

“Given this relative preference for U.S. large and U.S. mid-caps over U.S. small caps, and given the recent rally, we would use this opportunity to trim small-cap holdings back to long-term target allocations.”

Earlier this week, LPL Financial’s “chart of the week” explored the potential for small-caps from a more technical perspective following their recent recovery:

Source: LPL Financial

Adam Turnquist, Chief Technical Strategist for LPL Financial, wrote on June 10 that the S&P Small Cap 600 Index had reversed a downtrend off the 2024 highs, and a close above 1,325 (which occurred that trading day) would validate a breakout from its current chart formation.

Yet he too has concerns:

“Breadth is moving in the right direction but has more work to do before reaching bullish territory. Only about 37% of SML constituents are trading above their 200-DMA [daily moving average, the average closing price over a specific period; in this case, 200 days], while the percentage of constituents at four-week highs reached only 23% yesterday, significantly below levels recorded back in May.

“Despite the technical progress since April, small caps are struggling to keep up with their large-cap peers. The SML vs. S&P 500 ratio chart … remains in a multi-year declining price channel with no signs of an imminent reversal. Until this trend changes, watch for a continuation of small-cap underperformance.”

You can find differing viewpoints about almost any market opportunity at any moment in time, but between these and other opinions floated over the past few days, Wall Street is largely acknowledging that small caps are trading in value territory right now … but they’re largely split about whether now’s the time to strike.

But let’s say small caps do eventually get a strong consensus green light from the expert community. Do you just go out and buy a broad-based small-cap fund and call it a day?

Young and the Invested Tip: Sometimes, it does pay to invest broadly. Many of these index funds provide exactly that kind of exposure—and at bargain-basement prices, no less.

In truth, you could, and that would likely be enough to capture some of that upside.

However, one interesting argument for being choosier comes from investment firm Distillate Capital—the firm behind the Distillate U.S. Fundamental Stability & Value ETF (DSTL), which has been in my annual “best ETFs” list for several years running.

Distillate sees the same value proposition across small caps …

“Present underperformance of smaller stocks is not anomalous, but is reaching levels in relative performance, valuation, and duration that have given way to powerful reversals and reversions to the mean in the past.

“Only 15 years ago, we were at the opposite point on these measures and larger stocks had underperformed sharply and were strongly favored on valuation. After significant outperformance by larger stocks since, current conditions and valuations suggest there may be a substantial opportunity in the years ahead for both small companies and smaller companies within the large cap universe domestically and internationally.”

… but argues that looking at small caps through too wide a lens could leave some performance on the table:

“Since 1930, this small/mid cap group of stocks has substantially outperformed the biggest stocks in the market, but again with a great degree of cyclicality. While this longer-term performance data suggests that the duration and extent of recent small/mid stock underperformance may signal an eventual period of strong outperformance at some point, it ignores the issue of unprofitable stocks and their negative impact on overall performance and thus the opportunity for even better returns.”

Distillate makes the case that focusing on small-cap stocks with positive free cash flow (FCF, the cash that a company has after covering all operating expenses and capital expenditures), rather than a broader index containing many small caps with negative free cash flow, has historically produced much better returns.

Consider the following chart, which shows forward returns for the Russell 2000, as well as the Russell 2000 excluding any stocks with negative FCF:

Source: Distillate Capital

“What’s going to happen next?” is usually the top question on investors’ minds. And it’s always difficult to say—as you can see above, the smartest minds in the space are split on whether investors should jump into small-cap stocks right now.

But don’t hyperfocus on “what’s next”—save some of your bandwidth for considering “how.” Because when it does become time to make a decision, the upside potential of your decision could heavily depend on the strategy you choose.

Want to talk more about your financial goals or concerns? Our services include comprehensive financial planning, investment management, estate planning, taxes, and more! Schedule a call with Riley to discuss what you need, and what we can do for you.