Top Rewards Debit Cards

|

Primary Rating:

3.9

|

Primary Rating:

4.2

|

|

Standard: No monthly fees. Premium: $9.99/mo. Metal: $16.99/mo.

|

Free (no monthly fees).

|

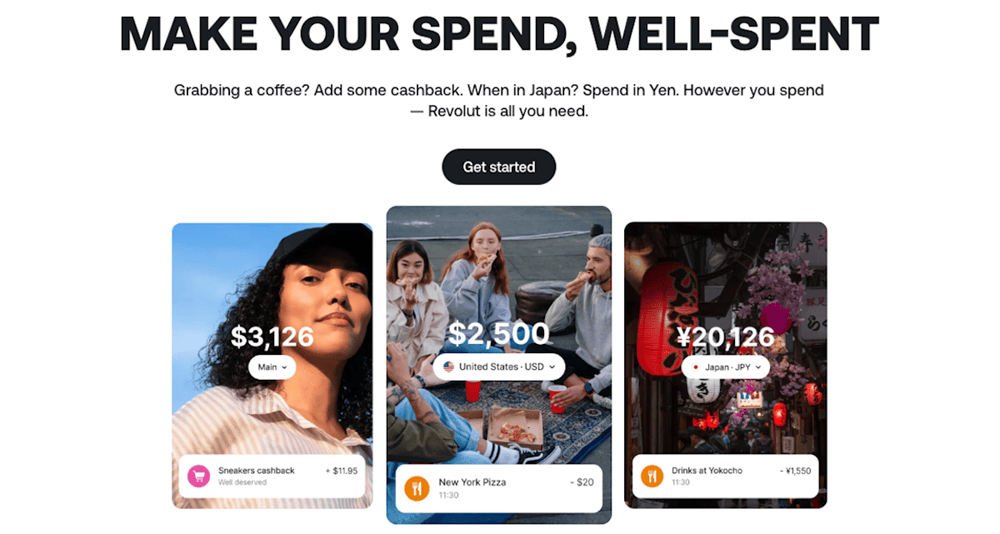

1. Revolut (Capable App for Many Money Needs + Cash-Back Rewards)

- Available: Sign up here

- Price: Standard: No monthly fees. Premium: $9.99/mo. Metal: $16.99/mo.

Revolut is a financial technology company that helps customers save money in several ways, offering payment tools, a prepaid debit card, currency exchange, investing… and, of course, savings.

Like many other financial apps, Revolut lets you make one-time deposits or set up recurring transfers to your Savings Vault, where you keep your savings. You can add money to a Revolut account in numerous ways, including bank transfer, debit card, Apple Pay or Google Pay, direct deposit, even transfers from other Revolut customers. You can also round-up purchases and have the spare change dropped into your Savings Vault.

You can withdraw money any time, quickly and at no cost from 55,000 in-network ATMs. Just note that Revolut limits out-of-network ATM withdrawals at up to $1,200 per month, and third party fees may apply.

Revolut offers other useful money-related features as well, such as the ability to get paid up to two days early*, Group Bills (to split costs), discounts, cash-back rewards on certain brands, discounted airport lounge access (Premium and Metal plans only), and more.

- Spend, save, invest, and more with Revolut—a financial app that simplifies your money.

- All plans come with a personalized Revolut prepaid debit card, unlimited single-use virtual cards for safer online shopping, no-fee currency exchange, and no-fee withdrawals at more than 55,000 in-network ATMs.

- You can save by yourself or even with family and friends in the Revolut Vault: a savings product that offers a 2.75% APY (or 3.5% for Premium and Metal users).

- Trade stocks and ETFs with no commissions with as little as $1, or invest in a robo-curated diversified portfolio for 0.25% annually (with a monthly minimum fee of 25¢.

- Special offer: Get a $10 bonus by opening a Revolut account and making your first virtual or physical Revolut card payment.

- 55,000+ no-fee in-network ATMs

- Direct deposit

- Early salary*

- International/foreign currency benefits

- Round-ups

- Ticket protection, returns protection, accidental medical insurance, and other perks with Metal subscription

- FDIC insurance

- 24/7 live chat support

- High fees for paid tiers

- Must subscribe to a paid plan for highest savings APY

- Phone support is automated only

2. Axos Cash Back Checking Account (Best Card With Domestic ATM Fee Reimbursements)

- Available: Sign up here

- Price: Free (no monthly fees)

The Axos Cash Back Checking Account’s debit card earns you 1% cash back¹ on every single transaction that requires a signature. It also reimburses all domestic ATM fees when you use your cash-back debit card, so you can grab cash guilt-free at any time.

Similar to Venmo, you can send peer-to-peer payments to friends and family using just a phone number or email. And users have unlimited check-writing privileges.

If you choose to turn on alerts, you can get activity updates as text messages, emails, or push notifications (your choice). This is a great way to detect any potential fraud right away.

In the event you lose your debit card, you can activate, deactivate, or reactivate it from your banking dashboard. You can also use the dashboard to put in a travel notice.

Additionally, Axos offers online bill pay. Through its Bill Pay feature, you can pay bills automatically from your checking account.

You do have to muster a small ($50) minimum balance to open an account, but you don’t have to worry about a monthly maintenance fee cutting into the cash back that you earn.

- Axos Bank's Cash Back Checking account allows you to save every time you spend, offering up to 1% cash back¹ on any purchase that requires a signature.

- Features include peer-to-peer payments, online bill pay, unlimited check writing, credit score checking, and more.

- Never pay to withdraw cash ever again thanks to Axos's unlimited domestic ATM fee reimbursement.

- Fee-free account and debit card

- Up to 1% cash back

- Online bill pay

- Unlimited check writing

- Unlimited domestic ATM fee reimbursement

- Minimum balance required

- Cash-back rewards limited to transactions that include a signature

3. Greenlight (Best-Rated Debit Card for Teens)

- Available: Sign up here

- Price: Free 1-month trial. Core: $4.99/mo. Max: $9.98/mo. Infinity: $14.98/mo. (All plans include cards for up to 5 children)

Among many other things, the Greenlight prepaid debit card offers savings and cash-back rewards. These former features encourage kids to save, while the latter ensures that even when kids are spending, they’re saving, too.

Greenlight’s Savings Reward provides a monthly reward, similar to an APY, on up to $5,000 saved in users’ General Savings and Savings Goals. The Reward rate varies based on plan: 1% per annum for Core, 2% per annum for Max, and 5% per annum for Infinity.

Greenlight Max and Infinity subscribers can also earn 1% cash-back rewards (which is distributed to Savings) when they use their card to spend.

An alternative way to get cash-back rewards with Greenlight is by signing up for the cash-back Family Cash Card. Parents can add their teenagers as authorized users to this Mastercard to help them learn how credit cards function and establish a credit history. This credit card offers the following cash-back rewards:

- 3% cash back when you spend at least $4,000 in a billing cycle

- 2% cash back when you spend at least $1,000 (but less than $4,000) in a billing cycle

- 1% cash back when you spend less than $1,000 in a billing cycle

There is no limit to the cash back that can be earned, and users can also auto-invest the cash-back rewards.

Read more in our Greenlight card review, or sign up for Greenlight here.

- Greenlight offers flexible parental controls for each child and real-time notifications of each transaction.

- Greenlight is the only debit card letting you choose the exact stores where kids can spend on the card.

- Parents can use this app to teach them how to invest with a brokerage account through Greenlight Max and Greenlight Infinity plans.

- Unlike many apps that simply provide features and controls, Greenlight is also designed to spark discussions with children about spending, investing, and more, fostering more education.

- Best-in-class parental controls (can prohibit specific stores)

- Can add brokerage account to invest in stocks

- Intuitive Parent + Kid apps

- Competitive cash back & interest rates

- Parent-Paid Interest

- High price points

- No cash reload options

- No parent / child lending

What Features Do Cash-Back + Rewards Debit Cards Offer?

When I’m reviewing debit cards, the top products typically offer several of the features below:

Cash Back

One of the best features of rewards debit cards is the ability to earn cash back on purchases. Cash back is like getting an automatic discount, albeit a delayed one.

Typically, the debit card cash back amount is a percentage of the overall money spent on eligible purchases. For instance, you might earn 1% cash back with some cash back debit cards. The more money you spend, the more cash back you receive.

Fraud Protection

Debit card users are protected by the Electronic Funds Transfer Act (EFTA). Let’s say your debit card is lost or stolen. You can immediately report this to your debit card provider. Later, if fraudulent purchases are made with the debit card, you are not liable for those costs.

Rewards

Besides earning cash back on debit card purchases, some debit cards have additional rewards programs for points you can use on products from popular brands or other merchandise.

Online Banking

Many rewards debit cards don’t require you to go to a physical bank. You can access an online savings account and checking account from a website browser or user-friendly mobile app.

Mobile App

Banks and credit unions usually have mobile apps for online banking. Everything can be done on the app, on any device, from anywhere.

Mobile Check Deposit

Are you still paid with physical checks or receive checks as gifts? The bank account that issued your debit card can receive check deposits from your mobile app. Simply take a photo of the check and fill in a few blanks. Your bank will deposit the check amount into your checking account.

Direct Deposit

Direct deposit is even easier than mobile check deposit. Give your employer your account number and bank routing number, and they can start sending payments directly to your checking account.

Once the money hits your account, you can start spending it with your debit card and earn debit card rewards for your purchases. Some debit cards have early direct deposit to get your paychecks faster.

No Minimum Balance

The best rewards or cash back debit cards have no minimum balance requirement. You can transfer small amounts of money or set up direct deposit, and there is no need to worry if you dip below a certain balance.

Overdraft Protection

A debit card with overdraft protection helps cover payments when your balance falls below the amount coming out of your account. This service moves funds from a different bank account to make your balance positive.

Link to a Venmo or PayPal Account

Linking your debit card to a Venmo or PayPal account means you don’t need to have cash on hand every time you’re splitting a bill. If your friend pays for you, you can easily use Venmo to send your share of the costs. The money will come directly out of the checking account connected to your debit card.

Build Credit

Most debit cards don’t help you build credit. However, some rewards debit cards do. There are Visa debit card options that report on-time payments to credit bureaus. They will be a prepaid debit card you add funds to, or money will come right out of your account.

Do Debit Cards Offer Rewards?

Typically, debit cards don’t offer rewards, but some do. Rewards debit cards may pay cash back on eligible purchases, points you can spend on rewards, or other perks.

Rather than getting a debit card that only lets you make purchases and pull out cash, opt for a dit card that rewards your spending. Sign-up bonuses can add even more rewards.

Some reward debit cards have a monthly maintenance fee, but if you spend enough, the cash back or other rewards can offset these costs.

How Do You Earn Points on Your Debit Card?

You earn cash back or points on your debit card by making purchases. Depending on the card and rewards checking account, your purchases may earn a flat rate or more points at certain merchants. You won’t earn points by pulling cash out of an ATM, so make sure to use your card whenever possible.

Are Cash-Back Debit Cards Worth it?

A cash-back debit card is usually worth it, but not always. If the debit card requires no monthly maintenance fee or annual fee, it is definitely worth it. Even if you earn minimal cash rewards, you come out ahead.

For debit cards that charge a monthly fee, whether or not the card is worth it depends on how much you use it and the features it offers. If you only plan to use your debit card for emergencies or once a month for a small purchase, you likely won’t earn more than you spend on the monthly fee.

However, if you use your debit card regularly, your rewards will likely outweigh any fees. Even if you don’t earn much cash back, some cards may be worth it for the other benefits. For example, some debit cards help you build credit.

Related Questions on the Best Debit Cards for Cash Back and Rewards

Does applying for a debit card impact your credit?

No, applying for a debit card doesn’t impact your credit. These cards don’t require a hard credit check, so your credit score won’t be negatively impacted.

Do debit card transactions get reported to the major credit bureaus?

Usually, debit card transactions are not reported to the major credit bureaus. However, the Step Visa Card stands out from competitors because it will report your debit card transactions to credit bureaus, helping you build credit.

Do debit cards offer access to other banking products?

Yes, debit cards are tied to checking accounts, which provide you access to other banking products. For example, you may be able to pay bills, send peer-to-peer payments, earn cash back, invest money, and much more.

You can also have a debit card that acts like a cash-back credit card or prepaid card for building credit. Other banking products you may have access to include rewards credit cards and personal loans.

Are there debit cards that give cash back?

Yes, while uncommon, there are debit cards that give cash back. Axos and Greenlight both offer users cash back.

Disclosures

Axos Bank Cash Back Checking

¹ Earn up to 1.00% cash back on signature-based transaction purchases. Earn up to $2,000.00 per month in cash back on your signature-based transactions. Maintain a $1,500.00 average daily collected balance to earn 1.00% cash back on signature-based transaction purchases. If your average daily collected balance falls below $1,500 you will earn .50% in cash back for the month.

Revolut

* Early salary subject to employer deposit timing and not guaranteed.

Revolut is not a bank, banking services are provided by Lead Bank, Member FDIC. Fees may apply. The Revolut USA Prepaid Visa and Prepaid Mastercard are issued by Lead Bank pursuant to licensing by Visa® U.S.A. Inc. and Mastercard International for Mastercard cards. Funds in your Revolut Prepaid Card Account are held at or transferred to Lead Bank, Member FDIC, and are insured by the FDIC up to $250,000 applicable limits by the FDIC in the event Lead Bank fails if specific deposit insurance requirements are met. See FDIC-Prepaid Cards and Deposit Insurance Coverage

Securities products and services provided by Revolut Securities Inc., member FINRA/SIPC. Securities products are not insured by the FDIC or any federal government agency, are not bank deposits, are not obligations of or guaranteed by any bank and are subject to investment risks, including possible loss of the principal amount invested.Automated investing is provided by Revolut Wealth Inc., an SEC registered investment advisor. Information about operations, services, and fees is set forth in Revolut Wealth’s current Form ADV Part 2 (Brochure), a copy of which is available upon request and at IAPD – Investment Adviser Public Disclosure – Homepage.

Bonus Terms & Conditions: https://www.revolut.com/en-US/legal/partner-sign-up-bonus/