The best dividend stocks can give us the best of two worlds.

“Stocks go up.” It’s the base instinct driving your typical stock purchase. When you buy a company, you hope that its sales and profits will grow, and that investors will chase that success by purchasing shares—making yours worth all the more. But dividends provide us with a stream of income—not a guaranteed one, per say, but we’ll call it a high-confidence one—that can provide us with some sort of return no matter what that stock price does.

Thing is, some investors chase as much of that high-confidence income as they can get, favoring high yields above all else—even if those payouts are built on shaky foundations. But many of us would do well to focus on high quality instead—focusing on stocks with both greater potential to enjoy price upside, and more durable payouts that we can count on being there (and possibly being higher) for decades down the road.

If that sounds like a plan to you, read on as I discuss the importance of dividends and dividend safety, followed by a look at 10 of the best dividend stocks through a high-quality lens.

Disclaimer: This article does not constitute individualized investment advice. These securities appear for your consideration and not as personalized investment recommendations. Act at your own discretion.

Featured Financial Products

Why Dividend Stocks?

Dividend stocks can do wonders for the long-term performance of your portfolio. These companies pay a regular flow of their profits directly back to shareholders, meaning you receive some sort of return—even when share prices aren’t cooperating.

Stocks that can both grow and pay dividends are the ultimate long-term stocks given just how much in additional returns they can generate over the long term.

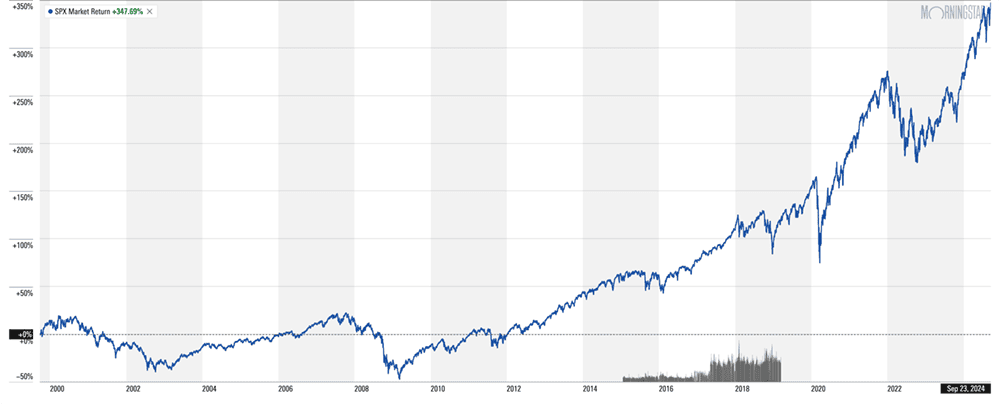

Here’s a look at the return someone could expect if they received just the price returns from the S&P 500 over the past 25 years:

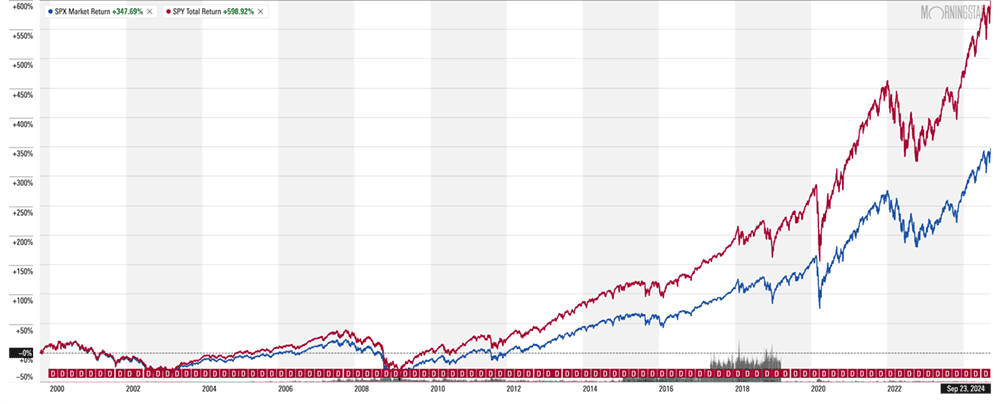

Now look at how much better the return is when you factor in dividends had you had reinvested those dividends back into the S&P 500 (returns illustrated by an S&P 500-tracking ETF; note that expenses are included in performance):

The price return is a little less than 350%. The total return (price plus dividends) is nearly 600%!

Just like price return on stocks can be improved upon with dividends, though, a stock that pays dividends but doesn’t go anywhere isn’t exactly ideal, either. Thus, the best dividend stocks will provide both a steady baseline of income and provide you with the potential for meaningful price upside.

Dividend Yields (And Dividend Safety)

Dividend yield is a simple calculation—annual dividend / price x 100—that can mean a world of difference for investors, especially those reliant on income.

But dividend yield isn’t everything. Sometimes, stocks with high yields can look more attractive, but they’re actually flashing a warning signal that the dividend isn’t sustainable. You see, a company can get a very high annual dividend yield in two very different ways: the dividend growing very rapidly, or the share price falling very quickly.

For example, Alpha Corp., which trades for $100 per share, pays a 75¢-per-share quarterly dividend, or $3 across the whole year. It yields 3.0%. In a month, however, it yields 6.0%. Here are two ways that could have happened:

- Alpha Corp. doubled its dividend to $1.50 per share quarterly, good for a $6-per-share annual dividend. The share price stays the same. ($6 / $100 x 100 = 6.0%)

- Alpha Corp. kept its dividend at 75¢ quarterly ($3 annually), but its share price plunged in half to $50 per share. ($3 / $50 x 100 = 6.0%)

In one of those scenarios, Alpha Corp. has a very safe dividend. In the other one, Alpha’s dividend could be ready to implode.

So, if you’re sniffing out the best dividend stocks to buy, make sure you’re not just looking at yield, but also gauging a dividend’s safety. Among other things, you’ll want to look at payout ratio, which determines what percentage of a company’s profits, distributable cash flow, and other financial metrics (depending on the type of stock) are being used to finance the dividend. Generally speaking, the lower the payout ratio, the more sustainable the payout.

Related: 10 Best Vanguard Index Funds to Buy

How We Chose the Best Dividend Stocks to Buy

Before I started this article, I was video calling a colleague and joked, in a pseudo-philosophical voice, “What is a good dividend stock, anyways?”

But I was only partly kidding. What’s ideal to one investor might not fit the bill for another. Ultimately, though, I coalesced around safe dividends, with some capacity to grow, sporting above-average yields, paid by larger (and thus likelier to be more stable) companies. Specifically, they have to …

- Be in the S&P 500.

- Have a yield greater than 1.5%, to ensure they’re better than the overall market. Most of the stocks on here are around 2% or higher. (And if that’s too low a yield for you, I suggest you instead check out our list of high-yield dividend stocks, which have payouts of 5%-plus.)

- Have an earnings payout ratio below 60%. This is a generally safe level where there’s still at least some room for dividend growth, and the lower the payout ratio, typically the more growth potential there is. (Note: Free cash flow payout ratio is an even better metric, but screening data for this tends to be unreliable.)

- Have at least a consensus Buy rating according to analysts tracked by S&P Global Market Intelligence. S&P boils down consensus ratings down to a numerical system where anything less than 1.5 is a Strong Buy, 1.5 to 2.5 is a Buy, between 2.5 and 3.5 is a Hold, 3.5 to 4.5 is a Sell, and anything greater than 4.5 is a Strong Sell. In this case, I only included stocks with a 2.0 rating or less—so at least a pretty firm consensus Buy rating, if not an outright Strong Buy.

I also limited the energy sector to just one stock. Energy companies were extremely overrepresented in the screen; most problematic is that several sport variable dividends that rise and fall based on available cash flow, which is largely tethered to the motion of energy prices. So a 3% yield today could be 1% in a year, 2% the year after, and so on. Instead, the list is populated with stocks that have more traditional dividend programs—regular payouts that typically only change when the company announces a hike.

The equities here are listed in reverse order of their consensus analyst rating, starting with the worst-rated stock and ending with the best-rated stock.

Related: 7 Best High-Dividend ETFs for Income-Hungry Investors

Featured Financial Products

Best Dividend Stock #10: Bunge Global

- Sector: Consumer staples

- Market cap: $12.3 billion

- Dividend yield: 3.1%

- Consensus analyst rating: 2.00 (Buy)

Bunge Global (BG) is a leading agribusiness and food company, operating across the entire agricultural supply chain through its many subsidiaries. All told, its operations span roughly 23,000 employees across more than 300 facilities in over 40 countries.

Among other things, the U.S.-headquartered but Switzerland-incorporated firm is a leading global oilseed processor and producer of vegetable oils and protein meals. It sources, processes, and distributes grains such as soybeans, wheat, and corn. And it produces agricultural products such as fertilizers and sugars.

Bunge is very much a “patience stock” right now. The company has warned of a weaker-than-expected 2024, thanks in part to lower margins on crush (the process that produces soybean oil and protein meal). Moreover, its proposed mega-acquisition of Canadian grain handling business Viterra ran into a potential wall this spring, with Canada’s Competition Bureau voicing concerns over the deal.

Wall Street’s pros appear patient, though. Coverage isn’t exactly thick at just 10 analysts currently, but of those, seven call BG shares a Buy, while three call it a Hold—no Sells are on the table. BMO Capital Markets analyst Andrew Strelzik is among the bulls; although he tempered expectations and lowered his price target on shares earlier this year, he still maintains an Outperform rating (equivalent of Buy), saying “we see upside potential and view [the] pullback in shares as a buying opportunity ahead of transformational M&A.”

Bunge can pay investors a decent sum for their patience. The 3.1% yield is more than a point better than the market average. And the dividend has grown by a total of 36% over the past three years. That cash distribution is as safe as you could want it, too; even based on softer earnings expectations for this year, BG maintains a conservative payout ratio of under 30%.

Related: 10 Best Fidelity Funds to Buy

Best Dividend Stock #9: Prologis

- Sector: Real estate

- Market cap: $108.4 billion

- Dividend yield: 3.3%

- Consensus analyst rating: 1.96 (Buy)

Prologis (PLD) is a global real estate investment trust (REIT) that specializes in logistics properties to both business-to-business and retail/online fulfillment customers. It currently leases roughly 5,600 buildings to 6,700 customers in 19 countries on four continents.

To be clear, Prologis doesn’t just rent out warehouses. It’s a total logistics provider, dealing in solutions such as forklifts, network infrastructure, automation, even providing training and education to warehouse employees.

Prologis has plodded through a lackluster 2024, but things are a lot better than they were. PLD shares had lost nearly a quarter of their value by early summer as the real estate sector sagged, in part fueled by a cut to its guidance for earnings, demand, and growth in long-term market rents, and in part fueled by the Federal Reserve’s insistence in keeping its federal funds rate in place. However, anticipation of an eventual rate cut, and the Fed actually going through with a 50-basis-point reduction in September, has helped Prologis claw back most of those losses.

Wall Street remained optimistic throughout the summer, and it’s still rosy on the name today. PLD currently enjoys 15 Buys vs. eight Holds and no Sells.

“Weaker growth and occupancy is being driven by near-record new supply, while the leasing environment remains off peak levels due to higher rates and slower e-commerce growth,” says CFRA analyst Shreya Gheewala (Buy). “Supply headwinds should start to fade in 2H 24, helping drive stronger growth in ’25.”

J.P.Morgan’s Michael Mueller (Overweight, equivalent of Buy) adds that “it is encouraging that 2Q’s ending occupancy was 96.4%, which was ~30 basis points higher than the quarter’s average occupancy. Strong rent spreads continued to be a bright spot and underscore the embedded rent mark-to-markets.”

A reminder that Prologis is a REIT, which is a special type of business structure that receives significant tax breaks, but in return, it must pay out at least 90% of its taxable income back to shareholders in the form of dividends. And unlike regular stocks, with which we use profits or free cash flow to determine payout ratio, REIT dividend coverage is typically gauged by funds from operations (FFO), a non-generally accepted accounting principles (GAAP) metric of profitability. FFO payout ratio standards are somewhat different, with 70% to 80% considered quite healthy.

Prologis? It has an FFO payout ratio of 70%. That should allow it to continue its dividend-growth streak, which hit 11 years in February with a 10% hike, to 96¢ per share.

Related: The 10 Best Vanguard Funds to Buy for the Everyday Investor

Best Dividend Stock #8: McDonald’s

- Sector: Consumer discretionary

- Market cap: $210.1 billion

- Dividend yield: 2.4%

- Consensus analyst rating: 1.89 (Buy)

McDonald’s (MCD) is the world’s largest fast-food chain, with a sprawling 40,000-plus locations in more than 100 countries. Big Macs and the world’s best fast-food fries are partly responsible for that reach, but so too is its business model. Most McDonald’s locations are run by franchisees, allowing McDonald’s to expand aggressively without absorbing high capital expenditures.

Earlier this year, the Golden Arches were in the news for all the wrong reasons. Namely, some consumers, pinched by inflation on all fronts, were balking at rising menu prices at McDonald’s, which itself was being hit by increasing input and wage costs.

It’s hardly anecdotal. In MCD’s fourth-quarter earnings report in February, “management noted continued pressure on the lower-income consumer <$45K, citing instances of trade-down, transaction size reduction, and losing transaction share within that segment to grocery,” say Wedbush analysts Nick Setyan and Michael Symington (Outperform).

However, McDonald’s has clearly received the message. Here at home, you might be familiar with MCD’s rollout of the $5 value meal, but the restaurateur is also implementing new value strategies in France, Canada, Australia, and more.

“We are very optimistic these efforts will help to drive better sales/traffic momentum over the next several quarters, especially when considering McDonald’s should have significant advantages on “value” versus key competitors given its advertising/purchasing scale,” say Baird analysts, who rate the stock at Outperform. “We note that history would suggest McDonald’s can be a relative share winner when the brand flexes its advertising muscle on value promotions.”

All told, 24 analysts call McDonald’s a Buy right now, versus 13 on the sidelines at Hold and no Sells.

MCD stock also offers up a safe, growing, and above-average dividend. McDonald’s management has improved the payout for 47 consecutive years, most recently in September 2024, when the company announced a 6% hike to $1.77 per share quarterly. That track record is more than enough to qualify it for membership in the S&P 500 Dividend Aristocrats—a group of Wall Street’s top dividend stocks that have bettered their dividends on an annual basis for at least 25 consecutive years. A moderate payout ratio of 56% indicates plenty of headway for decent dividend growth going forward, too.

Related: 9 Best Fidelity Index Funds to Buy

Best Dividend Stock #7: Abbott Laboratories

- Sector: Health care

- Market cap: $202.0 billion

- Dividend yield: 1.9%

- Consensus analyst rating: 1.81 (Buy)

Abbott Laboratories (ABT) is a large health care firm that develops, makes, and sells medical devices, diagnostic products, nutritional products, and generic pharmaceuticals. Among other things, it’s responsible for FreeStyle (and FreeStyle Libre) glucose monitors, Pedialyte hydration products, Similac formulas, PediaSure children’s nutritional products, and BinaxNow COVID-19 antigen tests.

Medical devices are Abbott’s biggest breadwinner at about 45% of revenues, and has been a key driver of growth of late. In fact, a big first quarter for the division prompted Abbott to raise its full-year guidance, and continued faith in the division is helping to drive William Blair’s Outperform rating.

“While we believe the company is in the final stages of turning the corner on more difficult COVID comps and early stages of seeing its investments translate to more normalized bottom-line growth, we view the ongoing NEC litigation as a near-term overhang on the stock given the risk it could have on future nutrition growth (though we believe it is manageable),” they say. “However, we continue to believe in the momentum of the core business and reiterate our 2025 growth outlook on sustainable top-line growth as a result of opportunities across the portfolio, notably in med devices.”

William Blair is just one of 19 Buy calls on ABT shares, versus just seven Holds and zero Sells.

Also noteworthy? In April, Abbott received FDA approval for the company’s novel TriClip transcatheter edge-to-edge repair system, which is designed to treat tricuspid regurgitation (TR), or a leaky tricuspid valve. Stifel analysts (Buy) talked to a high-volume interventional-cardiologist following an earlier FDA panel recommendation. “This doctor expects rapid tricuspid-valve treatment/growth, and expects to use both TriClip and Evoque [a tricuspid-valve-replacement-device]. Encouragingly, by 2025, the physician potentially expects his tricuspid cases to exceed his current annual mitral case run-rate (60).”

Abbott is a Dividend King—a Dividend Aristocrat with at least 50 consecutive years of payout growth—whose cash distribution streak has continued even after spinning off biopharma unit AbbVie (ABBV) at the start of 2013. And the dividend itself dates back a full century, to 1924. For now, a safe payout ratio of 47% provides little reason to think both streaks won’t continue.

Related: 5 Best Fidelity Retirement Funds [Low-Cost + Long-Term]

Best Dividend Stock #6: BlackRock

- Sector: Financials

- Market cap: $154.2 billion

- Dividend yield: 2.1%

- Consensus analyst rating: 1.67 (Buy)

BlackRock (BLK) is one of the world’s largest asset management firms, boasting about $10 trillion in assets across its many lines of business. Individual investors know it well for both its BlackRock mutual funds and closed-end funds (CEFs) and iShares exchange-traded funds (ETFs). But it also manages money for institutional clients, including pension plans, foundations, charities, and insurance companies, among others.

With the exception of a few understandable hiccups (COVID, for instance), BlackRock has been in a pretty consistent uptrend since the depths of the Great Recession. That has come alongside similar progression in both the company’s top and bottom lines.

It’s difficult to find any Wall Street pros with something negative to say about BLK. Shares currently enjoy 15 Buy calls versus three Holds and no Sells, and the analysts’ consensus for long-term earnings growth sits near 13% annually.

“We believe that BLK remains well positioned to deliver above-peer organic growth given its unmatched product breadth and distribution footprint (helped by its iShares franchise),” say Keefe, Bruyette & Woods analysts Aidan Hall and Kyle Voigt, who rate BLK at Outperform. “Also, its scale and demonstrated ability to generate operating leverage bodes well for future earnings growth.”

BlackRock has been a fount of dividend growth since the Great Recession, too. In the past decade alone, BLK has managed to average 10% annual dividend growth, though that pace has been slowing in recent years—its most recent hike, announced in January 2024, was a mere 2% bump to $5.10 per share. Still, a payout ratio just under 50% should keep investors plenty confident in the dividend’s health and its ability to keep growing.

Related: 7 Best Schwab Funds to Buy

Featured Financial Products

Best Dividend Stock #5: General Dynamics

- Sector: Industrials

- Market cap: $76.3 billion

- Dividend yield: 2.1%

- Consensus analyst rating: 1.64 (Buy)

General Dynamics (GD) is an aerospace and defense firm that operates across four major segments: Aerospace, Marine Systems, Combat Systems, and Technologies. It provides a wide range of well-known products, including Abrams tanks, Stryker fighting vehicles, and Virginia-class attack submarines and Gulfstream business jets. But it also provides back-end technology: mobile communication, mission support services, intelligence and surveillance solutions, and more.

For all of that military might, one massive area of opportunity is its Gulfstream business jets.

In late March, GD announced that its G700 received Federal Aviation Administration certification, with the company saying in January that it already had 15 of the aircraft ready for delivery, and that it expects 160 aircraft deliveries in 2024, versus 111 last year. At the time, William Blair analysts, who rate the stock at Outperform, said “G700 deliveries and subsequent G800 deliveries are expected to be the cornerstone for Gulfstream’s growth and margin expansion for the next decade.”

More recently, in July, unexpectedly slow deliveries for the G700 caused Wall Street to at least blink; a few analysts reduced their earnings expectations, but they remained heavily bullish on the stock, with 19 Buys versus six Holds and no Sells.

“In our view, shares can re-rate higher than their historical range due to growing international acceptance for defense stocks and the four major geopolitical conflicts that are taking place around the globe,” William Blair said after GD’s June-quarter earnings report. “We see greater than 20% upside over the next 12 months, driven by both multiple expansion and earnings growth.”

GD also already announced a fresh dividend hike earlier this year—a 7%-plus improvement to $1.42 per share quarterly that’s only a smidge below its 10-year average annual dividend growth rate. That dividend is very well covered, too, with payouts currently amounting to just 39% of earnings.

Related: WealthUp’s Winningest Tech Stocks for 2025

Best Dividend Stock #4: Emerson Electric

- Sector: Industrials

- Market cap: $75.8 billion

- Dividend yield: 1.6%

- Consensus analyst rating: 1.56 (Buy)

Emerson Electric (EMR) is an industrial-sector firm that was founded in 1890 and headquartered in St. Louis. Emerson has established itself as a global leader in technology and engineering, providing innovative solutions in process control, industrial automation, heating, ventilation, and air conditioning (HVAC), and more.

The company’s emphasis on technological advancement and diversified market penetration has been crucial in maintaining a competitive edge over the last 125-plus years. What once was a maker of electric motors and fans is now a global industrial-technology giant that produces not just tens of thousands of products, but even industry, automation, and operations management software.

And EMR continues to evolve today.

“The company has shifted its focus in recent quarters, divesting legacy segments and investing in new businesses that target energy security and affordability, sustainability and decarbonization, nearshoring, and digital transformation,” say Argus Research analysts Stephen Biggar and Michelle Han, who rate the stock at Buy. “These are good long-term businesses.”

Argus’s analysts are among the 20 Buys in the analyst bull camp, who greatly outnumber four Holds and a lonely Sell.

While its most recent payout increases haven’t been much to crow about, Emerson Electric has delivered decades of consistent dividend growth. This industrial firm’s dividend track record spans 68 consecutive years, including a 1% uptick to its payout, to 52.75¢ per share quarterly, announced in November 2024.

Related: 7 Best Schwab Index Funds to Buy

Best Dividend Stock #3: Merck

- Sector: Health care

- Market cap: $258.1 billion

- Dividend yield: 3.2%

- Consensus analyst rating: 1.50 (Strong Buy)

You’ll typically find multiple pharmaceutical stocks in any list of the best dividend stocks, and our grouping is no different. Coming in a few spots higher than Abbott is fellow Big Pharma name Merck (MRK).

Merck is one of the largest health care companies in the world. It offers a wide variety of products in oncology, immunology, neuroscience, virology, and diabetes—its blockbuster drug list includes the likes of cancer medicine Keytruda, HPV vaccine Gardasil, and diabetes pill Januvia. That said, it also has a sizable animal health unit that deals in vaccines, pharmaceuticals, even ID and monitoring products that it markets to not just pet owners, but also farmers, veterinarians, and more.

MRK shares have suffered a substandard 2024, but that’s largely thanks to a swift drop near the end of July, when Merck delivered mixed full-year guidance thanks in part to one-time charges related to this year’s acquisitions of oncology firm Harpoon Therapeutics and ophthalmology-focused biotech company EyeBio.

But perhaps lost in the news was another Street-beating set of quarterly results, continued strength in Keytruda, and better-than-expected sales in its animal health unit.

Wall Street appears largely unfazed—collectively, MRK remains one of the pharmaceutical industry’s top-rated stocks, with 24 Buy ratings, four Holds, and zero Sells.

Among those Buy calls is Argus Research analyst Jasper Hellweg, who says, “Merck continues to receive regulatory approvals for expanded or additional indications for its products, including further indications for major revenue generator Keytruda, as well as approvals for new products, such as Capvaxive, for the prevention of invasive pneumococcal disease and pneumococcal pneumonia, and Nobivac NXT Canine Flu H3N2, for canine influenza.” He adds that the summer selloff is an opportunity to pick up shares that still trade significantly cheaper than peer biopharmaceutical names.

As for the dividend? Merck has raised its payout for 14 consecutive years, including a 5.5% hike, to 77¢ per share quarterly, effective as of the beginning of 2024. And MRK has plenty more room to grow that dividend, paying out just 38% of this year’s expected earnings.

Related: 9 Monthly Dividend Stocks for Frequent, Regular Income

Best Dividend Stock #2: Targa Resources

- Sector: Energy

- Market cap: $43.0 billion

- Dividend yield: 1.5%

- Consensus analyst rating: 1.48 (Strong Buy)

Energy businesses are typically referred to by their “stream.” Upstream companies search for and extract oil, gas, and other raw energy resources; midstream companies transport, store, and sometimes process those resources; and downstream companies refine these resources into final products such as gasoline, diesel, and natural gas liquids (NGLs).

Targa Resources (TRGP) deals in the midstream energy market segment—alongside its subsidiary, Targa Resource Partners LP, it owns a wide array of gathering, processing, logistics, and transportation assets across numerous natural resource plays, including the Permian Basin, Bakken Shale, Anadarko Basin, and the Gulf of Mexico, among others. The Permian Basin is arguably Targa’s biggest growth driver; roughly 3 in 5 lower-48 U.S. shale rigs are located there, and about 80% of Targa’s natural gas inlet volumes are sourced from there.

Targa went public in 2010, peaked in 2014, cratered, then largely hovered for a few years after that. But after bottoming out during COVID, the stock has roared back to life and has since eclipsed its decade-ago peaks to hit all-time highs. Even after an 80% run year-to-date, the analyst community remains wildly bullish on TRGP shares; 22 Buys dwarf a single Sell call (and zero Holds).

Much of this can be attributed to Targa’s positioning in the Permian.

“TRGP has become an integrated midstream player from the wellhead to the export dock with a dominant position in the Permian basin, which has the best growth profile of any basin in the U.S. Additionally, we continue to favor Targa’s attractive financial profile with leverage well within its 3.0x to 4.0x range and a dividend that is well covered,” Stifel analysts (Buy) said earlier in the year.

More recently, in July, they updated their price targets, adding that “We assume a faster ramp to some of TRGP’s upcoming growth projects, most notably Frac Train 9, which should be incremental to 2Q24 and beyond. We have also updated our [gathering and processing] margin assumptions, which slightly increased our estimates.”

Energy infrastructure stocks are a different breed. Many of them are master limited partnerships (MLPs), which are required to return a majority of their income to unitholders (shares in MLPs) in the form of distributions (dividend-like payments to shareholders that have different tax consequences). Targa is technically a corporation, so it pays dividends like a traditional stock. But like an MLP, the proper metric for its payout ratio is distributable cash flow (DCF) … and by that gauge, Targa’s quarterly distribution is well-covered, indeed, at less than 25% of DCF, even after the company’s recent 50% hike to 75¢ per share.

“There are numerous assets continuing to come online that we forecast will push [earnings before interest, taxes, depreciation, and amortization] to continued records and given the likely inflection this year, we estimate FCF could notably improve from today’s solid level,” says Truist analyst Neal Dingmann (Buy). “As such, we anticipate no slowdown in dividend growth or buybacks; both of which should continue to gain steam well into next year.”

Related: 7 Best T. Rowe Price Funds to Buy

Best Dividend Stock #1: Mondelez International

- Sector: Consumer staples

- Market cap: $86.6 billion

- Dividend yield: 2.9%

- Consensus analyst rating: 1.40 (Strong Buy)

Mondelez International (MDLZ) is a prototypical defensive-minded, dividend-yielding consumer staples play that peddles its snacks to people in more than 150 countries worldwide. It’s responsible for brands including Oreo, Belvita, Tang, Cadbury, Philadelphia, Toblerone, and Halls. It’s the world’s top producer of cookies and crackers (they say “biscuits”; I decline) and No. 2 in chocolate.

There’s a reason “consumer staples” are often referred to as “consumer defensive.” That’s because while our consumption of certain products might ebb and flow with the economy, there are certain products we will hunker down and keep consuming no matter what. Sure, there are more true “needs” like basic produce, dairy, proteins, and personal-care items. But it applies to snacks too. After all, if the economy forces you to cut back on going out, you’ll still want treats at home—and price be darned, you probably won’t downgrade from Oreos to store-brand cookies unless you have no other choice.

Both Mondelez’s operational and stock performances have seemed downright agnostic for more than a decade, though the stock has delivered a marginally positive performance so far in 2024. Not to worry, say Stifel analysts.

“2024 is a year of two halves for Mondelez: a weaker volume/mix performance in the first half, with growth and sequential improvement taking hold in the second half, and a very strong margin performance driving the majority of EPS growth for the year in the first half before inflation-related margin pressure takes hold in the second half,” says Stifel, which rates MDLZ shares at Buy. “We continue to view Mondelez as a best-in-class consumer staples company, supported by the resilient growth of its categories, and the sustainable top and bottom line growth benefiting from disciplined reinvestment.”

Mondelez is just one of three stocks meeting my criteria that earn a Strong Buy consensus rating, per analyst ratings gathered by S&P Global Market Research. Currently, 24 Buys greatly outnumber a lone Hold and an absence of Sells.

A reminder: Mondelez was previously Kraft Foods, but it adopted the new name after it spun off Kraft Foods Group–the company’s North American grocery business—in 2012. Its dividend was stagnant for a few years before that transaction, but it has grown at a pretty reliable 10% average annual rate after that. Indeed, the yield, while decent, would be much higher if it weren’t for the persistent advance in MDLZ shares … not that anyone’s complaining. And between Mondelez’s consistent earnings growth and moderate 54% payout ratio, MDLZ should have the resources to continue its brisk dividend-growth pace.

Related: Best Self-Employed Retirement Plans

Featured Financial Products