While tens of millions of Americans invest with Fidelity, you don’t necessarily need a Fidelity account to yoke your retirement portfolio to this famed investment titan.

All you need are a handful of Fidelity’s best mutual funds, which for more than seven decades have built a reputation on sterling human management and, in more recent years, some smart, cost-efficient index products too.

One of the only real problems with Fidelity’s fund lineup is its size. At more than 200 products, you could get lost in the weeds for days trying to sort out which of its mutual funds stand out from the rest. The job is made all the more difficult when you realize Fidelity has numerous share classes, making it even more difficult to determine which funds you can actually access.

Today, I’m going to make it simple. Read along with me as I cover some of Fidelity’s best mutual funds to buy in 2025—a collection of products that showcase both Fidelity’s track record as a haven for smart stock and bond pickers, as well as its ability to provide superior index funds with thin fees. Importantly: All of the Fidelity funds on this list are Investor-class shares available to average Joes and Janes, and with no investment minimums to boot.

Disclaimer: This article does not constitute individualized investment advice. These securities appear for your consideration and not as personalized investment recommendations. Act at your own discretion.

Editor’s Note: Tabular data presented in this article are up-to-date as of Jan. 6, 2025.

Featured Financial Products

Table of Contents

Why Fidelity Mutual Funds?

Fidelity is a leader in mutual funds (and ETFs, for that matter) and has been a force in the industry since the launch of its Fidelity Puritan Fund (FPURX) back in 1947.

Today, this premier mutual fund company has roughly $15 trillion in assets under administration thanks in large part to the success of its talented fund managers. Most notably, that includes Peter Lynch, the longtime manager of the Fidelity Magellan Fund (FMAGX) who averaged an incredible 29.2% per year between 1977 and 1990.

However, while Fidelity first built its name on actively managed funds, over the past three decades, the firm has built out its low-cost and even no-cost index funds as part of the movement to reduce expense ratios and transaction costs for individual investors.

The end result is a fund lineup that can serve just about every need, and that’s typically competitive on price.

How Were the Best Fidelity Mutual Funds Selected?

Fidelity offers up quite the collection of mutual funds—in the hundreds, in fact, making it easy to succumb to analysis paralysis.

To whittle my way down to a more manageable list of the truly best Fidelity mutual funds, I’ve started with a quality screen, including only Fidelity mutual funds that have earned a Gold Morningstar Medalist rating.

Unlike Morningstar’s Star ratings, which are based upon past performance, Morningstar Medalist ratings are a forward-looking analytical view of a fund. Per Morningstar:

“For actively managed funds, the top three ratings of Gold, Silver, and Bronze all indicate that our analysts expect the rated investment vehicle to produce positive alpha relative to its Morningstar Category index over the long term, meaning a period of at least five years. For passive strategies, the same ratings indicate that we expect the fund to deliver alpha relative to its Morningstar Category index that is above the lesser of the category median or zero over the long term.”

As I’ve written in other Young and the Invested articles, a Medalist rating doesn’t mean Morningstar is necessarily bullish on the underlying asset class or categorization. It’s merely an expression of confidence in the fund compared to its peers.

Fidelity actually has dozens of Gold-rated funds, but several of them are specific share classes that are only available to certain subsets of investors—those enrolled in Fidelity Wealth Services, for instance, or those enrolled in eligible employer-sponsored retirement plans. So I’ve further narrowed the list to only Investor-class funds. Importantly, these funds typically offer no investment minimums, meaning you can get started for as little as one dollar.

From the remaining universe of funds, I selected a range of both indexed and actively managed mutual funds displaying the best Fidelity has to offer. This list includes both core portfolio holdings, as well as satellite products you can use to try to generate alpha.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

The Best Fidelity Mutual Funds to Buy

As mentioned before, Fidelity boasts some of the fund industry’s top managers. So while this list of Fidelity’s best mutual funds includes a few dirt-cheap index funds, I’ve highlighted several actively managed products—both core and satellite holdings alike—that demonstrate the firm’s ability to identify the market’s best opportunities.

Also, every fund highlighted on this list boasts annual expenses that are at least below their category average. So while Fidelity’s actively managed funds might be more expensive than your average index fund, you’re still getting good relative value. (That said, if you have access to more inexpensive share classes via your wealth manager, retirement plan, or elsewhere, use those instead!)

One last reminder: Each fund on this list has no investment minimums. So you can get started with as little or as much capital as you’d like.

1. Fidelity 500 Index Fund

— Style: U.S. large-cap stock

— Management: Index

— Assets under management: $631.6 billion

— Dividend yield: 1.3%

— Expense ratio: 0.015%, or 15¢ per year for every $1,000 invested

If a major mutual fund provider’s lineup includes a cheap S&P 500 index fund, chances are it’ll be one of their best-rated funds, and that’s the case here with Fidelity 500 Index Fund (FXAIX).

The logic goes like this: The S&P 500 Index is commonly used as a performance benchmark for mutual funds that invest in U.S.-based large-cap stocks. But the majority of fund managers who run these funds typically struggle to beat their benchmark. Indeed, according to S&P Dow Jones Indices, the majority of active large-cap U.S. equity funds had failed to beat the S&P 500 in 21 of the past 24 years … and fund managers were on track to underperform yet again in 2024.

Related: The 9 Best Fidelity Index Funds to Buy

So, as I typically say when confronted with an S&P 500 fund: If you can’t beat it, join it.

Fidelity 500 Index Fund tracks the S&P 500—a collection of some of the largest American companies, but to clarify, not the 500 largest American companies. To be included in this index, a company must have a market capitalization of at least $20.5 billion (up from $18 billion after a 2025 rule change), its shares must be highly liquid (shares are frequently bought and sold), and at least 50% of its outstanding shares must be available for public trading, among other criteria. A company must also have positive earnings in the most recent quarter, and the sum of its previous four quarters must be positive—two traits that weed out at least a few massive firms that would otherwise be included.

Note: Once a company becomes an S&P 500 component, it’s not automatically kicked out if it fails to meet all of the criteria. However, the selection committee would take this under consideration and possibly boot the company.

Related: Best Fidelity Retirement Funds for a 401(k) Plan

People like to consider the S&P 500 a reflection of the U.S. economy. But it’s hardly a perfect representation. For instance, the technology sector accounts for almost a third of FXAIX’s assets. Real estate, materials, and utilities merit less than 3% apiece. This is in no small part because, like many indexes, the S&P 500 is market capitalization-weighted, which means the greater the size of the company, the more “weight” it’s given in the index. Currently, trillion-dollar-plus companies Apple (AAPL), Nvidia (NVDA), and Microsoft (MSFT) sit atop Fidelity 500 Index Fund’s holdings list.

Turnover, which is how much the fund tends to buy and sell holdings, is always low, given that only a handful of stocks enter or leave the index in any given year. This tamps down (and often eliminates) capital-gains distributions, which receive unfavorable tax treatment. This makes FXAIX an extremely tax-efficient option for taxable brokerage accounts.

It’s this combination of traits—the S&P 500’s excellence as an index, bare-bones costs, and tax efficiency—that earn this Fidelity index fund a Gold Medalist rating from Morningstar. That makes FXAIX one of the best Fidelity mutual funds to buy, especially if you’re building the core of your portfolio.

Related: 10 Monthly Dividend Stocks for Frequent Investment Income

Featured Financial Products

2. Fidelity Focused Stock Fund

— Style: U.S. large-cap growth stock

— Management: Active

— Assets under management: $4.7 billion

— Dividend yield: 0.3%

— Expense ratio: 0.61%, or $6.10 per year for every $1,000 invested

If you did want to try to beat the index, Fidelity Focused Stock Fund (FTQGX) has historically been up for the job.

Fidelity Focused Stock Fund is an actively managed large-cap growth fund, helmed since 2007 by Stephen DuFour. S&P 500 funds (like FXAIX) are considered large-cap “blend” funds because they hold both growth stocks and value stocks. But FTQGX explicitly wants to hold companies with elements of both. Specifically, DuFour says he seeks out firms that “will grow earnings materially faster than the market and are still trading at attractive valuations.” (This strategy is typically referred to as “growth at a reasonable price,” or GARP.)

Related: The 7 Best Closed-End Funds (CEFs) With Yields Up to 11%

Fidelity Focused Stock Fund is benchmarked against the S&P 500, which in active-fund parlance means DuFour’s goal is to beat the S&P 500. To do this, DuFour primarily buys a few dozen growth-oriented S&P 500 stocks at higher percentages than their weights in the index, as well as a handful of stocks from outside the S&P 500. The “Focused” part of FTQGX’s name comes from the more “focused” portfolio list, with DeFour aiming to hold just 30 to 80 stocks at any given time. (Currently, that number is around 45.)

At the moment, technology is FTQGX’s top sector, though at 22%, that’s a lighter proportion of tech compared to the S&P 500. Consumer discretionary (17%), financials (16%), industrials (16%), and health care (10%) are all double-digit weights, too. Top holdings include the likes of Nvidia, Facebook parent Meta Platforms (META), and Modine Manufacturing (MOD).

Morningstar cites a “sensible investment philosophy,” Fidelity’s great track record as a fund provider, and low fees among reasons they awarded FTQGX a Gold Medalist rating. As for the S&P 500? Fidelity Focused Stock Fund has topped its benchmark on an average annual basis since its inception in November 1996, and over every other meaningful mid- and long-term time period.

Related: Best High-Dividend ETFs for Income-Hungry Investors

3. Fidelity Mid Cap Index Fund

— Style: U.S. mid-cap stock

— Management: Index

— Assets under management: $39.6 billion

— Dividend yield: 1.2%

— Expense ratio: 0.025%, or 25¢ per year for every $1,000 invested

Mid-cap stocks are a way to thread the needle between the relative size and stability of large-cap stocks and the high growth potential of small-cap stocks. Indeed, this ideal middle ground has earned mid-caps the nickname of “Goldilocks” stocks.

Related: 9 Best Fidelity ETFs for 2025 [Invest Tactically]

“In any given 1-year rolling period since 2003, small-, mid-, and large-cap stocks have outperformed 33%, 26%, and 41% of the time,” investment company Hennessy Funds said in a 2023 research note. “However, the longer mid-cap stocks are held, the more often they outperformed. In fact, 60% of the time, mid-caps outperformed small- and large-cap stocks over any 10-year rolling period in the past 20 years.”

Better still? During the 20-year period (through 9/30/23) that Hennessy studied, it found that while mid-caps delivered higher risk than large caps, they delivered better returns … and they generated both lower risk and higher returns than small caps.

Fidelity Mid Cap Index Fund (FSMDX) is an exceedingly cost-efficient way to tap this area of the market. FSMDX tracks the Russell MidCap Index, which is made up of the 800 smallest stocks in the Russell 1000 (which is itself an index of the U.S. market’s 1,000 largest stocks). As a result, you’re getting exposure to 800-plus mostly mid-cap stocks—the fund typically is 75% weighted in mids, with another 5%-10% in smaller large caps, and another 10%-15% in larger small caps.

Related: 7 Best Schwab ETFs to Buy [Build Your Core for Cheap]

That might sound odd. But it’s actually common for 20%-30% of a mid-cap fund’s holdings to bleed into small- and/or large-company territory, and some funds invest even more outside of mid-caps. Where FSMDX stands out is that it “tends to go higher up the market-cap ladder than other mid-cap indexes, favoring large-cap stocks that tend to be more established than mid-cap stocks,” Morningstar says.

Sector weights will naturally change over time as certain businesses come into and go out of favor, but right now, industrials are tops at 18%, followed by financials (17%), information technology (13%), and consumer discretionary stocks (10%). Also, thanks to both the market cap-weighting of the Russell MidCap Index and the high number of holdings, single-stock risk is minimal—the only stock it weights at more than 1% is Palantir Technologies (PLTR), which rocketed 340% higher in 2024 and will likely be pulled from the Russell MidCap Index (and thus FSMDX) when the index reconstitutes in June 2025.

A sound methodology for Wall Street’s mid-sized companies, dirt-cheap fee, and strong historical performance all make FSMDX one of the best Fidelity funds you can buy.

Related: The 7 Best Vanguard ETFs for 2025 [Build a Low-Cost Portfolio]

4. Fidelity Select Semiconductor Portfolio

— Style: Industry (Semiconductors)

— Management: Active

— Assets under management: $20.3 billion

— Dividend yield: <0.1%

— Expense ratio: 0.65%, or $6.50 per year for every $1,000 invested

Fidelity has roughly 30 “Select” funds—the company’s name for its sector- and industry-specific funds. Several of these funds currently boast Morningstar Gold Medalist ratings and thus deserve a spot among the best Fidelity funds you can buy; we’ll cover a pair of them today.

First up is the Fidelity Select Semiconductors Portfolio (FSELX), an actively managed industry fund focused on the semiconductor industry.

Related: The 13 Best Mutual Funds You Can Buy

The case for semiconductor stocks broadly is a simple one: As both our personal and business worlds become increasingly dependent on technology, semiconductor companies—which design and manufacture one of the most essential components of technology—stand to benefit. And some of the greatest opportunities rest within those semiconductor companies powering emergent and high-growth technologies such as data centers, cloud computing, and artificial intelligence.

Adam Benjamin, who has led the fund for four years, aims to beat the broader semiconductor industry by picking winners and losers within the space. In addition to single-company research, Benjamin also attempts to identify themes that will impact the largest end markets, and determine how technology disruptors might impact incumbent companies.

FSELX’s 45-stock portfolio might seem tight, but it’s pretty standard for a single-industry fund. The same goes for the massive 25% weight in Nvidia—as it goes, so too goes most semiconductor portfolios, not just Benjamin’s pick list.

Kudos to Fidelity Select Semiconductors: In addition to its Gold Medalist rating, it has beaten every meaningful benchmark—the S&P 500, the technology sector, the MSCI US IMI Information Technology 25/50 Index—over every meaningful time period. And over the trailing three-, five-, 10-, and 15-year periods, it has been in the top 1% of products in its Morningstar category: tech-stock funds.

Related: The Best Mutual Funds for Beginners

5. Fidelity Select Medical Tech and Devices Fund

— Style: Sector (Health)

— Management: Active

— Assets under management: $5.3 billion

— Dividend yield: N/A

— Expense ratio: 0.65%, or $6.50 per year for every $1,000 invested

While many investors unload their sector-specific needs to basic index exchange-traded funds (ETFs), Fidelity manager Eddie Lee Yoon makes a case for human stewardship with his Fidelity Select Medical Tech and Devices Fund (FSMEX).

Related: Best Vanguard Retirement Funds for an IRA

FSMEX is a health care sector fund, and an oddball at that. While most health care sector funds will be highest on pharmaceuticals and biotechnology stocks, Yoon’s 60-holding portfolio, which is 97% invested in domestic firms, is mostly dedicated to health care equipment (54% of assets) and life sciences tools and services (28%). The remaining portfolio is peppered with small holdings in health care technology, health care services, biotech, pharma, and other health care industries.

Fidelity Select Medical Tech and Devices does have something in common with your average health care fund, though: single-stock concentration. Many sector funds are cap-weighted and, as a result, often have a few allocations in the high single digits and even double digits. While FSMEX is hand-selected and not cap-weighted, Yoon holds a few outsized positions—most notably Boston Scientific (BSX, 13%), Danaher (DHR, 12%), and Thermo Fisher Scientific (TMO, 9%).

Related: 12 Best Long-Term Stocks to Buy and Hold Forever

And while FSMEX is certainly more expensive than your typical sector index fund, it has largely been worth it.

Morningstar, in explaining its Gold rating, states that at FSMEX, “Edward Yoon has delivered superior performance, outperforming both the category benchmark and average category peer for the past 10-year period.” Morningstar adds that a personal investment of between $500,000 and $1 million in FSMEX is a positive contributor to the rating: “This effort aligns interests with shareholders by investing alongside them.”

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

Related: Best Schwab Retirement Funds for an IRA

6. Fidelity Total International Index Fund

— Style: International all-cap stock

— Management: Index

— Assets under management: $13.5 billion

— Dividend yield: 2.9%

— Expense ratio: 0.06%, or 60¢ per year for every $1,000 invested

If you’re looking for a little exposure to stocks outside of the U.S. … good! You should! Yes, U.S. markets have long been among the most productive in the world, and if you believe in the American economy’s ability to keep growing, that should remain the case—and thus, most experts would tell you to own primarily U.S. stock and bond funds.

Related: 10 Best Dividend Stocks to Buy [Steady Eddies]

But those same experts would tell you that it’s worth having at least some international exposure. And you can do that mighty inexpensively through the Fidelity Total International Index Fund (FTIHX).

FTIHX tracks an international index that holds large-, mid-, and small-cap stocks in both developed and emerging markets—basically anywhere that isn’t the U.S. And its passport is covered in stamps. The fund holds more than 5,000 stocks across a few dozen countries.

Like with most index funds, Fidelity Total International Index Fund hardly does any of this equally. Geographically speaking, this Fidelity mutual fund favors developed markets, including Japan (15%), the U.K. (9%), and Canada (8%). From a company-size perspective, it’s predominantly large-cap in nature—nearly 80% of the portfolio is invested in big, blue-chip international firms such as Taiwan Semiconductor (TSM) and Danish pharmaceutical company Novo Nordisk (NVO). That’s common for international funds, and it tends to result in dividend yields that are much bigger than U.S. large-cap funds—FTIHX’s nearly 3% yield is more than double the S&P 500’s.

Related: 7 High-Quality, High-Yield Dividend Stocks

It is worth noting that while Fidelity Total International Index Fund does enjoy a Morningstar Gold medalist rating, that’s largely on the merits of its dirt-cheap investment fee. FTIHX’s historical performance has been more mixed—generally good, though it has wavered at times, and it has certainly not been excellent.

Also, are you’re compelled to build the lowest-fee portfolio possible? Do you have a Fidelity account (or are you willing to open one)? If so, you can own a similar, Silver-rated fund—Fidelity ZERO International Index Fund (FZILX)—for an annual fee of literally nothing.

Related: 12 Best Stock Screeners & Stock Scanners

Featured Financial Products

7. Fidelity Investment Grade Bond Fund

— Style: Intermediate-term core bond

— Management: Active

— Assets under management: $10.4 billion

— SEC yield: 4.6%*

— Expense ratio: 0.44%, or $4.40 per year for every $1,000 invested

Most investors need some exposure to bonds, which is debt that’s issued by governments, companies, and other entities. Their interest payments and relative lack of volatility make them an excellent tool for providing a portfolio with stability and income. But how much bond exposure you need will vary by age—because they’re better at protecting wealth than growing it, people typically start with little in the way of bond holdings earlier in life, then gradually hold more bonds as they get closer to (and into) retirement. (Purpose-built investment products called target-date funds capture this dynamic automatically for investors.)

But individual bonds can be a hassle. Data and research on individual issues is much thinner than it is for publicly traded stocks. And some bonds have minimum investments in the tens of thousands of dollars. But you can blunt these problems by purchasing a bond fund, which allows you to invest in hundreds or even thousands of bonds with a single click—and, in many cases, very low fees.

Related: The 10 Best Vanguard Index Funds You Can Buy

Core bond funds like the Fidelity Investment Grade Bond Fund (FBNDX) are the, ahem, gold standard.

FBNDX’s five co-managers have built a portfolio of more than 4,400 investment-grade securities spanning numerous debt types. The fund’s largest current allocation is to U.S. Treasury bonds, which command 47% of assets. It also holds a 25% weight in corporate bonds, 14% in pass-through mortgage-backed securities (MBSes), 8% in asset-backed securities (ABSes), 7% in commercial MBSes, and sprinklings of other debt. Roughly 6% of assets are in cash waiting for new opportunities.

Diversification goes beyond debt categories, too. The fund holds bonds with maturities of between just a few months and more than 20 years, though the biggest slug is in intermediate-term bonds of five to 10 years until maturity. Duration, a measure of interest-rate sensitivity, is a bit above six years. While the actual calculation is much more complex, this basically implies that for every 1-percentage-point increase in interest rates, FBNDX would decline by 6%, and vice versa. It’s a moderate amount of risk, but no more.

Related: 10 Best Dividend Stocks to Buy [Steady Eddies]

From a performance standpoint, Fidelity Investment Grade Bond’s management has been up to the task, beating both its category average and index over every meaningful time period. It is particularly productive over the long-term, topping at least 89% of funds (if not more) over the trailing five-, 10-, and 15-year periods.

Long story short: Fund shareholders are instantly plugged into a widely diversified and well-selected set of fixed-income assets, and at a very reasonable cost. This makes FBNDX one of the best Fidelity mutual funds to buy for anyone who wants to buy a single core bond product and call it a day.

* SEC yield reflects the interest earned across the most recent 30-day period. This is a standard measure for funds holding bonds and preferred stocks.

Related: The 10 Best Vanguard Funds to Buy for Everyday Investors

8. Fidelity Total Bond Fund

— Style: Intermediate-term core-plus bond

— Management: Active

— Assets under management: $38.9 billion

— SEC yield: 5.0%

— Expense ratio: 0.44%, or $4.40 per year for every $1,000 invested

Fidelity’s FBNDX is referred to as a “core” bond fund, which means it holds several types of core debt categories, such as U.S. Treasuries and investment-grade corporate bonds. Investors with a little more appetite for risk might also consider a “core-plus” bond fund, which also holds a variety of debt securities—but in addition to core bond categories, they can also hold noncore categories such as below-investment-grade (junk) corporate bonds and emerging-market debt.

Related: 5 Best Vanguard Dividend Funds [Low-Cost Income]

One such core-plus fund is the Fidelity Total Bond Fund (FTBFX). A team of eight co-managers spreads the fund’s assets across nearly 6,700 issues in a number of categories. Currently, it invests roughly a third of assets each into U.S. government and U.S. corporate bonds, and another 20% or so in pass-through mortgage-backed securities (MBSes). The rest is sprinkled across ABSes, commercial MBSes, foreign sovereign debt, and more.

Sure, the portfolio isn’t a huge diversion from a core bond fund. But this isn’t a fully investment-grade portfolio like FBNDX—you’re getting some exposure to high-yield corporate debt (12%) and emerging-market bonds (3%), too.

Credit quality is still high overall. And while management holds bonds with maturities ranging anywhere from 20 years to a few months, the biggest chunk of bonds sits between four and eight years. Duration, meanwhile, is just a hair under six years.

Performance-wise, Fidelity Total Bond has been in the top 25% (at least!) of its category peers over every long-term time frame. And you get that exposure at a below-average 0.44% in annual fees.

Related: The 7 Best T. Rowe Price Funds to Buy and Hold

9. Fidelity Floating Rate High Income Fund

— Style: Floating-rate bank loan

— Management: Active

— Assets under management: $15.1 billion

— SEC yield: 7.3%

— Expense ratio: 0.73%, or $7.30 per year for every $1,000 invested

A less-traveled debt investment is the bank loan, which is a loan made by a bank or another financial institution to a company for any number of reasons—the money could be used for something specific like paying for an acquisition or refinancing debt, or just for general purposes.

Related: The 10 Best Fidelity Funds You Can Own

Bank loans are typically “floating-rate” in nature, which means the rate adjusts over time based on changes in a reference interest rate. These are typically riskier than traditional bonds, so they often have lower credit quality (many are junk-rated); on the flip side, this enhanced risk means they usually throw off much higher interest rates.

That’s the case with Fidelity Floating Rate High Income Fund (FFRHX), which invests primarily in floating-rate bank loans and currently yields well more than 7%. Management takes a conservative tack, typically buying B- and BB-rated securities (the higher end of junk) while making fewer opportunistic dives in lower-rated loans than many of its contemporaries. And the fund wants to invest in loans made to companies with strong balance sheets, high free cash flow, improving credit profiles, and other positive financial traits.

Almost 90% of the fund is invested in term and revolving bank loans, with the rest spread among other floating-rate securities, fixed-rate bonds, and cash. Holdings rated CCC or below account for just 7% of assets.

Related: 10 Best Vanguard Funds for the Everyday Investor

FFRHX is an excellent illustration of how management makes or breaks the fund. Fidelity Floating Rate High Income is just above the bottom third of its category, by performance, over the trailing 15-year period. But current manager Eric Mollenhauer didn’t take the helm until April 2013. Under his stewardship—along with co-managers Kevin Nielsen (joined in 2018) and Chandler Perine (joined in 2022)—FFRHX’s performance has been around the top 10% over the trailing three, five, and 10 years.

And in this case, the provider itself offers the fund an additional edge.

“Fidelity’s size and presence in the bank-loan market give this strategy a unique edge extending beyond the fundamental credit research that has long been the hallmark of this high-income research team,” says Morningstar Analyst Max Curtin. “With a dedicated capital markets solutions advisor honing relationships with private equity sponsors, this group takes advantage of harder-to-source deals and favorable allocations compared with smaller players in the asset class.”

In short: This is one of the best Fidelity funds you can buy … and part of that edge is because the fund is from Fidelity!

Related: 7 Best Schwab Funds You Can Buy: Low Fees, Low Minimums

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

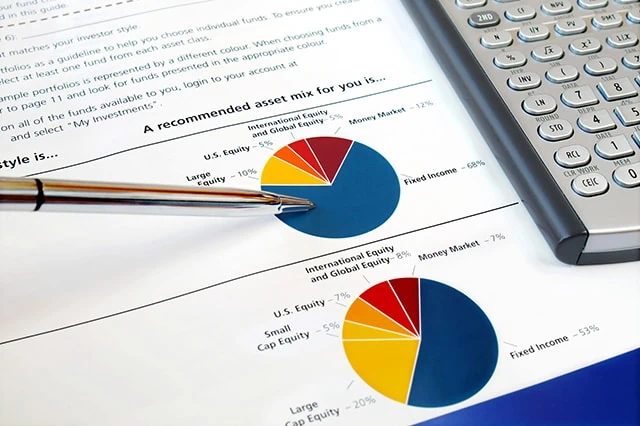

10. Fidelity Freedom Index Funds

— Style: Target-date

— Management: Index

— Assets under management (collectively): $163.6 billion

— Expense ratio: 0.12%, or $1.20 per year for every $1,000 invested

Target-date funds are the ultimate buy-and-hold instrument, meant to stay in your portfolio for literally decades.

You can read more about this type of product in our primer on target-date funds, but in short, they’re funds that shift their asset allocation over time to meet investors’ changing needs as they age. A person who’s, say, 25 in 2025 would expect to retire in 2065, so they’d buy a fund with a target retirement date of 2065. That fund will probably start out with a very heavy allocation to stocks (to grow the investors’ wealth), but as the years roll on and the fund approaches its target retirement date, it will start putting more of its assets into bonds (to protect the investors’ wealth).

Many fund providers have at least one target-date series, though larger asset managers sometimes offer more. Fidelity is well outside the norm, however, with a whopping four—and the highest-rated among them are the Fidelity Freedom Index Funds.

Fidelity Freedom Index Funds, which are built exclusively from Fidelity’s lineup of low-cost index funds, are a rarity—few target-date series can boast a Gold Medalist rating. That rating is due in no small part to extremely low costs. Unlike actively managed target-date funds whose management fees tend to be different across the series, all Fidelity Freedom Index Funds charge the same fee: 0.12%.

Related: The 7 Best Fidelity Index Funds for Beginners

Here’s a quick look at the full lineup:

— Fidelity Freedom Index 2010 Fund (FKIFX)

— Fidelity Freedom Index 2015 Fund (FLIFX)

— Fidelity Freedom Index 2020 Fund (FPIFX)

— Fidelity Freedom Index 2025 Fund (FQIFX)

— Fidelity Freedom Index 2030 Fund (FXIFX)

— Fidelity Freedom Index 2035 Fund (FIHFX)

— Fidelity Freedom Index 2040 Fund (FBIFX)

— Fidelity Freedom Index 2045 Fund (FIOFX)

— Fidelity Freedom Index 2050 Fund (FIPFX)

— Fidelity Freedom Index 2055 Fund (FDEWX)

— Fidelity Freedom Index 2060 Fund (FDKLX)

— Fidelity Freedom Index 2065 Fund (FFIJX)

— Fidelity Freedom Index 2070 Fund (FRBVX)

— Fidelity Freedom Index Income Fund (FIKFX)

Fidelity Freedom Index Income Fund is designed for people who have reached retirement, and it boasts the most conservative asset blend. When a Fidelity Freedom Index target-date fund expires, it merges with Fidelity Freedom Index Income.

Interestingly, Fidelity’s target-date lineups include two Gold Medalist honorees. The other is the Fidelity Flex Freedom Blend Fund series, which holds a blend of index and actively managed Fidelity funds. However, the “Flex” designation refers to a share class you can only buy with certain Fidelity accounts; the Fidelity Freedom Index Funds mentioned here are open to everyone.

For a longer explanation of all of Fidelity’s target-date lineups, check out our Beginner’s Guide to Fidelity Target-Date Funds.

Related: 7 Best High-Dividend ETFs for Income-Minded Investors

Featured Financial Products

Learn More About These and Other Funds With Morningstar Investor

If you’re buying a fund you plan on holding for years (if not forever), you want to know you’re making the right selection. And Morningstar Investor can help you do that.

Morningstar Investor provides a wealth of information and comparable data points about mutual funds and ETFs—fees, risk, portfolio composition, performance, distributions, and more. Morningstar experts also provide detailed explanations and analysis of many of the funds the site covers.

With Morningstar Investor, you’ll enjoy a wealth of features, including Morningstar Portfolio X-Ray®, stock and fund watchlists, news and commentary, screeners, and more. And you can try it before you buy it. Right now, Morningstar Investor is offering a free seven-day trial. You can check out the current deal, as well as discounted rates for students and teachers, by visiting the Morningstar Investor website.

What is the Minimum Investment Amount on Fidelity Mutual Funds?

Fidelity’s mutual funds (and ETFs, for that matter) make plenty of sense for investors of all shapes and sizes, but they have a particular appeal among people who don’t have much money to work with. That’s because many Fidelity mutual funds have no investment minimums—you can literally start with as little as $1.

That’s extremely beneficial in self-directed accounts like a brokerage or health savings account (HSA). Many mutual funds from other providers require high minimums in the thousands of dollars, hamstringing investors with little capital to work with.

Actively Managed Funds vs. Index Funds

There are infinite types of mutual funds, but all can be divided into two main camps:

— actively managed funds

— passively managed funds, also known as passive funds or, most commonly, index funds

Actively managed funds have professional managers that use their discretion to buy and sell securities. Whether they are value funds, growth funds, or anything in between, they are all essentially run the same way: A manager or team of managers buys and sells stocks, bonds, or other securities in the pursuit of price returns, dividends/income, or both.

Related: The 7 Best Mutual Funds for Beginners

Index funds, in contrast, are passive. There’s no manager actively looking to “beat the market.” The fund is simply looking to copy an index—which is based on a set of rules that the index automatically applies—enjoying that underlying investment exposure. Actively managed stock funds will try to cherry pick the stocks or bonds they like best. An index fund simply buys whatever its rules say to buy, then lets that portfolio run until it’s time to “rebalance” (apply the rules again).

Related: 6 Best Stock Recommendation Services [Stock Tips + Picks]

The primary advantages of actively managed funds is that a talented manager can potentially outperform over time and may be adept at navigating a difficult period such as a bear market. But with an index fund, you generally get much lower costs in terms of management fees and trading expenses, better tax efficiency and performance that often ends up being better than that of many active managers.

What Are Balanced Mutual Funds?

Balanced mutual funds, sometimes also called “hybrid funds” or “allocation funds,” hold both stocks and bonds. However, while the name might imply that all balanced funds hold an equal amount of stocks and bonds, that’s not quite the case.

Some balanced funds are “aggressive” and dedicate far greater assets to stocks than bonds—say, 80/20 stocks, or 70/30 stocks. Meanwhile, some balanced funds are “conservative” and invest most of their assets in bonds. Still more are much closer to a 50/50 split.

Like Young and the Invested’s content? Be sure to follow us.

How Are Mutual Funds Different From Exchange-Traded Funds?

There is a lot of overlap between traditional mutual funds and their cousins, exchange-traded funds (ETFs). That’s because exchange-traded funds are very similar to mutual funds, but with a few different traits.

Related: The 15 Best ETFs to Buy for a Prosperous 2025

Like traditional mutual funds, an ETF will hold a basket of stocks, bonds, and other securities. These can be broad and tied to a major index like the S&P 500, or they can be exceptionally narrow and focus on a specific sector or even a specific trading strategy. For the most part, anything that can be held in an exchange traded fund can also be held in a mutual fund.

But there are some major differences. When you invest in a mutual fund, you (or your broker) actually send money to the manager, who in turn uses the cash to buy stocks or other investments. When you want to sell, the manager will sell off a tiny piece of the securities the mutual fund owns and send you the proceeds. Money generally enters or exits the fund once per day.

Related: Best Target Date Funds: Vanguard vs. Schwab vs. Fidelity

Exchange-traded funds, on the other hand, trade on the New York Stock Exchange or another major exchange like a stock. If you want to buy shares, you don’t send the manager money; you just buy shares from another investor on the open market.

There are two advantages here. The first is that ETFs allow for intraday liquidity. If you want to buy or sell in the middle of the trading day—or multiple times throughout the trading day—you can.

The second advantage is tax efficiency. In a traditional mutual fund, redemptions by investors can generate selling by the manager that creates taxable capital gains for the remaining investors who didn’t sell. This doesn’t happen with ETFs, as the manager isn’t forced to buy or sell anything when an investor sells their shares.

Related: The 9 Best ETFs for Beginners

Why Does a Fund’s Expense Ratio Matter So Much?

Every dollar you pay in expenses is a dollar that comes directly out of your returns. So, it is absolutely in your best interests to keep your expense ratios to an absolute minimum.

The expense ratio is the percentage of your investment lost each year to management fees, trading expenses and other fund expenses. Because index funds are passively managed and don’t have large staffs of portfolio managers and analysts to pay, they tend to have some of the lowest expense ratios of all mutual funds.

This matters because every dollar not lost to expenses is a dollar that is available to grow and compound. And over an investing lifetime, even a half a percent can have a huge impact. If you invest just $1,000 in a fund generating 5% per year after fees, over a 30-year horizon, it will grow to $4,116. However, if you invested $1,000 in the same fund, but it had an additional 50 basis points in fees (so it only generated 4.5% per year in returns), it would grow to only $3,584 over the same period.

Related: 13 Best Long-Term Stocks to Buy and Hold Forever

As even novice investors probably know, funds—whether they’re mutual funds or exchange-traded funds (ETFs)—are the simplest and easiest ways to invest in the stock market. But the best long-term stocks also offer many investors a way to stay “invested” intellectually—by following companies they believe in. They also provide investors with the potential for outperformance.

So if you’re looking for a starting point for your own portfolio, look no further. Check out our list of the best long-term stocks for buy-and-hold investors.

Related: 10 Best Monthly Dividend Stocks for Frequent, Regular Income

The vast majority of American dividend stocks pay regular, reliable payouts—and they do so at a more frequent clip (quarterly) than dividend stocks in most other countries (typically every six months or year).

Still, if you’ve ever thought to yourself, “it’d sure be nice to collect these dividends more often,” you don’t have to look far. While they’re not terribly common, American exchanges boast dozens of monthly dividend stocks.

Please Don’t Forget to Like, Follow and Comment

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Subscribe to Retire With Riley, our free weekly retirement planning newsletter, and

3. Give the article a Thumbs Up on the top-left side of the screen.

4. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!