Individual retirement accounts (IRAs) are one of the most popular ways for Americans to save for retirement. That’s because IRAs and Roth IRAs alike provide a tax-advantaged home for your investments. But IRA investing isn’t a monolith. How you invest in your IRA will change depending on your age. And even the two primary types of IRA have very different tax benefits.

Today, I’m going to talk about the best Roth IRA investments you can make. We’ll also briefly go over what not to put in a Roth IRA, what contribution limits are, and more.

Table of Contents

Roth IRAs: Goals for Before, And During, Retirement

What you invest in will evolve throughout your entire life—there are very few points in which you’ll need to flip a switch and completely change your strategy. That said, I’m breaking down my list into two very distinct periods of your life, because your goals will be quite different during those times:

— Before retirement: Your primary goal for most of your investing life (pre-retirement) is to take what money you have and grow it. Now, you’ll probably be more interested in growth when you’re 30 than when you’re 60—and your blend of investments should reflect that—but if we’re generalizing, your main goal here is growth.

— During retirement: Once you’re in retirement, you no longer collect a paycheck. But you still have to pay regular expenses like utilities, a phone bill, and more. You’ll finance those expenses with a combination of Social Security income and your retirement investments. For most people, this involves withdrawing (“drawing down”) on the retirement funds you’ve accumulated. So while some of your investments will be geared toward growing your nest egg, much of your focus will be on preserving what you have. Also, you’ll likely try to generate a regular stream of dividend and investment income with your portfolio—doing so may help reduce how much you have to “draw down” your account.

And remember: Roth IRAs are a tax-advantaged account. Specifically, funds are allowed to grow tax-free within the account, and you won’t pay tax on any of the withdrawals you make in retirement. So in some cases, the best Roth IRA investments are those that put these tax advantages to maximum use.

Conversely, a Roth IRA can actually negate certain tax-advantaged investments. I’ll talk about those later on.

Best Roth IRA Investments [Before Retirement]

Let’s start with investments you’d want to hold in a Roth IRA before you retire. The primary goal here is going to be growth, though admittedly, as you come close to retirement age, you’ll likely pull back on more aggressive investments that grow your wealth and pile into more conservative investments that protect your wealth.

1. Individual Stocks

When people think about high-yield, high-return investment options, most people tend first to consider individual stocks.

Stocks are tiny fractions of ownership in a public company. These “shares” of stock are effectively a bet that the company will grow over time—and in return, the shares will be worth more in the future, allowing you to sell for a profit.

Individual stock investors put myriad strategies to work. For instance, some investors target financially stable companies that can produce good, even returns (and sometimes dividends) over time—like the “Steady Eddies” recommended by a stock picking service like Motley Fool’s Stock Advisor—while others look for companies that might be riskier but can offer much more aggressive price growth.

Stocks are an appreciating asset—if you perform diligent stock research and make wise choices, the shares you hold should become more valuable over time. You can then sell to other investors willing to pay more for them than you did.

The average stock market return over the past few decades has been roughly 10% annually. But this doesn’t mean you’ll get the same return every year, and it doesn’t mean you’ll get the same return as other investors, depending on which stocks you buy.

Beginners wondering how to invest in stocks should start with established companies with solid balance sheets, which might not grow as fast as smaller companies, but which can help build wealth while reducing some risk.

Getting started in the stock market can be a daunting task for beginners, though it doesn’t need to be. The best investing apps for beginners make the process painless and straightforward to get started and continue growing your investment account balance for many years to come. And you don’t need much money—if you invest through a brokerage with fractional shares (apps like Robinhood and Webull), you can invest for $10, $5, and sometimes as little as $1.

What About Taxes?

In a taxable account, you’re taxed when you sell a stock for a profit, and you’re also taxed when you receive dividends (cash distributions from companies to shareholders). But you’re not taxed for either of these events within a Roth IRA. Still, the benefit differs. Consider this:

— Scenario 1: Selling a stock within a year or less. In a taxable account, when you sell a stock for a profit, you’re taxed on the earnings. If you’ve held an asset for a year or less, you’ll pay less favorable short-term capital gains taxes, which are the same as your ordinary income rates (see: your federal tax brackets). So, a Roth IRA is an extremely tax-efficient place to do short-term trading.

— Scenario 2: Selling a stock after a year. If you sell an asset that you’ve held for more than a year, you’ll pay more favorable long-term capital gains taxes, which are lower than short-term rates. In theory, you can temporarily defer paying taxes on gains by simply waiting to sell and lock in those investment earnings in future years—but if you need to sell a stock because the story has changed and you don’t believe in it anymore, you’ll have to pay taxes. A Roth IRA shields you from any tax obligation from selling, though, so while the tax savings aren’t as great as they are with short-term trades, Roth accounts are a great place to hold stocks you plan on holding long-term, too.

— Scenario 3: Collecting dividends. In addition to capital gains, some stocks pay dividends, which also trigger taxes. And while you might be able to push off when you sell a stock, dividends are paid no matter what. Most dividends from traditional stocks are “qualified” dividends and enjoy long-term capital gains tax rates, so the tax savings in a Roth IRA aren’t as dramatic. But you still enjoy some savings and get to avoid a tax headache every year.

Growth Stocks or Value Stocks?

Growth stocks are companies that are expanding their profits and sales at a steady clip. Typically, growth stocks are firms that have either an attractive product they are bringing to new markets or a steady drumbeat of new items they can sell to existing customers to open up new revenue streams.

Technology companies are typically the most common example of growth stocks, as they bring new gadgets to market that are better or faster than previous products.

Value stocks, on the other hand, are companies that might not be expanding rapidly but have a strong underlying business. Think of a local bank or a utility company that might have trouble doubling in size over the next few years, but doesn’t face a lot of competition or disruption to its business model. These kinds of companies are often more stable thanks to the underlying value of their businesses.

The best long-term stocks cover both camps. Reliable growth can result in significant gains over many years, but alternatively, a rock-solid value stock will most commonly weather any market disruptions much better than a company that relies on enterprise spending trends or consumer confidence to drive its sales.

What About Dividend Stocks?

Dividend stocks (which commonly are value stocks, but can be growth stocks) are great ways to drive long-term performance of your portfolio. These companies pay a regular flow of their profits directly back to shareholders, meaning you receive some sort of return regardless of the ebb and flow of share prices.

Related: 9 Best Monthly Dividend Stocks for Frequent, Regular Income

Stocks that can both grow and pay dividends are the ultimate long-term stocks given just how much in additional returns they can generate over the long term.

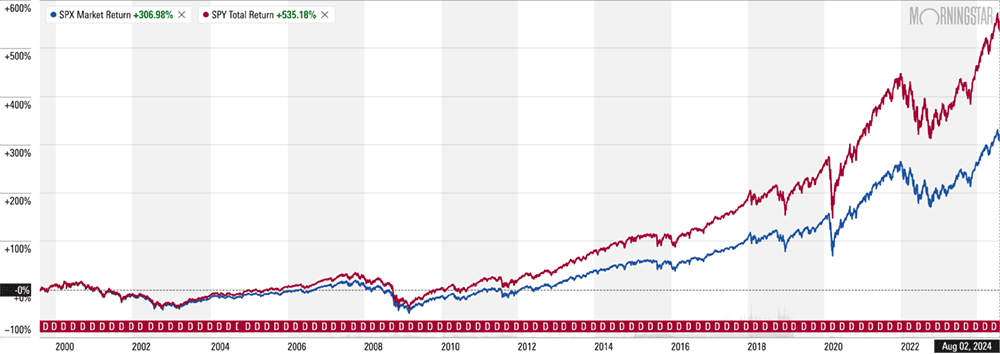

Above, you’ll see the return someone could expect if they received just the price returns from the S&P 500 over the past 25 years.

And If I Reinvested Those Dividends?

Now look at how much better the return is when you factor in dividends had you had reinvested those dividends back into the S&P 500 (returns illustrated by an S&P 500-tracking ETF; note that expenses are included in performance):

The price return is about 307%. The total return (price plus dividends) is 535%!

Related: The 13 Best Dividend King Stocks for Royally Resilient Income

The best long-term stocks tend to be companies that aren’t overly dependent on specific trends in the global economy, and companies that can deliver returns in any environment. Dividend growth stocks (companies that pay larger dividends over time) tend to check both those boxes, proving they have operations that generate significant profits, and are growing those profits enough to deliver larger paydays to shareholders each year.

2. High-Yield Bonds

A bond is effectively a loan that an investor makes to a business, government, or other entity. When an investor buys a bond, the borrower promises to pay back the original principal after a certain amount of time, as well as interest, which is usually made in regular payments until the bond is paid back.

Investors make money from bonds in two ways:

1. Holding them until the maturity date and collecting interest payments and their original principal.

2. Selling them at a higher price to someone else before the bond matures.

Related: Beginner’s Guide to Vanguard Target-Date Funds

Bonds don’t act like stocks, however. They tend to trade in a band around their “par value,” which is the amount the borrower has promised to pay back. They can trade a little above or a little below, but generally speaking, they don’t fluctuate the same way stock prices do.

Interest tends to be the biggest source of returns from bonds. And interest income is taxed at less favorable ordinary income rates. So in general, you can do well holding bonds in a Roth IRA.

But all bonds aren’t built the same. Some are more aggressive, while others are more defensive. So, if we’re talking about bonds that belong in an IRA before you retire, one type to focus on is the high-yield bond.

Related: 5 Best Vanguard Dividend Funds [Low-Cost Income]

“High-yield bonds” is another way of saying “junk bonds.” Many bond issuers are evaluated by credit ratings agencies, and their debt is assigned grades based on the risk that the interest will or won’t be repaid. Safer bonds are referred to as “investment-grade.” Bonds that fall below investment-grade are referred to as junk.

As a general rule, the worse the grade, the more in yield an issuer has to offer to entice investors to buy their bonds. Thus, junk bonds tend to yield better than investment-grade bonds (hence the name “high-yield bonds”).

Despite the name, how “junky” junk bonds are is relative. Some junk is safer than other junk. For the average investor, it often makes more sense to invest in a junk-bond fund so you can diversify across hundreds or even thousands of junk bonds—that way a few bad eggs won’t crack your portfolio.

3. Actively Managed Mutual Funds

An investment fund is a type of pooled investment where money is collectively managed and invested by a third party. The two most common types of investment funds are mutual funds, exchange-traded funds (ETFs).

You can learn more about each type of fund by clicking the links above, but one of the best types of investment fund to hold in a Roth IRA is an actively managed mutual fund.

Without getting too in the weeds, just know a couple of things:

— An actively managed fund (one or more human managers make decisions at their own discretion) will typically trade more than an index fund (all decisions are made according to a rules-based index). This generates more capital gains, which must be distributed to shareholders, who must pay taxes on those capital gains.

— ETFs are generally much more tax-efficient than mutual funds. They’re literally built differently, and as a result, they rarely distribute capital gains. Most ETFs are index funds, but even actively managed ETFs distribute capital gains much less frequently than actively managed mutual funds.

Related: The 24 Best ETFs to Buy for a Prosperous 2024

Actively managed mutual funds will typically invest in stocks, bonds, or a combination of the two. The combination is pretty irrelevant—virtually all types of actively managed mutual funds are best held in a Roth IRA or other tax-advantaged account to negate the impact of taxes, whether you’re selling the fund, collecting dividends or interest income from the fund, or collecting capital-gains distributions from the fund.

Like Young and the Invested’s Content? Be sure to follow us.

4. Publicly Traded Real Estate Investment Trusts (REITs)

Real estate investing provides a wide range of benefits, including diversification, less correlation with the stock market, and income. And investors have several ways of tapping the opportunities of property ownership.

Perhaps the easiest route is to own shares of real estate investment trusts (REITs).

REITs are a special type of business structure for companies that own (and sometimes operate) real estate. And they’re particularly sought-after by income-focused investors.

You see, REITs receive federal income tax breaks—in exchange for distributing at least 90% of their taxable income back to shareholders in the form of dividends. The result? REITs typically yield well more than the broader market. For example, a popular REIT ETF—the Vanguard Real Estate ETF (VNQ)—currently yields well more than twice as much as the S&P 500 right now.

Related: 11 Best Alternative Investments [Options to Consider]

Real estate investment trusts typically will hold dozens if not hundreds (or even thousands) of properties. Most REITs will invest in properties related to a certain industry—say, commercial real estate, apartments, hotels, industrial parks, even driving ranges—though some hold a variety of different properties.

Publicly traded REITs allow you to buy these companies exactly how you would any other stock—with a couple clicks of your mouse in your Roth IRA. And given both REITs’ potential to generate price appreciation and high dividends, it makes plenty of sense to keep them in a Roth and shelter them from Uncle Sam.

Best Self-Directed Roth IRA Investments (Before Retirement)

Investing is confusing. One example? “Self-directed.”

“Self-directed” investing typically means you just manage your investments by yourself. Most IRAs give you total control to invest in thousands of stocks, ETFs, mutual funds, bonds, options—you name it—on American (and sometimes even international) exchanges.

Despite this, your average IRA or Roth IRA isn’t technically considered “self-directed.”

There’s a special classification of account—a “self-directed individual retirement account,” or SDIRA—that allows you to invest in certain categories that are actually prohibited in a regular IRA. (And yes, SDIRAs can be traditional or Roth, too.)

SDIRAs are typically used to hold alternative investments, such as physical gold, real estate, wines, art, and more. But there are a few things you should know:

— SDIRAs still have limitations. Chief among them: You can’t actually hold collectibles in them. For instance, you could use an SDIRA to invest in a platform that offers securitized shares or other exposure to wine, and enjoy in the profits of those investments. But you couldn’t use an SDIRA to hold a physical bottle of wine.

— Alternative investments don’t have the same rules and regulations as publicly traded stocks and bonds—and many times, there’s less information to base your decisions on.

— Most traditional providers of brokerage accounts, IRAs, and Roth IRAs don’t offer self-directed IRAs. Instead, your choices will be SDIRA providers that allow for numerous types of alternative investments or alternative investment providers that offer SDIRAs as part of their platform.

Related: 12 Best Investment Opportunities for Accredited Investors

With that out of the way, let’s delve into a few of the best investments for a self-directed Roth IRA:

5. Private Real Estate (Indirect)

While publicly traded REITs are an excellent way to hold real estate, they’re not the only way. Private real estate tends to be a lot less correlated with the stock market, making it a sought-after source of diversified returns that can help keep your performance aloft even if stocks are struggling.

That said, directly owning real estate isn’t for everyone. It’s prohibitively expensive. It’s complicated. Real estate accounting can be a nightmare. And while we’ll discuss this aspect a little later on, you can’t directly hold real estate in a regular Roth IRA, and it rarely makes sense to do so in an SDIRA.

Indirect private real estate is another matter entirely.

Related: 12 Best Investment Opportunities for Accredited Investors

Financial technology has made it much, much easier for you and I to invest in private real estate. Now, thanks to real estate crowdfunding platforms, large groups of individual investors can combine to own properties—allowing each to commit far, far less capital than what would be required to buy a property on their own.

6. Fine Art

Fine art is a potentially high-growth investment that is almost completely detached from the performance of traditional investments like stocks and bonds. It’s both a source of diversification and a way to invest in an asset that might have a personal meaning to you.

Of course, buying physical investment-grade art typically requires extremely deep pockets, not to mention the means and will to store a masterpiece or three. And unlike, say, a publicly traded stock, you can’t just log into your brokerage account and click a button to sell off a suddenly unwanted Rembrandt. Not to mention: You can’t hold physical art in an SDIRA.

But like with private real estate, you can enjoy the upsides of art through your self-directed Roth IRA thanks to the help of investing platforms.

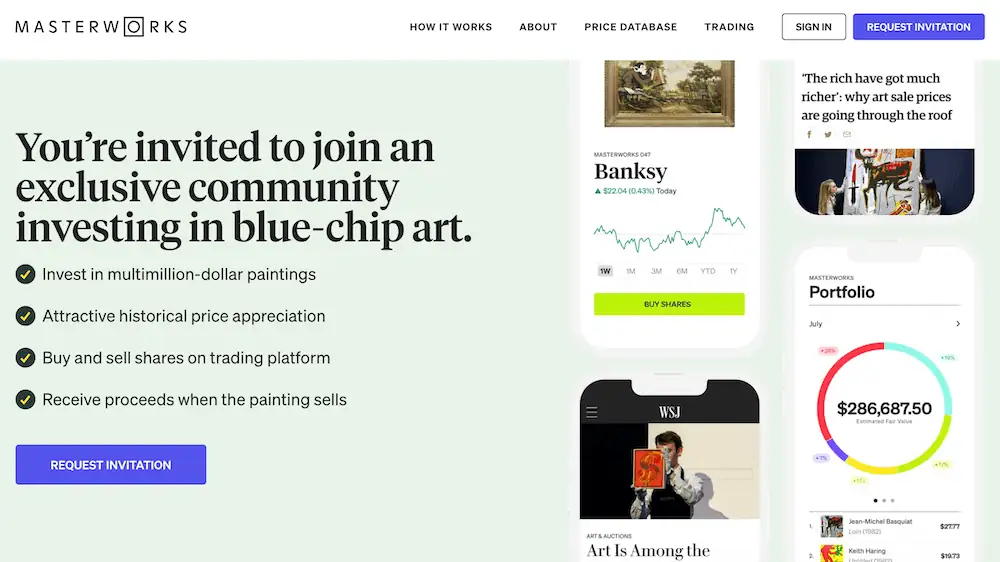

Invest in Fine Art With Masterworks

Masterworks has made blue-chip art investments more accessible than ever, allowing non-accredited investors with much more reasonable sums to purchase fractional interests in expensive pieces of art. That means if your application is approved, you can buy partial shares of ownership of artwork created by the likes of Andy Warhol, Claude Monet, Banksy, and more.

The Masterworks team has over 75 years of collective experience as dealers, collectors, or working for auction houses. They look at a database of more than a million auction records and choose artists based on risk profiles and appreciation. They then find artwork they believe is of high quality and strong value, purchase it, then file an offering with the SEC to allow its members to invest in the work. Masterworks will hold each piece of artwork for between three and 10 years.

During that time, investors can purchase shares in the artwork (typically at $20 per share). If they want to exit, they can do so in one of two ways:

— If the investor wants to exit early, they can try to sell their shares on Masterworks’ trading market.

— If they hold their shares until Masterworks sells the painting, they’ll receive a pro rata share of the proceeds.

Masterworks collects a 1.5% annual fee per year, and takes 20% of all future profits on the sale of artwork.

You can invest in Masterworks directly, or through a self-directed Roth IRA from the likes of Alto IRA.

7. Fine Wine

Want your retirement profits to get better as they age, much like fine wine? Fine wine is not only delicious, but it can be a profitable alternative investment.

As an investment rationale, consider a few things:

— As the amount of wine from specific years and regions diminishes, the value goes up.

— Wine isn’t directly correlated with the economy and can hedge against inflation.

— If nothing else, in the event your wine doesn’t sell, you can still drink it.

Unfortunately, buying your favorite wine and sticking it in the far corner of your basement isn’t considered a strategic retirement plan, and it doesn’t provide the tax benefits of Roth IRAs.

If you plan to make money from wine through a self-directed Roth IRA, you’ll want to use a service like Vinovest.

Vinovest

Unless you already have vast wine knowledge and a professional storage setup, I recommend using Vinovest. Vinovest ensures wine authenticity, stores it for you, and ships it to buyers when they’re ready to sell. Users of the platform can fund an account with a mere minimum of $1,000, select an investment style, and wait patiently as their account balances (hopefully) grow. If you decide you’d actually like to taste some of that rare wine yourself, Vinovest will ship it to you.

And if you prefer a spirit with a little more bite, Vinovest now allows users to invest in whiskey. You can buy entire casks of American Whiskey from the likes of Whistle Pig and Breckenridge, or Scotch from Macallan, Highland Park, and more. You’ll receive a sample bottle from your cask every year, and if you decide it’s too good to sell, they’ll bottle the rest for you. You can start investing in whiskey via Vinovest for as little as $300; just note that Vinovest’s whiskey investing currently only offers managed accounts, with similar terms and fees as Vinovest’s wine-based managed accounts.

Vinovest’s managed portfolios charge annual fees between 1.90% and 2.50%, depending on which investment tier you fall in. You can learn more or sign up at Vinovest, or dive deeper into this platform by reading our Vinovest review.

Related: How to Invest in Whiskey [A Not-So-Whiskey Business?]

8. Cryptocurrency

Cryptocurrencies such as Bitcoin and Ethereum are extremely risky and volatile investments that have delivered enormous gains to some investors—but they’re also resulted in catastrophic losses to some investors, too, and still other investors have lost everything in crypto-related scams, which continue to plague the industry.

But if you have the risk tolerance for it, you can invest in cryptocurrencies using an SDIRA.

For what it’s worth, the past few years have brought about some pretty big advancements in the crypto investing space—including the launch of spot Bitcoin ETFs that allow investors to get exposure to Bitcoin price movements through their regular brokerage accounts and IRAs.

SDIRAs, however, remain the only way to invest directly in cryptocurrencies while enjoying the tax benefits of a traditional or Roth IRA.

Best Roth IRA Investments (During Retirement)

Like I mentioned before, your investing goals will assuredly shift as you get closer to retirement. But especially once you enter retirement, generating income becomes a much higher priority—so why not give yourself a leg up and generate tax-free income?

So I’m going to talk about a couple additional options that will become much more attractive once you’ve entered retirement. Both are centered around generating various levels of income, which can be withdrawn tax-free in retirement.

(And to be clear: Many of the aforementioned investments still make sense to hold in a Roth IRA even once you’ve reached retirement. For instance, you might continue investing in individual stocks or actively managed mutual funds even after you’ve hung up your workplace spurs.)

Like Young and the Invested’s Content? Be sure to follow us.

9. Other Bonds

Earlier, I mentioned high-yield bonds as an idea for Roth IRA investors who are looking for growth. But there are several other bond choices for retirees who would like to generate some income while avoiding the higher risk of junk debt.

— Treasuries: U.S. Treasury bonds are backed by the full faith and credit of the U.S. government, and as such, they’re considered some of the safest debt on earth. As a result, their yields are typically lower than comparable debt issued by corporations. But like with any type of bond, you can typically get a higher yield by investing in longer-dated Treasuries. (Say, those that mature in 20 to 30 years.) I will note that Treasury interest is typically exempt from state and local income taxes, so a Roth IRA won’t give you as much tax-saving bang for your buck.

— Investment-grade corporate bonds: Corporations raise money to pay for research, development, new hires, and a wealth of other needs. While some of those bonds will fall into the “junk” category, you can also invest in investment-grade corporate bonds from larger, more creditworthy corporations. Like with junk, not all investment-grade corporates are built the same—some are safer than others, and some yield much more than others.

— TIPS: Treasury Inflation-Protected Securities (TIPS) are U.S. government bonds that protect against inflation. Like with other bonds, TIPS pay a fixed rate of interest. But where TIPS differ from most other bonds is that the principal can change across its life—going down with deflation, and going up with inflation. When a TIPS matures, if the principal increases, you receive the inflation-adjusted principal back; if the principal decreases, you still get your original principal—you’ll never get back less than what you originally paid. Investors are taxed on both the interest income and these upward adjustments, making Roth IRAs an excellent shelter for TIPS.

Like with high-yield bonds, investors might have an easier time holding other bonds via bond funds, which manage hundreds or even thousands of issues for you. That can defray your risk, not to mention save you the time of having to research many, many bond issues yourself.

Related: 5 Best Vanguard Dividend Funds [Low-Cost Income]

What Not to Invest in a Roth IRA

Between regular Roth IRAs and self-directed Roth IRAs, you can invest in just about anything.

However, in some cases, you can actually get more out of an investment by holding it in a taxable account. Usually, these investments will already sport certain tax efficiencies that a Roth IRA (or other tax-advantaged account) would negate.

For instance …

1. Municipal Bonds

Municipal bonds (or “munis” if you’re into the whole brevity thing) are issued by states, counties, cities, and other types of nonfederal government entities. These can fund projects such as creating roads or building schools.

Municipal bonds have outstanding tax benefits—you not only won’t pay federal taxes on the interest, but you might also avoid state/city/etc. taxes if you live in the state/city/etc. that issued the bond.

The savings can be downright massive. For instance, let’s say you live in Maryland and were in the top federal income tax bracket, and you invested in a municipal bond yielding 2%. A taxable bond would have to yield nearly double that—3.98%—to throw off an equivalent amount of income once you factored in taxes!

Related: These Funds Yield Up to 11% (And Almost No One Knows About Them)

2. Physical Real Estate

You can’t directly hold real estate in a regular Roth IRA. You can in a self-directed Roth IRA, but there are a number of complicating factors:

— For one, it must be investment property; disqualified persons (you, any beneficiaries, and any fiduciaries) can’t use the property for any reason.

— You don’t actually own the real estate—the account does—so the real estate will have to be titled in your IRA’s name.

— All of the money involved in the real estate flows in and out of the IRA. That means rental income is paid to the IRA, and you’re paying expenses out of the IRA.

— Disqualified persons can’t perform maintenance on the property, which means you can’t personally fix or update anything that needs work.

— Did the property generate income? You can’t pay yourself—that income can only go into the IRA. (IRAs specifically prohibit “self-dealing.”)

Direct real estate ownership can be an excellent investment. But you should strongly consider doing so in a different account.

3. Equity ETFs

As I mentioned before, ETFs are a much more tax-efficient vehicle than mutual funds. On top of that, most ETFs are of the index variety, so they generate low turnover anyways (and thus low to no capital gains).

Also, you might collect some dividends each year from an equity ETF, but most of your returns will likely come from price appreciation—and you won’t trigger taxes on those until you sell, which could be many, many years down the road.

Related: The 7 Best Dividend ETFs [Get Income + Diversify]

So in general, equity ETFs tend to be extremely tax-efficient on their own. You can absolutely hold them in a Roth IRA if you’d like, but you’re not gaining much of a tax benefit from doing so.

4. Series EE and Series I Bonds

Series EE and Series I Bonds are some of our favorite gifts for kids, but you can buy them for yourself, too. The former offers a fixed interest rate, while the latter offers both a fixed interest rate and an inflation-adjusted rate.

Both series of bonds are free of state and local taxes, so a Roth IRA will negate that tax benefit. However, EE bonds really have no place in a Roth IRA if you plan on redeeming them for qualified education expenses. That’s because, depending on your income, the interest can be federal tax-free too.

Like Young and the Invested’s Content? Be sure to follow us.